Things are breaking

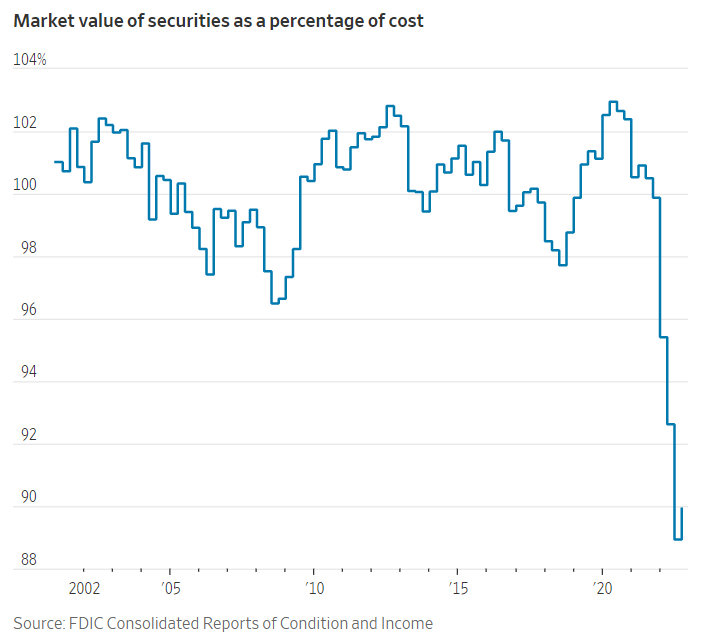

The last few weeks of March were filled with concerns about the banking system as the failure of Silicon Valley Bank and Signature Bank caught most people by surprise. This immediately brought memories of the 2008 Financial Crisis which led to risks of more contagion as deposits flowed from smaller banks to the largest banks. Regulators rushed in to assure Americans their money was safe. Many people are pointing to the Federal Reserve’s rate increases as the cause of the liquidity issues at the failed banks. The failures are just a symptom of a much bigger problem. The Fed kept rates too low for too long, which created excesses in the system. The chart on the right shows the primary issue — overall banks have lost 11% on their assets and not marked them down. This is a complex issue that cannot be covered in this short newsletter. This story is still developing. Stay tuned for ongoing coverage on the blog.

Markets move in cycles

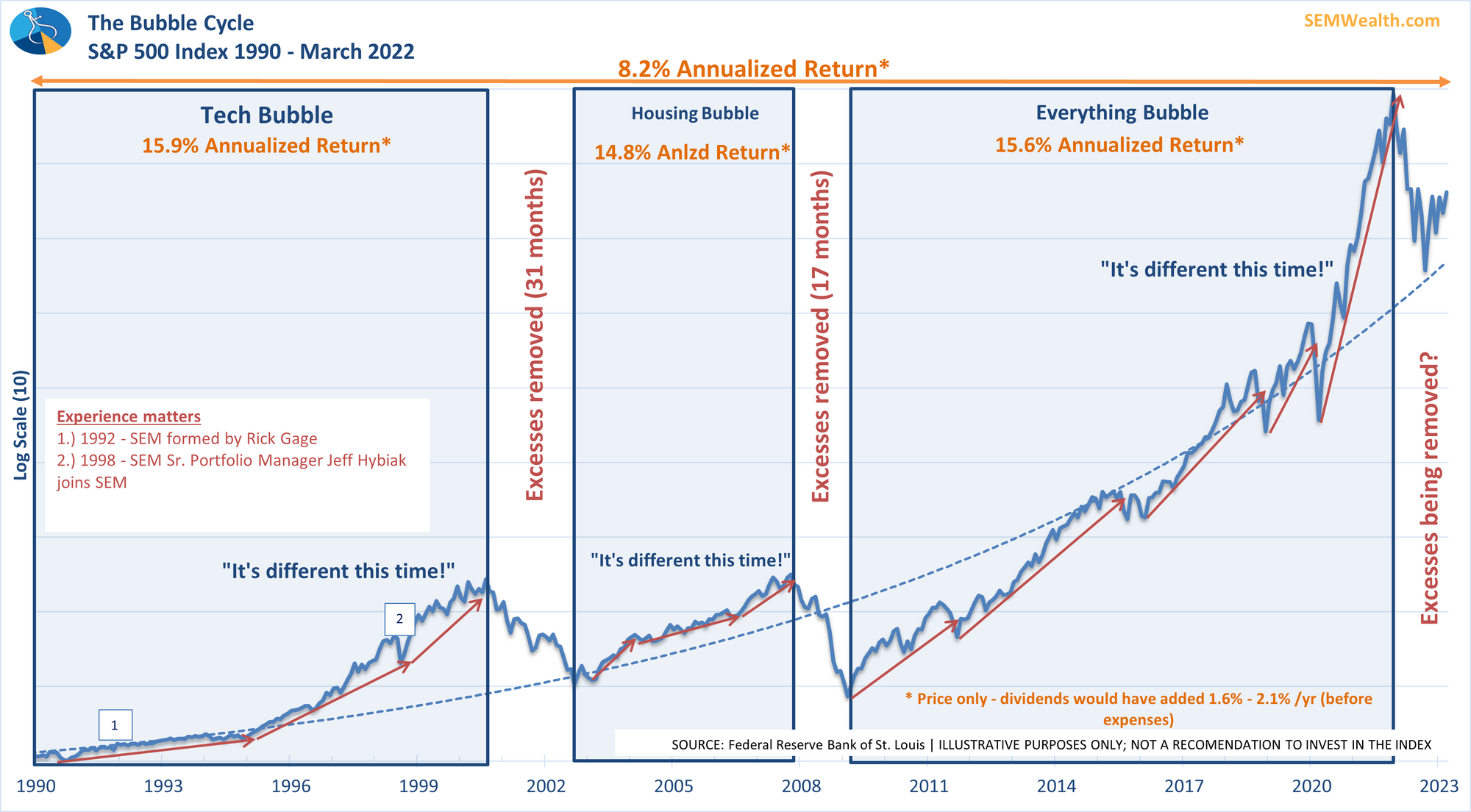

Regardless of the current market environment, we warn our clients and advisors that the stock market is driven by humans who tend to overreact in both directions. These swings can go on far longer than most people think is rational. So long as our economy continues to expand over the long-term, stocks SHOULD move higher over the very long-term. The problem is the in between periods. We often see periods where stocks far exceed the long-term average as investors believe we are in a “new era”. This is followed by a period where the excess from the prior period are removed, often quite quickly as investors overreact to reality setting in. We use this chart to help set expectations and put things in perspective for investors. While it seems like the market has fallen significantly, all we’ve seen so far is removal of the 2021 returns.

Market Musings

The SEM Trader’s Blog is a resource for our advisors and clients who want a deeper look at some of the things we are seeing in the markets. Each Monday we post, “Monday Morning Musings” (MMM) which can range from a short look at a singular topic or as we’ve seen lately a random brain dump of all the things impacting the markets that week. [You can “subscribe” here.] With so much going on and not much space, here are some of the things to consider as we move into the 2nd Quarter:

Patience is key: While it has been comforting to see the markets stabilize following the rapid government response to the banking crisis, there are much deeper concerns for the financial system and overall economy that cannot be solved with short-term measures. We often say, “a bottom is a process, not an event” meaning we will see plenty of “false rallies” before we work through all of the excesses.

This isn’t 2008: The cause of the bank failures is much different than we saw in 2008. This is more likely going to be similar to the 2000-2002 bear market where we saw rolling sell-offs and a mild recession before the markets finally hit the ultimate bottom.

Expectations are still too high: Stock prices are based on expected future earnings growth. Right now, analysts are still expecting 11% earnings growth (the long-term average is 10%). We hope they are right, but know analysts are often too optimistic in their projections. Like 2022, when they expected 13% growth, if we head into a recession, estimates will drop as reality sets in and stocks could fall along with them.

Inflation is still a problem: The irony of the rapid response to the bank failures is it could make inflation much more difficult for the Fed. Just 2 days before the failures, the Fed had warned they needed to accelerate their rate hikes (again) as inflation was still stubbornly high. Depositors losing some money on uninsured funds would have certainly squashed speculation and inflation quickly. The risky stock sectors have moved higher the last few weeks of March which is bad news if you want inflation to come back down to “normal” (2-3%).

We cannot trust the Fed: The Fed didn’t start raising rates until March 2022, a year after SEM had warned inflation was a problem. Two days before two banks failed, Fed Chair Jerome Powell told Congress he did not see any “systematic” issues due to their rate hikes. Somehow investors have confidence the Fed knows all and will not do any harm to the economy, but their track record is abysmal.

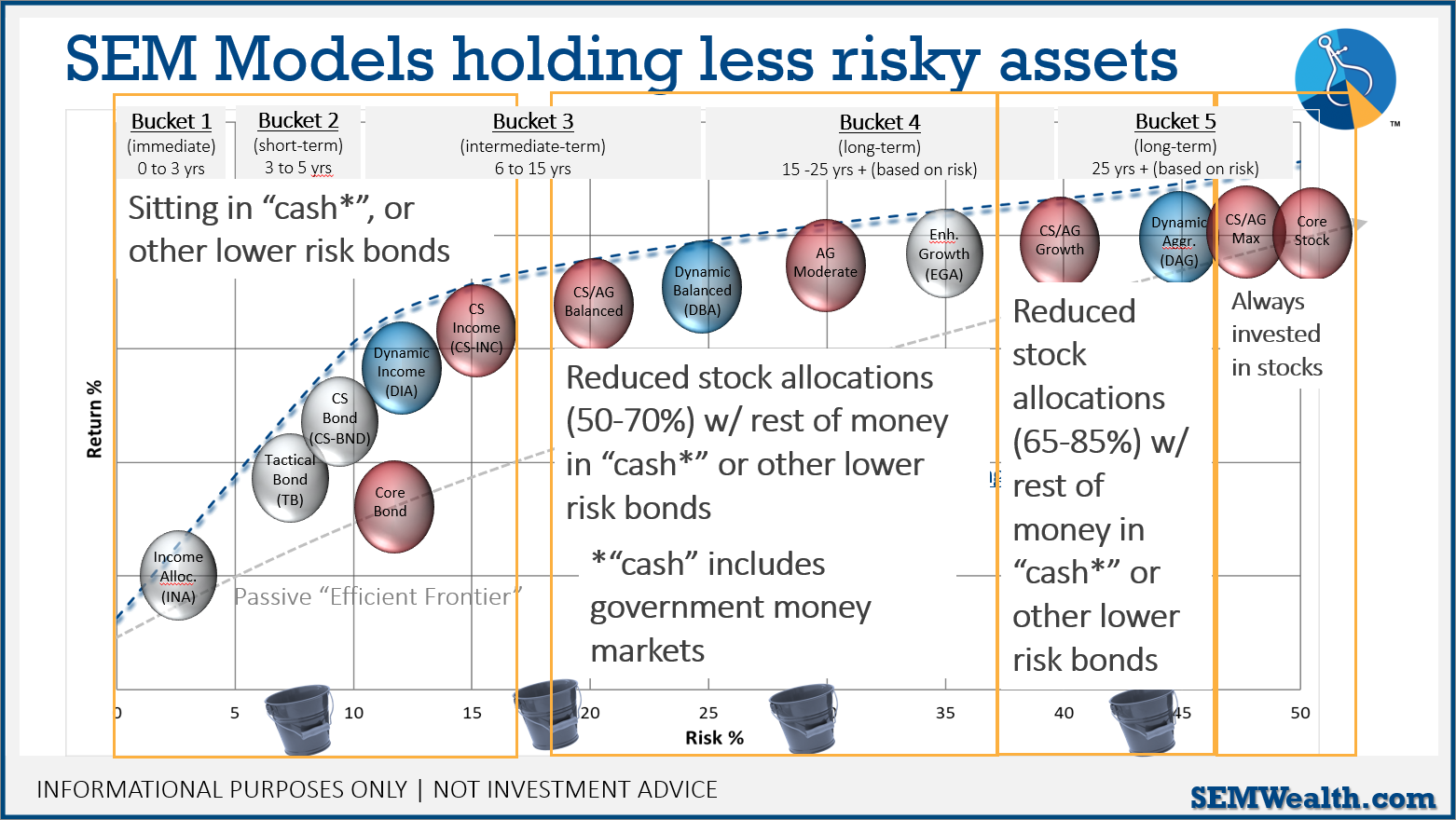

Don’t be lured by “guaranteed” returns: The most often asked question this quarter has been “should I buy a CD paying x%” (typically 4 1/2—5%). The answer is always “it depends”. One thing we warn everyone considering this is how hard it will be to move from the “low risk/guaranteed” instruments when we get to the inevitable “bottom”. The market won’t go straight down forever and based on history in the next 6-12 months we could see a drop which makes stocks and certain bonds quite attractive. In that environment, sentiment will be poor, which is why we follow quantitative investment strategies which remove the emotion from the equation.

Your plan is all that matters: The only time you should make a major re-allocation in your investments is if your financial plan changes. Our investments are designed to work with your plan and that included planning for a bear market!

Download/Print version of the Newsletter

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Model Factsheets for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.