In the television industry there is a term used when a show goes completely “off the rails”. It is based on the Happy Days episode where Fonzie jumps a shark. Most critics say that was the point the show was essentially over. Now whenever a show gets sidetracked the critics will wonder if it was a “jumping the shark” episode.

As I read Warren Buffett’s latest annual letter to shareholders I had to wonder if the the “Oracle of Omaha” had decided to jump his own shark. As you may recall, he was deeply criticized during the tech bubble for failing to invest in the “new economy”. He was called a “has been” and many had expected him to simply disappear from the investing landscape. Instead his focus on value vindicated his reputation.

During the financial/housing bubble his exposure to the insurance industry and other cyclical stocks again threatened his reputation, but some sage purchases (using private deals that were well below the current market prices & low risk to his shareholders) and wise words in the depths of the crisis cemented him as the “oracle”. While Mr. Buffett’s latest letter does acknowledge the downside risks in the market over the long-term, he seems afraid to say anything negative about the market. He is even ignoring what he described as the single best indicator of long-term market value.

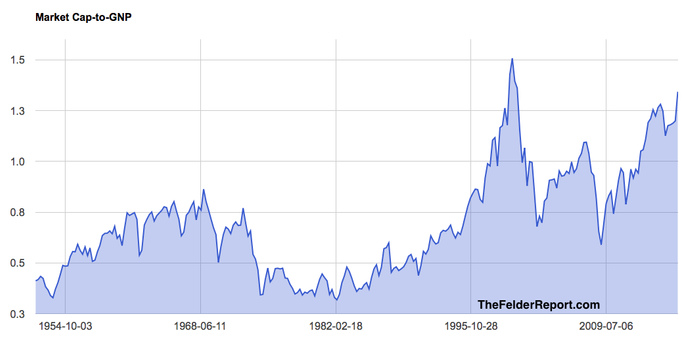

Jessie Felder picked up on this fear in his blog last week. He even provided the quote from the Oracle in describing what is now known as the “Buffett Indicator” (Market Cap / GDP ratio).

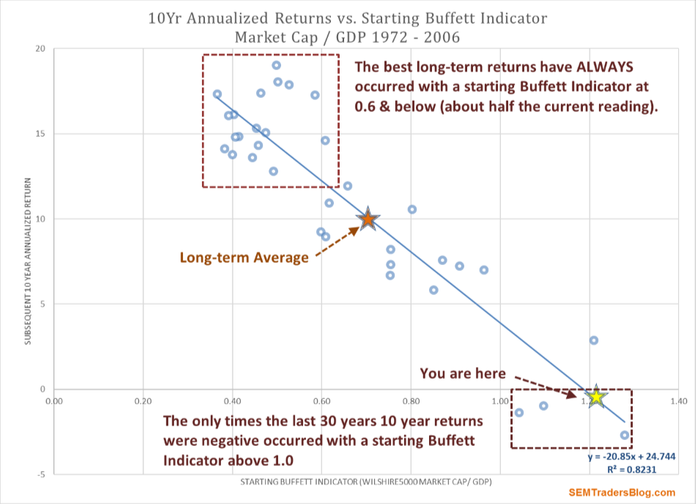

On a macro basis, quantification doesn’t have to be complicated at all. Below is a chart, starting almost 80 years ago and really quite fundamental in what it says. The chart shows the market value of all publicly traded securities as a percentage of the country’s business–that is, as a percentage of GNP. The ratio has certain limitations in telling you what you need to know. Still, it is probably the best single measure of where valuations stand at any given moment. And as you can see, nearly two years ago the ratio rose to an unprecedented level. That should have been a very strong warning signal.

As I have said for quite some time, the fact the market is overvalued is not a sell signal by itself. In fact, if we’ve learned anything it’s the market can stay overvalued far longer than anybody believes it can. The best thing we can do is to stay diligent and not “jump the shark” on our risk management strategies that have kept us around for the last 25 years.

Tuesday, March 7

Stocks have hit a bit of rough ground following the testimony on Friday by Fed Chair Janet Yellen that hinted a March rate hike is likely. Honestly, if the economy or the market cannot handle a 1/4% increase in SHORT-TERM rates investors have no business investing any long-term money in stocks at this point. Of course, investors are not thinking very rationally right now. Like Warren Buffett they seem to have forgotten the past and are throwing out longer-term valuation metrics in favor of just chasing whatever is going higher because the “story” sounds good. (In this case the “story” is the return of the Reagan years with tax cuts, lower regulation, and rampant government spending.)

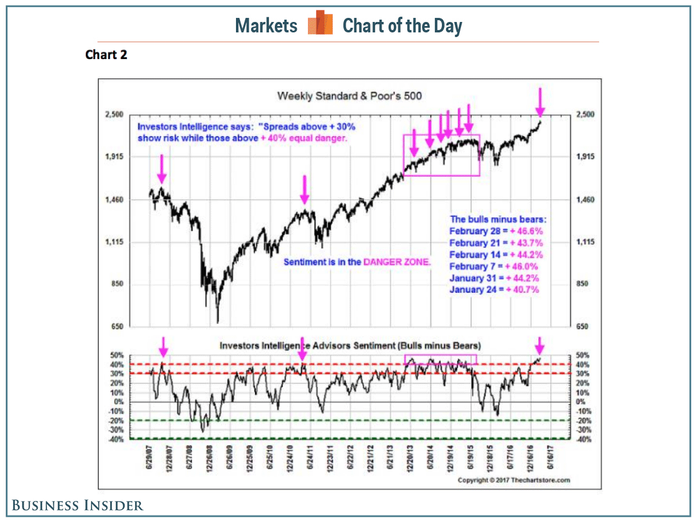

Jeff Saut from Raymond James indicated investors have put the market in the “danger zone” with their overwhelming bullishness. A well functioning market needs buyers beneath it to step in to prevent large corrections. When you have too many people already in the market that doesn’t leave much support underneath.

Again, a sentiment reading such as this is not an imminent sell signal. Investors can still get even more bullish. What it does signal is continued “danger” for those abandoning risk management strategies in favor of lower cost investments that have done better recently.

Wednesday, March 8

The market did something it hasn’t done since January — went down two days in a row. That’s how resilient stocks have been, but a resilient market should not embolden investors. The problem for money managers such as SEM is individual investors only look at the returns stocks are generating, not the underlying risk. This means if as a manager you focus too much on risk management you risk losing all your clients. This is the third time in my 18 year career I’ve seen in happen.

David Tepper, who has also been around through some euphoric times in the market when risk management was looked down upon understands this pull. The famous Appaloosa hedge fund manager told CNBC this morning, “stocks are by no means cheap, but it’s too dangerous to short them right now.”

So what are we left with? Dancing on the needle, trying to keep our investors from abandoning risk management at the same time not wanting to lose focus and get eaten by the “shark” that awaits.

Thursday, March 9

We started the week with a quote from Warren Buffett circa 2001, which led to the creation of the “Buffett Indicator”. As mentioned on Monday, the “Oracle” seems more concerned about his legacy and the impact he could have on markets if he were to say stocks were overvalued. Even somebody seemingly as rational as Warren Buffett is human and prone to his own behavioral biases.

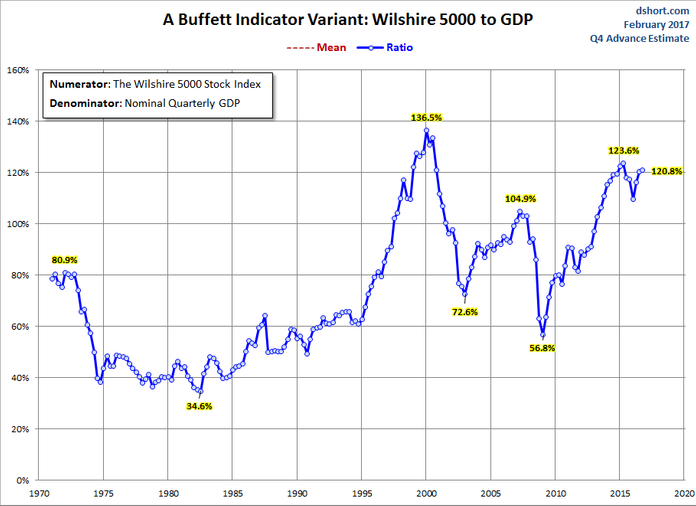

In my seminars I tell attendees the best way to overcome your own personal biases is with DATA. The DATA clearly shows we are in a bubble. The Buffett indicator is off its high, but is still at levels only experienced during past market bubbles.

For tactical (and dynamic) managers like SEM, this is not as big of an issue. Our investment programs are designed to move to more defensive investments when the market runs into trouble. For investors in a buy & hold strategy or using managers that are tied directly to the gains (and losses) of the market, this chart should be a warning to watch your asset allocation carefully.

For those of you unfamiliar with the chart above, it shows the 10 year annualized returns based on the Buffett Indicator. In other words, for those people starting at a Buffett Indicator this high, the expected returns for the next 10 years are NEGATIVE!

The irony of Warren Buffett ignoring his own indicator to preserve his legacy should not be lost. Investors always remember the thing you did most recently. If we go into a bear market and Mr. Buffett was bullish that could be the last thing we remember about him.

Bubble or not, we are not “jumping the shark” and moving money into the market just because it’s going up and our clients are demanding “higher returns”.

Friday, March 10

Sticking to the focus of the week — VALUATIONS and not letting our emotions cloud our analysis, check out our CHART OF THE WEEK.

SEM is certainly not “jumping the Shark”. We received a partial high yield bond sell signal yesterday, cutting our high yield exposure between 25-33% depending on the funds we own. (As a reminder, our buy signals are based on the index, the sells on the specific holdings, so if a fund is holding up better than the index we may not sell it right away, if at all.)

Using DATA is the only way to overcome the emotions that are inevitable in a market such as this.