We've been programmed to believe the Fed is all-knowing and has the ability to control the financial markets. This idea has brought a perception of "stability" and added to investors' appetite for risk. If you believe the Fed will be there to save the day, you will take on more risk than you normally would be comfortable with. An article in the Wall Street Journal on Friday hinting the Fed may not be as aggressive with their December rate hikes along with comments over the weekend from other Fed members about needing to reassess the economic impact of the Fed's rate hikes has led to a sense of optimism that the worst is over for the stock market.

To that I say, don't be fooled.

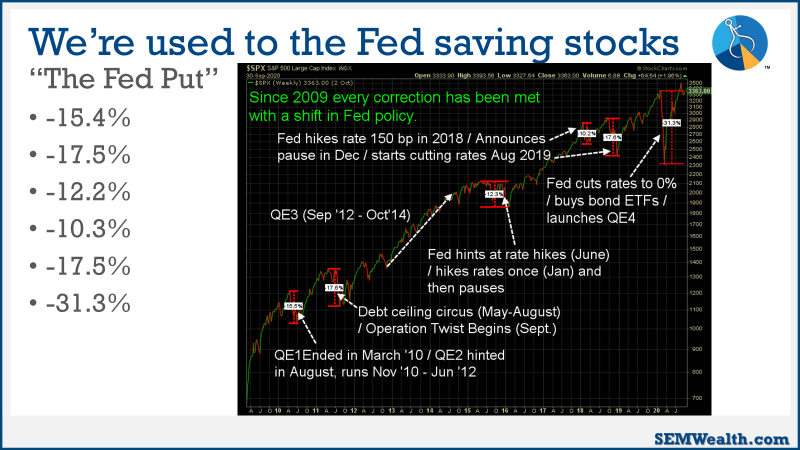

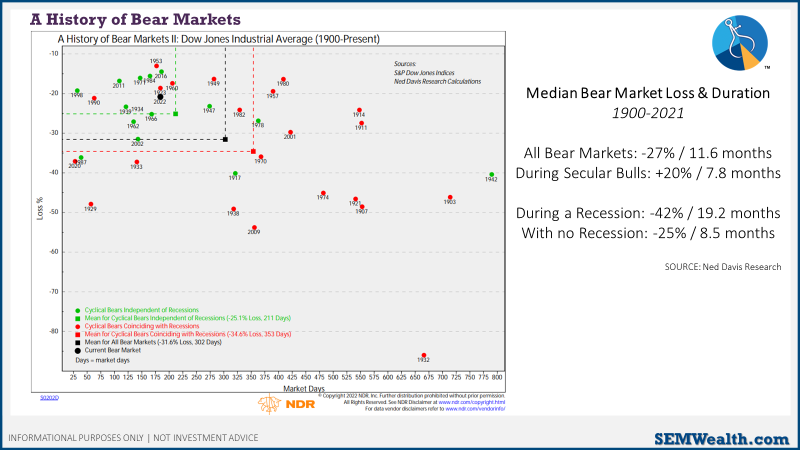

I continue to show this chart any time I talk about bear markets. This is what most people remember. Since 2009, anytime the market dropped 10% we saw the Fed reverse course with their tightening policies.

What people forget is during that time we had stubbornly low inflation (the Fed was targeting 2-3% and failed to even get it up to 2%) as well as an economic expansion. When our $20+ trillion economy enters a correction cycle (which usually leads to a recession), nothing the Fed does can stop it. Here are the charts that are most important.

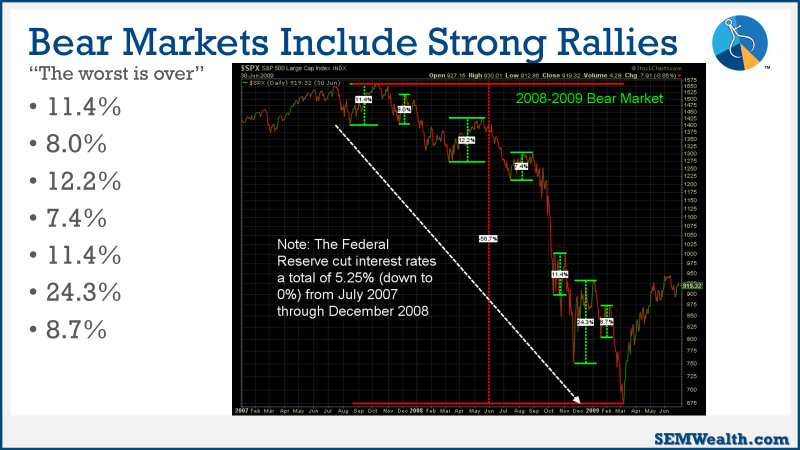

The Fed was literally pulling out all of the stops in 2000-2002 and 2008-2009 to save the economy (and stock market). They failed miserably.

Don't be fooled by this rally.

The Fed is not the reason stocks are going down.

In our "Navigating the Bear" update in September I reminded everyone of the real reason stocks are going down (and will continue to drop until they wash out the excesses of the last bubble.

- Inflation will continue to be a problem – it may have "peaked", but higher inflation may be entrenched in the economy over the next year

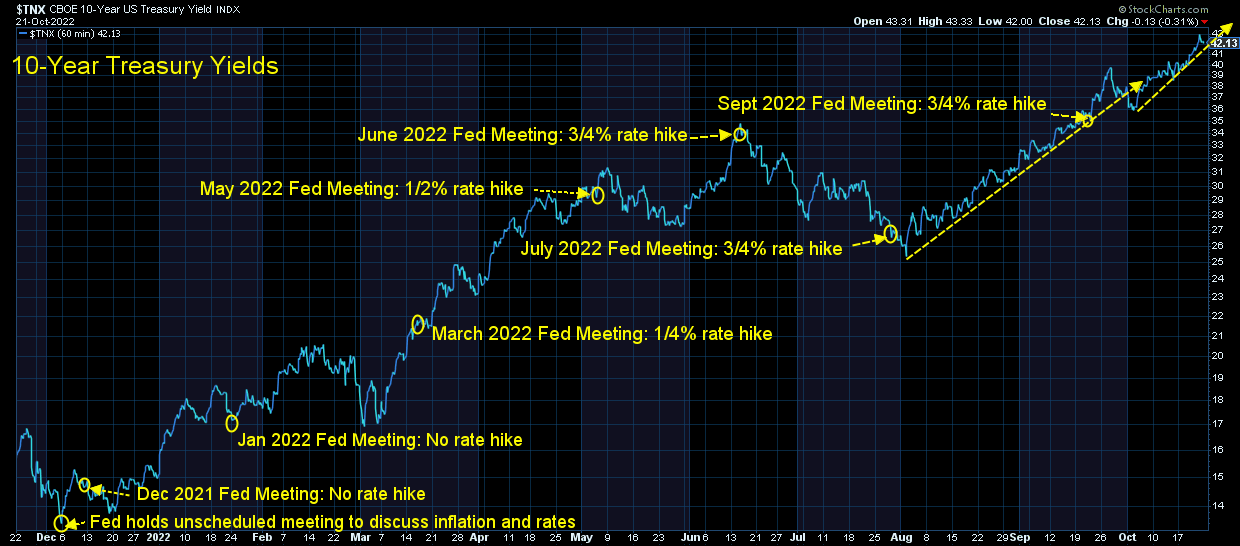

- The Federal Reserve has barely begun fighting inflation (and has told us they will continue to fight)

- Both of the above will hurt the economy

- This also means corporate earnings will be hurt

- Stocks remain overvalued – they started the year overvalued and with the drop in earnings may be even more overvalued despite the losses in the market

Don't be fooled by this rally.

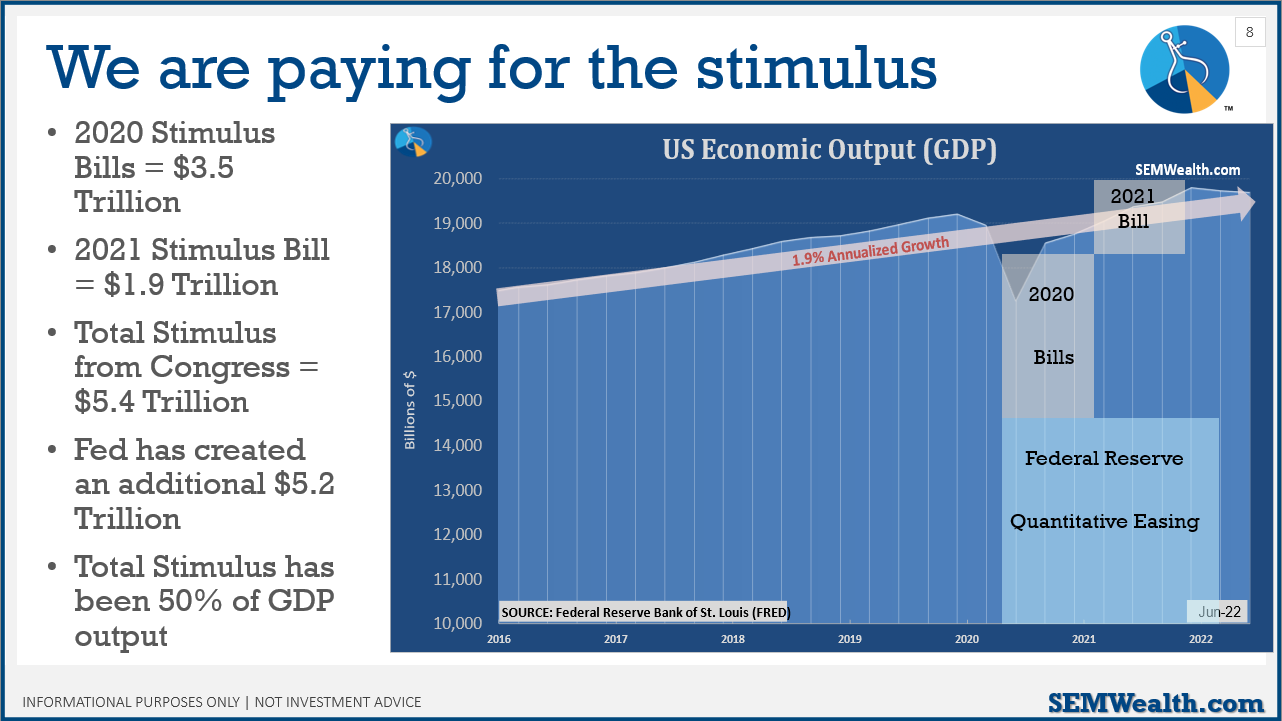

Our economy was breaking before COVID. The massive stimulus may have "saved" the economy, but it actually created even bigger problems which we are now dealing with. I showed this chart during our "Surviving the Bear" webinar last week.

Don't be fooled by this rally.

Despite massive stimulus and easy Fed policies over the past 7 years, our economy has only grown by 2% annually. "Normal" growth is 3%. Has anybody bothered to ask how we failed to grow at 3%?

Don't be fooled by this rally.

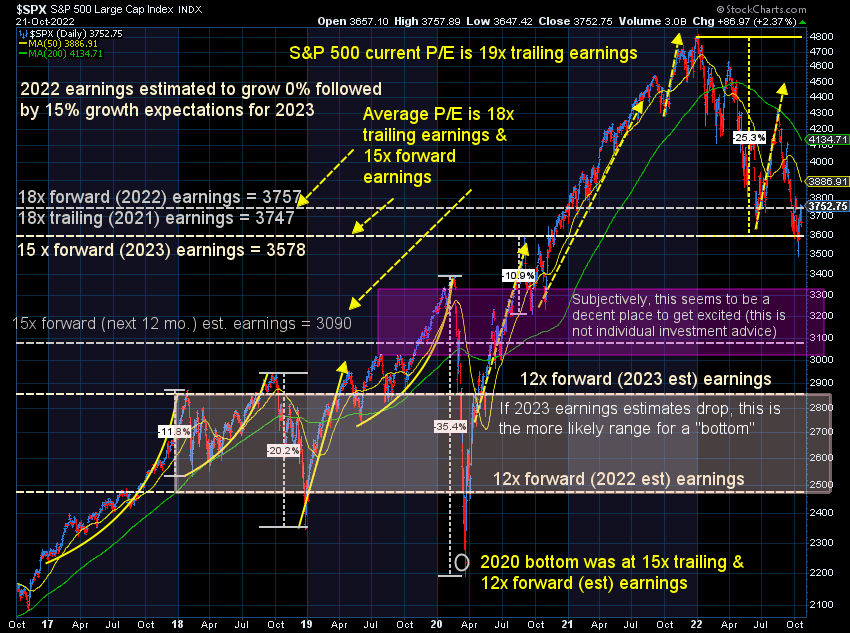

Earnings are just now starting to take a hit. Stocks have yet to get down to a "normal" P/E ratio let alone a bear market P/E ratio. If you're buying stocks today you are betting the bear market is over, we won't have a recession, and stocks should be trading at above average multiples.

Don't be fooled by this rally.

The data says we are heading into a recessionary bear market. We are only about 2/3 of the way through the average recessionary bear market in terms of both loss and time. The last 1/3 is always the scariest.

Don't be fooled by this rally.

Interest rates are up significantly, which will be a drag on earnings growth, economic growth, and government spending.

Don't be fooled by this rally.

Stocks do not go straight down. Bear markets see big drops, an attempt at a "bottom", an enthusiastic relief rally which makes everyone believe the worst is over, before economic realities set in (stocks are overpriced because earnings are going to be less than everyone thought.) We hit a point where you'd expect a rally.

Don't be fooled by this rally.

Throughout time the one thing that has not changed in financial markets is the natural human reactions which drive prices higher and lower. During the last bear market rally I used identical boxes to show how the reactions were very similar to the previous bear market rally. Here is an update.

Those boxes are the exact same size. Let the rally play out. I could see a case where we actually go even higher and longer. We're past the seasonally weakest part of the year. Stocks are at historic losses on a year-to-date basis. Bearish sentiment is near all-time highs. We SHOULD rally, but.......

Don't be fooled by this rally.

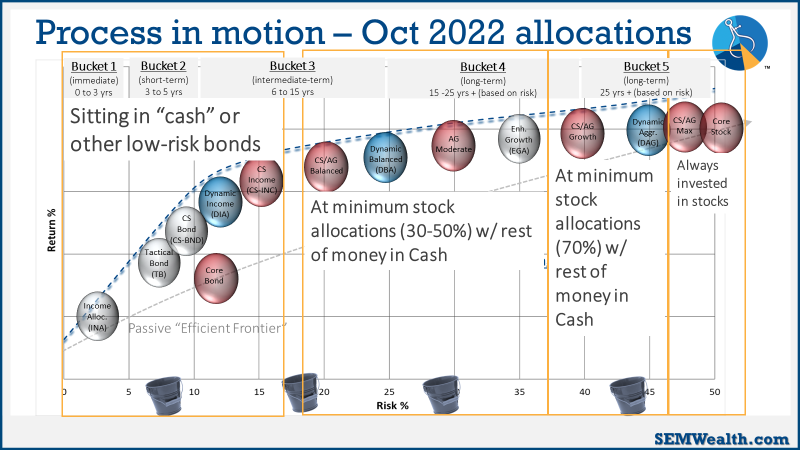

Until the data says otherwise, we are in a bear market. For over 30 years our data-driven quantitative approach has served to keep our emotions in check and provide a consistent, steady approach. This chart illustrates all of the moves we've made over the past year. No model is perfect, but it shows how we have a plan. There are no opinions, just data based on market history and robust testing.

More importantly, our "bucket" strategy means the lowest risk portions of our clients' portfolios is very defensively invested, which allows for our longer-term buckets to endure some of the pain in the stock market. Note even those strategies took money off the table so we haven't had to deal with the full brunt of the bear market. This also means we have money to redeploy when the DATA says the bear market is over.

Don't be fooled by this rally.

Let it play out. If you have too much risk in your portfolio, this could be a great opportunity to "right-size" your risk level. If you aren't sure, you can use our risk questionnaire to get a second opinion.