Why do we even bother listening to the Federal Reserve? Even if we ignore all of their failings in the late 1990s and again before, during, and after the financial crisis, let's look at how terrible the Fed has been at predicting the post-COVID economy.

Throughout 2021, the Fed told us inflation would be "transitory". Despite clear evidence spending was heating up in the spring of 2021 as the third and final round of stimulus checks hit, the Fed continued to keep interest rates at 0% and continued creating new money to purchase bonds from the Wall Street bank. Trust us, they said, we don't think inflation is a problem and we are here to make sure the economy keeps roaring along. Inflation in April 2021 was already up to 4.1%.

This belief that the Fed would stay easier for longer led to what I called a "stupid" rally for stocks in the 4th quarter. With all of the easy money floating around stocks who had no reason to still be in business were going up 100-400% in a month. The market indexes went parabolic and everyone on Wall Street told us 2022 was going to be another great year. Inflation at the end of 2021 was up to 7.1%.

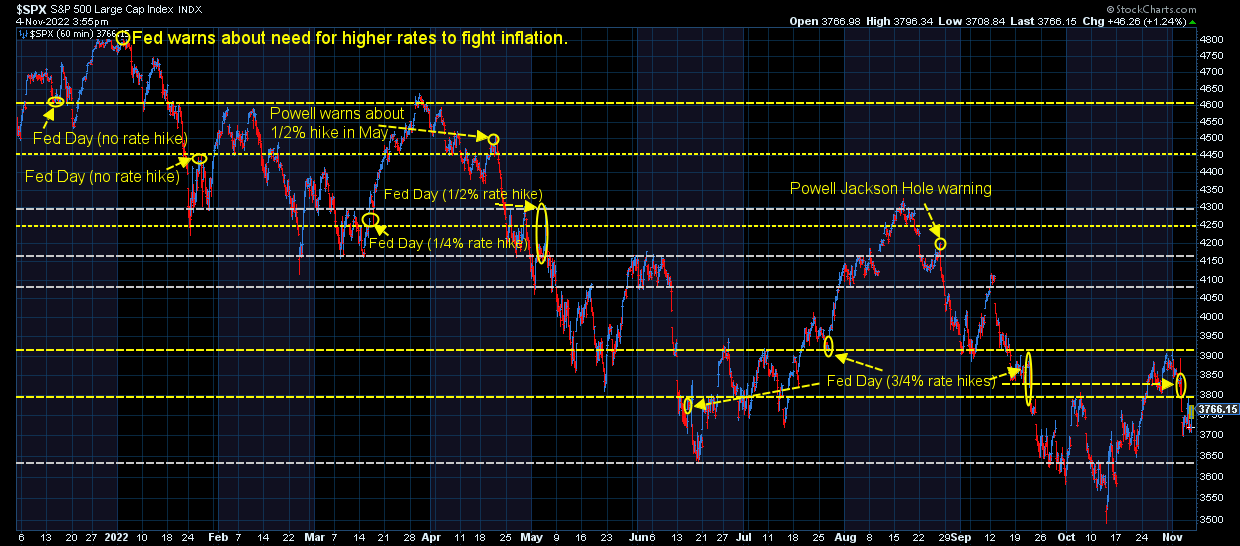

Fast forward to the second workday of 2022 when the Fed warned they may have to start raising interest rates at some point. They then waited nearly 3 months before raising interest rates......from 0 to 0.25%. Inflation at the time was now 8.6%.

Then in mid-April, Chair Jerome Powell warned about needing to raise rates by 1/2% in May, which he followed through with. Inflation had "slowed" from 8.6% to 8.5% by that time.

During the press conference Chair Powell said a 75 basis point (3/4% hike) would not be necessary as they believed inflation would come down fairly quickly. Instead, inflation jumped to 9% in June and the Fed was forced to raise rates by 3/4%.

"Don't worry," the Fed hinted, this would probably be the only "big" hike. Instead they have hiked by 3/4% three more times. Inflation remains stubbornly high at 8.2% in September.

How bad has the Fed been at predicting their own policies? In March the "terminal rate" (the rate they believed they would be at when the tightening cycle was over) was just over 3%. By June it was up to 4%. Six weeks ago it was 4.5%. Now it is around 5.25%.

We need to remember two things (which we've warned about for quite some time):

1.) The Federal Reserve has little ability to forecast the economy, meaning they will stimulate for too long (creating a bubble), and then be forced to tighten for too long (bursting the bubble).

2.) The Federal Reserve CANNOT save the market.

That last point is important. Even if the Fed were to reverse course and stop raising rates today we'd still be heading into a recession. The Fed along with $5 Trillion of stimulus from Congress (funded by the Fed's QE purchases, which doubled the amount of money in circulation) helped fuel a speculative bubble which literally broke our economy. The supply chain couldn't handle it, prices on goods and services went crazy, and low interest rate financing helped people "afford" the higher prices.

I receive over 200 "research" emails a day. Here is one I received this morning from Stansberry Research which highlights the problem with focusing on what the Fed is doing.

The rally since mid-October was based on rumors the Fed would announce a slowdown in their rate hike cycle. Instead, we learned last week the Fed will be raising rates higher and longer than previously thought yet the various voting members will continue to send mixed signals.

The Fed has been dead wrong on inflation. Why would you trust them to fix the economy?

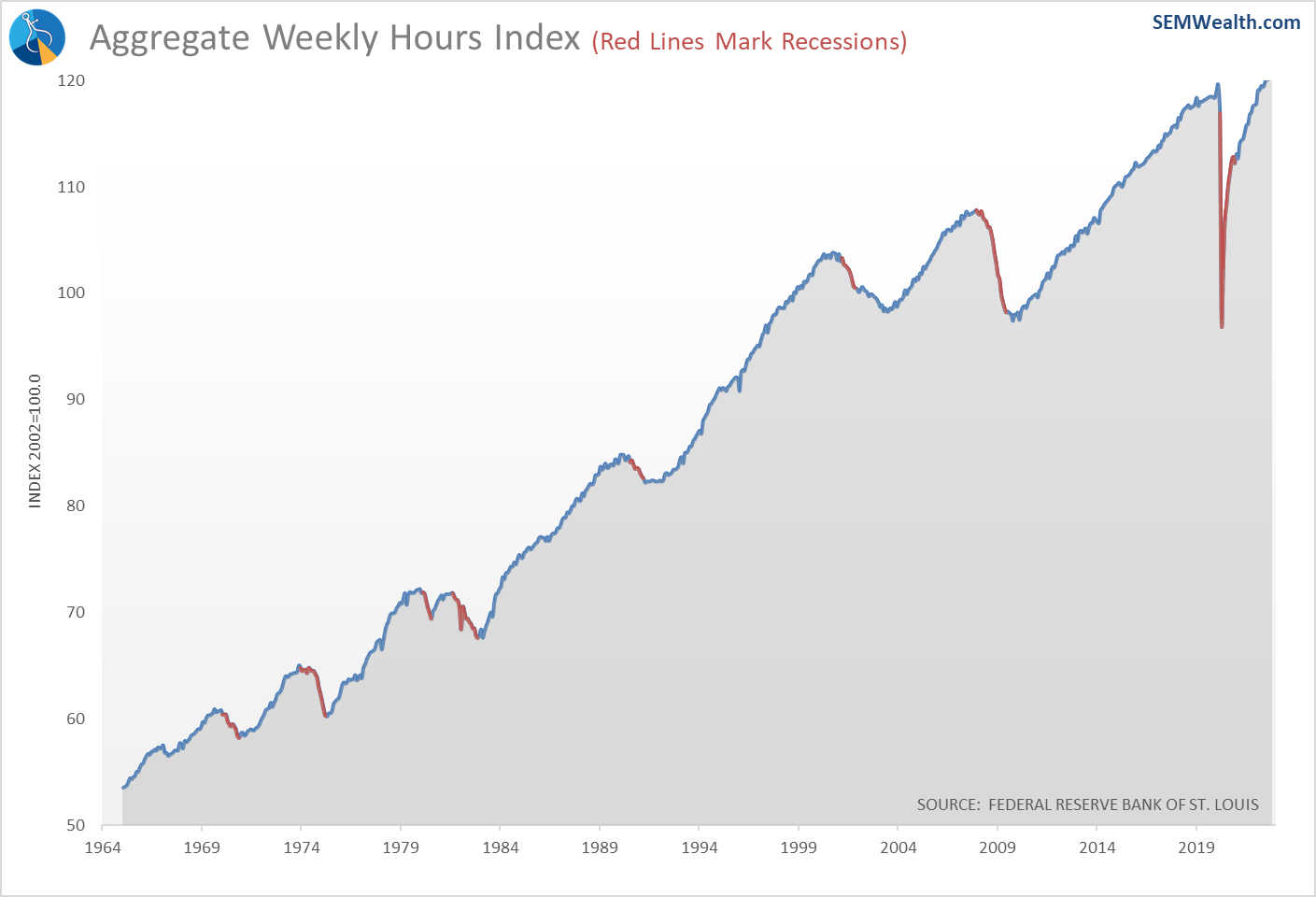

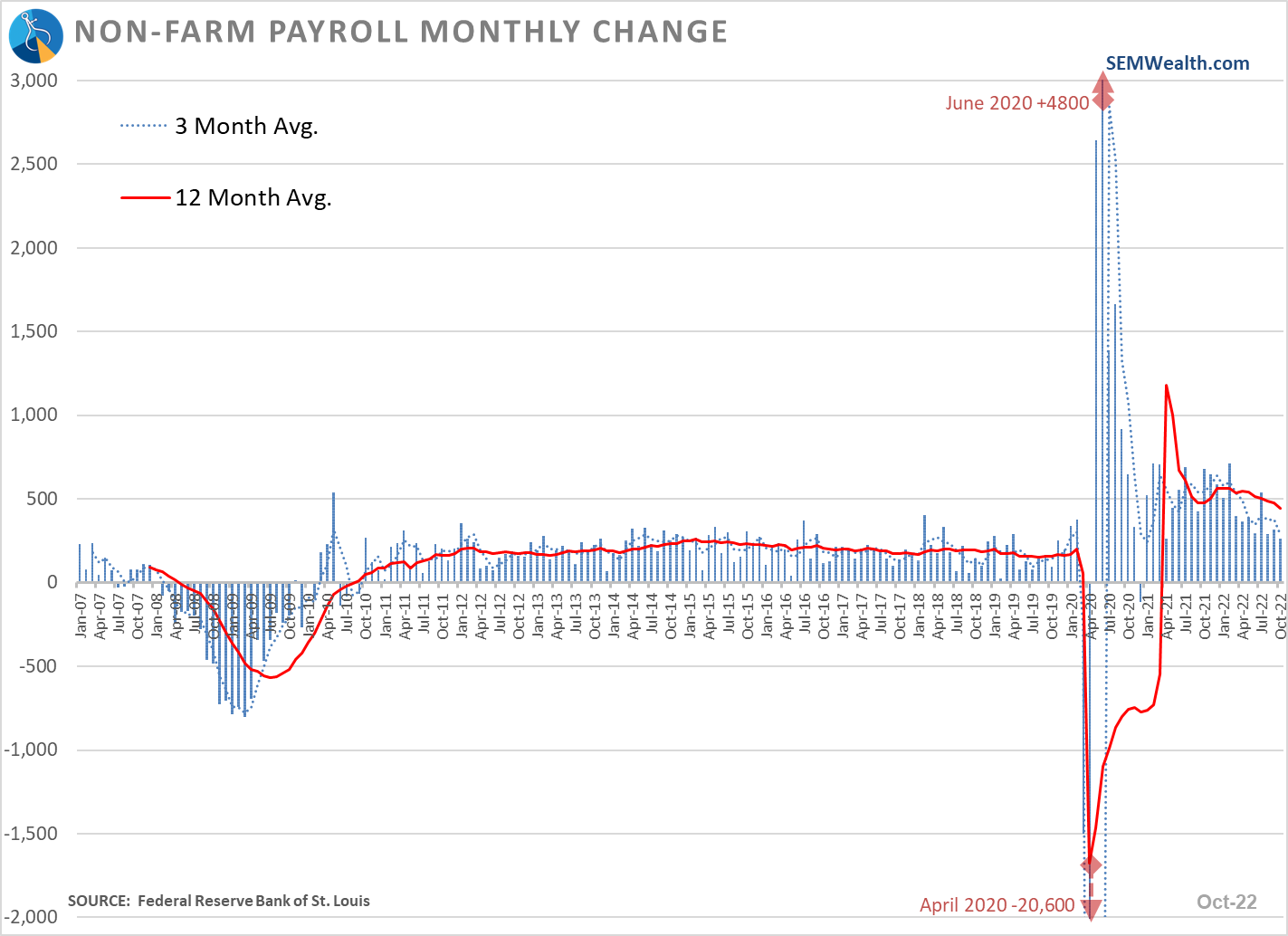

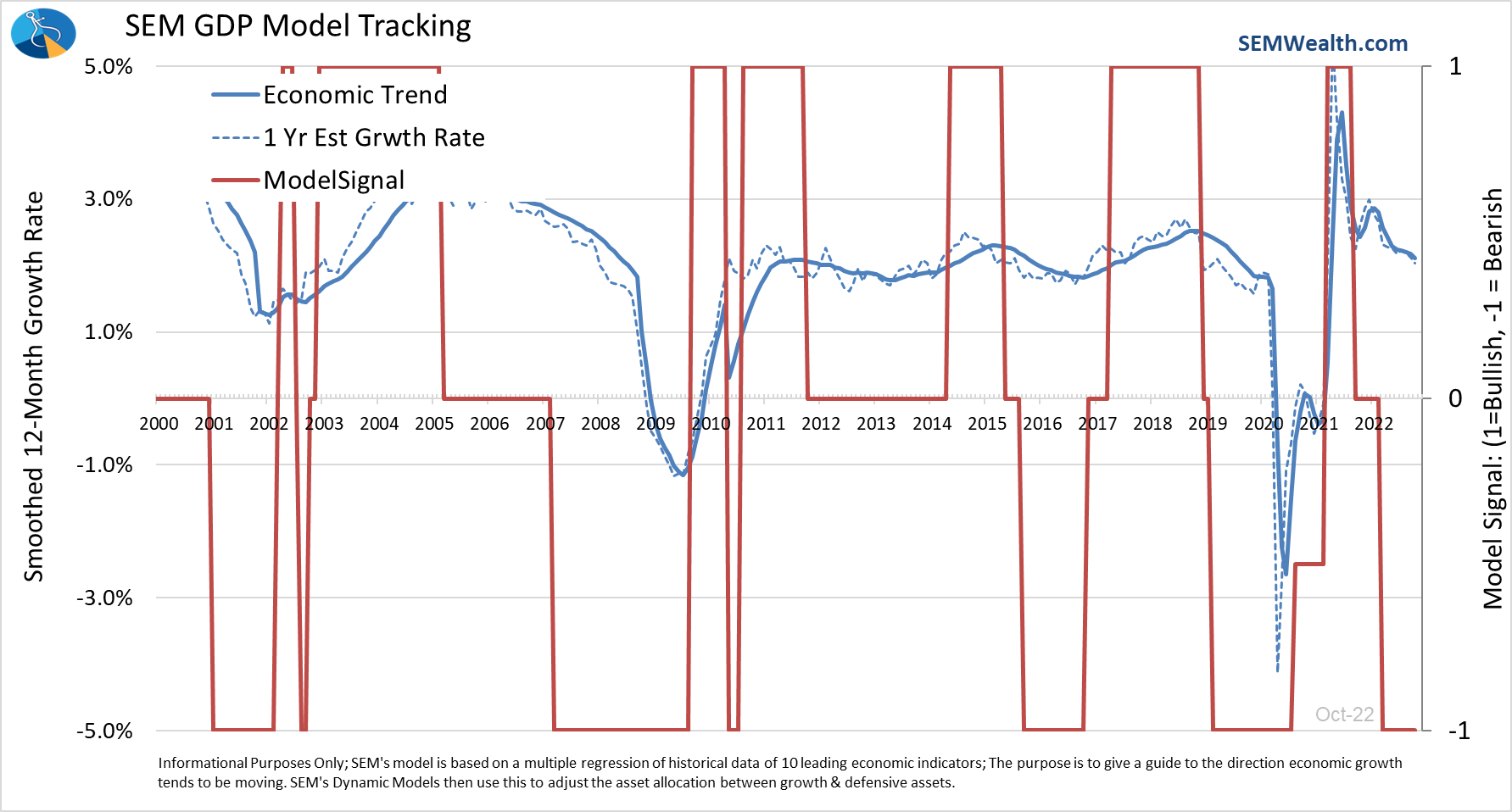

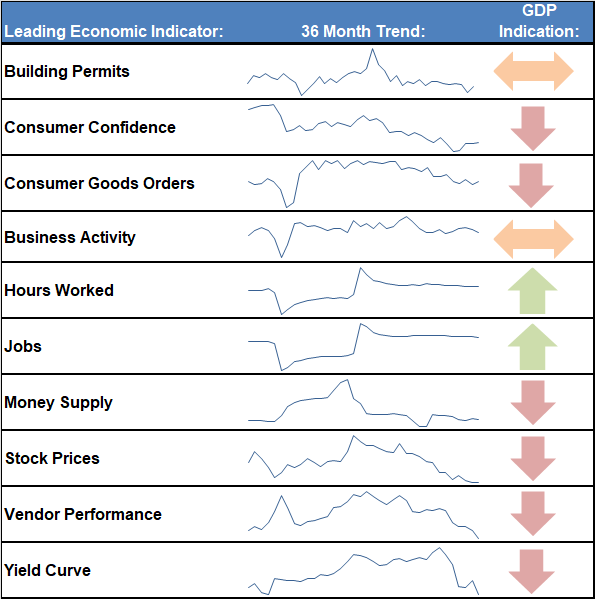

Turning to the economy, we received the last few pieces of data for our economic model last week. As you may recall there has been two areas in our leading indicators still strong – hours worked and jobs. Those areas continued chugging along in October.

The pace of growth in the number of jobs has leveled off, but it is still impressive. This will continue to create inflationary pressure for the Fed, which explains the tug-of-war in stocks on Friday. On the positive side, as long as jobs are increasing, we won't see a recession. On the negative side the strong job market means those who have extra money will keep spending, which will keep the inflationary pressures up, which means more rate hikes from the Fed.

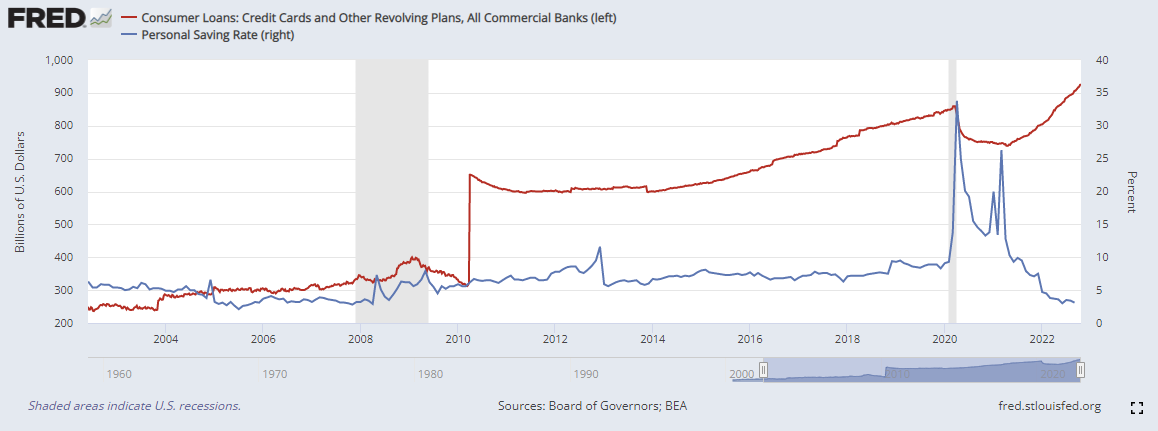

One of our advisors (thanks Isaac) sent me this chart last week. It plots the amount of credit card debt along with the savings rate. Ironically, the drop in credit card debt ended when the last round of stimulus checks went out. Since then consumers have dipped into their savings. The savings rate is at its lowest level since just before the financial crisis. This is not a sign of a healthy economy.

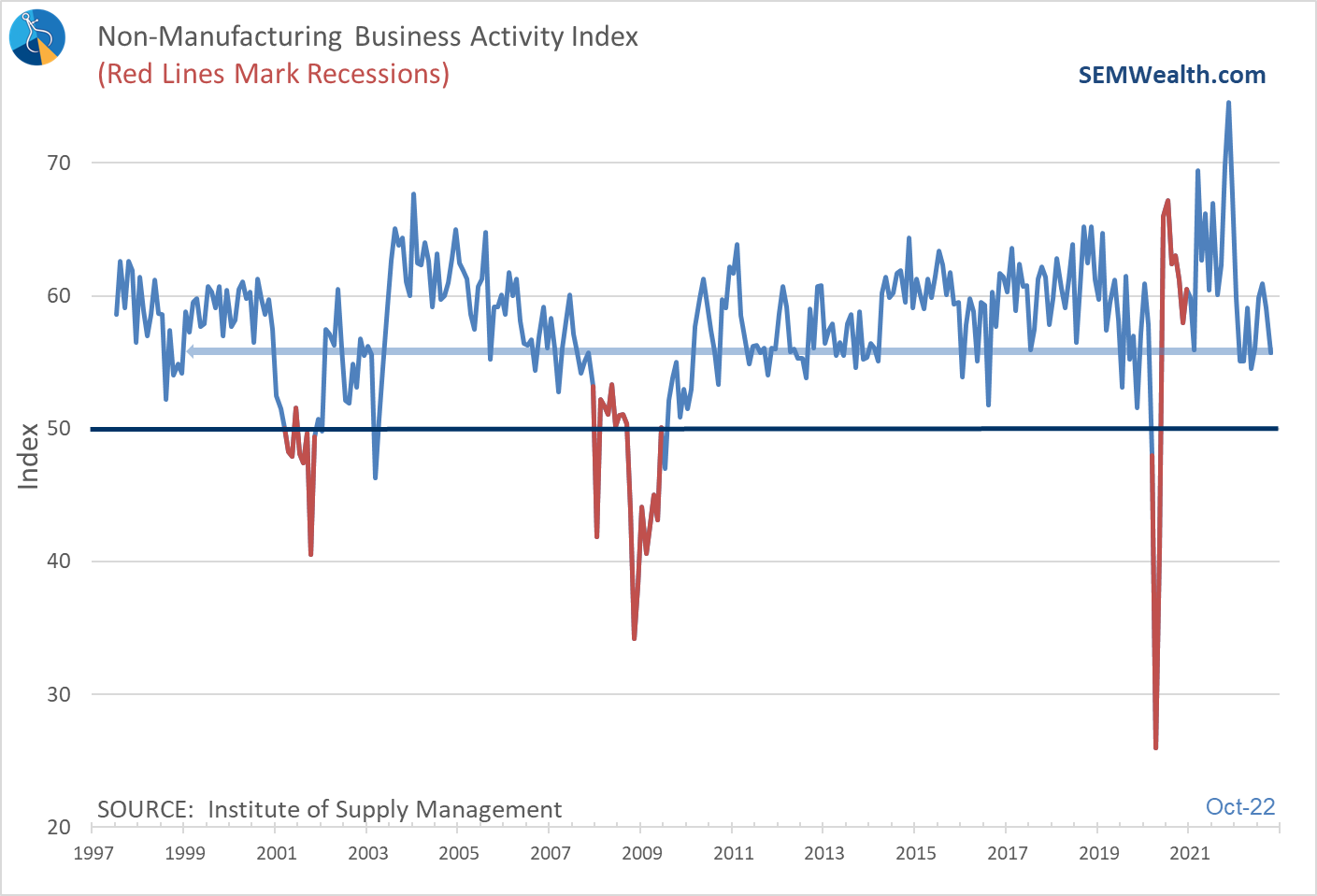

Looking at other components of our model, the underlying economy continues to weaken. The Service Sector Activity Index, which is a core driver of growth declined again last month and is teetering closer to recessionary levels.

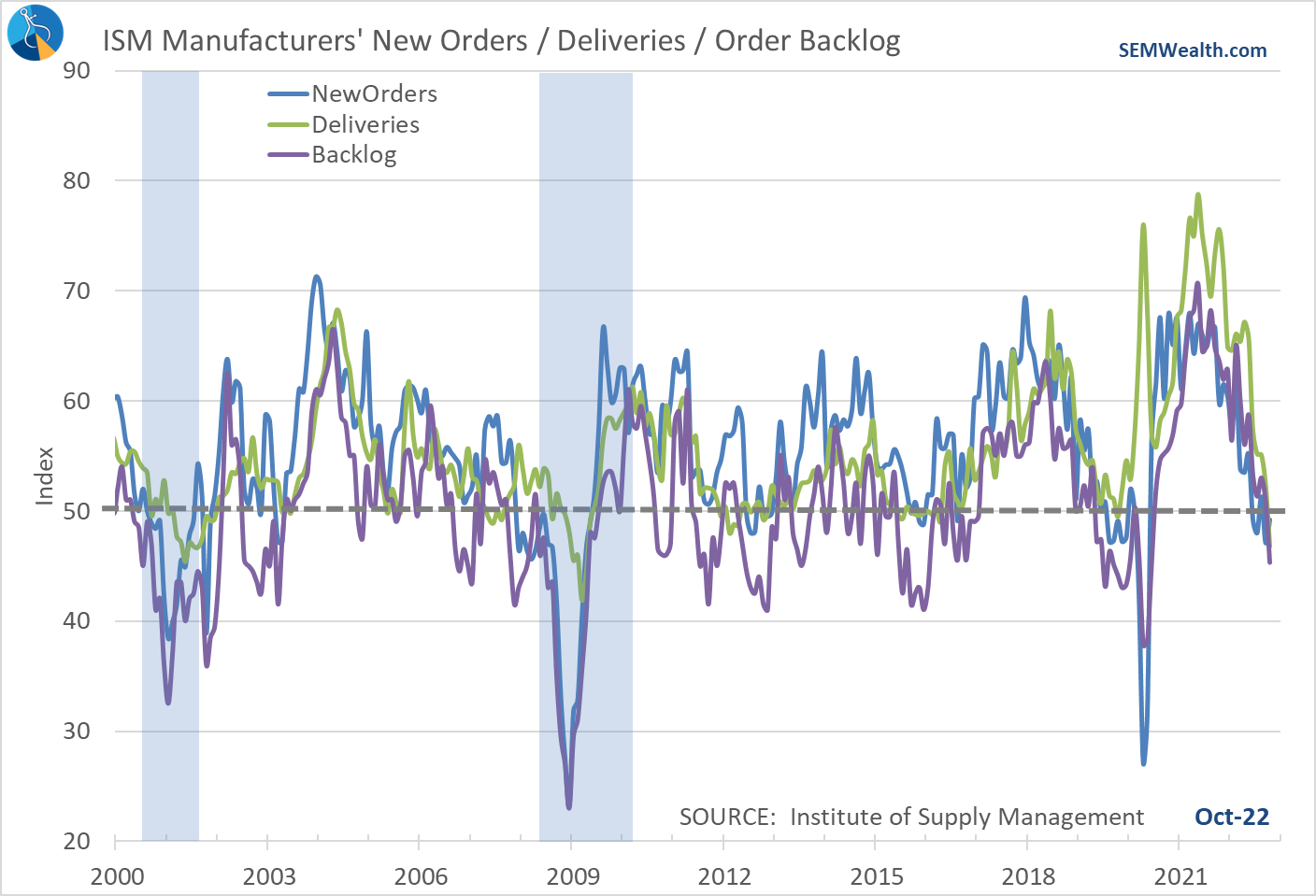

The manufacturing sector appears to already be near a recession. The key sub-components of the ISM index all are indicating a recession (below 50).

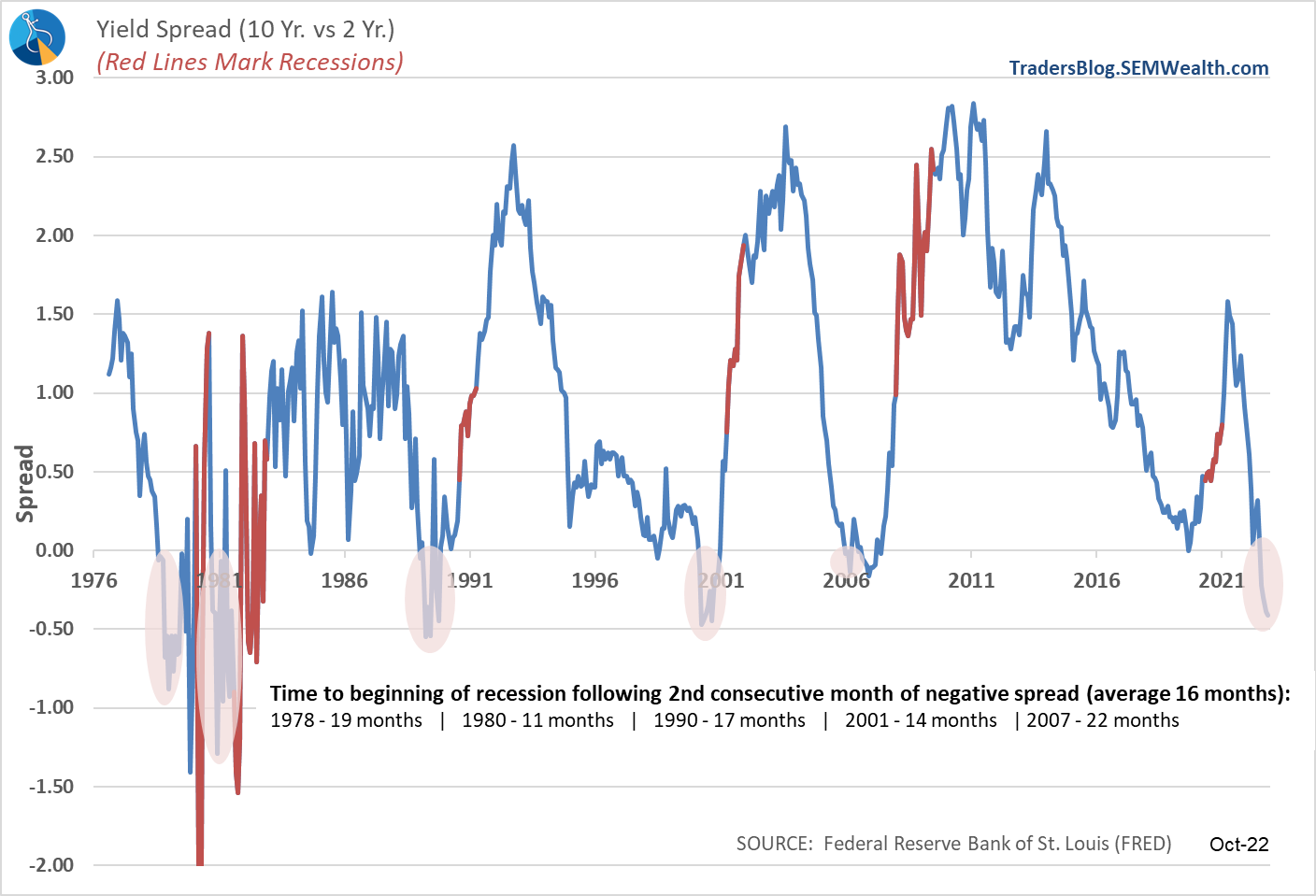

The bond market continues to give very strong recessionary signals. The spread between the 10-year and 2-year Treasury yields continues to be in negative territory.

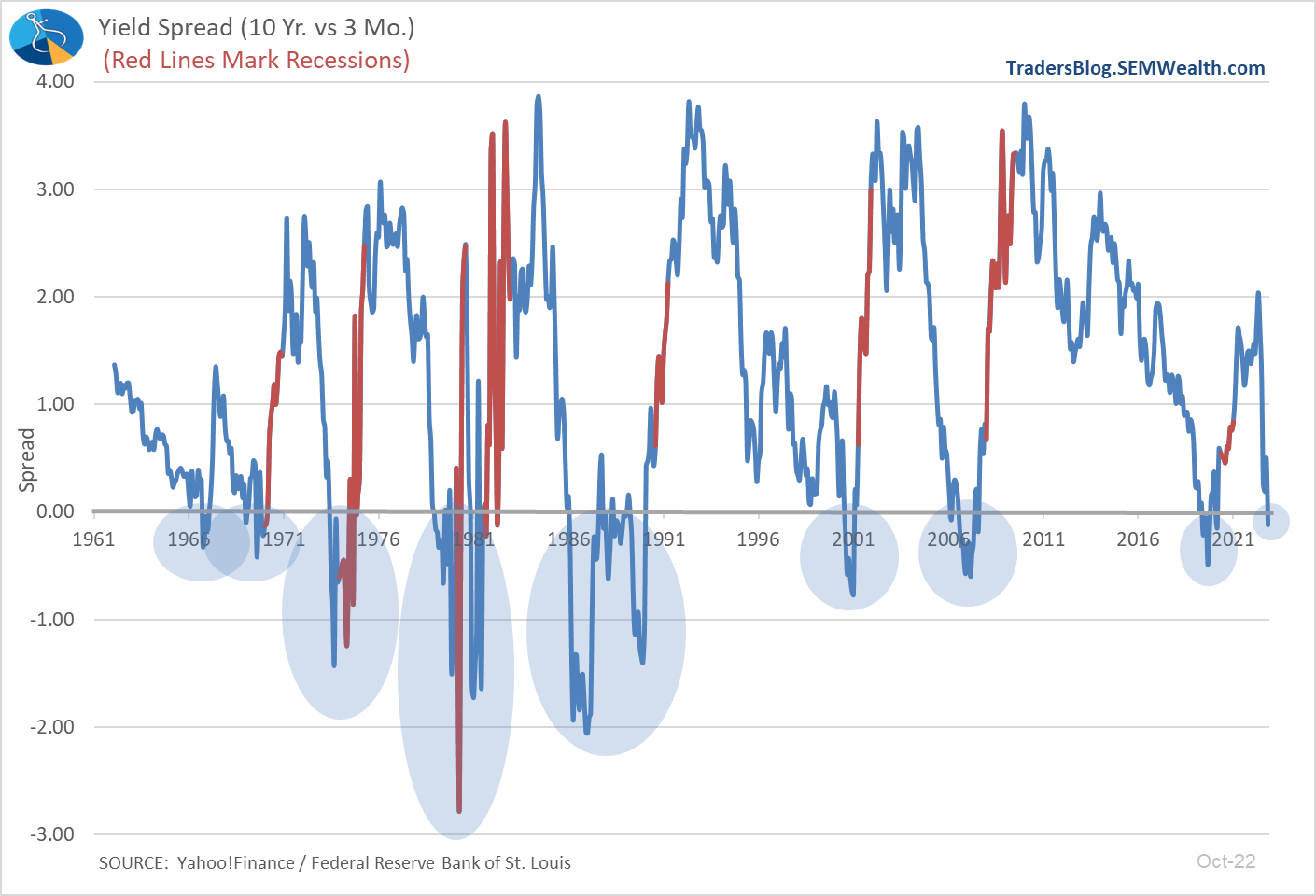

Last month even the 3-month yield went above the 10-year yield. These two combined have a very strong track record of preceding a recession (by 9-16 months). Borrowers are demanding higher and higher yields to be compensated for short-term risk. This will put a crimp in businesses who need to borrow money to pay their bills.

This means no change in our model, which went bearish on the economy in April of this year.

Overall, our dashboard looks like this:

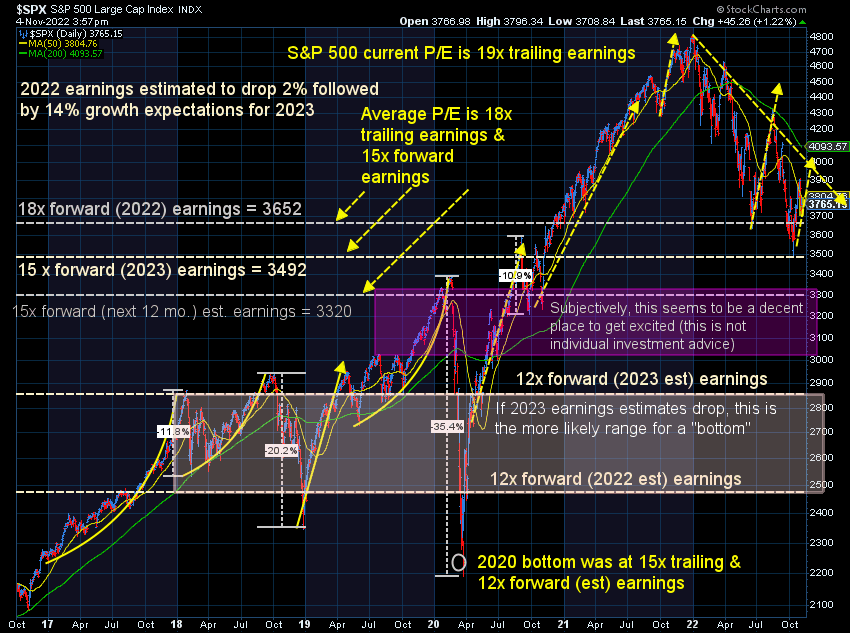

This hardly looks like an environment where corporate earnings are set to grow 13% in the next year which is the current estimate for the S&P 500. It also hardly looks like an environment where stocks should be trading at 18x earnings, which is the median P/E going back to 1990. Recessionary bear markets typically see a 10% drop in earnings and a P/E of around 12-15. That would put stocks down to the 2700-3000 level (20-28% DOWN from Friday's close).

We are in a seasonally strong part of the year, especially following a mid-term election, so we could see stocks stage a rally despite the incompetence of the Fed. Do not be fooled. Until the data says otherwise, we are in a bear market and should plan accordingly.

At SEM we follow a data-driven approach, which removes emotions and guesswork from the decision-making process. We raised a lot of cash across our models and are ready to put it to work. Last week we had some minor buy signals in one of our "trend" models inside of AmeriGuard and Cornerstone. As of this post, that signal is still hanging on, but could go back to cash if the market is not able to stabilize.

This is the key behind everything we do — when the data says to buy we buy. If it's the wrong call, we take our loss and wait for another opportunity.

Here's a look at the market charts I watch every day:

The "hope" rally took the market back to nearly the exact same level it was at during the last Fed meeting. The question is whether it will find some footing here or hit new lows.

As mentioned above, in the bigger scheme of things, stocks are still dramatically overvalued if we go into a recession.

Interest rates continue to be the biggest issue. It is making everything more expensive and is creating large disconnects beneath the surface. The uptrend was broken before the Fed meeting, but rates have climbed back up again.

I find it hard to believe there aren't some big "unmarked" losses on the books of pension plans, insurance companies, banks, and hedge funds. Private derivatives are not priced (marked) every day or even every month or quarter. When they are, we could see some more volatility in the markets as they scramble to cover their losses.

Follow us on Social Media

While the blog will continue to be the source for deeper dives into everything that is happening, we post a lot more short-form content to our social media channels. Some are funny, some are quick takes on that day's news, and some are answers to questions we've received. Regardless, if you're looking for some different financial content, make sure you are following us.

This week I plan on taking a lot about inflation, the Federal Reserve, the economy, and probably the election. Here's part 1 of me discussing who is to blame for inflation:

@finance_nerd Not one person is to blame for inflation. Heres what the data and common sense says caused inflation. #recession #inflation2022 #bidenfails #trumpfails #federalreserve ♬ original sound - finance_nerd