Humans typically struggle to think long-term. Our brains place a higher value on short-term stimulants which changes our behavior. As financial advisors we see the dangers of this thinking and try to provide data and roadmaps to incentivize our clients to think longer-term. It's a constant battle.

Politicians understand our human desire to avoid any sort of short-term pain. The House of Representatives is tasked with setting the budget for our country. Since they are elected every two years, this leads to most of their policies focusing on providing short-term 'benefits' no matter the long-term cost.

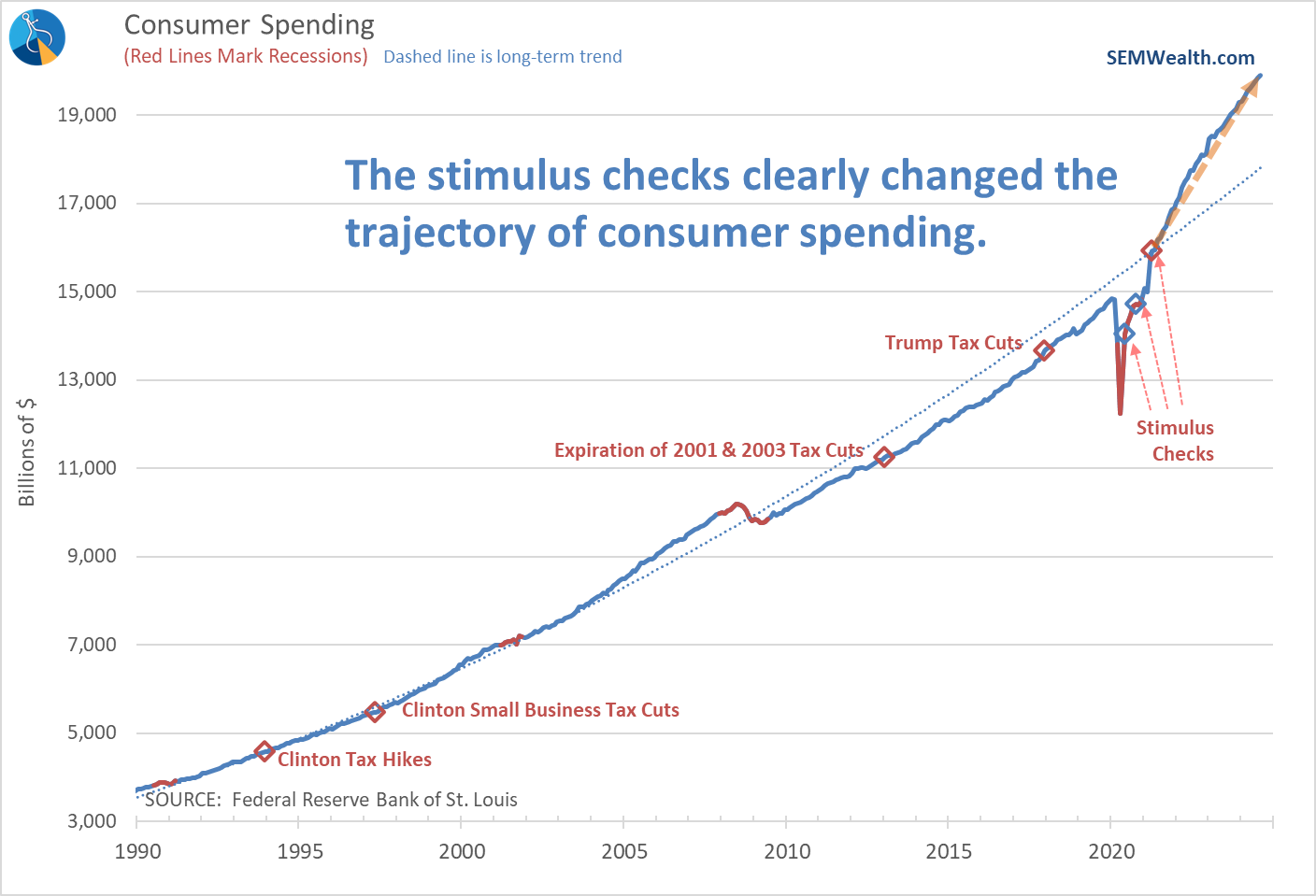

We saw a clear example of this short-sighted thinking during the pandemic with three rounds of stimulus checks being sent. These checks were sent to nearly everyone whether they had lost their source of income or not. This was despite the fact most of the economy was shut down meaning the things we spent our money on were not available. So not only did we have excess money from not being able to spend it, the government gave us even more money to spend.

Americans clearly spent it. This has completely shifted the spending curve higher and has kept the economy chugging a long at a pace not experienced over the last 20 years.

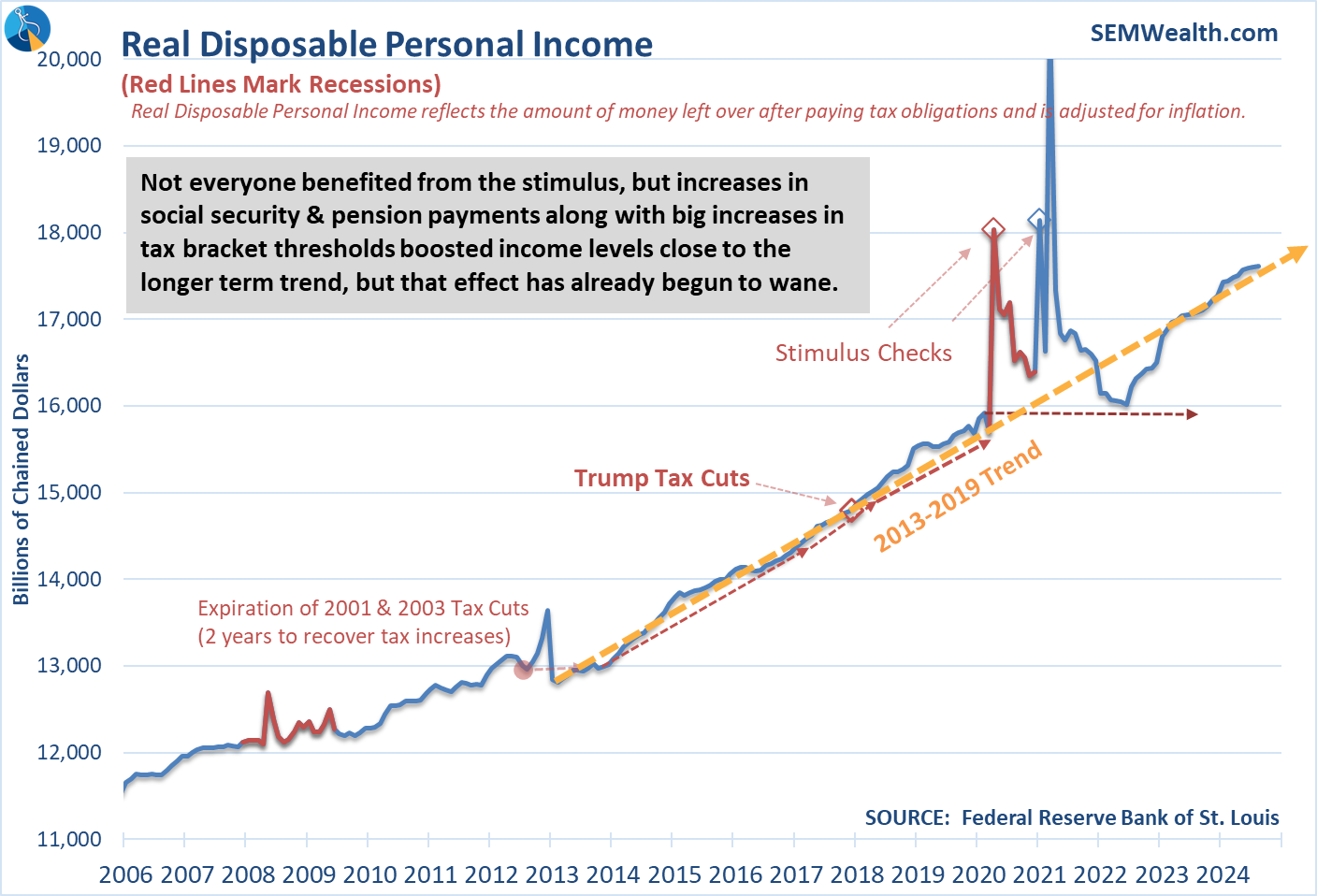

The problem is our income has not kept up with our appetite for spending. For now Americans appear to be spending the excess money they accumulated during the pandemic (overall).

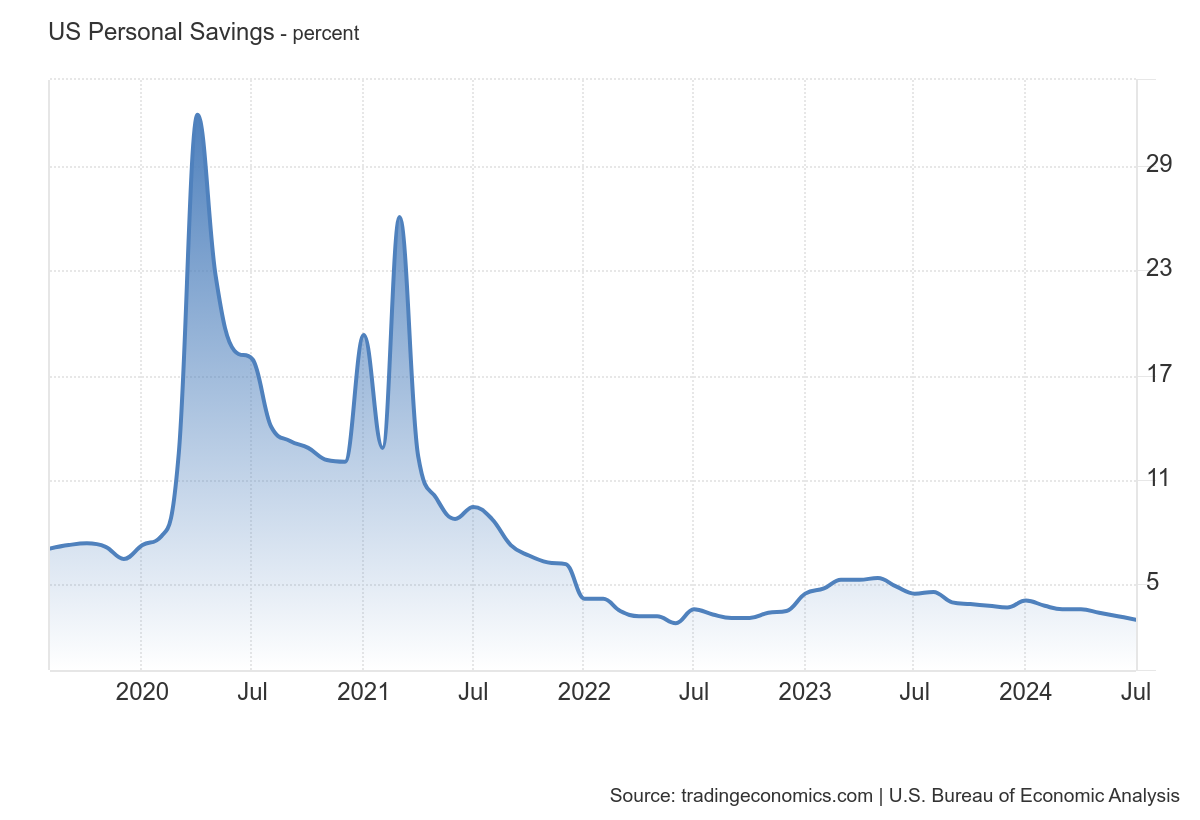

Overall the personal savings rate is still positive at 3%, but that is the lowest we've seen since April 2022. It is also approaching the 2% level last hit in late 2005 (as the housing bubble was nearing its end.)

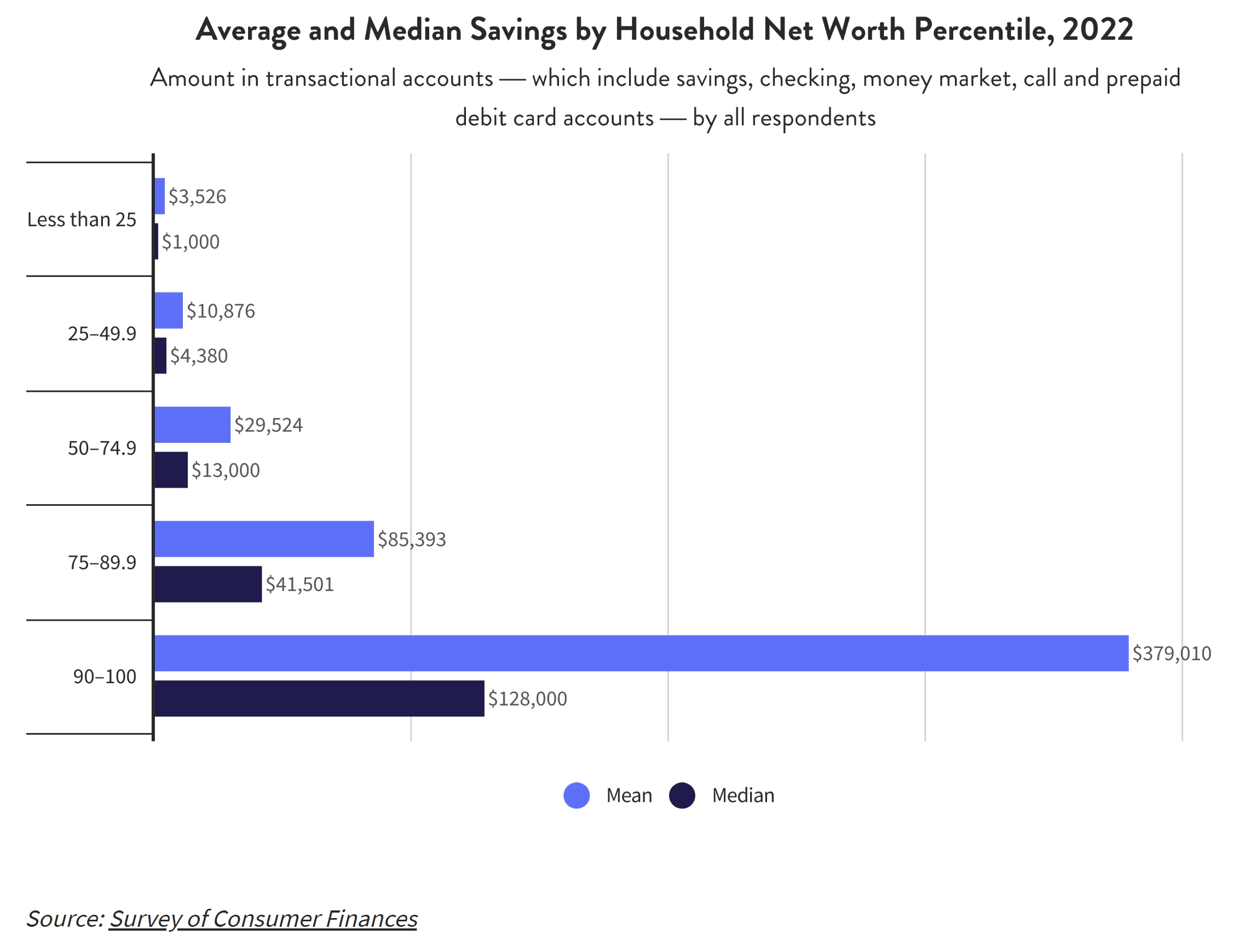

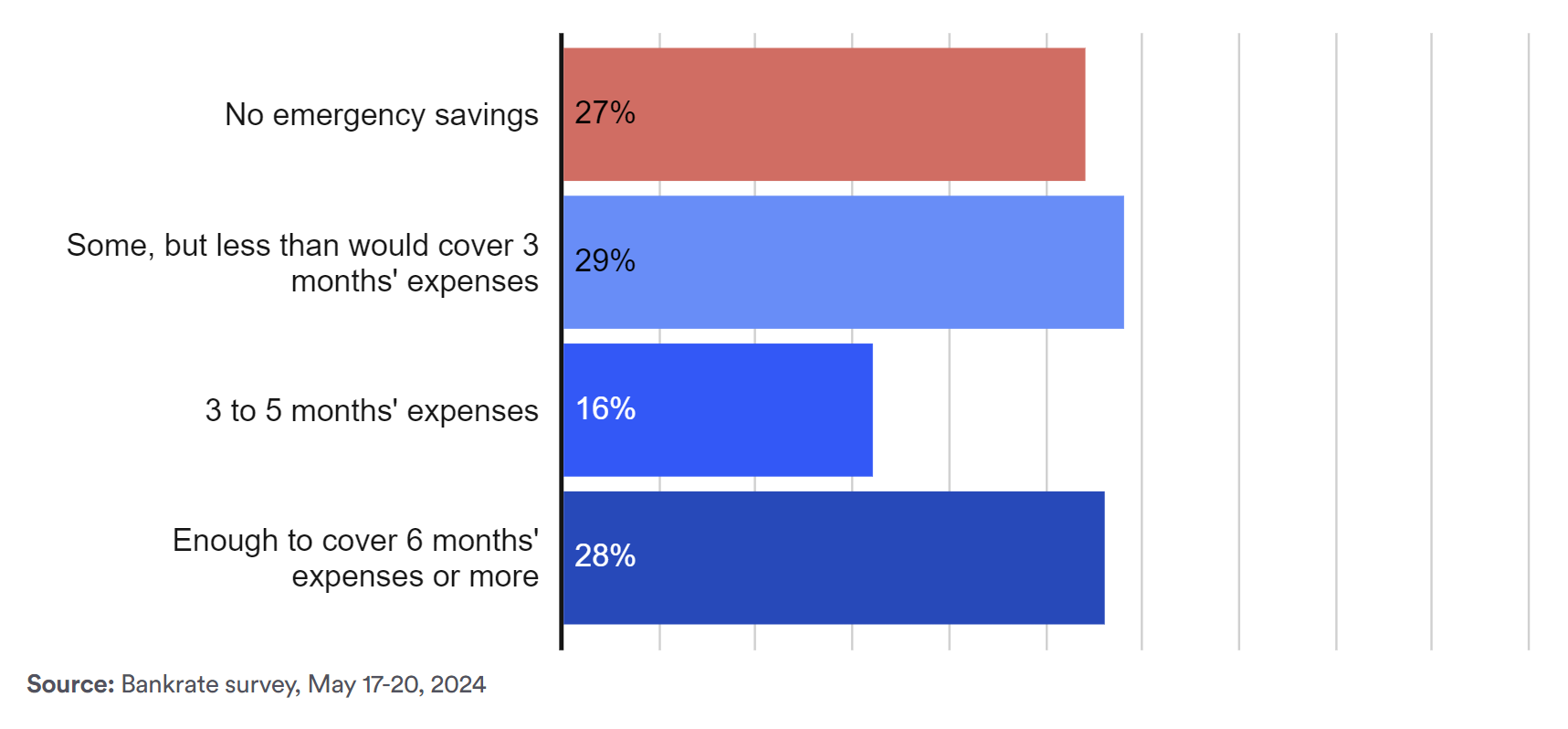

There's obviously a big gap in savings.

Over 1/4 of Americans have no emergency savings and over half have less than 3 months' of expenses saved

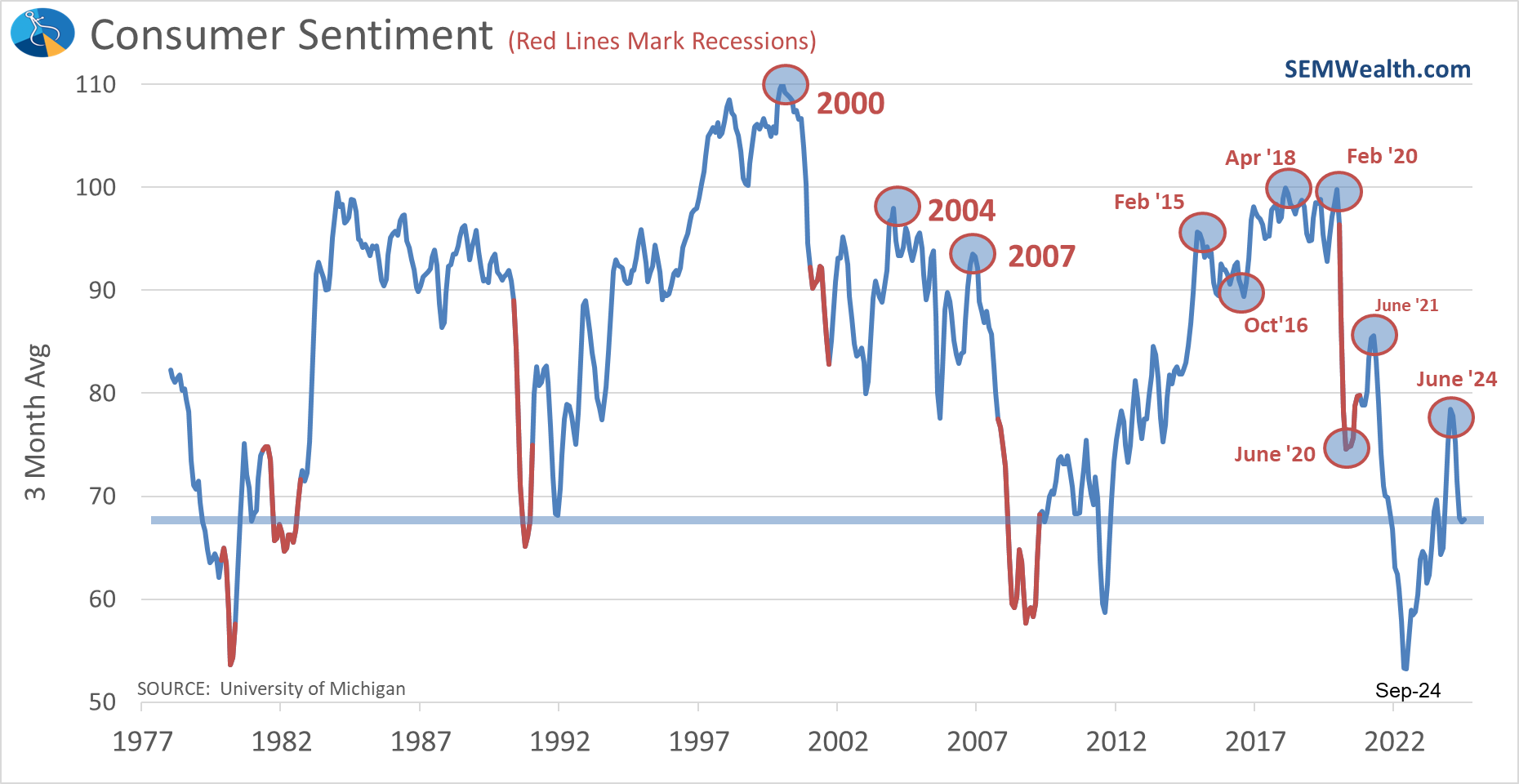

This leaves us with a very pessimistic consumer which will have a direct impact on the election.

Speaking of politics and the economy, we have a webinar coming up next week to discuss the impact of the election on the economy and the markets. You can sign-up here:

We also recorded a special 'Money Talks with Dad' episode talking about some of the more popular memes circulating about the election.

Of course all of the above is just speculation/worry about what could go wrong. At SEM we stick to the data when making investment decisions. For more on what the data is saying, check out the next two sections.

Market Charts

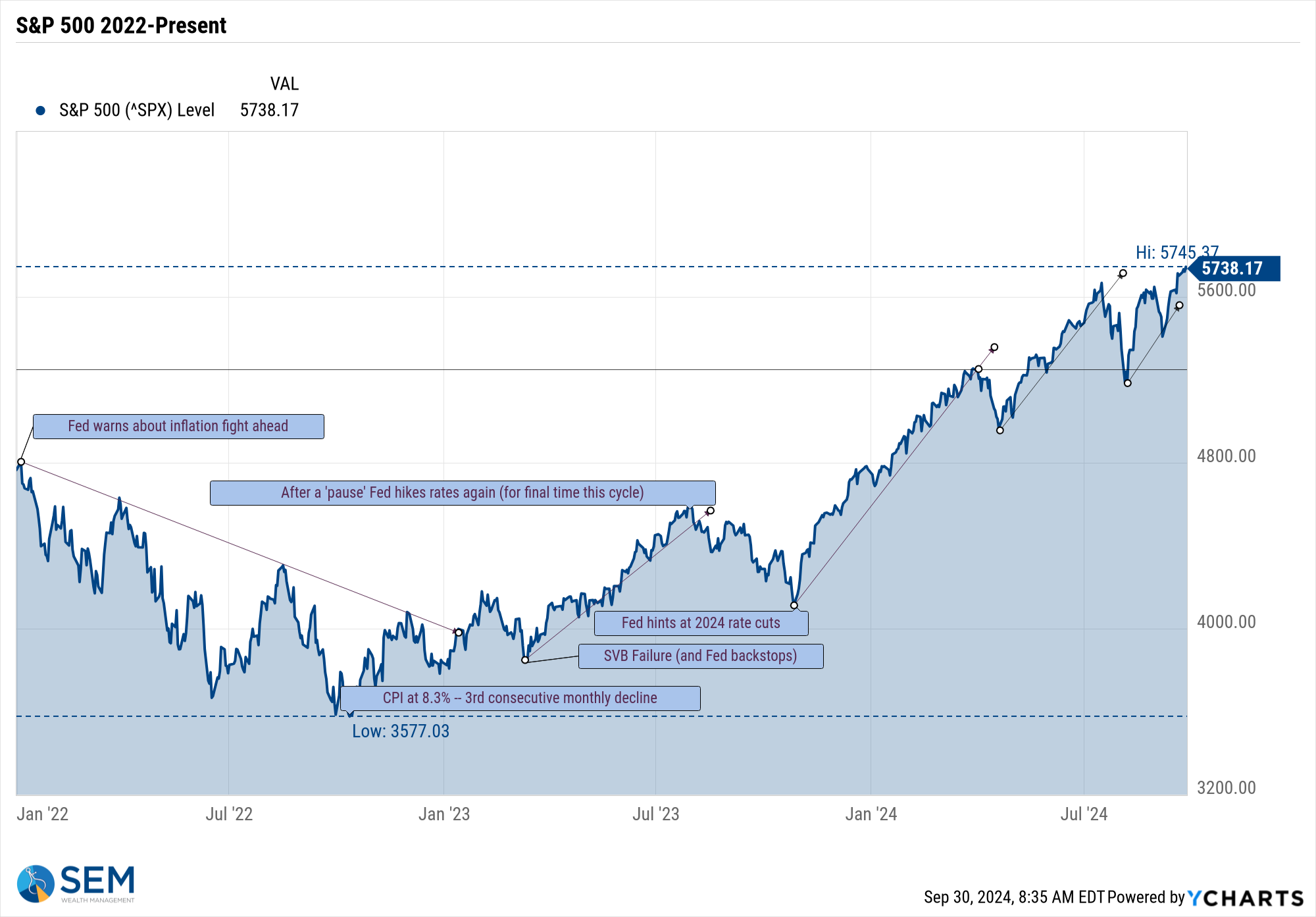

As I've said throughout the year – higher highs tend to lead to higher highs.....until something significant comes along to change the trend. This continues to be the case with the S&P 500 again hitting a new all-time high.

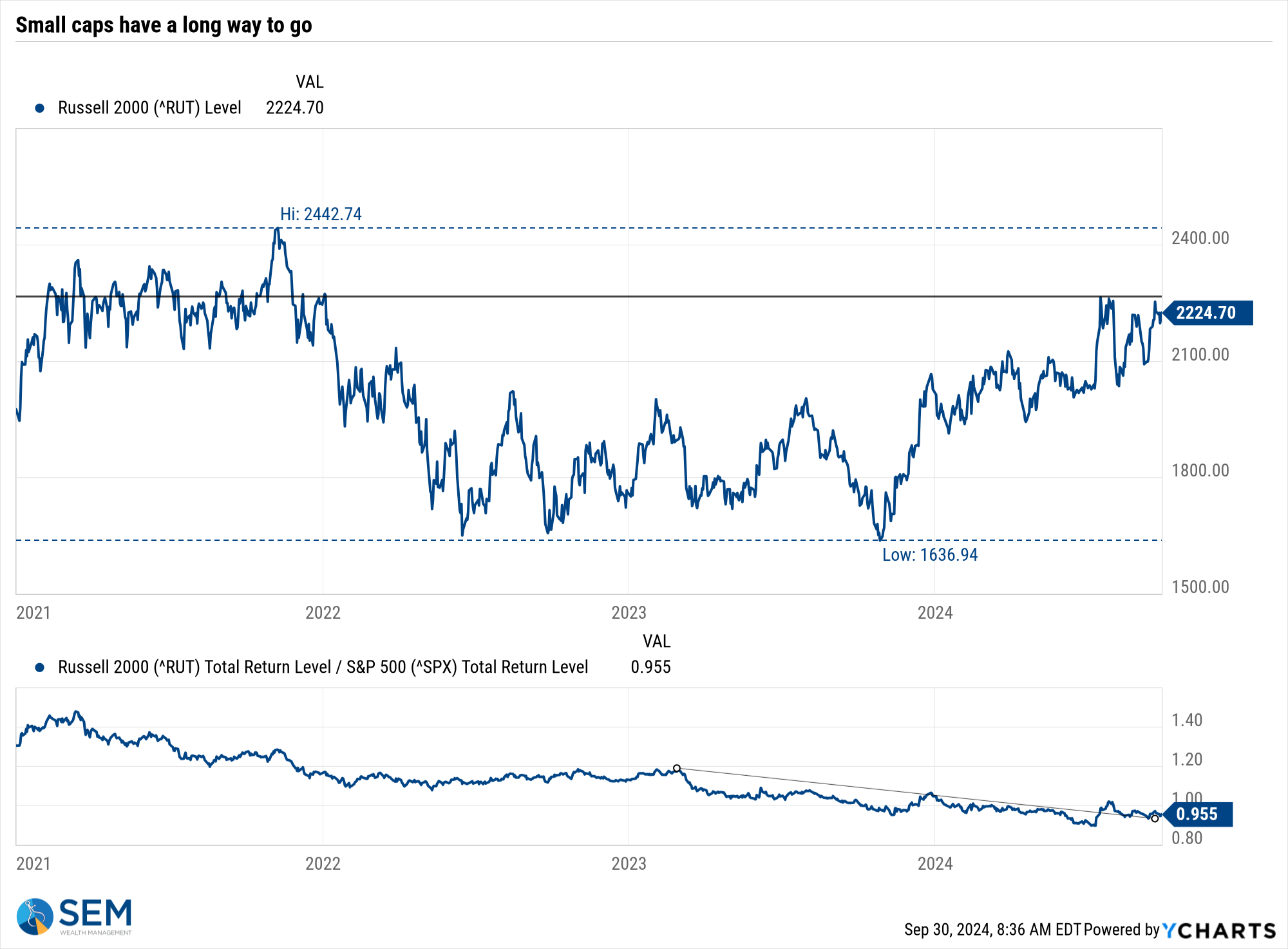

The problem (still) is the rally is being driven by the mega-cap stocks. As we'll discuss in the webinar, this could be a problem post-election. We NEED to see small cap stocks begin to participate to make this a healthy investment market/economy.

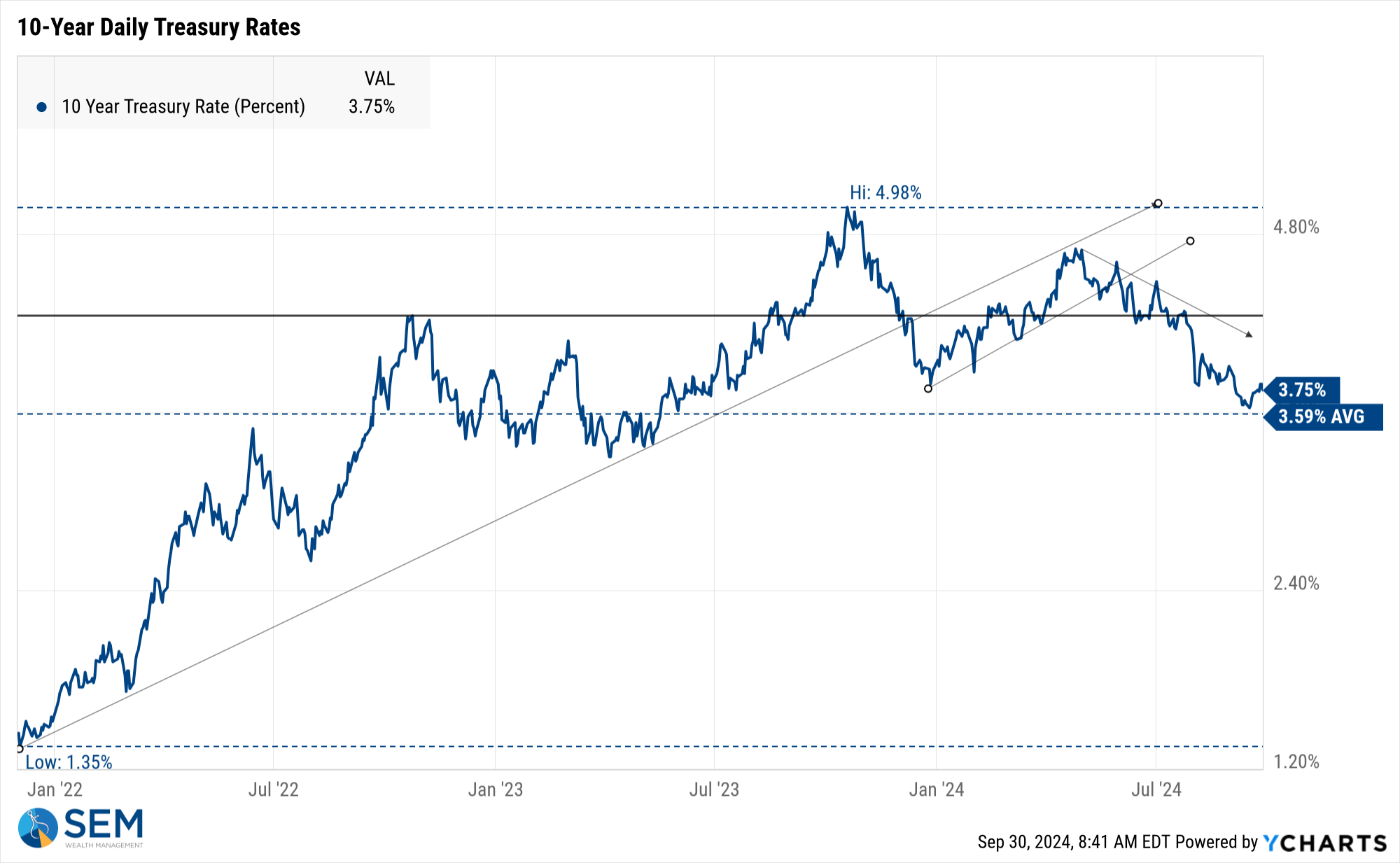

Bonds continue to be the most important area to watch. Long-term rates have already come down 1.25% from their highs. Since the Fed actually started cutting rates, long-term rates have started to drift higher. If this continues, we could have problems.

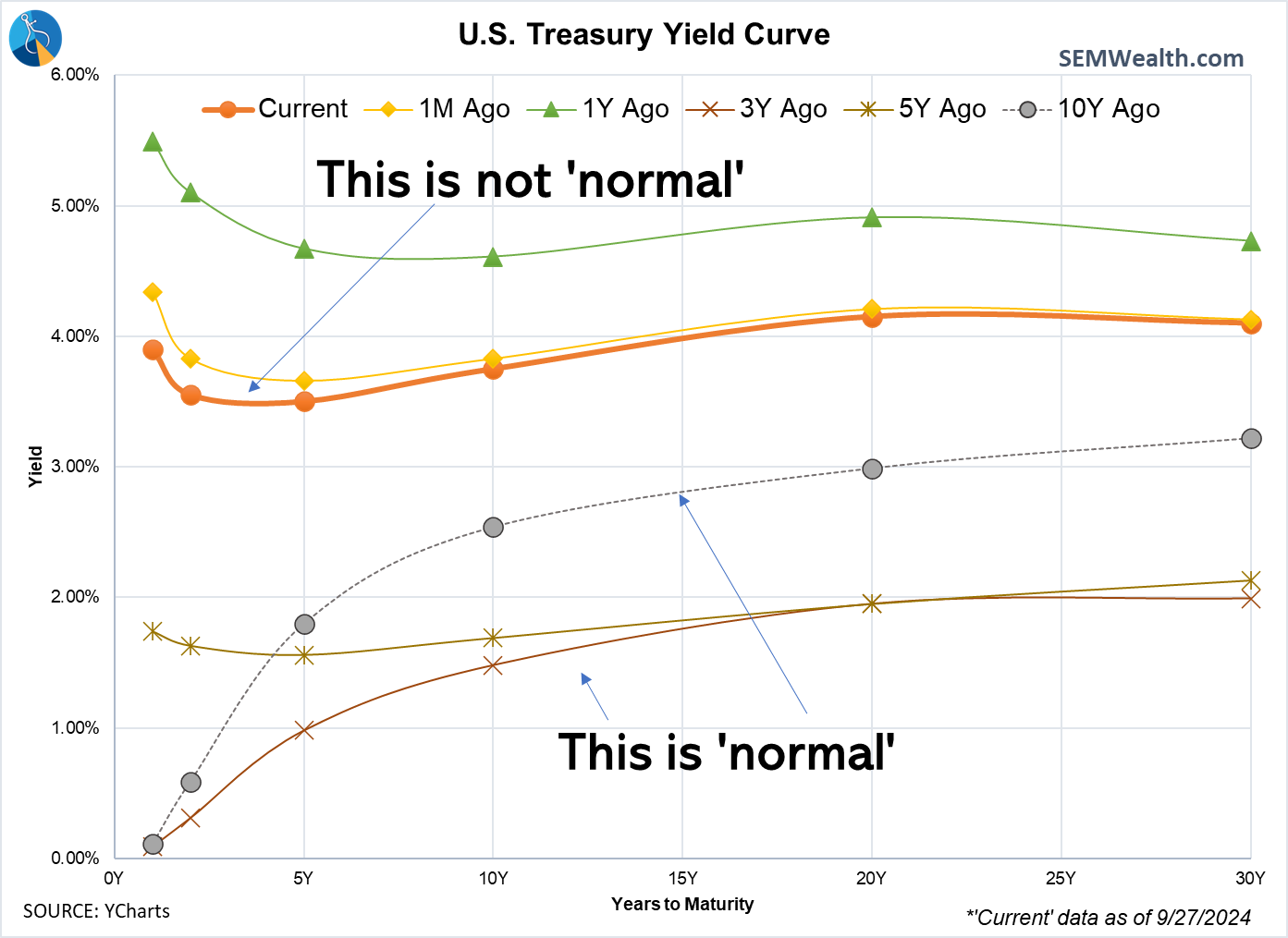

The yield curve continues to be abnormal and the question remains whether short-term rates are going to drop significantly more to 'normalize' or if we see longer-term rates move higher.

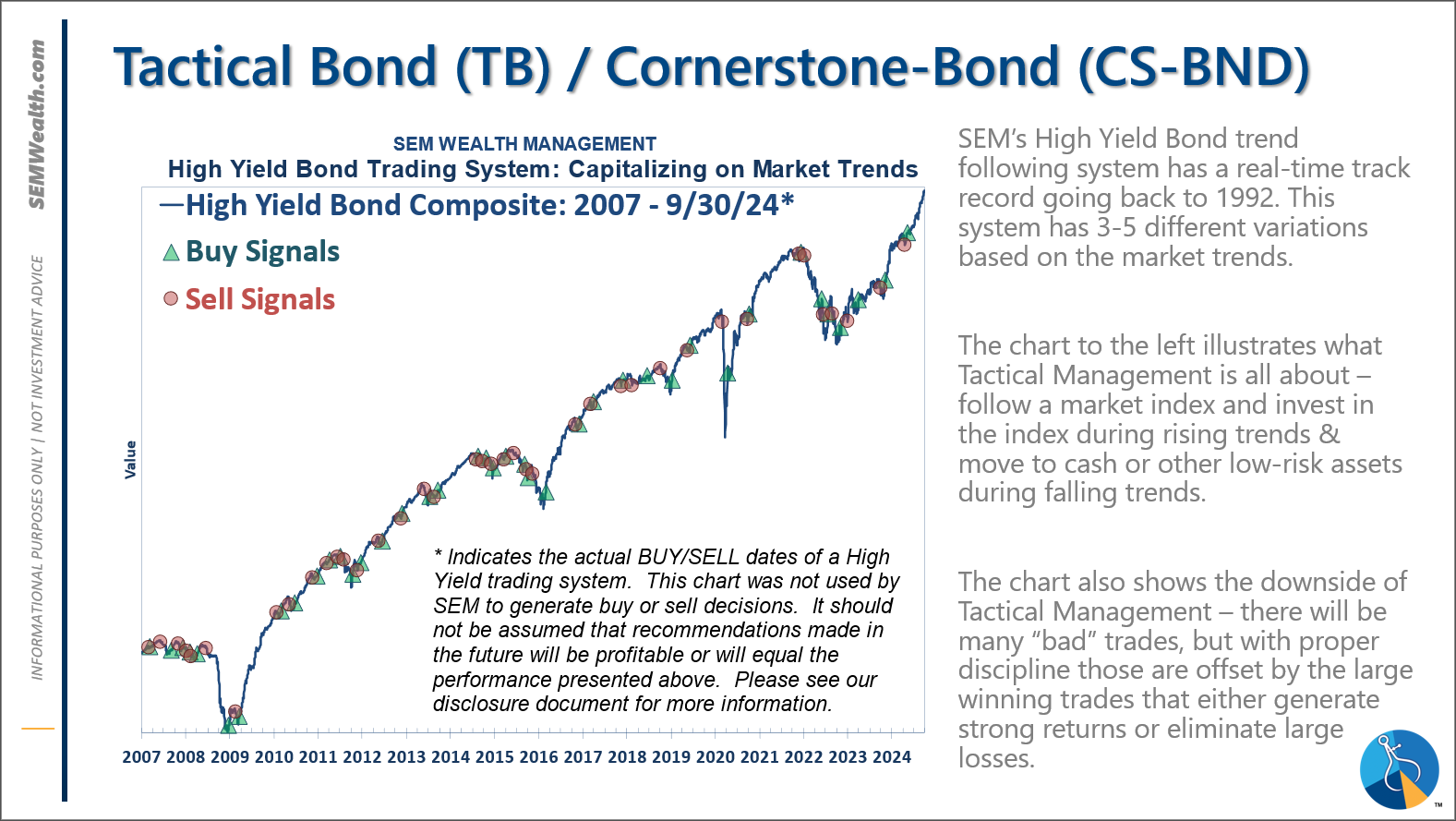

There is no point in guessing. We remain 'half-way' invested in high yield bonds. Even with the 1/2% rate cut we are still yielding around 4.8% by sitting in the safety of money markets. With the very risky high yield bonds only giving us around 6.6% it doesn't make sense to extend the risk in our portfolios trying to capture 2% more yield.

SEM Model Positioning

-Tactical High Yield had a partial buy signal on 5/6/24, reversing some of the sells on 4/16 & 17/2024 - the other portion of the signal remains on a sell as high yields continue to oscillate.

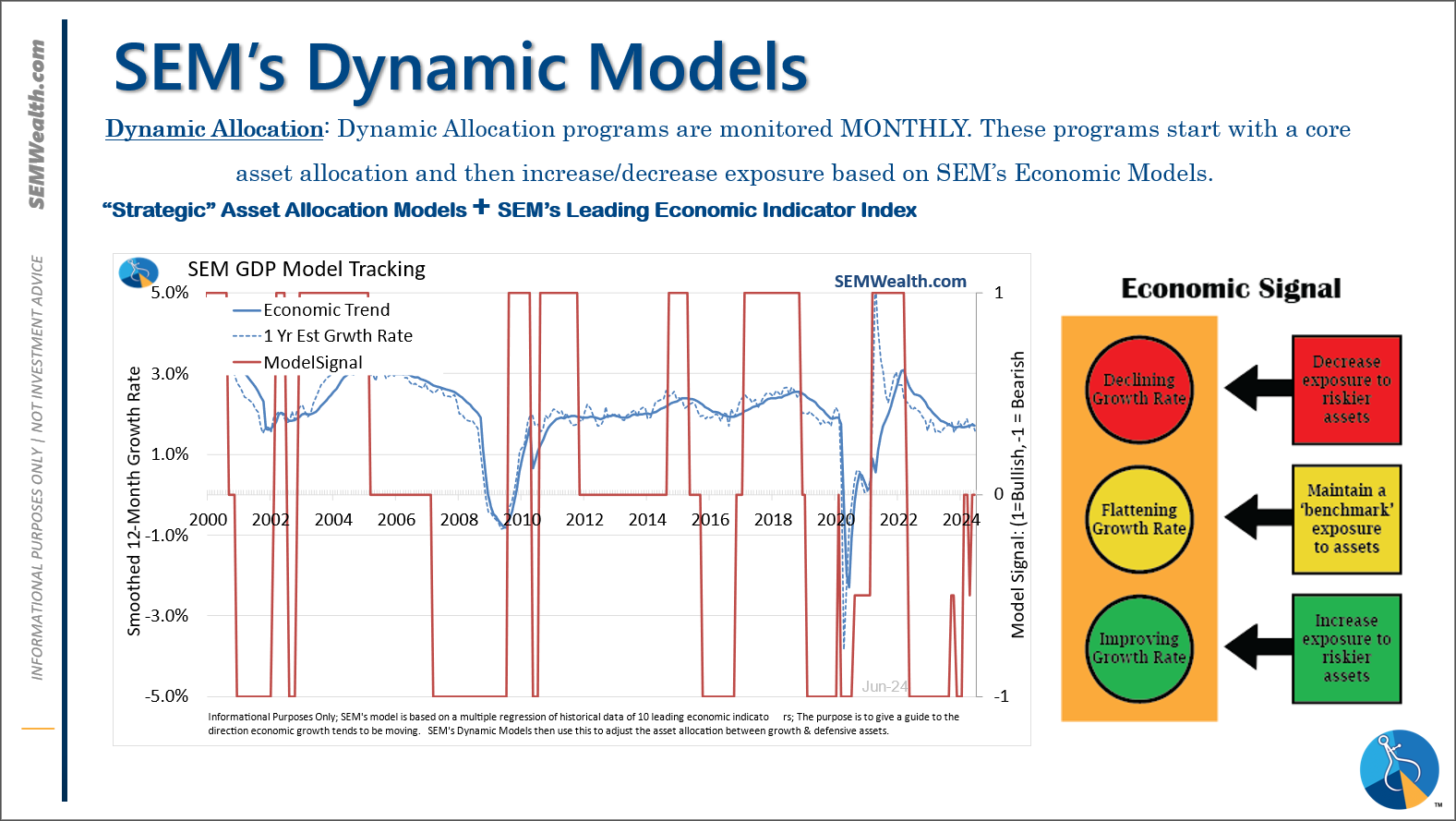

-Dynamic Models are 'neutral' as of 6/7/24, reversing the half 'bearish' signal from 5/3/2024. 7/8/24 - interest rate model flipped from partially bearish to partially bullish (lower long-term rates).

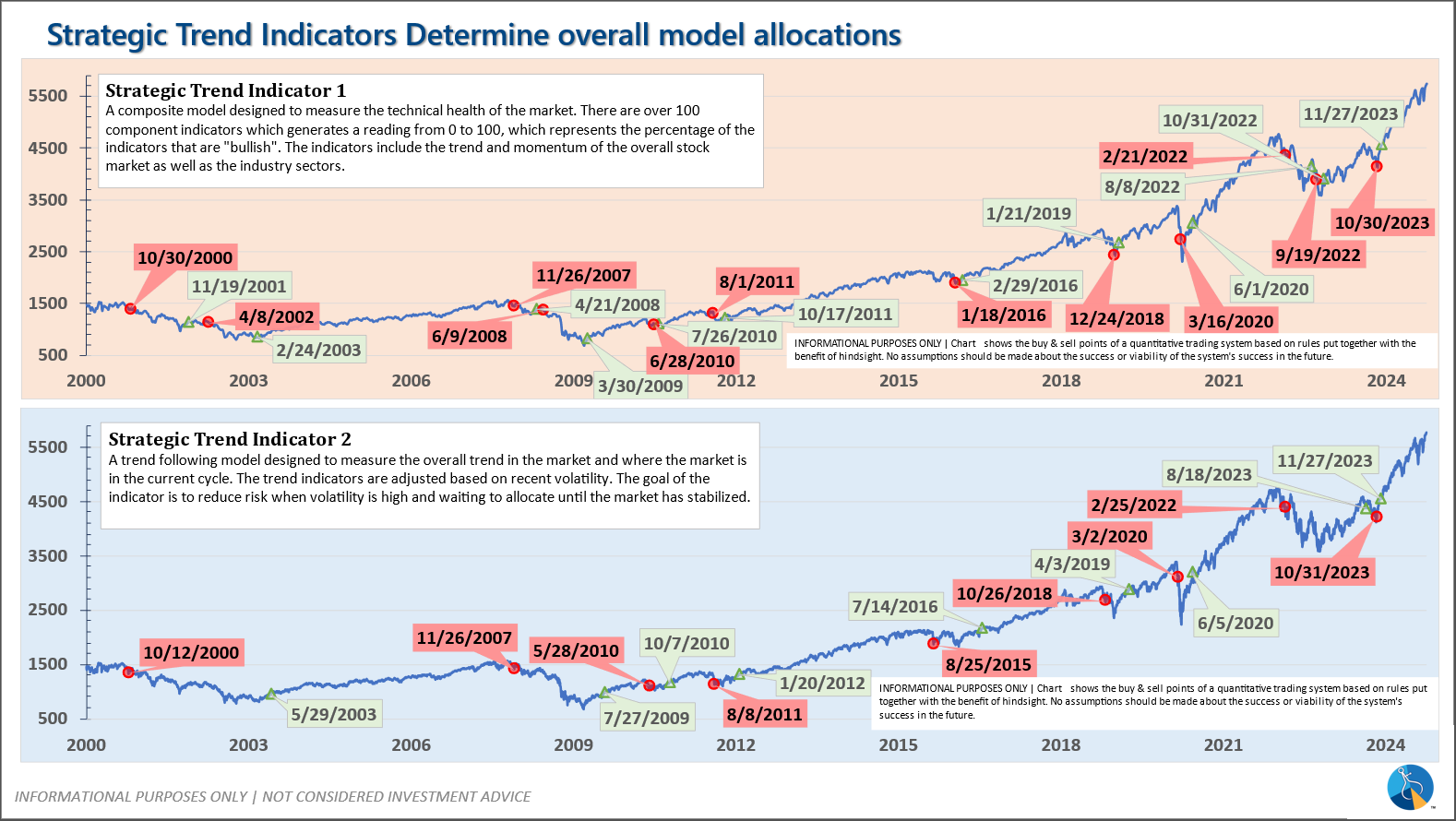

-Strategic Trend Models went on a buy 11/27/2023; 7/8/24 – small and mid-cap positions eliminated with latest Core Rotation System update – money shifted to Large Cap Value (Dividend Growth) & International Funds

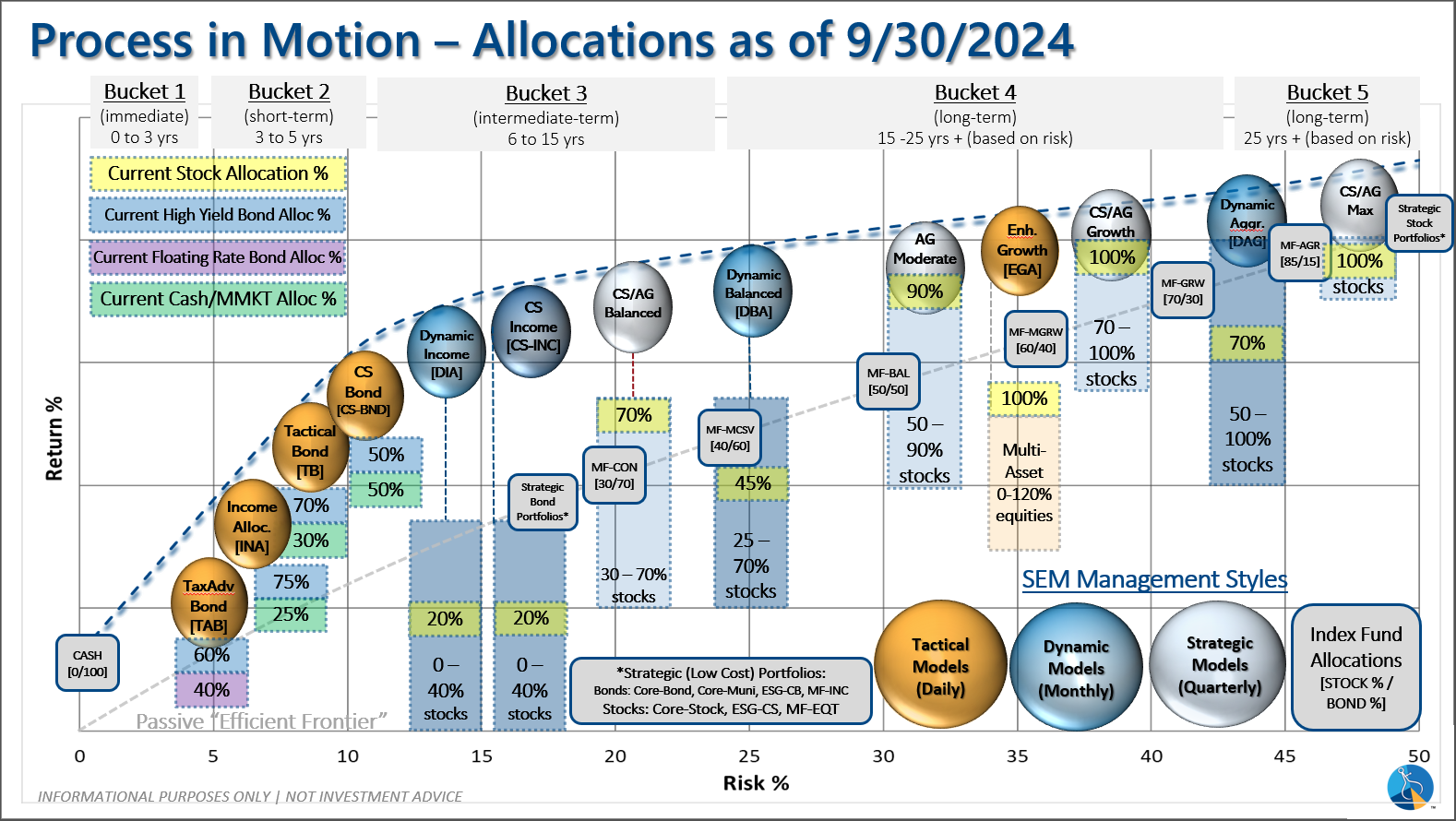

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): On 5/6/24 about half of the signals in our high yield models switched to a buy. The other half remains in money market funds. The money market funds we are currently invested in are yielding between 4.3-4.8% annually.

Dynamic (monthly): The economic model was 'neutral' since February. In early May the model moved slightly negative, but reversed back to 'neutral' in June. This means 'benchmark' positions – 20% dividend stocks in Dynamic Income and 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is slightly 'bullish'.

Strategic (quarterly)*: BOTH Trend Systems reversed back to a buy on 11/27/2023

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Questions or comments - drop us a note?

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire