During the Presidential campaign last year we heard a lot about the economic recovery. One side said it was the best recovery of all time, the other said it was the worst. (For more see my 1st Quarter Economic Update) Thee is one data point I don’t think either side would point to with pride when looking at the economic recovery (or at least I hope they won’t celebrate this) — the level of Household Debt.

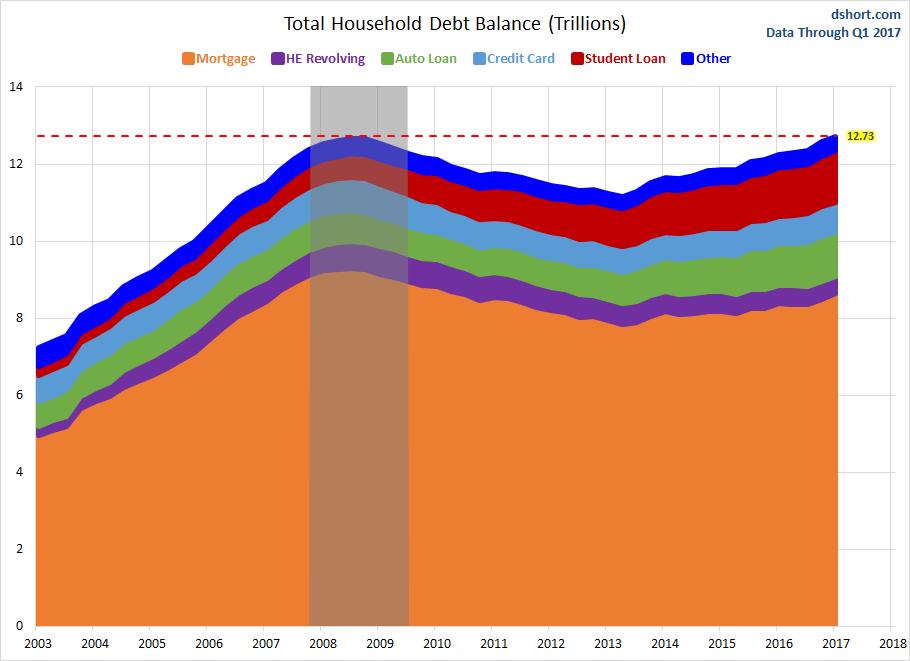

The Chart(s) of the Week this week come from Advisor Perspectives and focus in on Household Debt. The latest release from the Federal Reserve shows the amount of debt held by American households now surpassing the peak in 2008.

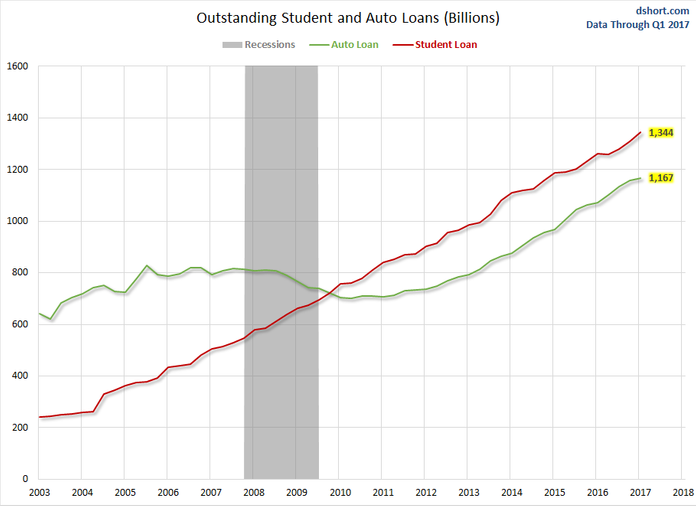

Mortgage debt still remains below its peak, but it has been replaced by two categories of debt — auto loans and student loans.

While too much mortgage debt was a primary issue during the Great Recession, the steady increase in these two categories should be alarming. Barring another “100 year storm” in housing, unless lenders again get stupid with their mortgage approvals (anecdotal evidence is growing that they are starting down that path again) at least with mortgage debt their is an asset that can be sold to repay it fully. I’ve yet to see a viable university offer a money back guarantee of the tens of thousands of dollars spent on the piece of paper with their name on it does not lead to a job sufficient enough to cover the debt payments.

While mortgage bankers have not yet gotten full on stupid again, the same cannot be said for auto loan issuers. Over the weekend we saw several different car commercials saying they would finance your negative equity to get you into a loan. Reading the fine print (thanks to the pause button on our Tivo remote) we saw that these companies would finance up to 150% of the cost of the car for 84 months. My kids asked me what negative equity meant. After I explained it they said, “who would be stupid enough to do that?” I said apparently a lot of people. It reminded me of a shirt my oldest son had in high school — “never underestimate the power of stupid people in large groups.” While the shirt had a picture of the US Capital Building, I think it could also include any banks making car loans.

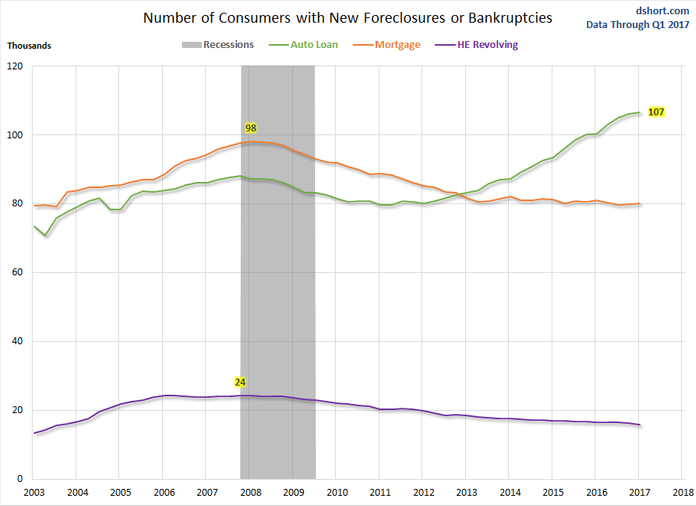

It appears those banks may be starting to run into problems. The number of “foreclosures” on auto loans is increasing which is never a good sign for an economy.

This is a very early economic indicator, but it should serve as a warning. The more “stupid” bankers become with their loans, the more at risk for another financial crisis.