As we move closer to the election, we are seeing more and more confident predictions about what a win from either side will mean for the economy and your investment portfolio. In this webinar we focus on what the DATA says about the true key drivers of the economy, what the impact of some of the proposed policies could be, and what historically happens following the election. We will also discuss what can be done after the election to mitigate any of the risks due to the outcome of the election.

SEM hosted a webinar on October 10 discussing this. Check out the replay below:

Click here to download the slides

The number 1 takeaway from looking at the data is this:

Not one President, not one Congress, not one party can change the direction of the economy in one, two, three, or even four years. Our economy is too large and complex for any of them to make significant changes. Therefore, you should vote for whomever you believe is best, but please do not believe one or the other will create a better or worse economy overall.

Some of the highlights:

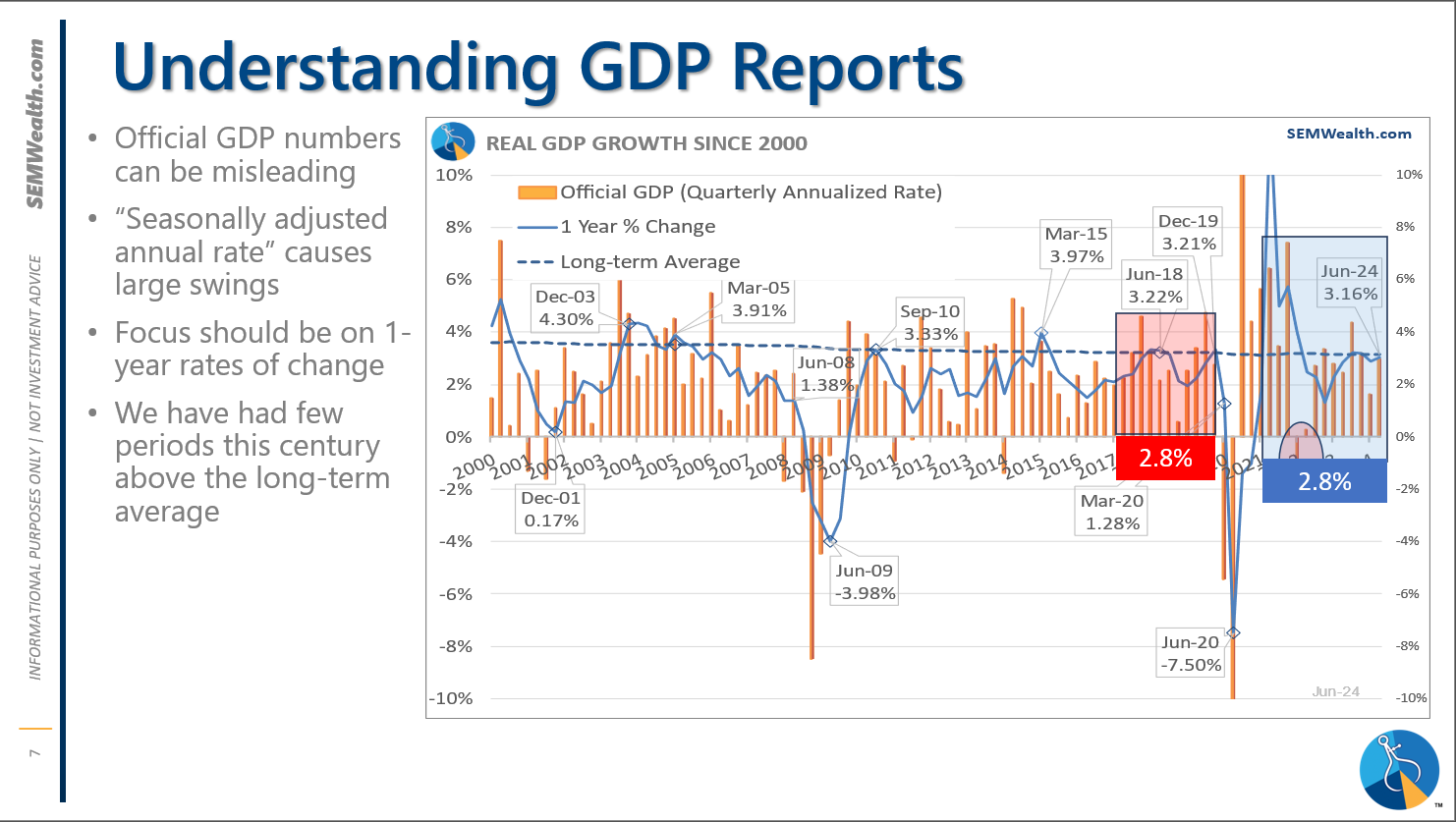

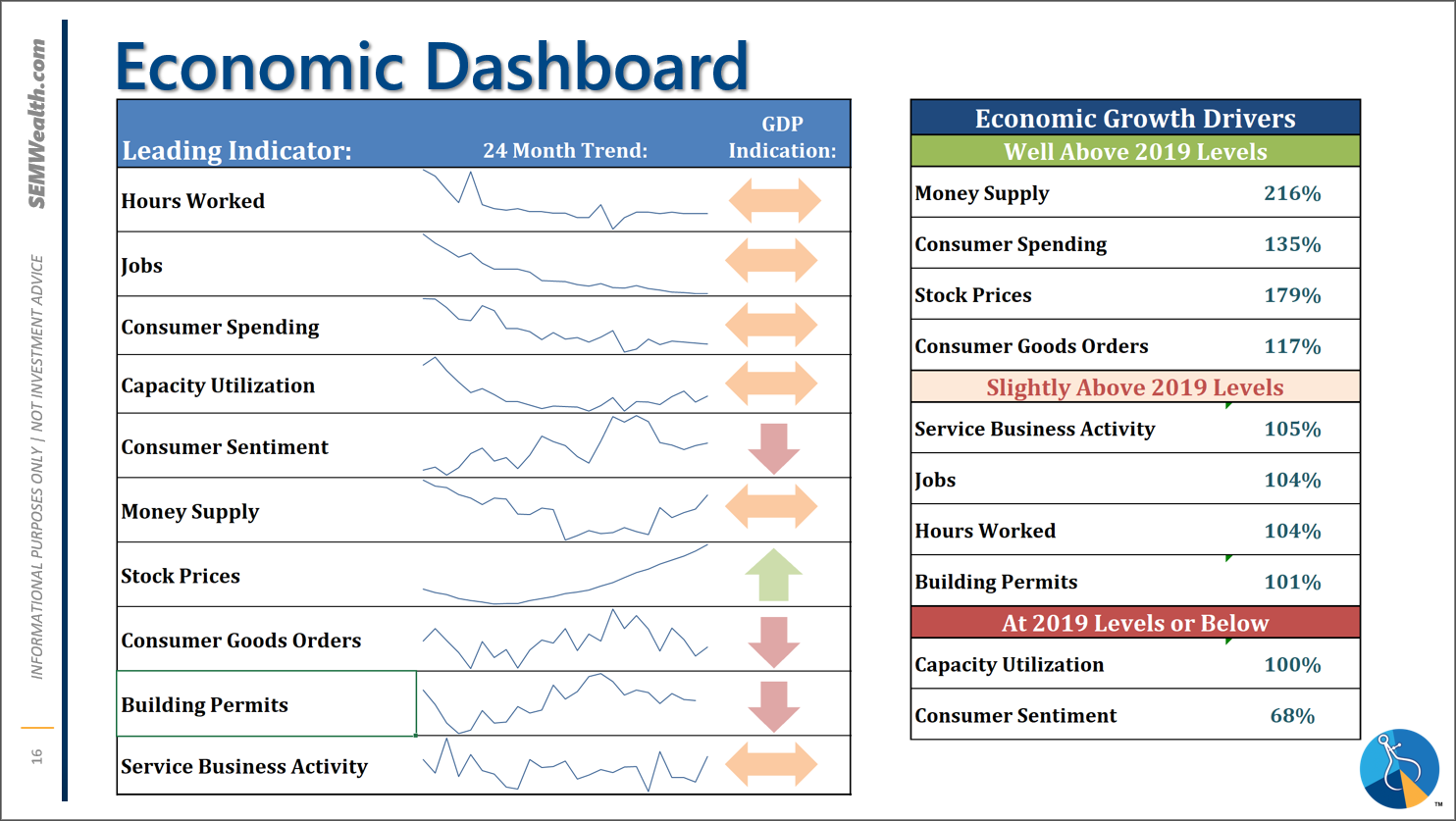

Pre-COVID Trump & Post-COVID Biden have seen similar economic growth rates.

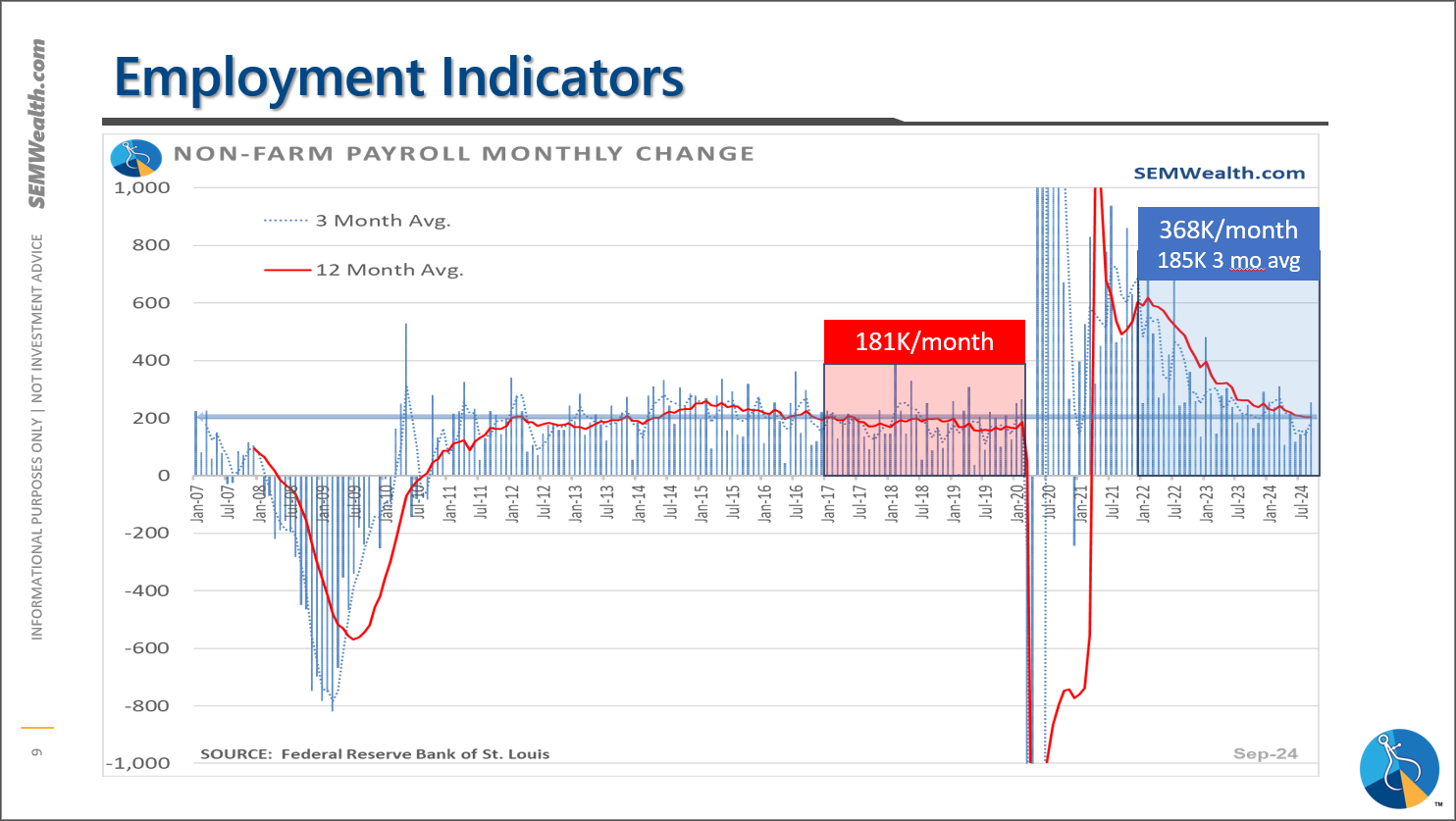

The current number of new jobs being created is basically the same as the Pre-COVID Trump years.

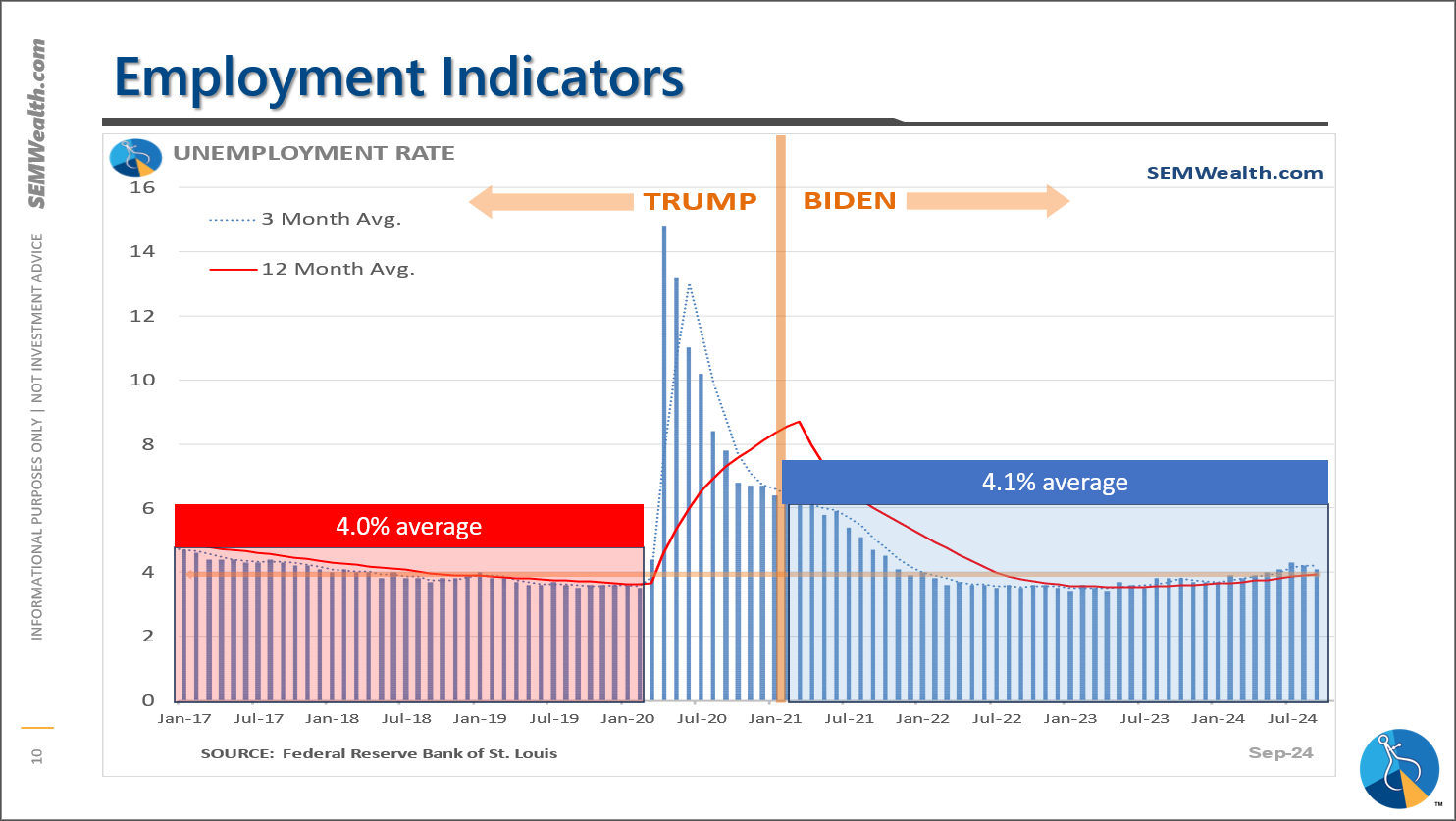

The current unemployment rate, while trending slightly higher is basically the same as the Pre-COVID Trump years.

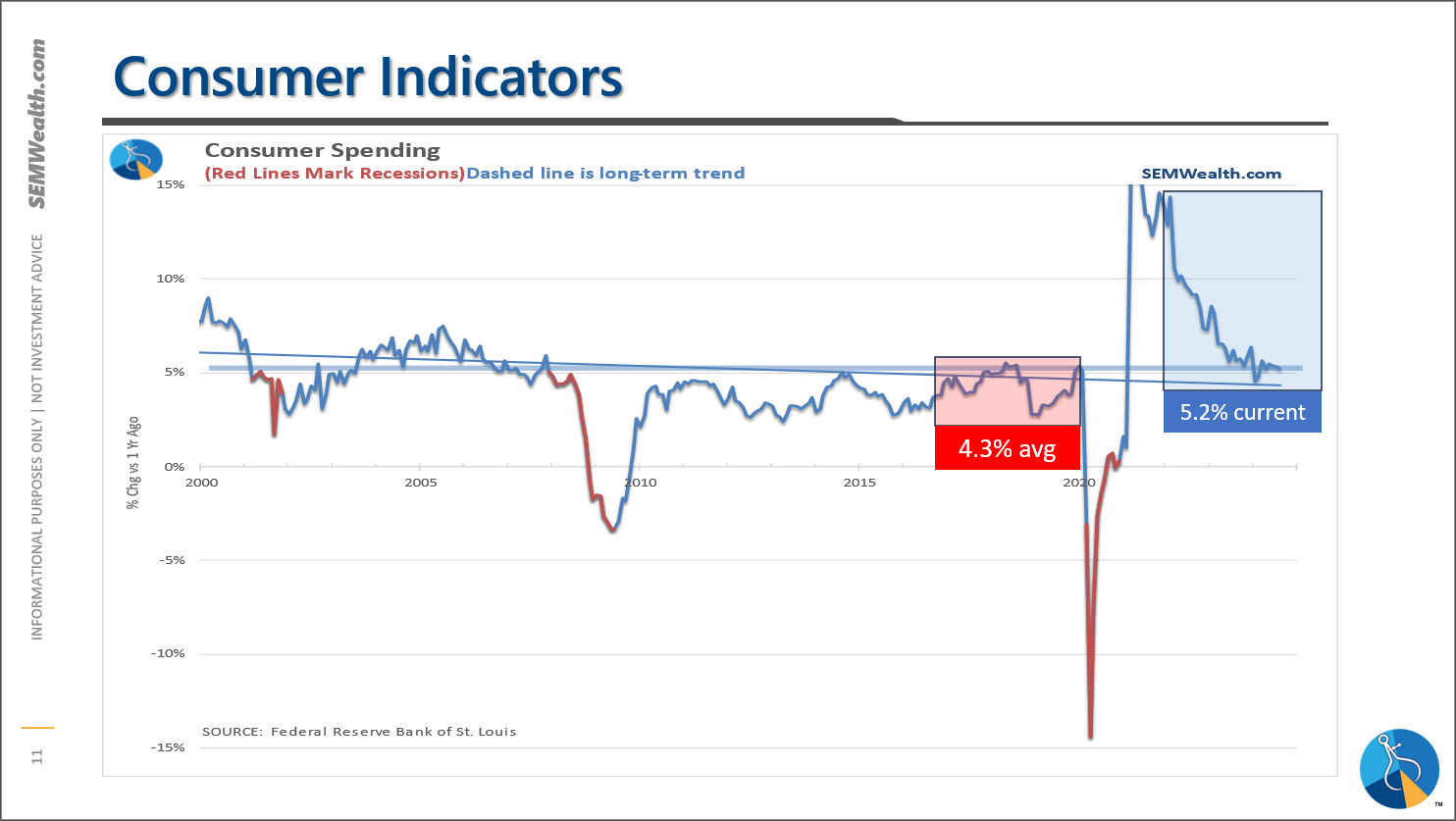

Consumer spending growth has been higher in than the Pre-COVID Trump years.......

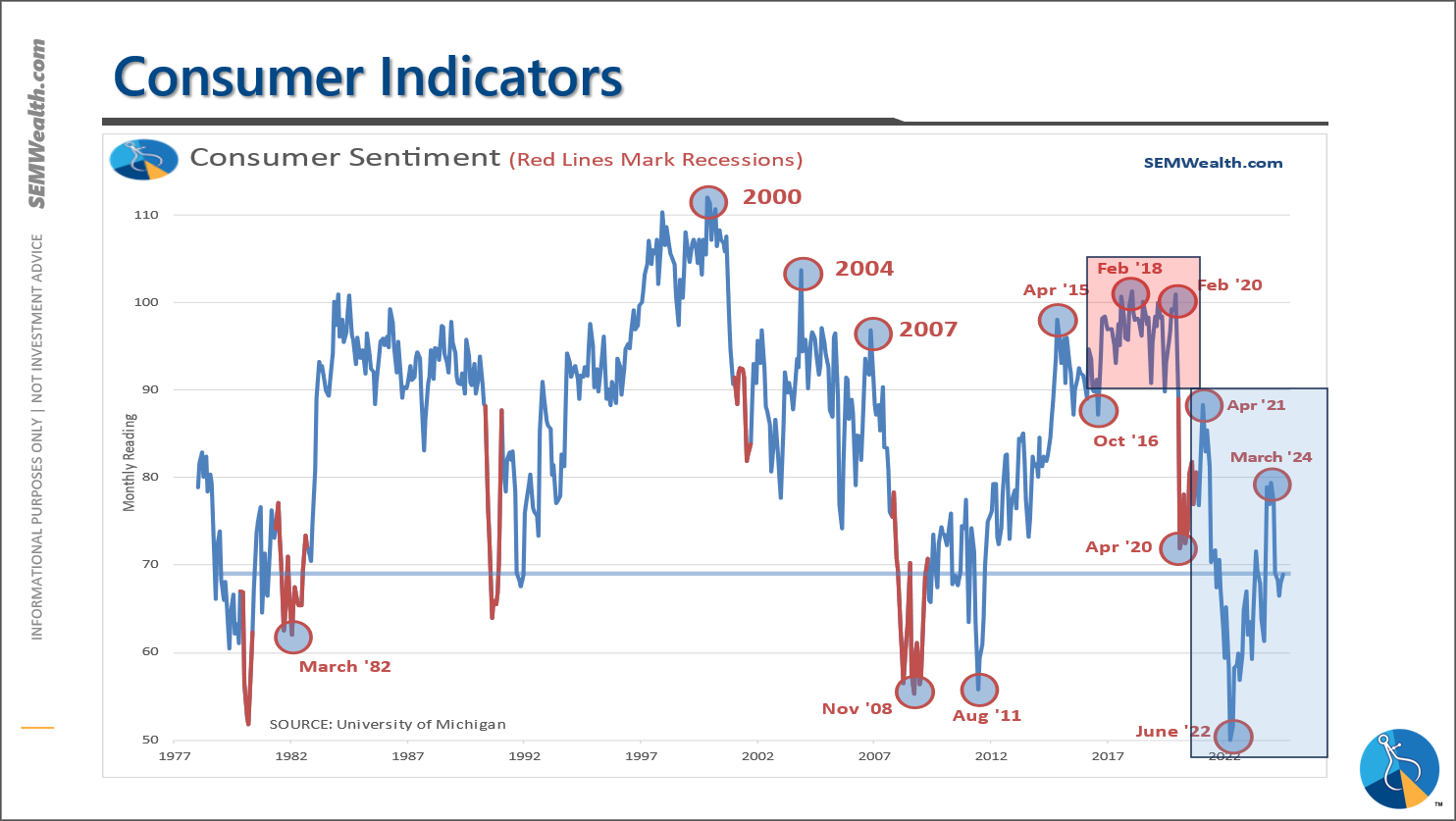

.......but consumers FEEL much worse the last four years, which tells us something is broken.

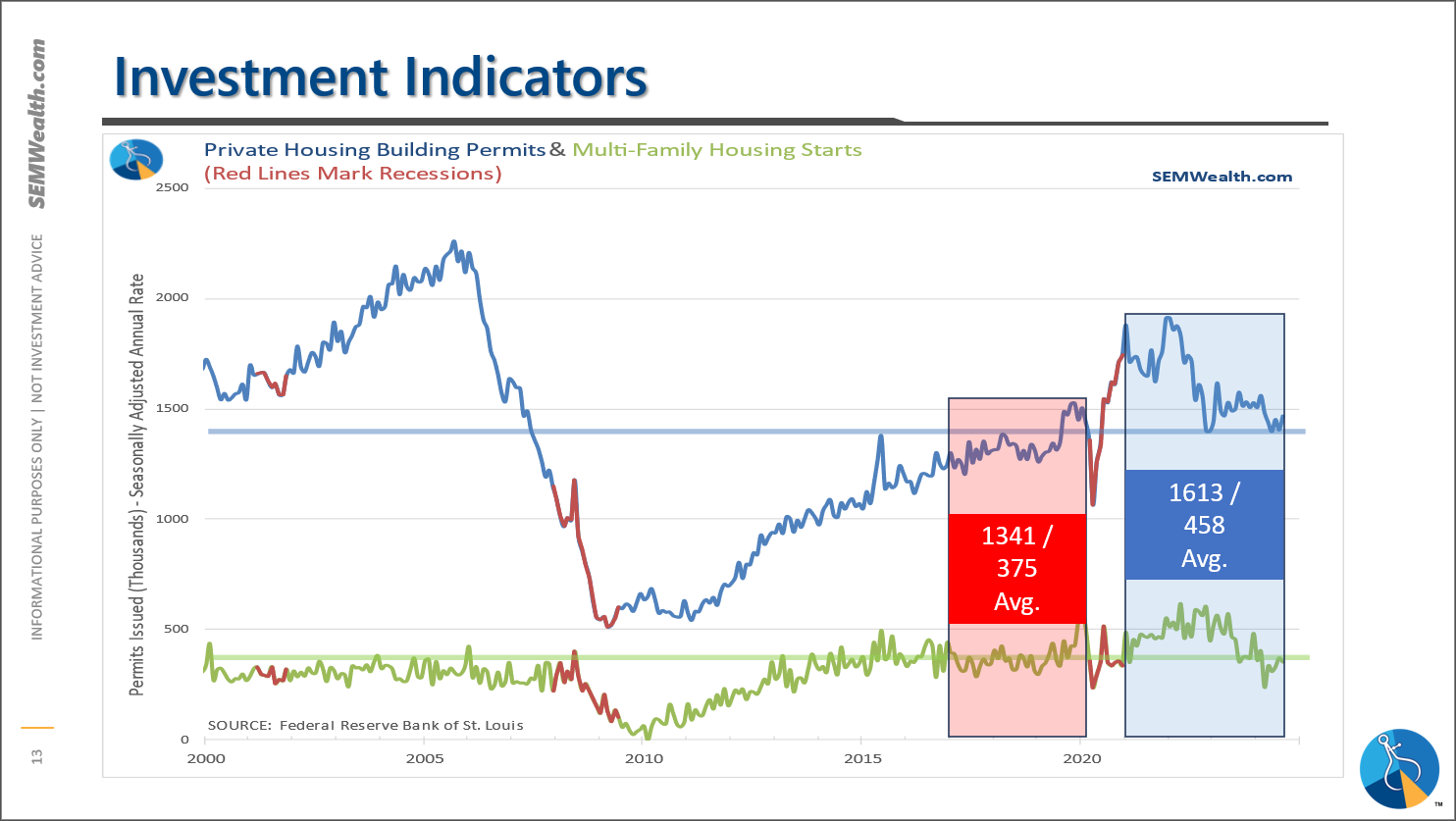

Even with significantly higher interest rates, housing investment has been significantly stronger in the Post-COVID Biden years (not saying it was Biden's policies, but a sign that something has shifted in our economy.)

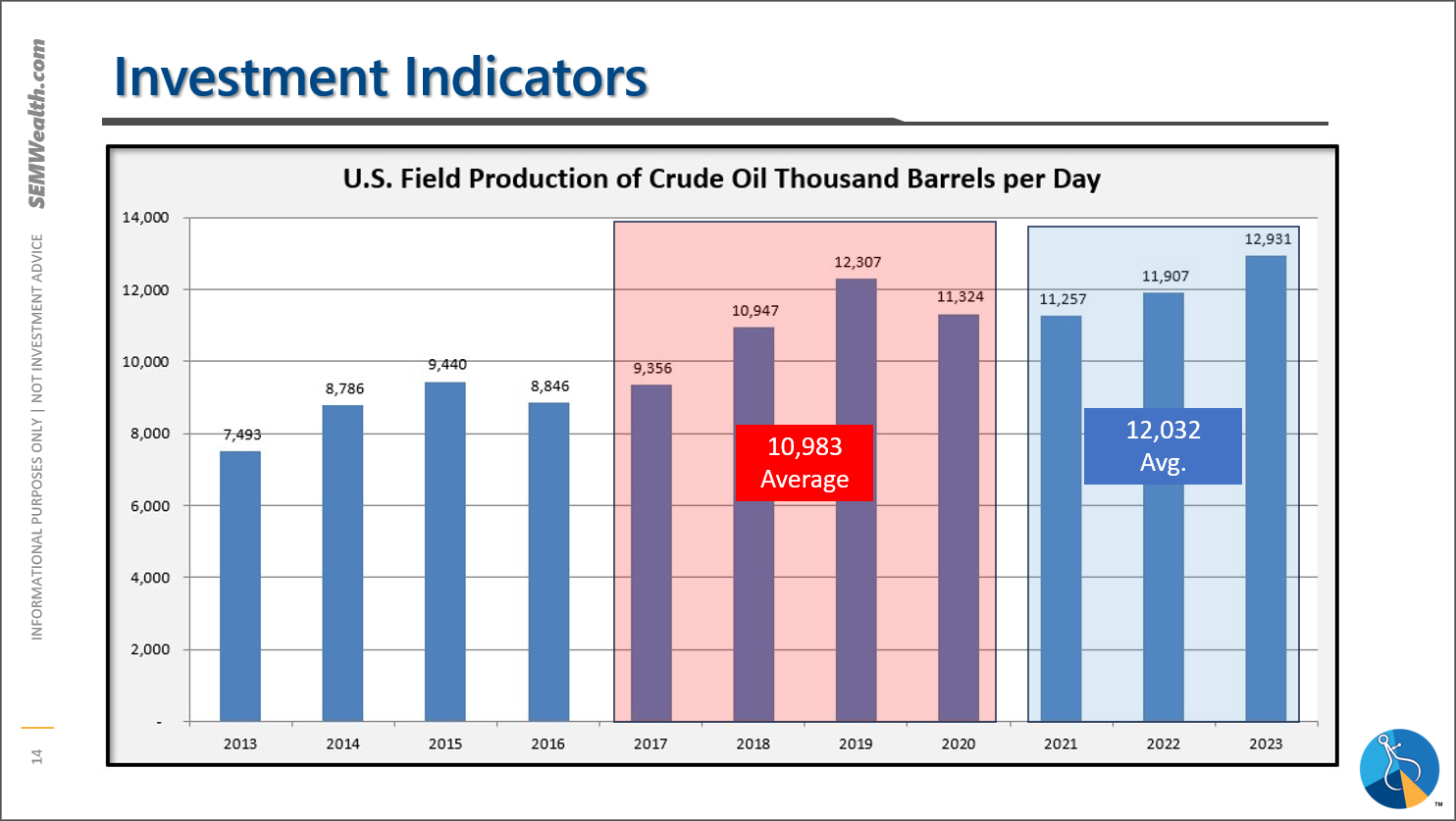

We are drilling more oil in the US today than we did at the peak in 2019. Not because of the president's energy policy but because the economy NEEDED (Demanded) more oil.

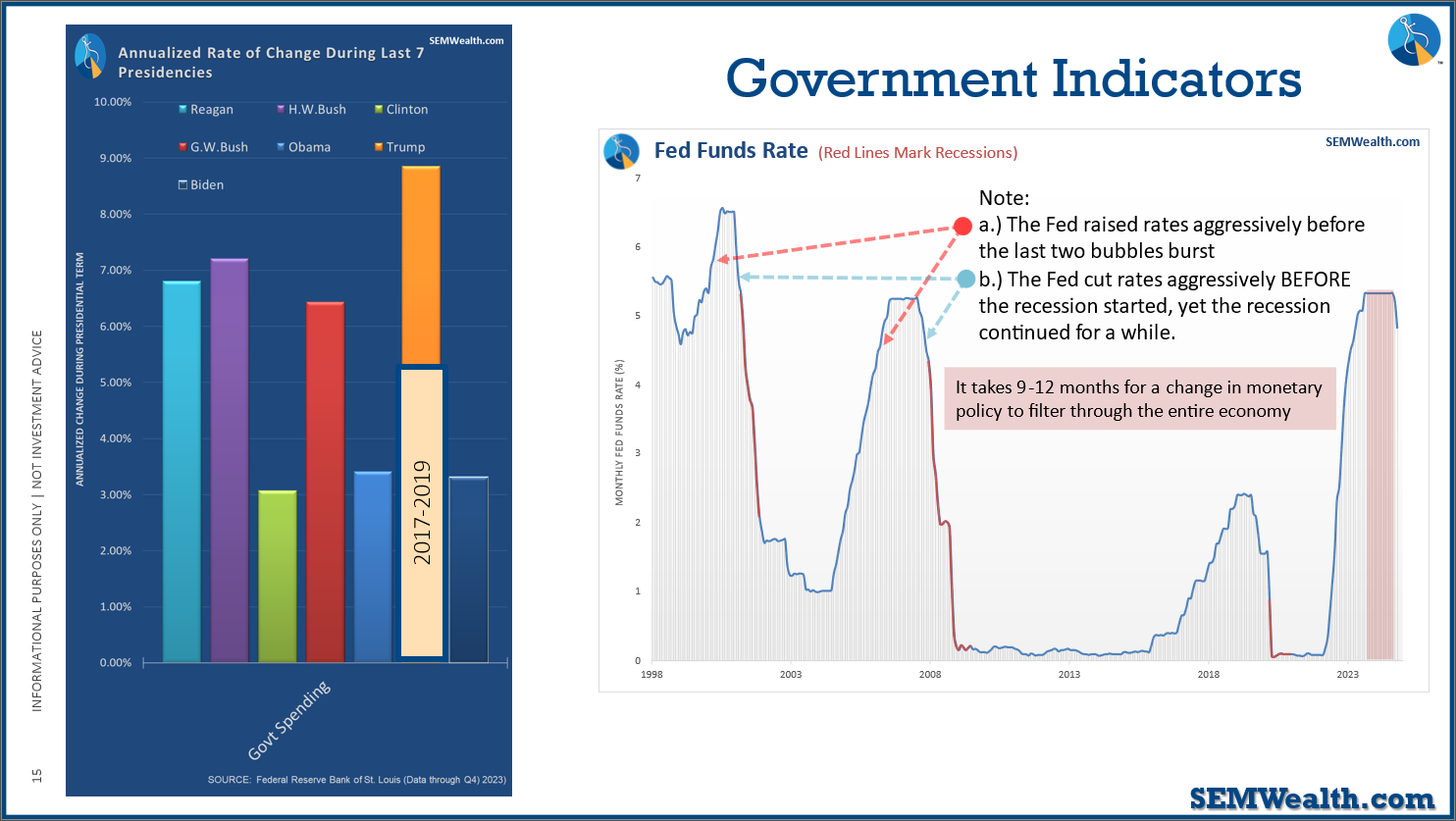

Historically, government spending has grown MORE under Republican presidents than Democratic presidents. Even pre-COVID, Trump's administration increase government spending significantly.

Whomever wins, the economy appears ready to head into a recession.

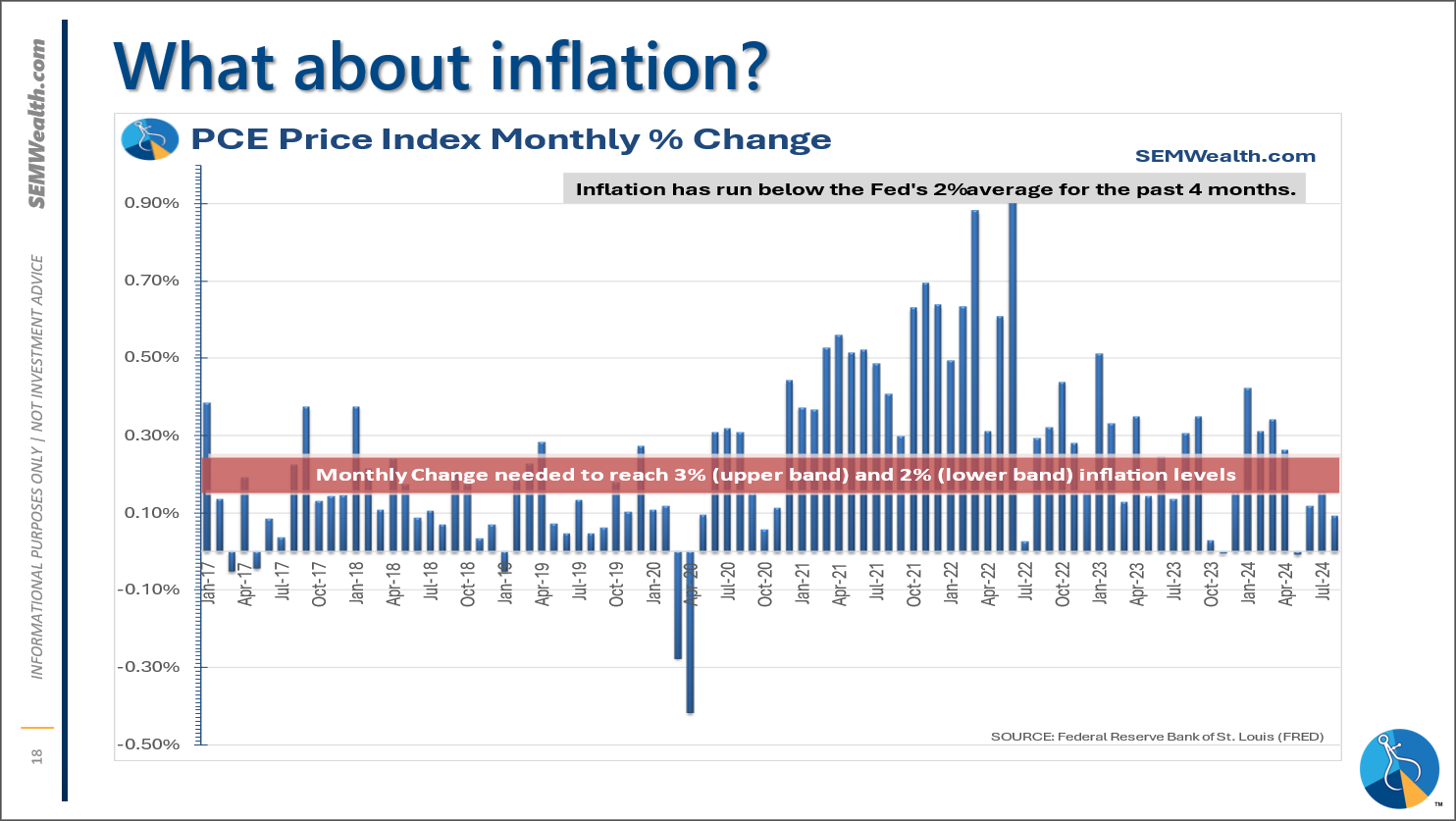

Inflation was clearly higher under Biden in the early years, but it was both trending up before Trump left office and was higher several times during Trump's presidency. It wasn't the policy of either president which sparked inflation, but rather than "solution" to the pandemic (sending way too much money to way too many people who didn't need it because the economy was shut down.)

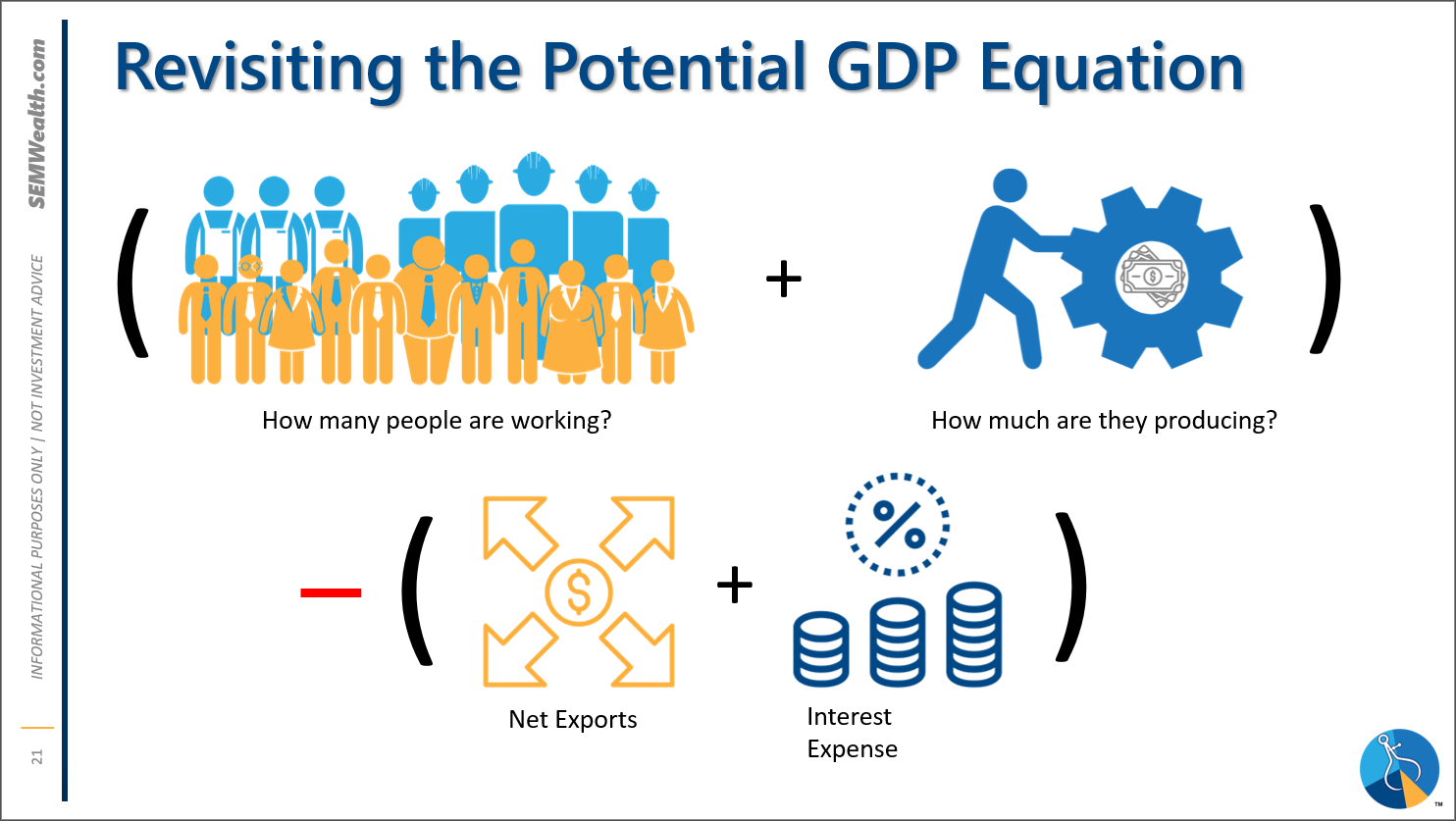

If an economic policy does not put more people to work and/or make them more productive, it is WASTEFUL spending. This becomes a bigger problem if we borrow money or run a trade deficit.

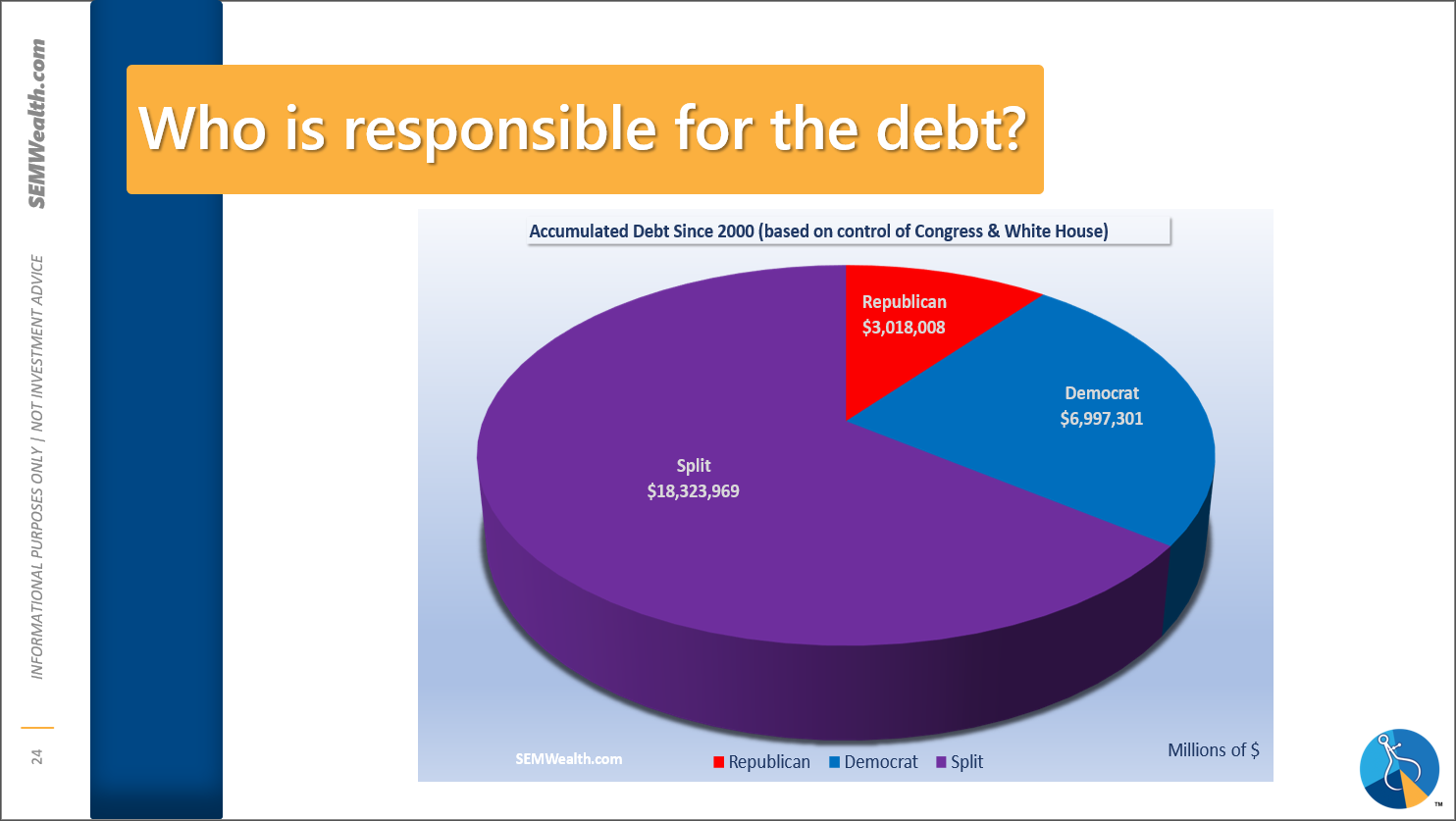

Most of our debt was generated with a split government, which tells us a "compromise" typically leads to decisions that hurt us long-term.

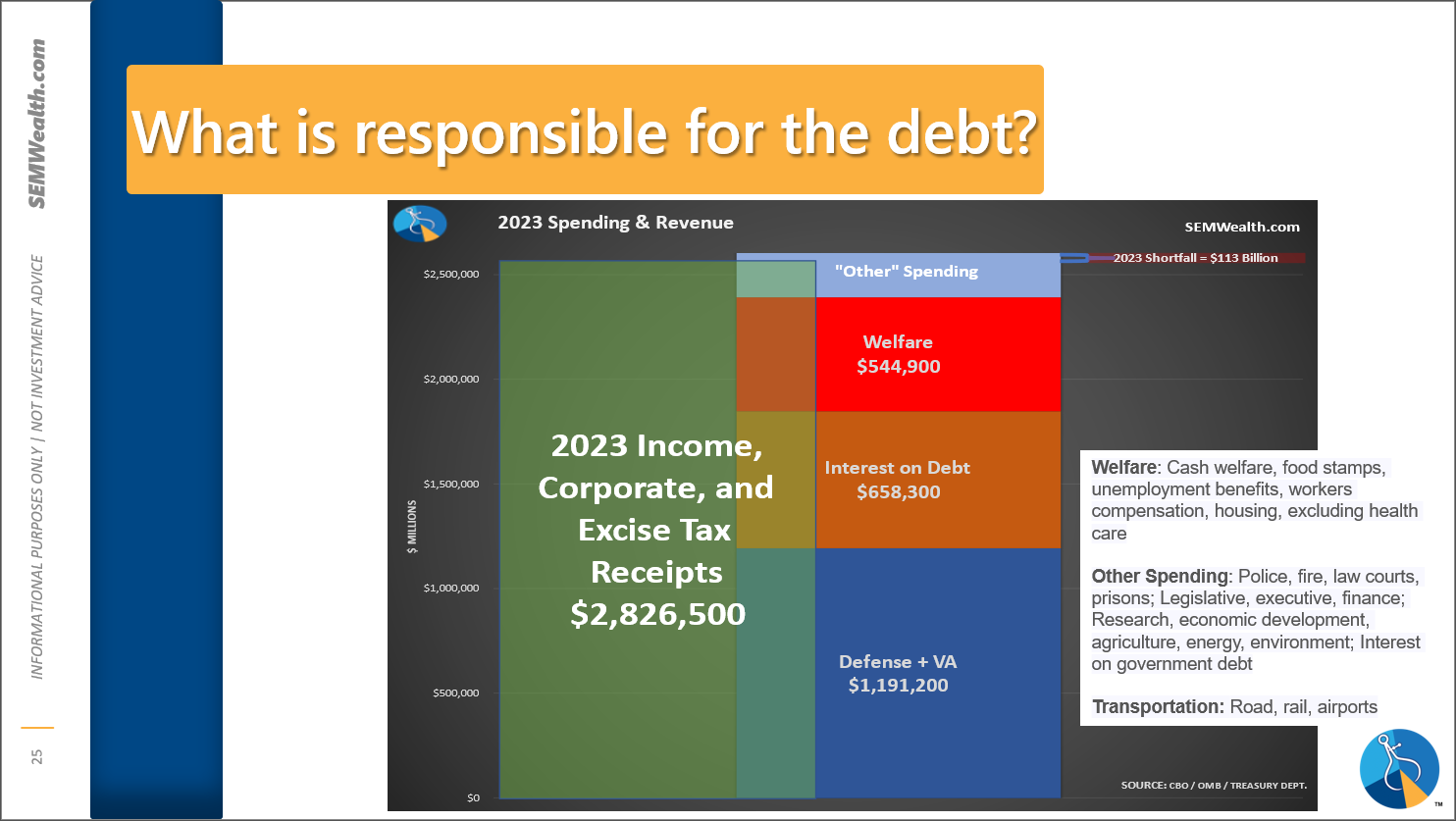

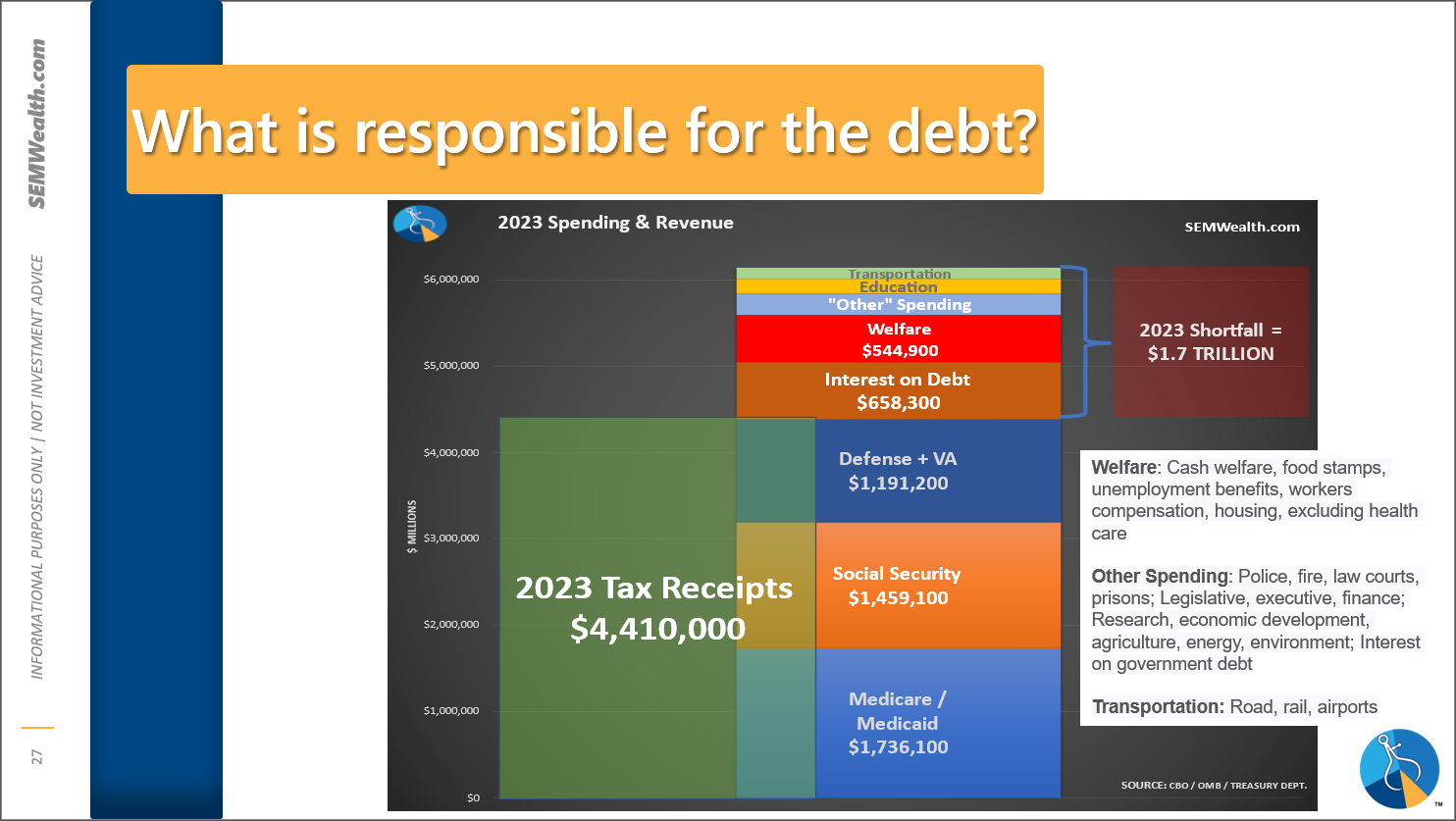

Non-FICA tax revenues cover nearly ALL of the government's needs.

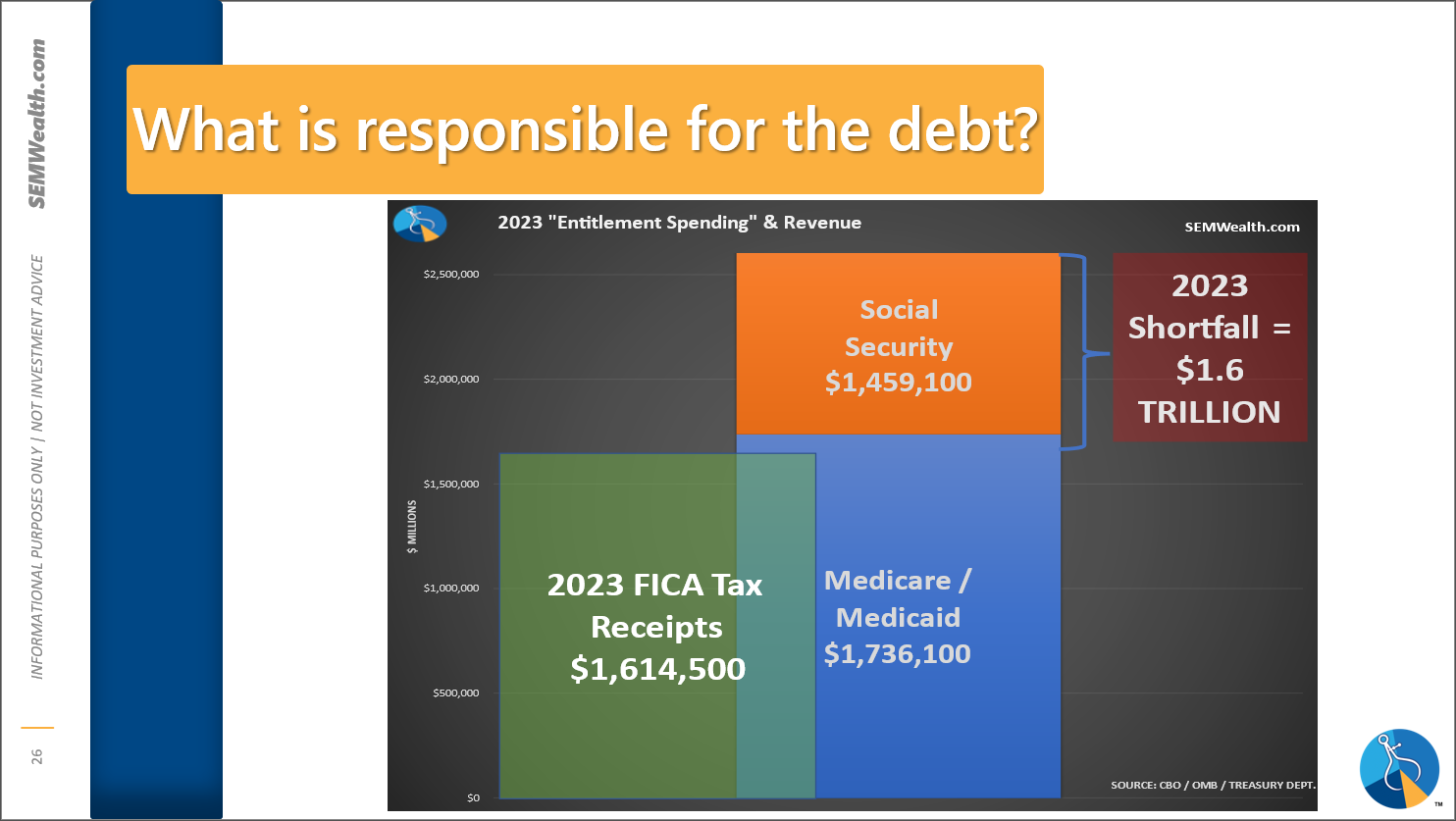

Social Security and Medicare are nowhere close to paying for themselves.

We could slash all areas of government spending except Social Security, Medicare, and Defense and STILL Run a deficit because of the interest on our debt. This means cutting "wasteful spending" or "taxing the rich" will not solve our problems. The only true solution is to fix the deficits in the "entitlement" programs AND find a way to reign in defense spending. (Neither party or candidate dares to do that.)

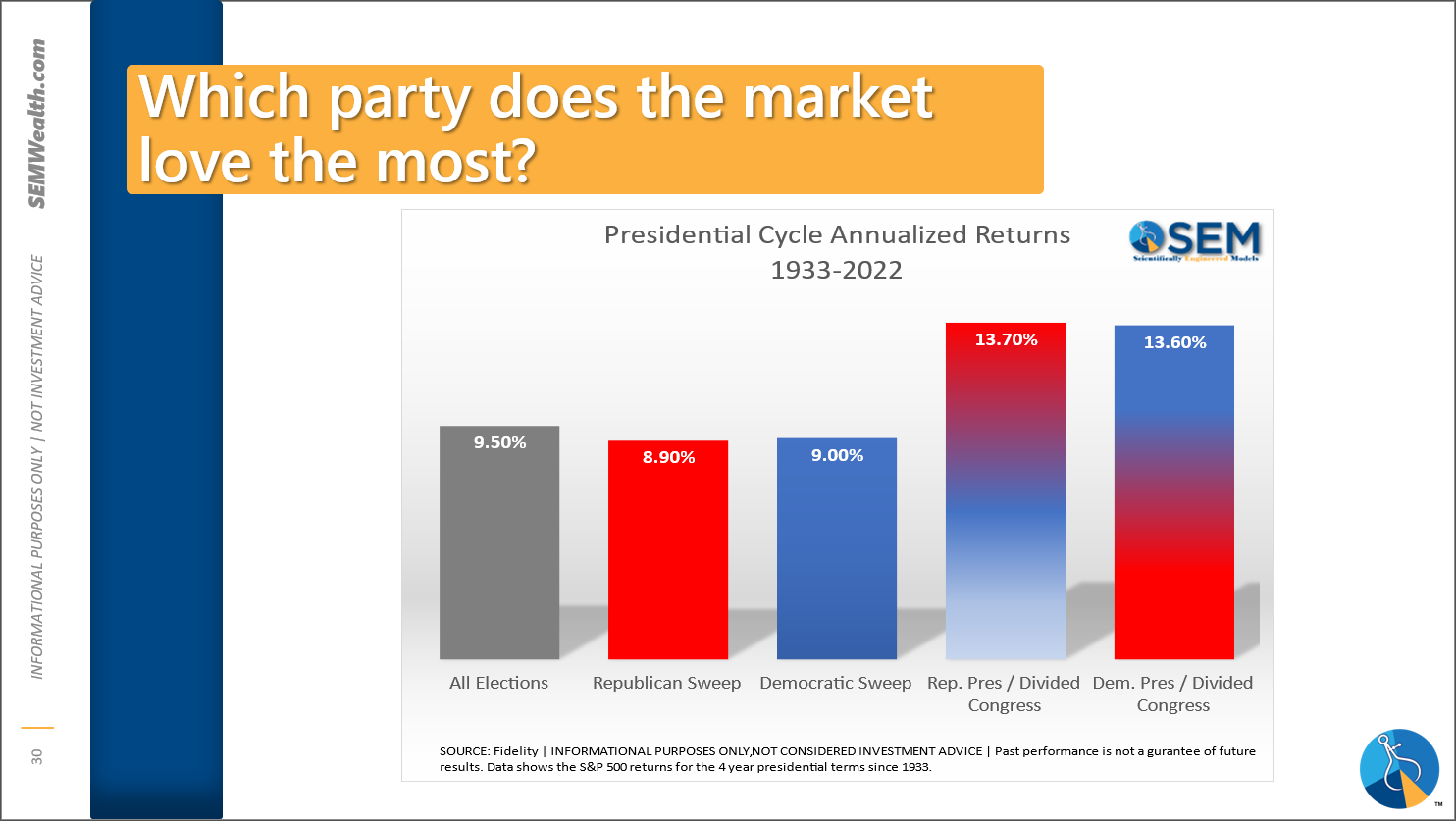

The stock market loves a divided government.

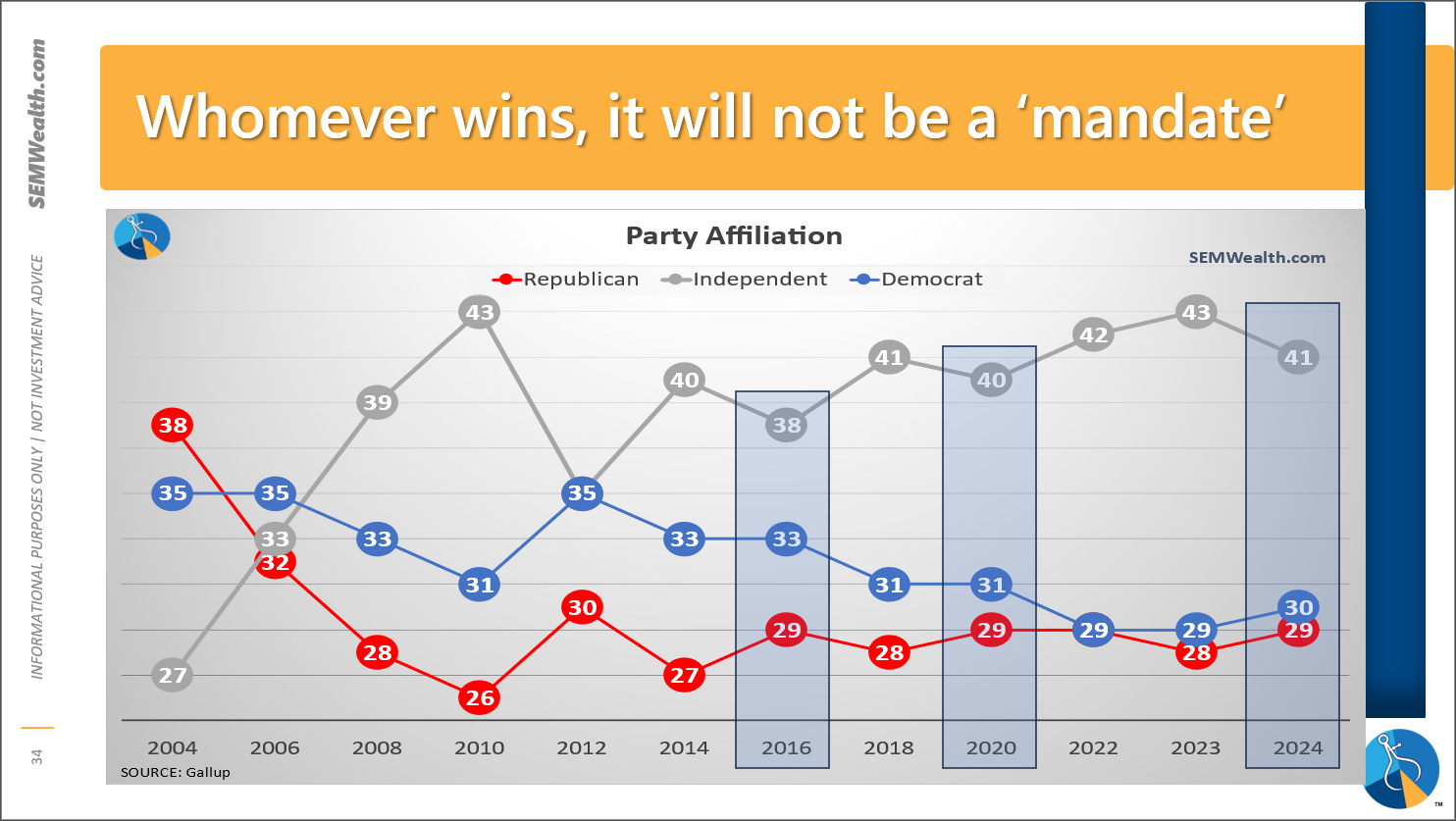

Even though the "winning" party will declare they now have a "mandate" from Americans, the only way either party wins is by pulling the votes from Independent (moderate) voters. Neither party seems to understand this, which is why our government changes hands so often and Americans are so divided – the minority is ruling from the far left or far right, which alienates most Americans.

Please keep this in mind heading into the election (and after):

Q&A:

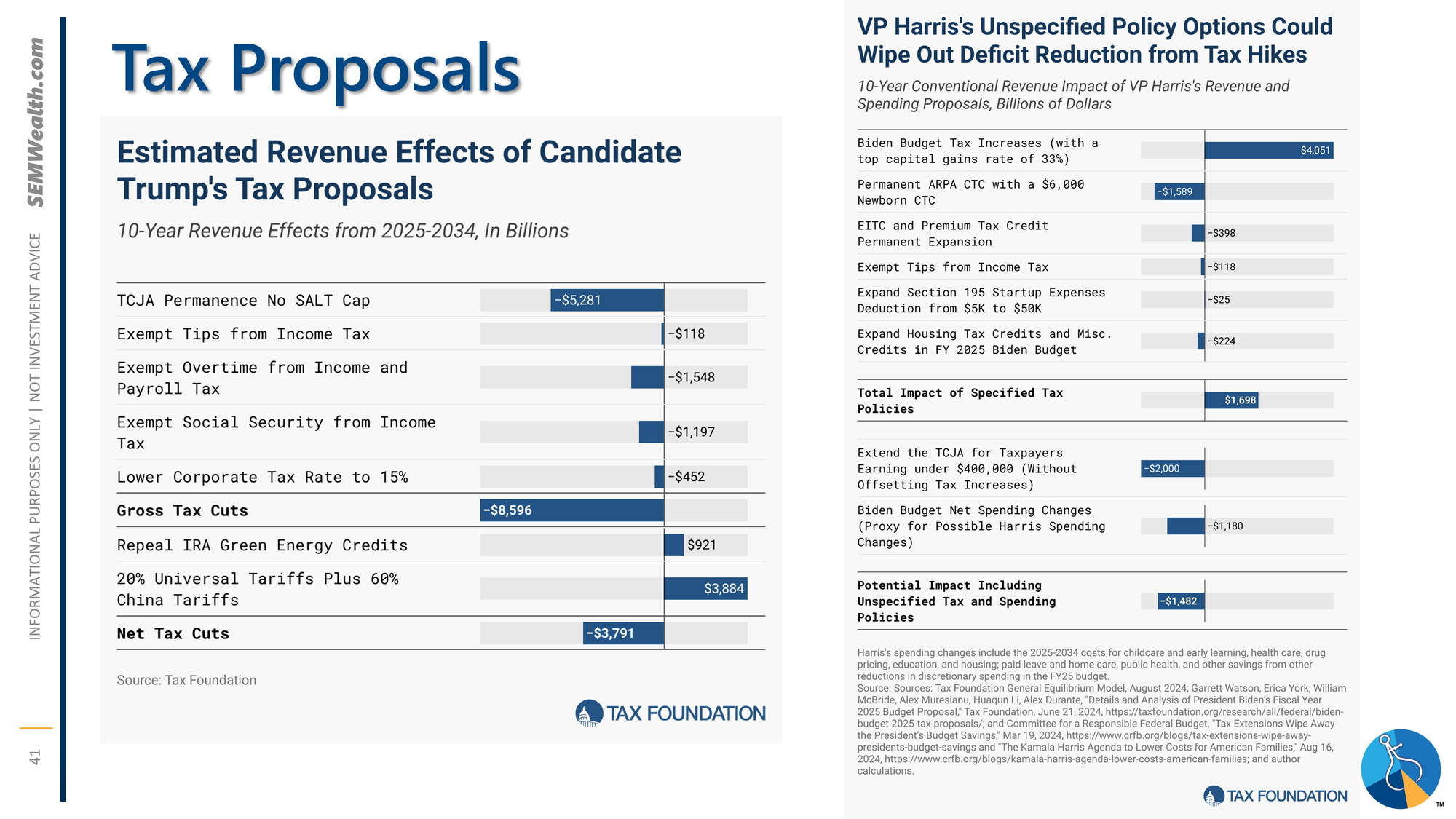

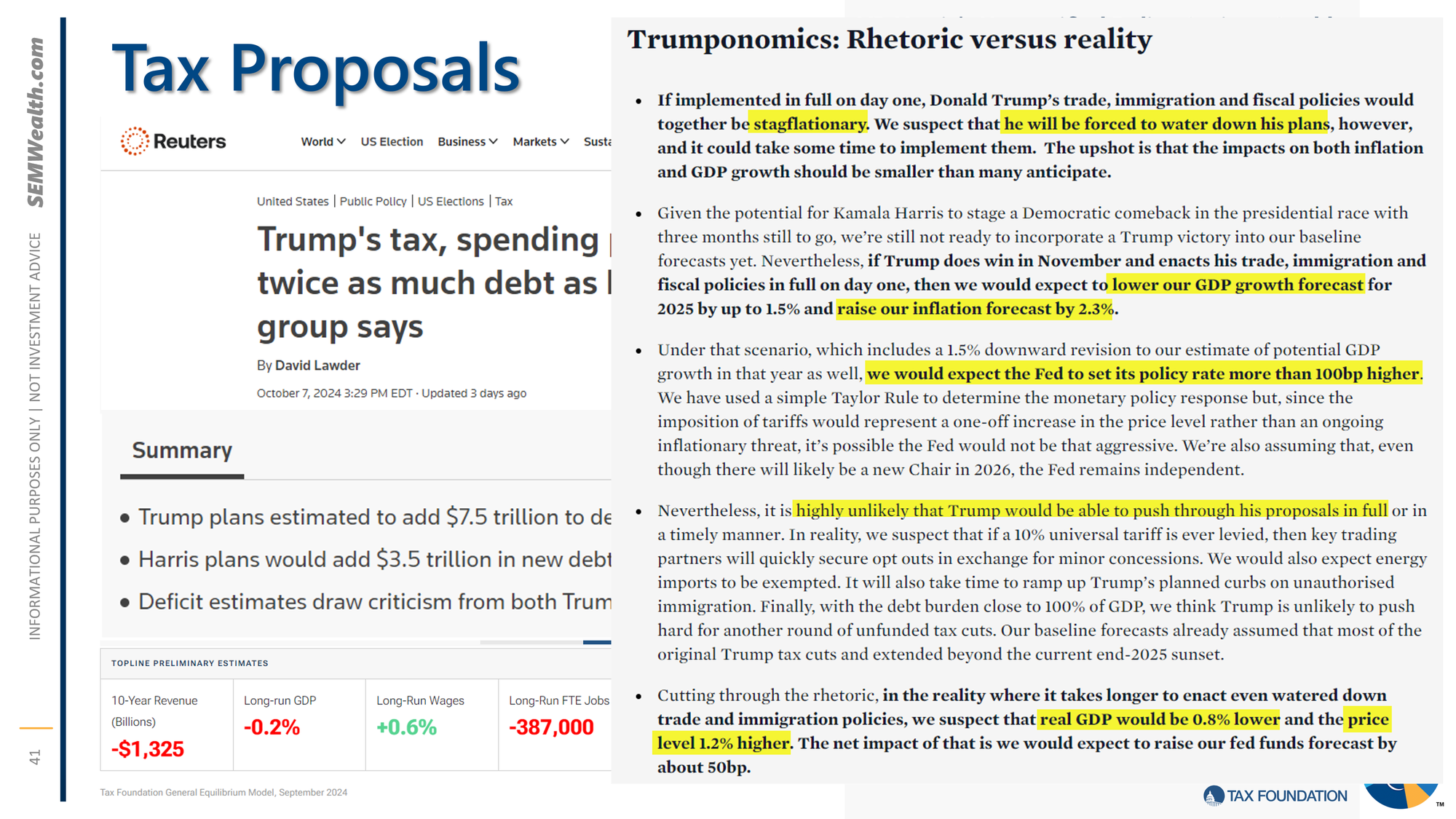

It is not easy to analyze the impact of either as they are campaign talking points and not actual policy:

On paper, most economists agree – Trump's proposals would add more to the deficit and create higher inflation (and thus mandate higher interest rates) despite likely creating more jobs than Harris. This is obviously counter to the talking points in the media.

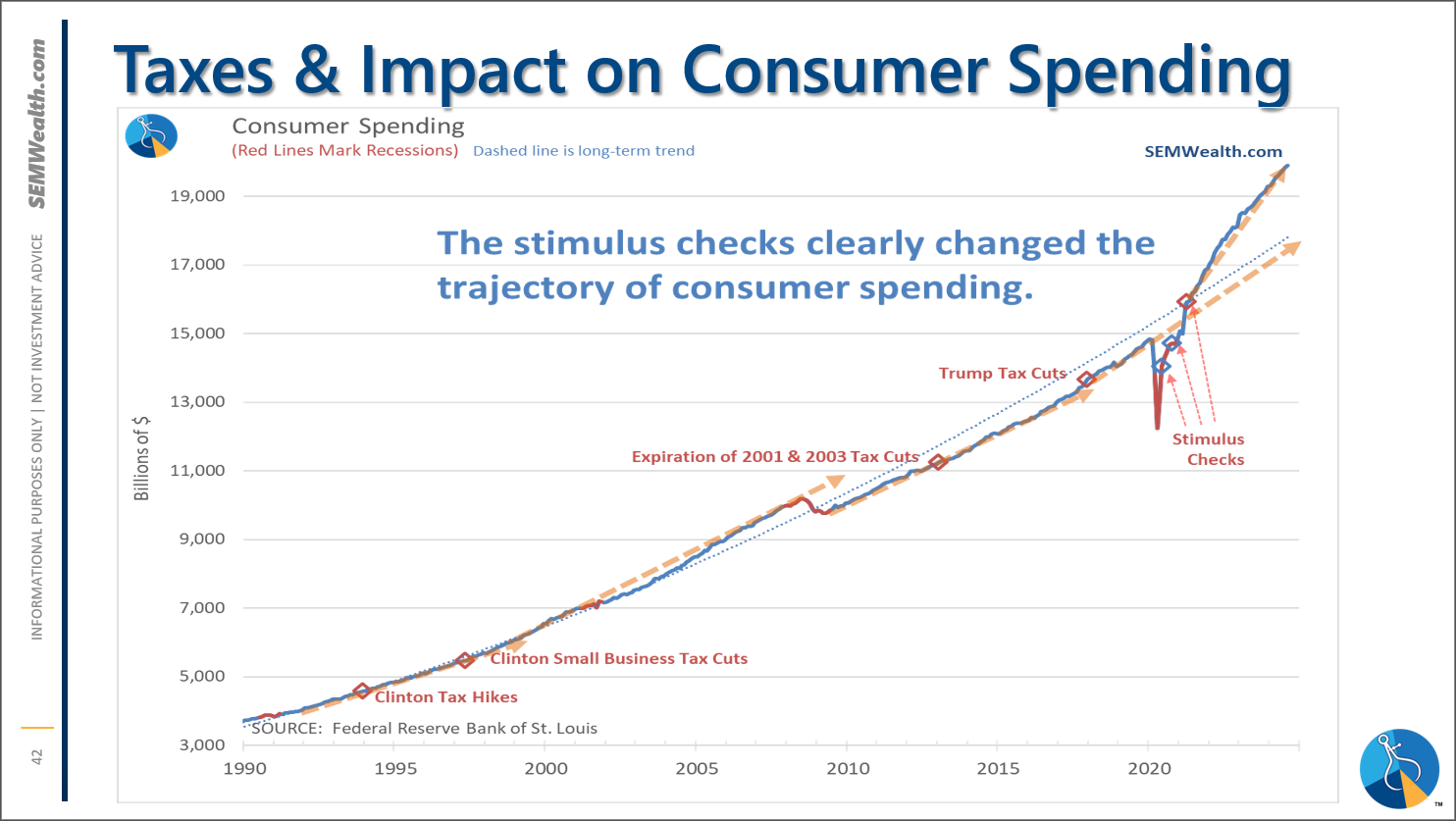

Tax hikes and cuts have done little to change the pace of consumer spending. The only real change came after the 3 rounds of stimulus checks (first 2 signed by Trump, last one signed by Biden):

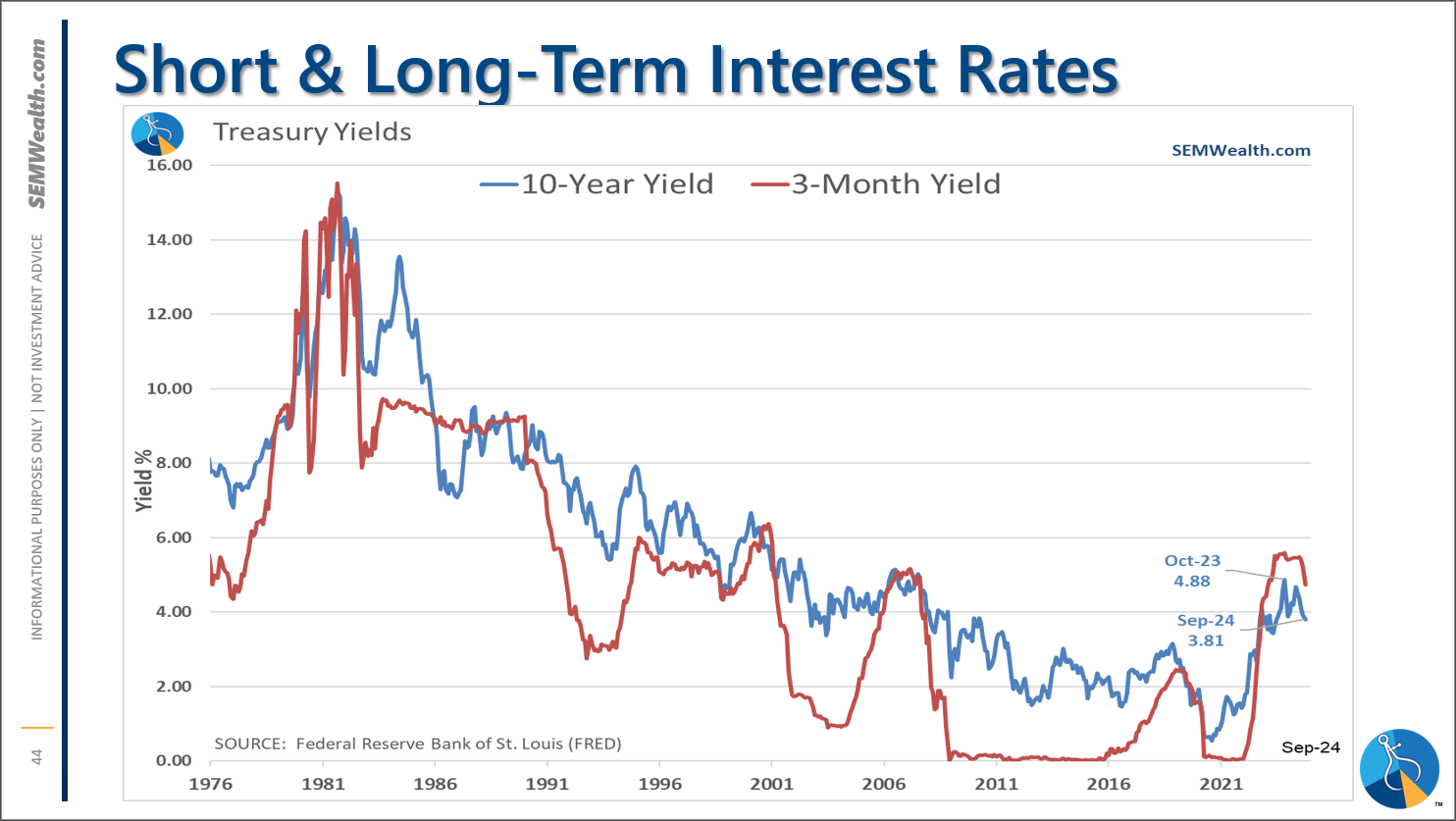

Short & long-term rates are not always corelated. Long-term rates dropped over 1% in 11 months, well ahead of the Fed cutting rates. (Also it is not a conspiracy that they cut rates ahead of the election.)

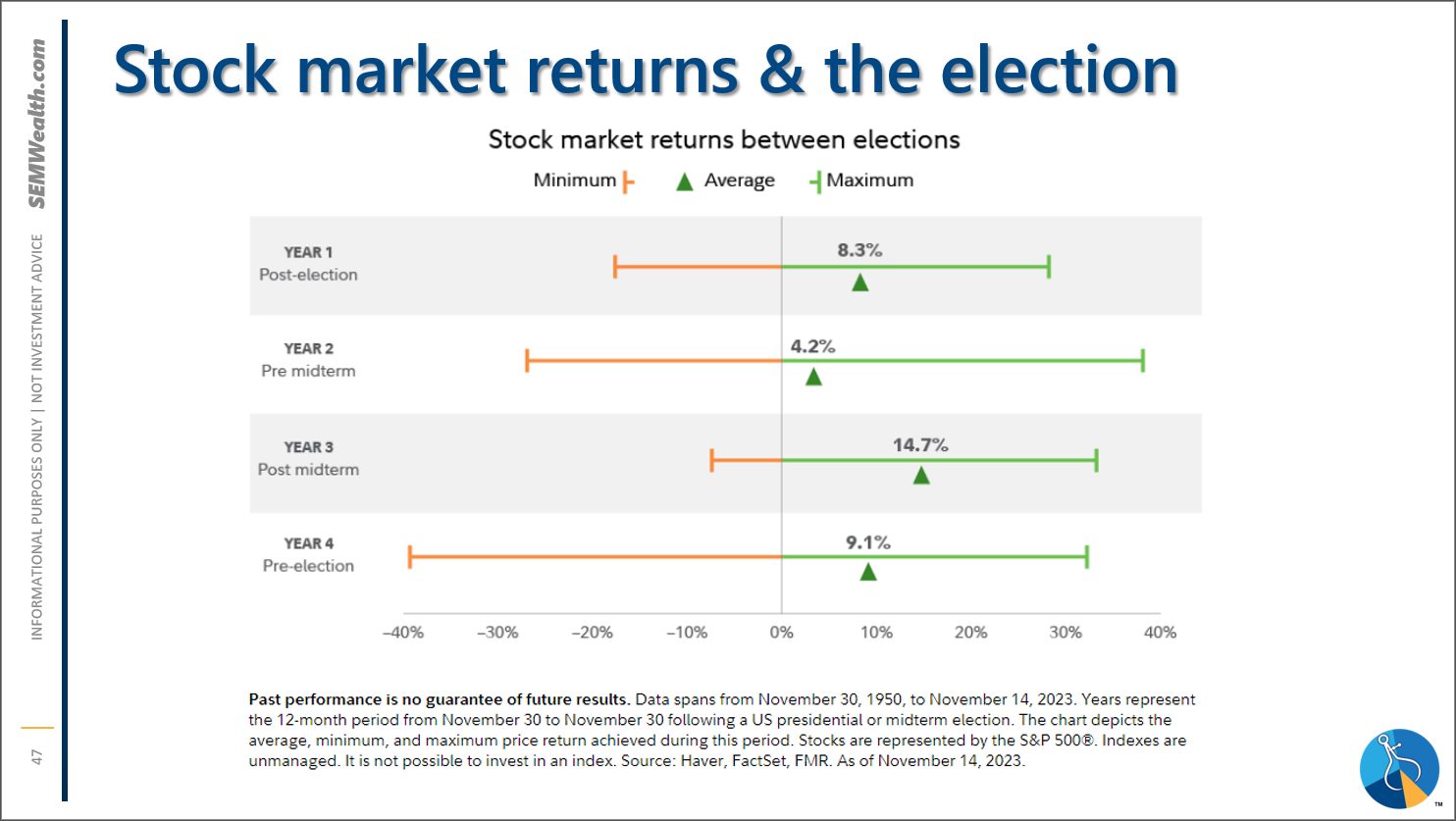

The best returns have historically been in the 3rd year of the presidential cycle. Returns have generally been strong after the election, but there have been some big drops as well.