After traveling for 7 weeks to conferences, advisor meetings, and client events it is good to be back in the office for a full week. The major theme across the board was confidence. Clients, advisors, and portfolio managers are overwhelmingly confident there are no risks ahead. The Fed is easing, the fears of a recession are all but gone, and the president is going to make a deal with China to help him win re-election according to the people I met with. Most expectations are for a strong rally into the end of the year with even bigger gains to follow in the first half of 2020.

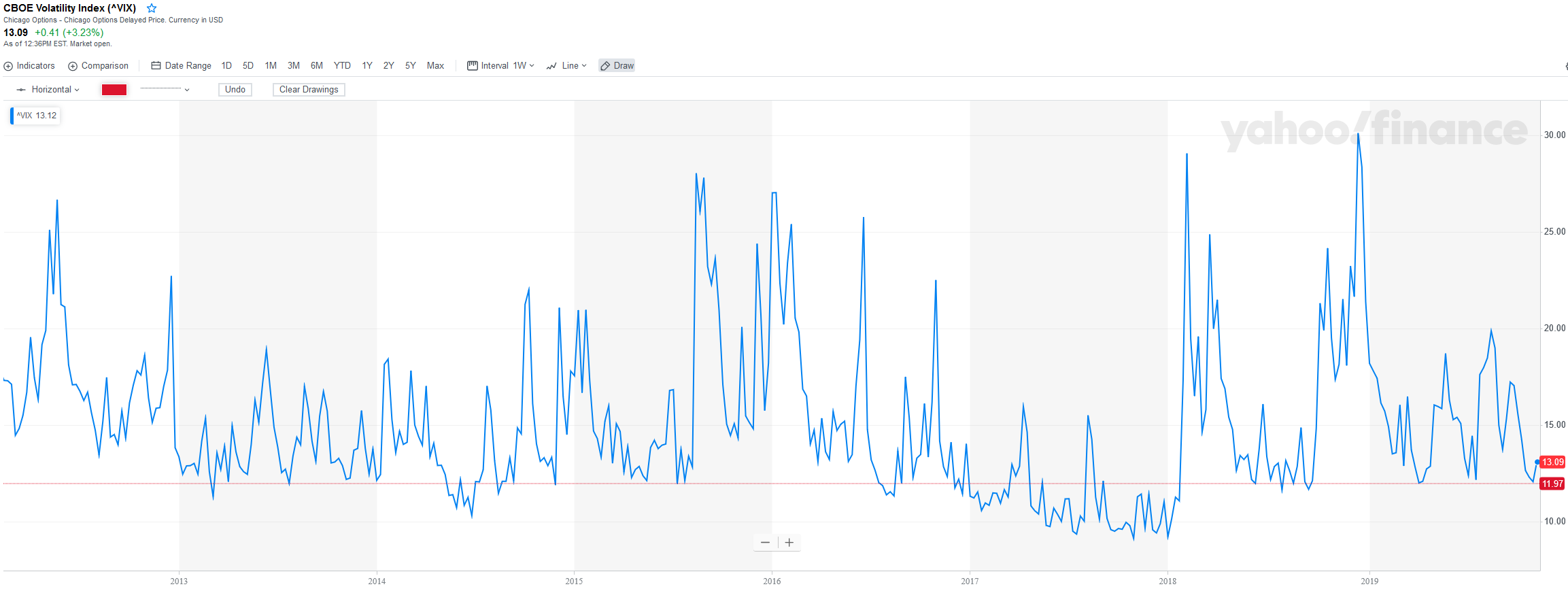

They may be right, but when that many people are so confident nothing could go wrong, I get worried. If “everyone” thinks the sky is the limit it doesn’t take much to cause a sharp sell-off when something “surprising” hits the market. One of my favorite tools in measuring investor sentiment is the Volatility Index (aka “the Vix”). The VIX is a quantitative measure of investor expectations for volatility, which can be extrapolated from the pricing of future’s contracts since all the other variables in the price are known values (time, interest rates, and price). If investors are confident in the future, the Volatility Index will be low. Why would you need compensation for taking on future risk if there is nothing to worry about?

Looking at the chart of the VIX, it is easy to see investors are too complacent. It is once again down to levels where we’ve seen a temporary top in the market (or the start of a more prolonged sell-off). The only time we spent time down at these levels was in 2017 when everyone was pricing in the economic growth the tax cuts was supposed to stimulate.

A low VIX is not something we use in any of our investment models, nor do we question the complacency or level of concern. We let the data dictate our investment allocations, not our opinions. What it does tell us is advisors and investors alike are probably too optimistic about the safety of stocks, which is entering their assessment of their investment portfolios.

Be careful!