As Cody mentioned last week, we are finally officially in election season (even though it seems like we've been there for two years now.) The strength of the economy is likely to be a major talking point. I even heard one fringe candidate during the Democratic debate last week call on the other candidates to remember the sage advice of former President Clinton -- "It's the economy, stupid!"

Hyperbole aside (from both sides of the spectrum), based on the data during the first 3 years of President Trump's tenure economic growth has been trending at a rate better than most of the years during the recovery, but it is still running below the long-term average despite a near Trillion dollar budget deficit last year. The impact of the tax cuts is gone, it could be years before we see any real benefit from any sort of trade deal that reverses our downhill slide in exports and production, and corporate earnings growth has slowed significantly over the past year.

It's not like we haven't had good news. Stocks are obviously pricing in very strong growth, the unemployment rate continues to tick lower, and wages have inched up over the past year. Economists like to point out how we are a consumer driven society, not a manufacturing one, so they are celebrating the 5% growth in consumer spending in 2019. What I've heard nobody mention is the fact personal income only grew by 3%. In other words, consumers spent 2% more than they earned. As my friend Bob said, "It's like getting a credit limit increase on your credit card and coming home to exclaim, 'honey, we got a raise!'"

I've heard some argue the increased spending despite lackluster income growth is a sign of growing confidence in the economy. Consumers figure they'll make more money in 2020 so don't mind borrowing more money. Others have pointed out the use of debt to support spending is a sign of strain, which always ends badly.

So the question of the year is whether the economy is heating up or melting down. I could make a case for either, but given the overwhelming optimism we are seeing from investors, I'm providing some charts from the New York Fed's Quarterly Household Debt report. You be the judge.

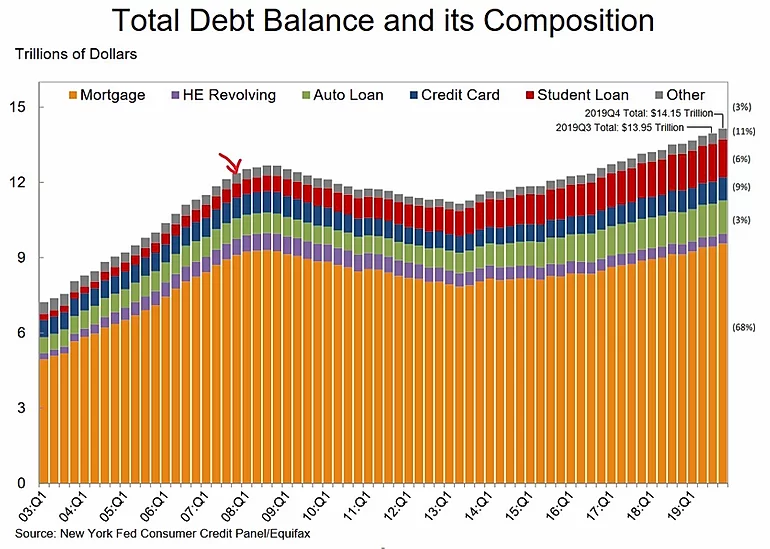

Total Debt continues to rise. Even though mortgage debt is just barely above pre-crisis levels, Student Loans, Auto Loans, and Credit Cards are rising rapidly.

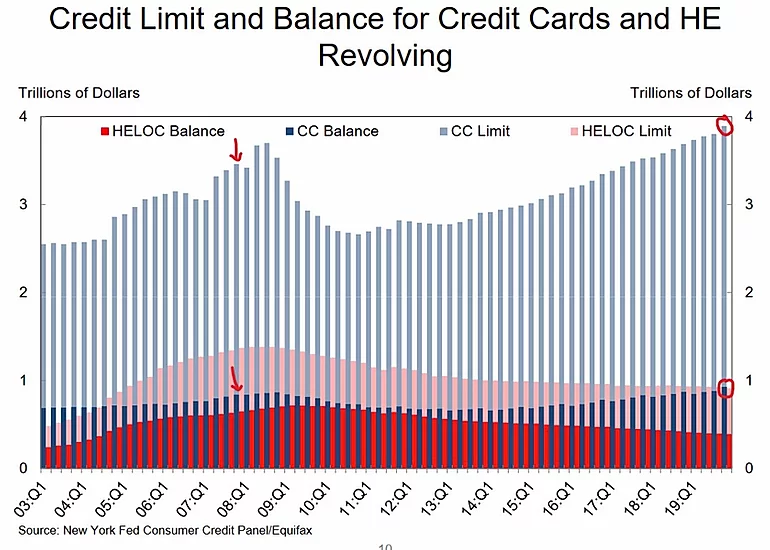

Both Credit Card Balances and the overall limits are higher than before the financial crisis.

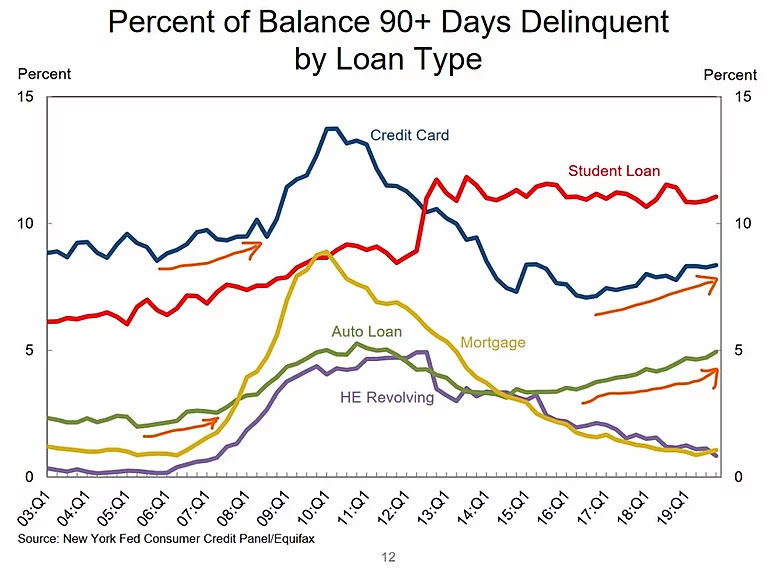

More importantly, the percentage of borrowers 90 days or more delinquent on their credit card or auto loans is climbing, similar to its rise ahead of the financial crisis.

Remember, debt is future spending pulled forward. Even if the income in the future is higher, if it needs to go to paying back the money already spent, it hurts economic growth. If income is not sufficient to cover the debt that must be paid back, somebody else is on the hook for it. If we get too many of those, the banks run into trouble.

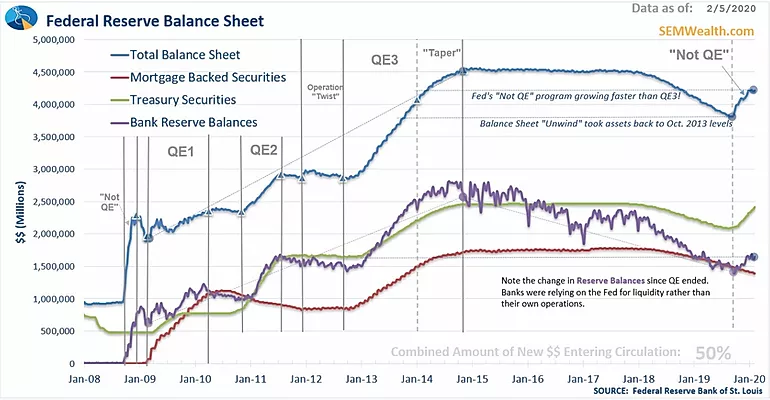

The Federal Reserve is already having to step in to fund banks' short-term needs. The stock market has taken off like a rocket ship since the Fed started bailing out the banks again in the fall.

My question from back then remains -- if banks were in trouble during an economic expansion and bull market, what will happen if we go into a recession and bear market? While I never like to see anybody lose any money, from an investment management standpoint, I am agnostic on the question of whether the economy is heating up or melting down. Our investment models are nicely positioned for either scenario. We are certainly enjoying the gains from the market since the Fed started bailing out the banks, but continue to be pleased with the positioning of each and their ability to react fairly quickly should the economy and financial system begin to melt down (again.)