There are a lot of things that create bubbles, but the primary driver behind all of them is our emotions. Our brains are programmed to both assume what has happened recently will continue to happen and to only watch for scenarios they believe are possible. I've called this current bull market a "liquidity bubble" for five years. Because we haven't experienced the aftermath of what happens when the bubble bursts our brains do not worry about the impact. The party goes on...............until the free market and unchangeable economic dynamics take over.

I continue to hear from the financial advisors we work with that a.) This is nothing to worry about, or b.) surely the Federal Reserve will not let the financial system implode. Rather than once again reminding everyone that too much debt is a bad thing, that paying a high premium for stocks when GDP growth is running below average, and most importantly that since their beginnings a hundred years ago the Fed has had one primary job -- to prevent the financial system from imploding. They've had additional jobs added to the list -- controlling inflation and maximizing employment, but those are both tied to not letting the financial system implode.

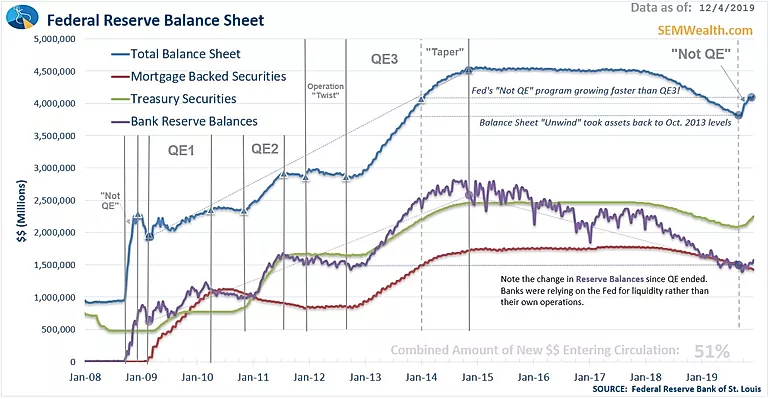

Lest we forget as late as August 2008, the Federal Reserve believed the problem in the banking system was both "contained" and "temporary". The reason I bring this up is because once again we've seen how dangerous it is to trust the Federal Reserve to control the financial system. Back in September we saw the overnight lending market essentially frozen as banks struggled to come up with enough cash to meet demands on the money. The Fed rushed to help and created a "temporary" program that Fed Chairman Jerome Powell has consistently argued is not Quantitative Easing to assist in the "short-term" funding issues.

Whatever you call this, it is reminiscent to when the Fed was caught flatfooted in the summer of 2008 and had to rush to create new money in order to buy assets from the banks who were struggling to meet cash demands. They then learned they had to launch not one, not two, but three Quantitative Easing programs where they had to create new money to purchase assets from the banks. Each time the program ended the banks again struggled to meet demands.

I'm not saying we are on the verge of another financial disaster, but what I am saying is it is completely misguided to believe the Federal Reserve has control of this. Just this week the Bank of International Settlements issued a report on the funding issues in the US in September. Their conclusion was the issues were neither short-term or the result of the calendar as the Fed had concluded. They instead believe the issues are both long-term and STRUCTURAL. The Bank of International Settlements is essentially the "central banks of central banks" and among their many roles is to study the financial systems of the world's leading economies.

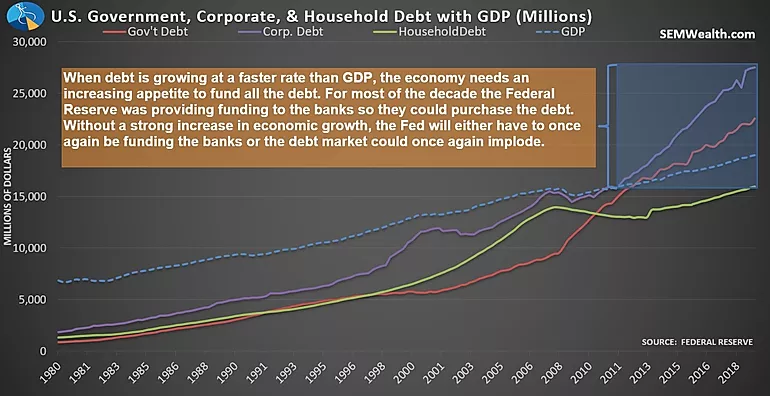

What also caught my eye this week is the growing concern from both the Fed and banks about more issues in the overnight lending market next week. Like we saw in September, the US Treasury has some very large debt auctions coming up at the same time quarterly tax payments are due. Since the Treasury relies on the primary dealers (the Wall Street banks) to buy up the newly issued supply of debt, the banks have to come up with the cash to fund it. For most of this decade the Fed was there to turn around and supply cash or to purchase the bonds back from the banks.

Does anybody see the irony? The government is now spending $1 Trillion more than they are taking in via tax receipts and in addition to the money rolling over to be re-issued for maturing debt has to borrow money to fund this. The financial system cannot handle both the lower tax receipts and the increasing amount of debt yet NOBODY from either party cares at all about getting the budget under control. Both parties are set to expand the spending in order to buy votes.

This is going to lead to a world of perpetual bailouts............until the free market and unchangeable economic dynamics take over. How long will the tax payers allow the Federal Reserve and Congress to bailout the Wall Street banks who not only were saved by the taxpayers in 2008, but became even bigger than they were before the crisis?

That's not something I want to base my investment plan or my business on going into the next decade.