The labor market continues to show signs of strain. While the headline payroll number didn’t move much, digging into the details reveals a troubling trend. Job growth has essentially stalled over the last three months......something that historically happens just before or during a recession. We’re not

Tag: Valuations

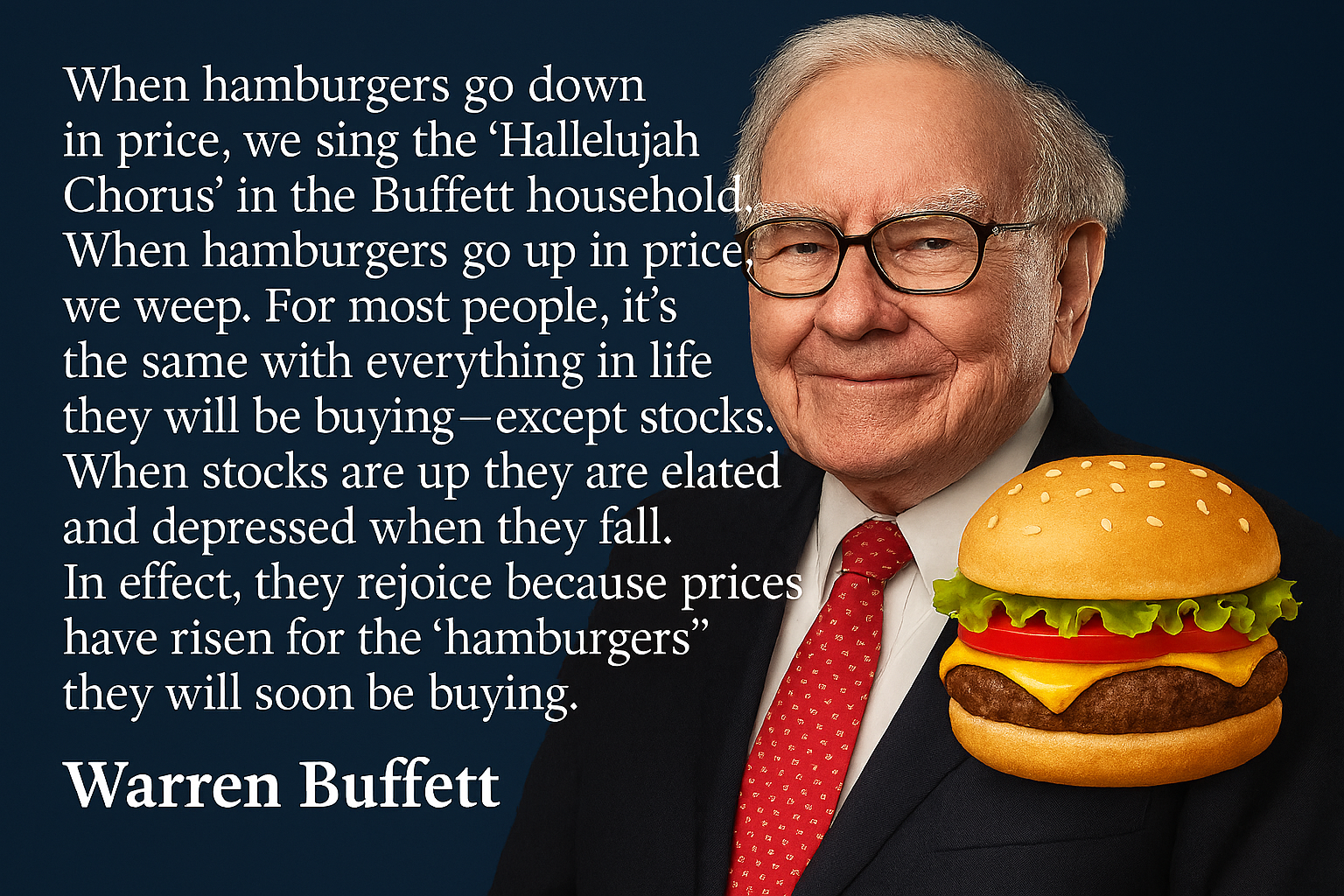

Nobody likes going through anything uncomfortable. That's just human nature. This is also true when investing.

Over the long-term, stock market returns have averaged around 10% per year. This is true whether you go back to 1990, 1950, or even 1926. When you start investing the 10% sounds great. What

We're at that point of the year between Christmas and New Year where it's hard to remember what day of the week it is. At SEM where we have advisors across the country it will be a heavy dose of "out of office" messages when we try to contact them

As I've said since the election, there is no point right now trying to predict what will happen over the next year (or four). Based on my inbox, everyone has their predictions. Maybe it's because their marketing people tell them they have to, but based on my experience there is

The past few weeks we've discussed the current positioning of the market. Most investors like to believe they are following a 'buy low, sell high' philosophy, but too many times our emotions get the best of us and we end up buying high, which means our only hope is that