Availability Bias: an information-processing bias in which people take a heuristic (mental shortcut or rule-of-thumb) approach to estimating the probability of an outcome based on how easily the outcome comes to mind. Easily recalled outcomes are often perceived as being more likely than those that are harder to recall or understand. People often unconsciously assume that readily available thoughts, ideas, or images represent unbiased estimates of statistical probabilities. People decide the probability of an event by how easily they can recall a memory of an event. The basic problem is that there are biases in our memories. For instance, recent events are much more easily remembered and available. [1]

When I started with SEM 20 years ago, Rick Gage explained this phenomenon as “recency” bias. At the time there was no such thing as Behavioral Finance. Over the last two decades I’ve witnessed far too many times the damage Availability Bias does to investment portfolios. Both advisors and investors are subject to these biases. The best way to overcome an “information-processing” bias such as this is to take a step back and look at the data. The market moves in cycles. Always has, always will.

Right now I see advisors and their clients making decisions based on the most available information. Over the last 9 years, investors have enjoyed significant rewards by buying the dip. That works — until the bull market cycle is over. In the same way, I’ve heard too many times advisors and clients say, “[Fill in fixed income fund name here] has done a good job for [10, 20, 30] years”. What they do not realize is these funds have only managed money in a bond bull market.

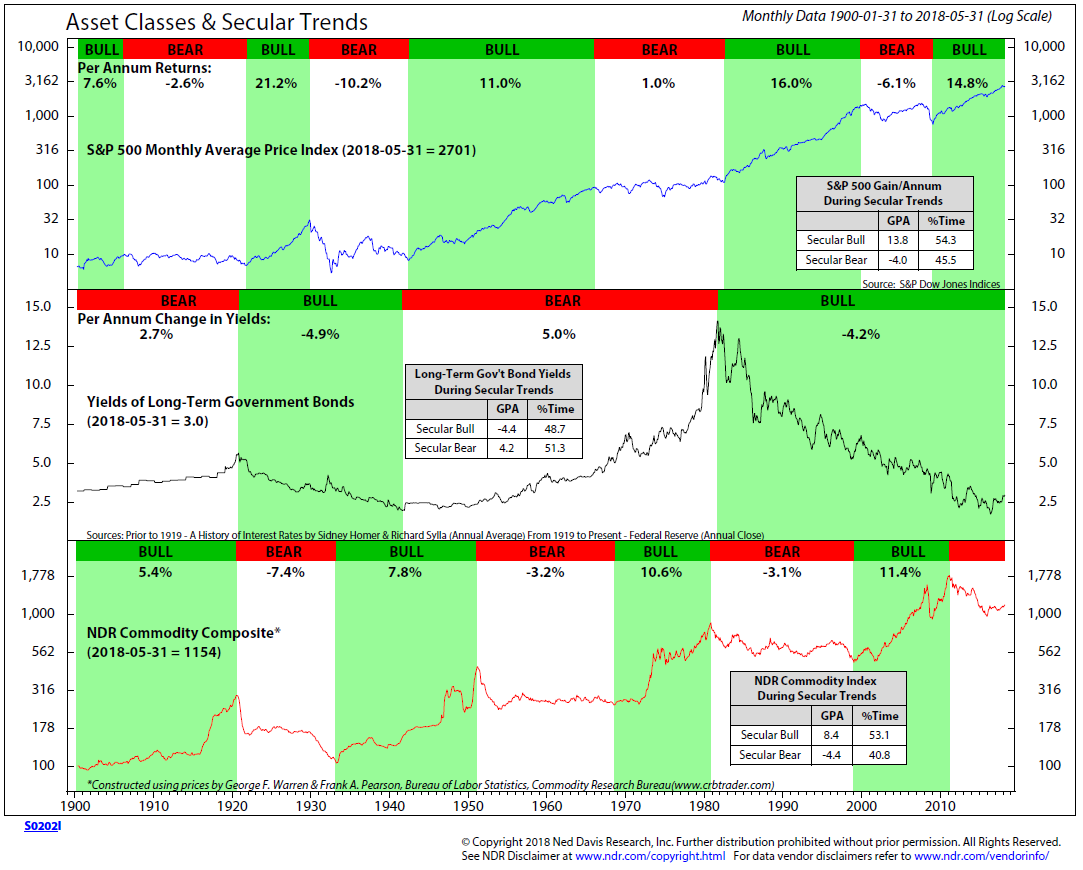

I saw this chart earlier this week from Ned Davis Research. Nobody knows until we have the benefit of hindsight when the market cycle has shifted, but it is interesting to remember there are long periods of time where stocks & bonds have significant declines. It’s been a long time since we’ve had a bond bear market, but it can and will happen. The funds you think will provide downside protection because they did last time may not provide the same protections this time around.

The only answer, in my opinion is to use a data driven approach that is designed to adapt to whatever the market has to offer. Focusing on shorter-term trends allows us to take advantage of opportunities that will develop regardless of the market environment. We’ve been doing this along time and have seen Availability Bias rear its ugly head far too many times. If you would like help developing a portfolio that is designed to adapt to whatever market environment we are in, drop me a note.

[1] SOURCE: The Behavioral Biases of Individuals; Behavioral Finance, Individual Investors, and Institutional Investors, 2016 CFA Level III Program Curriculum, CFA Institute, pg 67