The wait for the Fed to give us more insight into their tapering decisions ended last week, with the tapering set to begin sometime this year. With the Fed's help going away, the market will remove its training wheels. Will that lead to a crash or a sharp pullback like we saw when they tried to get out of their Financial Crisis stimulus?

The short-term response to this news was a little bit shocking to me. With the market toward the top, any minor setback has the potential for a giant stumble. However, this move must have been telegraphed by market-makers, because it didn’t lead to any short-term sell-off. While taking the Fed's assistance out of the equation certainly isn't good news for the market, it gave us some certainty to expectations. With the market not liking uncertainty, it looks like the price on certainty is more valuable to the market than this tapering. Of course, this is incredibly short-term, so the medium or long-term effects aren’t known yet. That will likely depend on any setbacks in the market, that might require delays to the tapering. While we got some certainty, I can promise you there are plenty that we have no idea about.

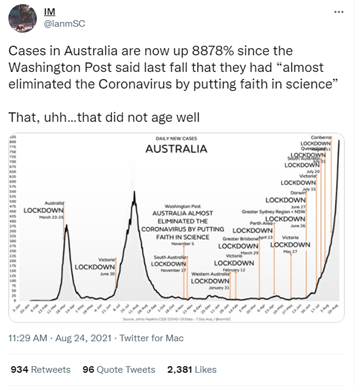

For both the market and the economy, perhaps the one thing there is still a lot of uncertainty about is the threat of the pandemic we find ourselves in. While we have opened the economy more than we have in the past 18 months, there is still a need to monitor COVID. I don’t think there is much of a stomach to a shutdown, even if the number of infections and hospitalizations continue to rise – that would lead to some tough decisions to be made by local or maybe federal officials. The difference in political opinion still plays a large factor in how we view the threat of COVID. That is the difficult part about this entire thing, nobody is sitting here wanting COVID to continue. We ALL want it to go away. It isn’t easy finding commonality in opinion, so there is always relishing to do when we find it. There will always be data available, no matter how skewed the data might be, to back up your opinion. This tweet has a chart showing the daily cases in Australia. Luckily for us, the argument being made is that lockdowns by themselves do not appear to eliminate the Coronavirus.

There is probably a chart out there that says the opposite of this chart and has the exact opposite argument. Unfortunately, it’s almost impossible to look at a single chart that shows all factors that gives us a definite answer to what we should be doing. However, there is one piece of data that, while not perfect, is constantly encouraging; the effects of those who are vaccinated show real safety and protection from COVID-19. The number that I look at when it comes to Australia: 1 in 4 Australians are fully vaccinated. Their situation isn’t quite like ours, where anyone who wants one can get a vaccine – it is truly unique to the US. With that being said, the US is still among the world leaders in % of fully vaccinated adults. But we’re looking at just over 60% of Americans who have at least one shot. That means 40% of willing adults, who can walk into any pharmacy and get their vaccine, are NOT 99.99% safe from breakthrough infections. Yes, there is a .01% there.

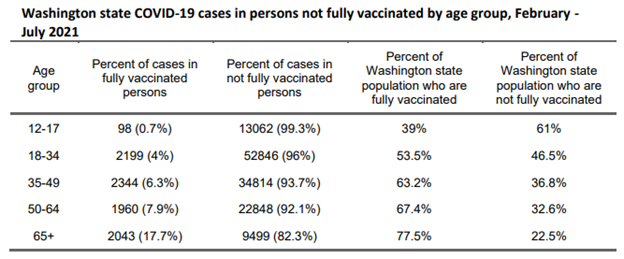

I think the flaw I’ve seen the most is comparing that .01% risk of non-mild symptoms to 0% and saying 0% risk is better than .01%. The issue is we should know by now there isn’t a non-zero risk if you don’t get vaccinated – or anything for that matter, including the market. The .01% does not mean the vaccine is a failure, but we do see that it helps significantly. We have a resource available to us, that requires 1 or 2 appointments over a 3 week period, and maybe a day or so of aches and chills, that costs us nothing, that not only significantly helps us individually, but that help make alternatives - full hospitals, shutdowns, masks, whatever else you can think of, unnecessary. This data is provided to us by the Washington State Department of Health, which shows us how effective this little noninvasive vaccine really is. Again, you can cherry pick any part of this chart to confirm whatever opinion you have, but the most interesting part of this chart in my opinion is that in the groups from 18-64 we see the majority of population in this group is vaccinated, and the overwhelming majority of the cases were in those NOT VACCINATED. Yes there is still a chance you can catch COVID if you're vaccinated, but the risk to the economy and markets is if too many unvaccinated people cause schools and businesses to be shut down again.

You can look at charts a lot of ways, but when you can segment 2 samples of a population and come up with a divide THAT overwhelming, it is clear to me we have an OBVIOUS cause and effect. It is very difficult to come up with any concrete data points in charts this definitive. Chances are I didn’t change any minds, but I care about the person reading this and want the person reading this to have the best financial and life situation. You are much more likely to catch COVID and deal with life threatening complications and potentially life altering long-term effects than you are to have any lasting side effects from the vaccine.

When it comes to making decisions on whether to do or not to do something, we help ourselves when we try to leave any biases we may have at the door. If we don’t, then we’re only hurting ourselves. We don’t want to hurt ourselves. It is HARD to turn your biases off. We’re all human and we all have them. We live in an excellent time where we don’t have to follow our own intuition to make decisions. There are aids, data, studies and plenty of people to help you make the very best decision for you. We also live in a time where all of that aid can be a detriment if we aren’t being honest about our motives. While this has been long-winded about a topic that has been a heavy-discussed conversation of the past year, the impacts unfortunately make their way over to the financial area. We know at SEM that is where we are truly an aid to people, and we will continue to avoid our own human biases and simply look at the data. As we showed throughout the last 20 months, our systems are designed to adapt to whatever COVID (and our biases) throw our way.

Jeff here, I know this post may seem political, but ironically Cody is far more "conservative" than I am in his points of view. He is also extremely analytical and good at digging deep into wide ranges of data to come up with a clear point of view. COVID remains the number one risk to the economy and thus the markets, which is why we are still having to discuss this in the blog. This shouldn't be political. As Cody said, we all want COVID to go away. I guess this is a good segue into my Random Musing this week.

Jeff's Random Musings

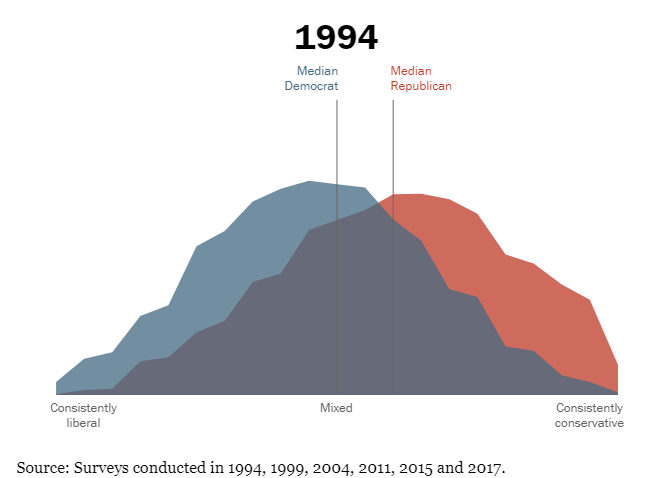

For over a decade I’ve written and presented on the “Social Cycle” an 80-90 year cycle with 4 distinct periods. I won’t go too deep today. I’d encourage you to check out these two posts as they remain almost more relevant today than when I first wrote them.

We are in the middle of the “Crisis” stage of the cycle. This is the period where all of the divisions created by uneven policies driven by the “ideological” generation begin to tear our country down. The younger generations begin to question decades of policies and institutions which creates further division as the older leaders attempt to hang onto their ideals. It’s a messy time, but necessary for future growth. Prior crisis stages included the Great Depression/World War II, The Civil War, and the Revolutionary War. All were preceded by times of great economic booms. All were followed by an even greater economic recovery.

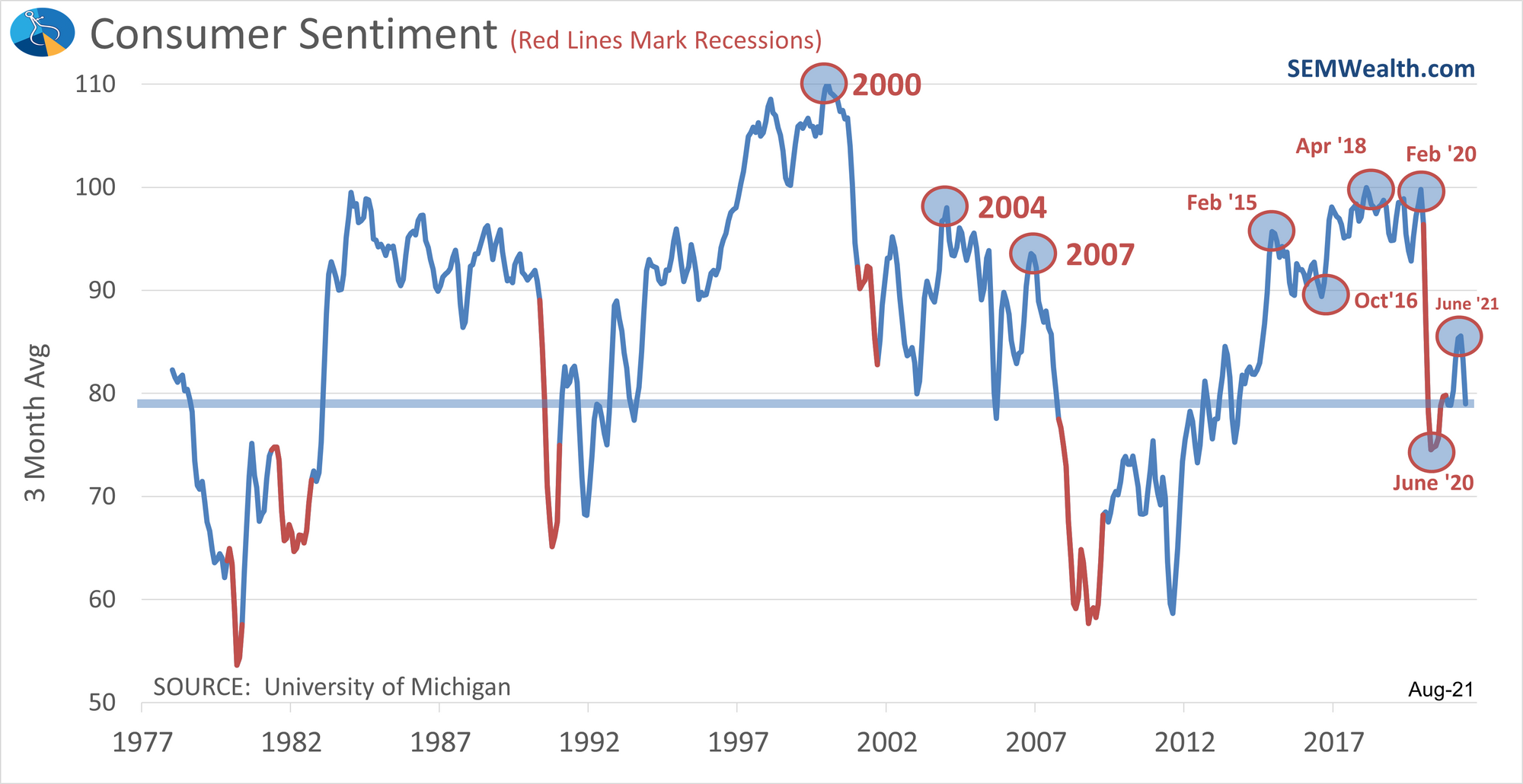

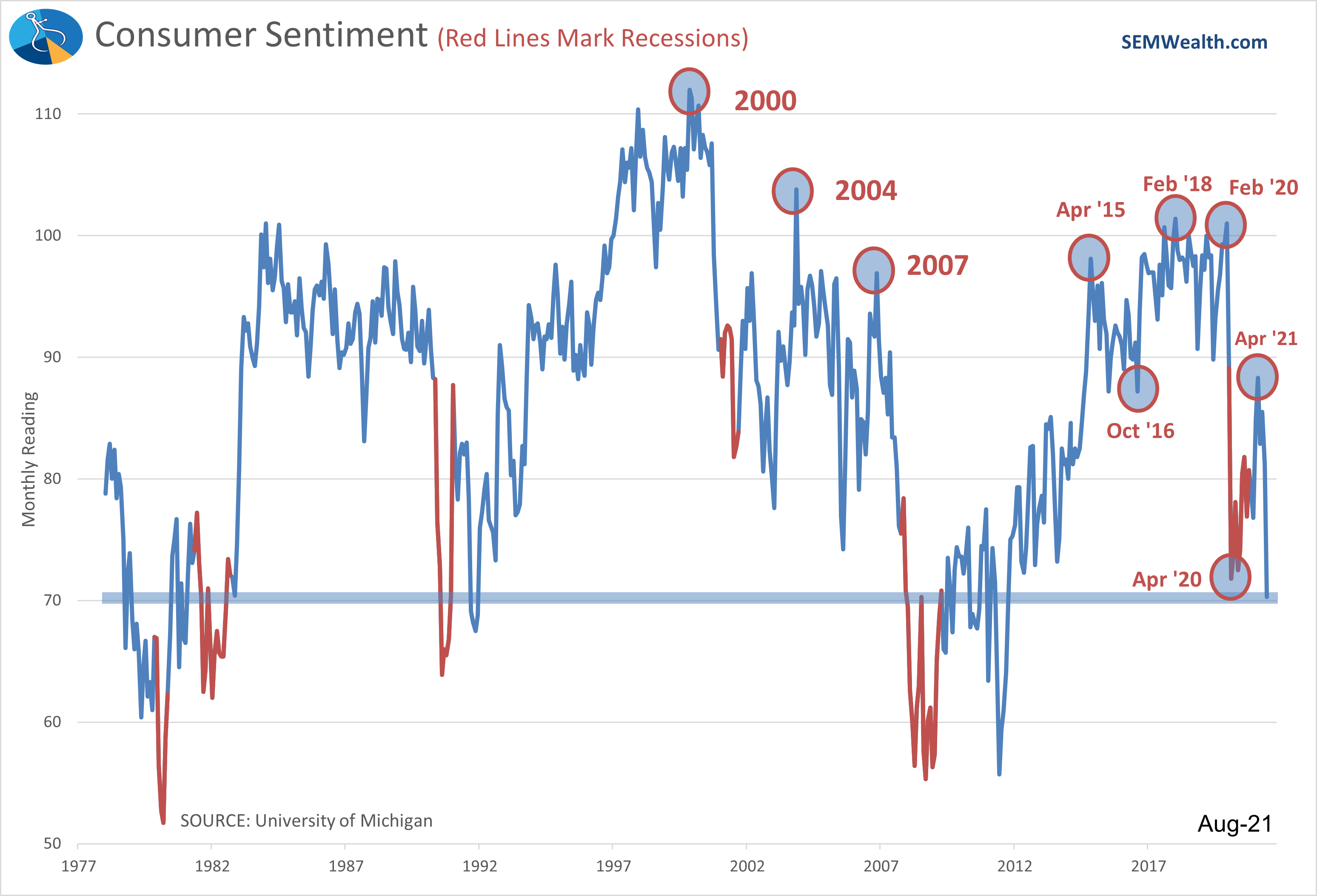

I think one data point that reflects this stage is Consumer Sentiment. It peaked in 2000 and had successively lower peaks in 2004 and again in 2007. It climbed slightly above 2007 levels in 2018 and again just before COVID hit in 2020, but still was nowhere near the “glory days” of 2000.

When you take a step back and understand the demographics, this makes sense. The Boomer generation enjoyed spectacular economic and investment gains throughout their working lives. Just as Gen X was hitting peak working years, the Tech Bubble burst. Then when the average Gen Xer was in their peak family formation years, the housing bubble burst. Millennials saw many of their parents lose half of their retirement savings (or more) when the tech bubble burst and then their homes when the housing bubble burst. At the same time, skyrocketing college costs and limited job prospects have saddled both generations with more debt and less income than the older generations enjoyed.

Both Gen X and Millennials are not as confident in their futures, which is showing up in the Consumer Sentiment numbers. For our economic model we use a 3 month smoothing to take out some volatility, but zooming into the 1 month change we see a striking drop in overall sentiment.

Sentiment peaked at the same time the 3rd round of stimulus checks were hitting. This was also the same time pretty much anybody who wanted a COVID vaccine could have received one. Sentiment is now LOWER than it was at the depths of the COVID crisis! This could be temporary, but I think it is something we should all be aware of. Stocks can fight negative sentiment for a while, but this will start to drag on earnings and economic growth. With stocks again hitting all-time highs there is little room for error.

Whether this drop was short-term or not, the overall decline in sentiment is not. There are major structural things that must be done. This is not a political statement. I see merit and serious damage in proposals from BOTH sides. The trick for investors will be how much of the good is mixed in with the bad as politicians with 2-year terms attempt to keep voters happy while dealing with long-term issues.

Long-term (10-years+) I’m very optimistic about the market and our country’s economic growth. I know Americans will eventually come together and fix the mess that was created over the last 40 years. If you need your money in the next 10 years (meaning you are already retired or planning on retiring during that time) OR you simply cannot stomach the thought of losing 35-50% of your investment accounts, we need to talk. ASAP.