It's probably hard for most people to understand 25 years ago the Federal Reserve was quite secretive and didn't have the sole (perceived) focus of keeping the stock market afloat. Then in 1998, the Federal Reserve decided to bailout a handful of Wall Street banks who were overexposed to a quite risky currency bet and the "Fed Put" was created.

A put option is a derivative contract which can be purchased to protect an investment from additional downside. It allows investors to take on more risk knowing they have a defined risk level. The Fed Put since that time has become much more prevalent. In 2008, Fed Chair Ben Bernanke fully implemented one of his many academic theories which was that monetary policy could be enhanced with open communication from the central banks. This "new era" of Fed policy has led to a constant focus on speeches made by Fed members.

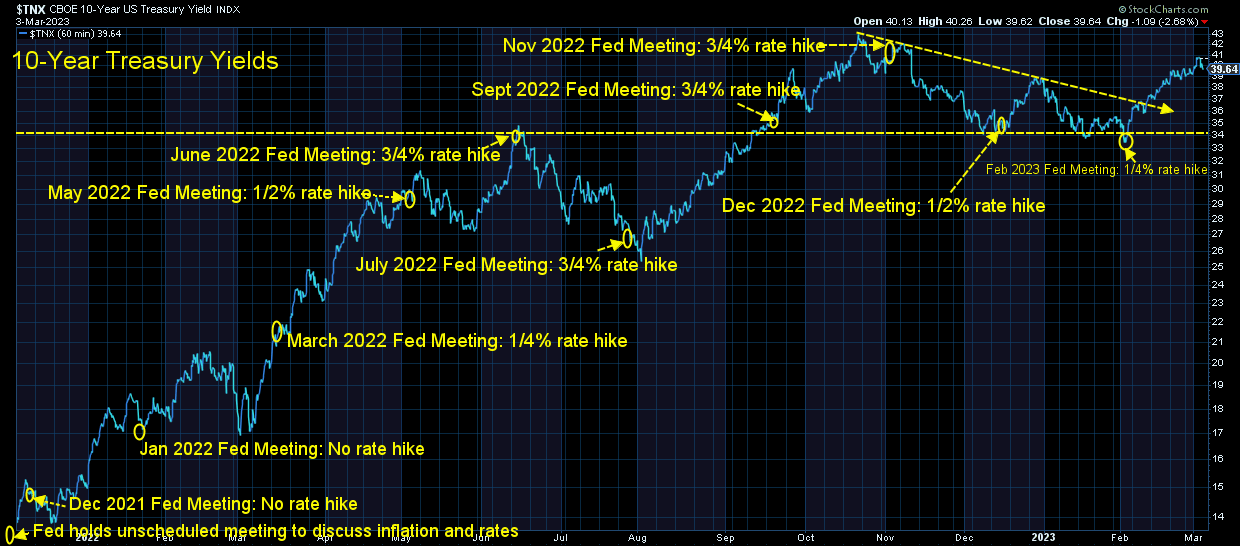

Combine this with the expectation that the Fed will save the stock market and we have seen instances where slight changes in a message in one speech cause a big rally (or sell-off) in the market. This was the case late last week when despite a parade of Fed members the past two weeks reminding anyone who would listen their primary concern is not raising rates so much the economy falls into a recession, but instead that inflation has become to embedded in the economy. We've seen interest rates move significantly higher as the bond market shares the concern of the Fed's members. The longer inflation sticks around at higher levels, the more difficult it will be to control.

The head of the Atlanta Fed still indicated he is concerned about inflation, but when he said during a Q&A session following a speech on Thursday he is "open" to a "pause" in rate hikes, the market shot higher. He obviously does not set policy and just the day before said in an essay the Fed had "a long way to go." By nature, the market is eternally optimistic. The thought of a "pause" was enough to spark a big rally off the lows on Thursday and continue into Friday.

I spoke about "overconfidence" last week and will continue to warn anybody about having confidence in both the earnings outlook and the Fed's ability to control inflation without causing a recession.

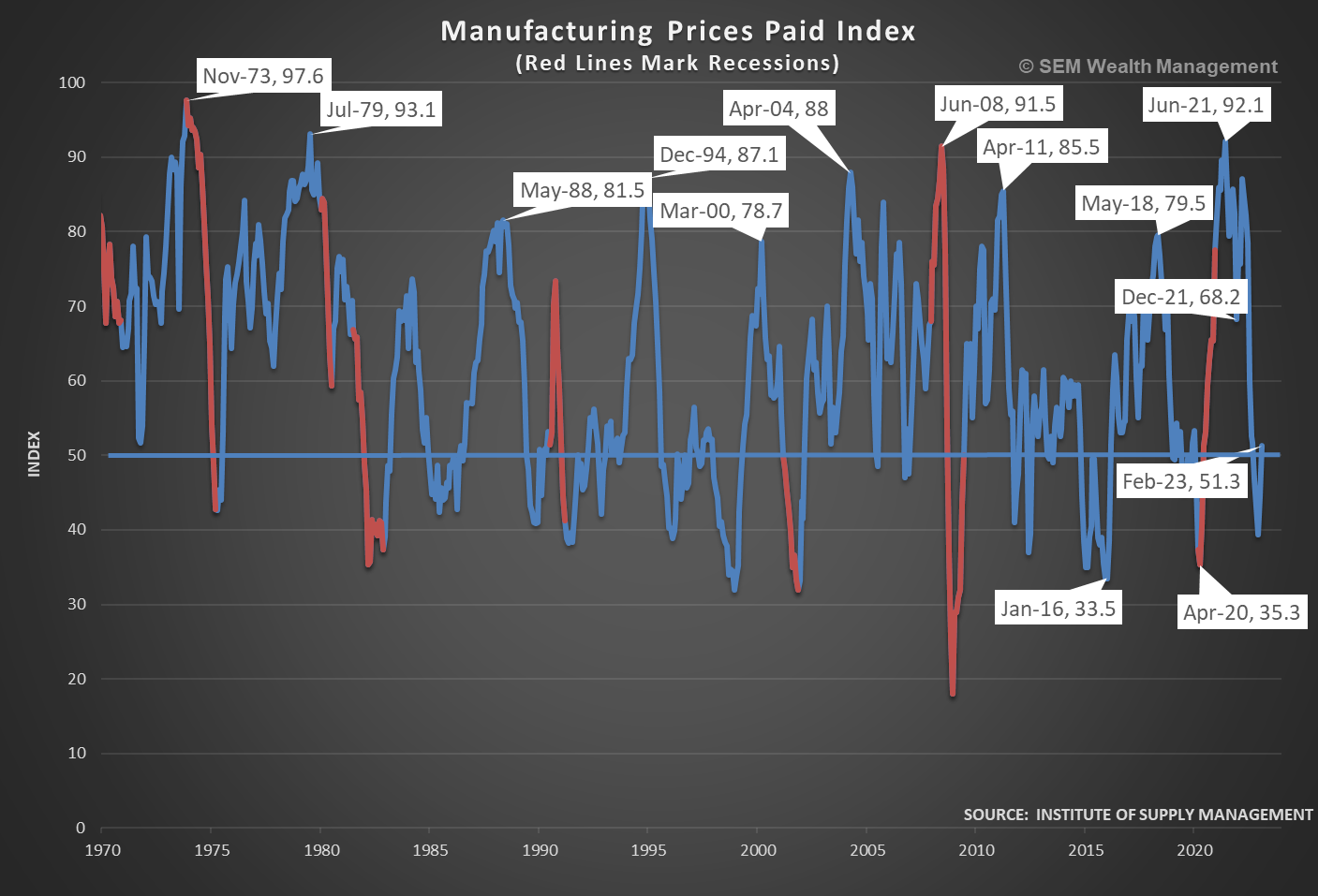

The economic data last week was solid if you believe the economy will continue to expand. The problem is if the economy remains strong inflation is going to be higher for longer, which could lead to more aggressive Fed actions. We will have a full economic update next week following the payrolls report to be released on Friday. One piece of worrisome news for those who believe the Fed is almost done did show up in the ISM Manufacturing report. The prices paid component has moved back into "expansionary" territory meaning the deflationary trend inside the supply chain appears to be coming to an end.

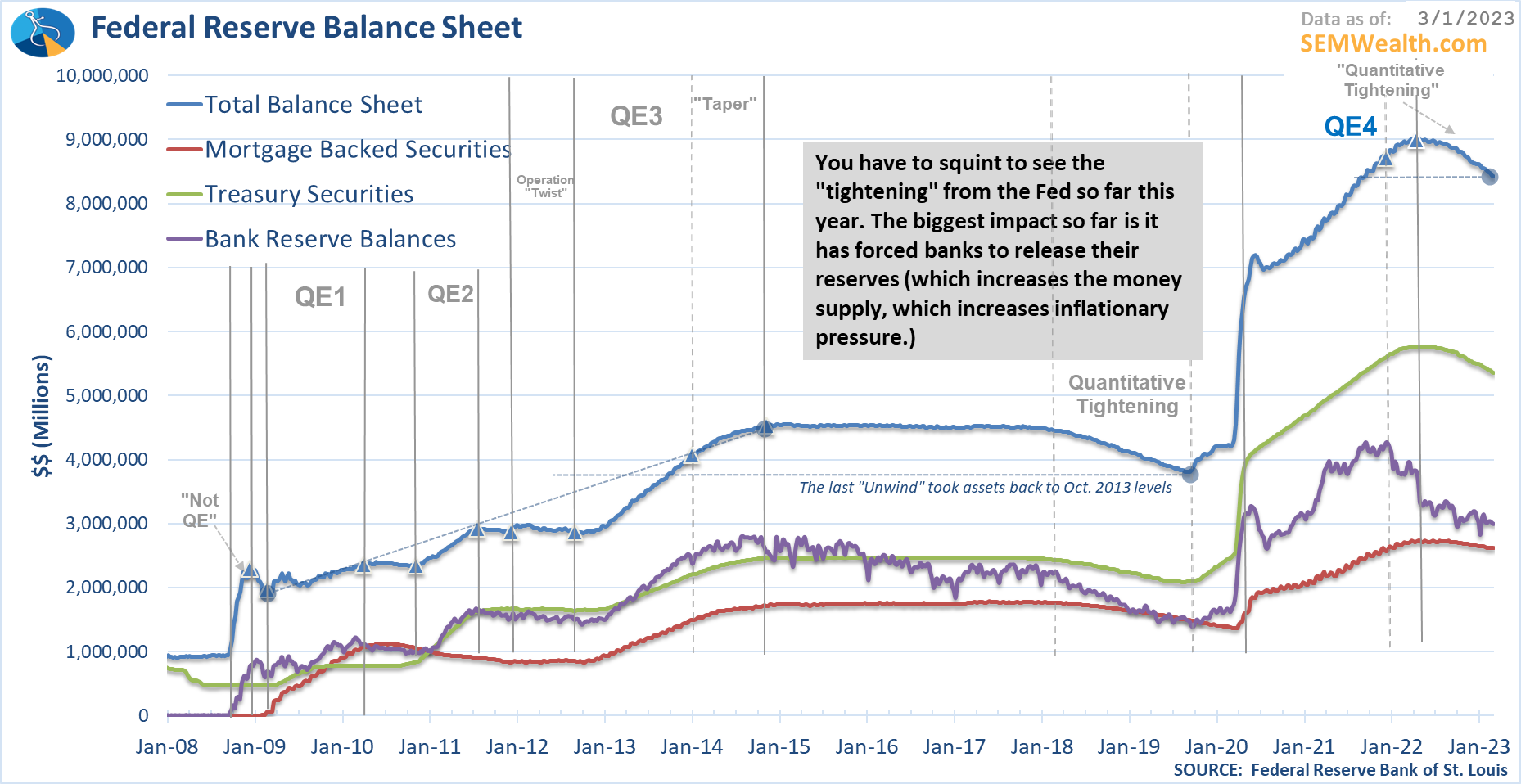

One other thing the eternal optimists may be forgetting is the overwhelming role the Fed has played the last 3 years in financing our government debt. At one point in 2020 the Fed was buying 100% of all newly issued securities (technically the Wall Street banks would buy them at auction and they would flip those to the Fed (at a small profit margin)). The Fed was still purchasing over 80% of newly issued debt a year ago.

Now, the Fed is not only not buying, but they are also gradually selling their positions (in an attempt to reign in inflationary pressures. This could be playing a bigger role than any of us realize. This is what their balance sheet looks like. Note the drop in the blue and green lines (the overall balance sheet and Treasury positions respectively).

It's interesting to see the different reactions from the stock market and the bond market. I've always said the bond market is smarter than the stock market simply because they care more about making sure they get their money back where stock traders only care about selling at a higher price.

The trend in yields is still higher, which is not good news for stocks. From a technical perspective the rally at the end of last week put the S&P 500 back into a position where you could argue the trend is higher.

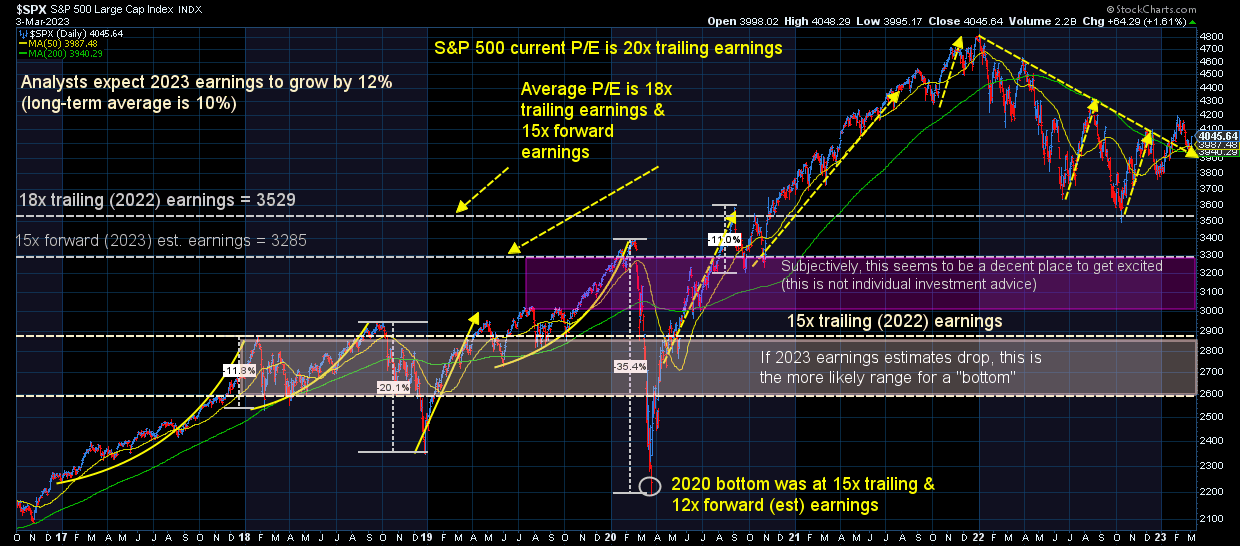

From a bigger picture perspective I still use this chart as a guide. Stocks are well above what anybody would consider a "fair" value, so buying at these levels would be considered a "trade" (hoping to sell at even higher valuations) instead of an investment.

2022 started with the P/E ratio at 21. The current P/E is 20 and analysts are not only assuming no recession, but ABOVE AVERAGE earnings growth this year. The average P/E is 18 (based on these rosy estimates). Stocks are not a bargain today. Stay patient and stick to your plan!