Investor behavior is fascinating to watch. While we all have implicit biases in how we analyze the market environment, the bias which causes the most damage is "overconfidence". Most humans overestimate their ability to both forecast the future as well as to adapt to new information. Ironically, the higher the level of experience/education the more overconfident we can become. The past several years this has been doubly harmful.

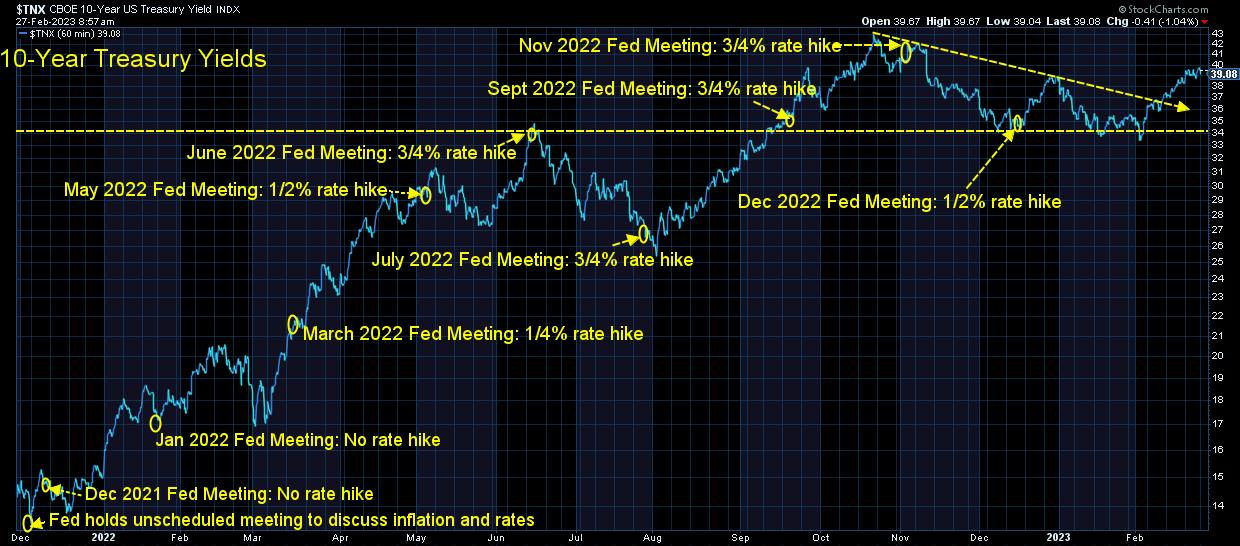

The Federal Reserve has always expressed confidence in their ability to both forecast the economic data and to be able to adjust their policies accordingly. Investors have great confidence in the Fed to "do no harm" (even though their track record is pathetically bad.) A lot of the damage done to stocks and bonds last year was because the Fed failed to see inflation swelling in the spring of 2021 and allowed runaway speculation to take hold throughout the year. Even after warning in early January 2022 that they would need to start fighting inflation, they waited 3 more months to get around to their first rate hike (a meager 1/4% increase).

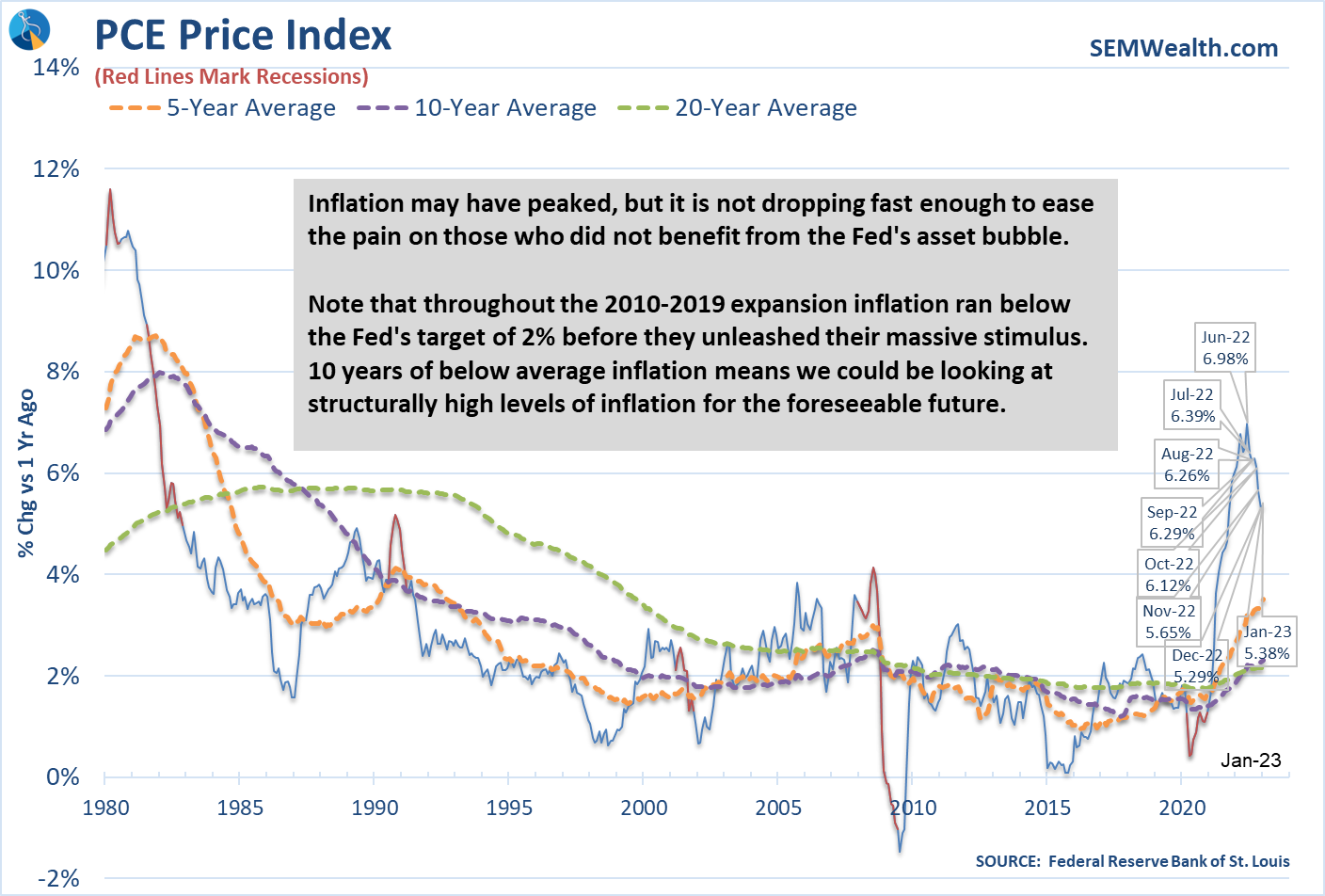

Inflation has run hotter and longer than the Fed (or investors') forecasts. Despite this, the market "bottomed" in October as investors believed the "worst" was over. There were a few scares along the way, but investors confidently started the year with the belief we had seen the worst.

I thought this summary from the "Sevens Report" this morning described exactly what is happening with the market right now. Here was the assumption that led to the impressive rally to start the year:

- inflation was declining

- the Fed was almost done with rate hikes

- there wouldn't be a hard economic landing

I've said since the beginning of the year, rallying on the hope the Fed was done didn't make sense. The Fed has gone out of their way the past several months to warn everyone their primary focus is controlling inflation and they have a long way to go in this fight. Everyone likes to say "don't fight the Fed" when the Fed is easing conditions, but I don't understand why they don't apply this to when the Fed is trying to slow things down.

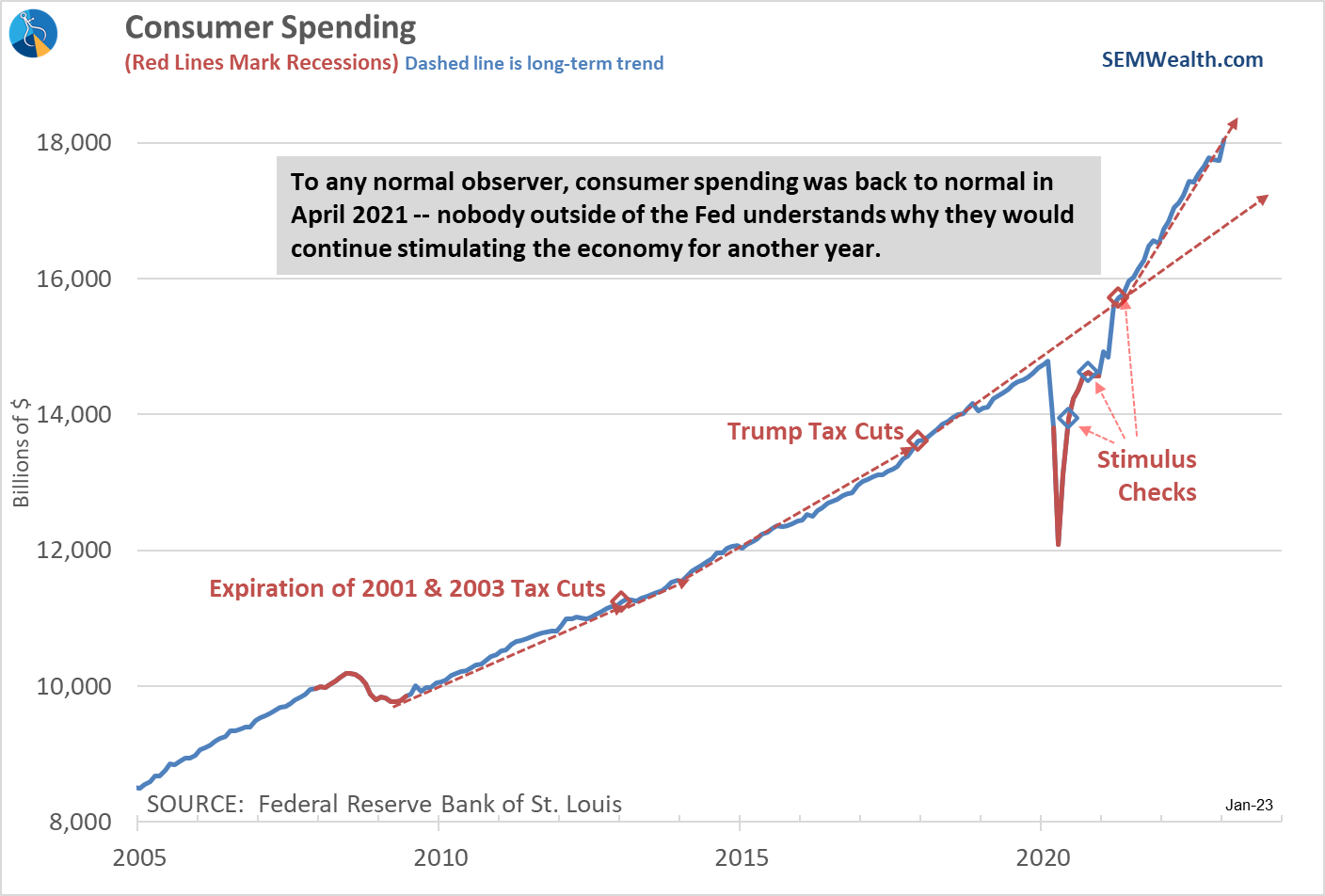

Last week there were several pieces of data which threw off the belief the Fed was going to soon be done in their inflation fight. Consumers are still spending money as if there will always be a constant stream of cheap cash flowing in. (Higher inflation actually causes shorter-term increases in spending as consumers fear waiting too long will lead to prices which are no longer affordable).

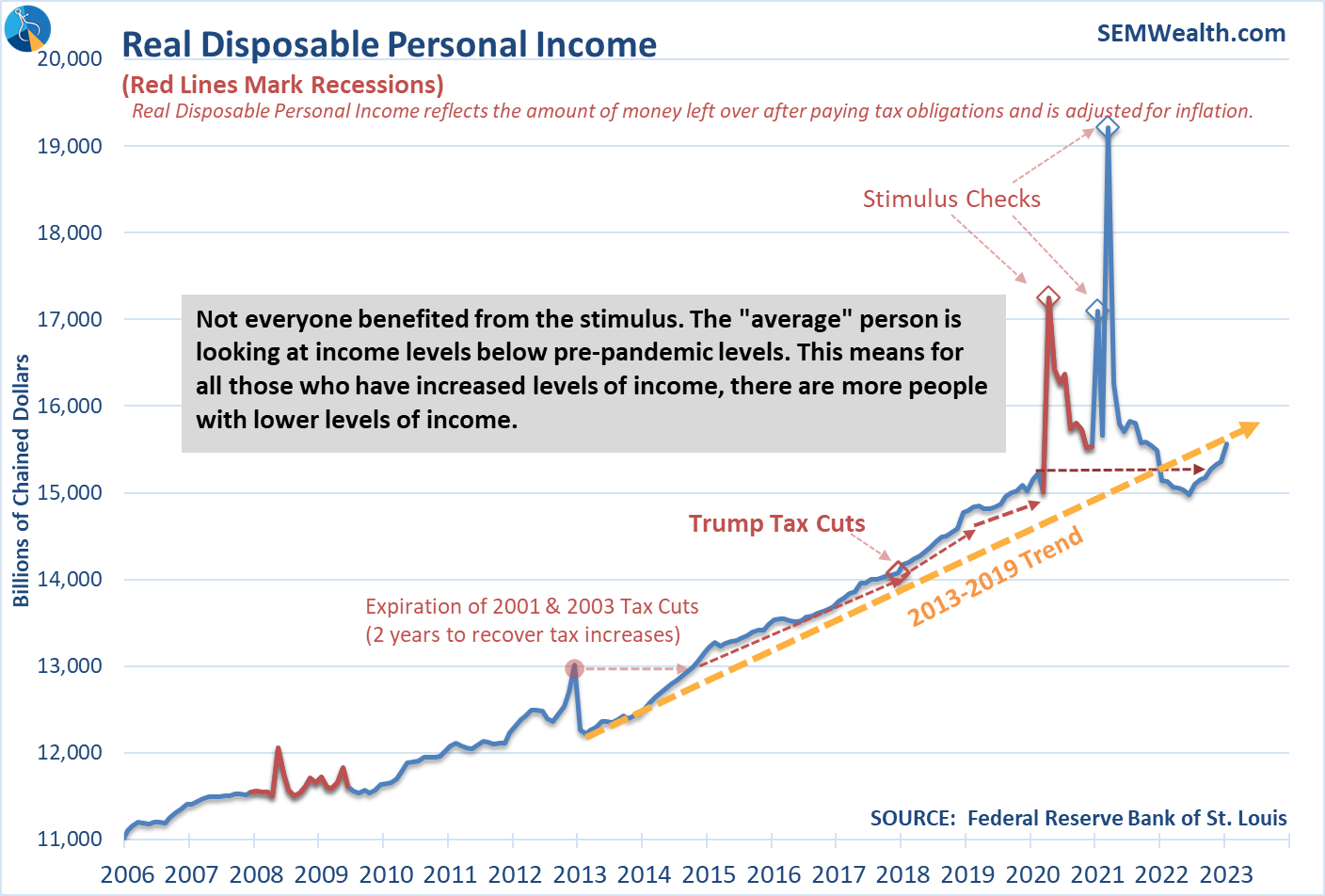

Personal income also saw a nice bump in January, although this may be a temporary impact. I've been surprised nobody has mentioned the tax cuts everyone received to start the year. Thanks to inflation, the IRS pushed up the income thresholds for each tax bracket to start the year. This increase will lead to an estimated 7% bump in disposable income for the average American this year. This is a double-edged sword. While it is good personal income is back on the 2013-2019 trend, it could also cause more inflationary pressure which will lead to more rate hikes.

The consumer spending and income report also includes the Fed's preferred inflation measurement (PCE Price Index, which is a more stable measurement of inflation compared to CPI). After 6 months of declines in the annual inflation rate, the PCE increase in January. This obviously is not indicative of an inflation fight that is almost over.

Looking at our market charts, we can see the disappointment with the inflation data.

To share a little technical mumbo-jumbo, if we were in a "new bull market" as many people bought into in January, the point the market broke the downtrend SHOULD have held (around 4000 on the S&P 500). We will see if the market can stage a rally and attempt to start another uptrend.

Turning to bonds and interest rates, we've seen a steady climb all month. Yields seem to have run into resistance just below 4% on the 10-year.

Things are not working according to the plans of the Fed or the investors who believe the worst is over. This doesn't mean it won't change, but you have to be especially careful about chasing the market higher just because it is going up. (You also should be especially careful selling your investments simply because it is going lower.)

Whenever somebody asks me what they should do about their investments, my answer is always the same – it depends on your financial plan. If you don't know how they fit, ask your advisor. If your advisor doesn't know or you don't have an advisor, ask us – we can provide a no cost financial roadmap to help you determine the correct investment mix.

At SEM we follow a data-driven, quantitative approach because we understand we all have behavioral biases which damage our ability to make wise decisions. This approach is not always perfect, but it helps smooth out the highs and lows as well as provides more predictable reactions. Most of our systems did not embrace this "worst is over" rally, which means we don't have to react and start selling into these declines, especially on our lower risk income models. We are quite happy sitting in money market or shorter-term bond funds to reduce the risk and collect what are some nice dividends each month.