We're starting the 2nd half of the year with a disjointed trading week. Monday is a half day and the markets are closed on Tuesday. This should give investors/speculators a chance to take a breath and assess the outlook for the rest of the year.

In case you missed it, our quarterly client newsletter was posted on Friday. It provides a short summary of the current market conditions and what we should be focusing on in the next quarter.

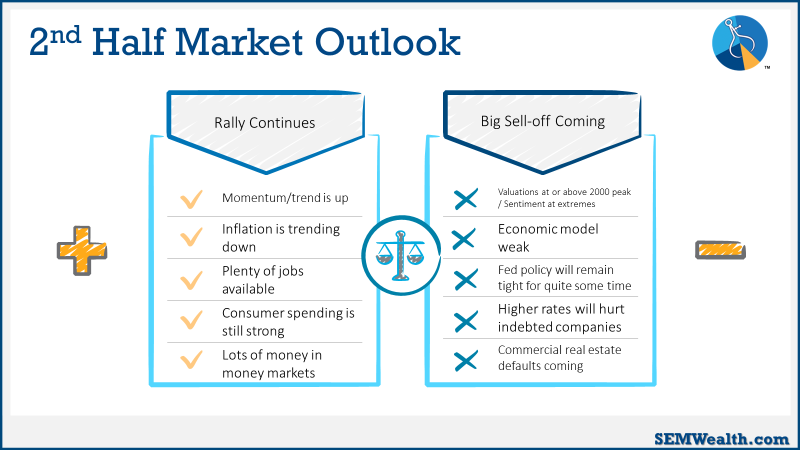

Given the short week, I'll keep today's comments brief. We'll have our full monthly economic update next week. I like to make lists to help my mind get a feel for the current environment. I worked last week from Colorado, which gave me some time to reflect on our current situation. I could make a case for a continued rally in the 2nd half or a big sell-off. Here's the list I came up with.

Based on my experience, market history, and most importantly the data, if I had to make a bet (thankfully I don't) I'd put strong money on the right side of the list. However, at SEM we know you have to respect market momentum. The trend is up and the market could push to the 4650 level (another 4-5%) before it runs into problems.

That said, all the past momentum driven rallies during this bear market have ended with essentially no news. Once momentum to the buying stops, all those people who were buying because the market was going up will turn into sellers.

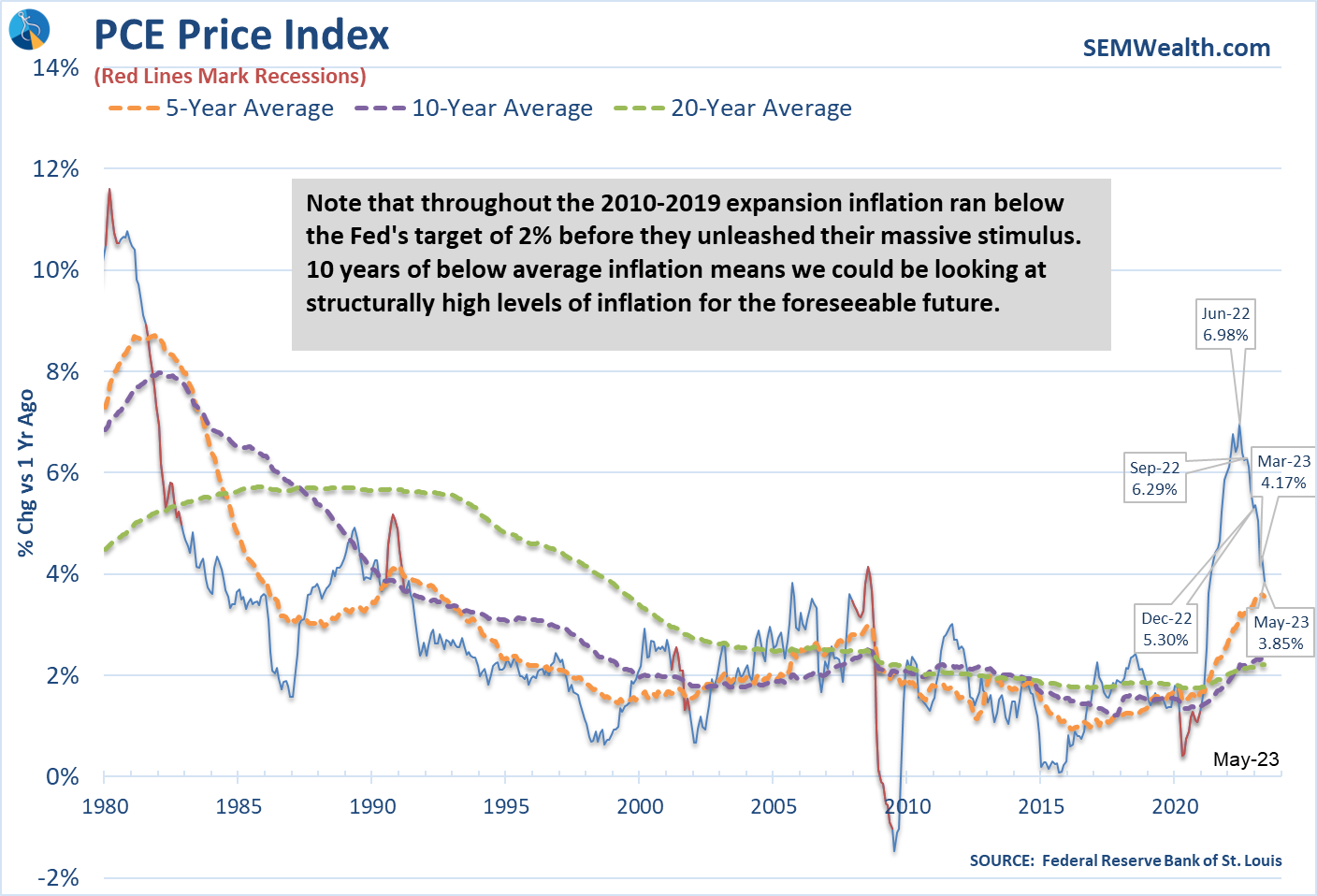

Inflation (for now) is trending down, but there are signs we could see this level off above the Fed's 2% target, which could be a problem.

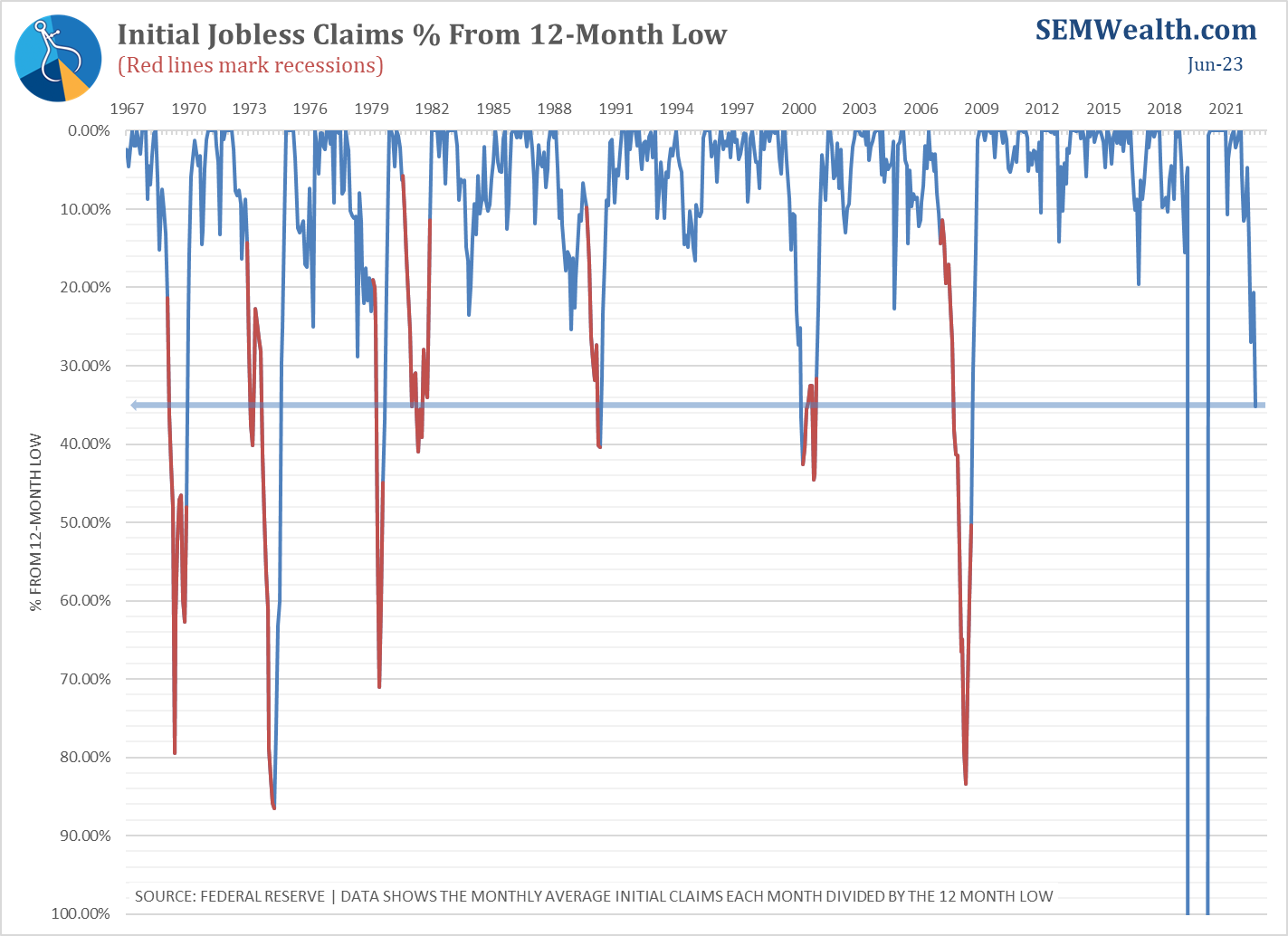

There are plenty of jobs available. We will get the next data point on Friday, but the initial jobless claims data is pointing to that pillar of strength finally showing signs of cracks. Claims are now 35% higher than the low, which has always been a strong indication of a looming recession.

Consumer spending continues to be strong and defy predictions of a slowdown (based on the increasing usage of debt to finance spending).

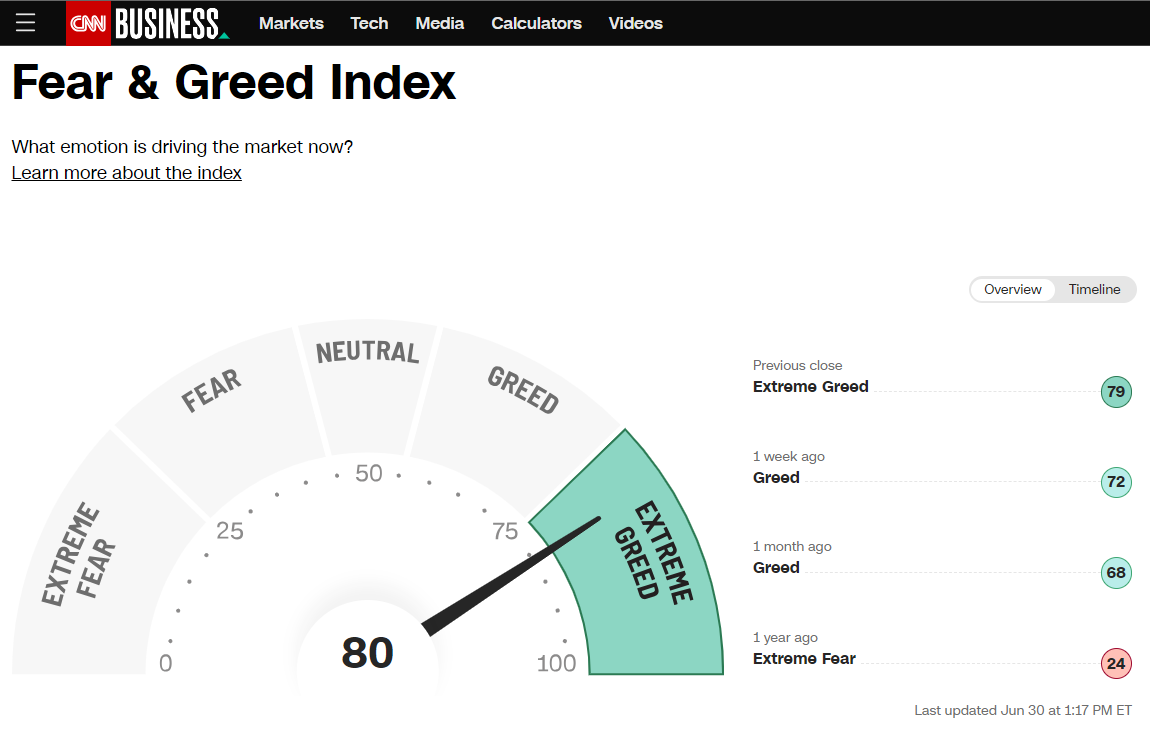

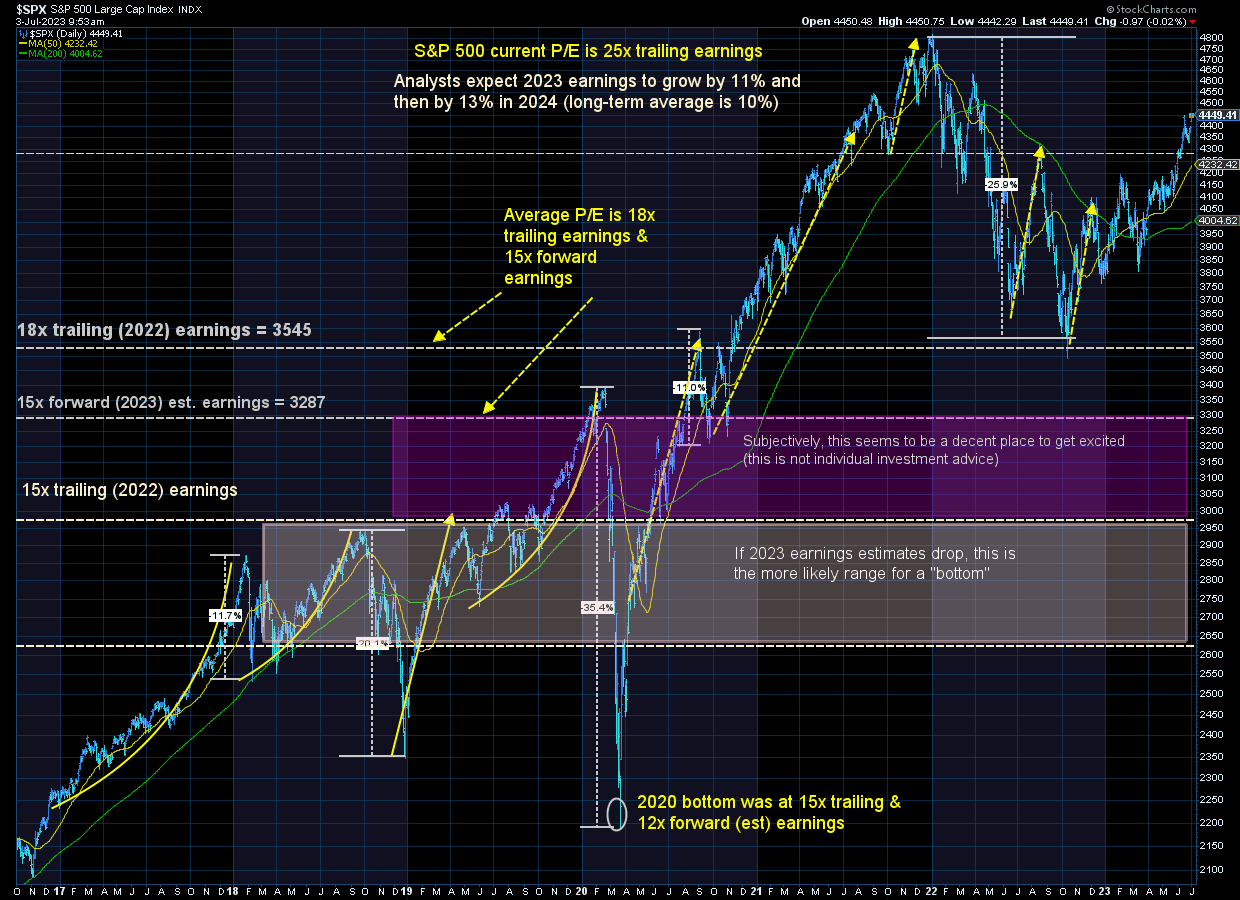

You add all of these "strengths" to the negatives on the list and at least in my mind, it is easy to envision a large sell-off coming soon. The biggest issue is the current valuation levels along with 'sentiment' readings hitting extremes. The best predictor of long-term returns is the starting valuation point and right now they are screaming for low future returns.

I saw an interesting data point on Twitter this week, further cementing how extreme the current market prices are. For those of you who remember the craziness of the 1990s where we couldn't use the P/E ratio because so many of the companies had losses, we've actually exceeded those extremes.

As the Nasdaq has rallied this year, fundamentals for some of the smaller issues have weakened. Almost 60% of the stocks in the composite have negative EPS over the last 12 months, a record going back to 1981. pic.twitter.com/yEpcEf2iKJ

— Rob Anderson (@_rob_anderson) June 28, 2023

I continue to look at this chart to keep things in perspective.

We are happy to see strong gains in our stock positions, but know these gains will probably be short-lived. Sustainable gains won't be available until we get valuations down to 18 (based on last year's earnings) or 15 (based on projected earnings, which usually end up being too optimistic).

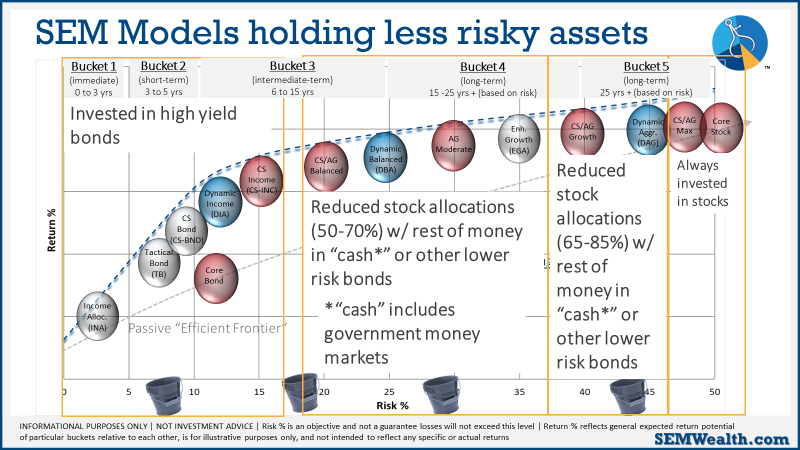

For now, here's our current positioning.

SEM Market Positioning

While all of the things above are certainly on our radar, we remain heavily invested. The key difference between our advice to readers and our own investments is we have a quantitatively based plan to leave the party when things start to look shaky.

There were no changes (again) last week in any of our models. We remain mostly invested in high yield bonds in Tactical Bond, Income Allocator, and Cornerstone Bond. We remain "bearish" in the Dynamic models (reduced risk exposure based on our economic model), and right in between minimum and maximum exposure in our 'strategic' models.

Our high yield model, is once again close to a "sell" signal. The other "trend" indicator which determines the overall asset allocation in our AmeriGuard and Cornerstone models needs to see either the 'breadth' of the rally to broaden out or a pull back to ease the current overbought "greedy" environment.

This chart summarizes where we are as we enter the week:

As always, our models will change if the environment changes. For now, calculated, short-term risks are acceptable with the knowledge things could change quickly.

No matter what happens, our models are designed to monitor the overall TRENDS. If Wall Street gets concerned, they will tell their largest clients and we will see trends change in the market. Regardless of the reason, we only care about where the money is flowing (both in and out).

That said, we will be watching more closely than usual the underlying holdings in our funds to make sure they are not taking on abnormal risks. We will keep you posted if anything changes in our positions.

We are already in the heat of the election and it's only going to get more heated. With that I will continue to close with my primary piece of advice during times like this:

Do not let your political beliefs influence your investment decisions. The markets (and economy) do not always react the way you think they will based on the ideological talking points showing up in your media feeds.