Getting Greedy

It’s been a wild few years for investors in the stock market. We’ve seen big swings from fear (COVID outbreak in 2020 and interest rate hikes in 2022) to greed (‘meme’ stock idiocy in 2021 and ‘AI’ fueled euphoria in 2023). Throughout market history these cycles between fear and greed have led many investors to sell when things look bleak and waiting to buy after a large run-up.

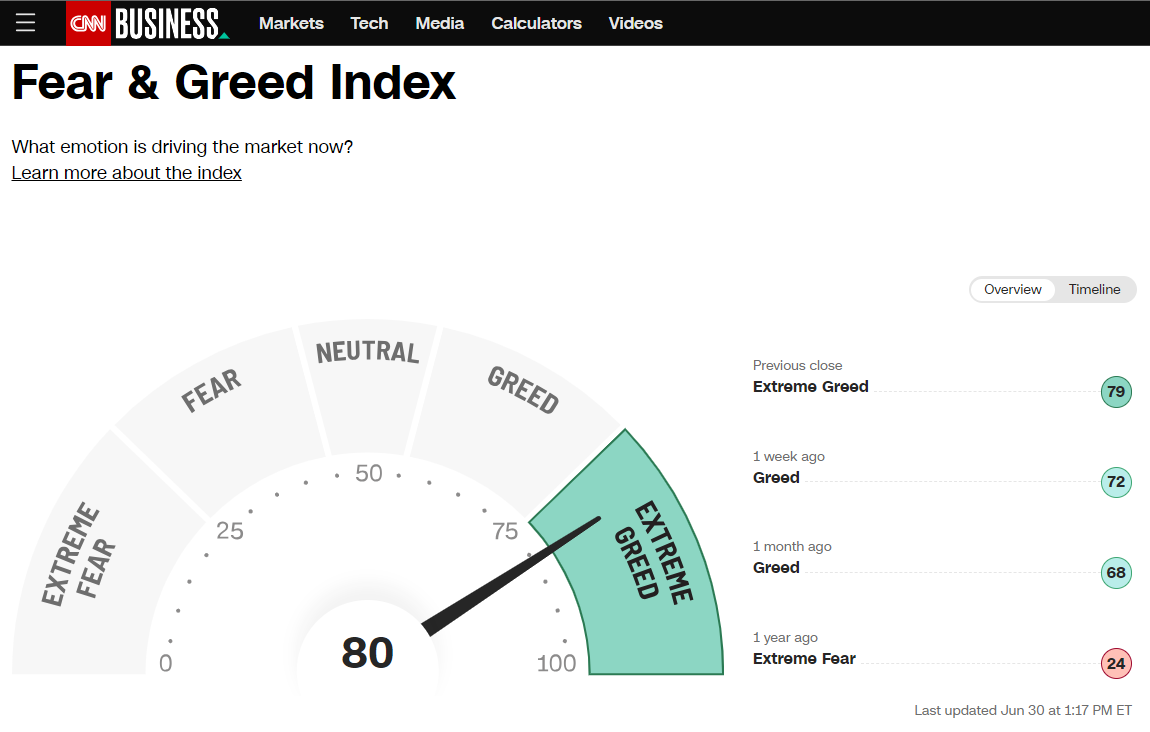

The CNN Fear & Greed Index is a composite of 7 ‘sentiment’ indicators. While over the long-term stock prices eventually reflect the underlying value of the company (or in the case of the market, the underlying economy), over short periods of time stocks go up when more people buy than sell and go down when more people sell than buy. Therefore, these sentiment readings are helpful in identifying when the market has likely run out of buyers (or sellers), which means the more recent trends are likely to reverse.

While we do not use sentiment indicators at SEM specifically, we do follow them to assist us in our communications and recommendations with advisors and clients. With the market at “extreme greed” levels as we move into the second half of the year, now is probably not the time to be adjusting the allocations in your portfolio to investments heavily invested in the stock market.

As always, stay up-to-date by visiting or subscribing to the Traders Blog.

Wise Words

If you are in the market for a new car and it went up by 15% in 3 months you’d probably be less likely to buy it. Conversely if it was down 15% you’d probably rush to buy it. For some reason that is not the case with stocks. Following the big jump in stock prices (already above the long-term average return for a year) we are seeing investors rushing to buy stocks.

The longer you’ve been around (SEM is in our 32nd year) the less surprised you are at these cycles. Given the big returns the first half of 2023, we thought we’d share some quotes from some successful investors who have been around longer than us:

“Quotations fluctuate constantly, reacting often illogically to all sorts of temporary and even trivial influences.” – Benjamin Graham

"I believe the market accurately reflects not the truth, which is what the efficient market hypothesis says, but it accurately and efficiently reflects everybody's opinion as to what's true." – Howard Marks

“The Stock Market is the story of cycles and of the human behavior that is responsible for overreactions in both directions.” – Seth Klarman

"There is evidence that the stock market is more efficient in processing information about what other investors are doing than it is in processing fundamental information about the underlying assets, which is why stock prices so often turn out with hindsight to have been crazy rather than rational." – Peter Bernstein

"When the price of a stock can be influenced by a "herd" on Wall Street with prices set at the margin by the most emotional person, or the greediest person, or the most depressed person, it is hard to argue that the market always prices rationally. In fact, market prices are frequently nonsensical." – Warren Buffett

For more on how these quotes factor into the current environment, click here.

Not a healthy market

Most of us have been told about the value of holding a diversified portfolio. Many ‘experts’ recommend S&P 500 index funds shortly after discussing the benefits of diversification. However many times the S&P 500 is anything but diversified. A few stats for perspective:

- Technology stocks are 32% of the index (2nd highest in history)

- Apple and Microsoft account for 15% of the overall index (highest in history)

- The top 5 stocks represent 22% of the overall index (highest in history)

- The top 10 stocks are 30% of the index (highest in history)

- Apple (the first $3 Trillion company in history) is bigger than the entire Russell 2000 (the smallest 2000 publicly traded companies)

- 43% of the stocks in the S&P 500 are DOWN for the year

When the market is this focused, keeping up is quite difficult. Diversification certainly helped in 2022 to keep losses lower, but in 2023 if you hold a diversified portfolio chances are you are trailing the S&P 500. The chart below illustrates the narrowness of the S&P 500 this year. Be careful to not compare your diversified investments to this index. They carry much different risks.

If you would like a review of your investments, go to Risk.SEMWealth.com.

BONUS CONTENT (not included in the printed newsletter):

Here is a pie chart showing the allocation of the S&P 500 index.

The top 10 positions are:

- Apple

- Microsoft

- Google (note there are 2 classes of stock, which combined makes Google the 3rd largest company)

- Amazon

- NVidia

- Tesla

- Meta (aka Facebook)

- Berkshire Hathaway

- United Health Care

- Exxon-Mobil

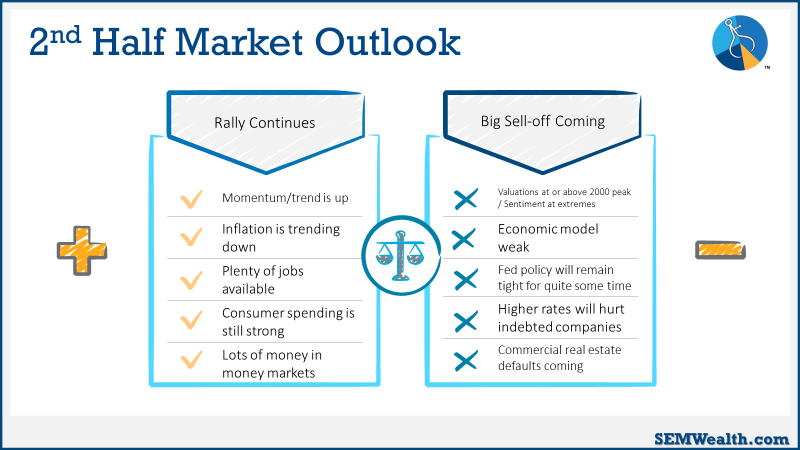

SEM's 2nd Half Outlook Notes (click here for the details)

SEM Performance

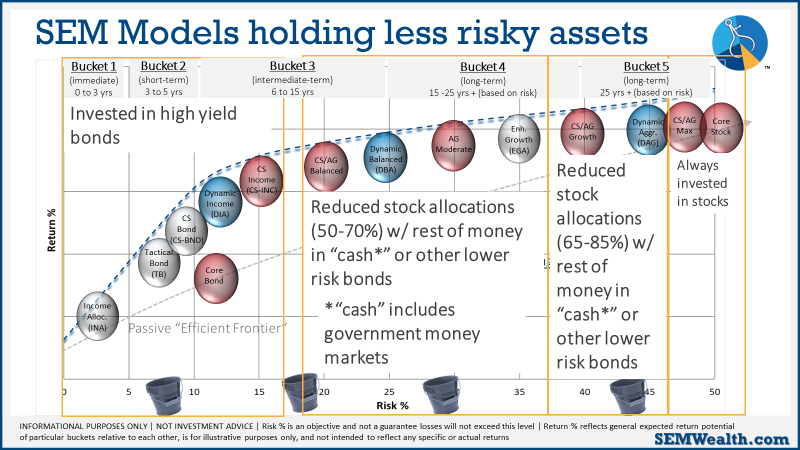

We understand in today's world everyone is evaluated on recent performance. However, we also know that our job at SEM is to provide customized portfolios designed to work with the financial plan, cash flow strategy, and each client's investment personality. This means several things:

1.) In nearly all cases, we will not be 100% exposed to the stock market (which means when the "market" is up we will not keep up.)

2.) Even with our stock exposure we will not be only invested exclusively in the S&P 500 due to the lack of diversification (and extreme risk because of this) (which means when the "market" is up we will not keep up.)

3.) With the exception of AmeriGuard-Max (and Core Stock) we have two trend indicators, which are designed to identify environments where the markets are at risk for uncomfortable drops (more than 12%). These models look at multiple indicators beyond just the S&P 500 performance. One is holding out due to the narrowness of the rally and the steepness of the price moves (which means when the "market" is up we will not keep up.)

4.) Most of our clients a.) do not need to keep up with the market, b.) do not want to lose more than 20%, c.) are taking distributions from their accounts, d.) have a shorter than 10-year time horizon, or e.) all of the above. This requires lower risk investments. Lower risk investments generally generate lower returns (which means when the "market" is up we will not keep up.)

5.) The bond market has gone through its worst period in over 40 years. While yields have stopped their upward momentum (which causes prices to drop), yields have not yet started to decline. The 'spread', the difference between high risk and low risk bonds is close to historic lows. This makes making money in the bond market difficult at the present time (which means when the "market" is up we will not keep up.)

In 2022, all of SEM's models beat the "market". They took money off the table quickly and kept losses within our risk targets despite the worst drop in bond prices in SEM's history. This was a win. It would be nice to capture more of the current rally, but that would have meant taking on more risk in 2022 and capturing more of the losses.

The market moves in cycles. Our DATA says stock prices are over-extended and the economy is at risk. HISTORY tells us even inside of a bear market we will see huge rallies. Take a look at the last 2 bear markets and note the rallies in green:

Patience is key at this point in the cycle. Based on data and history there will be much better times to invest. However, we also know that when those times come it will be difficult to decide to jump back in, which is why we follow a quantitative, data-driven approach to investing. This removes emotions and allows us to provide much more consistent results.

Reviewing our blended portfolio allocations and comparing them to similar investment allocations the 'full cycle' (3 and 5 year) returns net of all fees are all inline or above where they should be.

If you are at all concerned with how your portfolio is performing, we encourage you to take our short risk questionnaire. This will automatically generate a review of your portfolio and will be forwarded to your advisor to discuss with you.

SEM Market Positioning

We post the following chart each week in our blog. We typically recommend 3-5 'models' inside each client's portfolio. Each model is designed to fill different roles in the overall plan.

This chart summarizes where we are as we enter the new quarter:

As always, our models will change if the environment changes. For now, calculated, short-term risks are acceptable with the knowledge things could change quickly.

No matter what happens, our models are designed to monitor the overall TRENDS. If Wall Street gets concerned, they will tell their largest clients and we will see trends change in the market. Regardless of the reason, we only care about where the money is flowing (both in and out).

What am I Paying For?

When returns are leaner we often hear clients ask this question. While we would like to make money every month and every quarter we know that is not possible. It's important to understand the fees inside the account cover many different roles. You will see 3 categories of fees:

- Financial Advisor Fee

- SEM Investment Management Fee

- Custodial Fees

Financial Advisor Fee

While services vary from advisor to advisor, this is the largest fee inside your account for a reason – it is the most comprehensive. From development and monitoring of financial plans, tax strategies, goal setting, and simply being there to guide you through your investing life cycle, the financial advisor is there to assist you in this journey. Remember, you only get 1 shot. Your financial advisor has helped hundreds of people along this journey.

In addition to this, studies have shown the value of having an advisor. For more, click the box below.

SEM Investment Management Fee

We already discussed many of the things our models are designed to do throughout the market cycle. In addition to that, part of working with SEM is gaining access to institutional (lower cost) investments, offering scientific diversification, daily monitoring of your investments, tax management, and all kinds of operational duties (contributions, withdrawals, distributions, and other service items.)

Custodial Fee (Axos)

The custodian provides many different roles. The primary one is safeguarding your investments. Remember, all investments in your account are owned by you (not SEM or your financial advisor). This is important in an era where we continue to see fraud and other schemes. Axos also provides unlimited trading with no additional transaction costs, access to over 8000 mutual funds and ETFs, tax reporting, the client portal, performance calculations, and quarterly statements. They also handle ACH and check withdrawals at no additional costs.

For more see:

Download/Print version of the Newsletter

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Model Factsheets for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.