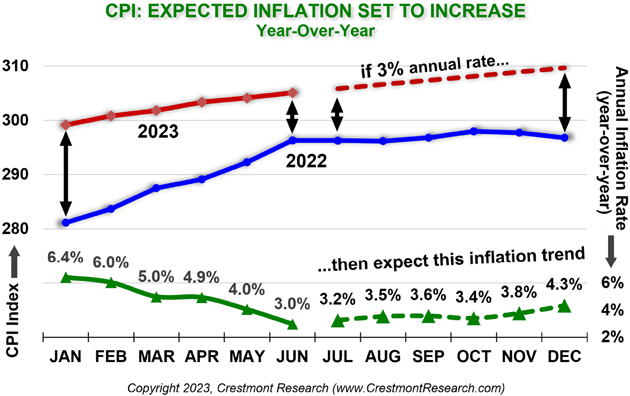

What a strange world we live in. On Wednesday the latest inflation reading showed the annual inflation rate dropping to 3%. Stocks rocketed higher on the news because in May the annual inflation rate (according to the CPI) was 4%. As we outlined last week, the "no landing" case has taken hold of the stock market (meaning inflation will be under control without any sort of economic (and earnings) recession.)

If you've seen any of my economic presentations or read this blog for a while you know that I am an advocate of using year-over-year comparisons with economic data as it removes the seasonality and other impacts which can skew the numbers when you annualize month-over-month changes. What is interesting is for the longest time the focus on the CPI number has been the annualized month-over-month rate of change.

Over the weekend, John Mauldin's always enlightening Front Line Thoughts dove deep into the inflation data and showed why those hoping for "no landing" may be in for some disappointment. First and foremost, the month-over-month number everyone used to use jumped from 3.1% in May to 3.9% in June. This is a warning to the bulls as the comparison data from becomes much more difficult.

Essentially from June through December 2022 the CPI Index was flat. CPI was high during that data because the flat index was being compared to the 2021 Index data which was significantly lower. Basically, the index hit its peak in June 2022 which means for the annual CPI numbers to continue to drop we have to see a sharp slowdown in prices.

If we AVERAGE 3% inflation month-over month the CPI reading could hit 3.6% in September and be at 4.3% in December! That certainly would take the "no landing" case off the table.

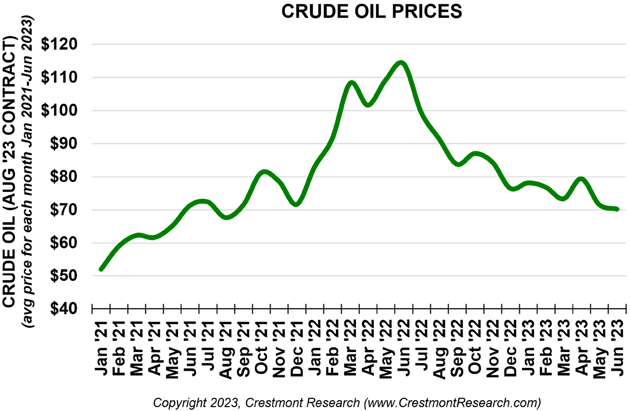

The other big issue is the two biggest contributors to CPI Inflation, Energy & Shelter (housing/rent) seem to be completely out of the Fed's control. Energy prices may be getting close to a bottom as OPEC+ continues to push for production cuts, the war in Ukraine drags on, and more Americans than ever are traveling (using their credit cards).

We will get more data on housing activity and prices this week, but it is safe to say the stability of housing prices have surprised most people. I've mentioned for the last few years the issue with housing is a disconnect in supply and demand. While Boomers retire and (some) downsize, we are seeing an increasing number of Millennials enter the prime "household formation" age (now 33). We simply do not have enough entry level homes and we have too many "big" houses typically purchased by those in their 40s and 50s. At the same time, those Boomers who are downsizing with plenty of equity and spending power have driven the prices up of townhomes, condos, and smaller single family homes to the point it's just not affordable for most younger buyers.

Overall, any increase in housing or energy prices will cause CPI to at best remain above not just the Fed's "target" of 2%, but possibly above 3% through the rest of the year (and possibly beyond), which could put pressure on the Fed to do more and quickly drain the animal spirits driving stocks higher in 2023.

What about earnings?

One thought occurred to me after the CPI reading and seeing the data from Front Line Thoughts:

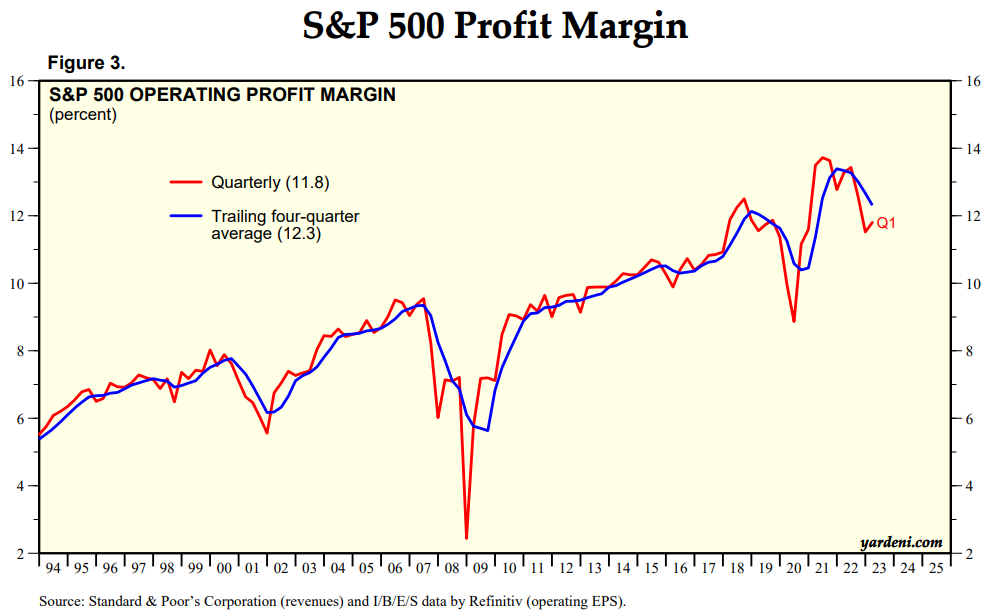

With the stimulus money and easy credit most companies were able to pass on the high inflation costs to their customers. This led profit margins to hit the highest level ever for the S&P 500. Over the past few quarters we've seen profit margins begin to fall which is an early sign companies are no longer able to pass on all of their costs to customers.

While we are just above the pre-pandemic highs, if we do have an economic slowdown (or worse a recession) because inflation remains high (above 3%), we could see profit margins contract even further (sales will slow and input costs will remain high).

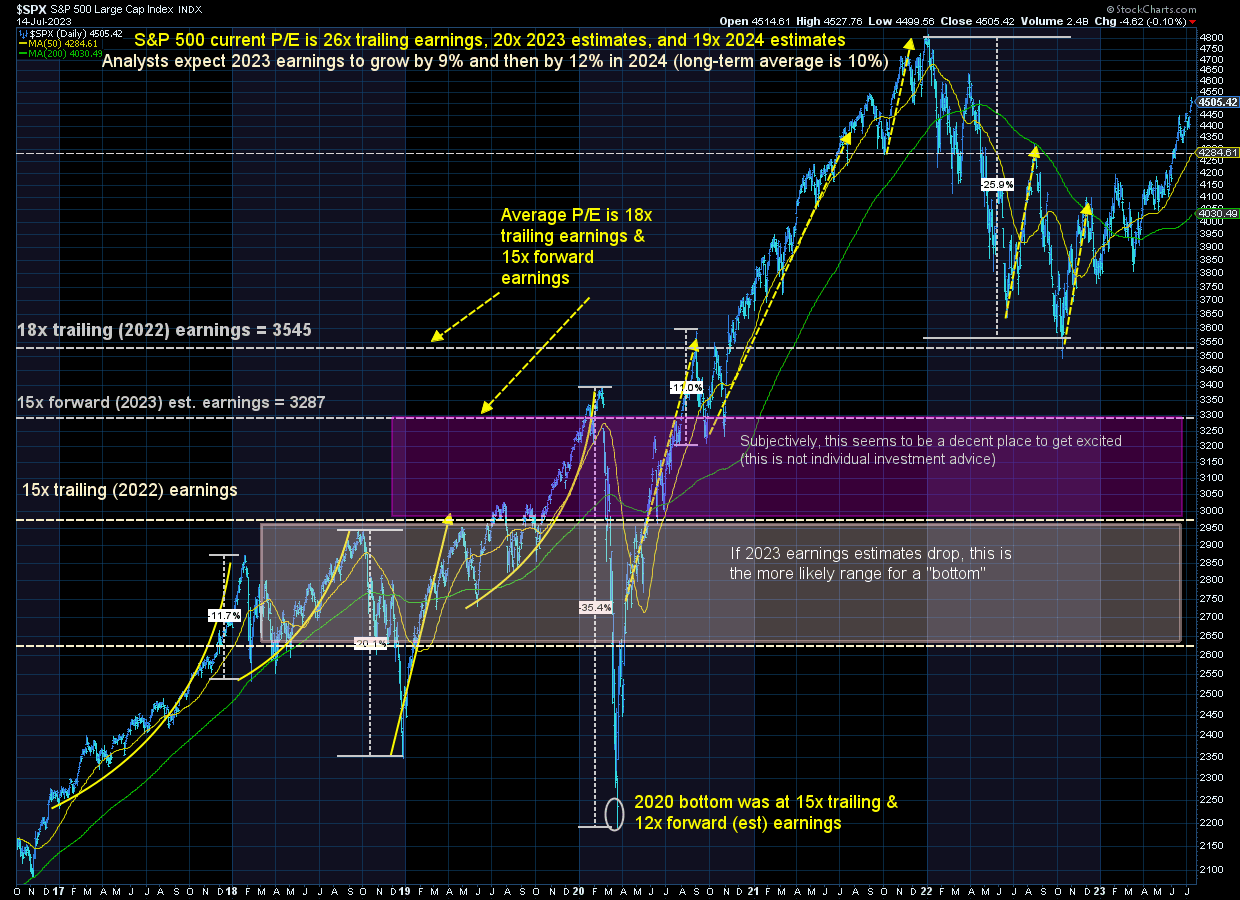

This obviously isn't priced into the stock market. This recent rally has been in the face of all fundamental logic. Earnings estimates have actually DECLINED over the past month. Just a month ago estimates were calling for 11% growth in 2023 followed by 15% growth in 2024. Those numbers have dropped to 9% and 13% respectively. This has put already high P/E ratios into uncomfortable if not bubble-like territory.

Patience is key when you have markets like this. We are enjoying the gains in our accounts, but know it will not take much (such as inflation moving up again) to squash the euphoria and put us back closer to reality.

If you're not Dollar Cost Averaging into the stock market, for those with patience we continue to use this chart as a guide. Your potential returns are much higher if you can wait for P/Es to get down to "average" levels. The potential returns are even better if you let them get down to below average levels.

Shorter-term, the S&P 500 keeps being pulled to round numbers. This is typically an indication of speculators using options and other derivatives driving the market (since they come in round number values).

We've gone through 4300, 4400, and now 4500 in the last month. The S&P is all the way back to the levels from April 2022 when the Fed finally got around to getting "serious" about inflation with warnings of a 1/2% hike. Last week several Fed members were out saying inflation is still way too high and the Fed needs to get more aggressive. That should at least put a short-term damper on enthusiasm.

On the bond side, interest rates have fallen back to the range we've been stuck in for the better part of the last 7 months.

When we started the year I thought we could make a case that interest rates had peaked for this cycle. After looking at the Mauldin research I fear a spike in CPI back to 4% could seen 10-year Treasury bond yields take out the November 2022 highs. I hope I'm wrong, but the "easy" money seems to be nearing the end and it's about to get a whole lot more difficult.

What that means for us will be spending more time in lower risk investments waiting for a lower risk opportunity. We aren't there yet, but stay tuned.

SEM Market Positioning

While all of the things above are certainly on our radar, we remain heavily invested. The key difference between our advice to readers and our own investments is we have a quantitatively based plan to leave the party when things start to look shaky (and we take those moves without broadcasting them in the blog)

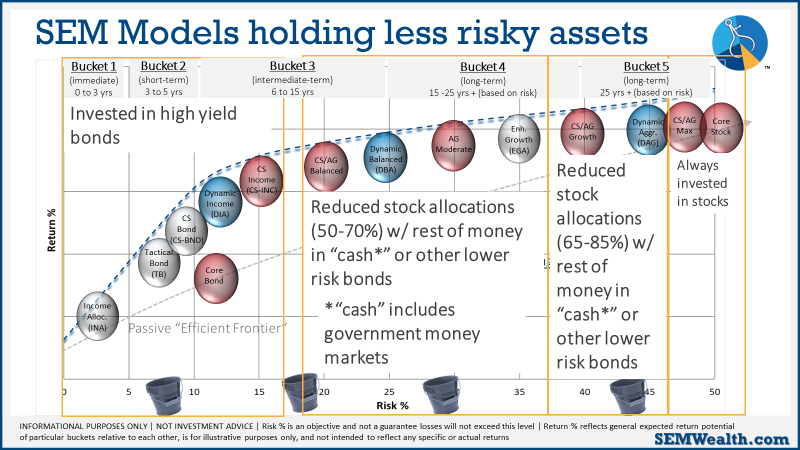

There were no changes (again) last week in any of our models. We remain mostly invested in high yield bonds in Tactical Bond, Income Allocator, and Cornerstone Bond. We remain "bearish" in the Dynamic models (reduced risk exposure based on our economic model), and right in between minimum and maximum exposure in our 'strategic' models.

Our high yield model, has flipped back to being solidly in "buy" territory. The other "trend" indicator which determines the overall asset allocation in our AmeriGuard and Cornerstone models needs to see either the 'breadth' of the rally to broaden out or a pull back to ease the current overbought "greedy" environment.

This chart summarizes where we are as we enter the week:

As always, our models will change if the environment changes. For now, calculated, short-term risks are acceptable with the knowledge things could change quickly.

No matter what happens, our models are designed to monitor the overall TRENDS. If Wall Street gets concerned, they will tell their largest clients and we will see trends change in the market. Regardless of the reason, we only care about where the money is flowing (both in and out).

We are already in the heat of the election and it's only going to get more heated. With that I will continue to close with my primary piece of advice during times like this: