I know most of the country is already back in school, so if you have kids your summer ended. On the east coast many schools still start after Labor Day which means the roads this week are crowded with vacationers trying to squeeze the last bit out of their summer. This also means plenty of people seeing the words "recalculating" pop up on their phones or car screens as GPS apps attempt to find a better route.

We're in our 6th summer living on the east coast near the beach and one thing we've learned the hard way is the computers are not always right. If all of the devices recommend a "better route" the backroads become clogged with people who don't know how to drive on 2-lane, winding, tree-lined roads which do not have stop lights or passing lanes. People blindly follow the recommendations of their devices and create even more problems.

As we navigated to our first fall soccer game of the season this past weekend (for parents who have kids playing fall sports, our summers still ended the last week of July) the thought occurred to me that the markets act the same way. Everyone gets the same roadmap and recommendation and they follow it blindly without any data or reason to back it up.

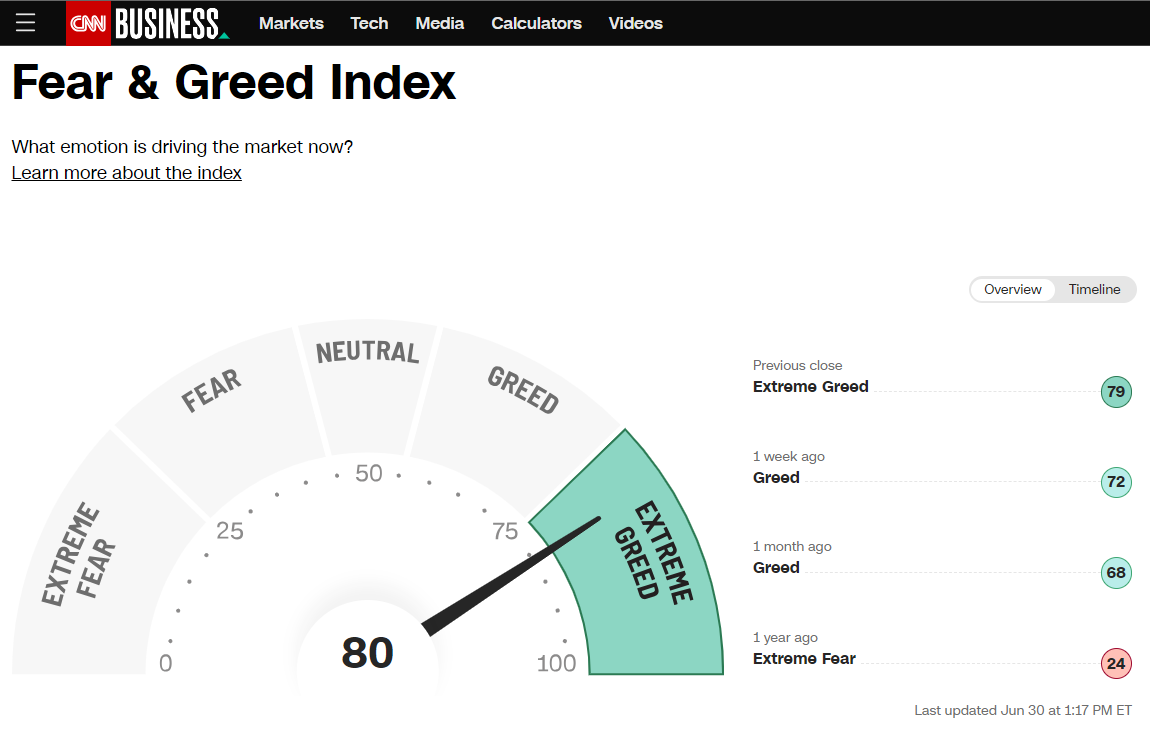

We entered the year expecting a recession, but as the economic data remained positive, everyone 'recalculated' their routes and we saw technology and cyclical stocks take off like a rocket. We discussed how narrow the stock market rally has been this year in our newsletter at the end of June.

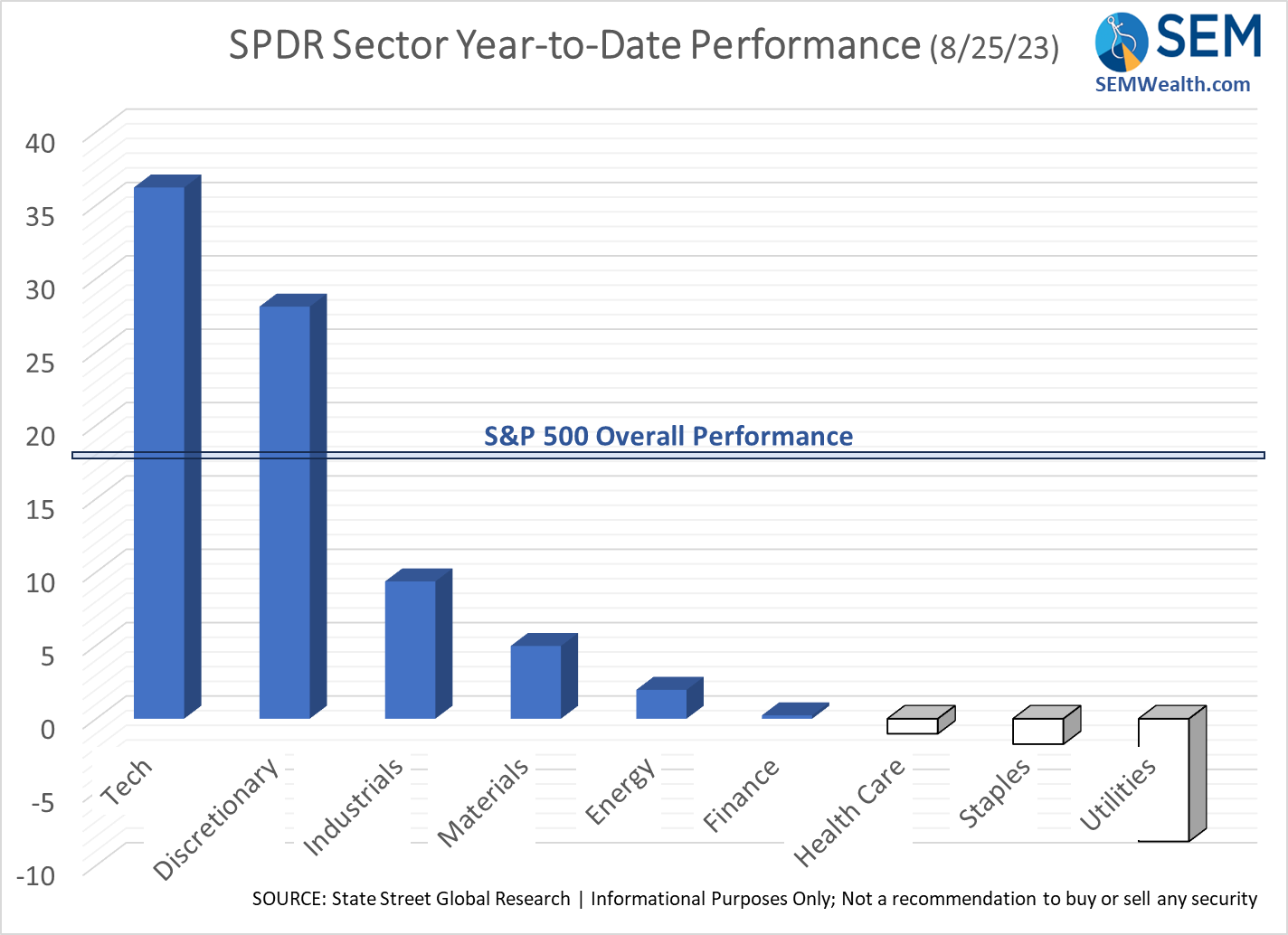

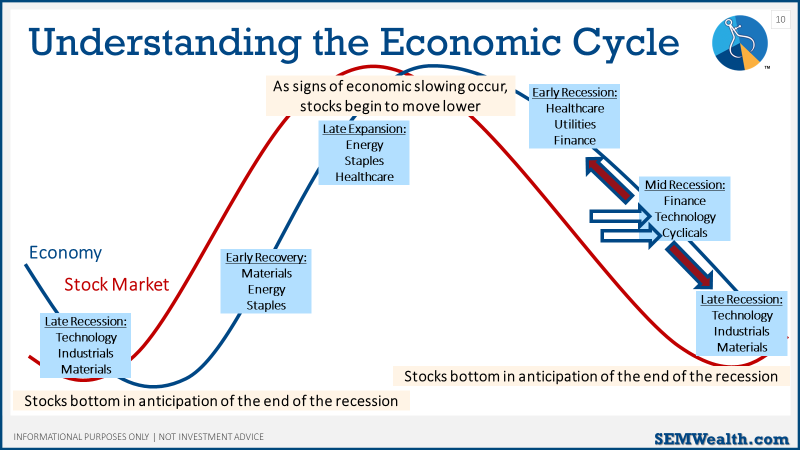

The thought was "we are near the end of the 'slowdown' and we need to get ready for the recovery". Looking at the performance of the underlying sectors we see the anticipation of the end of the down cycle.

I gave a presentation last week explaining what really drives the economy. I showed this slide illustrating how the stock market anticipates where we are in the economic cycle. Combining the sector data above, it is clear the market believes we are nearly done with any sort of slowdown. Technology and Cyclicals (Discretionary) are performing the best, Utilities, Healthcare, Staples, and Finance are the worst.

The problem is the DATA does not support this. Yes we've had a stubbornly strong economy despite Fed rate hikes, the underlying data says things are likely to get worse (we'll have more on this next week when we update our economic model). What that means is we could see investors hear "recalculating" which would be bad for Technology and Cyclical stocks.

Even if the economy improves from here, the outperformance of technology stocks will likely end and we will see the other sectors begin to take the gains (Industrials & Materials followed by Energy & Consumer Staples). The lack of a rally following another blowout quarter by Nvidia is an early warning sign that technology stocks may have hit their peak for this cycle.

As a side note, mark your calendars for September 27 when we'll be discussing our Behavioral Approach to Economic Analysis. Click here to register/sign-up for the replay.

As we've been saying throughout the summer, caution is warranted.

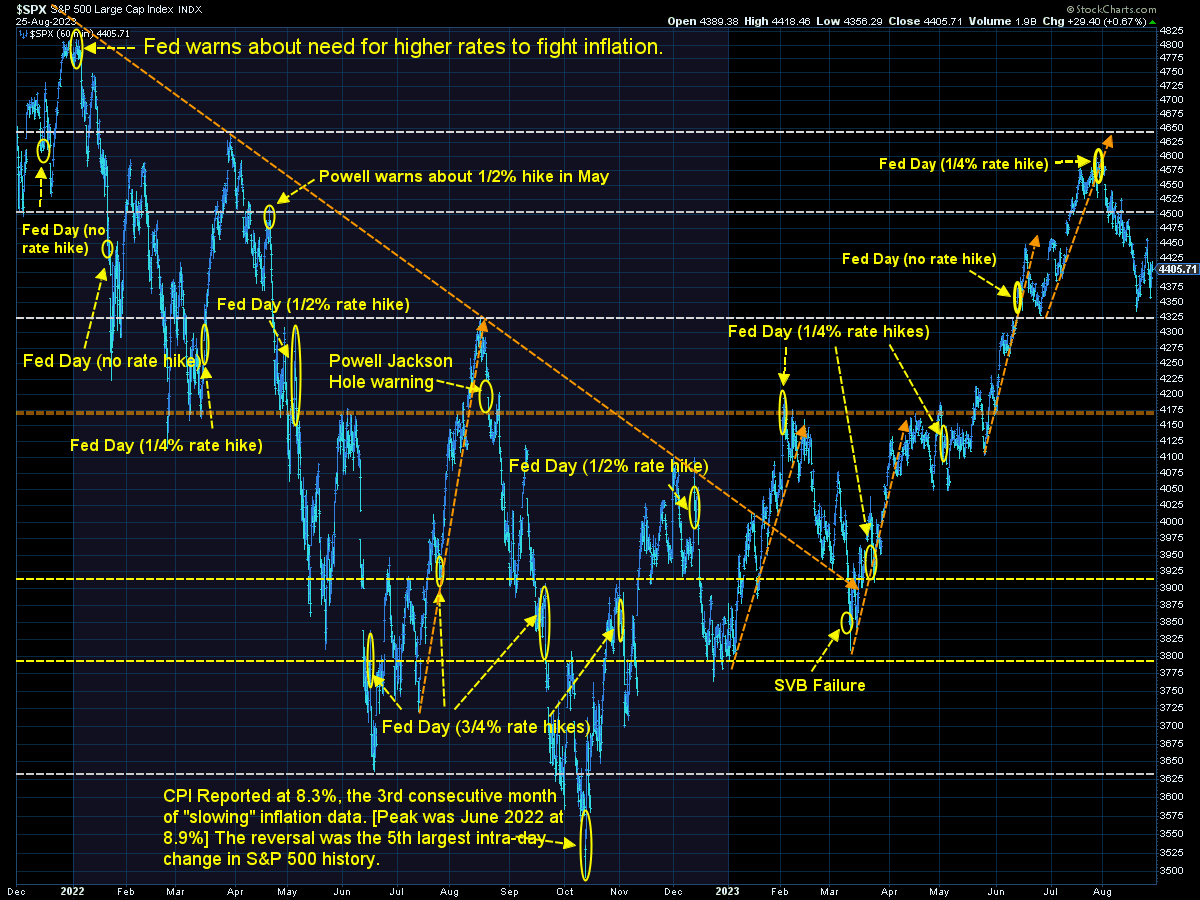

Looking at the markets, the S&P 500 was able to bounce last week off the 4325 level and is now attempting to find another base to build on.

Overall, the market remains significantly overvalued (mostly because technology stocks are over 30% of the index and they are also overvalued). The S&P also failed at the 50-day moving average a level short-term traders often use to indicate market trends.

Bond yields eased a bit late in the week, but are still worried about inflation and will continue to be a drag on growth.

The fact 10-year rates are all the way back to where they were in December 2007 and June 2008 is a bit worrisome.

We've heard from Fitch, Moody's, and S&P about their concerns over banks given the interest rate and economic environment. I saw some alerts last week from Weiss regarding several of the popular credit unions in Virginia & Arizona. The concern from Weiss is similar to the other ratings services – poor profitability in community and regional banks has lead to concerns about their capitalization. So far the more name brand banks appear to be ok (according to Weiss), but we learned in March how 3 relatively unknown and relatively unknown banks can create chaos in the financial system. Keep in mind, those 3 banks wiped out 25% of the FDIC insurance fund and led to large assessments to all member banks to refill the fund.

I'm not saying anything dire is imminent, but those banking on a strong 2024 economic environment should be prepared for some shocks to the system.

SEM Model Positioning

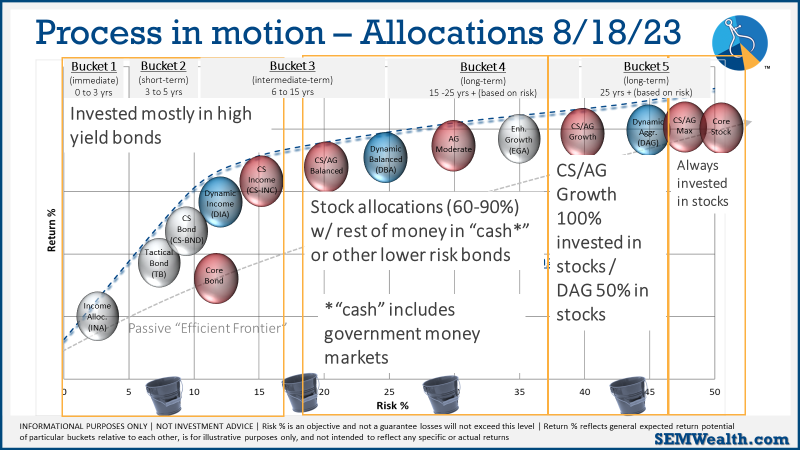

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): The High Yield Bond system which bought the beginning of April remains very close to a sell. Once again after being within one more down day of triggering, a late week rally kept us invested (for now).

Dynamic (monthly): As we've been since April 2022, our economic model remains "bearish". This doesn't mean we are predicting a recession, but rather a slowdown which means a difficult environment for corporate earnings. Other than the technology and discretionary sector this has been the case.

Strategic (quarterly)*: The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.)

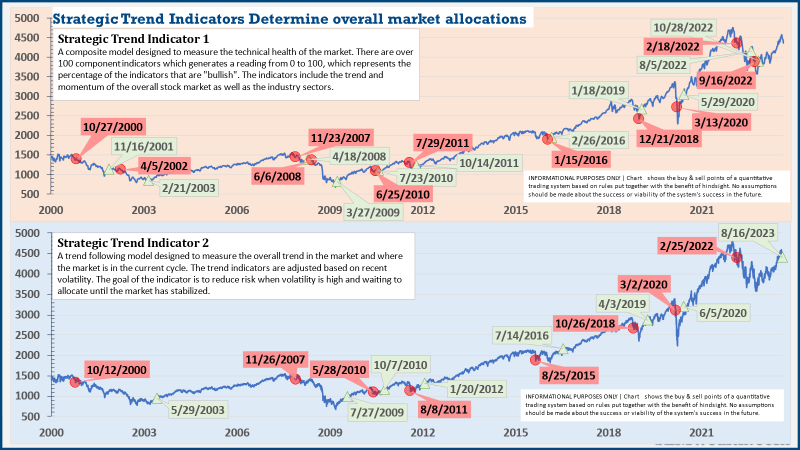

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The second indicator triggered on August 16, brining the strategic models to a fully invested position. We are NOT locked into these for the next quarter. The 'sell-point' for this system is down around 3-4% from here.

This is the beauty of SEM's truly diversified approach. You get 3 distinct investment management styles inside one portfolio. We can customize models to match nearly any objective, risk level, and investment personality.

Our "bucket" approach allows for different parts of the portfolio to be positioned differently based on where we are in the market cycle. Whenever we are at a crossroads moment it is especially risky. This requires a disciplined approach which is what SEM brings. There will be much easier times to invest. Our goal is to get there with as much capital in tact to take advantage of that opportunity.