The media has declared stocks are in a bear market. What does that mean? Should we be worried? What should you do if this is a bear market? How is SEM positioned for a bear market? Watch the short video below for answers to all of these questions and more.

If you've been following along, SEM has been concerned about an economic slowdown and a bear market for the past year. This week the media has declared the start of a bear market. This can be misleading for many reasons. The most important is because we do not believe from a behavioral perspective simply dropping 20% should define a bear market. It is more about the DEPTH of the loss and the LENGTH of the loss.

We are most worried about a bear market which is combined with an economic slowdown. The data says we are there, which means we should expect declines lasting 12, 15, 18, or even 24 months with the total losses in the 35-50% range. We are only 5 1/2 months in and 20% down so far.

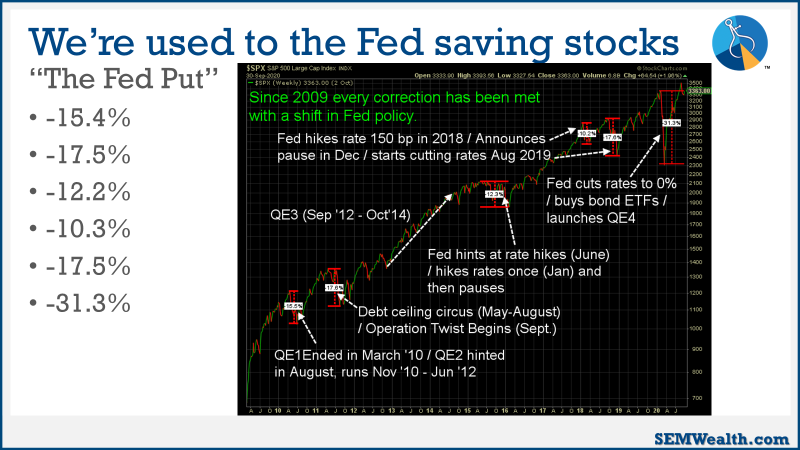

Below we have 3 tips to prepare you for a bear market. Before we list them, keep in mind, the Federal Reserve will not be there to save stocks like we've become accustomed to the last 12+ years. Remember, they are part of the problem. They created too much excess liquidity, which created excess inflation, which will slow the economy significantly. Their focus will be on reigning in inflation, not helping the stock market.

Bear Market Tips

1.) Don't Panic

We understand all losses are painful, but we also understand they are part of investing. We base all investment recommendations into SEM portfolios on the Financial Plan, Cash Flow Strategy, Investment Objectives, and overall Risk Comfort Level.

The losses so far are well within the parameters we planned for. All of our models are acting as we would expect. All have taken risk off the table which has led to reduced risk the past several months versus a buy & hold strategy.

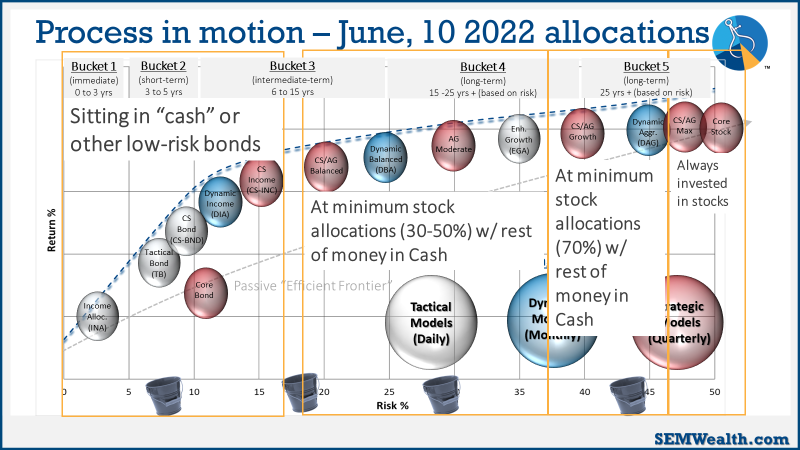

Each model has different risk levels and objectives inside the financial plan. Here is a general summary of how we are positioned. Note the lowest risk models, which are designed for shorter-term objectives are essentially invested in all low-risk investments. This doesn't mean they won't go down a bit more before the final bottom is reached, but they have born the brunt of their NORMAL losses already.

The longer-term models still have some exposure to the markets because they are looking beyond just the next couple of years. History and experience tells us markets should be higher over the long run. We've taken some money off the table to get us through the bear market, but want to make sure we keep some invested.

2.) Ignore the Media

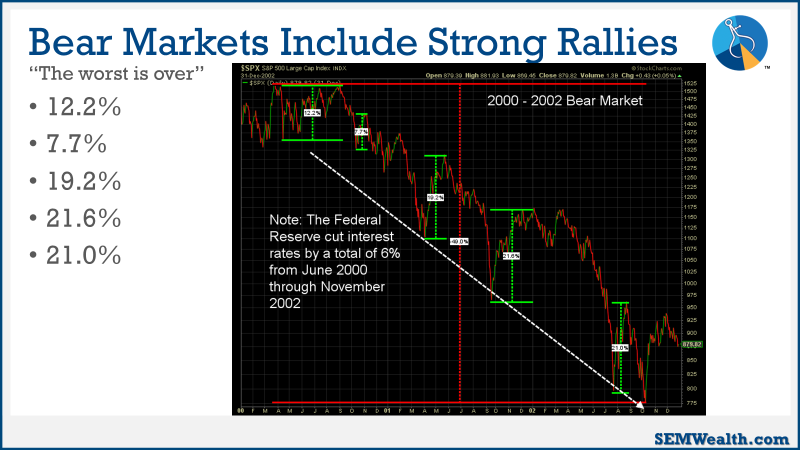

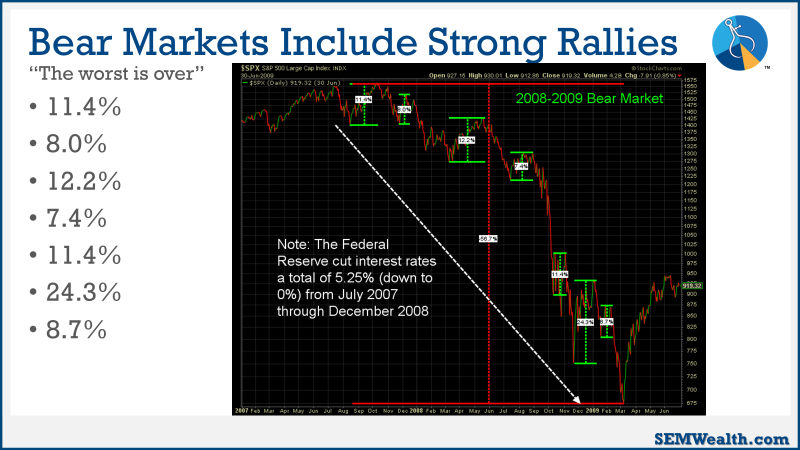

This is good advice all the time, but especially when emotions are high, which is typical for a bear market. There will be countless times the media will declare "the worst is over". Based on our experience, they will be wrong more times than they will be correct. Look at the last two bear markets and how many strong rallies occurred before the final bottom was in place.

3.) Be Patient

Remember, a true bear market which occurs during an economic slowdown can take well over a year. It will be frustrating seeing investment accounts not going up or drifting lower. Remember tip #1 – Don't Panic. We planned for this.

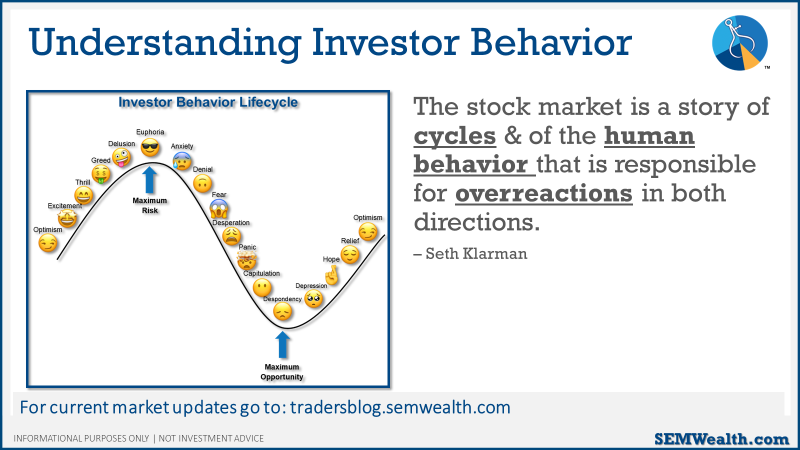

Just as bull markets create excesses on the upside, bear markets will create excesses on the downside. The only way to take advantage of these opportunities is to have cash available and a data-driven plan in place to take advantage. Experience tells us this will be when the majority of people are extremely negative about the future. This means if we wait until things feel "good" we will have already missed the best opportunities.

We've already taken a significant risk off the table. Now is the time to be patient and trust the process. Just as it did in 2000-2002, 2007-2009, the COVID panic of 2020 and many other mini-panics over the last 30 years, we need to trust the process. We use data and technical systems because we do not trust our own emotions. We know our brains will fail us, especially during a true bear market.

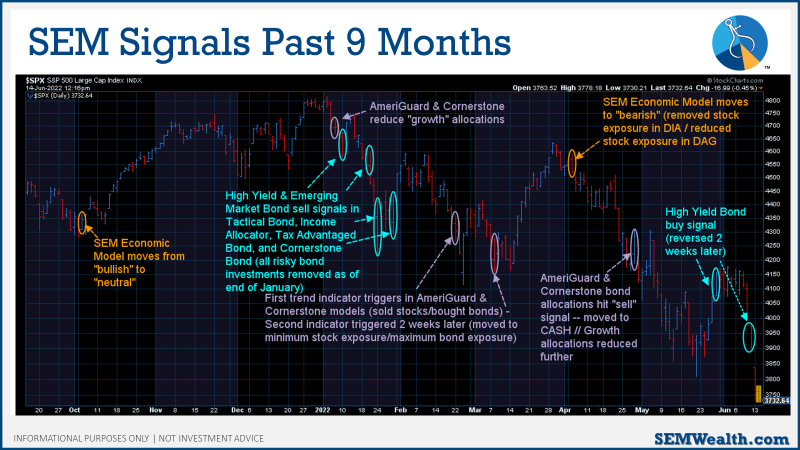

This chart illustrates all of the adjustments made within SEM's models over the past 9 months. Many of those changes came at a time where most investors were still euphoric. This is by design.

SEM will be here all along the way. Depending on your level of interest in current market events, the blog will be a good resource for you to see what is really happening inside the markets and the economy. I hope we are wrong about the severity of the bear market. If we are, our data-driven process has a plan to re-deploy all the cash we raised over the past six months.

If we are correct, however, following our three tips will be key:

1.) Don't panic

2.) Ignore the media

3.) Be patient

If at any point you'd like a portfolio review, start the process by taking our risk questionnaire. If you are not currently an SEM client or advisor and would like to learn more, you can contact us here.

Check out these other resources for more information: