Availability Bias: a heuristic (mental shortcut) where the easiest to recall experiences are used to make decisions. This is often the most recent experiences or traumatic events (core memories).

I was searching through the Trader's Blog archives for times we discussed Availability Bias, which is frequently referred to as "recency bias" and found it interesting given what I was going to write today that the most popular post with this term was titled "More Harm than Good."

I wrote this back in 2016, when after 7 years of unprecedented stimulus, the Fed was hinting at finally raising interest rates from 0%. They ended up raising rates once, seeing the market fall and then paused for the next year.

For nearly two decades investors have witnessed an environment where the Federal Reserve will step in and do “whatever it takes” to fight any sort of economic pain. From bailing out Long-Term Capital and the Wall Street Banks on the hook for their losses in 1998, to boosting liquidity ahead of Y2K, to keeping rates far below normal to fight the bursting tech bubble, to dropping interest rates to zero, arranging for the bailouts of the failed Wall Street banks, guaranteeing money markets from losses, and launching Quantitative Easing to purchase “sub-prime” assets from the failed banks, we’ve been conditioned to believe the Fed is there to help.

For most investors and advisors, their easiest to recall memories are the Federal Reserve standing ready to jump in and "stimulate" financial markets every time the market stumbles. We are seeing this sentiment prevail once again in 2022. Every data point is met with anticipation that maybe it will be enough to not only have the Fed stop raising interest rates or slow the "unwind" of their QE4 program but maybe even jump in and give the markets a bit more stimulus.

Weekly Talking Points

(each are discussed in detail below)

- We are used to the Fed saving us from severe losses

- Inflation is a problem for the Fed and thus the markets

- A true bear market is long and painful

- Bear markets have huge rallies that make you believe the worst is over

- If you're heading to recession, it's not too late to sell

We are used to the Fed saving us from severe losses

This simple chart of the bull market from 2009-2019 really tells the story. During this entire run, whenever the Fed stopped stimulating, stocks would fall. After a 12-17% drop, the Fed would reverse course. This is "normal" in many investors and advisors' eyes.

Inflation is a problem for the Fed and thus the markets

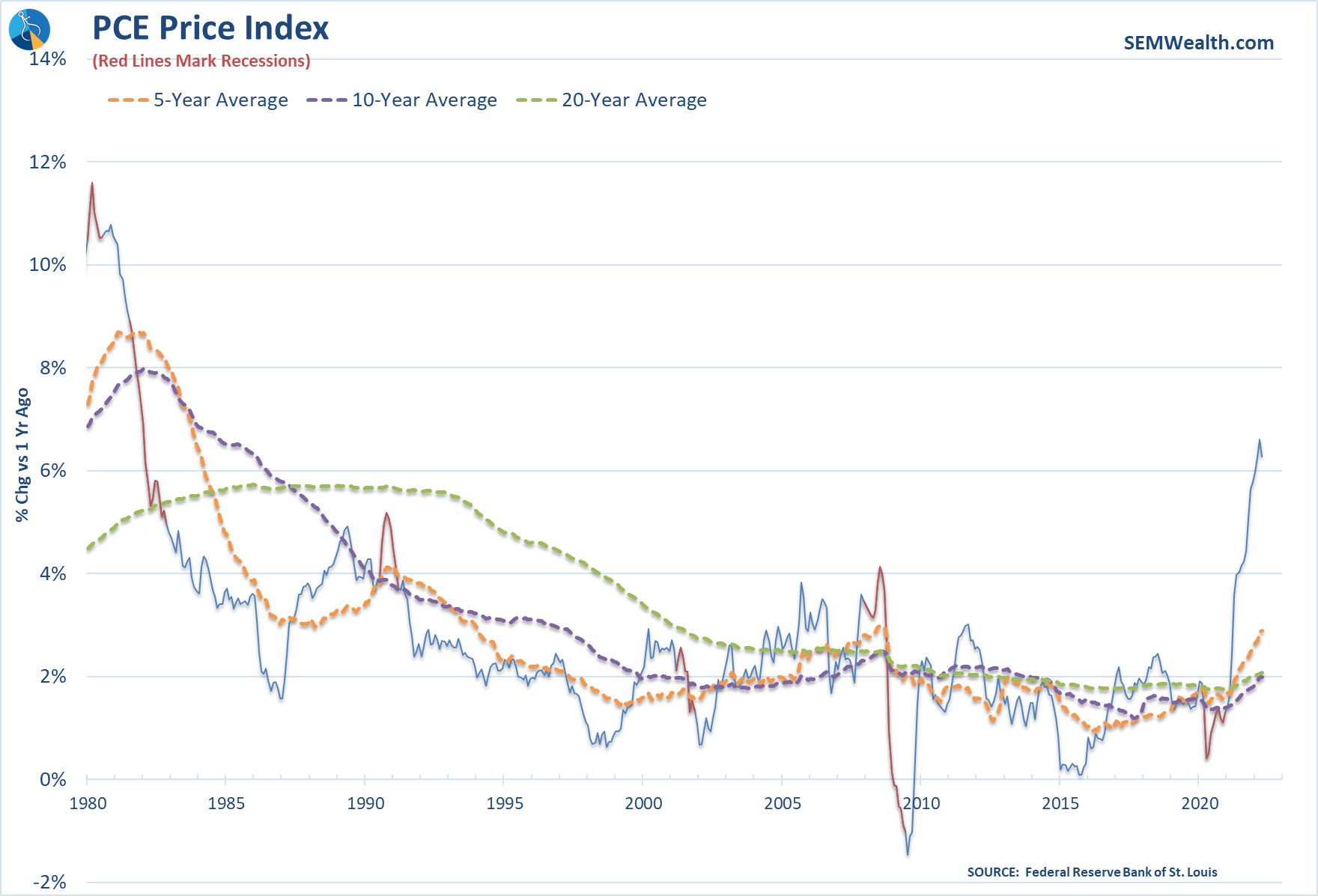

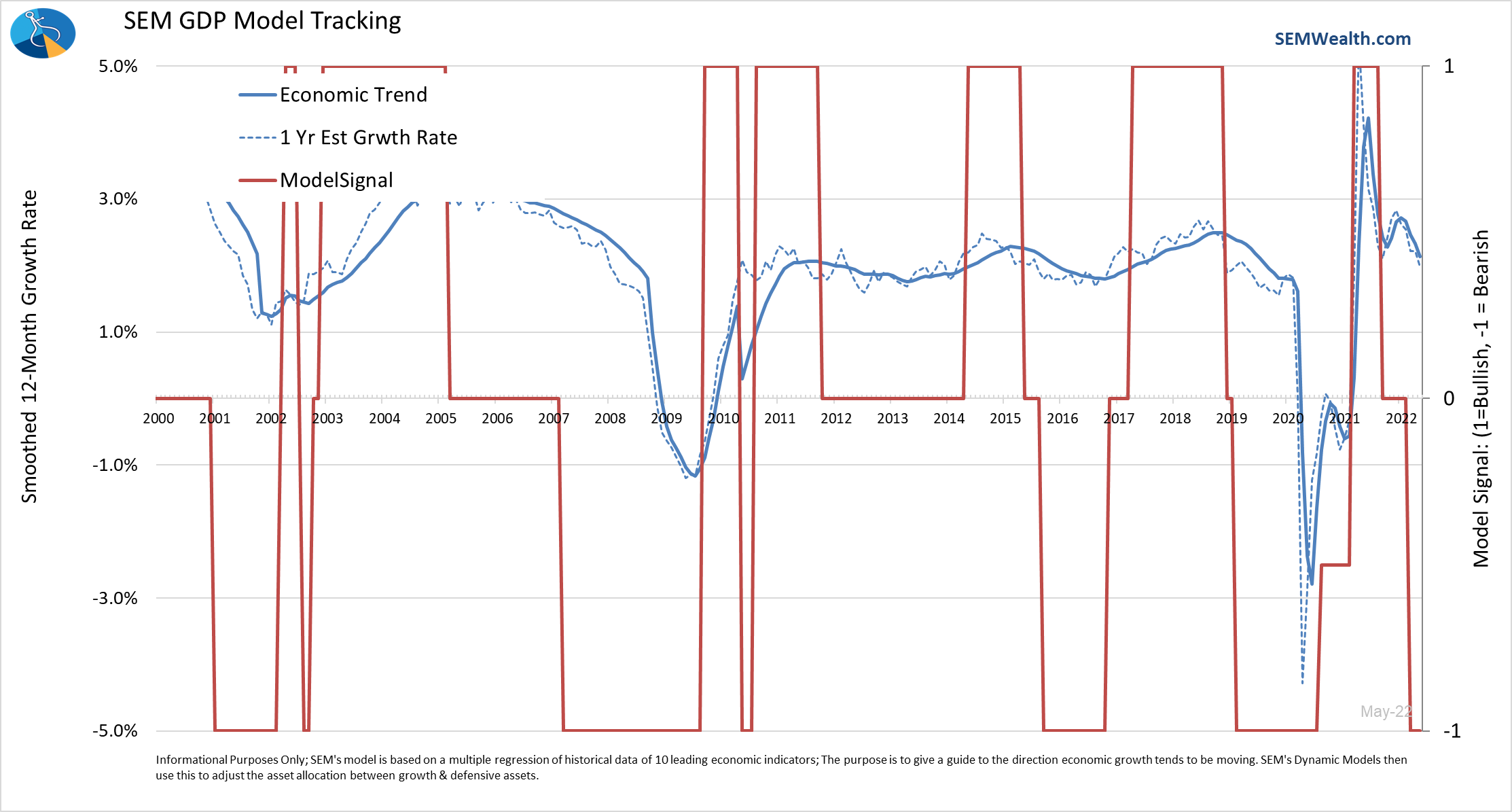

Of course, what people are forgetting is that for the better part of two decades we haven't had to deal with inflation. This made the Fed's "dual mandate" of price stability and maximum employment easy. With no worry about inflation the Fed could stimulate away. The problem now is we are certainly at "full employment" – the unemployment rate is a mere 0.1% higher than it was pre-COVID and is a whopping 1% lower than it was before the financial crisis. At the same time inflation is significantly above the Fed's 2-3% target range. It may have "peaked", but it is likely to stay stubbornly high for quite some time.

A true bear market is long and painful

The other thing many people forget is a true bear market, one that includes an economic recession typically lasts between 18-24 months with losses between 35-50%. I don't like the arbitrary 20% level used by market commentators because it ignores the time factor. At SEM we have an internally developed risk measure when evaluating trading systems called the ulcer index. It is a measurement of both the absolute loss along with the time spent losing money.

Psychologically, if you lose 35%, but it's only over 6 weeks (like we saw during COVID), your brain does not have the chance to feel the pain of the loss. Seeing your account lose 35% over a 12, 18, or 24 month period makes you believe this is a "new environment" and leads many investors to reach a level of despair that allows for stock valuations to not only fall to more reasonable levels, but to become deeply undervalued.

Over the long-run stock returns will equal economic output (GDP) + inflation + dividends. Over the short and intermediate term investors try to guess what that will be. They assign a "multiple" (P/E ration) based on their confidence. When the economy is growing and stocks have been rising, investors are confident and assign a higher P/E ratio. When the economy is teetering towards recession (or in a recession) that confidence is shot and we see a low P/E ratio. Combine that with rapidly declining growth rates and you get some large drops in prices.

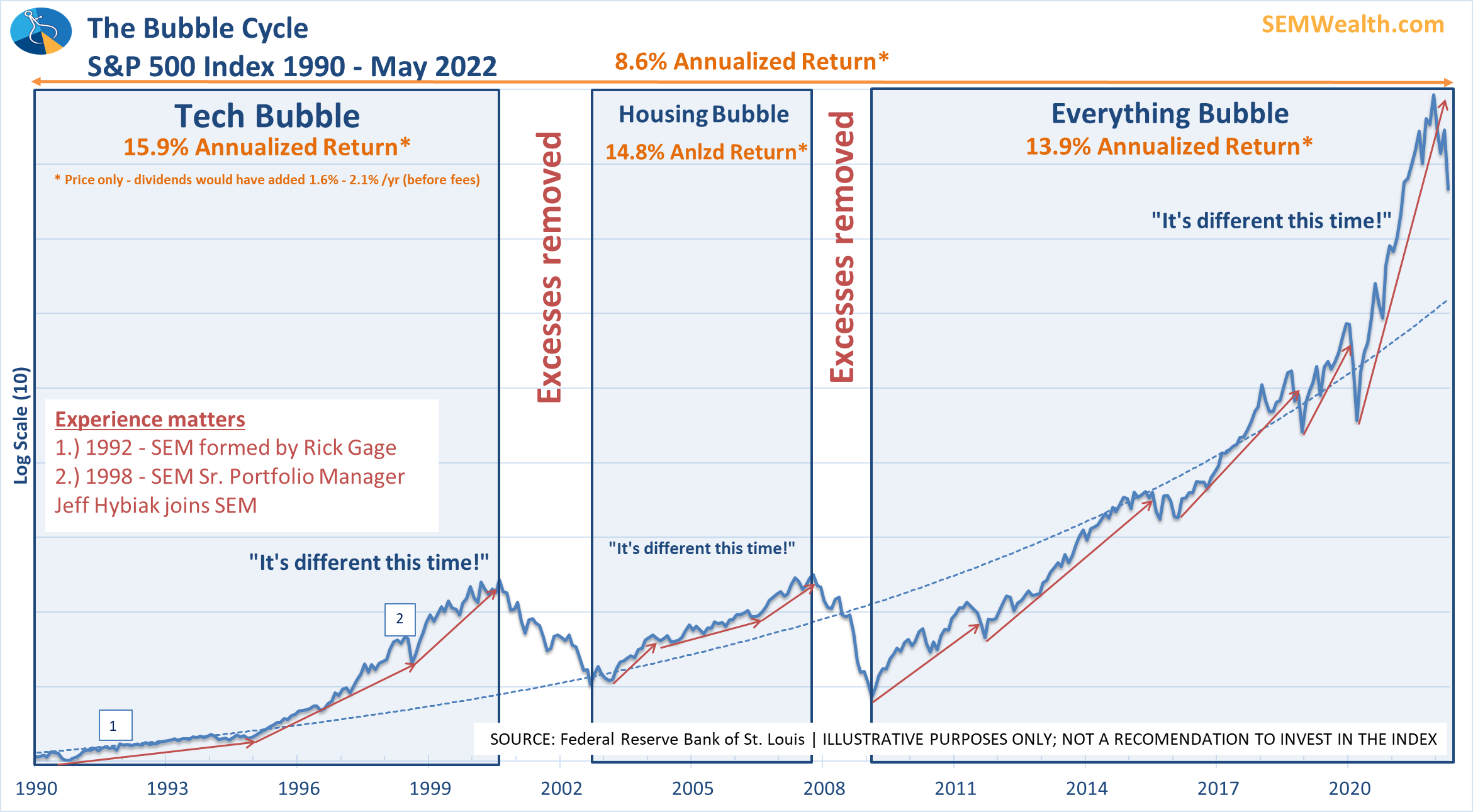

Throughout market history, we've seen the market move in cycles — we see furious "it's different this time" rallies where stocks generate mid-teen annual returns, followed by a big shock when everyone realizes it's really not different this time, which is followed by another furious "it's different this time" rally.

Bear markets have huge rallies that make you believe the worst is over

Because investors are trying to guess what the future growth rates will be and then assign a confidence level to those numbers (P/E ratio) we often see very convincing rallies that suck people into believing the worst is over. Take a look at the last two true bear markets. I marked in green the various bear market rallies.

The note added to each chart is key – the Federal Reserve was cutting rates throughout the bear market, but it was too late. The recession had already started and stock prices did not fully reflect the REALITY of the economic environment.

If we are heading to recession, it's not too late to sell

Study the charts above again. Having sat at the trading desk through both of those bear markets I remember the sense of relief and excitement during each of those rallies. "Woohoo, the worst is over! It's time to make some money!"

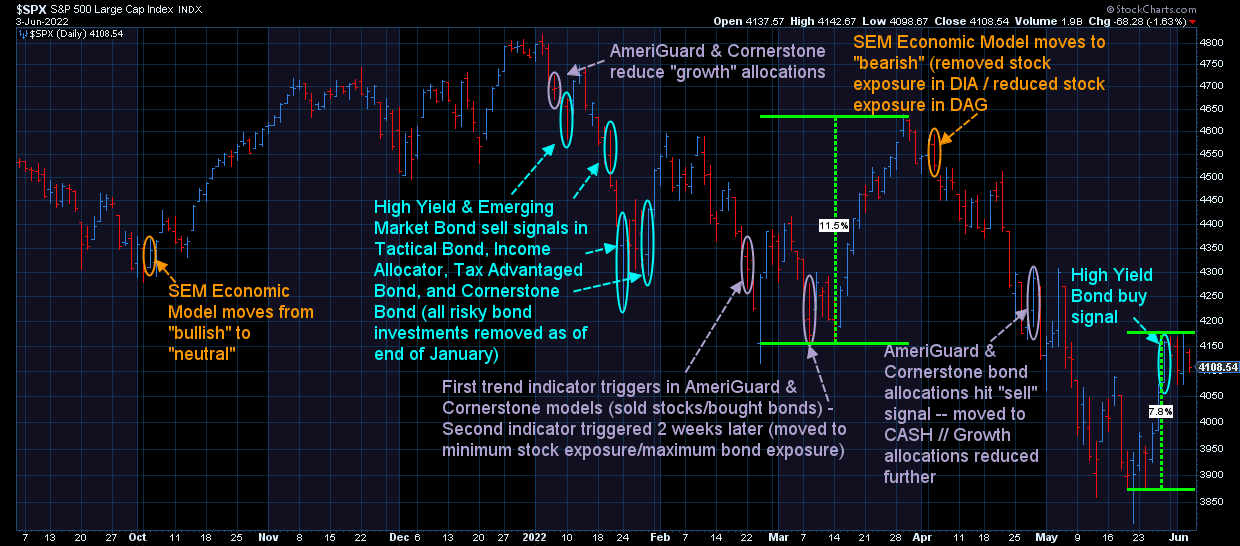

I'm not saying we are absolutely in a recessionary bear market (although the data and logic says we likely are), but look at the bear market thus far. We're in the midst of our second "woohoo, the worst is over" rally. The last one added nearly 12% before it rolled back over.

The chart above also has all of the adjustments we've made at SEM. All are based on data, not our opinions or guesses about what happens next. We always take our biggest lumps at the beginning of a bear market because we were most likely fully invested just before it started. Once the data shifts, we make adjustments accordingly.

You will notice on the far right, our high yield bond model has generated a buy signal. While we are hopeful this will turn into a nice, profitable trade, logic tells us it is likely going to be a short one. The economic data is simply too negative. Inflation is just now beginning to drag down economic growth. All of the drivers of the market and economy the past 2 years are either already gone or going away rapidly.

The defaults we expected and wrote about at the end of 2019 were postponed by the Fed's "emergency" measures during the pandemic. If this is a recessionary bear market we will likely see a rash of defaults in high yield (and even some investment grade) bonds. This will eventually create significant opportunities. I hope I'm wrong, but I'm not optimistic that I am.

Please, please, please, do not take anything in today's blog as investment advice. A month ago I did my best to give more specific advice based on your individual situation. I'd encourage you to read those points carefully:

The key point is your investment allocation should be based on your overall financial plan, cash flow strategy, investment objectives, and investment personality. A year ago investing was "fun". Now, not so much. That's the cycle we see time and time again with the markets. This is why we rely on data not our feelings to drive our buy/sell decisions. We know we cannot trust our brains. Recency, hindsight, confirmation, and many other biases make our brains unreliable and frequently lead to bad decisions.

If you are at all concerned about your investment allocations, please use our risk questionnaire. It will automatically generate a review of your account (if you're an existing client). If you aren't a client, it will give you an idea of whether you may need to make adjustments to your portfolio. At the end of the questionnaire there is a link to upload a statement of your existing account. Doing so will allow us to provide a free Morningstar X-Ray of your current portfolio to see how it aligns with your questionnaire.

Bear markets are a long, draining process. If I'm wrong that the bear market has already started, we aren't really missing out on too much. As I noted, our disciplined, data driven approach has already moved us back into the high yield bond market. If the rally shows signs of strength, our other models will follow shortly.

If I'm right, however we are only 1/3 to 1/2 through this bear market. The last half is always the most painful and when it becomes most likely emotional mistakes will be made.