-Every bear market is different.

-Every bear market is the same.

These statements are not mutually exclusive. I'll explain after this week's talking points.

Last week, I discussed what we should expect from a bear market. At SEM we don't make the big bold "we're in a bear market" call like so many Wall Street firms. We simply study the data and react accordingly. Most importantly, we strive to set proper expectations. SEM has been around for over 30 years and I've been here for 24 of them. We are more likely to have emotional reactions if we are surprised. Based on both the data and my experience, I firmly believe we are in a bear market.

Please take some time to read last week's post. It's been quite some time since any of us have experienced a bear market.

Weekly Talking Points

- We are used to the Fed saving us from severe losses

- Inflation is a problem for the Fed and thus the markets

- A true bear market is long and painful

- Bear markets have huge rallies that make you believe the worst is over

- If you're heading to recession, it's not too late to sell

Every bear market is different

Representativeness Bias: a heuristic (mental shortcut) where we find "similar" past situations to make predictions about the current situation.

The 2007-2008 Financial Crisis was so damaging to so many people we naturally are programmed to look for the obvious signs this is going to repeat. This also pulls in our "hindsight bias" where we look back and see how easily predictable the outcome was, which by itself is damaging. I constantly hear "experts" discuss how much better the "balance sheets" are of both households and businesses than what we saw leading up to the financial crisis. I hear discussions of how even with the past two years, housing prices are not in a bubble and banks are not overextended.

They are correct, but this doesn't mean we won't have a bear market.

I've also seen "experts" compare the current market environment to the the 2000-2002 bear market. They have pointed out how much lower the P/E ratio is for both the S&P 500 and the NASDAQ. They have pointed out how strong profit margins are (at record highs going into 2022). They have pointed out how much more rational investors are.

They are correct, but this doesn't mean we won't have a bear market.

I will say the current situation is similar to the 2000-2002 bear market. Ignoring the ridiculous valuations in the dot-com stocks, many people forget how everyone was afraid of the "Y2K bug". This led to massive spending on technology. Servers, network equipment, software, telephone systems, and computers were all upgraded. Money that would have been spent over the next 3-5 years was spent in the final year of the 20th century. Hardware and services were in short supply and prices (revenue) rose rapidly for the companies selling them. At the same time the Federal Reserve, worried about people pulling money out of the banking system ahead of January 1, 2000 flooded the system with liquidity (this was before they had formal names and announcements like QE3 or Operation Twist – they just did it and told us about it later.)

The turn of the century came and went without a hitch. Nobody needed new computers or tech equipment. Sales plummeted. There was too much money in the system so the Fed pulled it back. The market peaked in late March 2000. We saw attempts to rally. I especially remember the summer of 2000 rally which brought prices almost all the way back to the March peak. As fall approached and companies began warning about a prolonged slow down in sales, the market fell again.

What many people forget about the 2000-2002 bear market is the fact we didn't have that big of a recession (something the experts currently keep forgetting). We don't need a long, severe recession to have stocks go through a 50% bear market. We didn't have a recession in 2000 or 2002. The only recession was from March 2001 - November 2001. The experts didn't even declare a recession until two months before it was over.

Looking at our current economic environment, we likely won't have a deep, or even a prolonged recession, but that doesn't mean we won't have a potentially long and painful 50% bear market. Like in 1999, in 2020 we saw companies and consumers alike spend massive amounts of money on technology, this time to shift to a work-from-home economy. The spending on other goods, construction materials, appliances, and housing has been well documented. At the same time, the Federal Reserve has dumped in over 25% of GDP into the economy. Spending is already slowing, but now we have inflation, which means the Fed has to pull back a big chunk of their stimulus, just as they did in 2000.

Most importantly, I've seen too many people rely on their "availability" bias where we have "always" had the Federal Reserve jump in and save the markets from severe losses. I shared this chart last week of what we believe is "normal".

Not only can the Fed not jump in and save the markets this time around, we are not likely to see Congress jump in and save the markets/economy with more stimulus. The "solutions" in 2020 are now the problems of 2022. The returns from 2021 were excessive and not supported by anything other than the inflation we are fighting today.

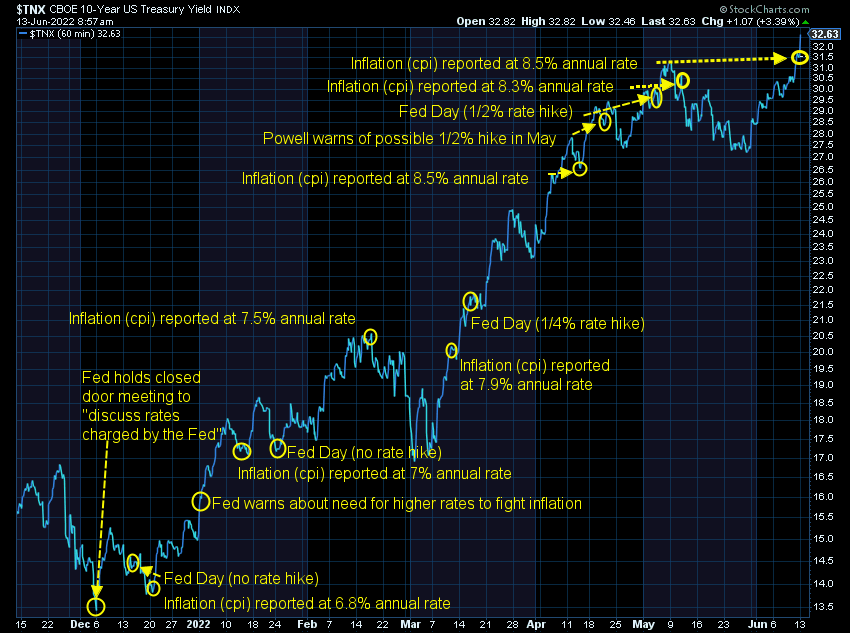

Friday's CPI report was "surprising" in that the narrative was inflation had "peaked". The fear now is the "structural" rate (what is embedded into the economy) is shifting higher than the Fed's 2% "target". The reaction in the 10-year Treasury market showed bond traders have zero confidence in the Fed.

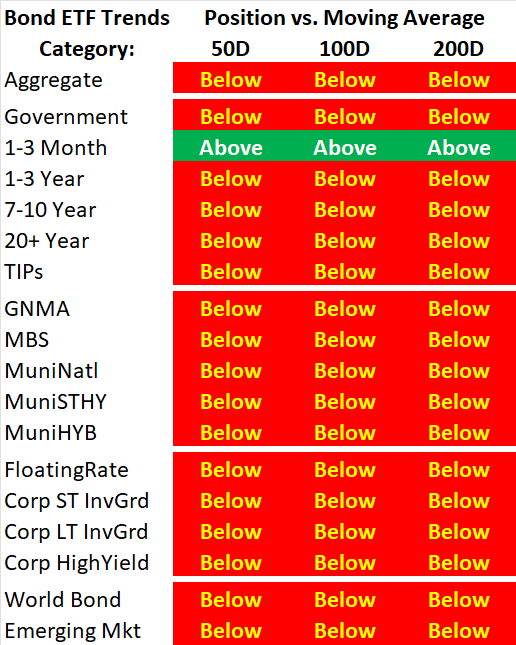

Overall, every bond category except the 1-3 month bond is in a severe downtrend. This is a striking change from just a few weeks ago when the question based on the big flows into the bond and stock markets was whether or not we would even have a recession (click here to read it). Clearly we now see how both the bond and stock markets are voting.

This bear market is certainly going to be different than the last two, although it has some of the same ingredients which caused them.

Every bear market is the same

I spoke at an FPA conference last week in Richmond. One thing I pointed out during my presentation is the complete waste of time it is for most advisors and our clients to watch CNBC/Bloomberg/Market Watch/Yahoo, etc. (The same can be said for most of the other forms of financial media.) I've spent over a quarter century digesting financial media (because it's my job). I have a pretty good BS filter. Most of the time the "experts" see what happens and then create a narrative to explain it. Like sports talk shows, they use hindsight to tell us how obvious the outcome was (even though they rarely predicted it BEFORE it happened.)

Markets go up when more people buy than sell. Markets go down when more people sell than buy.

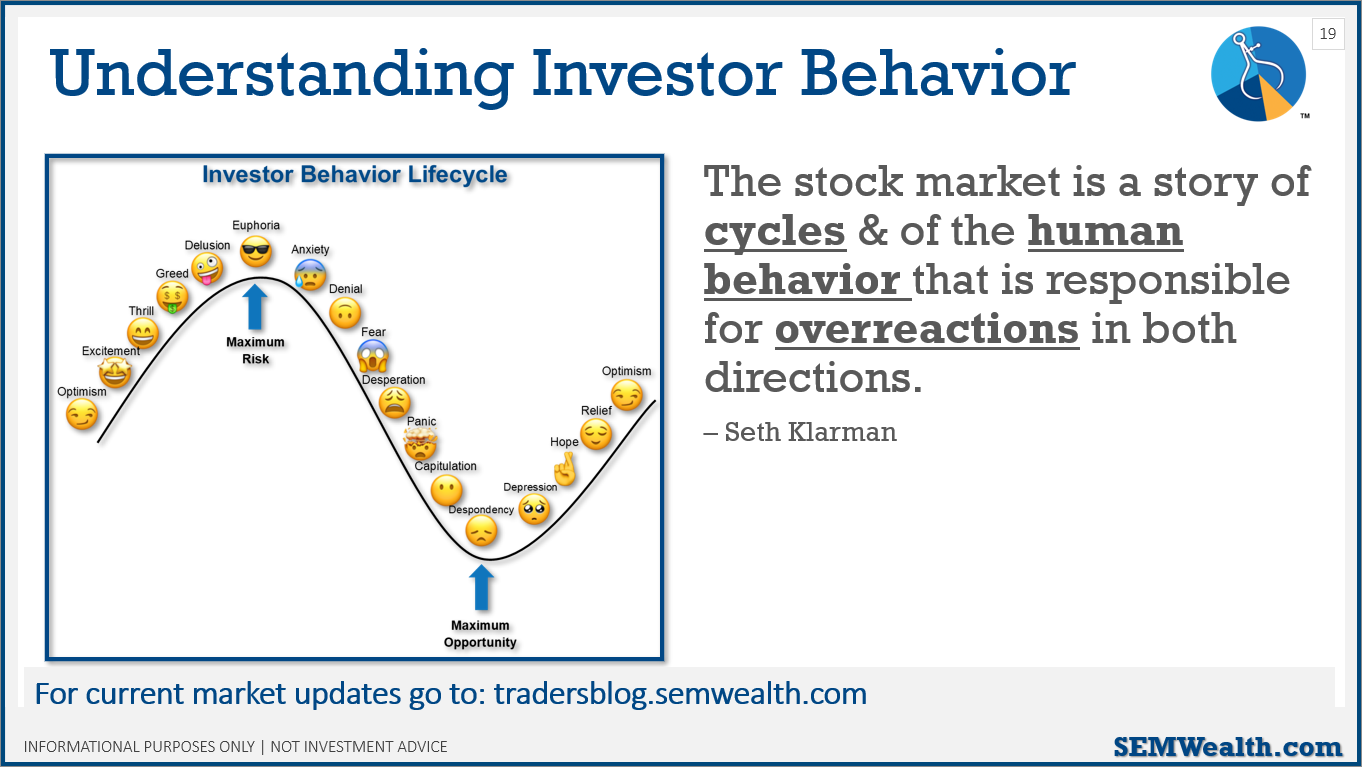

This is all you need to know about the markets. We use this graphic in every presentation. Psychologists have studied the emotions we each feel during a market cycle. Every advisor and investor goes through this cycle at different times. Overall, the reactions of the market are based on the consensus emotions. Based on my experience and the data we follow, we are somewhere between "anxiety" and "fear". We've not yet seen panic, capitulation, or despondency, which is the point we want to be ready to re-deploy all the cash we are sitting on.

The quote to the right is important – bear markets are always the same because they are always driven by an overreaction – first to the upside (see 2020/2021) and then to the downside.

This blog was created in 2008 as an evolution of our quarterly, then monthly, then weekly emails we were sending to our advisors. We understand we want to feel like we know what is going on. The goal of the blog is to tell you what is actually happening, not looking at the outcome and make up a story to explain it. Bear markets can be scary, but we are here to tell you what is REALLY going on. If necessary we will post more often, send emails, host webinars. There is no need to waste your time listening to the highly paid "experts" (most of which who had no idea a few months ago we would be in a bear market).

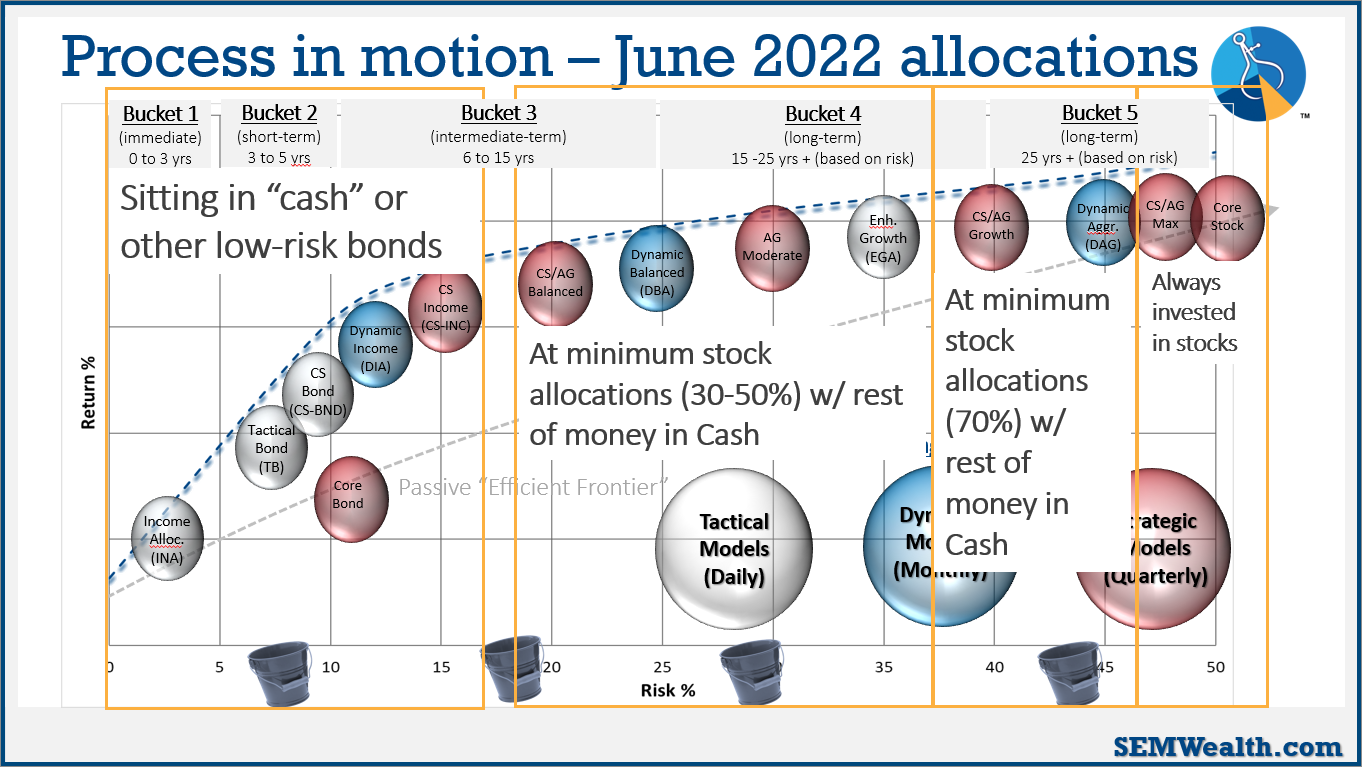

For our part, we are back in fully "bearish" mode. The high yield bond buy signal from a couple weeks ago reverted back to a sell. Apparently the institution(s) who slammed a bunch of money into the bond market the last week of May has yet to step back in. As of this morning, nearly every bond sector is set to break its lows from May. We are holding a lot of cash or money market funds even in our "growth" models.

We don't know how long we'll hold it. We don't know how bad it will get. We don't know when the next bear market rally will start. We don't know how long or how deep the recession will be. We don't know which companies or bond issues will end up failing.

We do know our systems have been designed to focus on one thing – are more people buying or selling? We don't care about the narrative or the reason, just whether or not based on history if it is a big enough change in the buying or selling volume to justify a change in our investments. For now, this snapshot of our positioning is important to understand. The amount of "cash" we hold is based on the time horizon and risk "bucket" of each model.

As always, if you're a current client and would like us to take a look at your allocation, you can start the process by taking our risk questionnaire. If you're not yet an SEM client and would like a second opinion, you can also use the risk questionnaire and the secure link at the end to upload your statement. We will use it to generate a Morningstar report, allowing us to compare your current holdings to your risk tolerance and objectives.