“Recency” bias, or the more formal term “availability” bias is something we have observed at SEM for years with our client and advisor base. The human brain by design more easily recalls the more recent events and then sets future expectations around these memories. The longer something occurs, the more our brains believe it is “normal”.

For nearly two decades investors have witnessed an environment where the Federal Reserve will step in and do “whatever it takes” to fight any sort of economic pain. From bailing out Long-Term Capital and the Wall Street Banks on the hook for their losses in 1998, to boosting liquidity ahead of Y2K, to keeping rates far below normal to fight the bursting tech bubble, to dropping interest rates to zero, arranging for the bailouts of the failed Wall Street banks, guaranteeing money markets from losses, and launching Quantitative Easing to purchase “sub-prime” assets from the failed banks, we’ve been conditioned to believe the Fed is there to help,

Back in August at the Fed’s annual Jackson Hole Symposium on Monetary Policy, the leaders of the central banks along with many academics gathered to discuss future monetary policy. With the central banks in Japan and Europe already resorting to Negative Interest Rate Policy (NIRP), I found it shocking how the overwhelming consensus coming out of the meeting was how successful NIRP would be to fight an economic slowdown.

This is shocking for me for two reasons: 1.) The evidence does not support the PAST policies being successful. We’ve witnessed the WORST ECONOMIC RECOVERY IN OUR HISTORY, yet nobody seems to look at the Fed’s policies as the reason for this, and 2.) We’ve barely seen the impact of NIRP on our economy.

I’ve been waiting over a month to share my summary of a powerful letter from John Mauldin from August 29. With a slow week on the economic data front, it may be a good time to review his “Six Ways NIRP is Economically Negative”.

[You can read the entire article here.]

#1 – Failure to Stimulate

The general opinion is “lower interest rates will stimulate demand”. But do they really? There are a lot of other variable that factor into this — how much debt the household or business already has, the stage in the life-cycle for the household or business, the overall outlook for that household or business, etc.

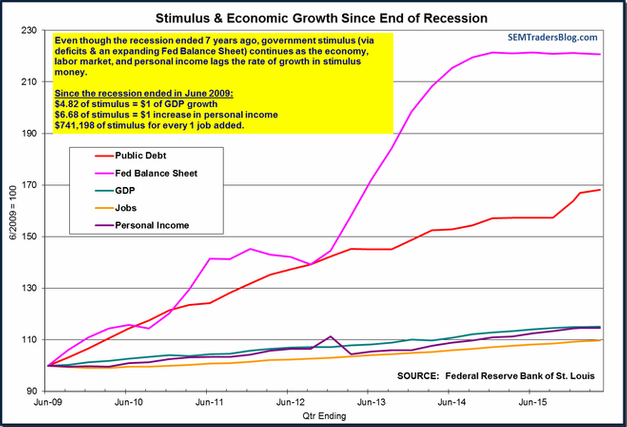

As I said in the opening, this is the worst economic recovery in the history of our country. Fed supporters will say, “imagine how bad it would have been without the Fed.” Few are asking, “did the Fed’s policies do more harm than good?” In our “Grand Experiment” article we walked through the two economic schools of thought & included this chart highlighting how expensive the “stimulus” from the Fed & Government has been.

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

The real issue then becomes — how do we pay back all of this “stimulus” and get back to a “normal” position without doing even more harm to the economy? This problem is compounded by already weak economic growth.

[I documented the crazy math behind the cost of each new job “created” in our CHART OF THE WEEK back on August 5. It will take approximately 26 years for these new jobs to pay back all the stimulus used to create it! Click here for the math behind it.]

#2 – Betraying Lord Keynes

I thought this was an interesting point brought up by Mr. Mauldin. I’ve always reminded anyone who will listen the “Keynesian Economists” have no problem with the first portion of John Maynard Keynes’ economic theory — the government needs to use deficit (debt) spending in order to stimulate the economy during times of economic weakness. This is essentially “gospel” to pretty much every modern economist working on Wall Street or at the central banks today.

One of the primary issues I’ve always had is the failure of any policy makers to follow-through on the second portion of Keynes’ theory — during times of prosperity the government needs to PAYBACK THE DEBT and let the free market function in order to be in a place where they can stimulate during the NEXT RECESSION. As I mention in the “Grand Experiment“, this has led to a real life application of another economic theory — The Law of Diminishing Returns. It now takes more and more “stimulus” to get the same impact as they had before. The problem is there isn’t enough money or appetite to borrow to get any sort of decent economic growth since the government has not bothered to pay back any of the past stimulus the past 40 years.

Back to the Fed. In 2008 they did their “Keynesian duty” by stepping in and “stimulating” in order to prevent even more widespread damage than already occurred. The real issue is they didn’t really stop “stimulating” until the end of 2014, 5 1/2 years after the recession had officially ended. They are not even close to beginning the process of unwinding their unprecedented balance sheet & the economy could not even handle a 1/4% increase in interest rates at the end of 2015.

Yet very few central bank insiders are stopping to ask if there is a problem with their policies or the economy. The real issue with the Fed is they are ignoring additional guidance from their “Lord” Keynes. Mr. Mauldin provided this fascinating quote by Lord Keynes from the 1930’s (the middle of the Depression)

Today and presumably for the future the schedule of the marginal efficiency of capital is, for a variety of reasons, much lower than it was in the nineteenth century. The acuteness and the peculiarity of our contemporary problem arises, therefore, out of the possibility that the average rate of interest which will allow a reasonable average level of employment is one so unacceptable to wealth-owners that it cannot be readily established merely by manipulating the quantity of money. So long as a tolerable level of employment could be attained on the average of one or two or three decades merely by assuring an adequate supply of money in terms of wage-units, even the nineteenth century could find a way. If this was our only problem now – if a sufficient degree of devaluation is all we need – we, today, would certainly find a way.

But the most stable, and the least easily shifted, element in our contemporary economy has been hitherto, and may prove to be in future, the minimum rate of interest acceptable to the generality of wealth-owners. If a tolerable level of employment requires a rate of interest much below the average rates which ruled in the nineteenth century, it is most doubtful whether it can be achieved merely by manipulating the quantity of money. From the percentage gain, which the schedule of marginal efficiency of capital allows the borrower to expect to earn, there has to be deducted (1) the cost of bringing borrowers and lenders together, (2) income and surtaxes and (3) the allowance which the lender requires to cover his risk and uncertainty, before we arrive at the net yield available to tempt the wealth-owner to sacrifice his liquidity. If, in conditions of tolerable average employment, this net yield turns out to be infinitesimal, time-honoured methods may prove unavailing.

In other words, Lord Keynes was warning his followers that if rates are TOO LOW lenders will have no desire to lend, and investors & business owners (wealth-owners) will have no desire to invest in long-term projects. This has been the case for the past 7 years at ZERO PERCENT. Lord Keynes did warn “time-honoured” methods may not work, but did his followers fail to see the preceding discussion where it said rates could be TOO LOW? Why in the world do the central bank leaders believe NEGATIVE RATES would be any different?

#3 – Policy Paralysis

The Fed & other central banks resorted to “unprecedented” policies in order to fight the financial crisis & recession, then continued to test policies that were previously classroom theories throughout this economic expansion. As I’ve said all along, one of the problem with these unprecedented policies is there is no precedent on how to unwind them.

The Fed and other central banks have been hyper-sensitive to the market reactions. They seem to float “trial balloons” via speeches, policy statements, and well placed “rumors” with key journalists to gauge how the markets might react. Over the past 7 years it has seemed if the S&P 500 loses more than 7 or 8%, the Fed sees this as the market saying it isn’t ready for the Fed to begin the long process of “normalization.”

This environment has created a very myopic focus in the markets and has led to excessive risk taking by market participants as they seek any kind of yield. Whenever the market participants are over extended on the risk frontier, they are quick to react to any signs of danger. With the Fed so focused on their reaction they have a false feedback loop that makes them believe they can’t normalize just yet.

#4 – Killing Pensions & Insurance Companies Softly

This is probably the most under-appreciated consequence of the Fed & other central banks’ “stimulus” programs. There are a few things most people do not understand with pension funds & insurance companies.

1.) They base their rates (either premiums or how much they can pay out in retirement) on the expected returns they can get in their portfolios.

2.) They are required by law and/or mandates to invest a certain (high) percentage of their assets in “low-risk” securities (typically government issued bonds.)

3.) If they are not generating the returns necessary in their “core” portfolio to meet their previous expectations for return, they are forced to take on higher risk in their “satellite” portfolio. This can lead to significantly higher losses that will cause them to then have to re-assess their rates of return.

The other thing I’m pretty sure nobody understands is the fact in the US pension funds measure their “funded” level based on their expected return from their portfolio. If the investment committee believes they can get 8%, then that is what they model. If they are too far underfunded, which would require a significant contribution from the company (or government entity) they can simply increase their expected return to 9%. There, problem solved!……….until they get to the point where they have not come anywhere near the expected return.

This topic deserves an entire week (or month, or book), but from what I’ve seen the expected returns modeled in US pension funds are nowhere close to realistic. Just looking at current dividend yields and interest rates, a 5% expected return is probably what should be in the models. This is a far cry from the 7 – 8% the funds are modeling. On a $100 million pension fund with a 20 year life span, a 2% funding short fall turns into a $148 million problem.

I’ve heard far too many people that belong to a pension plan a.) believing their pension promise is “guaranteed” & b.) believing Hillary Clinton will protect their pension. This isn’t about politics, it’s about math and from what I’ve seen neither candidate can do a thing about this for the simple fact that neither understands the MATH problem behind these plans; a problem that is exponentially compounded by the Fed’s “stimulus” tools. ZIRP has been bad enough for these plans. Imagine what NIRP would do to them.

DETOUR – 10/12 Market Comments

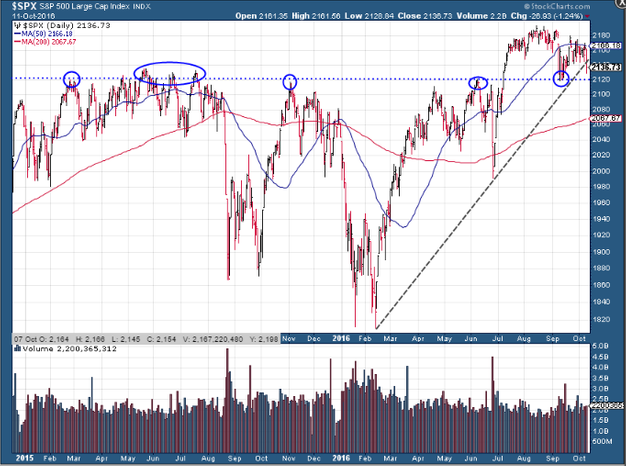

I was hoping for a quiet week as we discussed this important concept. Unfortunately the market does not always cooperate. Apparently there was more rumblings on Tuesday about an increased likelihood of a Fed rate hike in December that caused investors to sell stocks. This also hit bond prices and gave us a pretty ugly day. Last night as I was assessing our trading systems, the chart of the S&P really stood out to me. I’d make a note of S&P 2120. It was resistance for the market for quite some time and held up during the sell-off in June. A break below that, which follows a break in the uptrend off the February lows could bring out more sellers.

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

#5 – Distorting Signals

This is probably one of the more misunderstood problems with ZIRP and now NIRP. The “do whatever it takes” mentality of the central banks quickly led them to creating new money to purchase bonds from the banks. Their focus was on providing liquidity to the banks with the theory the excess liquidity would lead the banks to want to lend money and help stimulate the economy. Unfortunately, the central banks forgot one of John Maynard Keynes’s other economic theories — interest rates need to provide an incentive for “wealth holders” and lenders to take risks with their money (discussed above in NIRP Problem #2).

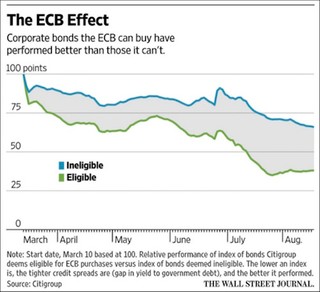

The free market is supposed to help us determine what the current “fair value” is for an asset, but adding central banks to the buyers with essentially monopoly money means we no longer have a free market. The WSJ pointed out the difference in pricing in the EU between bonds eligible for ECB purchases and those that are not. Notice the widening gap we saw this summer as the ECB ramped up its bond purchases.

There are two key questions here — 1.) what happens when the ECB runs out of “eligible” bonds to purchase and they still feel the need to stimulate? 2.) what happens to the prices of the “eligible” bonds when the ECB ends its bond purchases?

We’ve seen what happens in Japan and China when they run out of bonds to purchase — they resort to purchasing stocks (China) or stock index funds (Japan) hoping to boost their economy. This creates even more distorted signals.

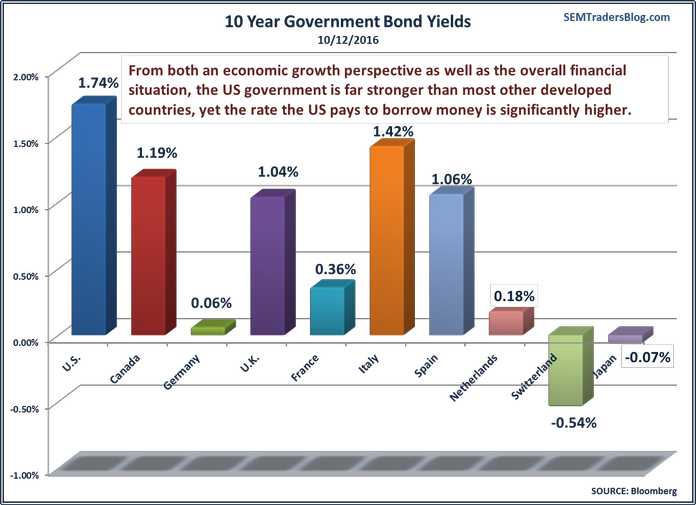

Another place we have seen this show up is the government bond market. All EU sovereign bonds are “eligible” for ECB purchases and Japan is essentially the only entity purchasing Japanese bonds. In the US at the peak of QE, the Fed was purchasing 55-75% of all newly issued US government bonds. Since QE ended at the end of 2014 the market has returned to being more “free”. Look at the difference between “freely traded” government bonds and those manipulated by the ECB or BOJ.

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

In a “free” market, this signal would be that the US is a risky investment compared to the rest of the world’s developed markets. From a pure investment stand-point the opposite is true. On a relative basis the US has better control of its spending, its demographic imbalance is not as great, and the prospects for growth are much stronger than in the EU or Japan. Who in their right mind would lend any of the EU governments money at those rates for 10 years? The answer — the ECB.

Finally, the other distorted signal this sends is to those that still believe in fundamental analysis of stocks. In nearly every valuation model, there is a “risk-free” rate used in the calculation. That rate is sometimes the 10-year rate (assuming a long-term time horizon for investing) or sometimes the short-term rate. All things equal, lower rates mean higher valuations in these models……to a point. When rates get close to zero and then go negative these models either produce valuations with a whole lot of commas and zeros or return a #VALUE# because it cannot be calculated with a negative risk free rate.

That leaves investors guessing about what the true value should be, not only of bonds, but also with stock prices. Guessing leads to second-guessing (and third, fourth, and fifth guessing often times), which then leads to the creation of a bubble and an eventual crash. Investing is already an emotional endeavor, but when the central banks remove all possibility of using any sort of data to help offset our emotions it becomes even more emotional. You would think with all the PhDs floating around the central bank offices somebody would realize this.

[NOTE: SEM does not use these types of valuation models in ANY of our programs. Our “Tactical” programs only use data produced from the market and are primarily based on momentum based on prices, volume, and breadth. While the central banks’ policies have certainly skewed our models to be too defensive during this bubble, the downside protection still remains solid as we’ve witnessed during the brief times the market actually corrected the last 7 years.

Our “Dynamic” programs do utilize economic and other “fundamental” data, but they use “relative” comparisons rather than absolute valuation principals, meaning they are more likely to participate in these types of bubbles, but are not skewed by the creation of a bubble in terms of shifting to more conservative allocations.}

#6 – Repressing Retirees

Out of all the issues I have with central bank “stimulus” policies, this is by far the most aggravating. Apparently John Mauldin agrees as he has devoted many letters to this over the past few years. One of the most descriptive terms he used was “killing retirees softly”. Here is a passage that sums up the real issue:

It was even simpler if you had an employer or union pension plan to do the work for you. Pension plans pooled people’s money, calculated how much cash they would need to pay benefits in future years, and built portfolios (mainly bonds) to match the liability projections. Government and corporate bonds yielded enough to make the process feasible.

Younger readers may think I just described a fantasy world. I assure you, it was very much a reality not so long ago. Ask your grandparents if you don’t believe me. However, you may find them in a state of shock today because they thought the fantasy would last forever. Indeed, their financial planner probably told them they could count on drawing down 5% of their portfolio per year to live on, because the income from the investments in their portfolio would more than make up for the drawdown.

None of this is possible today. Neither you nor a massive pension plan acting on your behalf can generate enough risk-free income to assure you a comfortable retirement.

Why not? Because our monetary overlords decreed that it should be so. Retirees and their pensions are being sacrificed for what now passes as “the greater good.” Because these very compassionate overlords understand that the most important prerequisite for successful future retirements is economic growth. And they think that an easy monetary environment is the necessary fertilizer for that growth. So, when they dropped rates to zero some years ago, they believed they would soon be able to raise them again – and get people’s retirements back on track – without risking future economic growth. The engine of growth would fire back up, and everything would return to normal.

So much for the brilliant plan. You and I, the expendable foot soldiers in the war to reignite growth, now gaze about, shell-shocked, as the economic battlefield morphs from the Plains of ZIRP to the Valley of NIRP.

From the time QE was launched I have been a critic. The Fed’s policies do not make sense because they failed to identify the STRUCTURAL issues with our economy. They quickly jumped to the conclusion the cause of the financial crisis was the bursting of the housing bubble. They theorized if they could just purchase the debt that was no longer “liquid” the banks would freely go about lending money to people that would be happy to borrow at those low rates. When that didn’t work the Fed then switched to buying government bonds hoping to push people from “savers” to “investors”. While that has helped the returns of the stock market, it has done little to stimulate economic growth.

The problem with their theory was the failure to see the financial crisis was a symptom of the real underlying problem — our country (and the rest of the world) relied too heavily on debt to generate growth over the past 30 years. Businesses & households alike do not have the same appetite for growth because they do not see how they can be rewarded.

ZIRP, QE, & now NIRP (along with the Republican led TARP Bailout of the banks) all have one thing in common — they punish those that did the right thing (savers & those that did not heavily use debt) and reward those that got over-extended or want to take on tremendous risks. This is a recipe for disaster down the road.

We are already seeing those that did the right thing and saved for retirement are not able to generate the income they thought they could. What is even more scary is a study last year from the GAO that showed only half the households with somebody 55 or older have ANY retirement savings. Of those people, only half had more than $104,000 saved, an amount that would quickly be absorbed in a couple of years in retirement. 24% of the group that has savings have $25,000 or less.

We cannot solve these problems in this blog or even if we were to write a book on it. When you consider the math problems facing social security, medicare, and pension plans the task is daunting. Unfortunately, once again we are seeing no presidential candidate willing to address what will be a MAJOR issue for all of us in the next 10-15 years.

What we can do is provide opportunities to generate solid returns without taking on too much risk. Our returns will not always keep up with the S&P 500, but historically our losses have not come anywhere near the 50% drops we’ve seen in stock prices twice over the past 16 years. This quarter we launched a new recommended ENCORE Portfolio — Dynamic Defensive Growth. It is a combination of our Bond ENCORE (Income Allocator & Tactical Bond) and our Dynamic Income Allocation program. The purpose is to provide multiple, diversified trading systems to help generate more consistent income for clients that cannot afford the risks of investing in the market but need returns higher than what is offered by traditional income products.