Whether it is an objective measurement of a bubble using past valuation levels or our own subjective observation of investor behavior, it is clear we are in some sort of a bubble.

How can you (or your clients) avoid participating in the next market crash?

As with anything involving our emotions, the first step is identifying the emotional biases you might be subject to. Nearly everyone (including me) will have some emotional biases. Understanding this and how it might shape your decisions is critical. The next step is to take a step back and look at the DATA. One of the more frustrating things I’ve seen happening this year are the clients that are moving their Income Allocator or Tactical Bond accounts to stock investments. The most common reason is the client wanted “higher returns.”

Ignoring the fact that both programs have posted strong returns thus far in 2016, with both closing the quarter at all-time highs, and Tactical Bond actually returning about the same amount as the S&P 500, focusing only on returns and ignoring risks is a dangerous decision that can end up costing clients severely over the long-term.

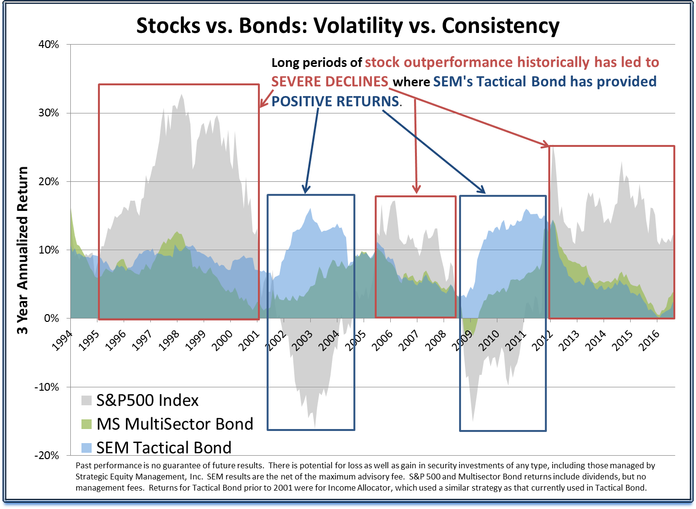

Looking at the DATA, we can see it is not uncommon for stocks to post significantly higher returns than our Tactical Bond program. The chart below illustrates the 3 year rates of return investors would have earned by investing in the S&P 500, the MultiSector Bond category at Morningstar, and SEM’s Tactical Bond Program.

The “favorable” recent performance has moved in cycles throughout our history. It is common for Tactical Bond (and our other programs) to underperform the S&P for what feels like a long time (red boxes on the chart). However, those “long” periods of underperformance have ended with severe declines in the S&P 500 (blue boxes on the chart).

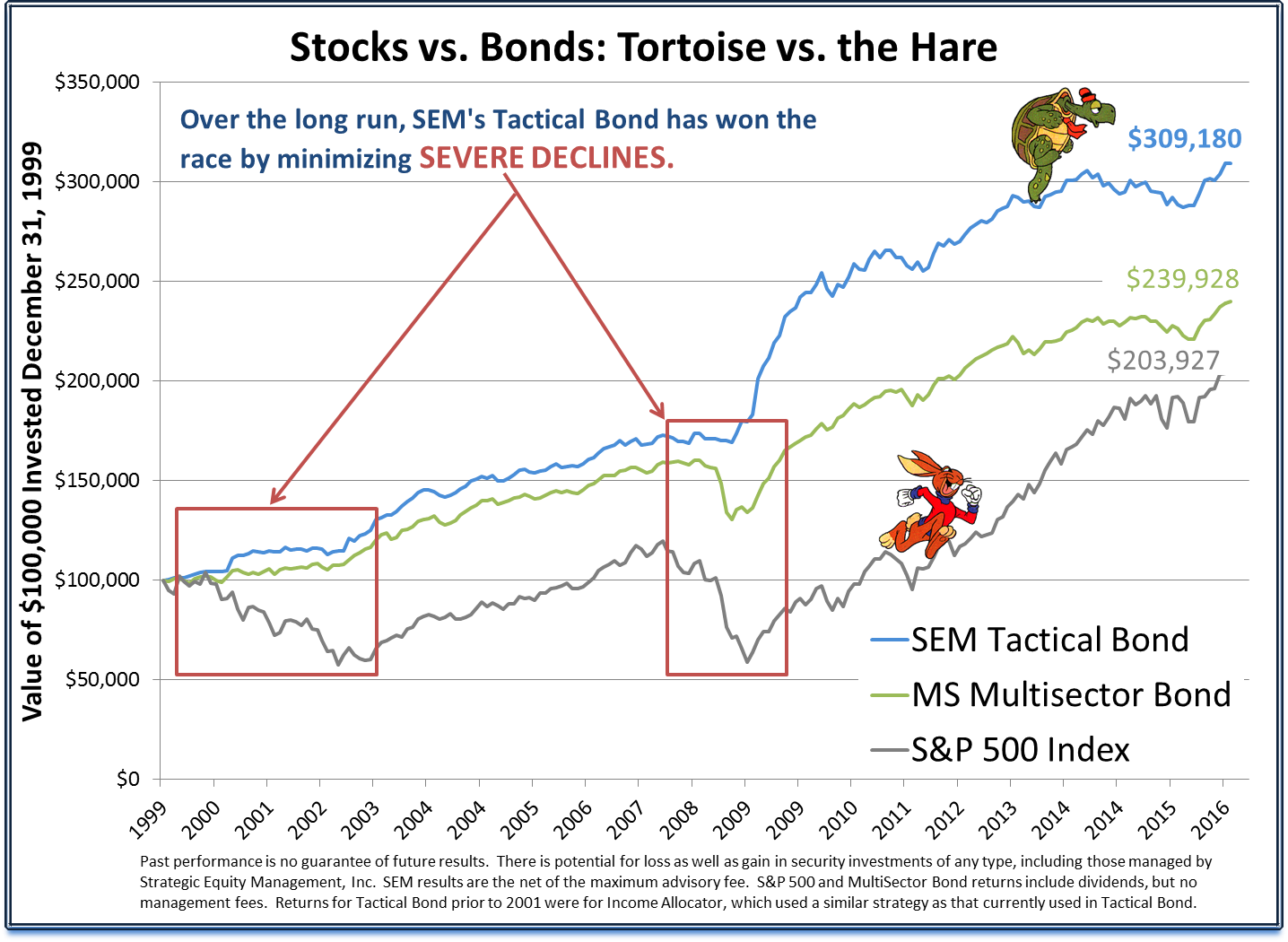

This is a real-life version of the “Tortoise & the Hare”. Clients who were patient and stuck with Tactical Bond were rewarded not only by not suffering the losses they would have faced, but significantly higher long-term returns.

We understand the emotions that develop during extended bull markets because we feel them too. Focusing on the DATA is what has been one of our keys to success the past 25 years. For those of you that still feel you want to place a “bet” on the “Hare”, we actually have a program that is designed to do just that. In May of this year we launched several “Dynamic” programs, one of which is constructed to provide CONSISTENT exposure to the market while still allowing for some reduction of exposure during periods of economic weakness. This program, Dynamic Aggressive Growth (DAG) blends nicely with our Tactical Bond & Income Allocator programs allowing our clients to participate in any further upside of the market while still maintaining the significantly lower risk allocation in Tactical Bond & Income Allocator.

For assistance with how you can allocate to these portfolios, please let me know.