Human's do not like change. Our brains like to know what to expect. Normally in a bull market a change in leadership in Washington will be met with angst. This of course is not a normal environment.

The stock market has staged a huge rally since Joe Biden became the apparent winner of the election in early November. Even though he ran on a platform of higher taxes, the progressive Democrats losses in the House as well as Biden's moderate history in the Senate was perceived as a more stable environment for the market and the economy. That's not a political opinion, simply the consensus view from Wall Street's top strategists.

This week I'm hosting a 2021 Outlook webinar for several of our advisors and clients. Unfortunately, politics will have to be discussed. Here are some of my slides and notes from the webinar. If you're an advisor and would like to host your own outlook webinar, let me know.

This shouldn't have been a surprise

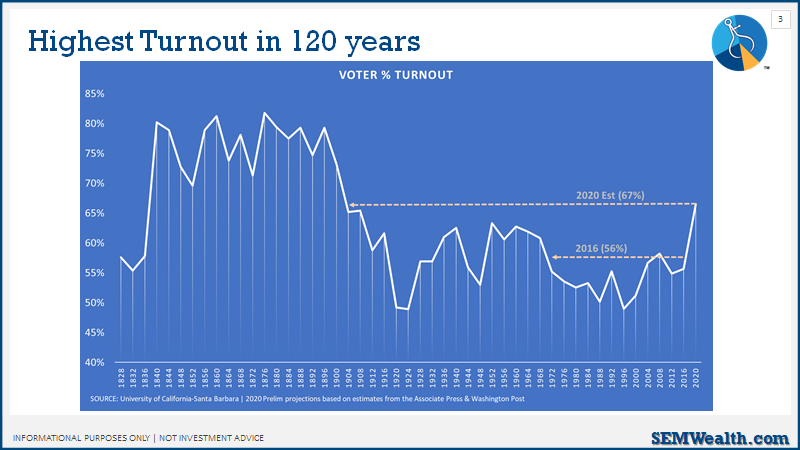

While the President lamented receiving a "record number of votes" yet still losing, simple math told us we should have expected record numbers. Even before the events of 2020 (both COVID and the summer racial unrest) our country was deeply divided. I've written about that on and off for the past 10+ years. This led to a record turnout (from both sides) and thus a "record number of votes" for both candidates.

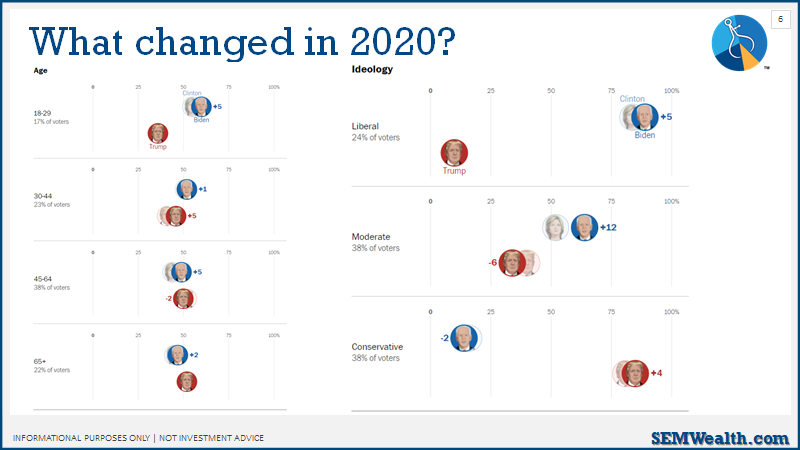

Moderates picked the government

While all of the noise came from the far left and the far right, as they did in 2016, the moderate voters were the ones who decided who would win. Moderates overwhelmingly moved from supporting Donald Trump to voting for Joe Biden.

In addition, the "blue wave" move to progressive candidates (or socialist as some feared) never transpired. In fact, moderate voters rejected those far left candidates in nearly every race. This will set-up an internal struggle in the Democratic party. If they move too far to the left, they are very likely to give up control of Congress in 2022.

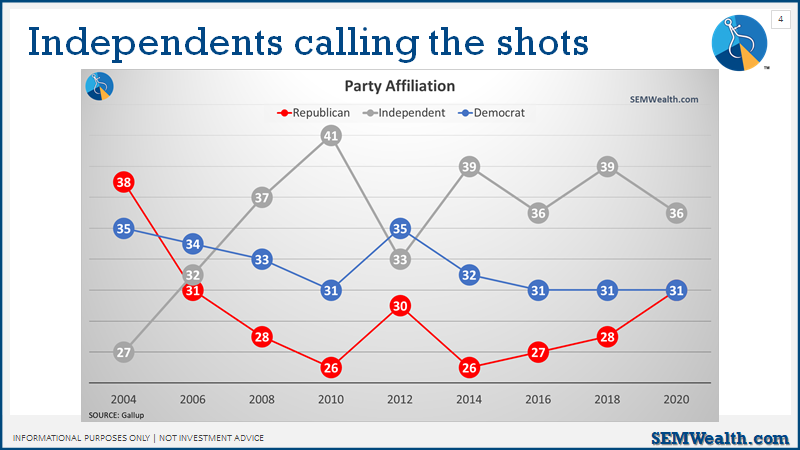

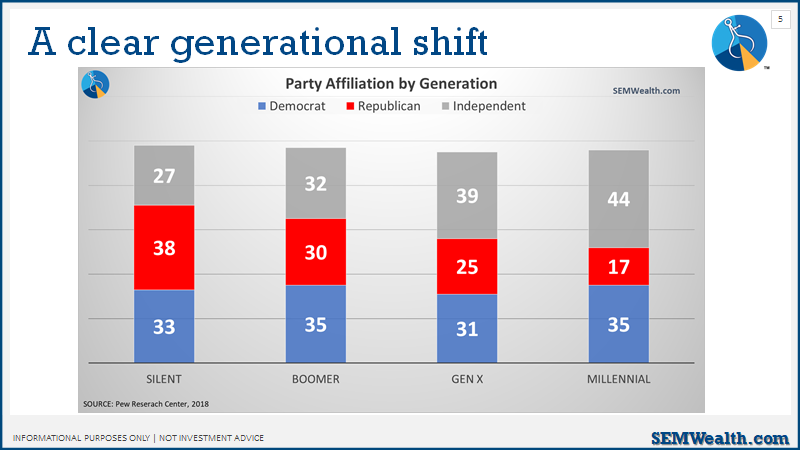

Both parties have lost voters to Independents over the past decade and a half.

Both parties also have an age problem with both Millennials and Gen Xers choosing to remain unaffiliated rather than joining their parents parties. This will lead to a vastly different electoral base in the years to come.

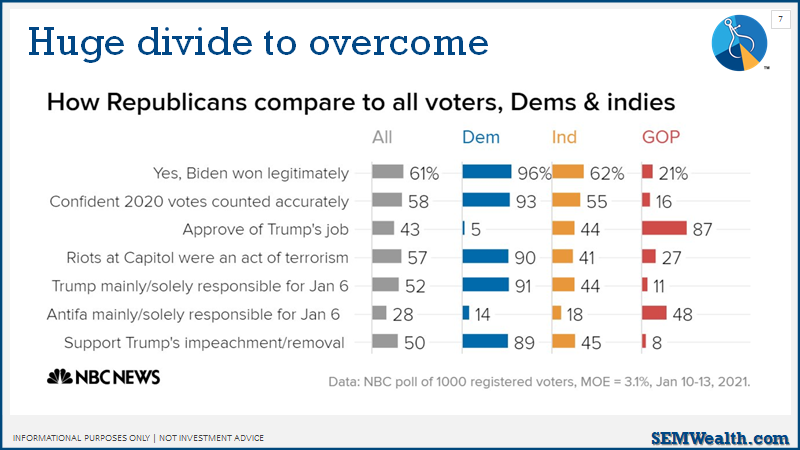

The most disheartening look at the current landscape is shown in this chart. We have a lot of healing to do.

How are they going to pay for it?

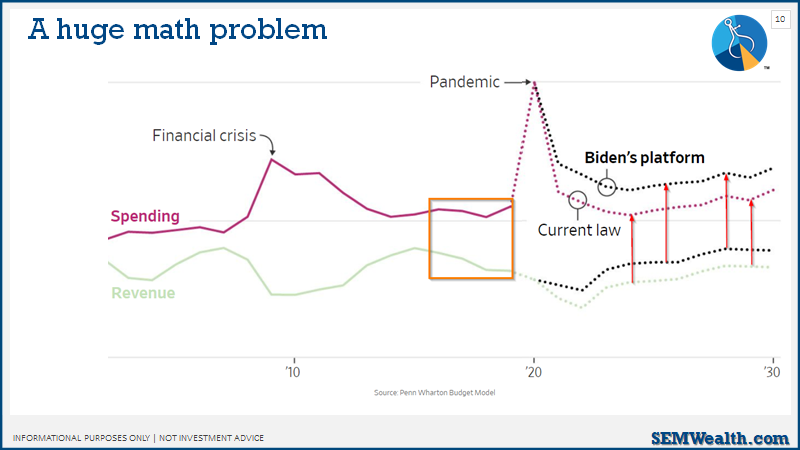

While the market has had a huge party since the election at the prospect of even more stimulus, the question is going to start coming up about how far they can push the deficit (more on that below).

Even before COVID, Donald Trump's budget was going to be pushing the limits. The proposed stimulus bill announced last week by Joe Biden will push those limits even higher.

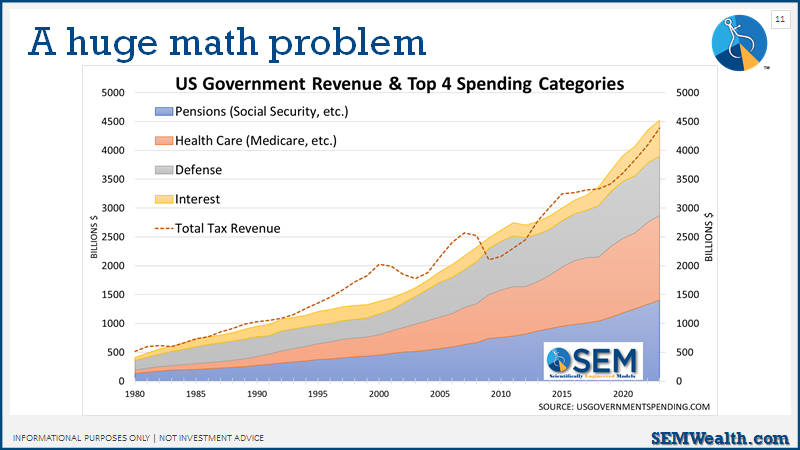

The bigger issue, which I've written about since I started our newsletter back in the late 1990s is the demographical math problem behind Social Security and Medicare (as well as all other pension plans). Promises were made that simply cannot be paid for without significant tax increases and cuts in current services. We could literally cut all other government spending and still be running a deficit.

We do have to do something

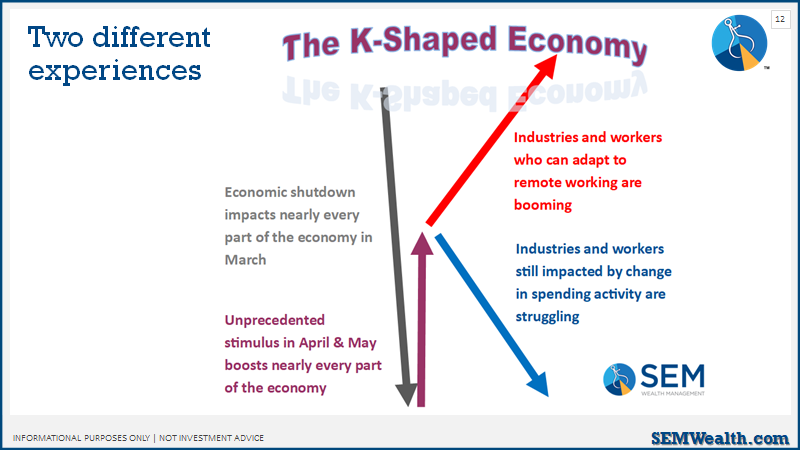

That said, we do have to do something. I've discussed the "K-shaped economy" since the middle of the pandemic. A large group of Americans (including probably everybody reading this blog) have not had their income interrupted and may have even ended 2020 with higher income than they had in 2019. Others have been pushed into a depression. The trick will be helping the bottom half of the K without doing too much damage to the top half and causing unforeseen damage to the economy.

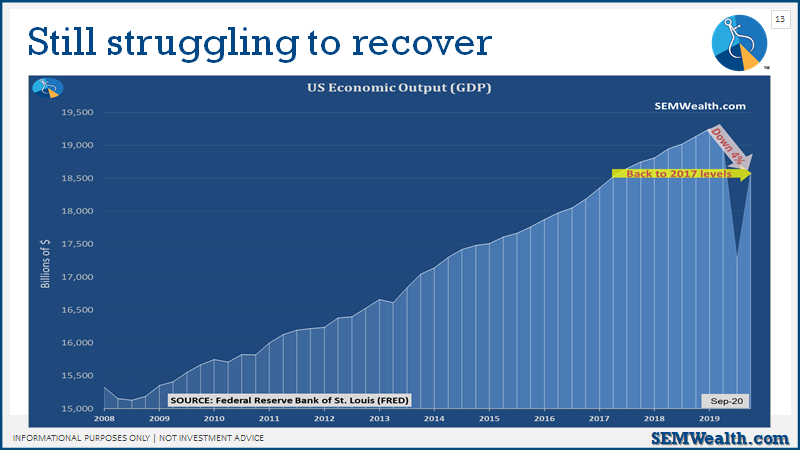

The economy is back to 2017 levels, but the underlying pieces have sustained much more damage.

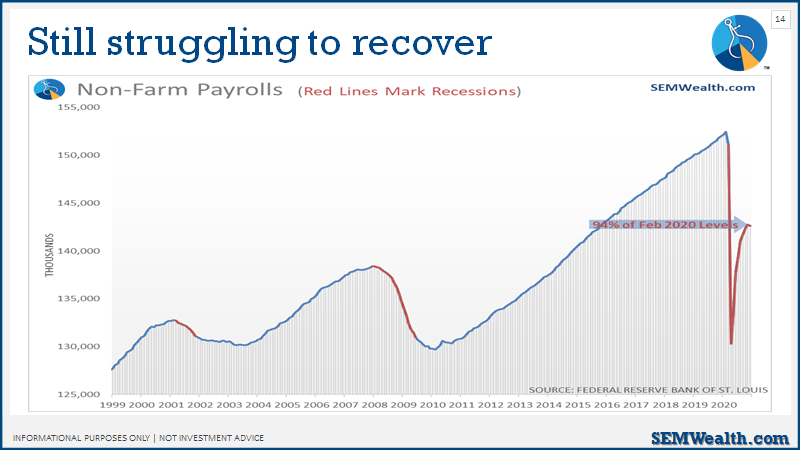

The most damage was done in the labor market. We still have 1.8 unemployed Americans for every job opening. The number of jobs is back to 2015 levels.

A tough environment for income investors

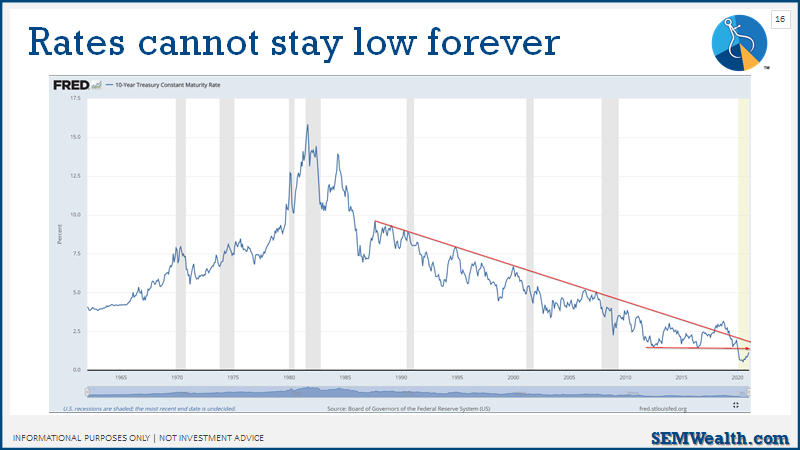

If you thought the last few years were difficult to find income, it could get even tougher in the coming years. Interest rates have been trending lower since the early 1980s. When rates fall, prices rise. With the expectations for an even larger deficit, rates have climbed significantly and are threatening to break the 35 year downtrend line.

The trendline was broken briefly in late 2018/early 2019 again out of fears of runaway deficit spending.

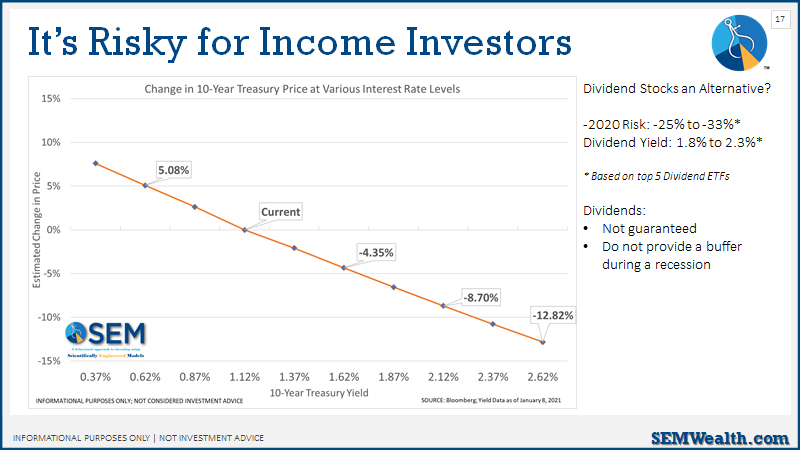

We shouldn't assume rates have to move higher. There are a lot of things that could cause rates to go back to the lows of earlier this year. When rates are this low, prices can move in big chunks – both up and down.

If rates moved back down just 0.5%, 10-year bonds would rise over 5%. A move back to 2.62%, where they were at the beginning of 2019 would cause a nearly 13% drop in prices. This has led to many people using dividend stocks as an alternative. I put some stats up on the chart to understand the risk/reward relationship.

- Dividend stocks lost between 25-33% from high to low in 2020

- Dividend yields are only 1.8 - 2.3%

There are higher yielding dividend stocks, but they come with even greater risks.

You need a plan

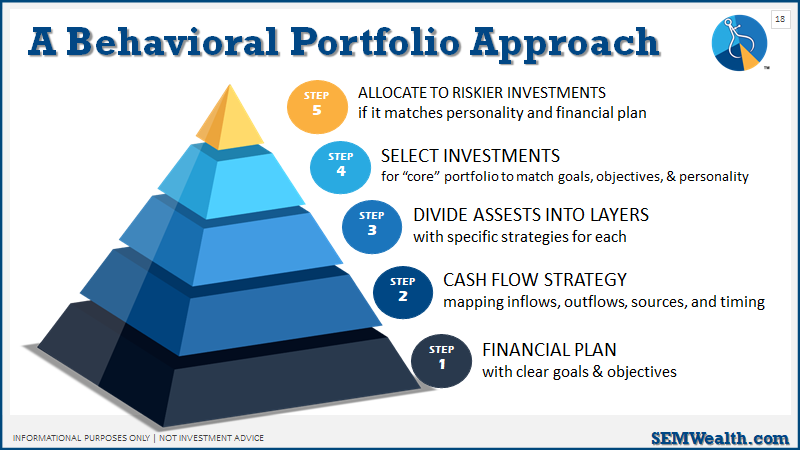

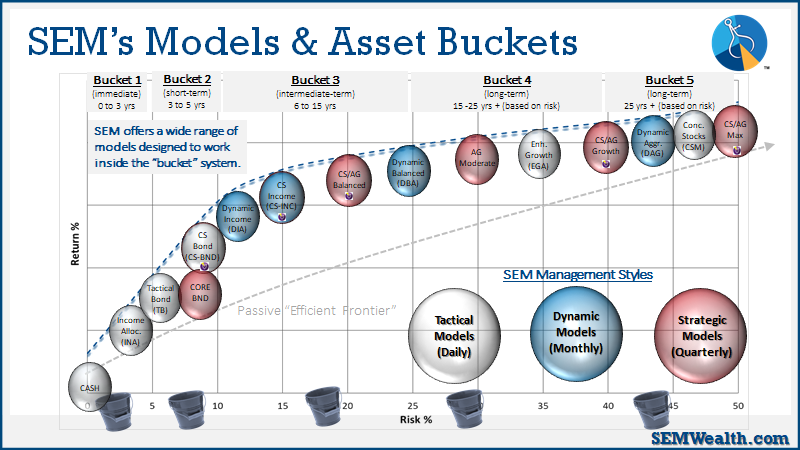

Regardless of your political leanings or your opinion on whether the change in leadership is good or bad, the key to success is a long-term plan to navigate all possible environments. We developed our Behavioral Portfolio Approach to help clients stay on the right track.

The key is to have a solid financial plan and a cash flow strategy. From there, SEM helps advisors and investors customize a diversified portfolio with a wide range of sophisticated strategies designed to adapt to any market environment. Given the uncertainty out there, now is as good a time as any to start on your own Behavioral Portfolio.

I realize emotions are high, but this quote is something that has served SEM, our advisors, and clients well the past 20+ years.

For those of you wanting to make an even bigger change in your practice or your investment portfolio, check out the latest Cornerstone Update: