Each morning this week I’ve scanned the news looking for the “story” to develop in my mind to relay to our advisors and clients. Each morning I’ve come away with nothing. This morning as I again could come up with nothing it finally hit me — maybe that’s the story.

I’m not saying nothing is happening. In fact A LOT is happening that could have MAJOR implications on the market and could possibly start the next phase — either the final blow off top of the bull market or the beginning of a bear market. The problem is there are so many things happening our minds are unable to adapt to all of them to make a sound decision about the future.

One of the critical issues of traditional economic theory and Modern Portfolio Theory is the assumption that our brains can take all current and future events, calculate probabilities of the various outcomes and make a rational, efficient decision. This is difficult to do in a “normal” environment. However we are not in a “normal” environment any more. Here is just a short list of things I think could be important.

-

The Fed is raising interest rates.

-

The Fed is beginning the process of unwinding $3 Trillion worth of bonds

-

Verbal and missile testing banter between US & North Korea

-

Tariffs on Canadian imports

-

Lack of ability to produce a coherent, and passable health care bill

-

Little movement on tax reforms

-

No movement on infrastructure spending

-

Disappointing economic growth

-

Brexit is happening in less than 2 years

-

President Trump suggested breaking up the big banks

A few weeks back I wrote about the most common behavioral biases I see investors (and their advisors) making when it comes to evaluating the markets and their investment portfolios. One of them is “Conservatism” Bias — failing to adapt to NEW information. I typically do not spend much time on this one, but looking at the list above I see far too many people exhibiting this bias right now. Just looking at the list above the entire market environment may shift. However, when the prices in the market do not move lower, or quickly recover, it reinforces the market participants in believing it doesn’t matter.

I have a common saying when somebody asks me why something they thought was important to the market had little impact — it doesn’t matter until it does. Looking at the list above, I’m confident one or more of them will matter in a big way & when it does you don’t want to look like this.

Thursday, May 4

Not much new is happening in the markets. We could add oil prices/production concerns and what it means to US economic growth and high yield bonds to the list above. We are also looking at once again seeing if the Republicans can pass the much promised Affordable Care Act “repeal & replace” bill. Even if they do pass some sort of bill the real question will be how it is implemented and what the economic impact will be.

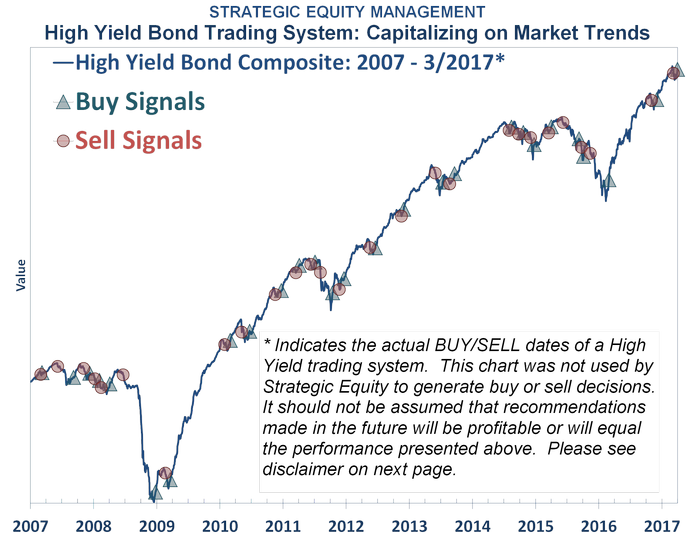

One thing that crossed my mind regarding Conservatism bias after I posted this yesterday is how easy it is to get in a mode where we think nothing can stop the current trend. Whether individual investors, advisors, or investment managers we are all susceptible to Conservatism bias. One area I’ve seen this occur most frequently is with our high yield bond trading system that represents all of our Tactical Bond program and a large chunk of our Income Allocator program.

As the economy chugs along, the need for risk management is less apparent. “Bad” news is ignored so investors, advisors, and too many investment managers begin to ignore the risks developing beneath the surface.

By now our readers should know the best way to overcome most behavioral biases is to use DATA. When clients & advisors look at this chart showing our buy and sell signals in our high yield bond trading system, far too often they focus on all the unnecessary trades. What they are missing out on are the trades that saved our clients (and their advisors) from significant losses. The beauty of our style of management that only uses DATA is the DATA will tell us when to adapt to new information, not our flawed brains.