Last week was a good reminder that while things were looking brighter for us economically, we still weren’t fully out of this mess. Perhaps the biggest sign of our complacency has led us to the CDC reversing course on mask mandates, once again recommending masks for people indoors regardless of vaccination status. This coming at a time where, over here in Arizona, K-12 schools were ready to start their first normal school year in 2 years, back in person and almost fully back to how things were in 2019.

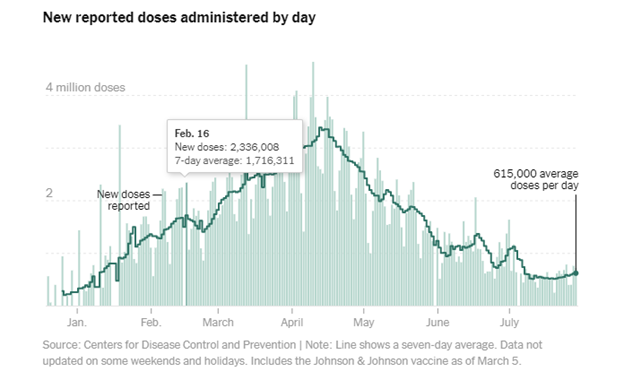

The anecdotal sentiments from those who are vaccinated (since those are the people who are really affected by this, because most places have only stopped the mask mandates for those who are vaccinated) has been a reluctance to start moving backwards again. The CDC’s reversion has some questioning if this is logic or science-based, since the much bigger threat of spreading the more contagious Delta Variant and getting hospitalized or dying from it aren’t those who are vaccinated, who again are the ones being affected by this. Of course, we are smart enough to know that when we are walking around a grocery store and see almost 100% of faces and are currently looking at just under 50% of the US being fully vaccinated, a large chunk of those who aren’t vaccinated aren’t following the mandate. So here we are, with another large-scale mask mandate, combating a rise in cases that is not being offset by a rise in new vaccinations. Are things going to get worse? Are we going to see another shutdown?

The good news on that front appears to be that thanks to the vaccine, those who are vaccinated, while they can catch COVID (this was never in question) are heavily protected from serious symptoms. After all, the reason for the original shutdown was to slow the spread to not overwhelm hospitals. So having about half of Americans virtually fully protected from serious illness that would require hospitalization, means that we should avoid any serious economic setbacks from this, barring severe administrative oversight. I do not see and have not seen the Biden Administration wanting to go down that path.

The economy marching toward reopening brought plenty of great news for quarterly earnings of tech giants, with Google, Microsoft, and Apple all exceeding their earnings targets. At the same time, Apple had warned of a future sales slowdown and despite EXCEEDING QUARTERLY EARNINGS EXPECTATIONS had Apple see a downturn in its share price – which perfectly explains how dangerous things are from the mountaintop. It shouldn’t really come as a surprise to us when Apple said that these record gains will eventually stop breaking records. We can’t just see this level of growth for THIS LONG and simply expect that things will always be this way. We are very good at projecting the future by looking at the past and as we know, that is not how the market works. We don’t know the future, but if Apple’s warning should make us feel anything, it’s that we should probably enjoy the crazy level of gains we have seen and to not get too greedy. As an investor, what level of return do you need from your investments? Are you at a point in your investment cycle where large losses will dampen your future financial outlook? Now would be the time to evaluate this while we are at the top of the mountain and before we start slipping down.

When will things start to slip? Surely the Fed would give us some insight to this. Unfortunately, their meeting appears to show it’s currently business as usual. No changes to the current borrowing rate, no changes to asset purchases and no changes to try to curb the near 6% inflation we have seen the past couple months, and no real insight to what some of those future decisions might look like. We will have updated data that we use for our Dynamic model signals next week, so that will be useful in seeing how those numbers changed over the course of this crazy month.

My personal favorite news of the last week: Robinhood went public. That’s right, the Robinhood that started out as a way to bring stock trading to the everyman is now on the NYSE.

I was one of the first million users to Robinhood. I had good intentions, I was just a college kid who wanted to start investing in stocks and couldn’t afford paying for each trade, and Robinhood was the right choice for me. Unfortunately, along the way Robinhood looked for more ways to attract more “investors” and offered free options trading to ANYONE with a Robinhood account. Seriously. All you had to do was click a button. I thought options trading sounded cool. I tried it, it was a horrible week. My friends heard about these guys on Reddit who got rich overnight thanks to these options trades. They tried it, they hated it. Options trading isn’t for everyone – Robinhood probably knows this now. The past year was a scrutinous one for Robinhood, but that didn’t stop them from taking all that press and turning it into their own ticker, and it was just a fun reminder for me about how things can start and with the right kind of mania where things can end up. But, this isn’t just the case for companies, it happens to people as well. This week is a good reminder that self-reflection is key for us. Where did we start? Where are we now? How did we get here? Let’s use that self-reflection, and let’s make it a great week!

Jeff's Random Musing

One of our Platinum Advisors sent me a recording from his B/D’s national conference last week. It was from my favorite all-time Fed official Richard Fisher. Unfortunately he “retired” from the board, but he is still plugged into the happenings at the Fed. In discussing the corner the Fed has painted themselves in, Mr. Fisher mentioned Inflation Expectations as the bigger problem than actual inflation. If consumers and businesses BELIEVE inflation is going to move significantly higher they will stock-up on things. This causes a short-term economic boost, followed by a bigger slowdown, especially if inflation begins to eat into economic growth.

I grabbed the attached chart from the Fed showing current inflation expectations. June’s number just came out and it is slightly higher than May’s number. One thing that jumped out at me was the spikes in 2001, 2008, & 2006. All preceded a sharp economic slowdown.

Mr. Fisher also lined out the 4 things that his him most concerned about the future:

- Excess Aggregate Demand (too much money floating around in the system and not enough supply)

- Demography (America is aging too quickly and older people are less productive and a drag on growth)

- Power of Labor (costs will be going higher, the question is how much)

- Heavy push to ESG, especially the “E” (Environment), which is going to be expensive.

All of the above would lead to lower stock prices as both earnings will be hit and the multiple of those earnings being reduced (because people will not want to pay for slower growth). These are long-term concerns that can be solved, but I stand by my (subjective) opinion that the 2020s will be a time where making money in passive investments will be difficult. There will be times to be aggressive and times to be defensive as we work through this. Mr. Fisher ended his speech in a similar way that I try to end all of mine – by declaring America the greatest country in the world and voicing confidence in the American people to get things right eventually.

During the Q&A Mr. Fisher added a 5th concern – Jay Powell not being re-appointed next February. Lael Brainard, another Fed Governor has made it clear she wants Powell’s job and has done, “everything possible to undermine the Fed chair.” Her husband is part of President Biden’s administration. Mr. Fisher called them the “most ambitious couple in Washington. And that’s saying a lot.” His fear is with her in charge of the Fed we will see unchecked spending which will be a dangerous and unprecedented position. Mr. Fisher suspects Powell is purposely being slow with any talk of tapering or rate increases, hoping to stay in the good graces of the president enough to be re-appointed. It is close to impossible to fire a Fed Chair, but easy to simply not re-appoint one.