While most of the country has been back in school for a few weeks, here in Virginia it's the first day of school. While we've had much more time to prepare than the disaster we had during the final quarter last year where I'm pretty sure few kids learned anything significant, we are bracing ourselves for a frustrating semester. I'm not blaming the teachers or the school administrators. We are all doing our best to cope with something none of us were prepared for.

The stock market appears to be making some adjustments on its own. It's too early to know if this is just another temporary bump or the start of some rationality when it comes to paying ridiculous prices for some of the high-flying stocks. With this being a short week, I'll keep this week's Musings short.

Still Ugly

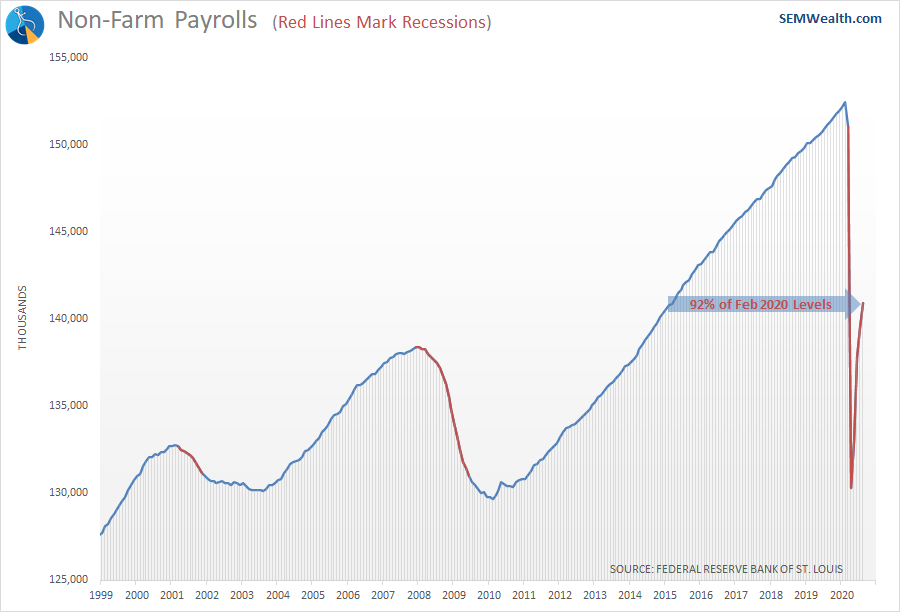

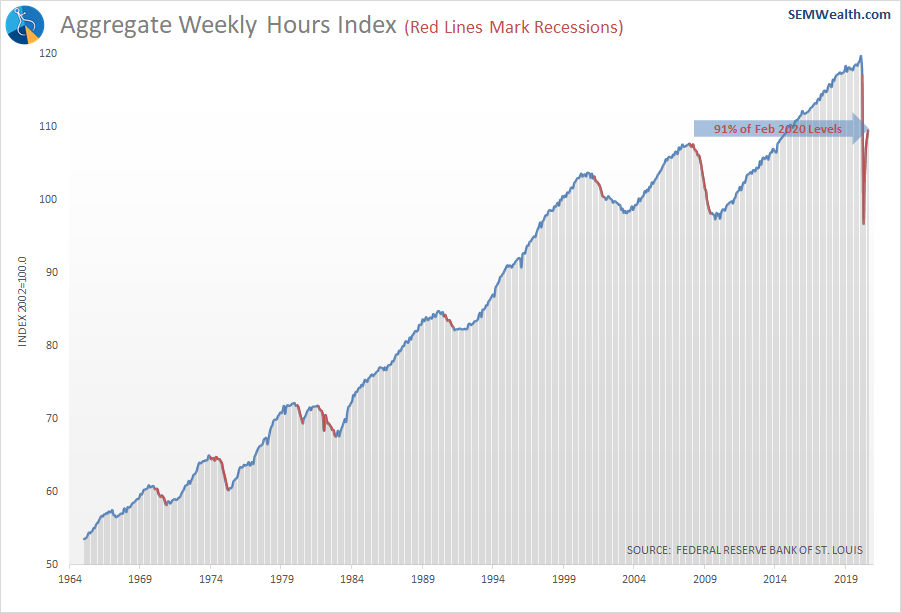

No matter how the White House wants to spin it, the Labor market is not a positive for the economy. It doesn't mean it won't recover, but the August data was nothing to write home about (or Tweet). Remember, a "job" counts even if it is 5-10 hours a week (when you wanted to work 40).

I'm most concerned with a '95% economy' – one where we are running at 95% of where we were at in February. The stock market is pricing in a 105% recovery (based on earnings estimates).

Hours worked is a key indicator to watch.

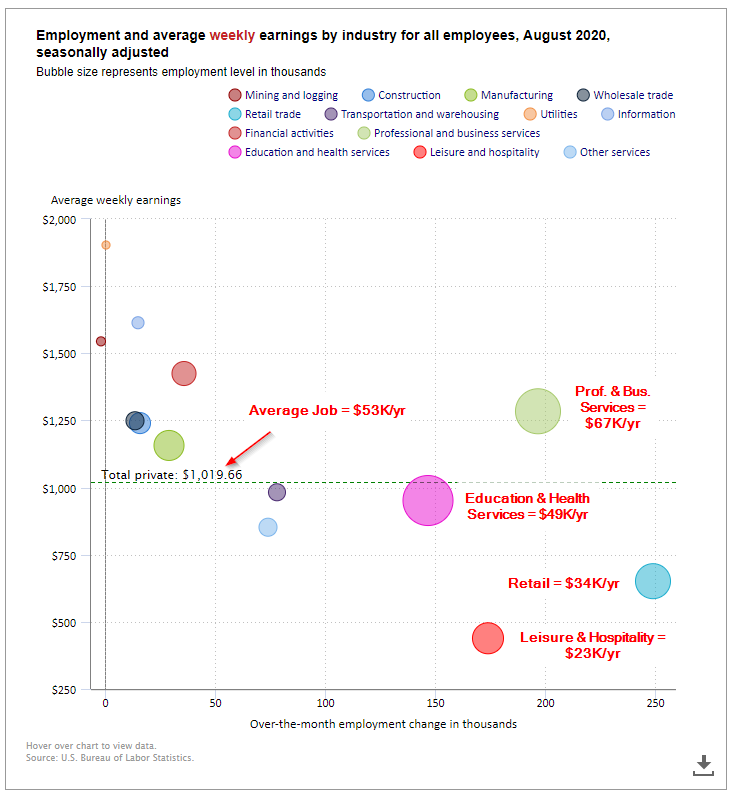

Quality of Jobs Matters

Like July, the low paying Retail and Leisure/Hospitality sector captured the majority of the job gains. Education/Health Services which has a pay rate just below the national average again saw a steady increase. (2/3 of the jobs were in health services). The biggest bright spot (on the surface) was the increase in Professional & Business Services jobs given their higher weekly earnings. Digging a bit deeper, 64% of the "new" jobs in this sector were in "employment services" (meaning temp agencies). In other words, businesses were not confident enough yet to add permanent jobs, so instead utilized temp services to fill their roles.

This chart illustrates where the gains were. I added the annualized rate of pay for the top 4 industries for comparison.

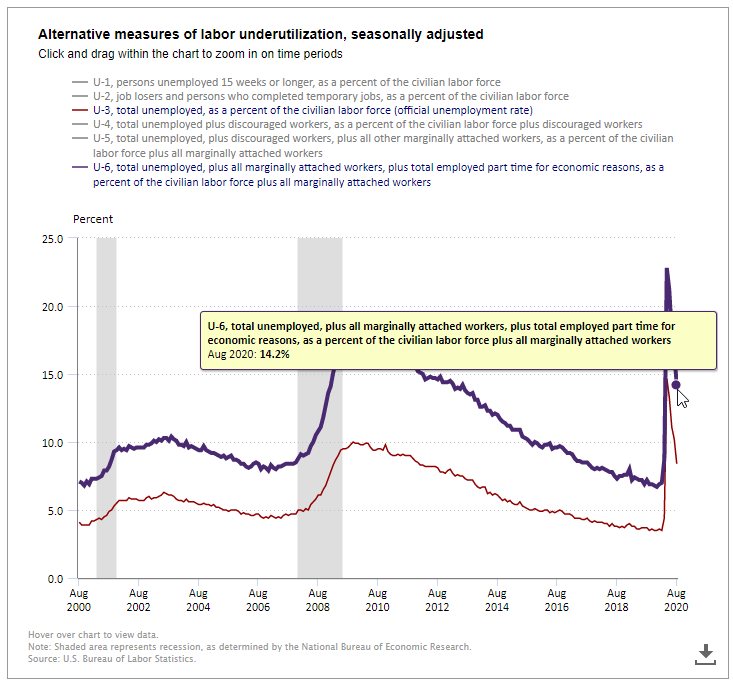

Underemployed a Key Metric

The White House was celebrating a sub-9% unemployment rate. Again, if you worked a few hours and wanted to work 40, you're no longer 'unemployed'. The real measure to watch is the 'U-6' number, which still shows 14% of the labor force is not working as much as they would like.

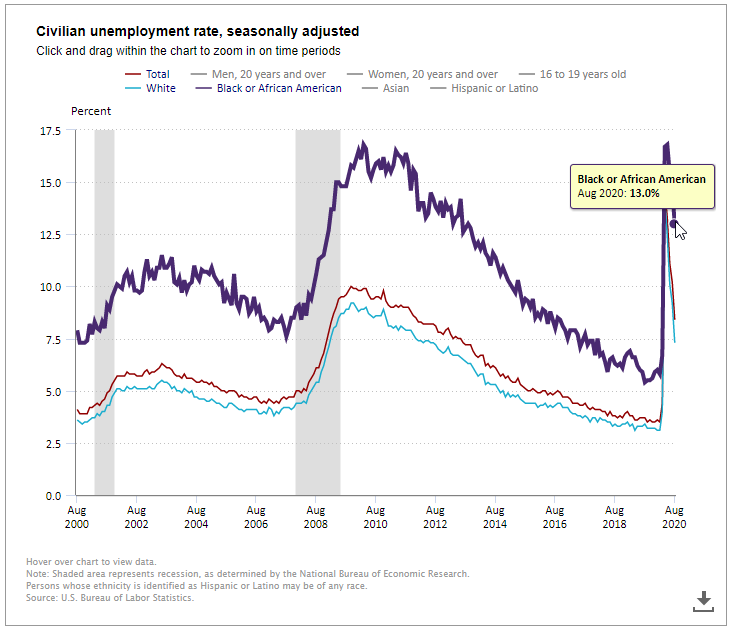

The Racial Divide

While the unemployment rate for Black Americans did hit a historic low going into the year, they have been hit especially hard during the pandemic. The White unemployment rate is down to 7.3% (where the Black unemployment was in October 2017), while the Black unemployment rate is still at 13%.

At SEM we are committed to finding ways to bridge the racial divide. A more balanced economy is a healthier economy. If you'd like to learn more about our efforts, check out our Diversity page.

Overall a Net Negative

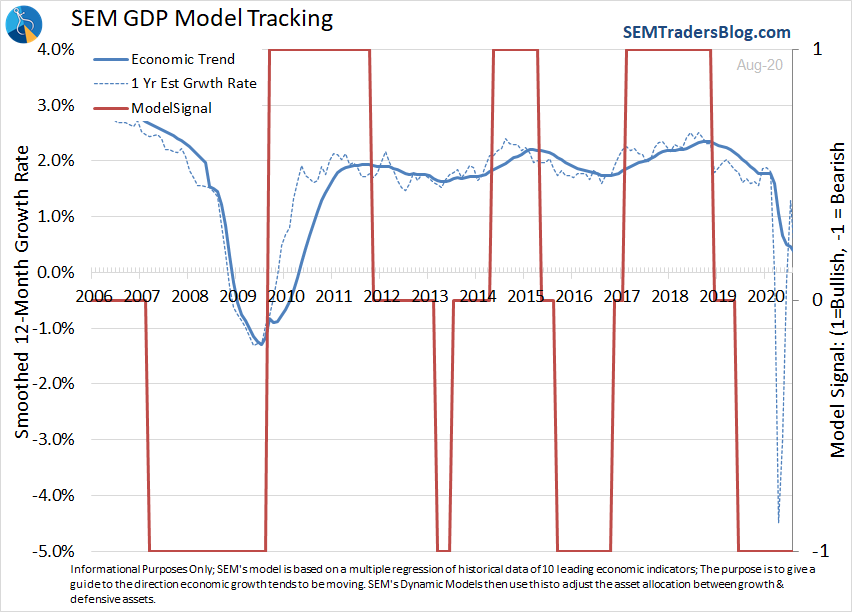

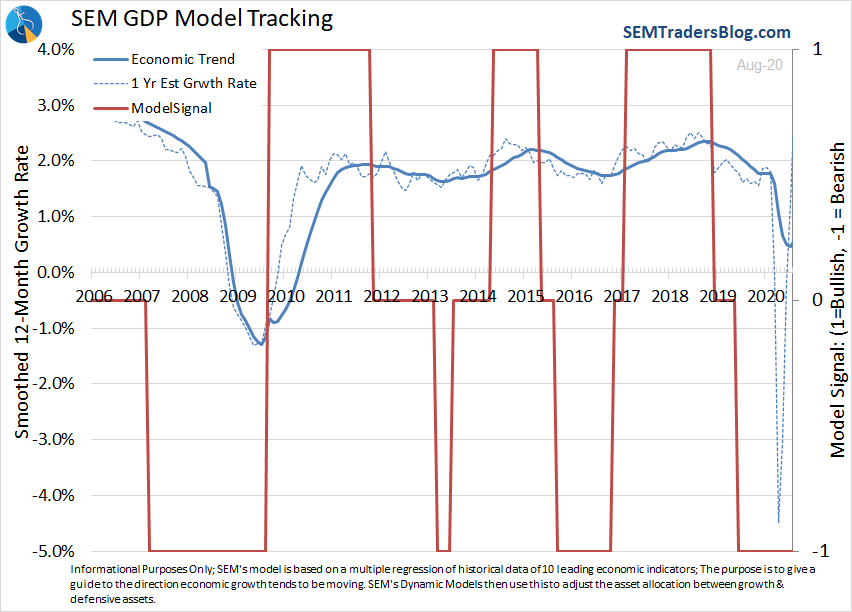

While our economic model only adjusts our allocations at the beginning of the month, I do monitor it throughout the month. Before the payrolls report, there was the slightest uptick in our model, indicating by the end of the month we could finally get off the "bearish" signal we've been on since early 2019 (well before the pandemic). The weaker jobs growth actually reversed the model a bit lower again (the solid blue line).

For more on our economic model, check out last week's post:

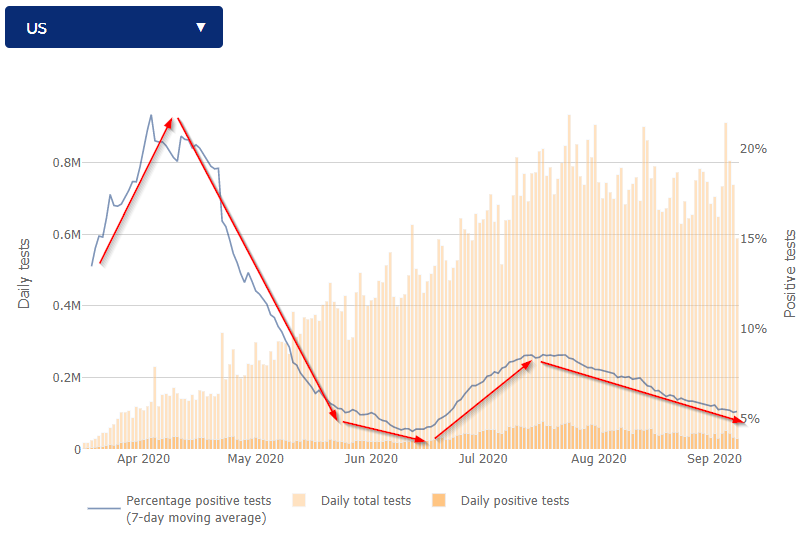

Will We See a Spike?

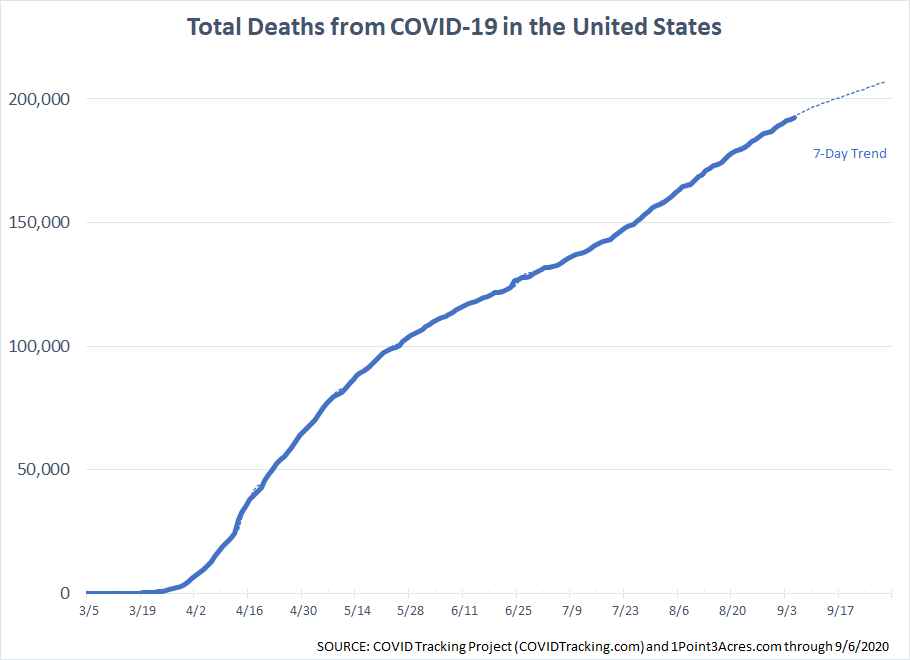

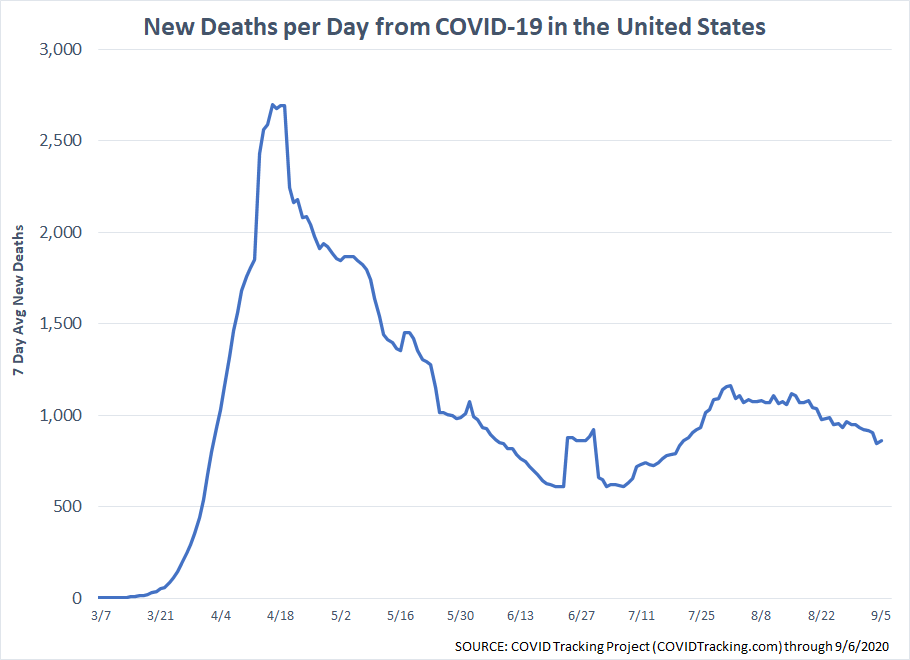

There were some dire warnings from some health officials going into the Labor Day weekend about a spike in cases. We won't know until about a week to 10 days from now if they were correct. For now, the trends remain positive in the US as a whole.

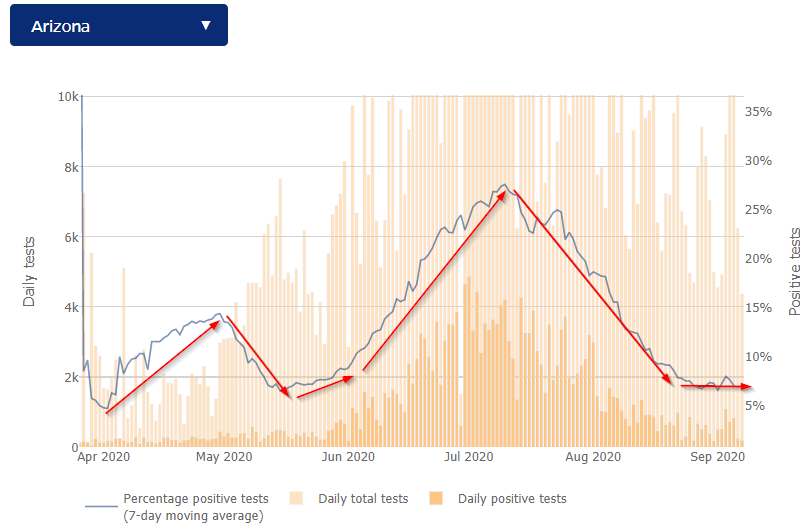

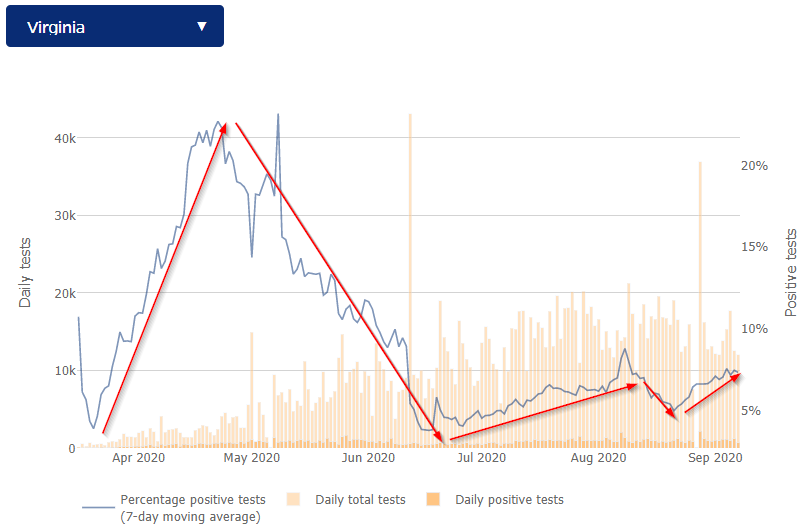

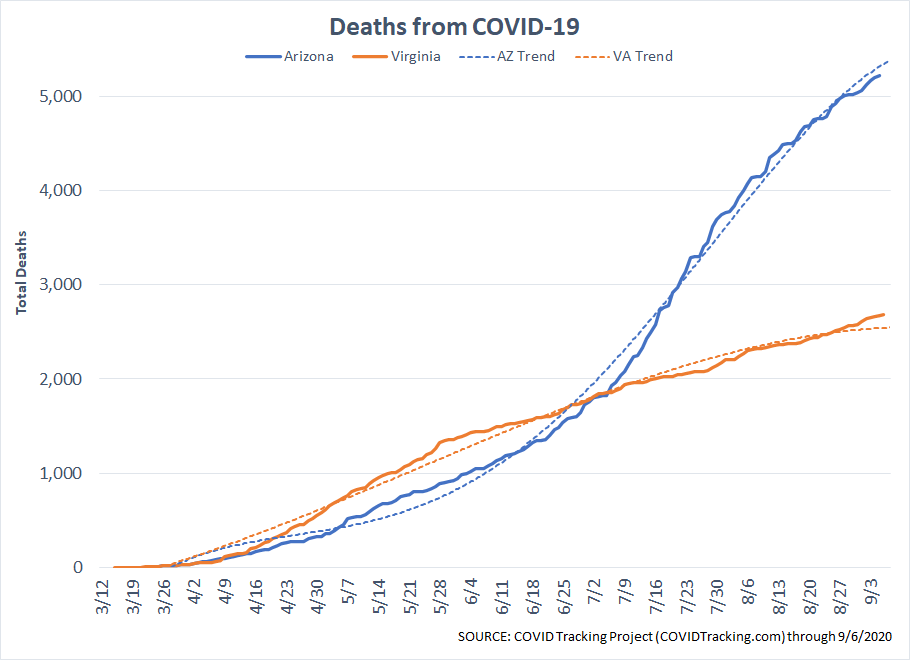

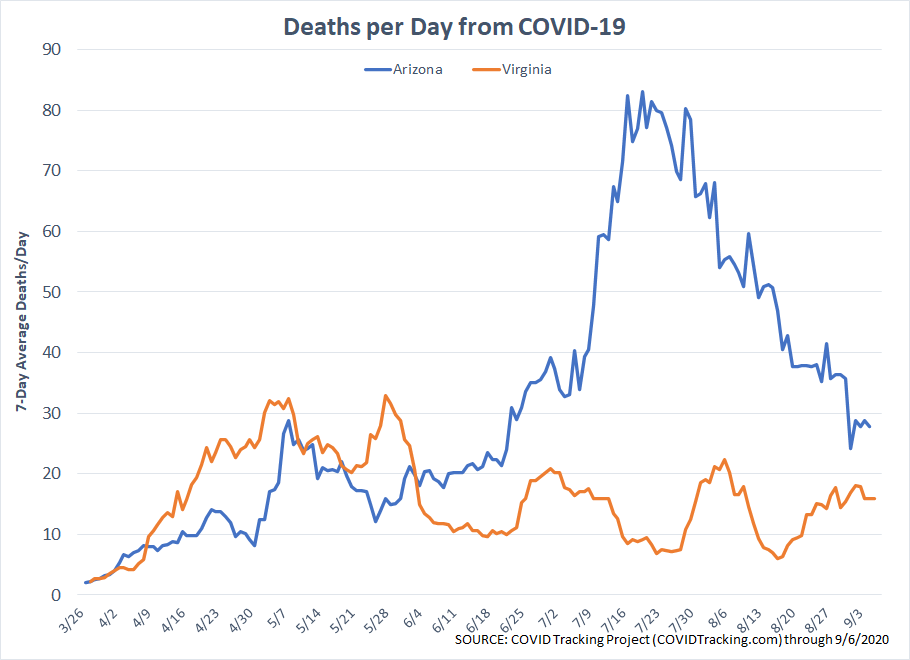

Continuing with our on-going experiment tracking between Arizona and Virginia, we see the impact of mask mandates and common-sense adjustments to social distancing measures. Arizona opened before medical experts recommended and then had to make adjustments. Virginia followed guidelines, but continues to suffer with spikes in the Virginia Beach region, despite restricting some in-person dining several weeks ago. Arizona and Virginia now have the same % positive tests (7%).

Keep in mind when looking at these charts, Virginia has about 2 million more people than Arizona.

Happy First Day of School

I'm going to try and not complain. Compared to most parents we have it easy. Four of our six kids are adults and our twins are entering 8th grade. Not quite completely self-sufficient (especially the one who like his father can get distracted when he finds something interesting on the internet and starts researching it.) We also own our own business and have plenty of space to set-up a very nice home school classroom at the empty operations' desks.

I absolutely could not imagine what this would have been like if our kids were in elementary school, we were trying to work from home, or worse, had a job where we could not work from home. We also happen to have Courtney working from our Virginia office currently who briefly wanted to be a teacher and had almost all A's pretty much from elementary school through college. I'll try to not complain, but this is going to be a major issue for our economy if we cannot get kids back in school soon.

How many of you parents out there feel like this?

Feeling Down

I found myself overwhelmingly sad as we went into the Labor Day weekend (sorry, I couldn't think of a more descriptive word). I'm sad for our twins' lost summer. I'm sad for the kids having to miss the interaction with their teachers and classmates. I'm sad for the teachers having to figure all of this out. I'm sad for the parents trying to juggle work and school schedules. I'm sad for all the people who don't even have jobs right now because of the pandemic. I'm sad for the business owners who have lost their businesses or had to make the decision to cut jobs. I'm sad for the increasing divide over racism between the political parties

Mostly, though, I'm sad for our entire country and our inability to come together, kick this thing to the curb and fix the mess. I know we'll get through this and I know it won't be easy.

From an investing standpoint, this is an extreme example of what I've always said about the advantage SEM's management style has over nearly every other investment firm out there – it doesn't matter how I feel (or anybody else on our portfolio management team). The systems are the systems and they are without emotion. They will adapt to whatever the market throws at them with a heavy focus on risk management.