In today's "always on" society, we've become accustomed to quick actions. We want quick resolutions to problems and believe if something goes on for too long it will "always" be like this. Sometimes it is important to take a step back, study history, unbiased data, and unplug from the constant noise.

We are seeing many investors become impatient with investment account losses. The question of when the losses will be made up were on many of our attendees' minds during our latest SEM University last week. In case you missed it, here is the link to the replay. We broke it into two parts – the 15 minute "outlook" and then the Q&A. We addressed the question of losses and how long it will take to recover in the Q&A.

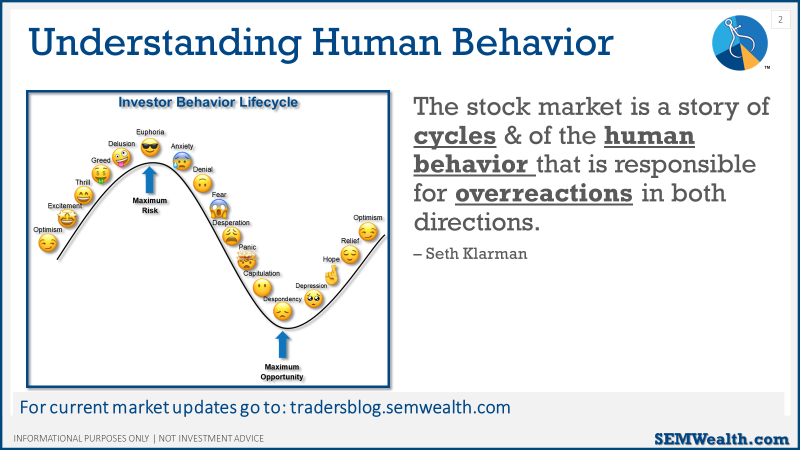

The most critical thing to understand is the CYCLE of the markets. I often say "a bear market (or market bottom) is a process, not an event." What I mean by that is we will see a bear market (or market bottom) go through some critical phases before it is over. Right now we are in the midst of another relief rally that may be getting ready to roll over once again.

Essentially, the market goes through these mini-cycles throughout the bear market process.

The quote on the chart is key – human behavior causes an over reaction in BOTH directions. This leads to big rallies that become unreasonable, followed by the removal of those excesses which often become unreasonable.

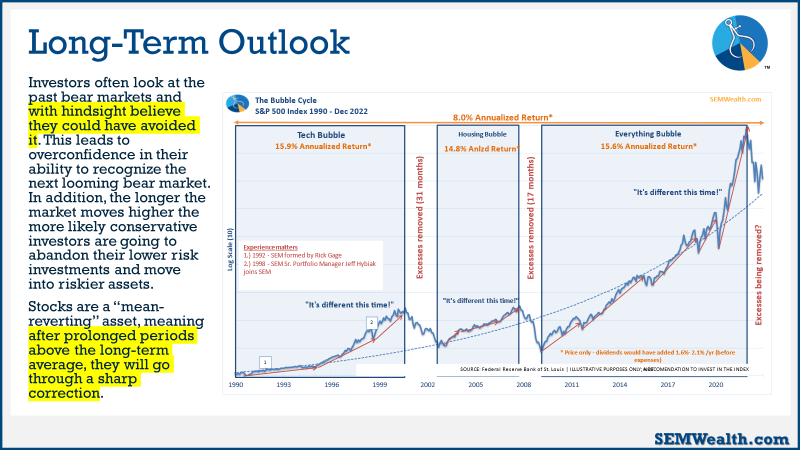

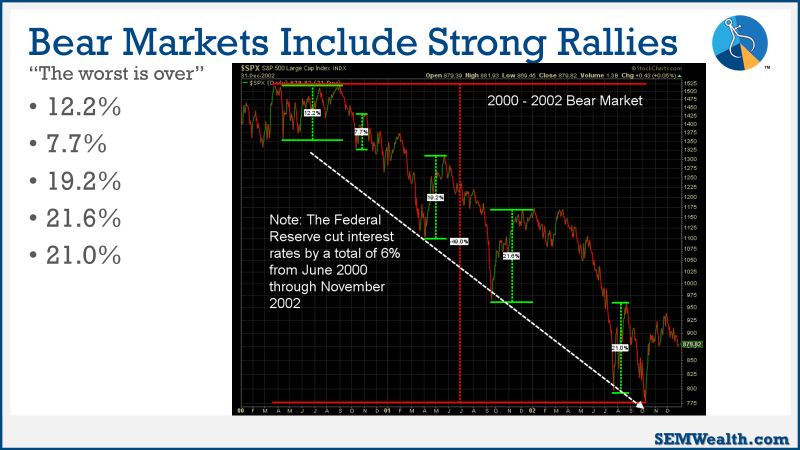

The emotional cycle leads to many episodes of "the worst is over" or "I'm going to miss the bottom" buying frenzies. During our webinar I again showed the slide of the previous bear markets, with a focus on all of the "worst is over" rallies. As I've mentioned many times, I believe this bear market has many fundamental similarities to the 2000-2002 bear market, not the 2008-09 financial crisis. I don't see any data that indicates a huge financial collapse, but rather a rolling recession caused by way too much money being given to way too many people who didn't need it.

This chart shows the false hope created by some of those rallies. Technical indicators such as breaking downtrend lines or "holding the lows". The process of a bear market is designed to remove all of the excesses created during the past bull market cycle. Companies who shouldn't have received funding need to go out of business (see AMC, Bed Bath & Beyond, Gamestop, Carvana, et. al). The longer they are propped up by these false hope rallies, the longer the process of the bear market will last.

Right now the market is being propped up by the (false) hope corporate earnings will not be hit as our economy avoids a recession. The belief is inflation is now under control, which will allow the Fed to not only stop hiking interest rates, but also reduce them to provide some additional help to the economy/earnings. I've not seen anything in the Fed's public statements indicating this will happen. The data last week confirmed the inflation fight still has a long way to go.

The bond market is giving the complete opposite signal than the stock market. The rally in bonds to start the year has nearly been wiped out as interest rates approach the 3.9% level we ended 2022 with. We've also seen emerging market bonds and high yield (junk bonds) begin to sell off, a sign that the bond market is much more concerned about inflation than the stock market.

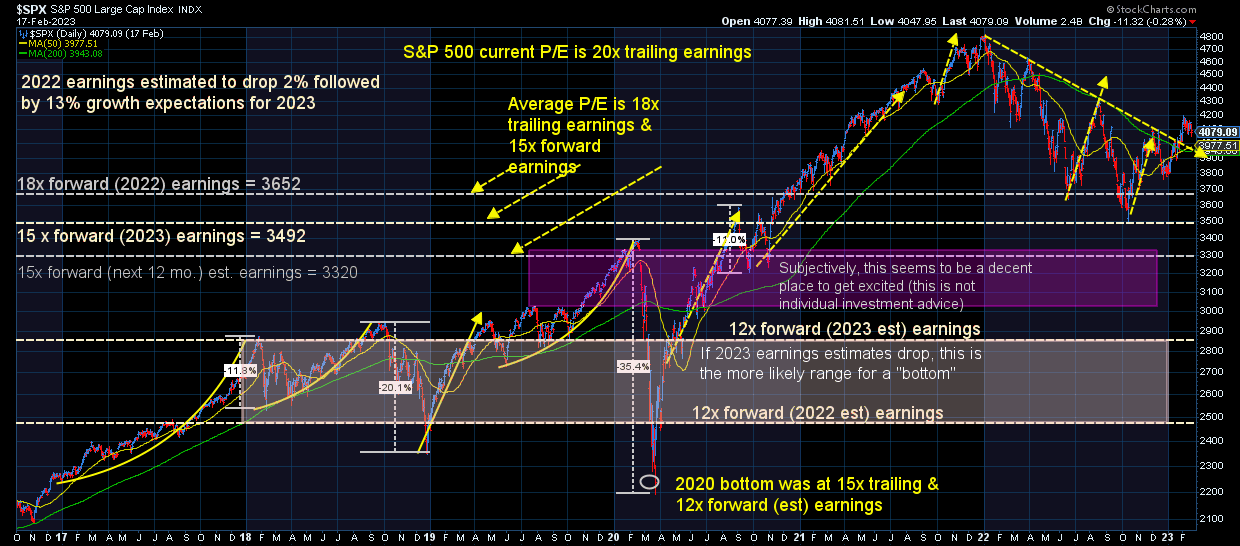

The stock market has been falling since the euphoric rally following the Fed's last meeting/press conference. As I said that day, my interpretation was Powell is far more concerned about inflation than causing a slowdown in the economy. From a technical perspective, the bear market rally remains in tact so long as the S&P 500 can hold above the 4000 mark.

Of course a study of the 2000-2002 chart shows many false breakouts/rallies. There is an old Wall Street adage that says "don't fight the Fed". The Fed has said they are going to push inflation down to 2%, which means you will be fighting the Fed if you are chasing stocks at these levels.

During our webinar I mentioned those I'm most concerned about – those retiring in the next 10 years who will need to live off their money and/or those who need their investment accounts for another purpose within the next 10 years. You need to understand the role of your investments and how dangerous it is to buy stocks when valuations are high.

I subjectively will not be excited about stocks until valuations get down to the 3300 level (19% lower from today's values). This is based simply on the average "bottom" of a recessionary bear market. When you buy stocks at a P/E of 20+ it is highly likely you will have below average (or even negative) returns over the next 10 years. If you wait until stocks are down to a P/E of 15 or lower, it is highly likely you will have returns well above average over the next 10 years (typically 15% or higher – ANNUALIZED). Patience is a key.

Keep in mind, the PROCESS of a bear market could take it even lower than my 3300 subjective target. We could easily see it drop to 3000 (27% lower) or even down to 2700 (34% lower). For long-term investors, this is just an inconvenience. For those with different time horizons, objectives, or risk personalities, it could completely derail your financial plan.

If you don't have a plan or know where your investments fit in your plan, you can start the process with our free risk questionnaire.