Our human brains are designed to recall the most recent data faster (as well as deep, meaningful experiences that spiked our emotions up or down). This shapes the way we make decisions, meaning unless we purposely push ourselves to think past the short-term, most of our decisions are slanted based on the current environment.

This plays a role in all aspects of our life, but especially when it comes to investing. Last week we asked whether the current AI mania was a bubble or an opportunity. We looked at how just a handful of companies are driving the returns of the popular S&P 500 index funds. We also took a look at how the top holding stocks in the S&P 500 at the beginning of 2000 fared over the next 15 years (spoiler alert: not great!).

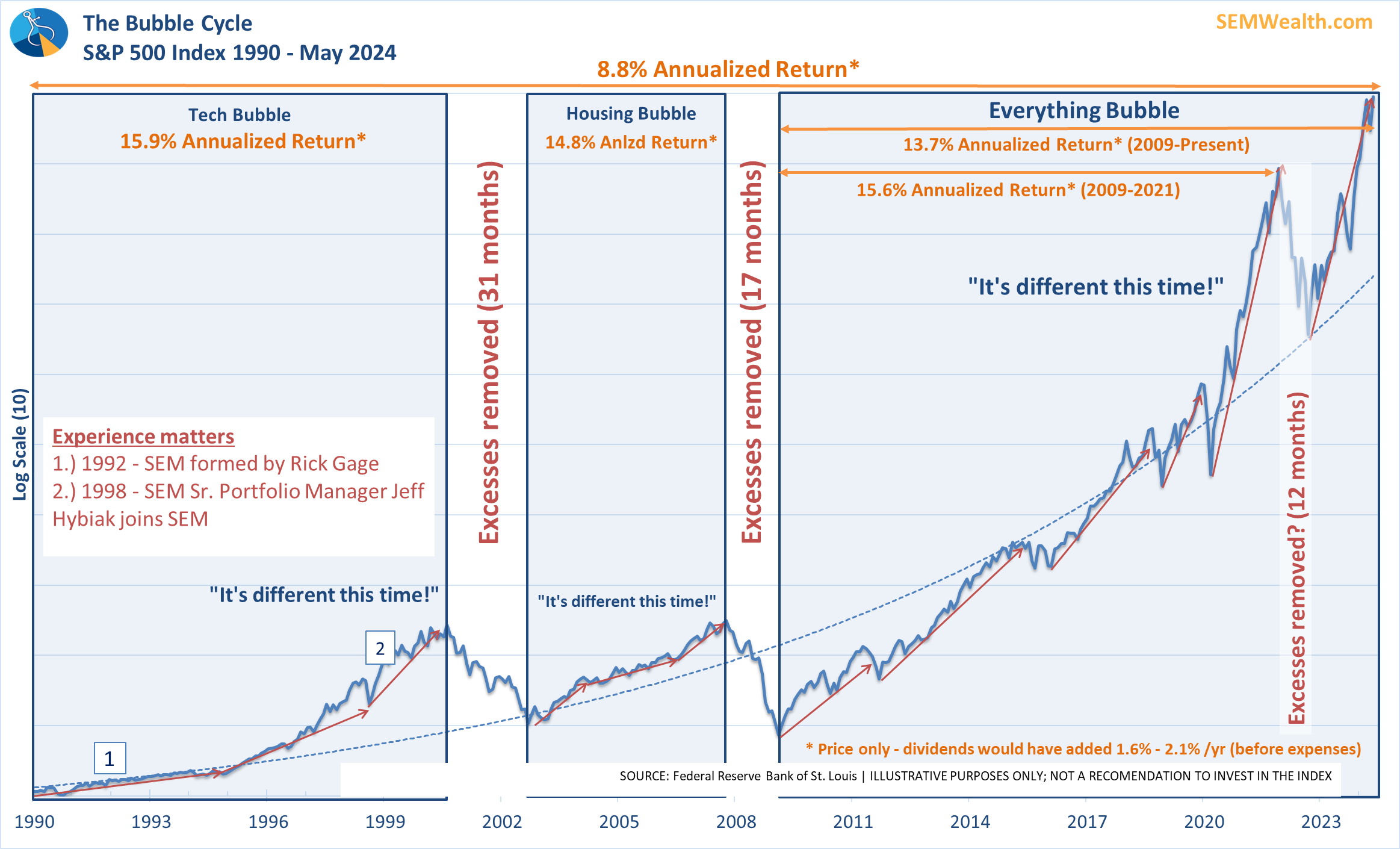

One thing I forgot to include was my favorite chart which highlights the cycles we've seen since 1990. The long-term return for stocks is around 9-10% going all the way back to the 1900s. Remember how averages work – the more time you spend well above average means the more time you need to spend below average.

My favorite stock market quote is from Seth Klarman:

The stock market is a story of cycles & of the human behavior that is responsible for overreactions in both directions.

Our brains cause us all to become overly optimistic the longer the uptrend continues only to turn overly pessimistic when the trend reverses. This short-term focus can hurt our long-term results.

It's not just the investment markets where we see this impact, but also in decisions made by regulators, the Federal Reserve, Congress, and businesses. I've lamented for 20 years about the constant focus from all of these parties to avoid pain at all costs. They short-term solutions end up hurting us long-term. This week we will be hosting a webinar where among other things we will discuss the long-term implications of our short-term focus – including our ballooning debt issues (click here for the details).

We've also been sharing all month clips from a recent presentation I gave to the Financial Planning Association. Last week we shared the portion where I discussed the investment indicators we follow.

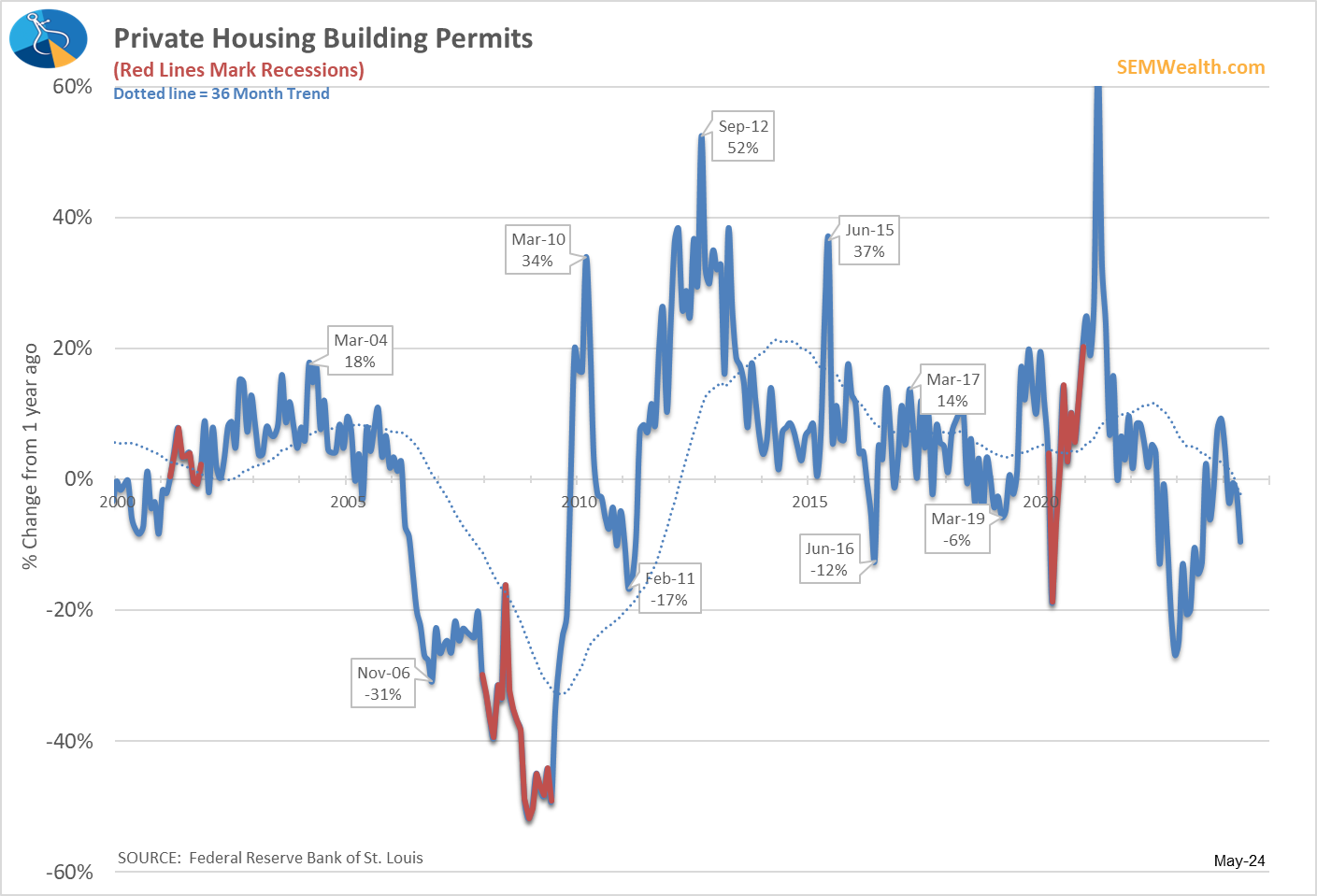

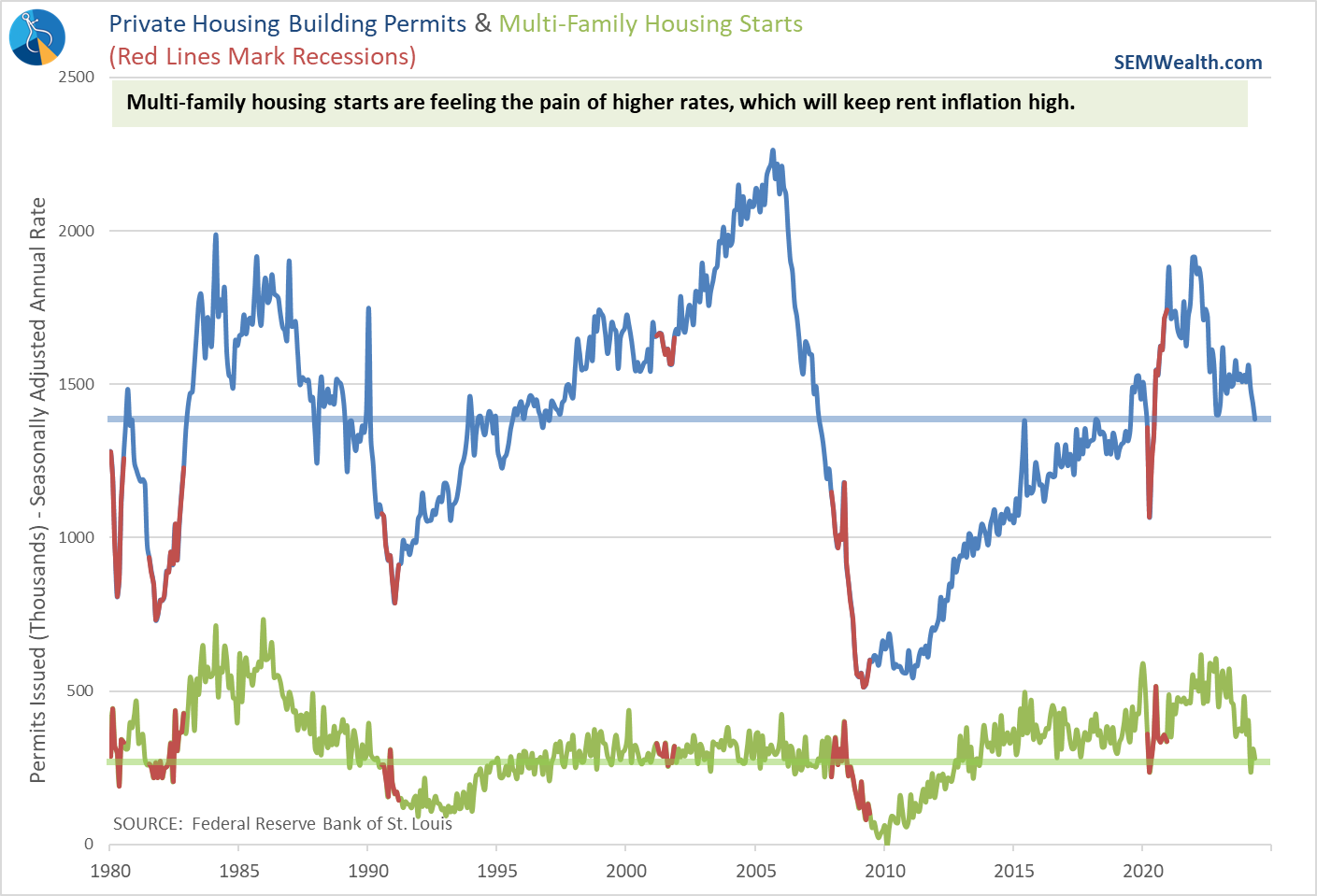

Last week we saw some disappointing building permit numbers. Long-time readers know this is one of my favorite indicators because it both indicates enthusiasm for the future economic environment and generates a snowball of economic activity both as the house is built and when they are completed. The market greeted these bad numbers as good news as the thought process is it will allow the Fed to cut interest rates soon. Experience and history tells me to be careful what you wish for. The Fed has a TERRIBLE track record of preventing recessions and a great track record of overinflating bubbles only to burst them.

Our economy is also facing a major housing imbalance. We have too many homes designed for retiring Babyboomers and not enough homes for young families. We do not have enough rental or multi-family units, which makes rent payments exorbitantly high. The problem isn't solely that interest rates are too high, it's that houses cost too much for younger families to live in.

As somebody with college-educated, dual income children in their late 20s and early 30s we see this firsthand. Something has to give to rebalance the housing market. Short-term solutions have made the problem worse and short-term ideas will not solve the problem.

With the webinar coming on Wednesday and the slate of economic data light last week, I think I'll end the discussion here.

Market Charts

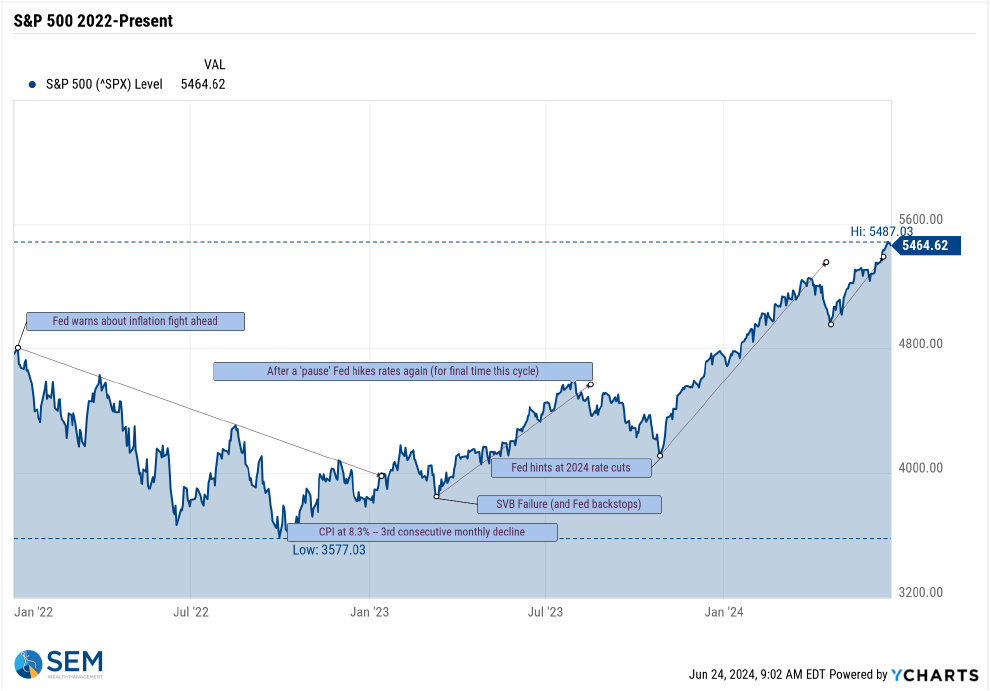

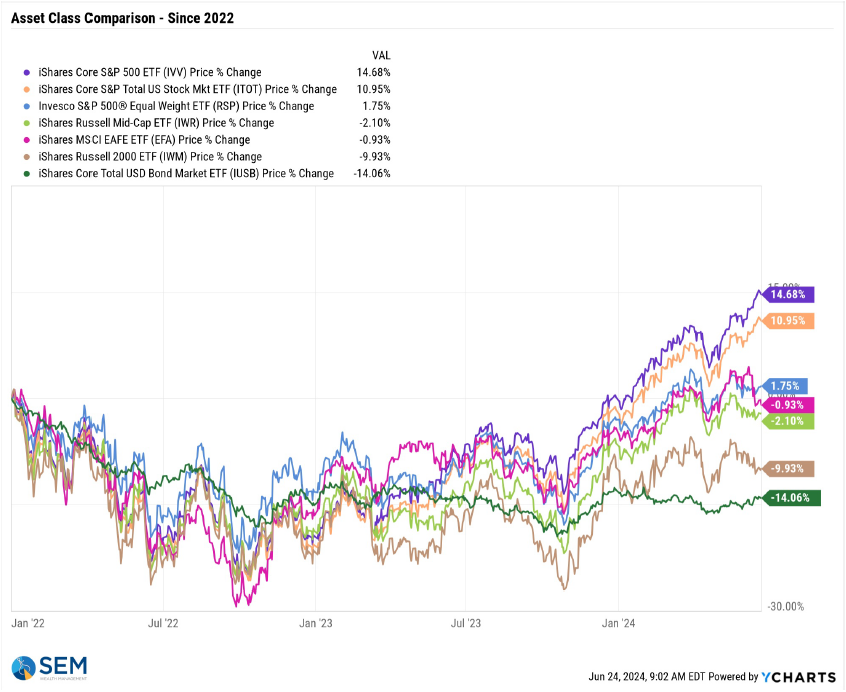

It was another bad week for those who believe the market is going to broaden out. Large caps were up for the week and small caps were down. Value slightly out-performed growth on the week. As we continue to say, higher-highs tend to breed higher highs......until something causes a structural shift. While we cannot identify what that shift will be, it is easy to imagine (based on experience and history) it being the inability for the projected AI hype to lead to actual bottom line profits. It is impossible for the largest companies to grow as quickly as the market is projecting over the long-term, when the market realizes this the valuation adjustment could be severe.

Until then, we will keep following the trend.

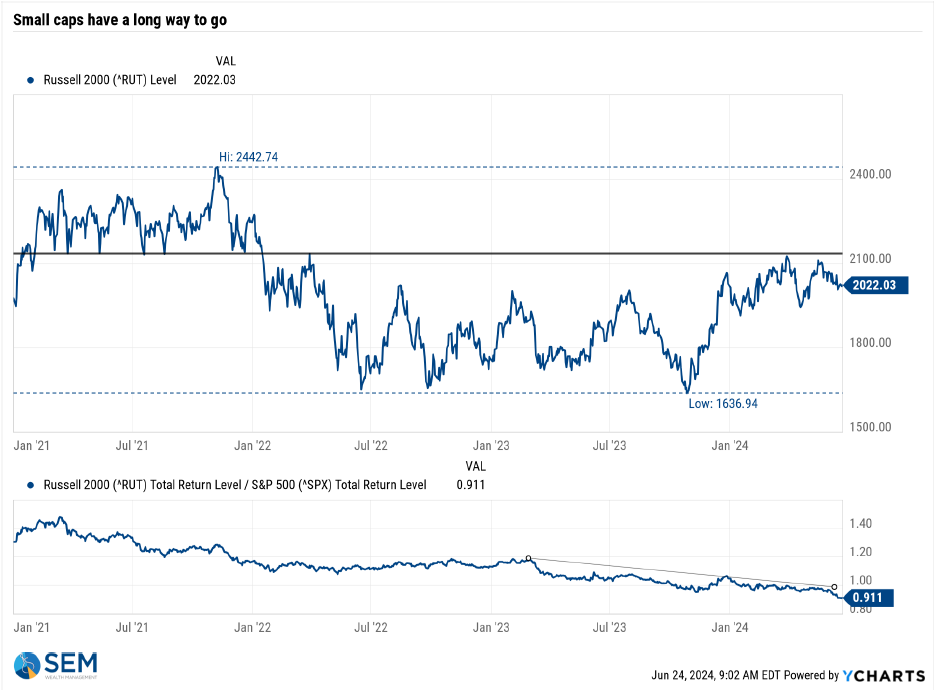

With large caps up and small caps down last week, the relative performance gap only got worse.

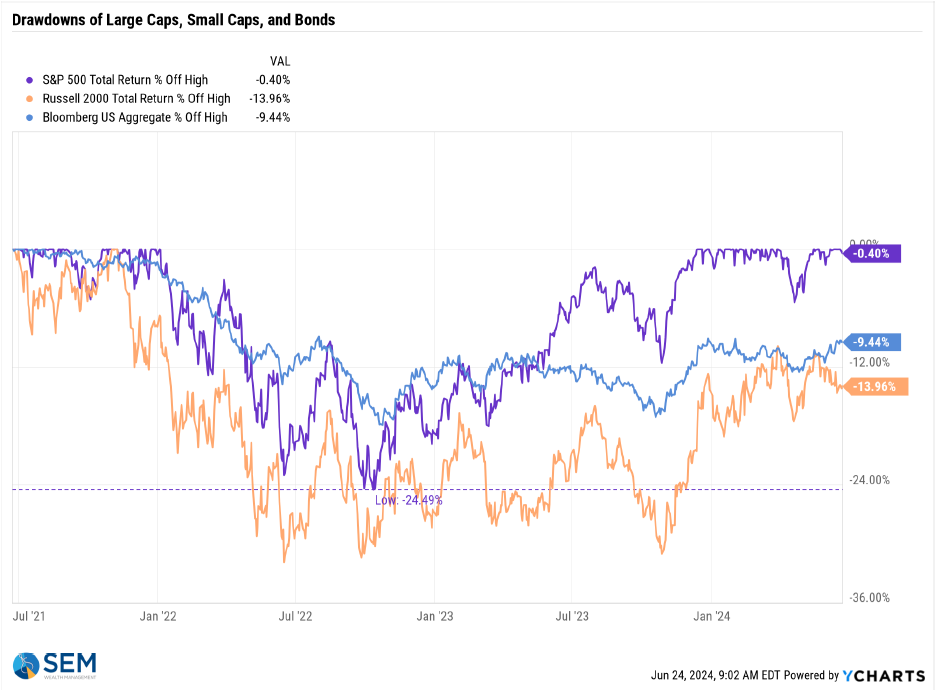

Small caps remaining 14% off the highs of 2021.

Diversified portfolios continue to lag.

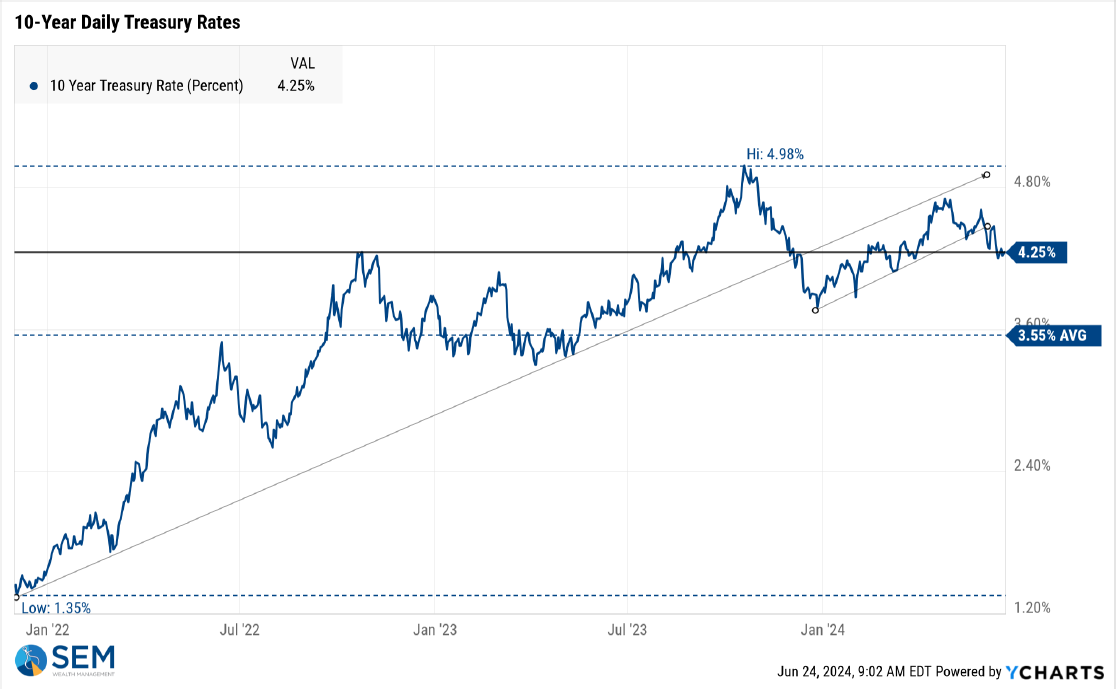

Interest rates are trying to move lower, which gave bonds a nice lift last week. It is still too soon to call the end of rising rates.

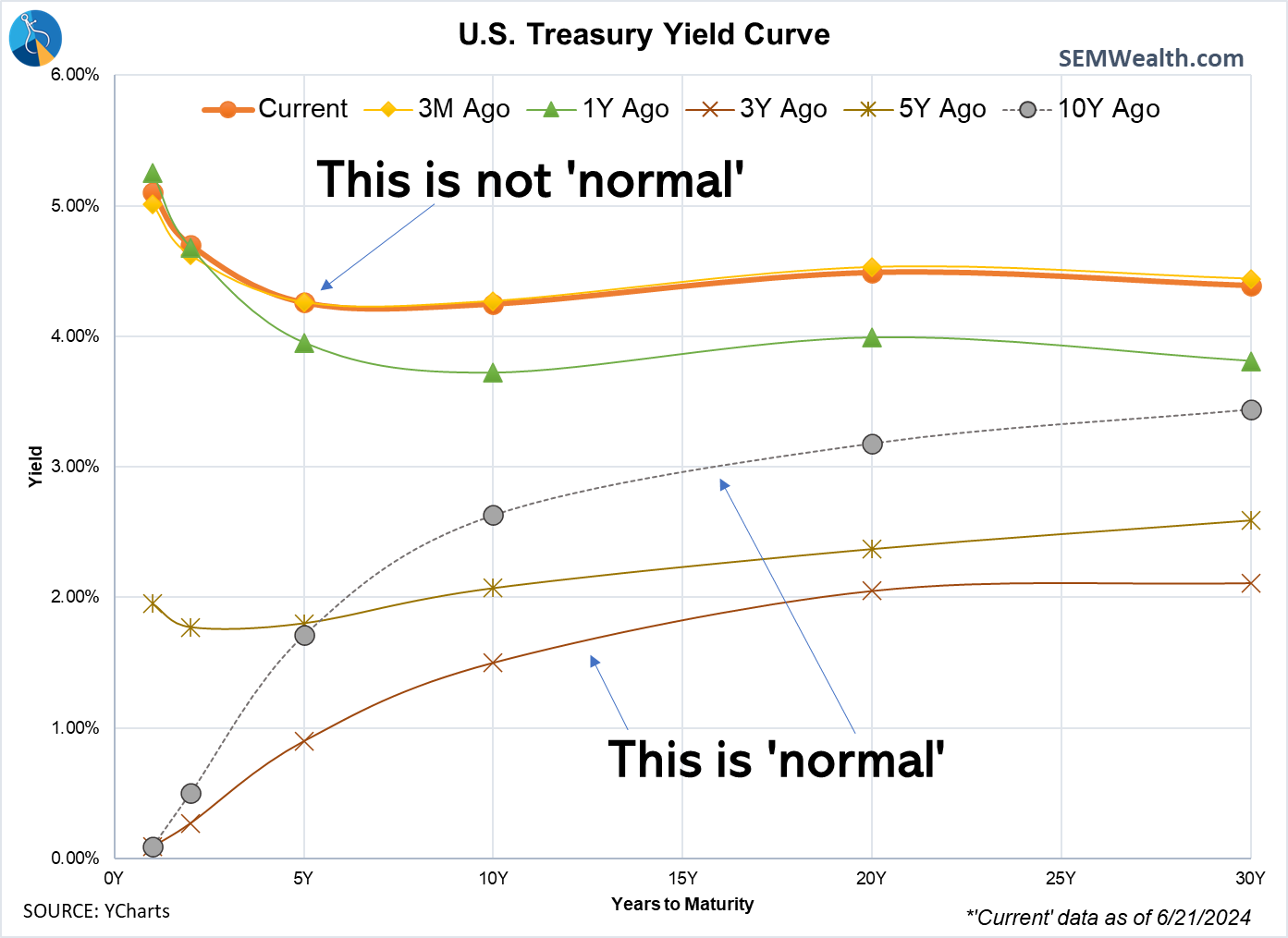

The yield curve improved a bit last week and has shifted back down to where we were 3 months ago. Rates are still higher than they were a year ago and more importantly the curve is still inverted. This means the economy is not functioning as it normally should, which means we will see abnormal behavior and reactions when policies change.

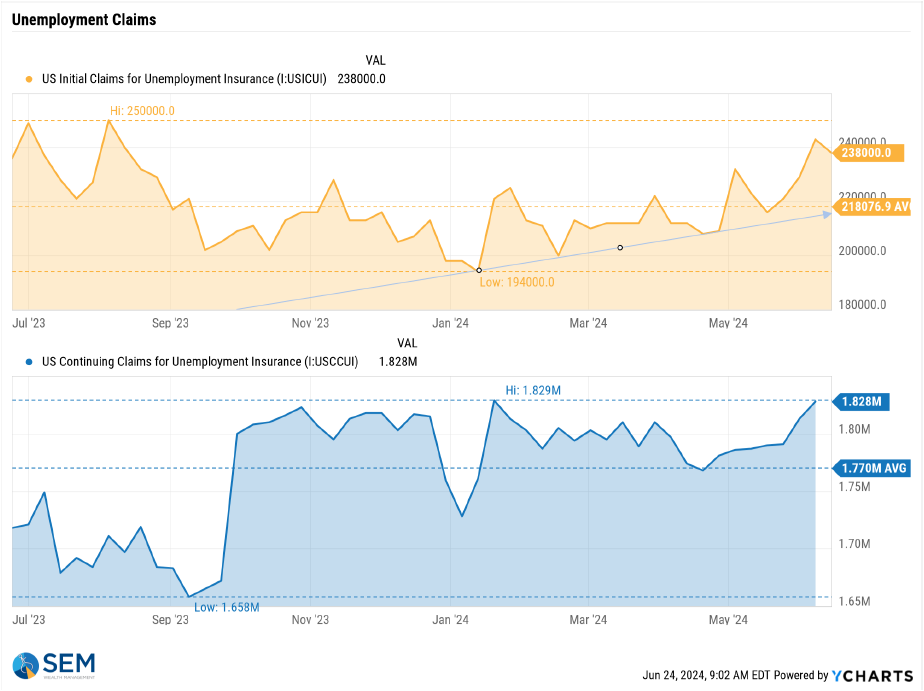

We need to see either short-term rates decline dramatically or long-term rates to rise to get things back to normal. The market is betting the economy is cooling enough to let the Fed start cutting rates, but as I said above, be careful what you wish for. Simply cutting rates will not magically unlock the economy, especially if it leads to a resumption of inflation. The labor market does appear to be cooling, but that is not necessarily a good thing for the LONG-TERM prospects of our economy.

SEM Model Positioning

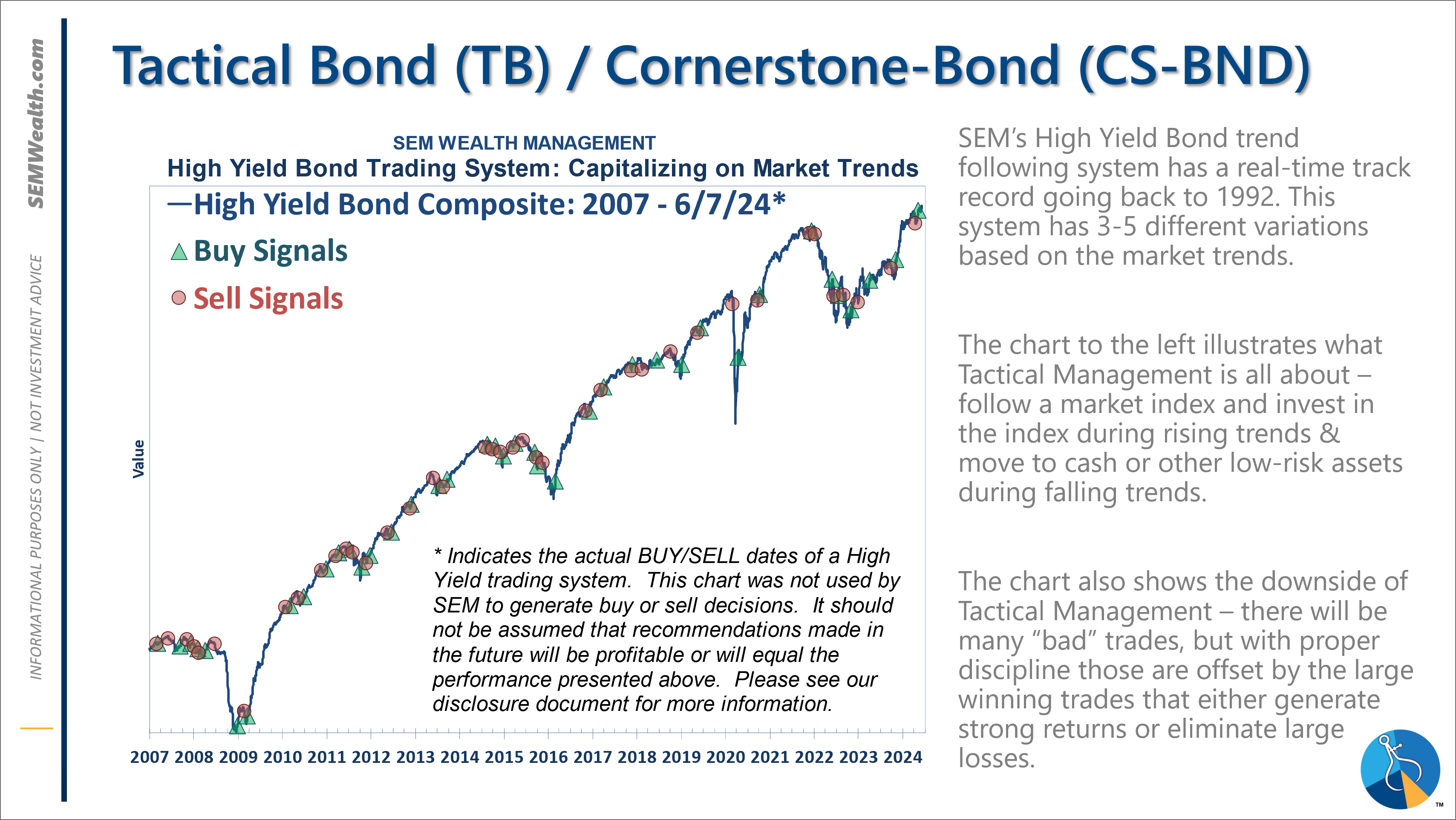

-Tactical High Yield had a partial buy signal on 5/6/24, reversing some of the sells on 4/16 & 17/2024 - the other portion of the signal remains on a sell as high yields continue to oscillate.

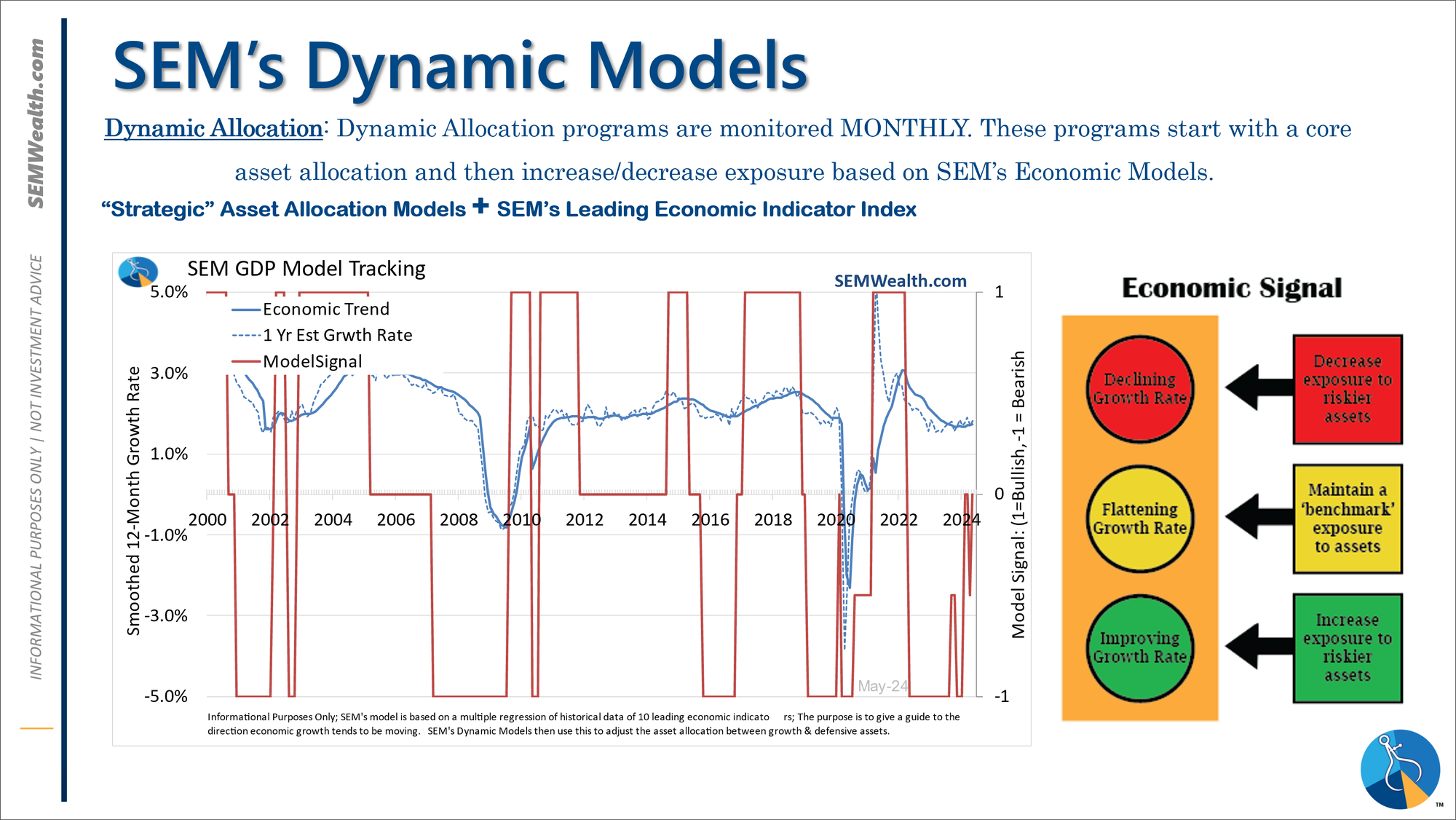

-*NEW* Dynamic Models are 'neutral' as of 6/7/24, reversing the half 'bearish' signal from 5/3/2024

-Strategic Trend Models went on a buy 11/27/2023

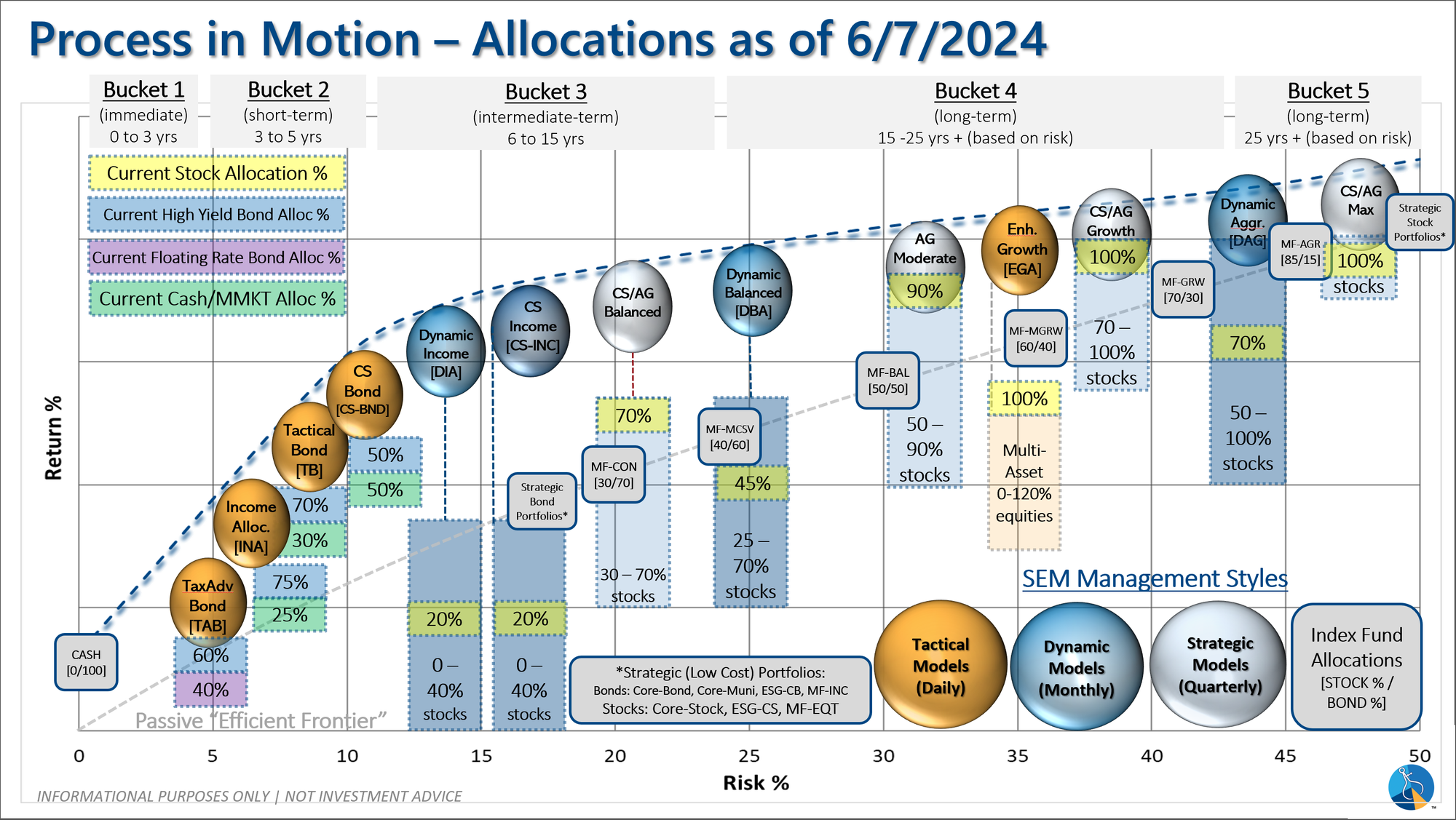

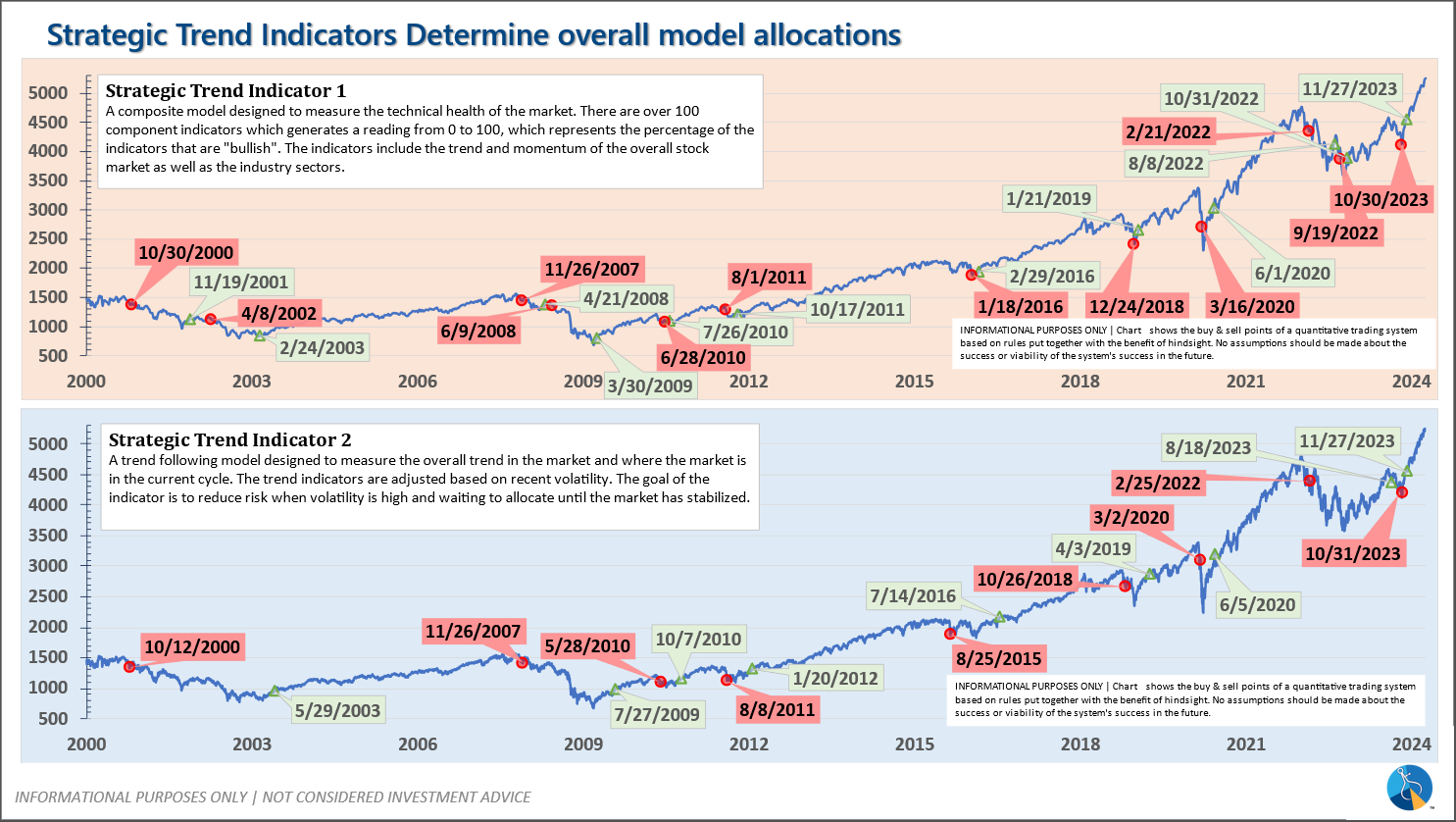

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): On 5/6/24 about half of the signals in our high yield models switched to a buy. The other half remains in money market funds. The money market funds we are currently invested in are yielding between 4.8-5.3% annually.

Dynamic (monthly): The economic model was 'neutral' since February. In early May the model moved slightly negative, but reversed back to 'neutral' in June. This means 'benchmark' positions – 20% dividend stocks in Dynamic Income and 20% small cap stocks in Dynamic Aggressive Growth.

Strategic (quarterly)*:

BOTH Trend Systems reversed back to a buy on 11/27/2023

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change: