You know what I haven’t heard about in a while? Crypto. When people hear you work in finance, you can get a pretty good gauge about where their mind is on the topic based on their own curiosities in your conversations with them. And for a long time, it seemed the most prevailing aspect of what we do was to try and pick out which coins were going to make them rich and which were scams. It was a funny time as we were so obviously new to this craze that the answers they were seeking weren’t quite available yet, but their minds were absorbed in trying to take advantage.

Our minds can only focus on so many things at once and it seems that while crypto hasn’t gone away, the craze for it has simply been replaced by other, more real concerns in their world of finance. The big one for the past several years has been the topic of inflation, as our finite dollars aren’t getting nearly what we were previously able to get. The financial data was there, and we can draw a pretty easy cause and effect with Covid, economic shutdowns, and stimulus that would all put great strain on our economy and something we were all going to have to struggle through. But the shutdown seems so long ago, the stimulus money come and gone, and most of the different Covid restrictions and “new normals” seem to have vanished, with the only newer normal sticking around seeming to be Americans spending more for less.

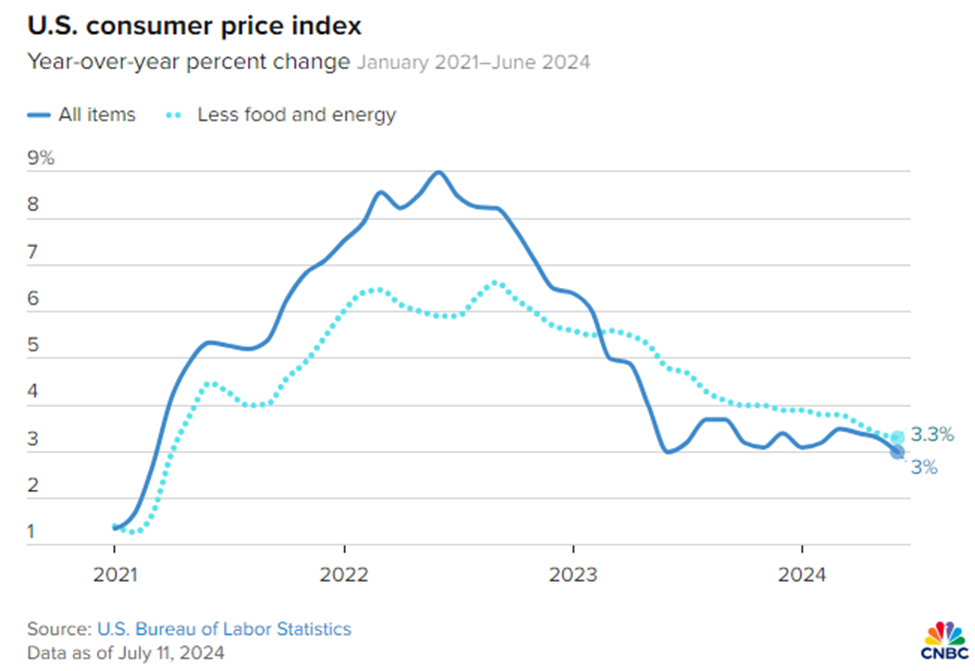

Inflation data for 2024 shows that we are almost back to where we were in our “normal” economy. Still higher than the 2% we grew used to, but the trends were there, and the finish line appears to be in sight. And although for economists this seems to be good news, that doesn’t lessen the sentiment that exists with Americans. In an Emerson poll conducted this month, the top most-important issue, by a long shot, remained “the economy”. While we can speculate that the economy can mean any number of things, most of the economy doesn’t leave much room for concern. Jobs data remains outstanding. No new tax plans have been discussed that would affect everyday Americans. The stock market is up big this year. So, when this survey asked people what the most important issue was, and 500 of the 1370 answered with “the economy” I think it’s safe to assume what they were really focusing on was inflation.

Good news for economists won’t really register with Americans, because getting inflation down to normal levels won’t have any impact on the rising inflation for the past few years. Unfortunately, calibration of what things cost now will probably be what’s required. This is frustrating to have to adjust when we would rather things be how they used to be. The great news for economists of slowing inflation still means that there is still inflation to deal with. The nature of a complex economy with interconnected prices, jobs and earnings reports means that any “easy” solution (get prices back to where they were before) will have impacts on other areas with wide, maybe worse ramifications. I’m not sure there is a “right” policy out there with a right policymaker to set it. One thing I think we can count on is the fix we are hoping for won’t be the fix to expect. We will probably have to live life with less Doordash, but we’ve done that before.

SEM has been around for 32 years and rather than speculating about what will happen next we instead focus on the data. If inflation becomes a problem again we have ways to adjust. If the drop in inflation sparks renewed economic optimism, we can adjust.

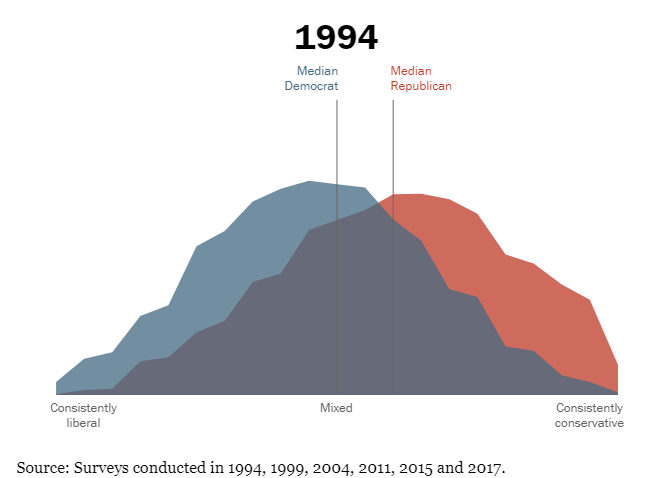

Assassination Attempt a Symptom of Our Nation's Problems

Saturday's assassination attempt on President Trump while shocking should not be a surprise given the growing divide we are seeing in our country. We obviously do not condone any act of violence and will stick to market and economic moving analysis. By far our most popular post was written a year after President Trump was elected. Re-reading this, we should not be surprised at Saturday's events, or what happened on January 6, 2021, or throughout 2020. It would be nice to think we could see a return to 'normal' (pre-1994 or even pre-2016) politics after the shock of this near miss, but that probably will not happen (yet.)

We're being inundated with coverage of this assassination attempt. Your time would probably be better spent taking a look at this post to understand the current environment.

For more on our current outlook, check out the sections below.

Market Charts

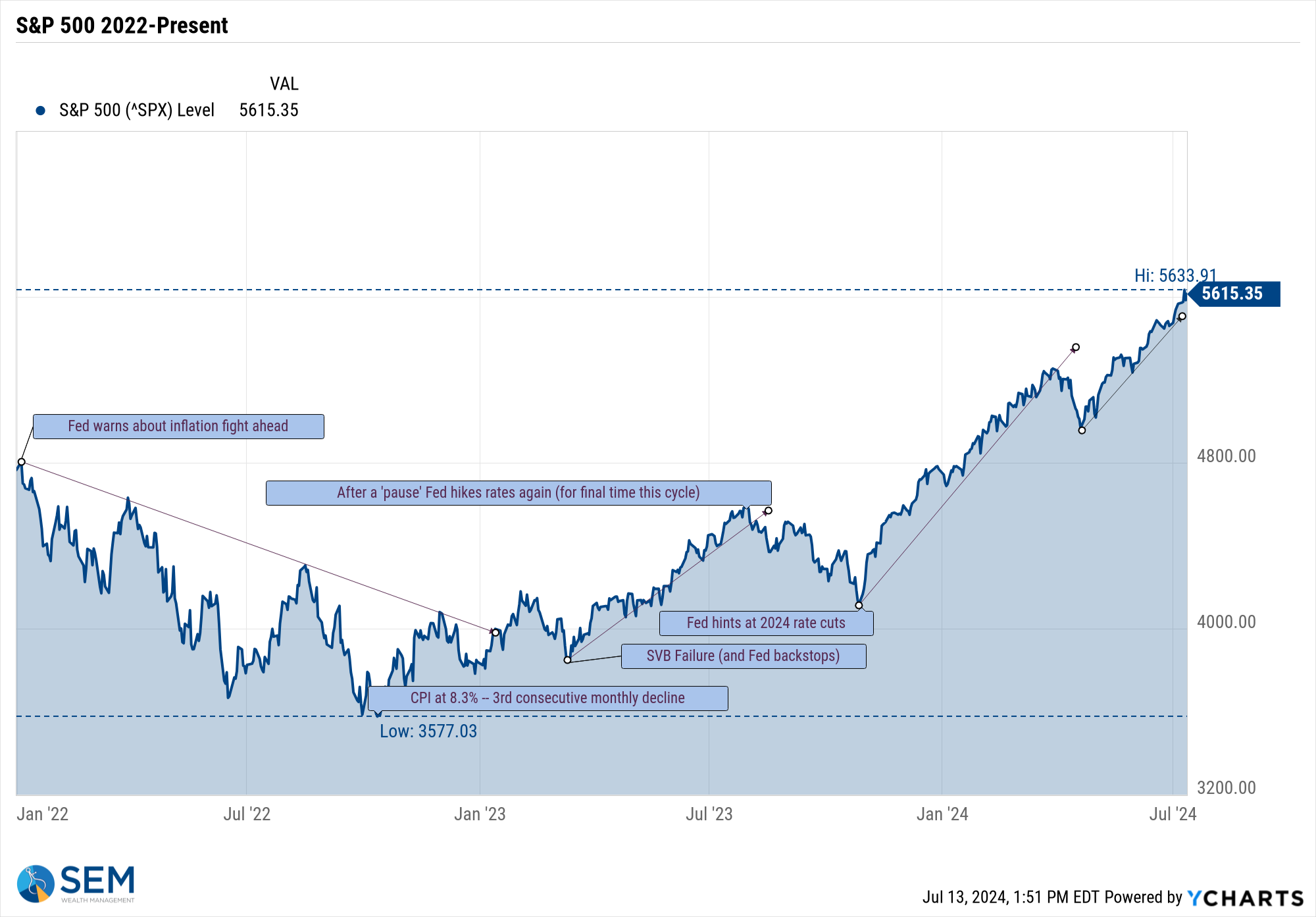

Higher highs continue to breed higher highs. This will continue until something significant comes along to change the trend and mood.

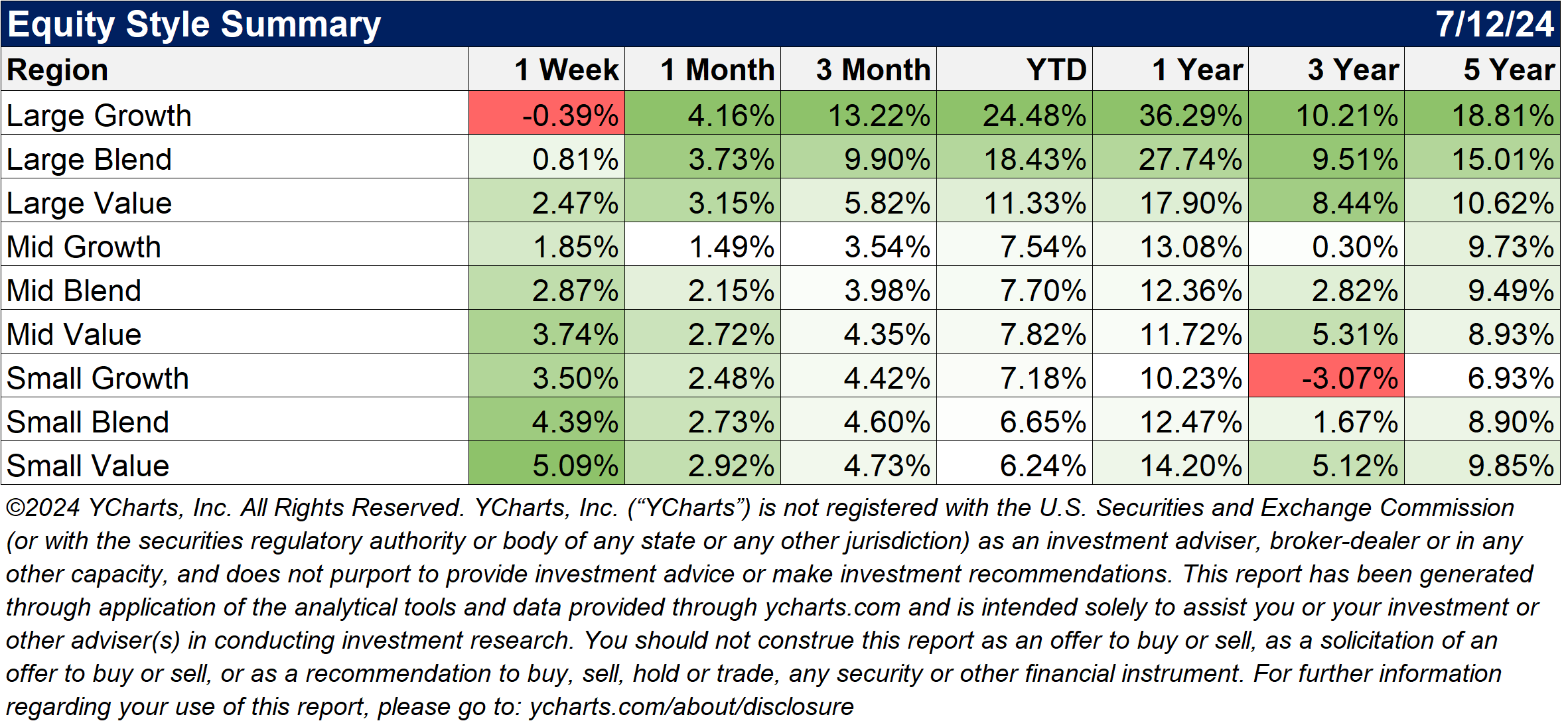

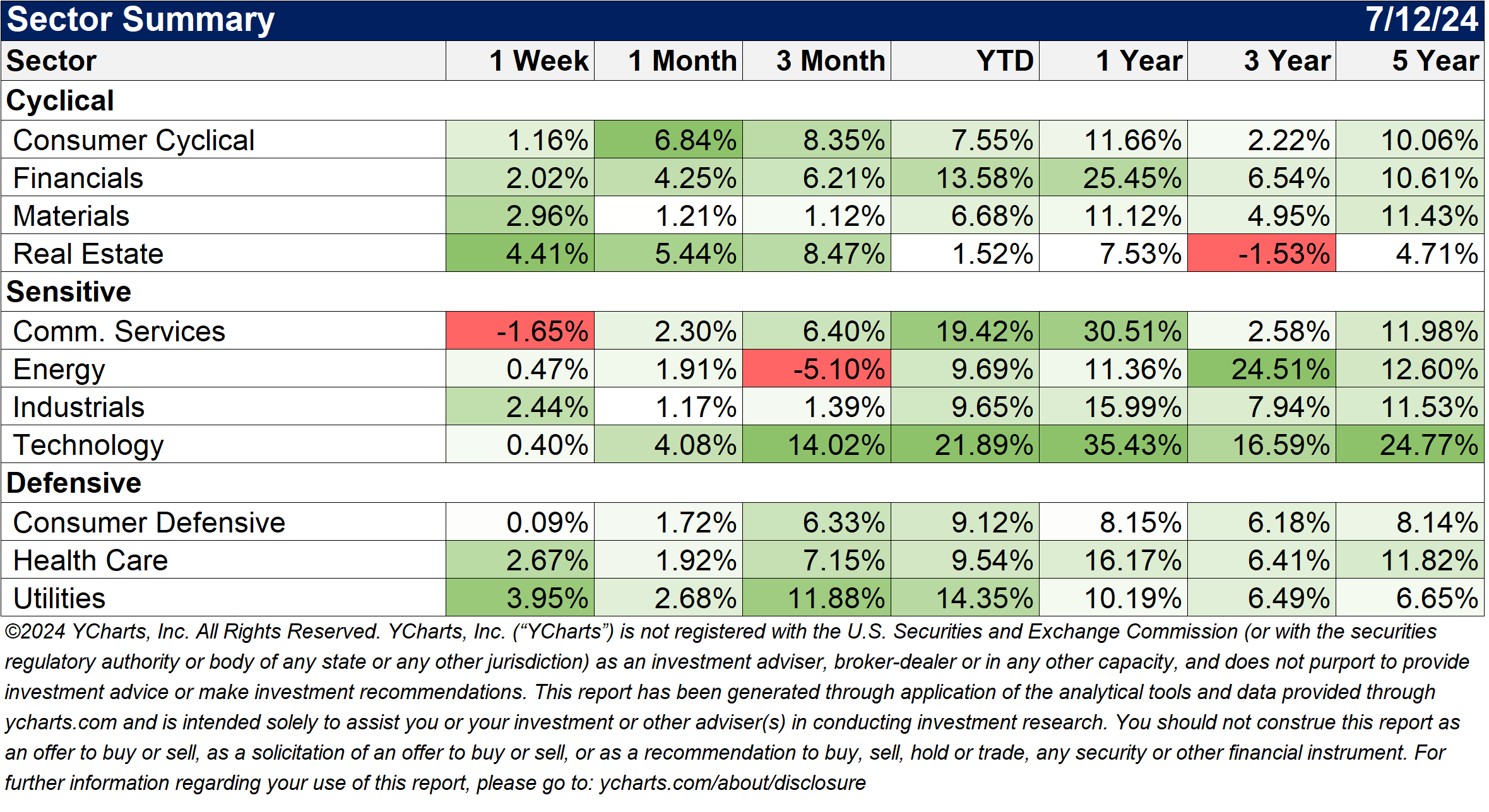

The Inflation data sparked a massive rebalance trade on Thursday with large cap growth down while small caps and value stocks posted their best rally in several years. These asset classes have underperformed so long it is hard to see if this is a real trend or a temporary blip in the mega-cap growth bubble. These performance tables tell the story.

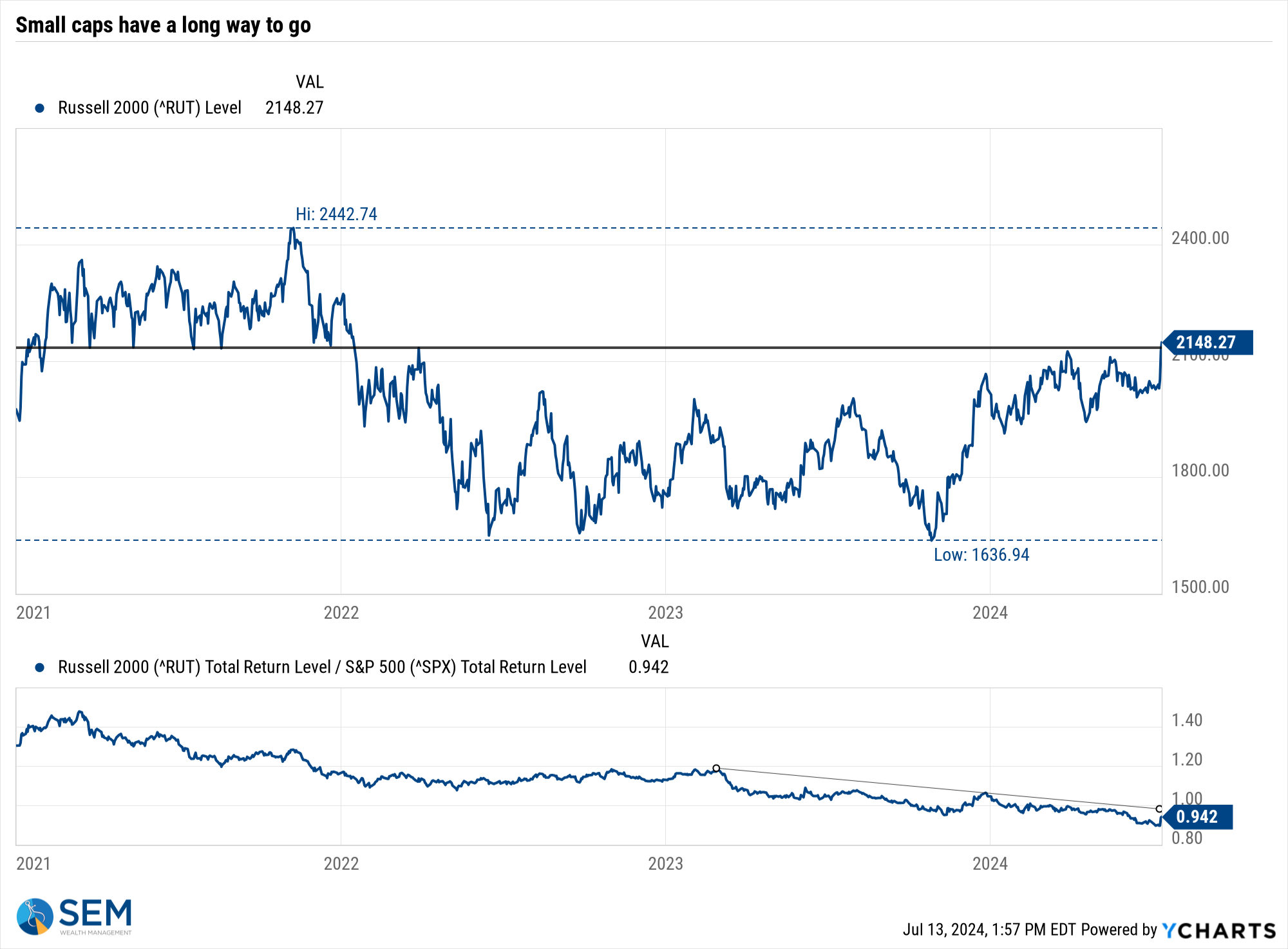

Small caps are still well below their peak and still technically in a downtrend relative to large caps.

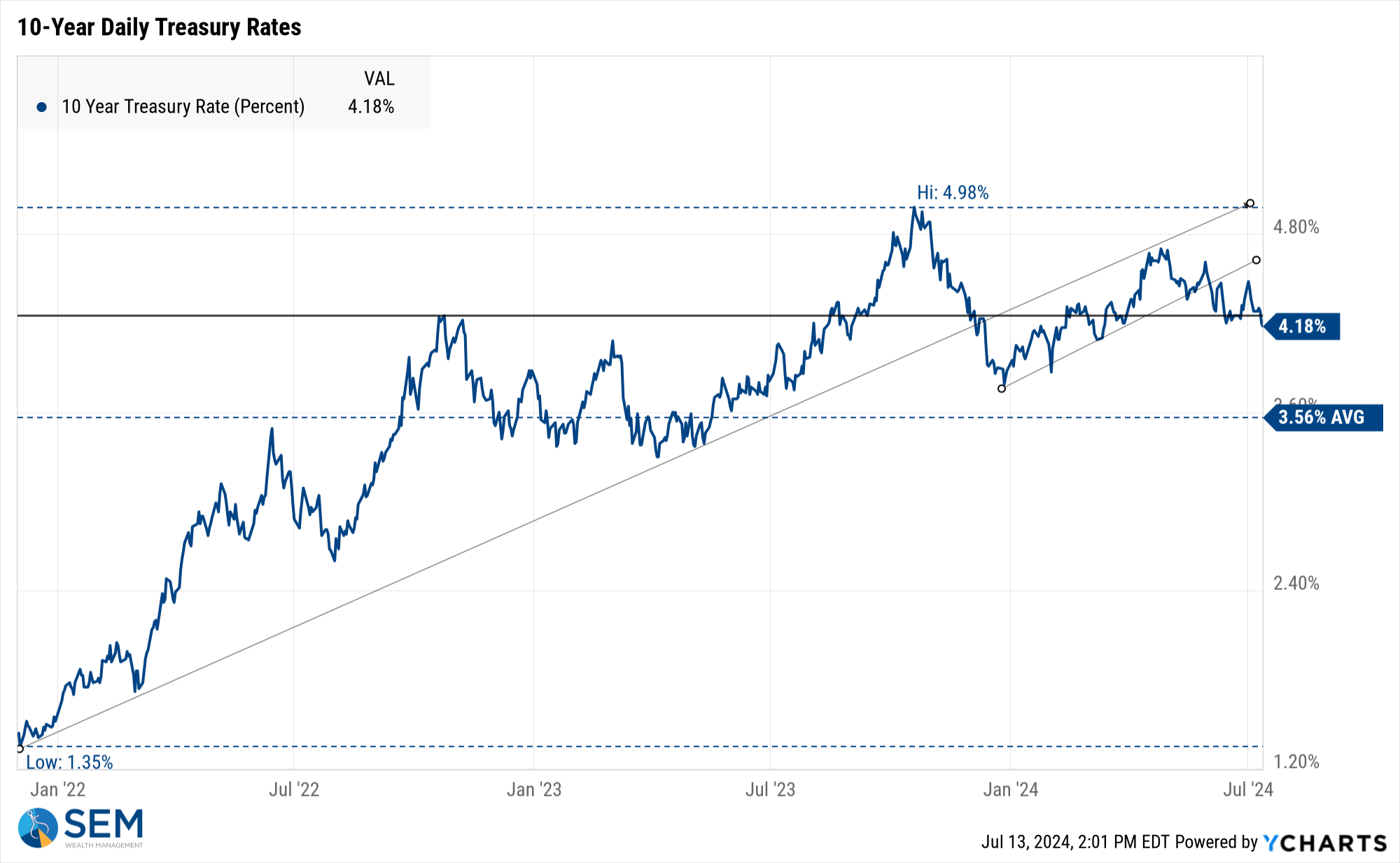

Turning to bonds, the CPI data also helped spark a push lower in interest rates on the long-end. 10-year Treasury yields are showing encouraging signs they may push lower, which could be good news.

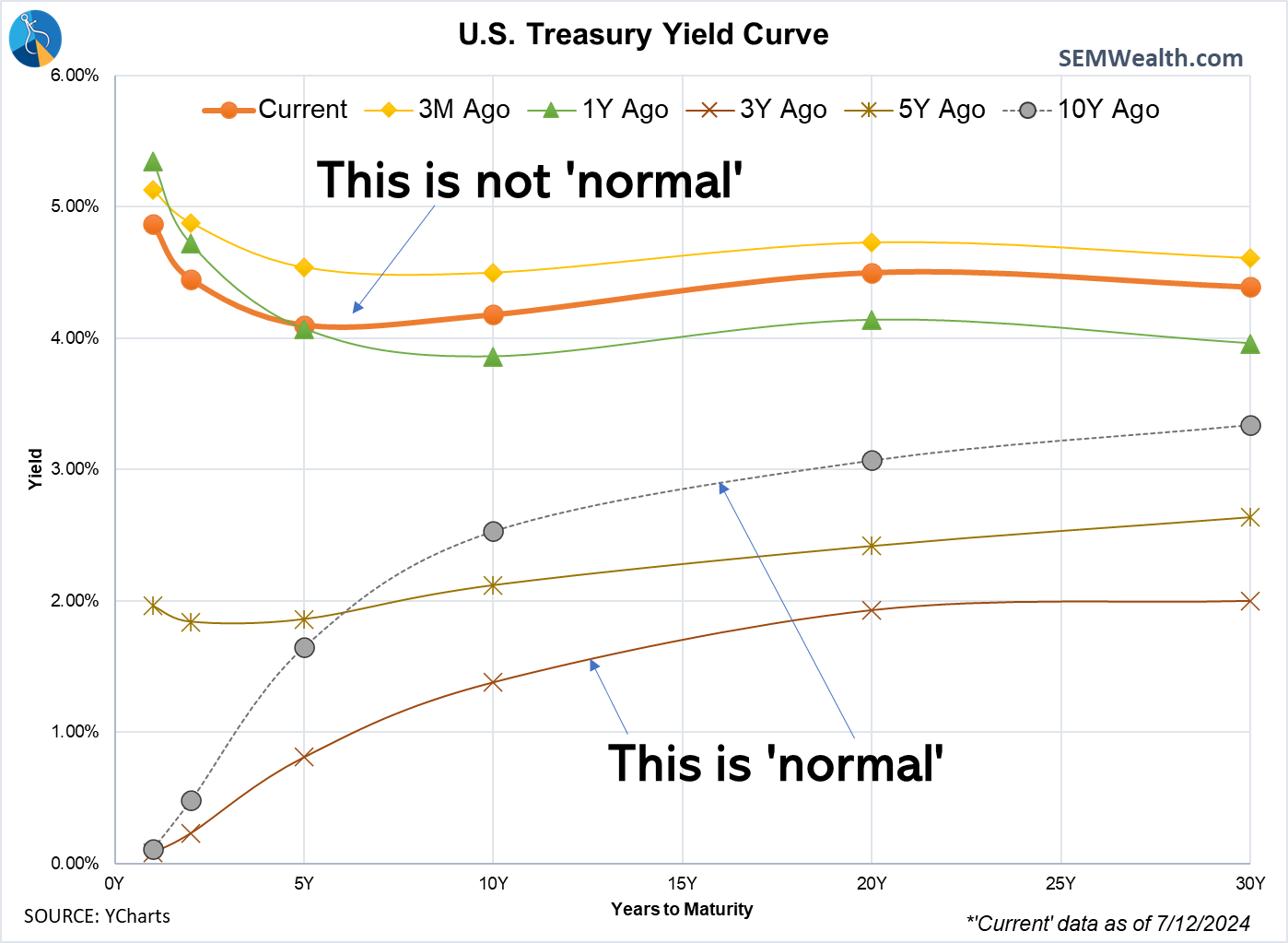

Even better news, the yield curve may be attempting to 'normalize'. It has shifted lower over the past month and looking more normal (shorter rates lower than longer rates) from the 5-20 year maturity range.

SEM Model Positioning

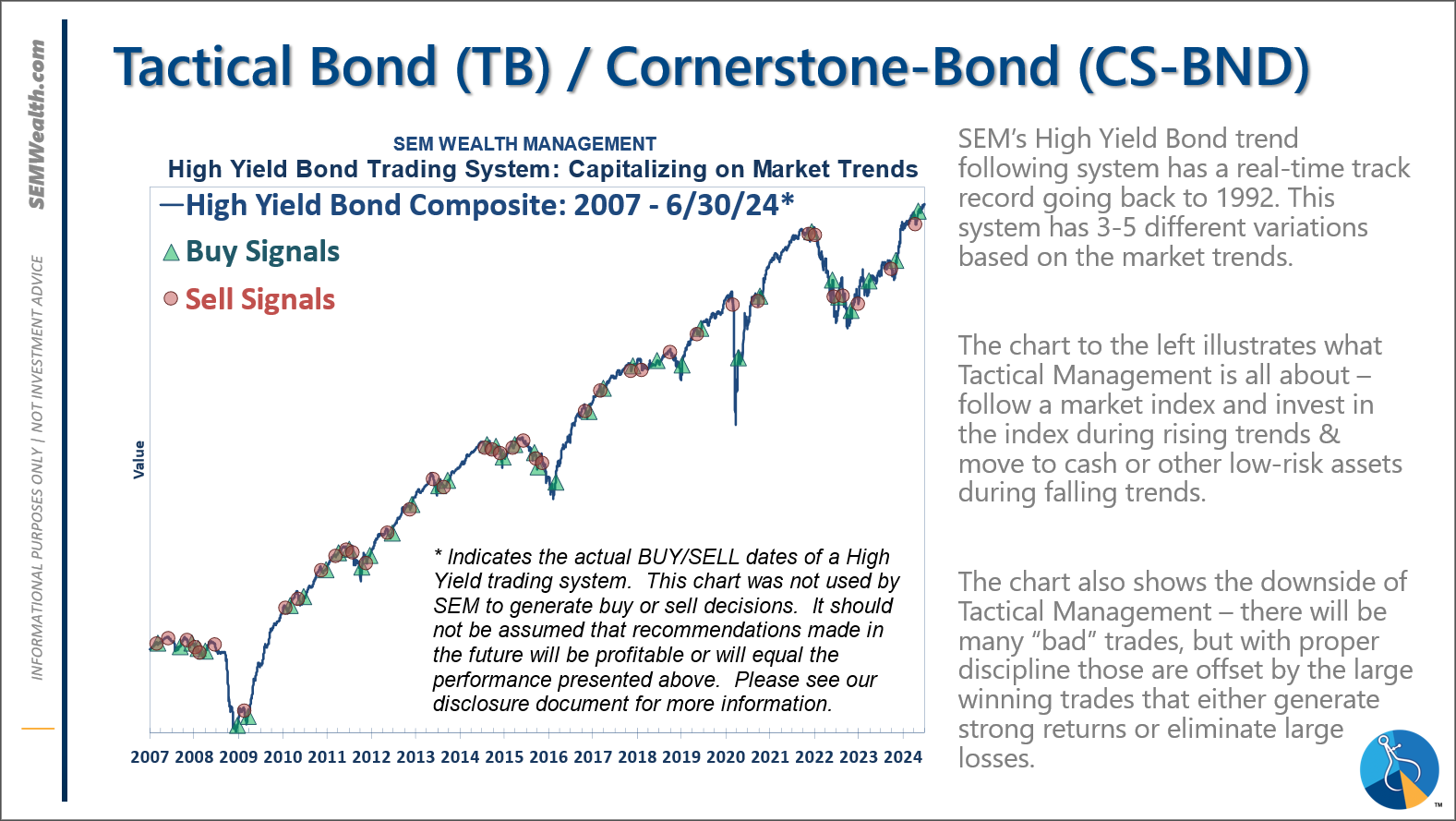

-Tactical High Yield had a partial buy signal on 5/6/24, reversing some of the sells on 4/16 & 17/2024 - the other portion of the signal remains on a sell as high yields continue to oscillate.

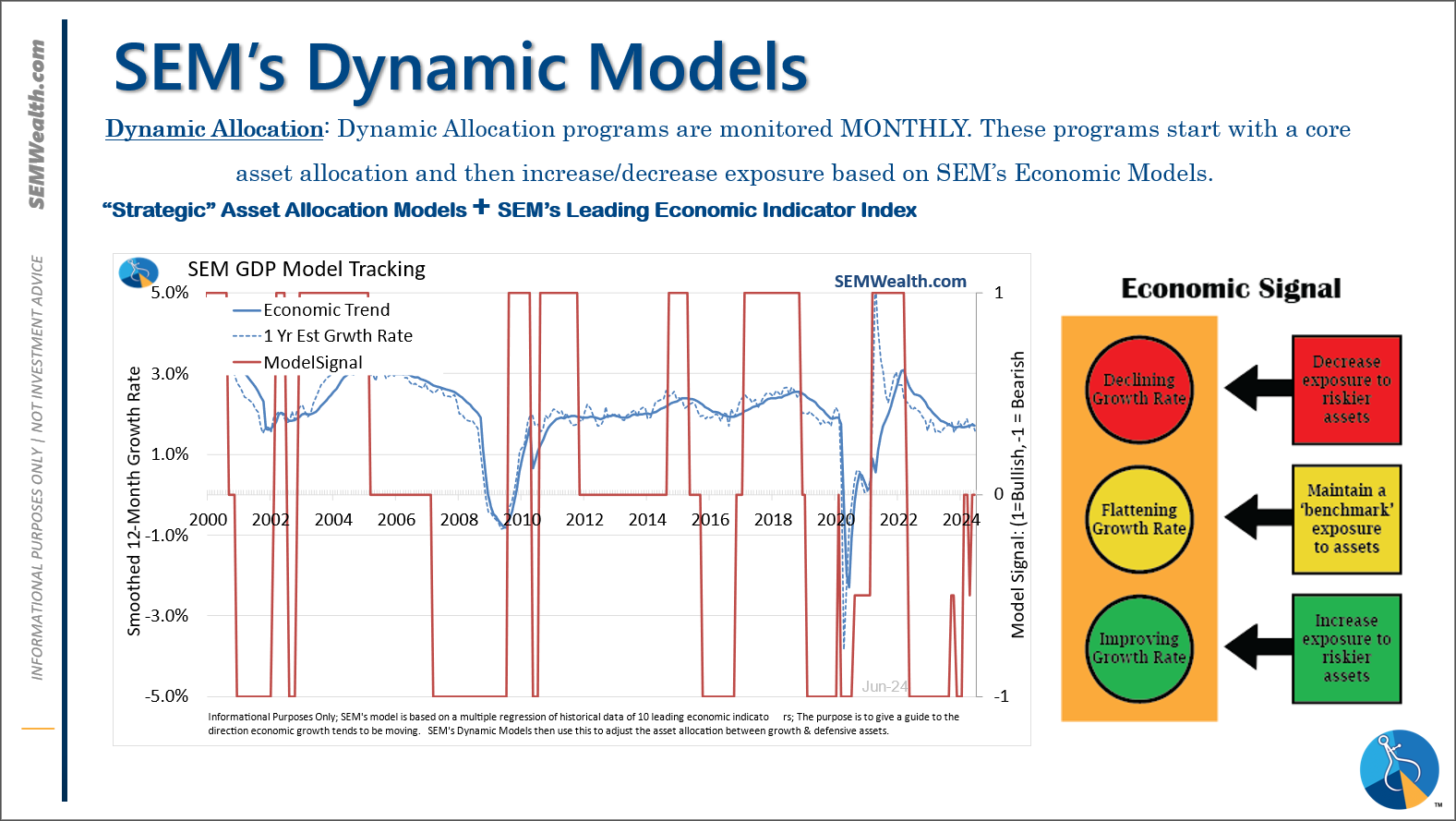

-Dynamic Models are 'neutral' as of 6/7/24, reversing the half 'bearish' signal from 5/3/2024. *NEW* 7/8/24 - interest rate model filled from partially bearish to partially bullish (lower long-term rates).

-Strategic Trend Models went on a buy 11/27/2023; *NEW* 7/8/24 – small and mid-cap positions eliminated with latest Core Rotation System update – money shifted to Large Cap Value (Dividend Growth) & International Funds

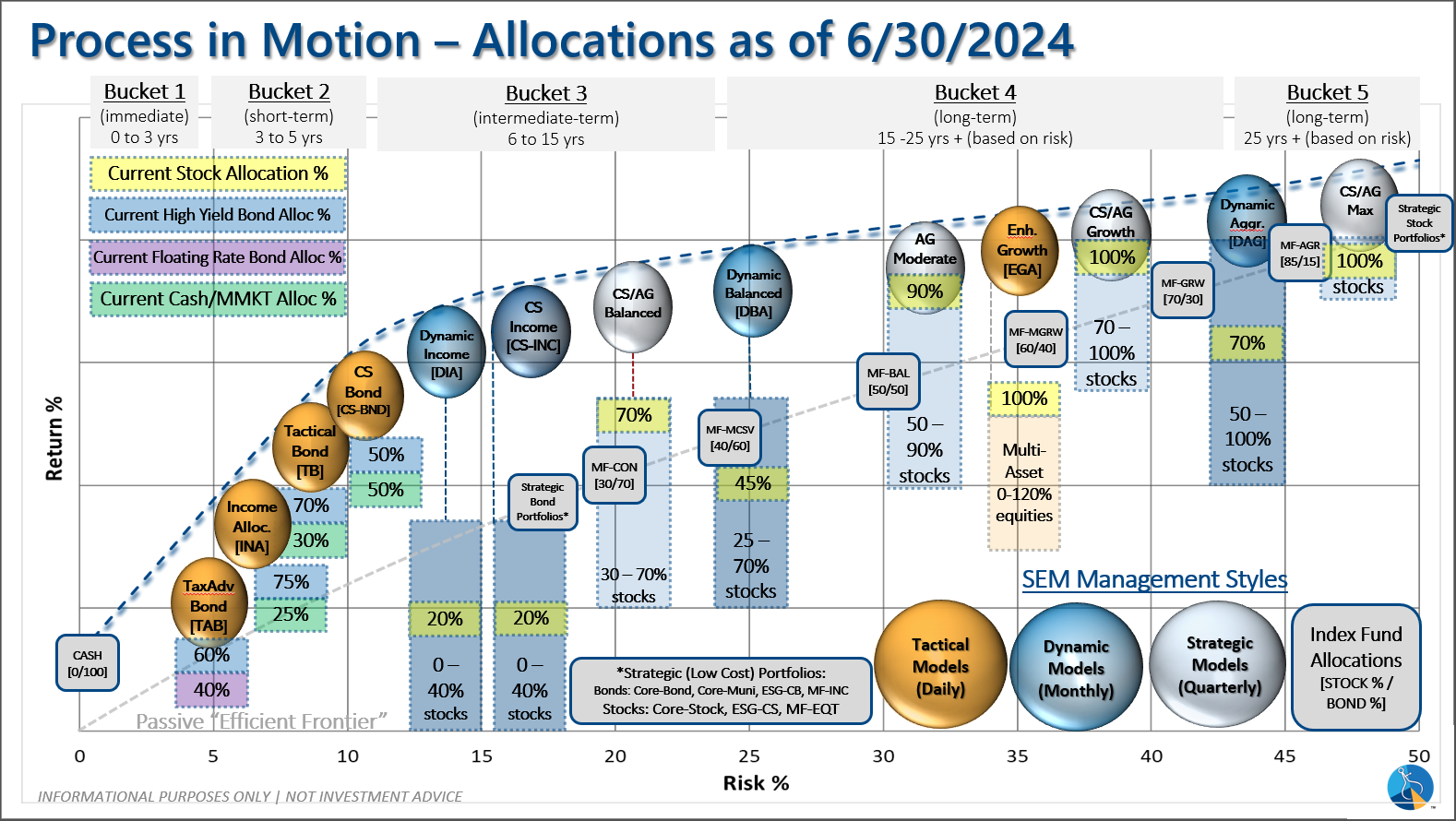

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): On 5/6/24 about half of the signals in our high yield models switched to a buy. The other half remains in money market funds. The money market funds we are currently invested in are yielding between 4.8-5.3% annually.

Dynamic (monthly): The economic model was 'neutral' since February. In early May the model moved slightly negative, but reversed back to 'neutral' in June. This means 'benchmark' positions – 20% dividend stocks in Dynamic Income and 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is slightly 'bullish'.

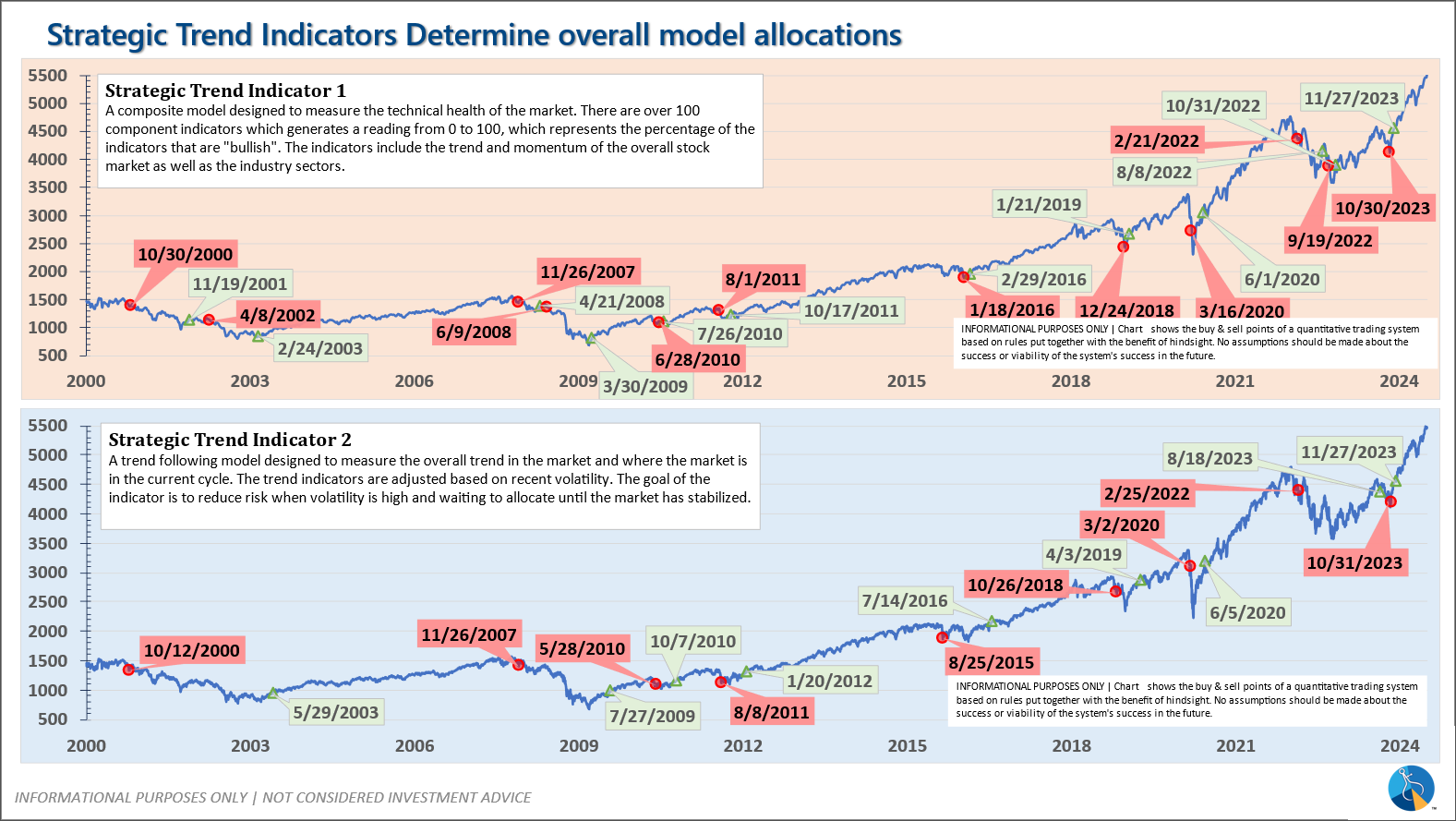

Strategic (quarterly)*: BOTH Trend Systems reversed back to a buy on 11/27/2023

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Questions or comments - drop us a note?

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire