It always goes in phases, but when there is a long, jaw-dropping run in a single stock and especially stocks inside of one industry we start getting questions from advisors and clients about first investing in the daily headline-making stock, followed by "what do you think is the NEXT (fill in the blank with the stock name)." Whenever I'm asked this my answer makes me feel very old. Maybe I am in the whole scheme of things, but my 30 years of managing money in the stock market does give me a bigger experience range than most people asking this question.

At SEM we do not pick individual stocks. We follow a "top down" approach where our MODELS look at the economy, then the asset class (size, value/growth), then the industry sector. We stop there and trust either index funds or actively managed funds to pick the stocks.

The reason we do not pick/recommend individual stocks is it is entirely too subjective. The ‘intrinsic value’ of a stock (what the CFA materials teach us to calculate by doing rigorous research on the company, the industry, etc.) is highly based on two key factors, both of which are subject to human behavior — what is the expected growth rate of the company and what is the appropriate “risk premium” that should be assigned. The higher the growth rate, the higher the 'intrinsic value'. The risk premium is a random number that the "market" demands to be paid in order to take on the unknown risk of the given company. Therefore, the lower the risk premium, the HIGHER the "intrinsic value".

Because there is no DATA which tells us what the CORRECT growth rate and risk premium should be, both are highly corelated to each other and both are highly corelated to sentiment. When the expected growth rate slows, the risk premium goes up. Both will hammer a stock. The same is true to create a bubble. The longer the growth rate is expected to continue the lower the risk premium will be (because we all start to believe this is the next ‘new” thing.)

Right now, stocks have an above average expected growth rate and a below average risk premium. Both are approaching all-time highs. Can stocks exceed the growth rate and force the risk premium even lower? Maybe. But if they do not, look out below. For individual stocks you are at even greater risk of being "wrong" because company specific items (like China & EU both talking about 'anti-trust' investigations into Nvidia or the Trump administration likely to continue pursuing an investigation into Google and Microsoft's "monopolies".)

When I came over to SEM in 1998 I brought with me my semi-quantitative stock picking models. I had formulas and screens I had tested to make the selection less ‘subjective’. Rather than using my growth rates and risk premiums I had formulas based on historic numbers and calculated Wall Street current estimates. Ultimately we all learned that the growth estimates were entirely too high and the risk premiums entirely too low for basically the entire stock market.

While I didn’t get out at the “top”, by August 2000 with the rapidly adjusting growth estimates and risk premiums, there was not a single stock in my spreadsheet of 125 stocks which met my ‘buy’ criteria. The market was down over 20% from the peak 10 months earlier yet not a single stock was “undervalued” in my list. I made the decision this was too much work with not enough reward. The handful of clients I had in those models were moved into what we know as EGA today (it was Sector Rotation in 1998, then Aggressive Growth Allocator in 2001).

[Side note: my academic research had told me the Fama-French model made popular by their Nobel Peace Prize and Dimensional Fund Advisor (DFA)'s use of these models was flawed. Value and small caps carried so much earnings risk (and thus large risk premium changes) that it was difficult to be successful over the long-term. If you factored out the tremendous outperformance of small cap and value stocks from the late 70s and early 80s, small cap and value UNDERPERFORMED large cap and growth over the long-term. (The same is true for international holdings.......at least according to our research.)]

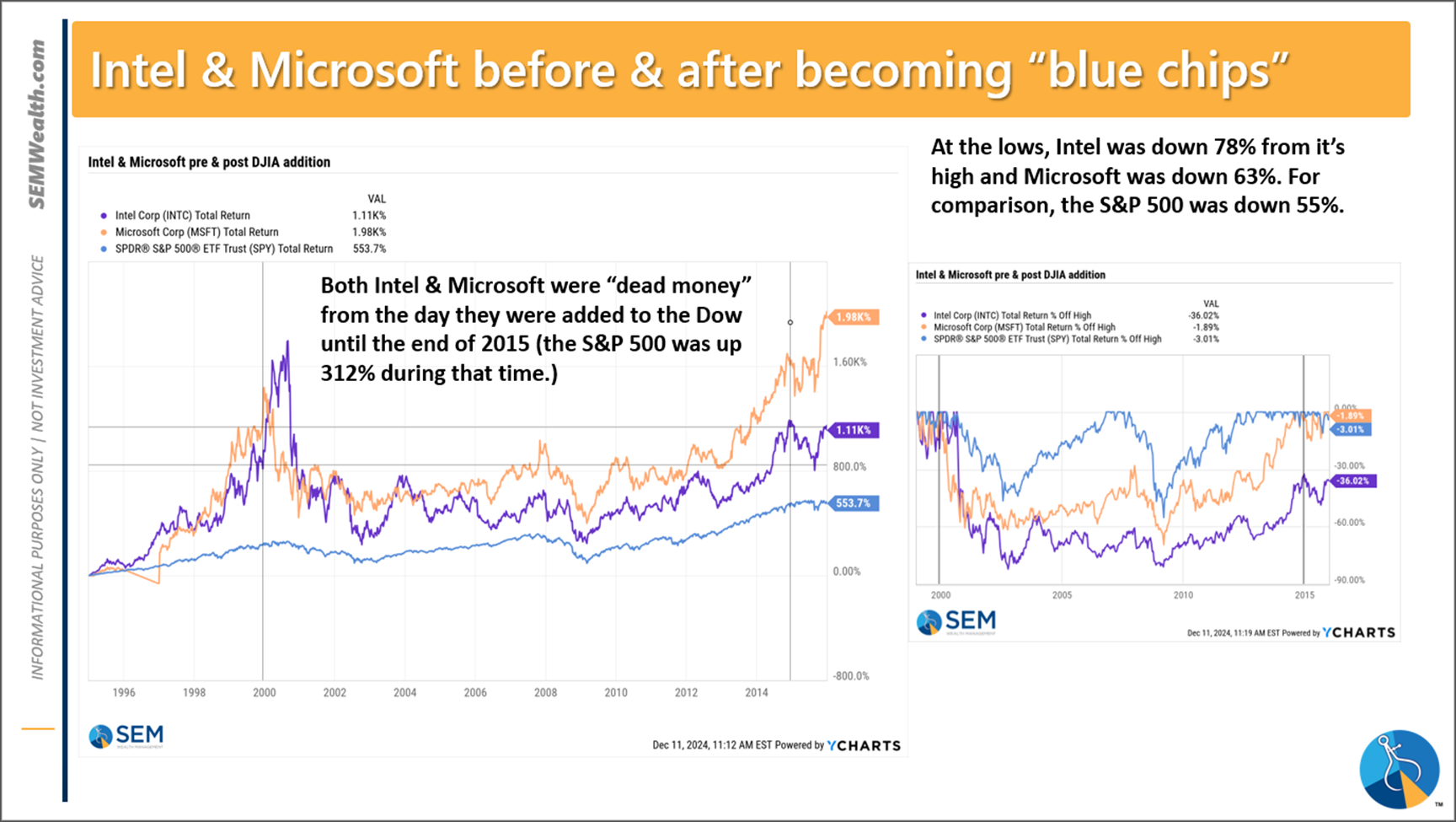

Another brief anecdote related to this. While I’ve never tracked or used the Dow Jones Industrial Average for anything, it does matter to people because the media reports it. In November 1999 the board running the Dow added two stocks, replacing long-time “blue chip” companies, Chevron & Goodyear. The stocks were Microsoft and Intel. These were thought to be the leaders going forward. Yes there were some start=ups or smaller companies trying to take market share, but their position was so dominant it was thought nobody would be able to take their spot at the top away from them. Furthermore, it didn’t matter because the internet was just now beginning its build-out. This will impact every industry across the board and increase the growth rate and productivity of everyone. It made sense to group Microsoft and Intel with the “blue chips”.

Does that sound familiar to another stock/technology?

Maybe I’m wrong, but Nvidia being added to the Dow in November smells a little too familiar to this old man. As somebody who owned both Intel & Microsoft from 1995-August 2000, this is the warning I give anybody wanting to either buy Nvidia or find the “next Nvidia”. (Ironically, Intel was dropped from the Dow the day Nvidia was added.)

I could easily be wrong, but the sentiment around AI is eerily similar to the tech bubble of 95-00. The “dot-com” stocks made the headlines, but the networking and networking related stocks were where the actual growth and excitement was. Everyone was looking at who would participate in the build-out of the internet, including the nationwide fiber optic network build-out. Most of the companies expected to participate in that build-out either ended up bankrupt or saw their stocks near $0 for over a decade (or two).

Some of the “winners” were not even around in the year 2000 (or were private companies). Most companies DID NOT make money and still are not making money. A few did (including Microsoft after they transitioned from operating system software to their subscription and cloud-based software model.) In fact, the ‘old tech’ companies who have been successful have all had to completely transition their pre-2000 business models to survive (which hurt their stocks for YEARS as they struggled to redefine their business model). The performance of Intel stock tells us it is failing at transitioning to the changing industry landscape.

25 years later we are still waiting for the full build-out of the fiber optic network. Our home in Virginia just received it (and there are A LOT of glitches in our neighborhood). Our prior home in Tucson, built in a growing part of town in the early 2000s still doesn’t have it. Some parts of Tucson still are on DSL. I don’t say this to defray any excitement over the AI rollout or stocks that will enjoy tremendous growth, but to highlight why SEM as a fiduciary investment advisor focused on Quantitative Models driven by data cannot offer much in selecting the next “big thing” in AI (or any industry).

Somewhat related to this – since moving to Virginia we've TRIED to have a "smart" home. We made sure we had "high speed", reliable internet, which for the most part we have. We've invested in top-end networking equipment to handle all of the devices in our home and to ensure there isn't a corner of the house without high speed WiFi, including rooms on every floor having wired internet connections. Despite this, there have been too many times (in our opinion) where we were left without internet, which rendered our "smart" home pretty dumb.

What about when we're on the go? In Arizona we used Verizon because (generally speaking) they had superior coverage over most of the western US. When we moved to Virginia, it was HORRIBLE. We couldn't even get signals inside our house and we live about 5 miles from the freeway. We switched to AT&T and again have great service -— on the east coast. When we are out west, AT&T (generally speaking) is terrible.

As my lovely wife has commented on many times – "how are we supposed to power all this AI stuff if we can't get reliable internet?"

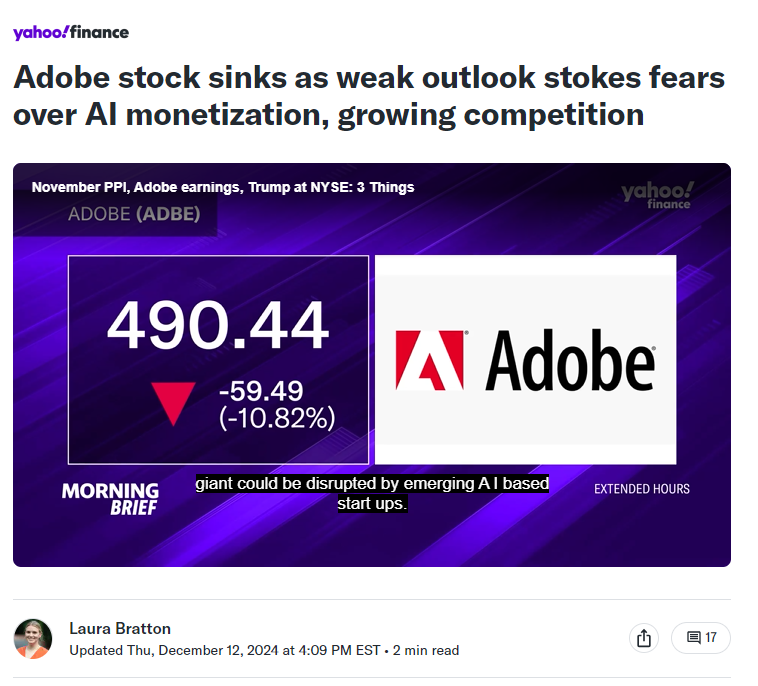

The other thing we've seen is every company seemingly adding "AI" to their offering. The SEC has warned companies about "AI" washing, but it doesn't seem to matter to most companies. As I've pointed out, simply having "AI" as part of the software and asking your customers to pay EXTRA for AI are two different things. Adobe is the latest to learn this.

All of this said, it doesn't mean we can't or won't participate in "AI". We already have in a significant way, we just haven't labeled it as such. There are several "AI" ETFs out there. If you take a look at the fund holdings, you will see the top ones are almost the same as the top holdings in the S&P 500, which means they are the top holdings in any SEM portfolio which has S&P 500 exposure (such as AmeriGuard or Core-Stock). As I said at the beginning, the "winners" are likely very small companies we've not even heard of yet, companies who are going through a complete restructuring, or like we learned during the Tech Bubble, have not even been formed yet. Expecting ANYBODY to have that ability is misguided.

One thing that has made SEM a success over the past 33 years, is we choose to stick to our area of expertise and 'outsource' the rest. We have models which have already and could continue to participate in "AI" if that is the way the market decides to go.

Some of the SEM models which tangentially participate in “AI” are:

- Momentum Stock Model (MSM) – this is as it sounds. We will rotate in and out of various stocks in the Russell 1000 based on some of our momentum indicators. It can get overweight “AI” related areas at times. It has enjoyed an amazing couple of months which always makes me nervous.

- Enhanced Growth Allocator (EGA) – 20% of the model is a “sector rotation” model which invests in various industry index funds. This again will rotate in and out of various sectors, but it currently is in the “Internet” and “Telecommunications” sector funds, both of which are “AI” heavy.

- AmeriGuard-Max (AG-MAX) – has a core holding in the “Total Stock Market” index, but can also overweight specific segments (such as large-cap growth). It also includes a sector model which invests in industry ETFs with about 12% of the money to give the model a chance to overweight specific sectors. Note the allocations and how many “AI’ related companies are in the top 15 holdings.

- Core-Stock (CORE-STK) – this model is designed to own the “total” stock market with some ‘overweight’ positions. Even it has a fairly heavy exposure to “AI” related stocks.

EGA & MSM are probably not the best choices for taxable accounts because they will trade frequently, which generates short-term gains. AG-MAX is good for most taxable accounts as the ‘core’ position of around 70% does not change too much. For those who are tax sensitive, but still want AI exposure, I would remind them that due to the spectacular growth of large cap growth stocks, if you own CORE-Stock you are already participating in AI and will if it actually does continue to drive everything higher.

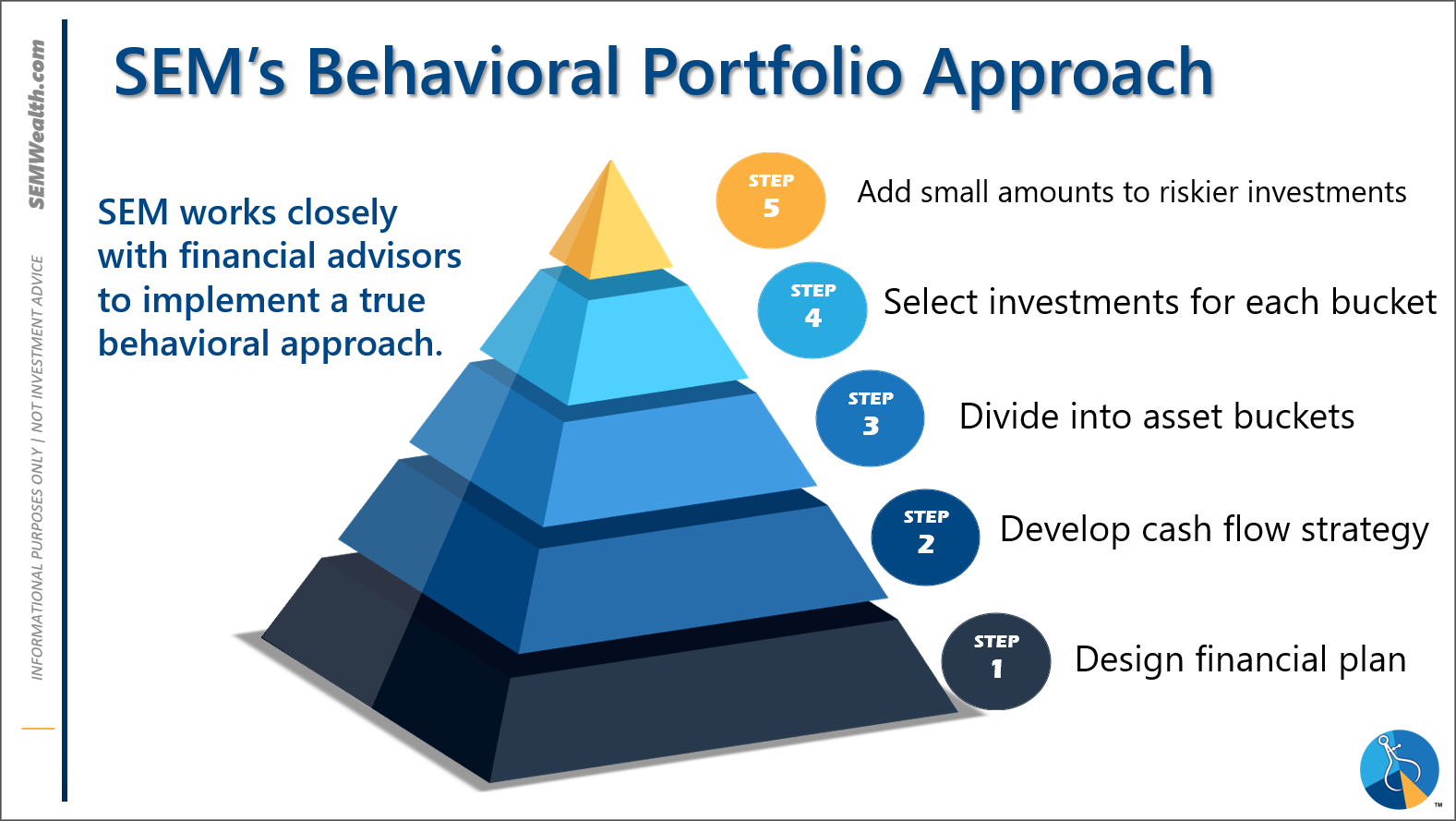

For everyone else, I encourage you to stick to your PLAN. Some plans allow the "top of the pyramid" for 'speculative' investments such as individual AI stocks, ETFs, or other more focused strategies. For everybody else, our experience tells us you are best to base your investment allocation on your financial plan, cash flow strategy, and risk personality, not what sector (or stock) you believe is going to make you rich.

By the way, since the theme this week is AI, I thought I'd ask Chat GPT, "How do I find the next big AI stock?" The answer was pretty academic, but in my opinion a well defined synopsis of the steps that must be taken. I'm not at all 'anti-AI'. In fact, I firmly believe AI is going to make all of our lives better and increase productivity........just as the internet build out did. The problem is NOBODY knows which companies will profit the most from this build-out. Far more companies will end up failing.

If you're curious how to find the next big AI stock, here's what AI says you need to do:

NOT INVESTMENT ADVICE!!!!!

Market Charts

On Thursday, President Trump, the newly minted "Time Person of the Year" made what can only be described as a "triumphant" entry on Wall Street. The amount of Wall Street execs who had distanced themselves from Trump throughout the last four years suddenly were pushing each other to sing his praises. As we should expect, the President-elect again mentioned the "tremendous" performance of the stock market (one quote - "we've never seen anything like it" – fact check - there have been plenty of 4.7% rallies over 5 weeks.)

I'm surprised Jim Cramer did not have a heart attack over the excitement of President Trump's reception. At one point he said, "everybody in America's lives are suddenly going to get better on January 20." I think there are plenty of things going well and a few things which will "suddenly" get better, but unless you are a hundred millionaire like Jim Cramer or most of the people chanting "USA" on the floor of the NYSE as the bell rang, it may not be "sudden". For some, their lives will actually be worse.

I'd encourage those leaning towards Cramer's assessment to watch our "Broken Economy" series. From what I've seen, the promises made by the President-elect will only further expand the chasm between the upper and lower-half of the K.

Since the theme this week is "AI" I decided to ask Chat GPT another question, first to generate a graphic for the K-shaped economy. When it did so it identified who is in the "struggling groups".

Those identified were: service industry workers, small business owners, and rural populations. I was intrigued why the "data" used to generate this suggested this and what it believes the impact would be. Since AI cannot make speculations, it can go off of what has happened historically. In this case, most of Trump's campaign promises are even more "yuge" than the first round. Chat GPT identified why some of his policies did not benefit the "struggling" (lower half of the K) groups.

- Focus on Deregulation and Tax Cuts: The data shows service workers and small businesses saw few direct benefits. Because rural areas often are where small businesses are located, they also did not see the "trickle down effect".

- Trade Policies & Tariffs: We discussed this last week. Click here for the full discussion. Let me be perfectly clear because the President again made this false statement on Thursday at the NYSE — Tariffs WILL NOT make grocery prices go down. They will go up — potentially by a significant enough amount to lose the mid-term elections and possibly to have the Fed forced to raise rates and lead to yet another Powell versus Trump showdown.

- Health Care Policies: the threatened (and unsuccessful) attempt to dismantle the Affordable Care Act (Obama Care) in his first term is again at the top of his agenda. We need to fix healthcare and I said from the beginning making things easier to pay for is not the way to do it. That in fact makes the underlying costs even higher. However, truly fixing the system will more indirectly impact the lower half of the K than the upper half.

- Minimum Wage Stagnation: Wages continue to lag behind inflation, which hurts those in the lower-half far more than the upper-half.

- Infrastructure Spending and Rural Investment: Paraphrasing ChatGPT's response, Trump 1.0 was "all talk, no action" on this critical topic which impacts rural areas far more than any other. His attack on most of Biden's spending plans (I share some of those negatives, but have pointed there were some positives, including our area's Fiber network build-out, which was funded by the "inflation reduction act".)

- Education and Workforce Development: I also agree with the idea of cutting the Department of Education, as I stated in this popular LinkedIn post. That said, Trump 1.0 did very little for retraining programs and to support more 'trade' training, which is one reason we started the Tyler Hybiak Memorial Fund after our son's death in 2020. End federal student loans and hold higher education institutions accountable – yes. Defund trade schools, High School Vocational courses, and other critical training – that is a mistake and disproportionately hurts the lower half of the K.

Back to the markets. Interestingly enough, the market was down both Thursday and Friday after President Trump rang the opening bell. It wasn't significant and nothing should be made of it, except for his continued touting of "his" market performance and the "trillions" he is adding to the economy via stock market growth.

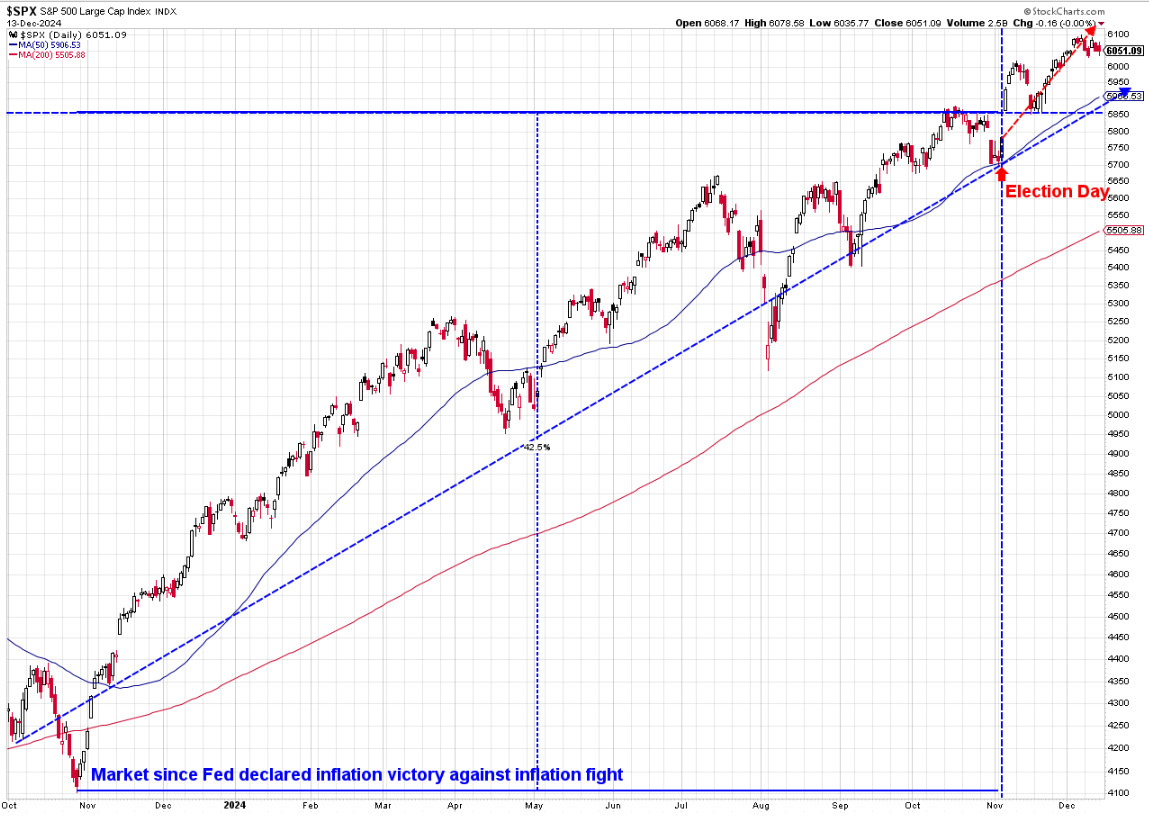

President Trump continued to expand the spin on who gets credit to the market rally and when he should begin getting the credit when he said on Thursday, "People have told me I should get credit going back to the summer because the market started rallying as soon as it was clear I was going to win." Not to reign on the parade, but this chart is important as it shows when the rally truly started.

The market was selling off until the Vice Presidential Debate. After that it appears (with hindsight) that was the thing that despite the polls seemed to be when Harris lost the election. People were already skeptical of her ability to lead and Tim Walz, to put it nicely, did not perform very well. Conversely, those who were 'worried' about an unchecked Trump 2.0 were swayed by J.D. Vance's calm, logical, intelligent performance, which combined with Walz's performance seemed to win the 6-8% of Independents who still hadn't decided whom to vote for.

Despite that, the market simply continued the trend started last year when the Fed said the inflation fight was over and started prepping the markets for some rate cuts.

Markets cannot go straight up for ever so we should expect a pullback to a more reasonable uptrend. That likely is the blue trendline started when the Fed was ending their inflation fight. In fact, the more it sells off this month, the better potential we have for a nice 2025 to actually happen.

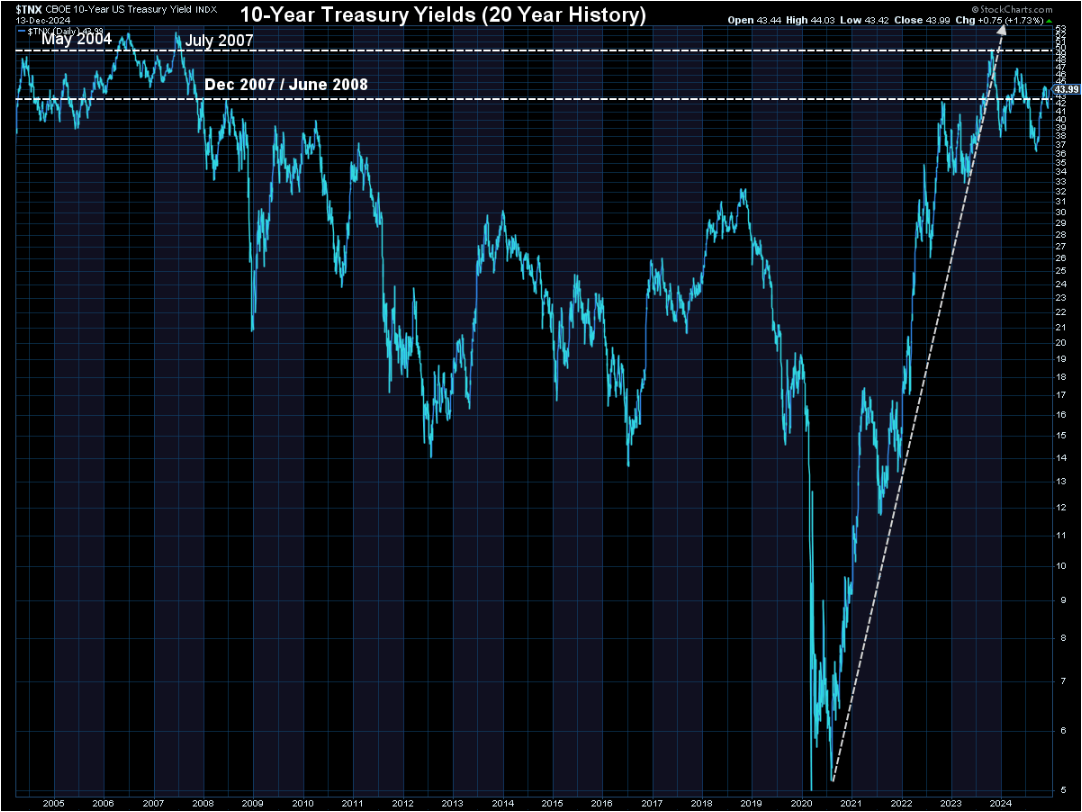

Again, what will be critical is what happens to interest rates. I'm not talking about the Fed, but about the market-set long-term interest rates. Those in the lower half of the K do not enjoy the cuts the Fed is making on rates – all of those on the floor of the NYSE on Thursday most certainly do. If long-term rates move higher that will be a problem. I like this chart for perspective. I'm happy when we are below the December 2007/June 2008 level. I'm worried when/if we get back above that July 2007 level. Last week rates climbed back to the 4.4 level marking the lower band. The inflation news was not great and continues to be something we need to watch.

I think it's important that despite my "negativity", SEM's models are participating nicely (or as much as they can given each model's specific risk mandate). What makes us different than most is we do not have to GUESS what MIGHT happen in 2025 and beyond. We can let the DATA determine whether we should continue to enjoy the AI-driven party or head to the exits.

More on our current positioning below:

SEM Model Positioning

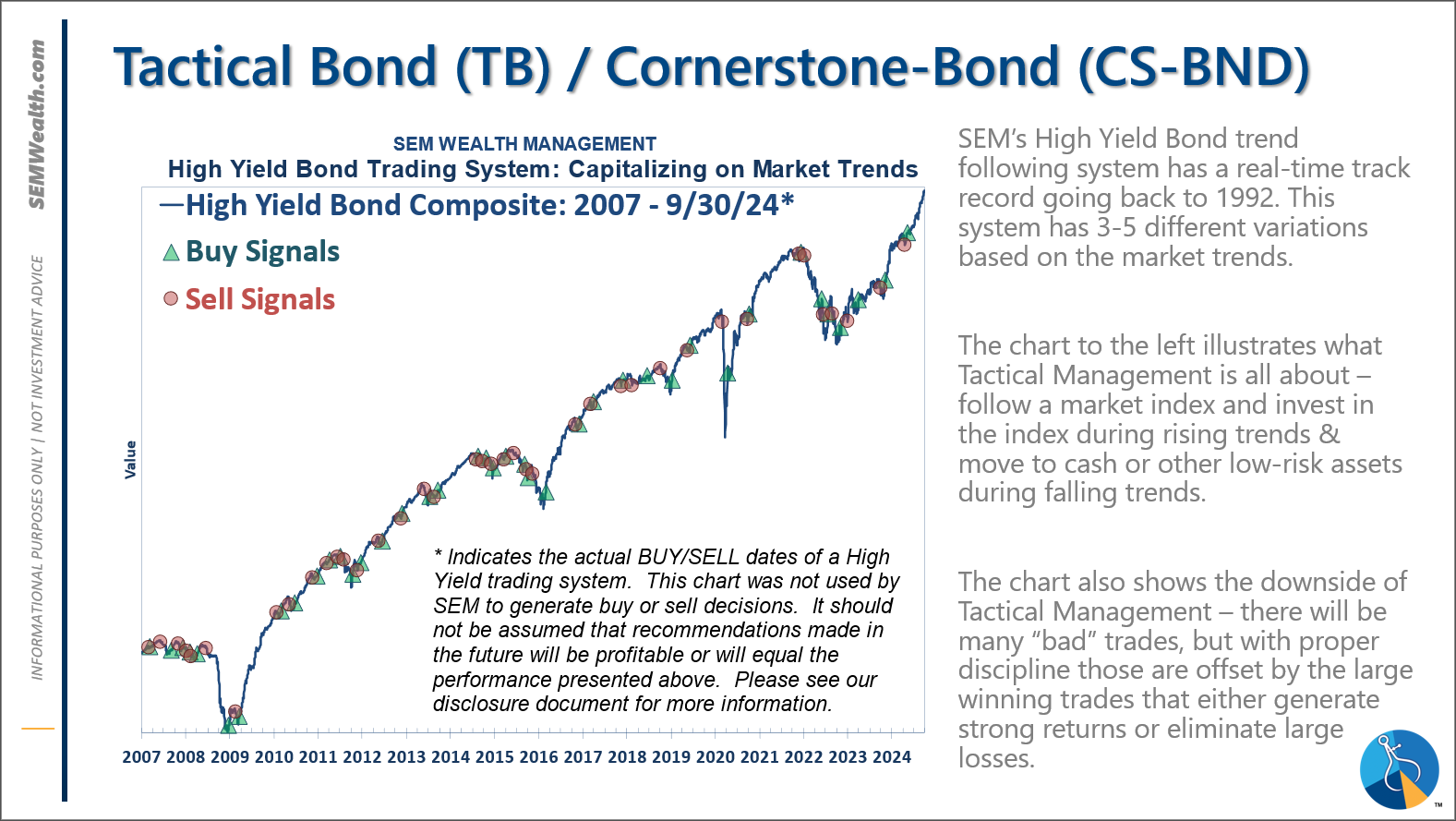

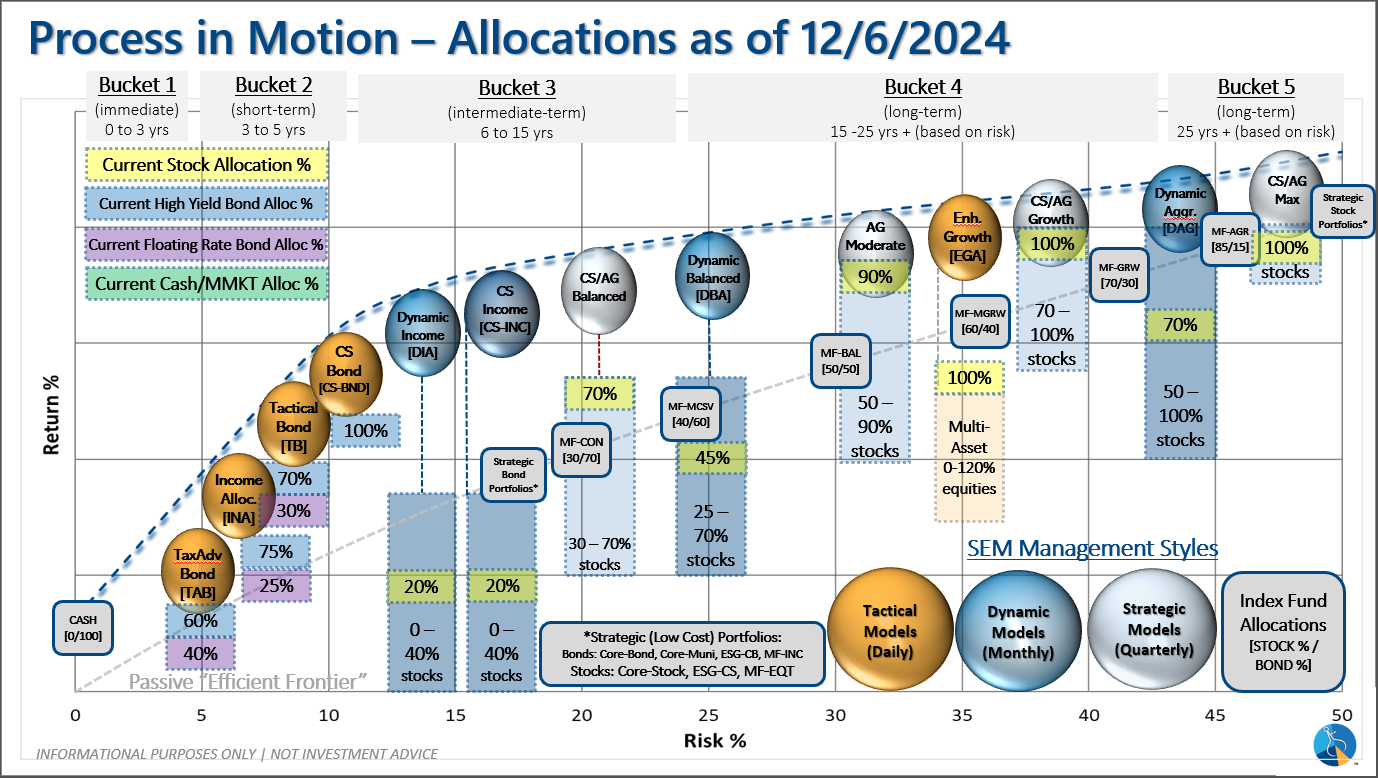

-Tactical High Yield added a 30% position in floating rate bonds, which currently have a 9% yield compared to a 6% yield in high yields and 4.6% in money markets. This follows the partial (about 67%) buy signal on 5/6/24.

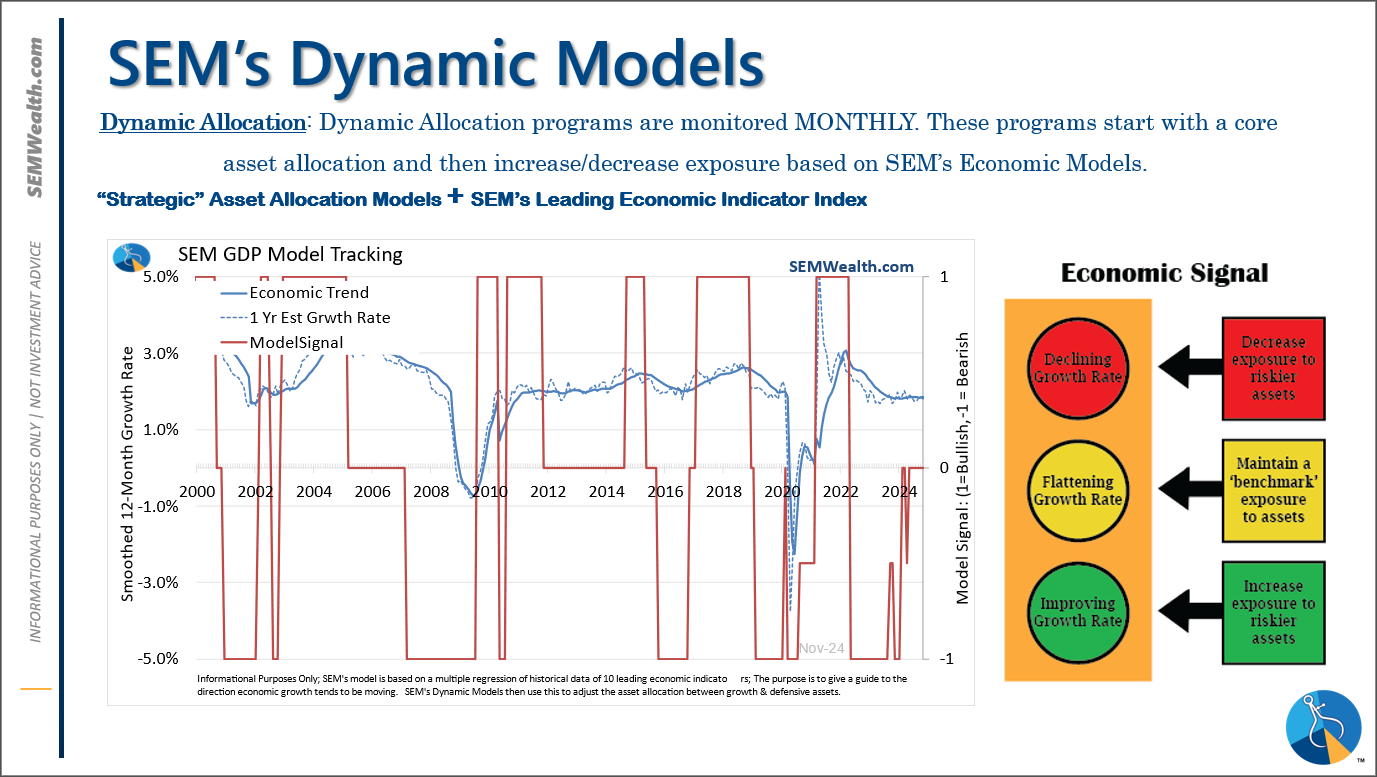

-Dynamic Models are 'neutral' as of 6/7/24, reversing the half 'bearish' signal from 5/3/2024. 7/8/24 - interest rate model flipped from partially bearish to partially bullish (lower long-term rates).

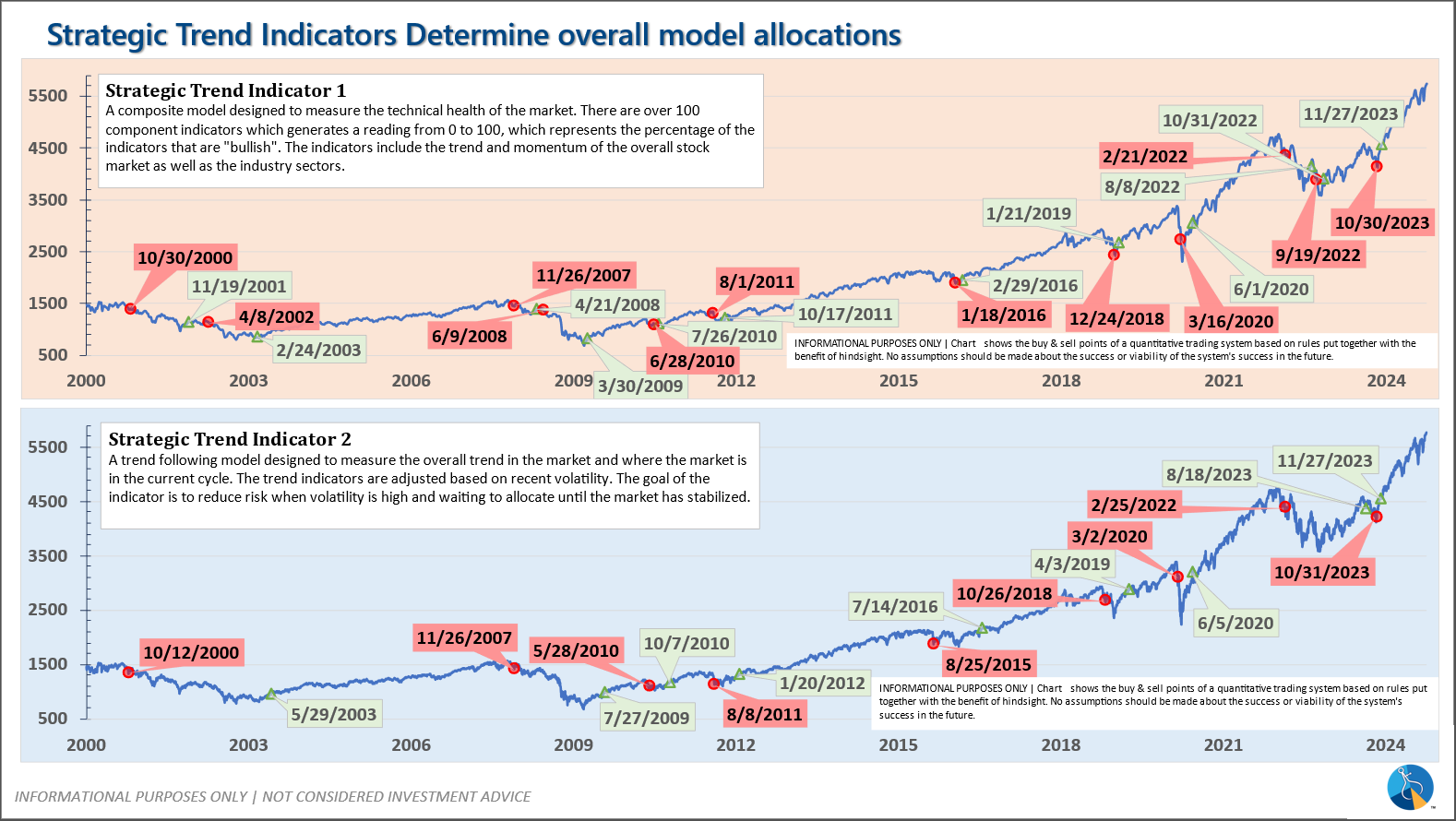

-Strategic Trend Models went on a buy 11/27/2023; 7/8/24 – small and mid-cap positions eliminated with latest Core Rotation System update – money shifted to Large Cap Value (Dividend Growth) & International Funds

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): On 12/6/2024 our tactical high yield model allocated about 30% of the portfolio to floating rate bonds, which are shorter duration and have a higher yield than traditional high yield bonds. These instruments are not as sensitive to credit risk and are typically allocated to in the early and late stages of a high yield bond move in our model.

Dynamic (monthly): The economic model was 'neutral' since February. In early May the model moved slightly negative, but reversed back to 'neutral' in June. This means 'benchmark' positions – 20% dividend stocks in Dynamic Income and 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is slightly 'bullish'.

Strategic (quarterly)*: BOTH Trend Systems reversed back to a buy on 11/27/2023

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Questions or comments - drop us a note?

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire