Last week on an advisor call I was recapping my post-election blogs as I discussed: the euphoric post election rally, not letting political opinions influence our investment decisions, valuations and the chances of yet another 20%+ rally in 2025, what tariffs really are and the likely impact on the economy (and inflation), and the prospects of AI and finding the next great AI stock. A comment was made towards me, "you sound like Ebenezer Scrooge. Does nothing make you happy?"

Ebenezer Scrooge was described by Dickens as "a squeezing, wrenching, grasping, scraping, clutching, covetous, old sinner! Hard and sharp as flint,… secret, and self-contained, and solitary as an oyster." Hopefully those who know me do not believe this, but if you read a lot of my blog entries you would see a lot of "negatives" in my posts. One thing you may not understand with my entries, especially if you haven't been around SEM for a while is these posts are designed to counter what is being widely circulated in the financial media or coming up in our client meetings.

Since this is a short week for most (or a vacation week for others), I won't go deep into why I try to counter the mainstream messaging of the time other than saying after 30+ years of doing this that by the time most Americans believe something it is close to the end of that current trend. I like to give everyone data-driven counter ideas to think about. With valuations at or above past bubble levels, there has certainly been a lot of "have you thought about what could go wrong" posts. This doesn't mean I'm not optimistic about many things going into 2025. Some of those include:

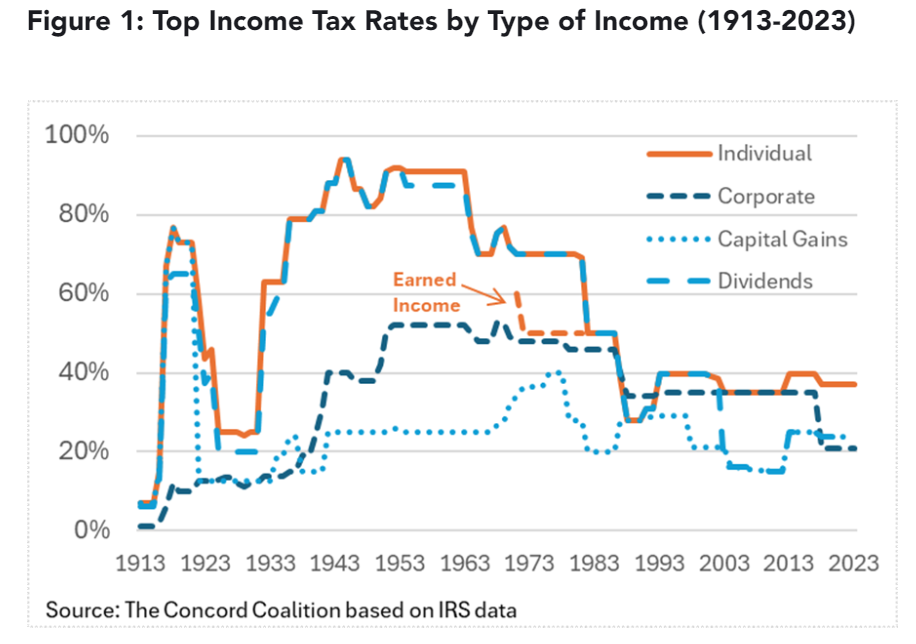

1.) Taxes should stay the same or be lowered – It may not have the impact some believe it will have and in some cases may do more long-term damage than we would like, but all things equal, letting Americans keep more in taxes is better than making them pay more.

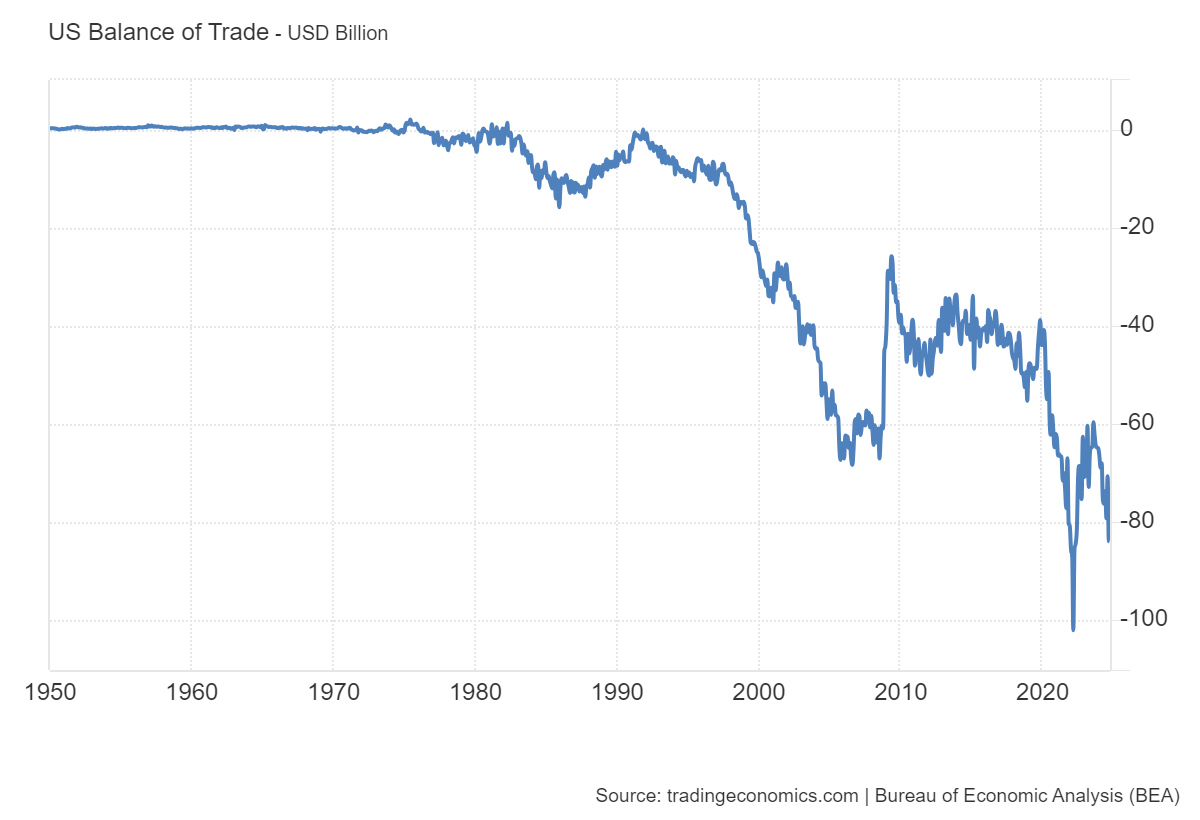

2.) At least somebody is willing to look at our trade deficit and do something about it – Again, the short-term impact may be opposite of what some people believe, but we MUST fix the imbalance we have to push our economy back above the long-term 3% average. (By the way, the data below shows the trade deficit worsened under Trump 1.0 even before COVID, but as I documented throughout his presidency, this was due to his hyper focus on the change in the stock market that week.)

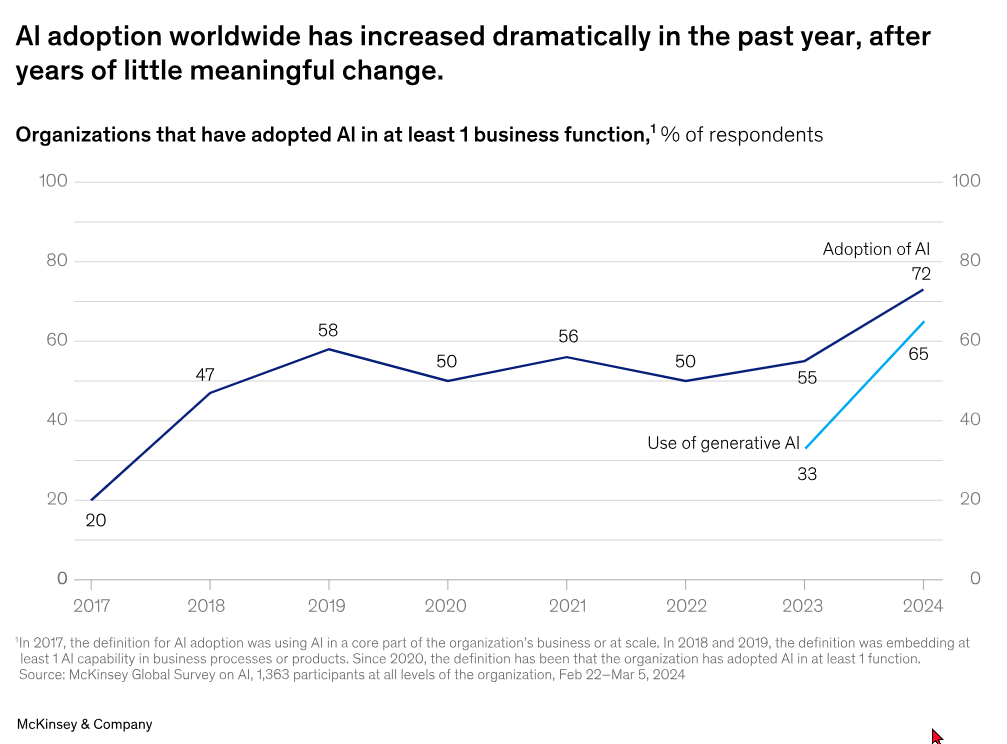

3.) AI has great potential -- You may be using it in every day life already to make yourself more productive. For me, the AI summary at the top of Google searches or the Amazon review summaries are quite helpful. We've also used AI tools to help us narrow down clips from "Money Talks with Dad" and other much longer videos. I still question how much consumers will be willing to pay for these tools and how long the investment will take to pay off, but AI is certainly one of the best innovations since the internet and personal computing became available to the mainstream in the mid-1990s.

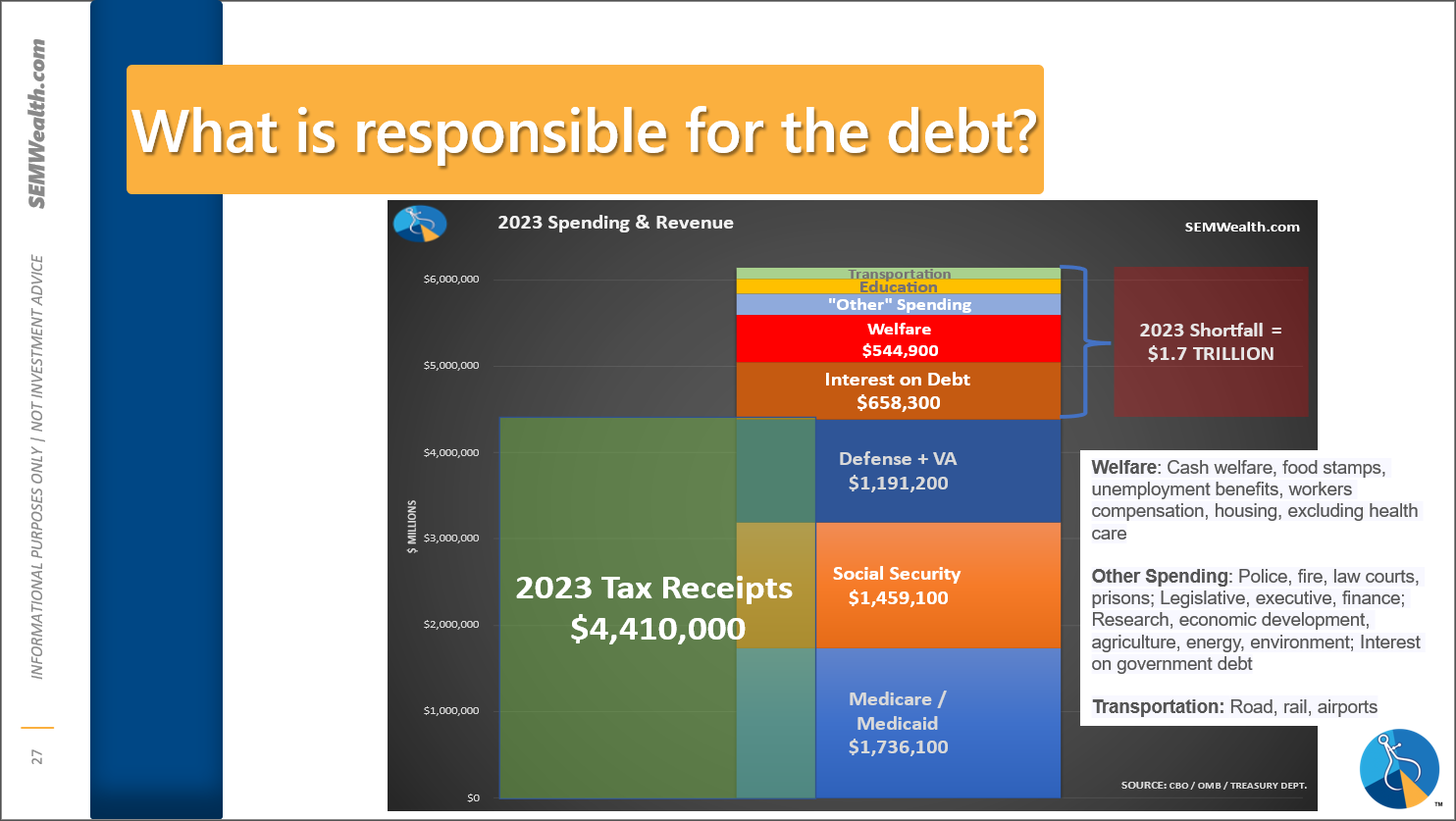

4.) There is actual talk of cutting the only spending categories that matter in terms of our national debt – Social Security, Medicare, and Defense -- Like him or hate him, Elon Musk and the Department of Government Efficiency (DOGE) is something that needs to happen.

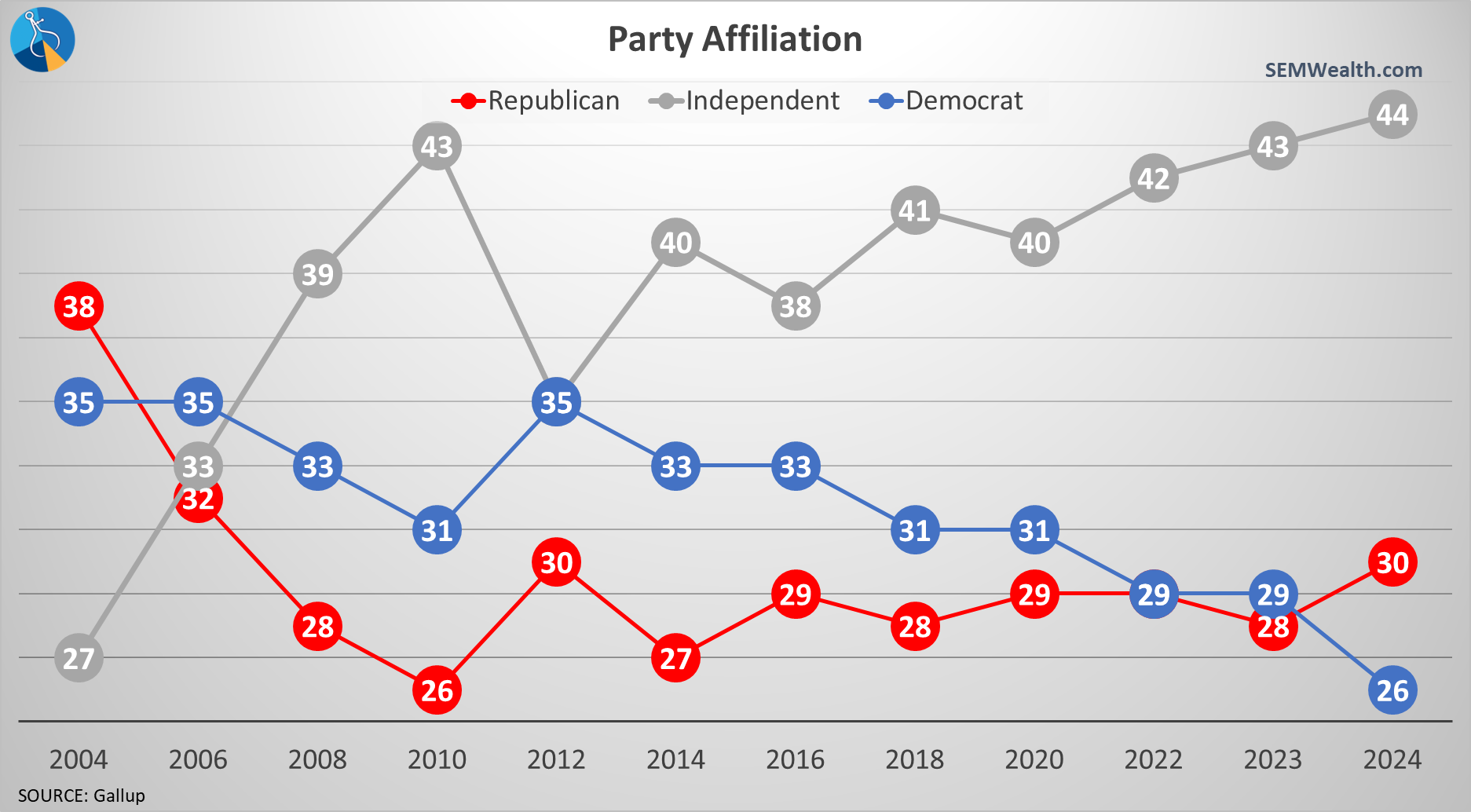

5.) Independent/moderate voters still control the vote, despite the "mandate" the extreme right believes they won – Americans more and more are seeing we have problems, that a lot of the problems are in what used to be highly regarded institutional structures, and we are willing to tear them down in order to fix things for the long-term.

If your time horizon is long-term (longer than 10 years), these are all GREAT things and you shouldn't worry about the short-term things I've been warning about the last 6 weeks. Regardless of your time horizon or political beliefs, Merry Christmas! We live in a (still) great country that cannot be ruined by one political party having control for a couple of years.

For those with a shorter than 10 year time horizon, please do not get sucked into the current euphoria. I'll be back next year to provide more things you should be worried about.

Market Charts

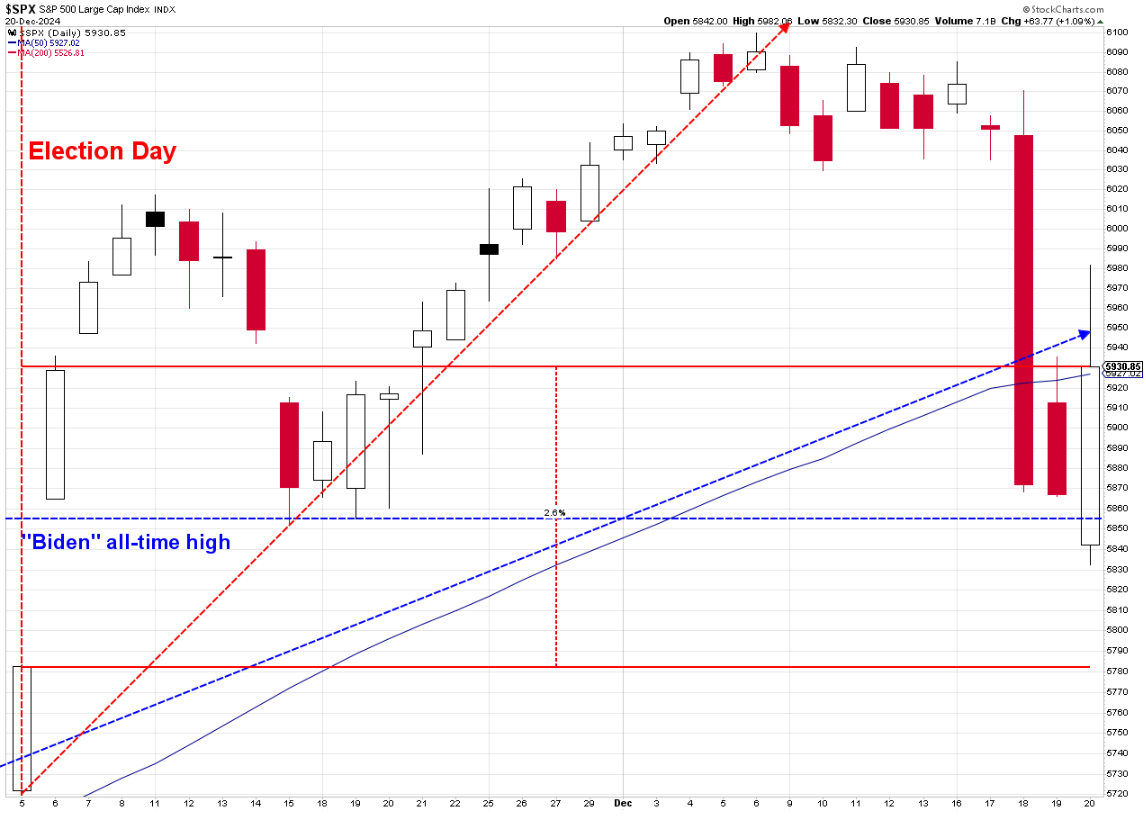

The 'everything is awesome' post-election rally seems to have ended on December 9. For those only focusing on giving credit to Trump, the last week is obviously concerning.

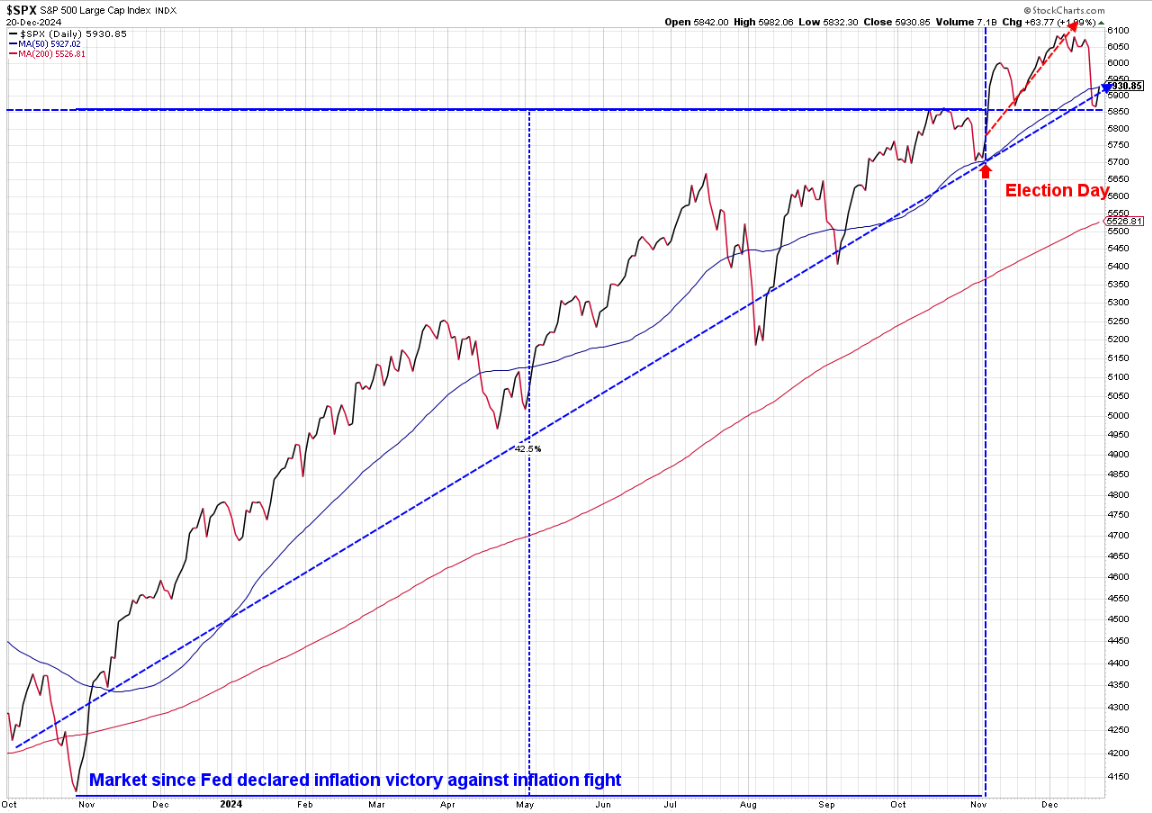

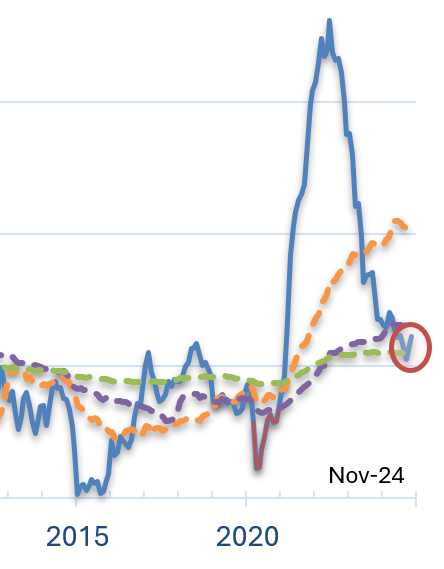

However, for those who realize the markets are far bigger than any one President, Congress, or political party, the pullback was healthy, leaving the uptrend which began over a year ago when the Fed essentially said, "mission accomplished" on their inflation fight.

That narrative though took a hit last week, first when the Fed ratcheted down expectations of several more rate cuts in 2025. I'm not sure why the market was surprised — if GDP is going to grow at an above average rate of 3%, which is the current market (and Fed) expectation and inflation is very near the Fed's target level of 2% (but still above it), why in the world did anybody believe the Fed would cut rates by that much?

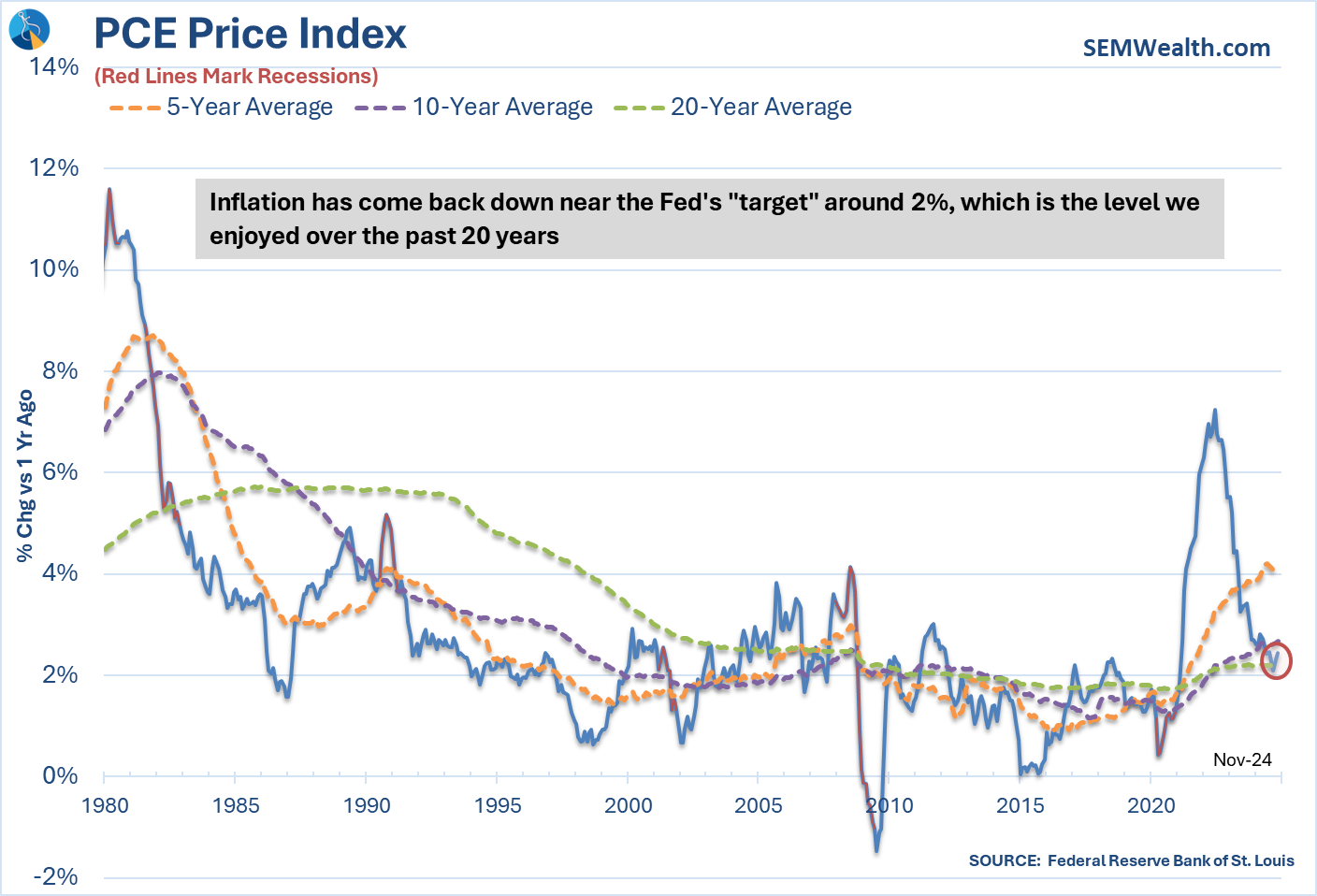

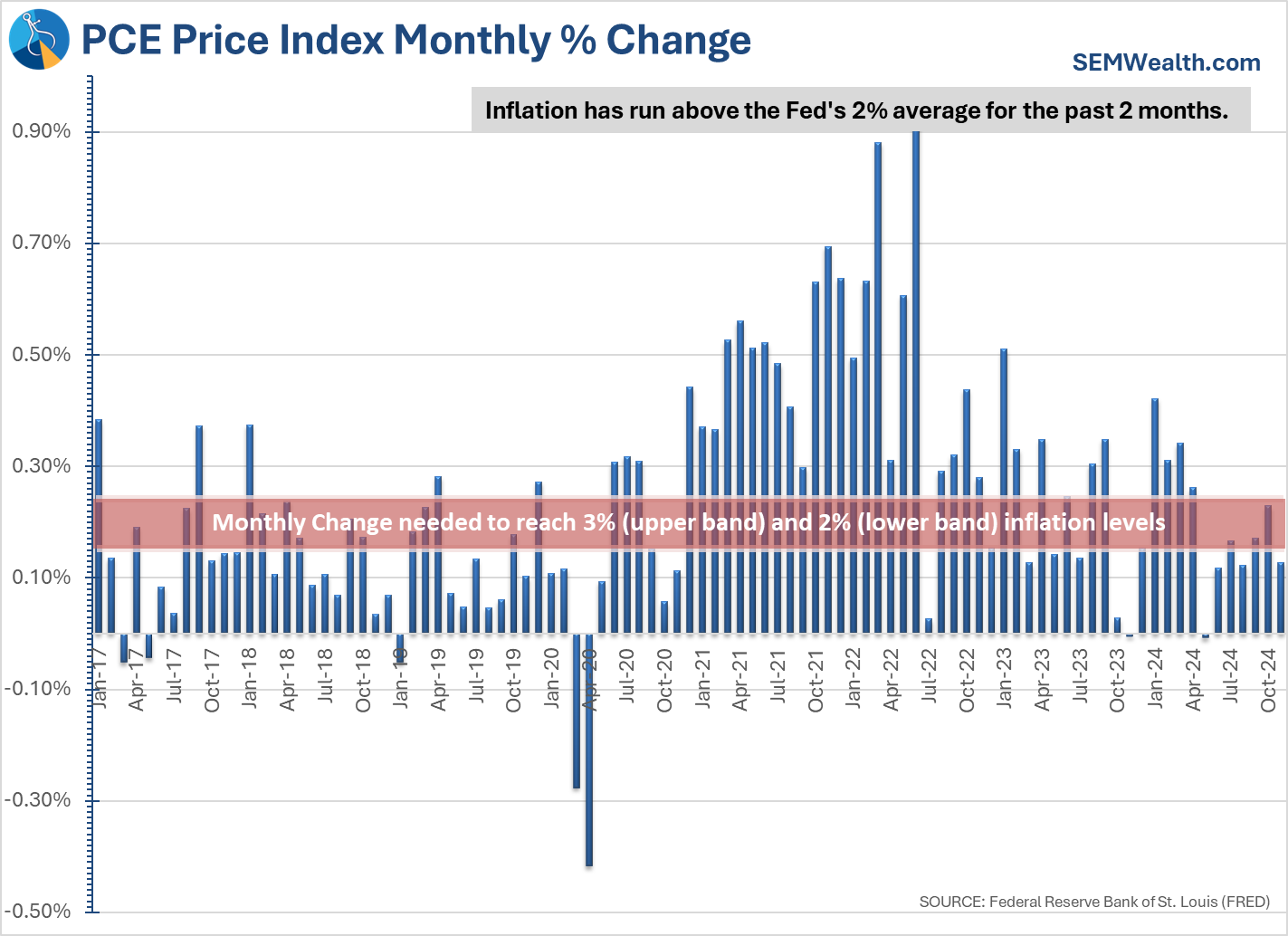

On Thursday, the Fed's preferred measure of inflation was released and again "surprised" the market. Here is the long-term chart:

If you zoom in to the red circle, you can see what has everybody concerned – the 12 month change hooked higher in November, obviously a threat to the narrative that inflation was coming back down to 2% (and justifying further Fed rate cuts).

Looking at the monthly chart, November's number was actually lower than the past 2 months. The hook higher was a function of the slightly negative November 2023 reading dropping off the 12 month number.

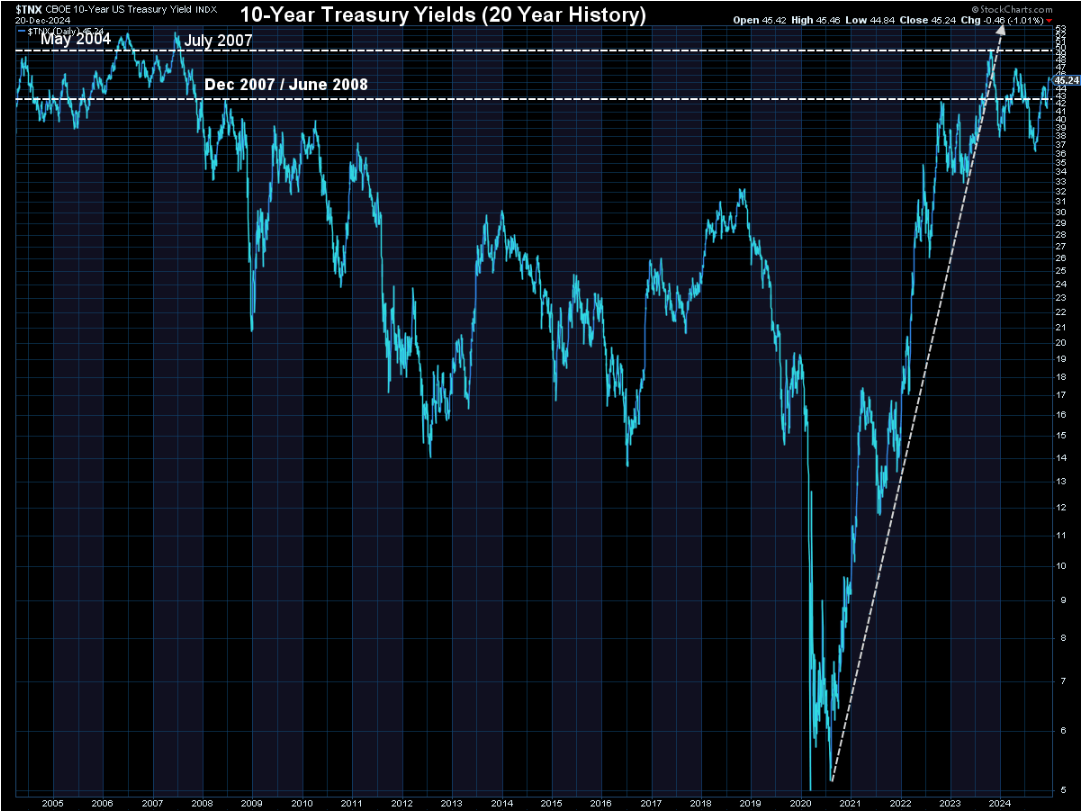

Regardless, the bond market should be all that matters. The Treasury Bond market continues to have a completely different outlook than the Fed & has been raising long-term interest rates since September. We're still below the peak from last November, but given the shenanigans in Washington, the continued wishy-washiness from the Fed, and the potential for tariffs and mass deportations causing prices to go up, we should pay far more attention to what the Treasury market has to say than the Fed.

SEM Model Positioning

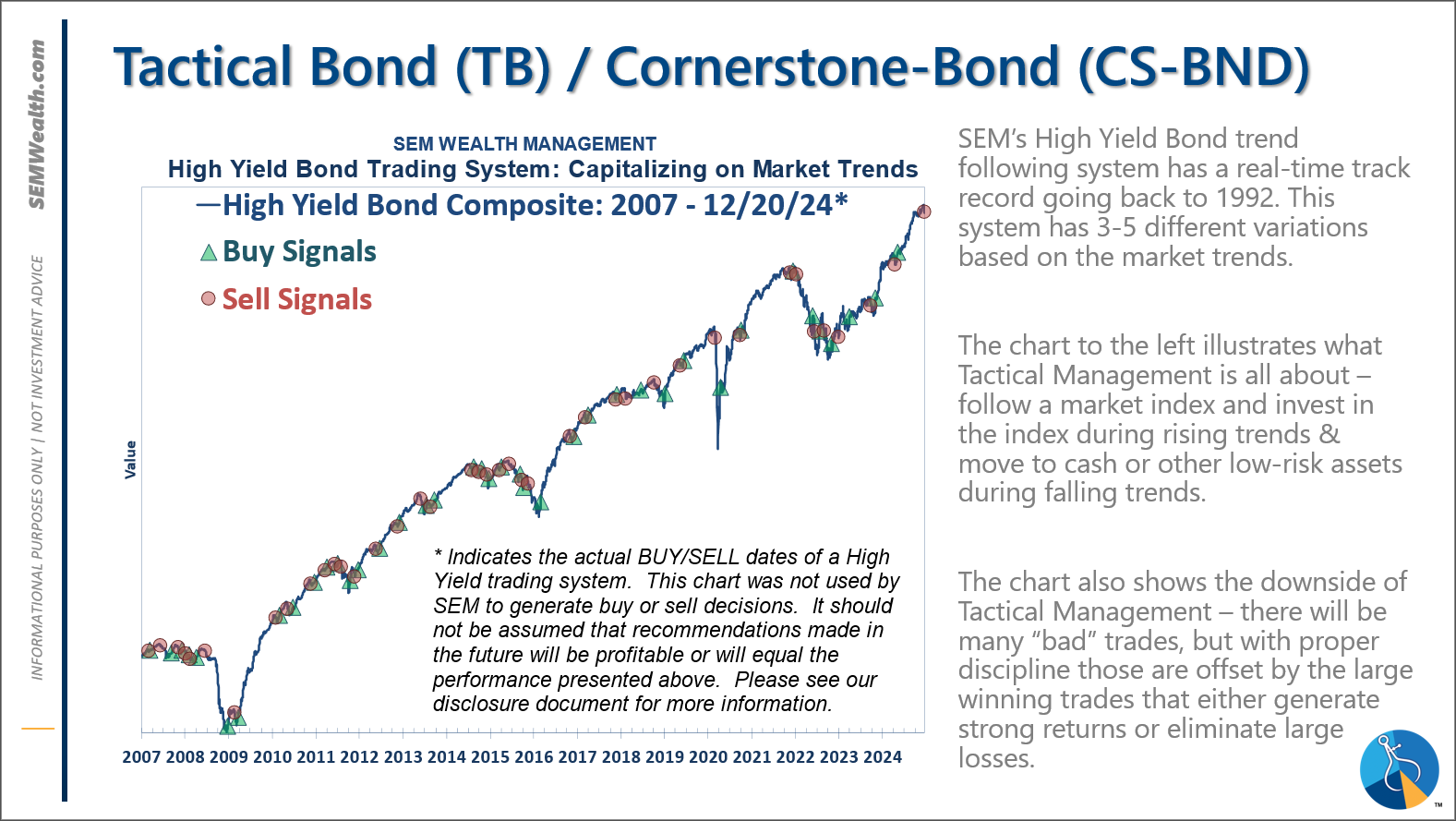

-**NEW* Tactical High Yield* sold our high yield bond positions purchased last spring on 12/20/24. We had added a 30% position in floating rate bonds on 12/6/24, which currently have a 9% yield compared to a 6% yield in high yields and 4.6% in money markets. This follows the partial (about 67%) buy signal on 5/6/24.

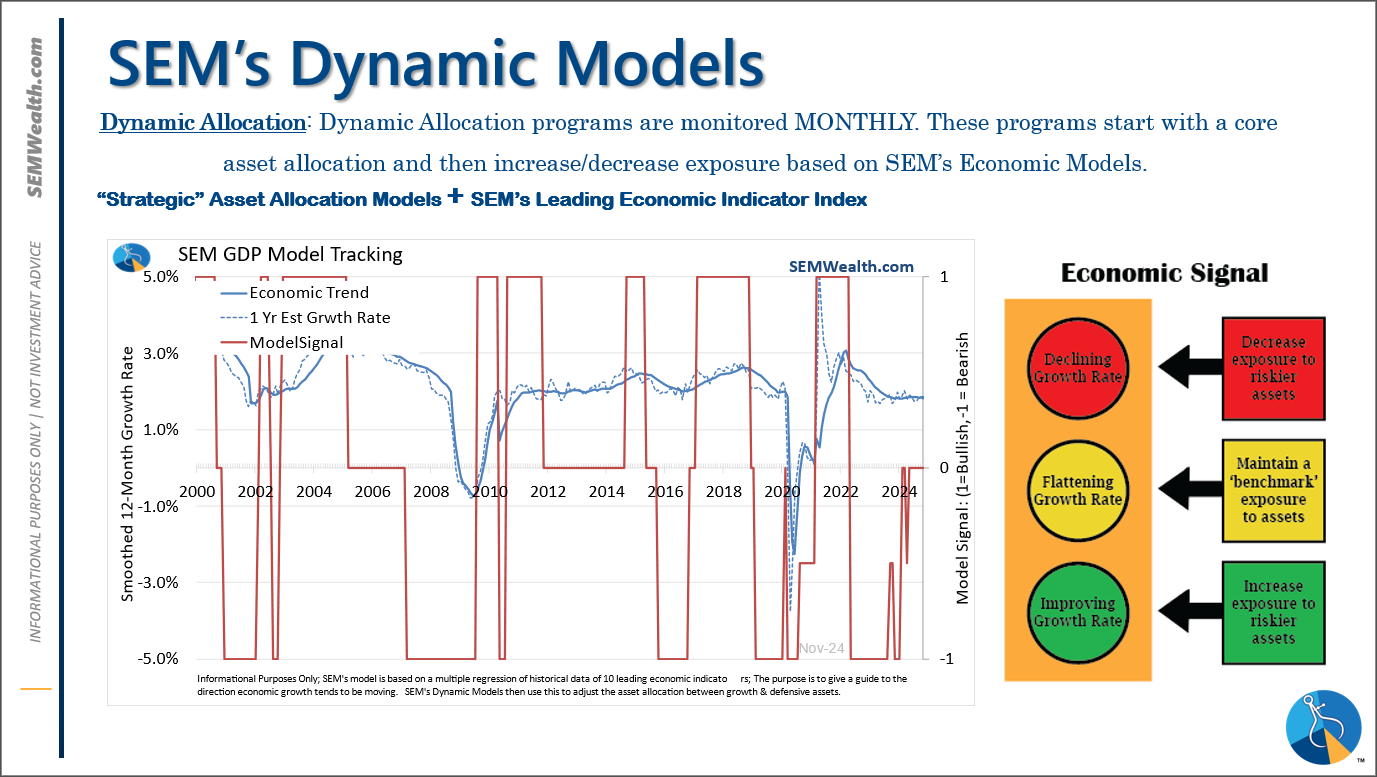

-Dynamic Models are 'neutral' as of 6/7/24, reversing the half 'bearish' signal from 5/3/2024. 7/8/24 - interest rate model flipped from partially bearish to partially bullish (lower long-term rates).

-Strategic Trend Models went on a buy 11/27/2023; 7/8/24 – small and mid-cap positions eliminated with latest Core Rotation System update – money shifted to Large Cap Value (Dividend Growth) & International Funds

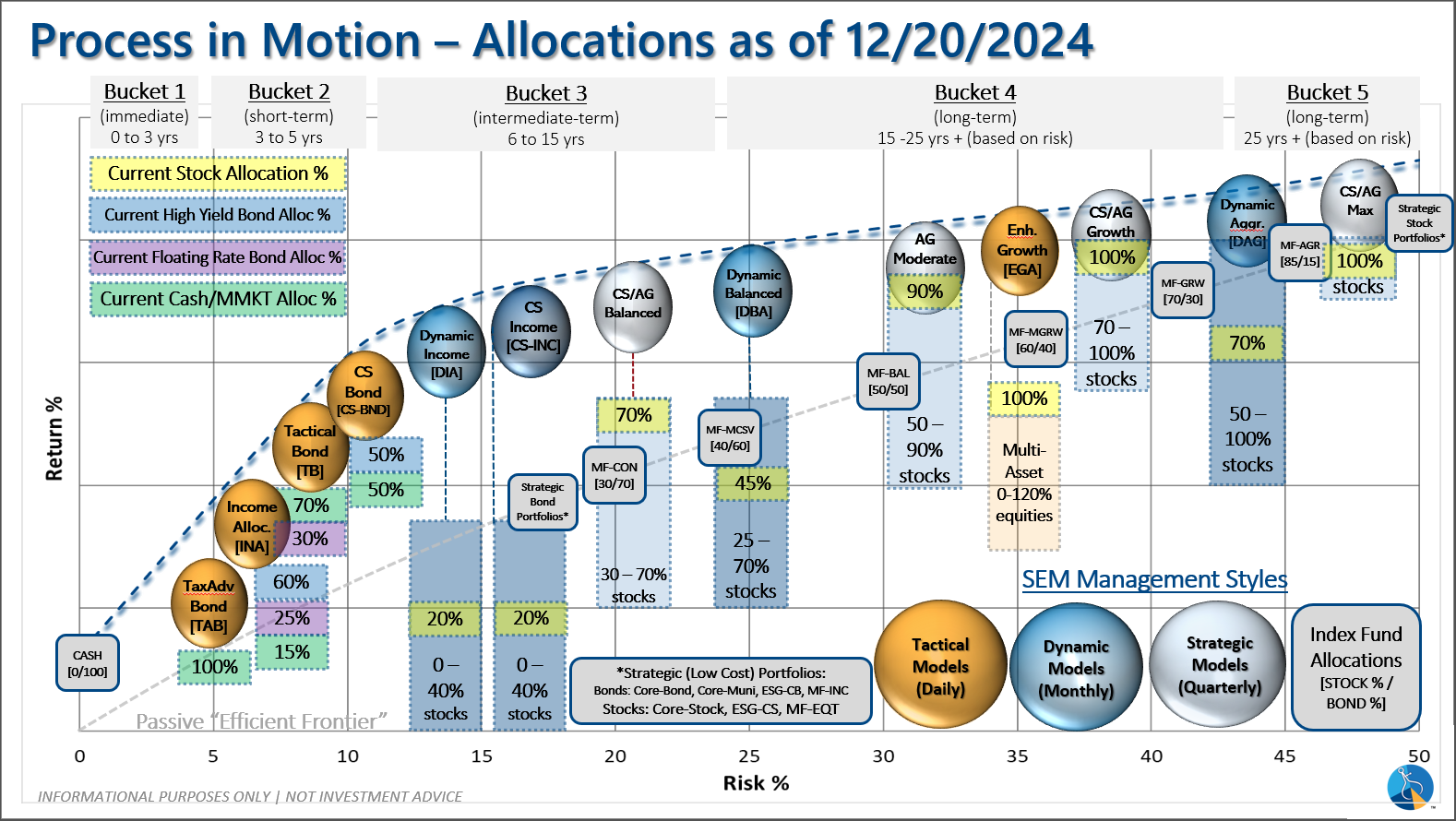

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): On 12/20/2024 our tactical high yield model sold out of high yield bond (about 70% of our holdings) into money market. The other 30% is invested in shorter duration, higher yielding floating rate bonds. These instruments are not as sensitive to credit risk and are typically allocated to in the early and late stages of a high yield bond move in our model.

Dynamic (monthly): The economic model was 'neutral' since February. In early May the model moved slightly negative, but reversed back to 'neutral' in June. This means 'benchmark' positions – 20% dividend stocks in Dynamic Income and 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is slightly 'bullish'.

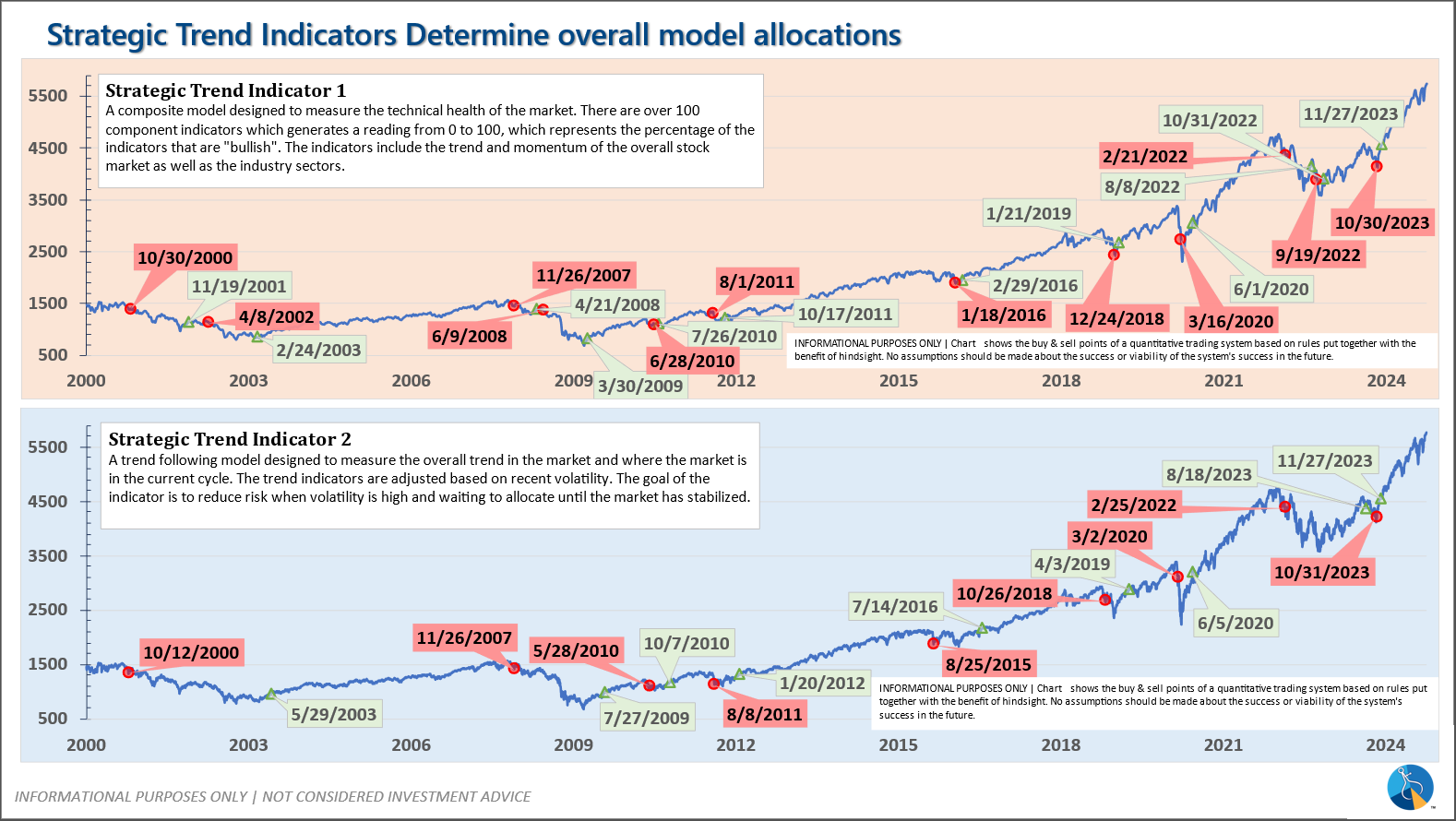

Strategic (quarterly)*: BOTH Trend Systems reversed back to a buy on 11/27/2023

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Questions or comments - drop us a note?

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire