We survived the first couple of days of 2025 along with the first test of our newly elected government – the re-election of Mike Johnson as Speaker of the House. This may seem inconsequential to some, but on Wall Street everyone was holding their breath to see whether or not we'd have some fractures in the very slim Republican majority.

This doesn't mean everything will flow smoothly, but it was nice to have a typically boring procedural vote exclude much drama. There will most certainly be plenty of times where Congress or the White House throws a curve ball to the markets. I think the most important thing for everyone should do for 2025 is to EXPECT chaos. If it happens, it's not a surprise. If it doesn't, then so long as you had a plan to adapt to whatever happens in the market this year, you're simply better off than before. It's a win-win!

I used one of my favorite clips from the office as the image for this week's blog. I thought it described pretty well what could happen in 2025 given where we are sentiment and expectation wise. Here is the full clip:

With this being the 6th year (volume) of "Monday Morning Musings (MMM)" I thought I'd kick off the first week going back to its roots. Here are some of the things on my mind as we start the first full week of 2025.

Good Trump vs. Bad Trump

As most of our long-time readers know, we try our best to stay out of politics at SEM. Whenever we do talk about it, we try to keep the discussion focused on economic and thus investment market impact of key developments. When I say "good" or "bad" Trump, I'm talking simply about the short (and intermediate) term impact on economic growth and risky assets.

We've talked about this exhaustively the past six years. It is pointless to guess what, how, and when various Trump talking points will look like when actually implemented. In general we can think of tax cuts and cutting regulations as "good". In the same way tariffs, mass deportations, and cutting the H1-B Visa program are "bad" (at least until the US economy is able to restructure itself).

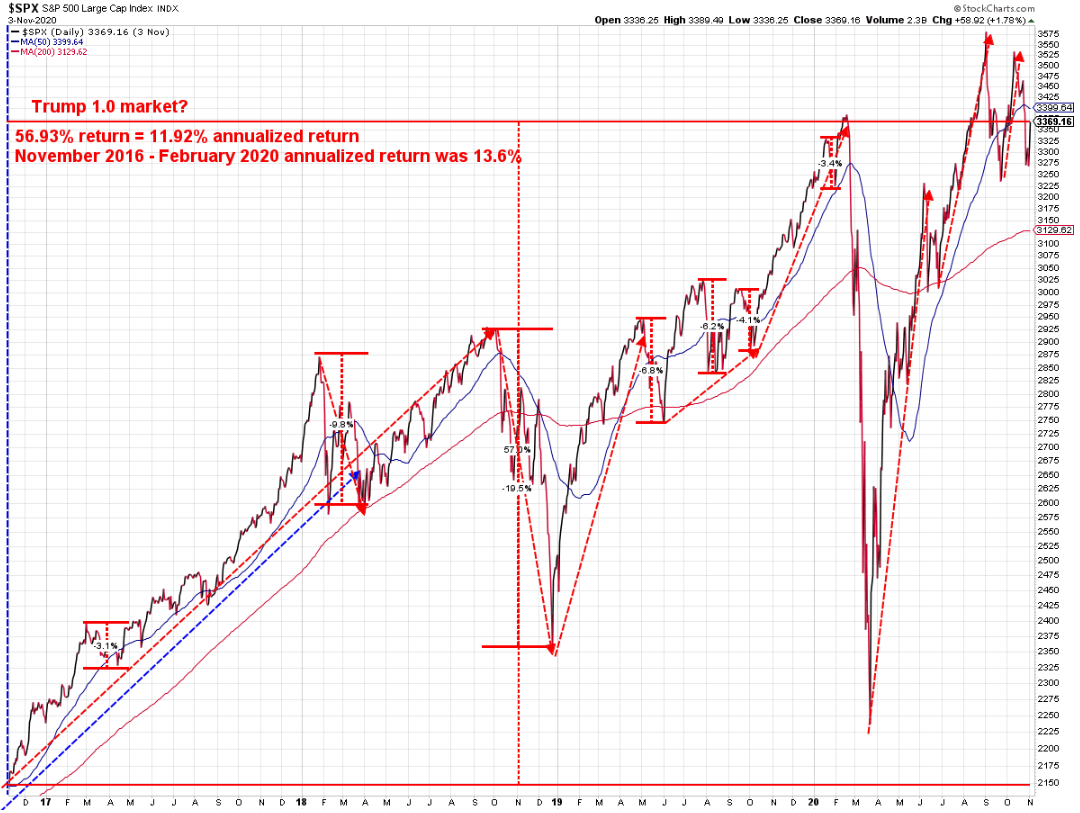

As the market digests each and every tweet (or whatever you call his posts on his buddy Elon's social network formerly known as Twitter), Truth Social post, and ad hoc press conferences and appearances, we should expect volatility. The market will vote whether the idea is good or bad over the SHORT-TERM. No matter where you fall politically, please expect stocks to look more like this in the next few years where we saw both good and bad policies.

Markets are much more volatile this decade

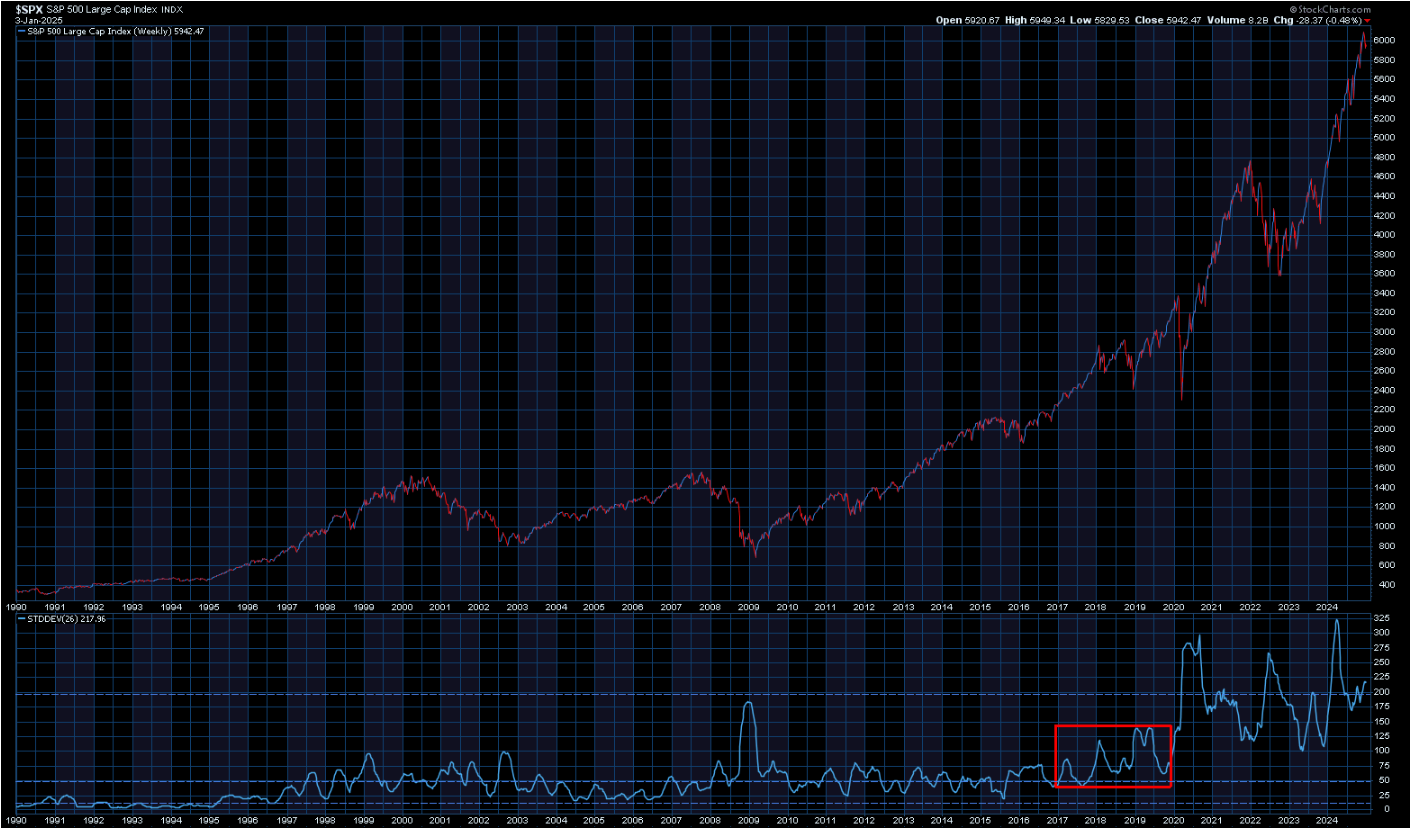

Looking at the chart above I wondered if the big up and down moves were simply normal market fluctuations, so I created the chart below. The chart is of the S&P 500 and goes back to 1990. The bottom half is the 26 week standard deviation (about 1/2 a year).

Standard deviation essentially measures the range of returns over a given period of time. What you will notice is we have seen big shifts in volatility. There are academic and fundamental reasons behind this, but I'll leave that to the academics to write the papers on. The first shift occurred during the end of the tech bubble in the mid-1990s.

Following the bursting of the bubble, volatility calmed down quite a bit. We saw a temporary spike during the financial crisis, but from 2010 until 2016 volatility essentially remained in the same range we enjoyed for the prior 20 years. In 2017-2019 (the red box) you do see a noticeable spike in volatility. What is interesting is that spike seems minor when compared to what we've experienced from 2020 until today.

The main lesson from this is we should EXPECT wild swings from stocks.

Are you an INVESTOR or a SPECULATOR?

For the better part of the past 16 years, anybody who diversified their portfolio outside the largest companies (or heaven-forbid rebalanced back to their original diversified portfolio) ended up trailing the "markets" as measured by the S&P 500. Investing takes patience, especially when buying smaller companies or those in the "value" category. The Federal Reserve's policies have punished the smaller companies and value stocks and rewarded those who already had the highest cash flow and least amount of debt (like technology focused companies).

Speculators instead buy investments with the hope of selling them for a profit. Unlike investors who take a long-term focus by understanding the nuts and bolts of the companies they invest in, speculators only care that the upward momentum continues. When it wanes, they skip over to the next 'hot' stock.

Will the highly focused stock market rally continue? History tells us it COULD for another year or three. History also tells us when things are this highly focused on a handful of stocks and industries, it always ends badly. Mathematically these companies cannot continue to dominate and attract capital. They will start eating each other (and may be already given that Nvidia's biggest customers are also in the top 20 S&P 500 stocks.) Growth simply cannot continue to go up at this pace without some sort of reset.

Are you part of the crowd?

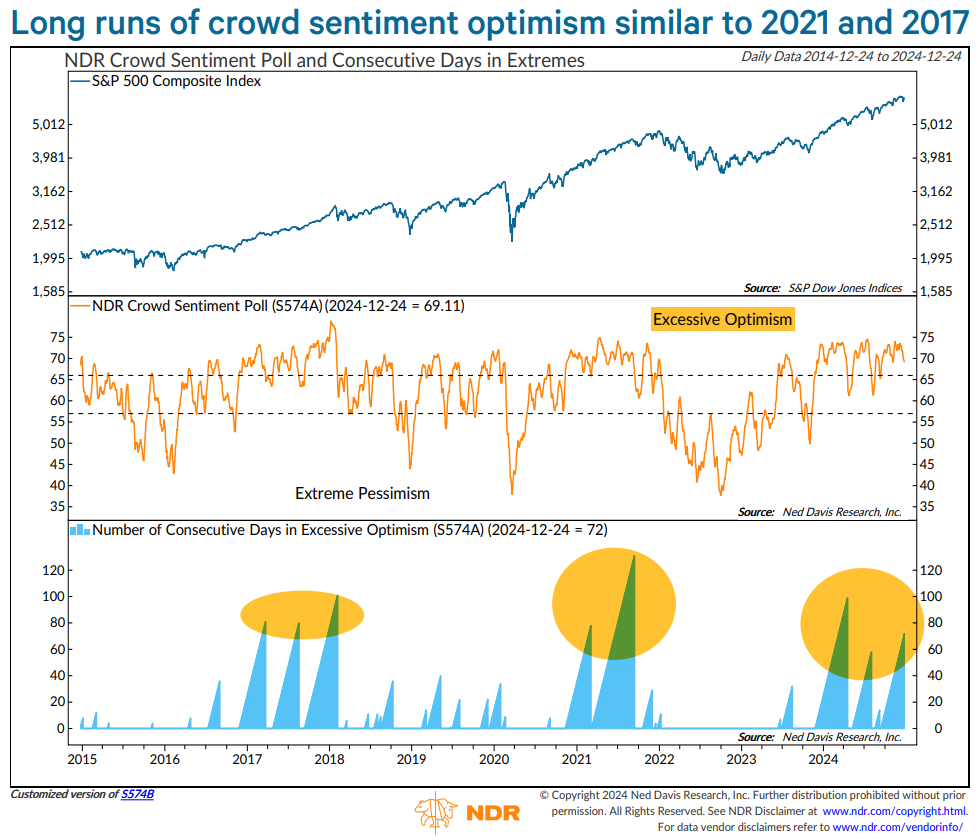

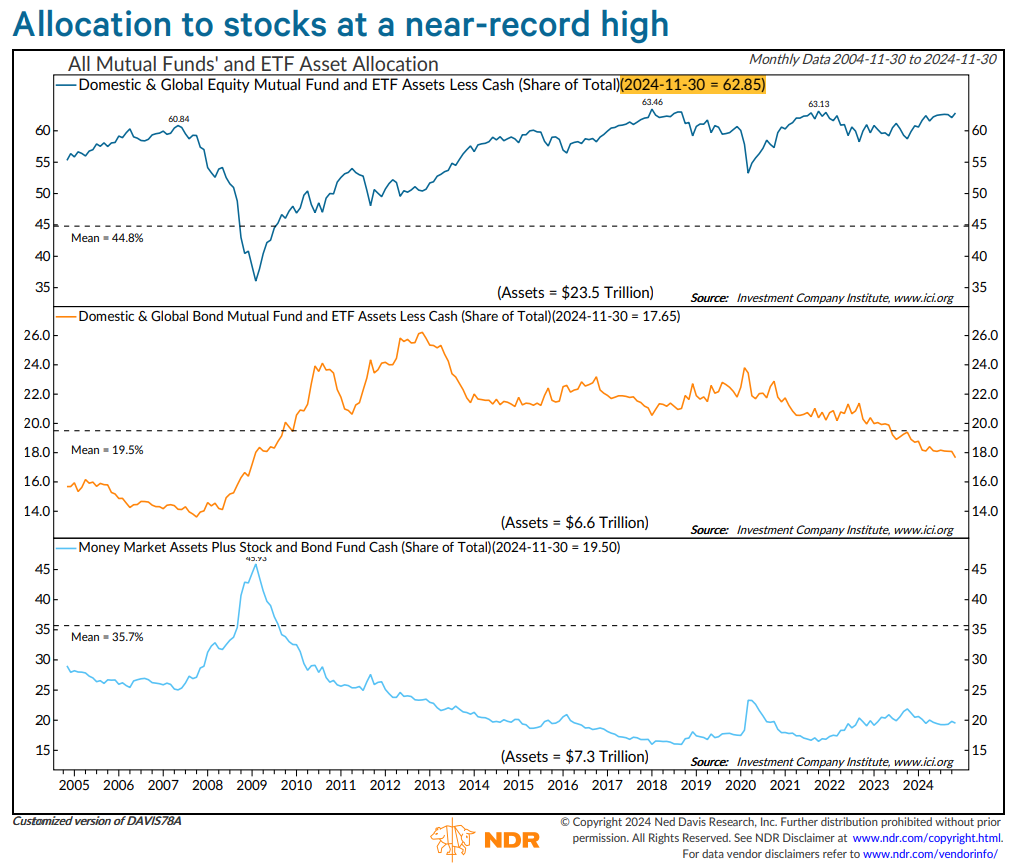

Last week we posted several 'sentiment' charts showing stocks either at or nearly at all-time highs in terms of valuations and sentiment.

This week, Ned Davis Research (NDR) posted a couple of different data points again highlighting the extremes we are currently at.

The question is, are you part of this crowd that is overly optimistic and fully invested in stocks? If so, what is your plan to get out or are you comfortable riding the inevitable reset down all the way? History tells us most investors do not have a plan and will not be comfortable when this ends.

What Wall Street Expects:

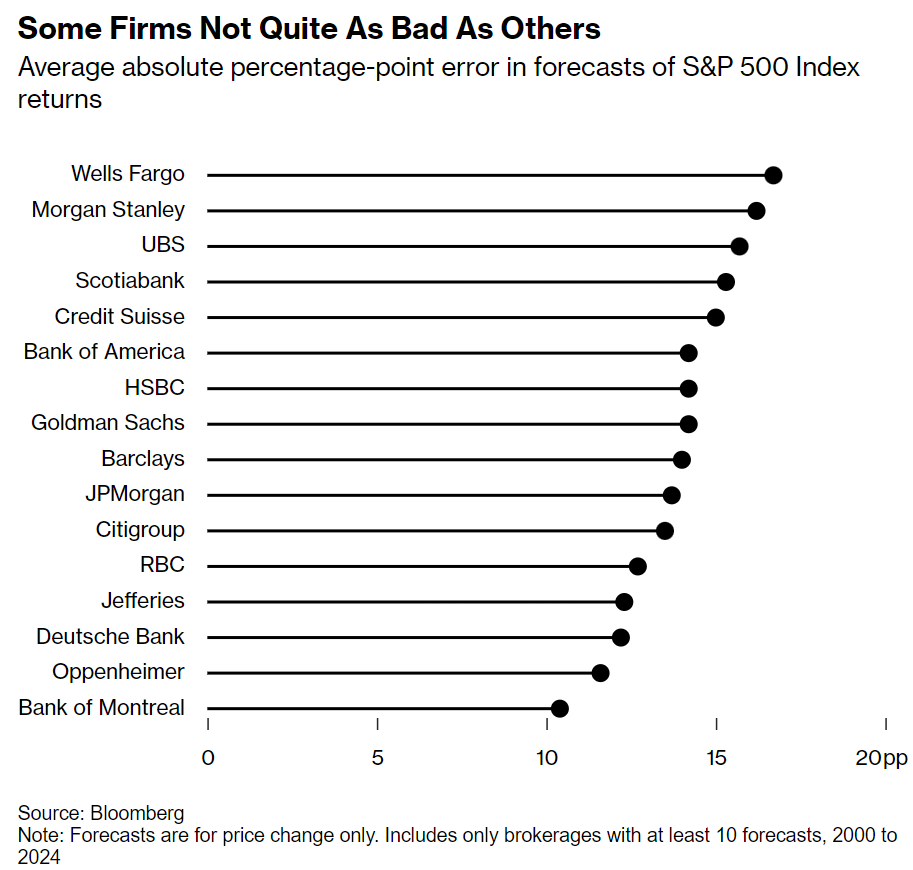

Last week we also posted some charts showing how wrong the overall market calls have been from Wall Street. This doesn't mean we should completely ignore them. They obviously are 'in the know' and thus have a better vantage point about what is happening behind the scenes than most people, especially on industry specific items. Last week Bloomberg posted a very detailed tool to look at all the things Wall Street is expecting across a wide range of topics. They included the actual analysis from those firms.

Check it out here, but before you do so, keep this chart in mind showing which firms have been the most wrong in their predictions:

Some client-friendly snippets in our Newsletter

Last week we posted our quarterly newsletter. Unlike this blog which is consistently around 1000 words (or 2 or 3 thousand at times), the newsletter is designed to include a wide range of topics we've been asked about in a format that is both written for people who do not follow the markets for a living as well as who don't have the time to read long articles.

Since moving the newsletter online, we've been able to include much more bonus content than the 2-page printed version allows. Check out this quarter's newsletter, including us answering the question, 'Should you invest in Bitcoin?'

Market Charts

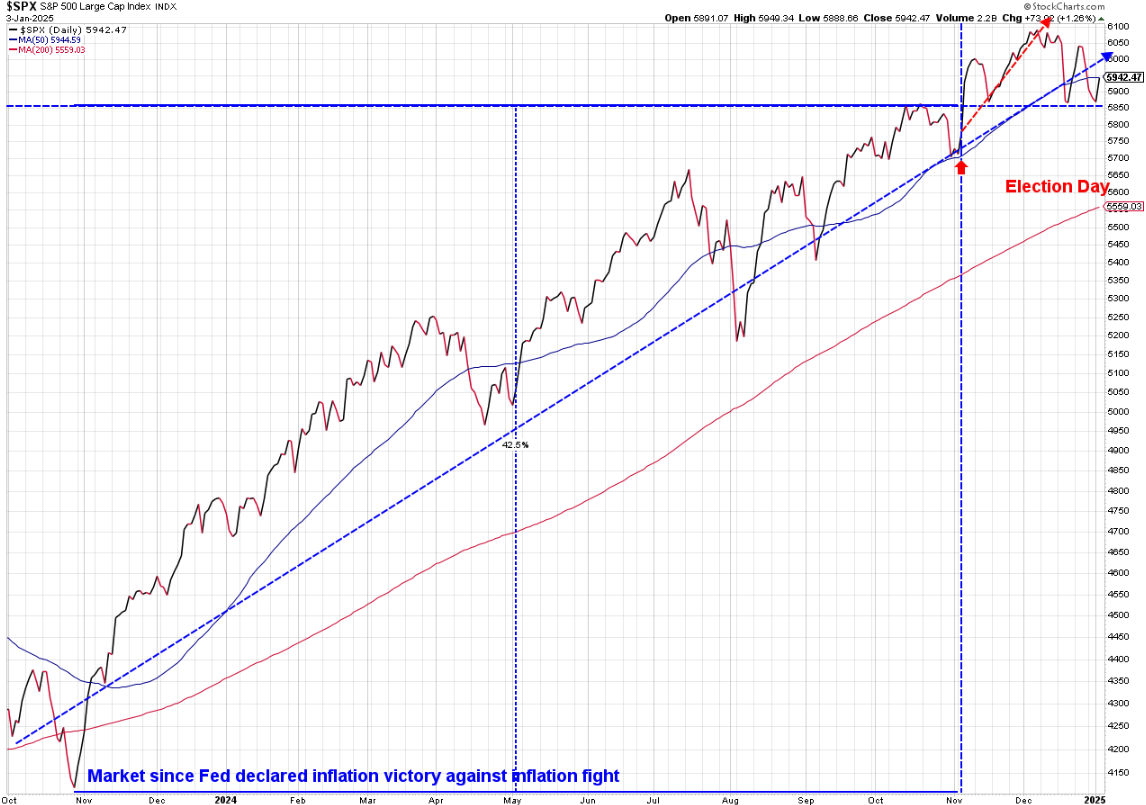

Until President Trump stops talking about how much he has done for the stock market, we will continue to show this chart which shows the market since election day. Stocks are now up less than 2% since the election. Worse, they are now BELOW where they were at the close the day after the election.

Now, I know and I think most of our readers know, a president (or Congress) cannot simply wave their magic wand and increase stock prices (or drop grocery or gasoline prices). I also hope the president understands this and touting the stock market performance is just part of his self-promotion strategy that has allowed him to win two presidential terms.

The issue I have is the same as his first term – if he allows the performance of the stock market to dictate his policies, then we will accomplish nothing and we will likely see even more chaos and volatility. The things he promised to do to "make America great again" are not all good for stocks (short-term).

The more important chart (because it shows we were ALREADY in an uptrend well before the election was in hand) shows the uptrend has been broken, but not too badly. As long as we stay above 5850, a level tested both before and after the election, we can safely assume the trend is still up.

However, if that uptrend is clearly broken, we have a bunch of money that poured into the market since election day, investors who are fully invested, sentiment already at an extreme, and what can only be considered still very attractive money market rates. We also have a new tax year where investors who didn't want to pay capital gains in 2024, could ring the register for 2025 and have the next 51 weeks to work on their tax strategy.

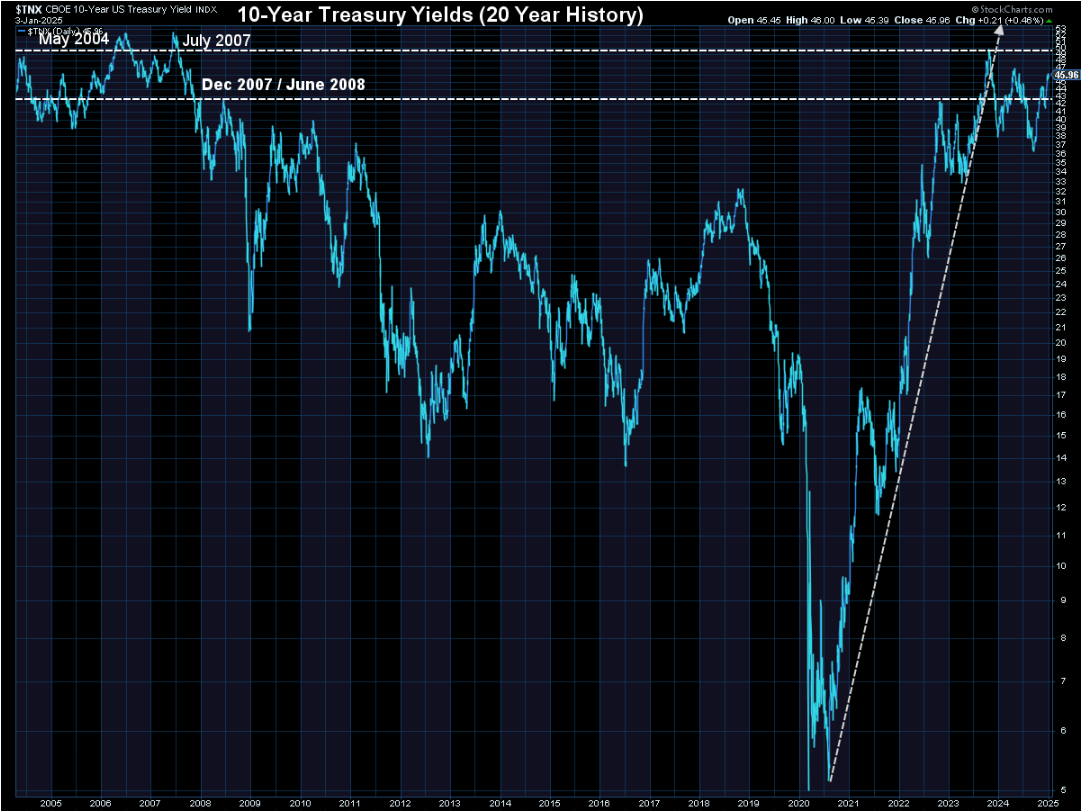

The more important chart remains the 10-year Treasury yield. Remember, Wall Street banks and mega-cap growth companies with solid balance sheets borrow at the Fed Funds rate, which has moved down by 1%. Everyone else (consumers, small companies, and those with a debt-heavy balance sheet) borrows at the rate set by the MARKET. The MARKET has said both inflation and credit risk could emerge under a 2nd Trump presidency and has driven rates UP by 1%. This could be a problem for both the Trump agenda and the stock market, so continue to watch the 10-year yield.

SEM Model Positioning

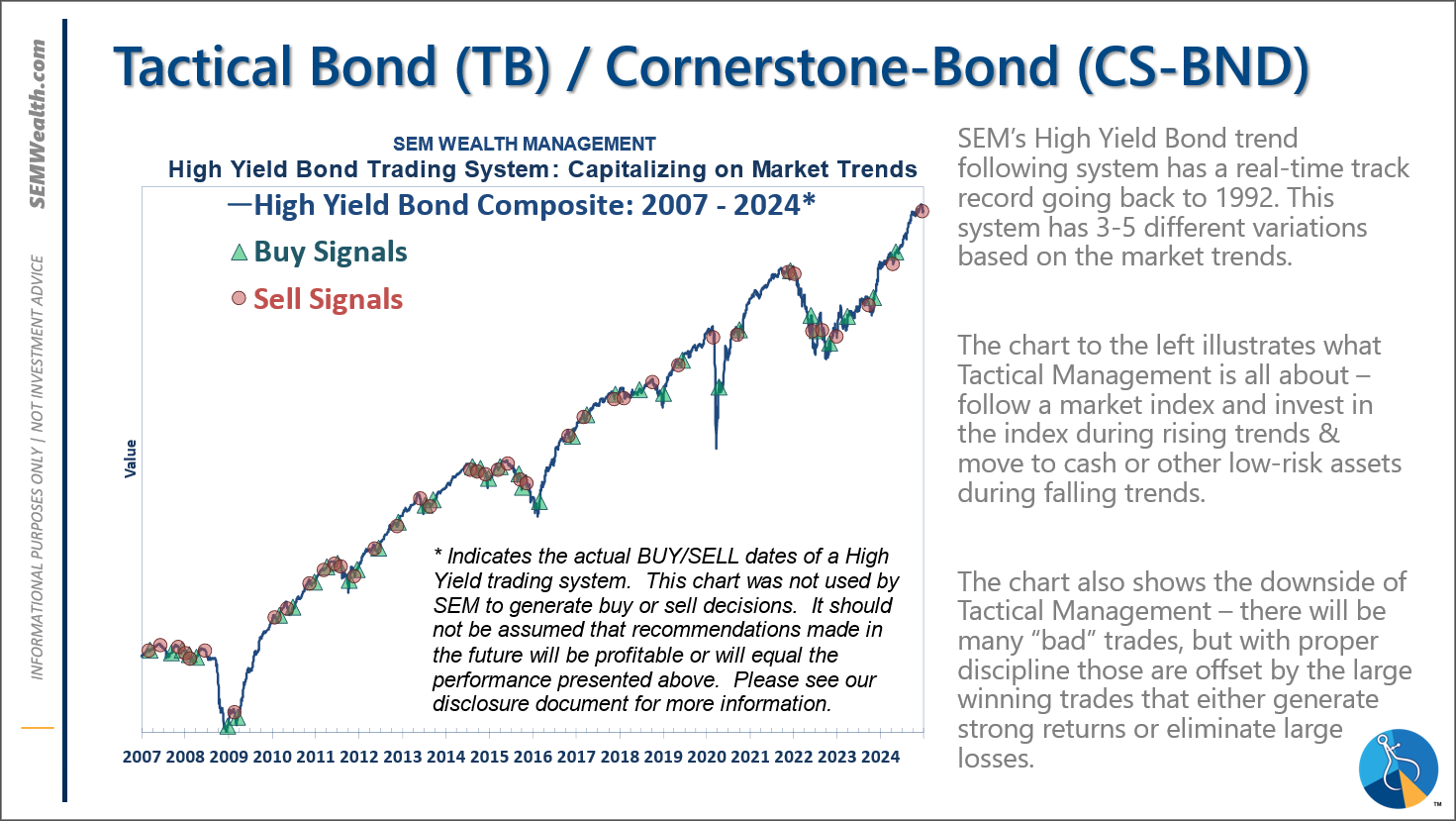

-Tactical High Yield sold our high yield bond positions purchased last spring on 12/20/24. We had added a 30% position in floating rate bonds on 12/6/24, which currently have a 9% yield compared to a 6% yield in high yields and 4.6% in money markets. This follows the partial (about 67%) buy signal on 5/6/24.

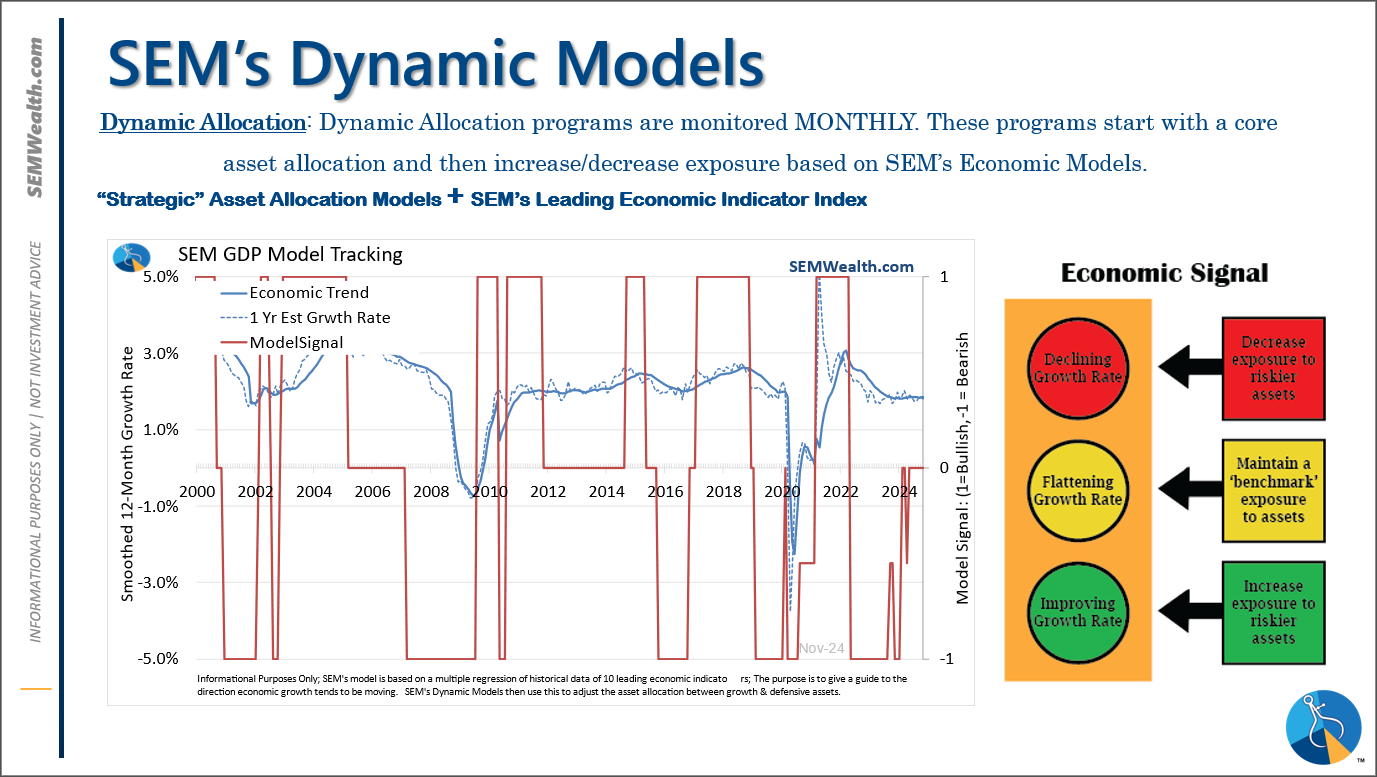

-Dynamic Models are 'neutral' as of 6/7/24, reversing the half 'bearish' signal from 5/3/2024. 7/8/24 - interest rate model flipped from partially bearish to partially bullish (lower long-term rates).

-Strategic Trend Models went on a buy 11/27/2023; 7/8/24 – small and mid-cap positions eliminated with latest Core Rotation System update – money shifted to Large Cap Value (Dividend Growth) & International Funds

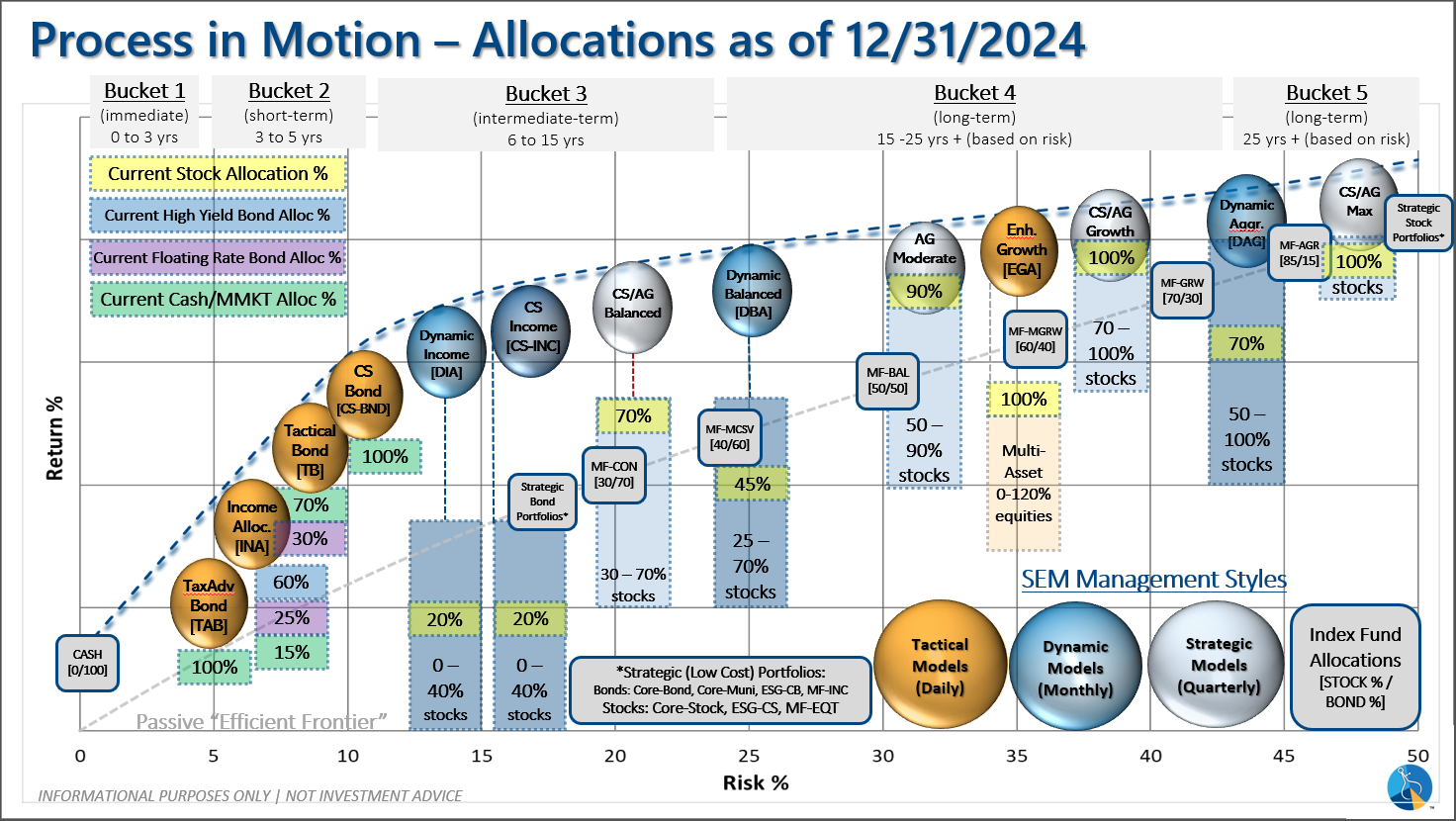

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): On 12/20/2024 our tactical high yield model sold out of high yield bond (about 70% of our holdings) into money market. The other 30% is invested in shorter duration, higher yielding floating rate bonds. These instruments are not as sensitive to credit risk and are typically allocated to in the early and late stages of a high yield bond move in our model.

Dynamic (monthly): The economic model was 'neutral' since February. In early May the model moved slightly negative, but reversed back to 'neutral' in June. This means 'benchmark' positions – 20% dividend stocks in Dynamic Income and 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is slightly 'bullish'.

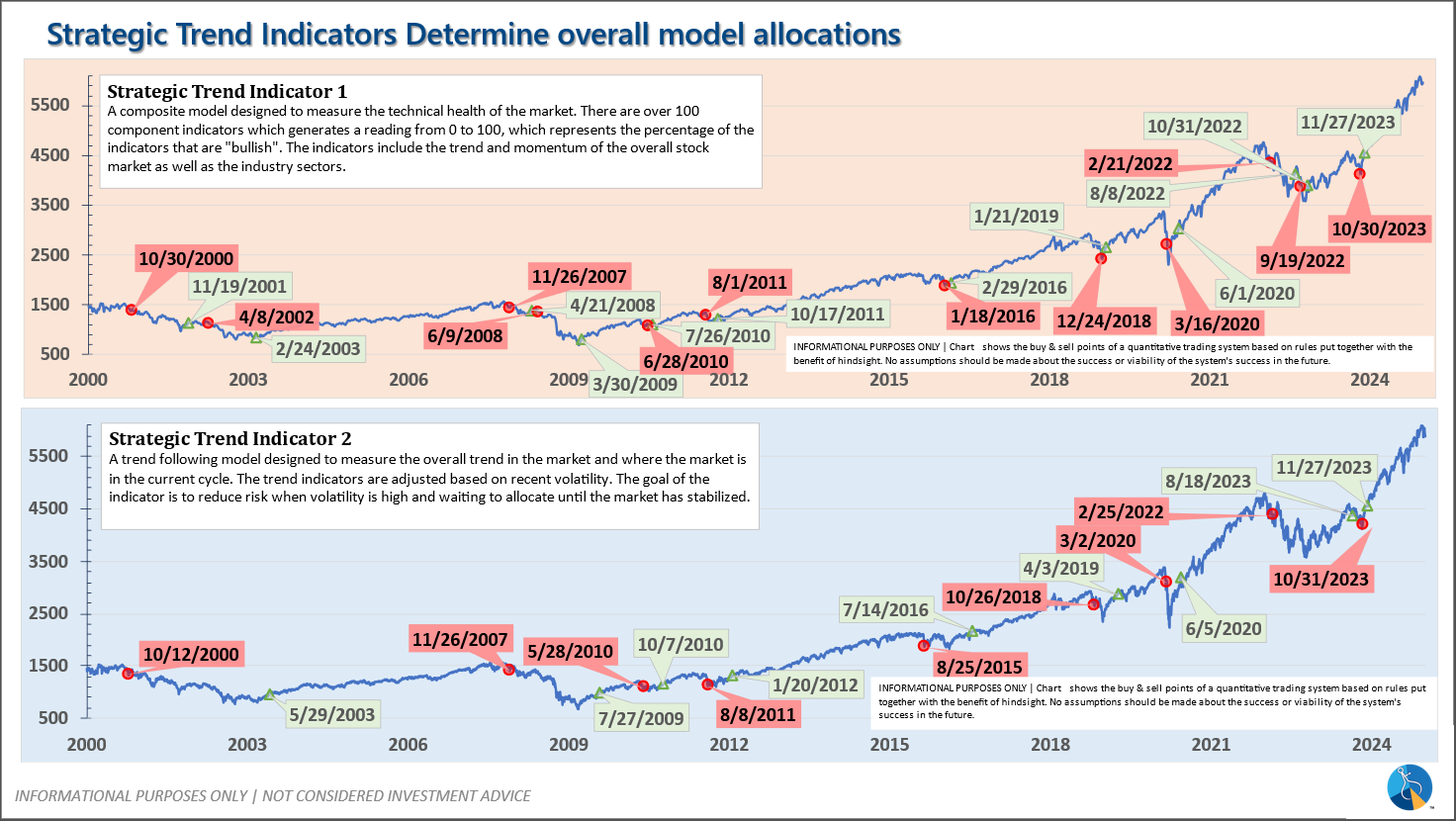

Strategic (quarterly)*: BOTH Trend Systems reversed back to a buy on 11/27/2023

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Questions or comments - drop us a note?

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire