Maybe the "Liberation Day" tariff announcements were nothing more than a negotiating strategy. Maybe President Trump does care what happens to the stock market. Maybe the bond market sell-off spooked the President. Maybe China and the US will come to agreeable terms without damaging their economies. Maybe the President will respect the independence of the Federal Reserve.

Maybe the worst is over and we can focus again on the positive things the President was expected to do for the economy and stock markets in 2025 and beyond.

Or maybe we are going to see a Truth Social post from the President which reverses the positive changes in his tone last week.

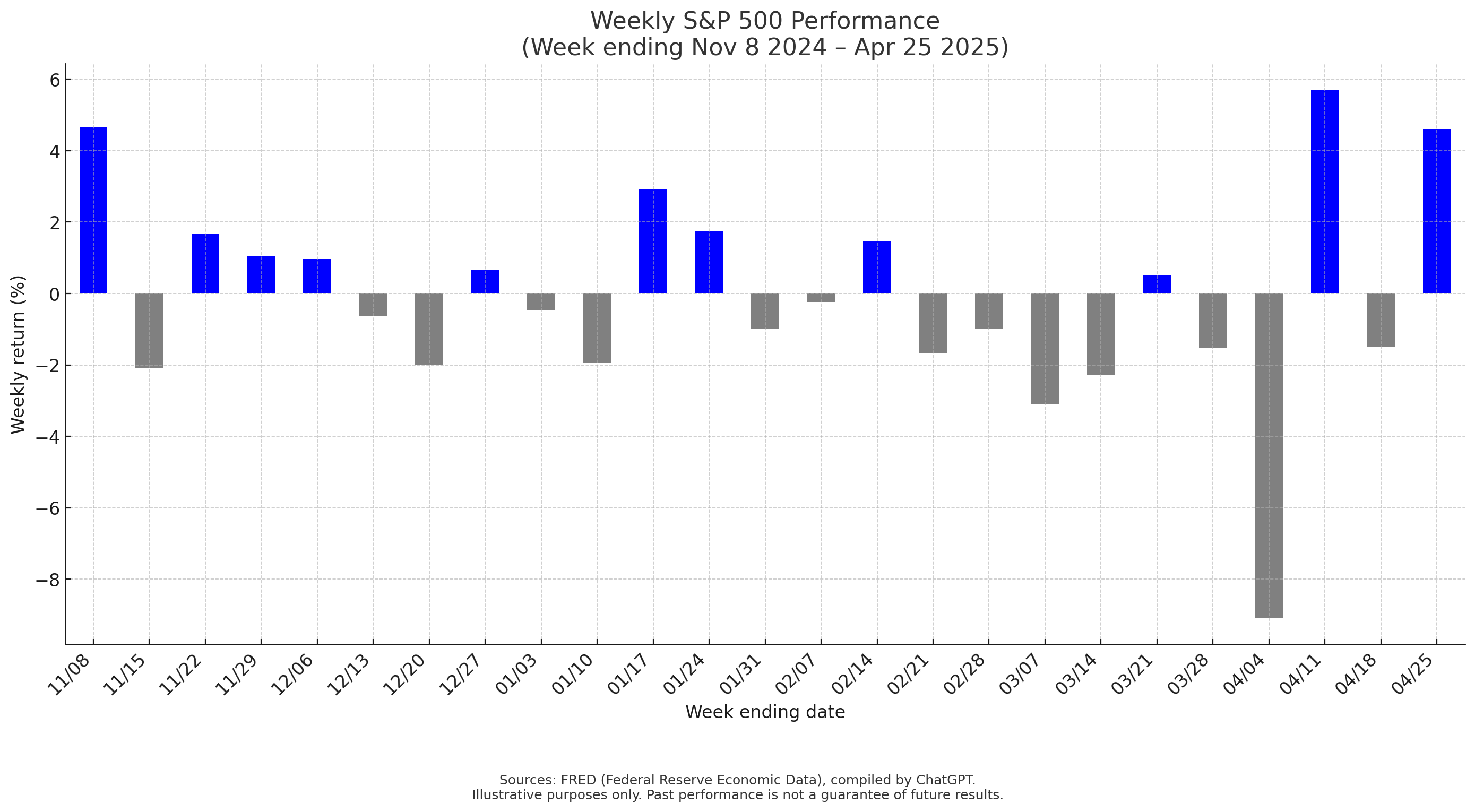

The stock market last week took solace in a much softer tone from the President than the past several weeks, posting an impressive 4% jump.

We have more details in the last section, but here's where we stand now:

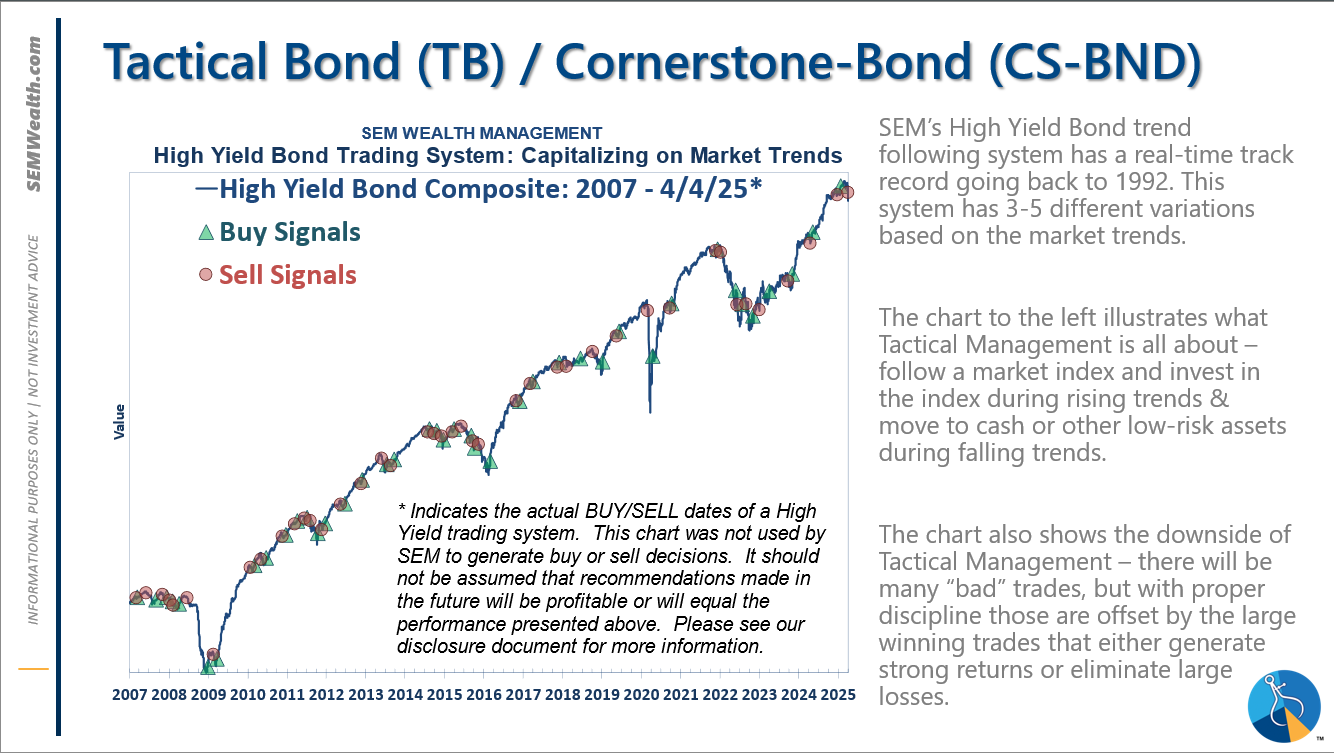

Tactical: the panic in the bond market was short-lived. The high yield market appears to have stabilized and we moved from money market back to high yields in the middle of last week.

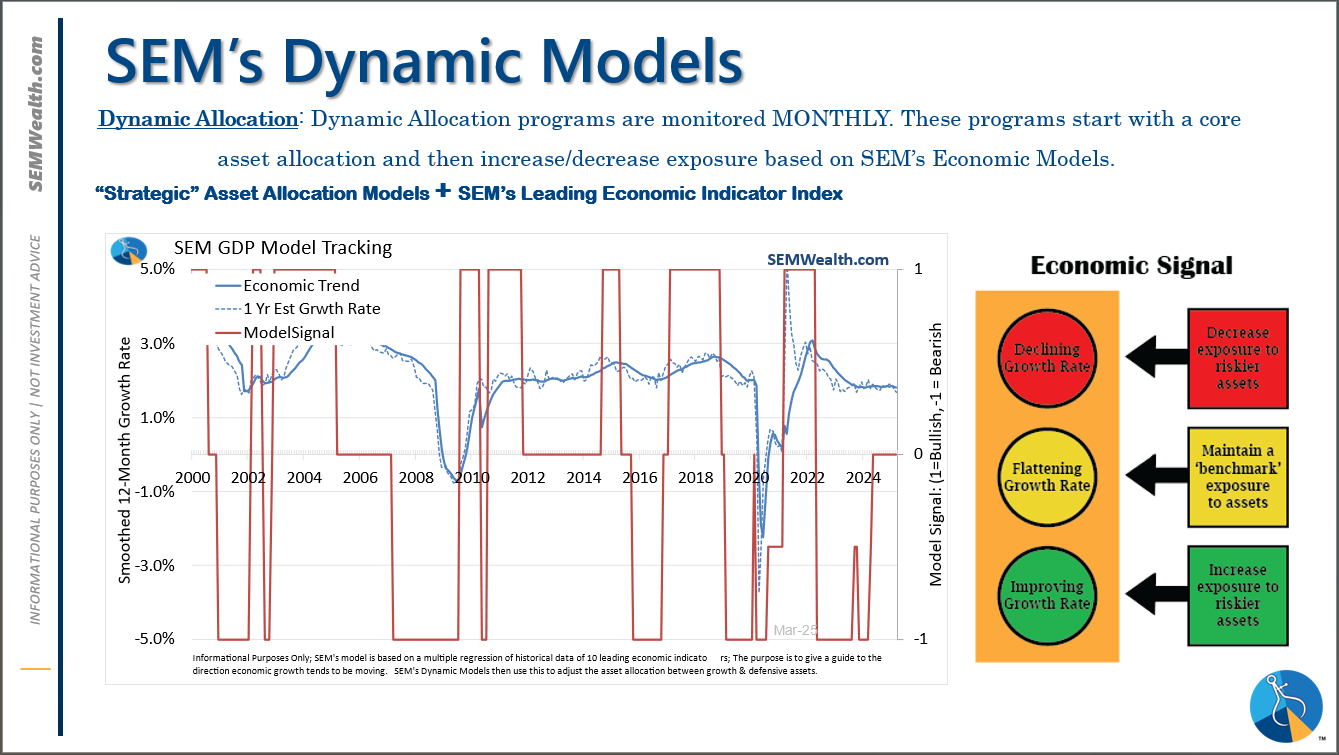

Dynamic: the “soft” (how do you feel) data is very weak. The “hard” (what is actually happening) data remains stable. The feelings can impact the future of the actual data, which is why we use both. For now, our economic model is “neutral” (no panic yet)

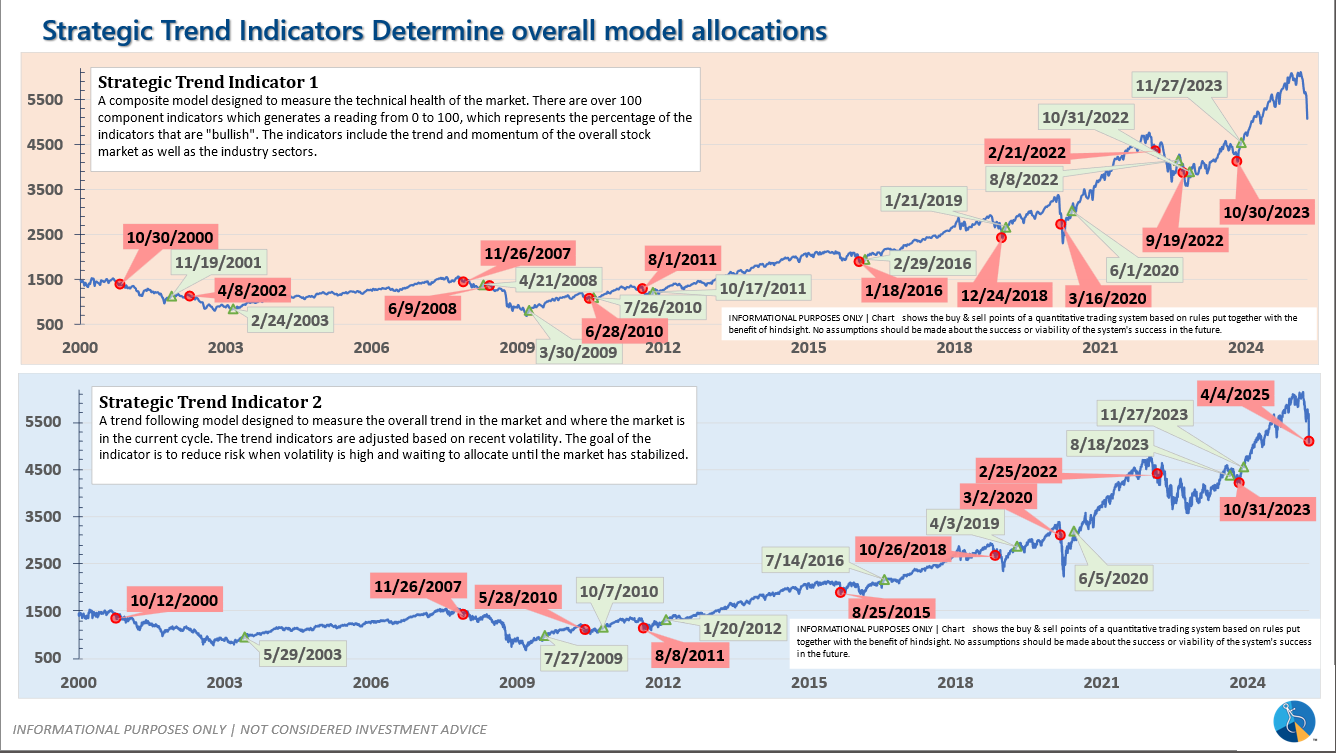

Strategic: The uptrend was broken on April 3 so we took some money off the table. There are enough sectors that held up to keep the rest of the money invested. Last week’s gain was encouraging, but not enough to get us back to fully invested.

It was again an exhaustingly busy week of market moving headlines. Here's a summary of the ones I thought were important:

Trade War rhetoric softening, possible deals being made?

Nothing official has been announced, but the President has announced several times over the past week that deals are close with key trading partners including China. China has both said there are not talks being held and that deals may be near. This would be huge news for the markets, but it also means if these deals "fall apart" the markets could give up a chunk of the recent gains.

Trump says he won't fire Powell

While we don't know how long he will stick by it, but the President helped boost stocks and bonds when the White House announced they were not pursuing ways to terminate Fed Chair Jerome Powel's term. The US Dollar has been getting hit throughout the term and bond yields had already spiked higher following Liberation Day. One of the reasons the US is the world's currency and our Treasury Debt is viewed as "risk free" is because of the independence and relative stability of our government. Obviously a President able to remove the Chair of what was thought to be an independent Central Bank would shake that stability.

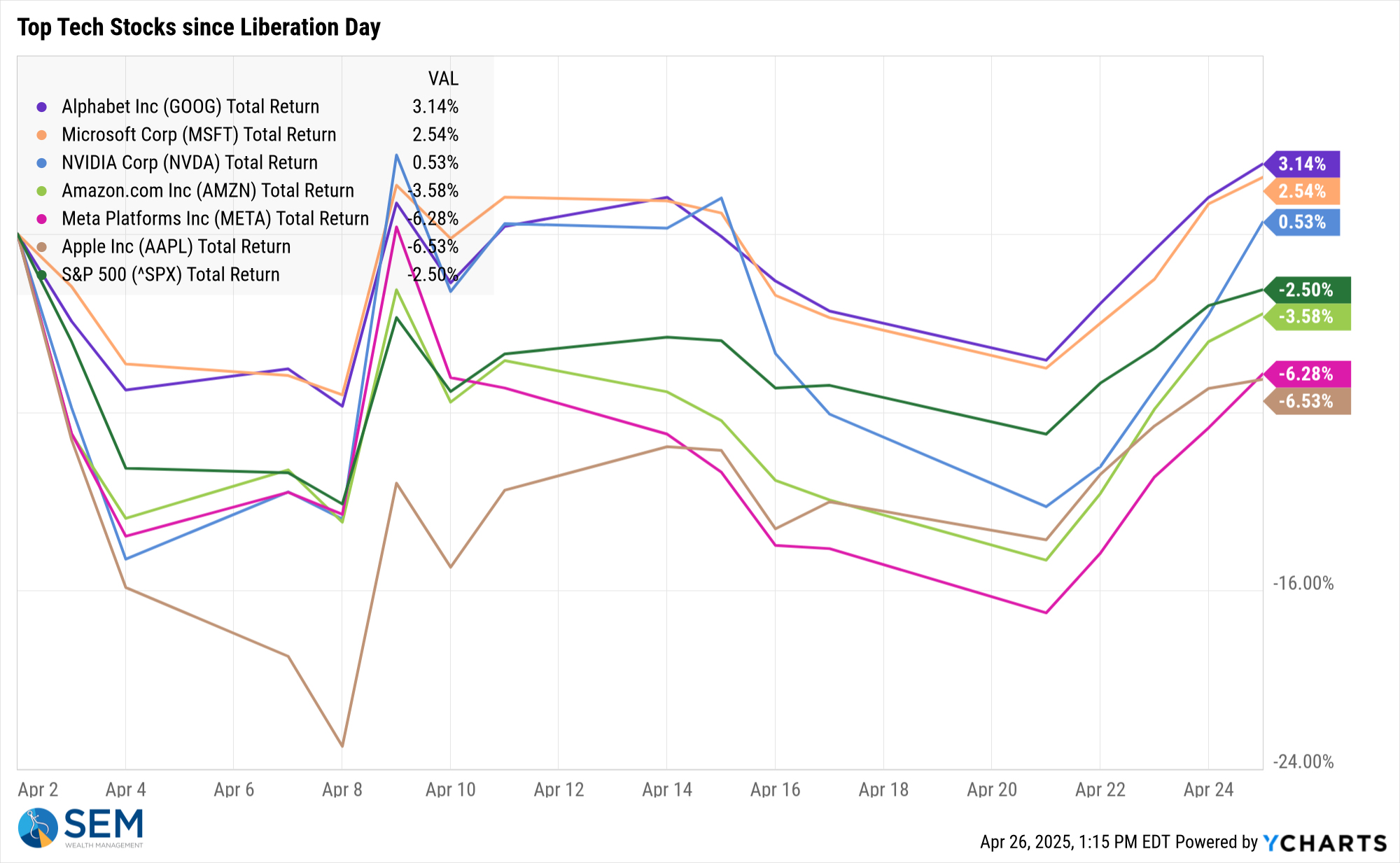

Tech earnings spark NASDAQ rally

The NASDAQ rose nearly 7% last week driven by strong results from Alphabet (Google) and Nvidia. The two bellwethers posted a 49% and 82% increase in earnings. Google cited strong growth in Google Cloud revenue, while Nvidia announced a jump of 93% in Data Center Revenue. This week will be even more important with Meta, Microsoft, Amazon, and Apple all scheduled to post earnings. These reports are obviously backward looking and occurred before the trade war heated up, so a close eye will be focused on what these companies say about any possible slowdown they have seen since the "liberation day" tariffs.

Since Liberation Day, Google and Microsoft have posted the best performance of the stocks mentioned above. Apple and Meta have been hurt the most with Amazon also trailing the S&P 500. Apple and Amazon's underperformance makes sense given their heavy exposure to China. Meta's problem appears to be related to the regulatory issues facing the firm, although Google is also in the crosshairs of both the EU and US governments for their monopolistic business practices.

President meets with top retail CEOs

President Trump met last Monday with the CEOs of Walmart, Target, Home Depot, and Lowes. The retail leaders expressed concerns about potential supply chain disruptions, increased consumer prices, and the broader implications for the U.S. economy. They warned that continued tariff pressures could lead to empty store shelves and heightened inflation. Following these meetings, President Trump indicated a willingness to reconsider certain aspects of the tariff policies, suggesting potential reductions in some levies and expressing optimism about reaching trade agreements with China.

I of course was encouraged by this given I wrote this following the Liberation Day announcement:

"My hope is this is a negotiation tactic and the President will bring the top CEOs to the White House to discuss ways to gain waivers on the tariffs while they work towards the end goal of making more stuff in the US."

If this trade war is the US versus the world, we most certainly need the CEOs from the largest US based companies to be part of the solution.

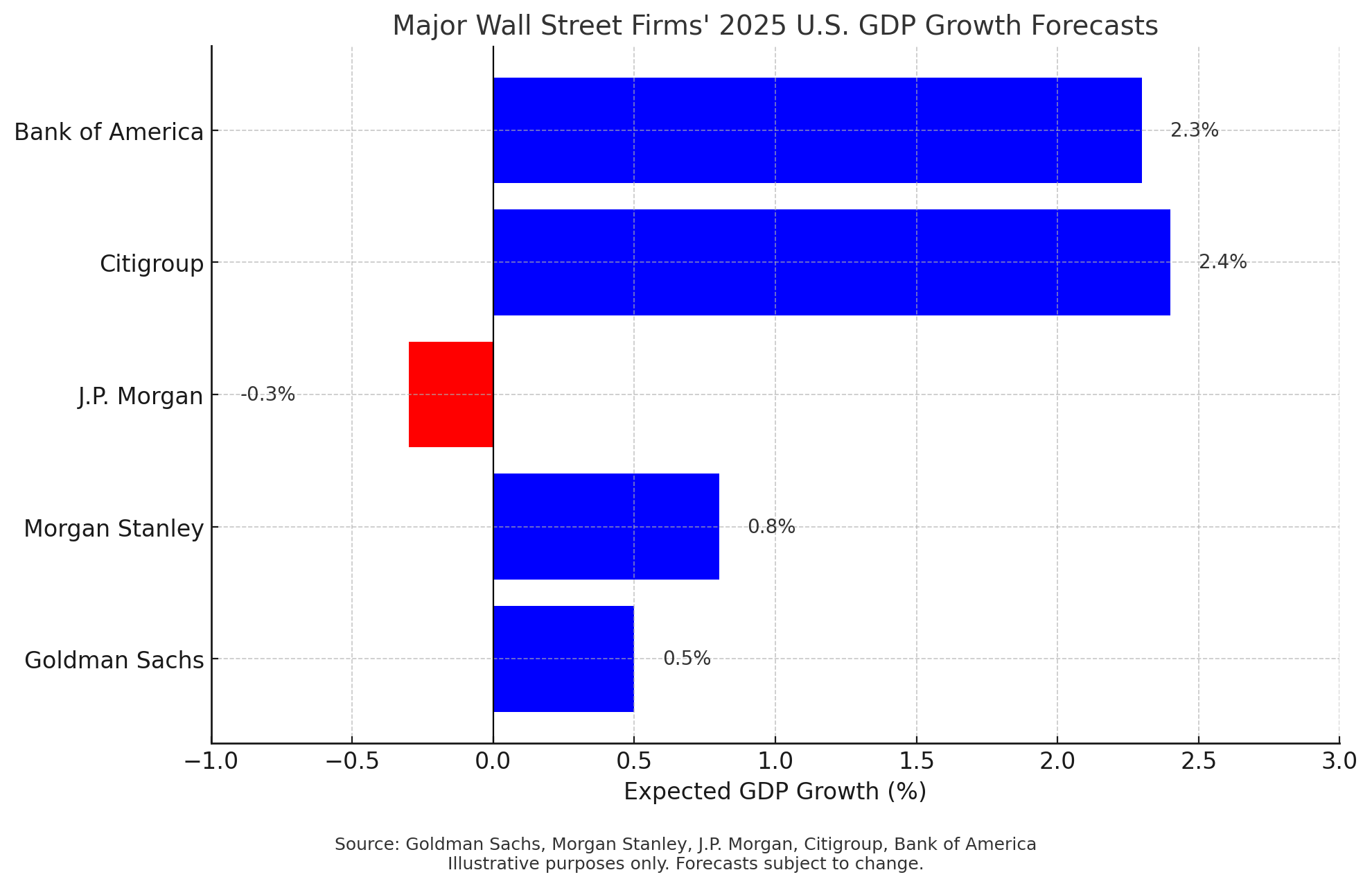

IMF lowers global growth forecast

This week the IMF cut their global growth estimate by 0.5% down to 2.8%. They also cut their US growth estimate to 1.8%. This falls in between the range of optimistic and pessimistic Wall Street forecasts for US GDP. Citigroup and Bank of America do not see any risk of a trade war hitting economic growth. Both have maintained their growth estimates of 2.4% and 2.3% respectively. On the other hand, Goldman Sachs, Morgan Stanley, and JP Morgan have slashed their estimates for 2025 to 0.5%, 0.8% and -0.3% respectively.

As I mentioned last week, the overall estimate for S&P 500 earnings has barely declined. Given the rebound in stocks, we can surmise they do not believe the Trade War will hit earnings. Otherwise, the PE ratio would be declining and stocks would be dropping rapidly. I'm not sure how we could have well below average economic growth and above average earnings growth, but I guess time will tell.

Last week was certainly enjoyable, but I would be cautious about believing the worst is over. Last week's blog still applies:

Market Charts

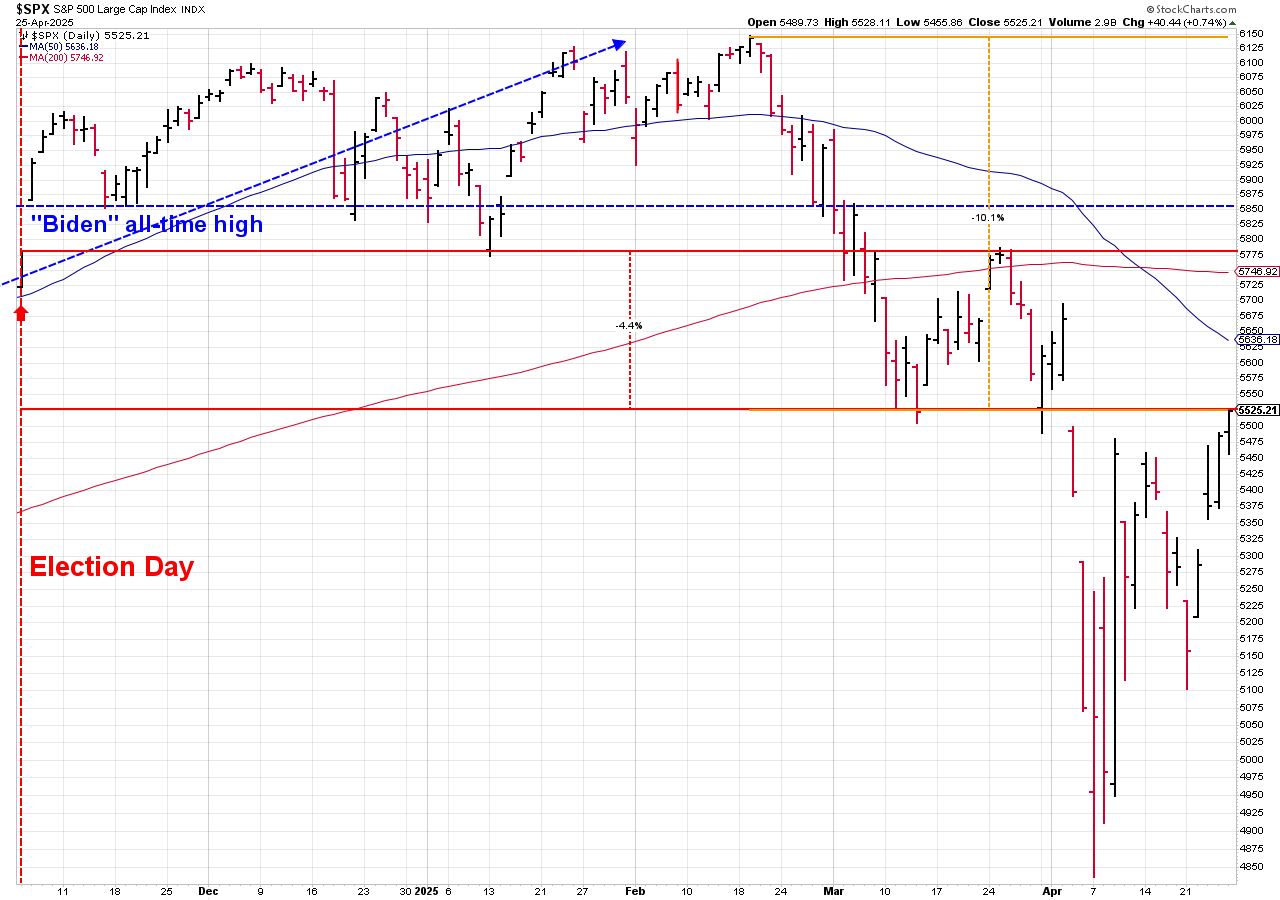

As we've been doing all year, we will start with the post-election S&P 500 chart. This shorter-term chart highlights the big moves we've seen since the Liberation Day announcement after the market close on April 2. The S&P 500 closed the week above the April 3 level, but still remains below the pre-announcement levels. The "gap" being filled is a positive sign, but is also normal. The question is will we also see another normal occurrence – a retest of the lows.

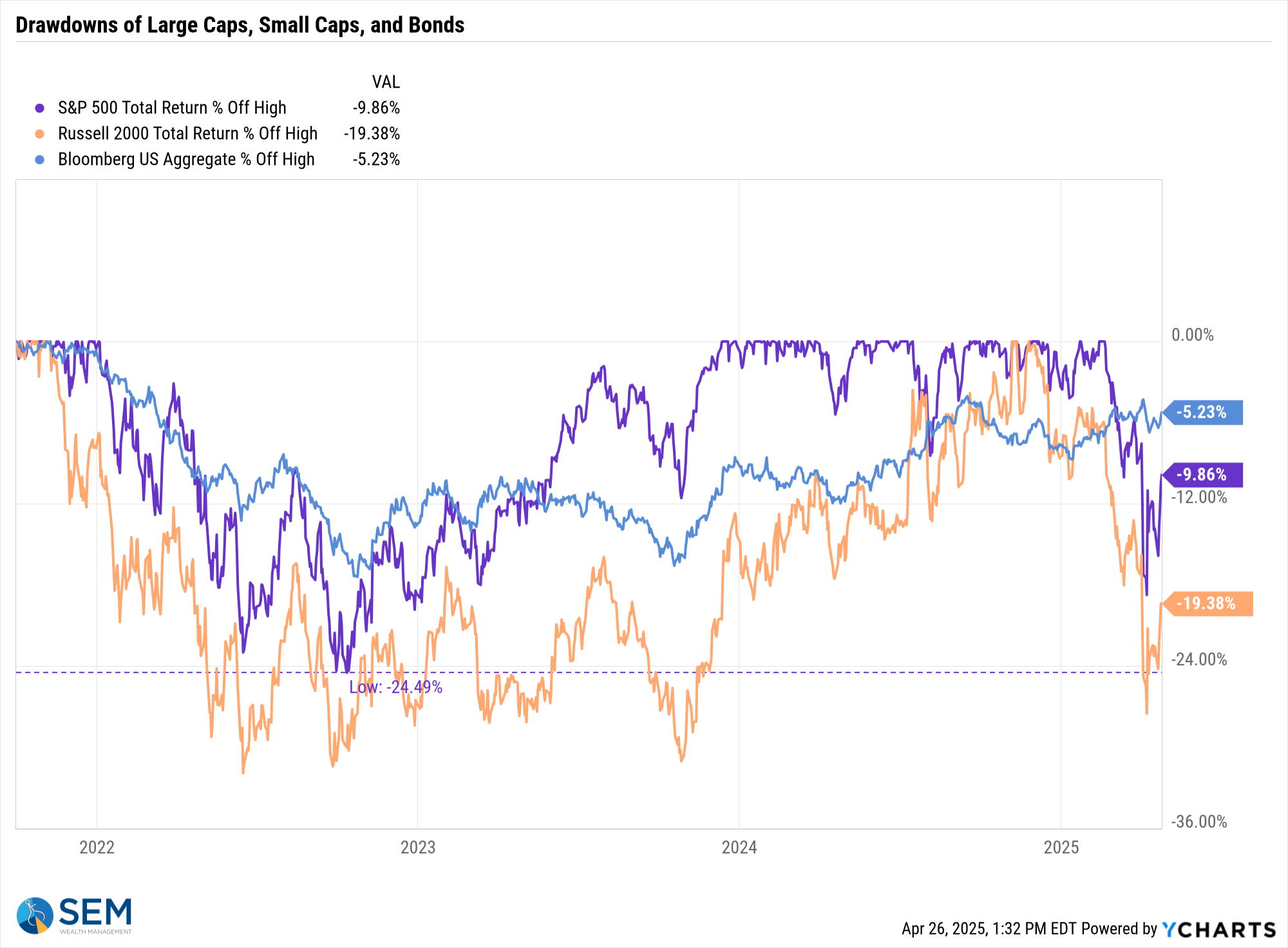

Stocks are still down 10% from their high in mid-February, but the S&P was able to break the steep downtrend line as it has recovered just over half of the losses. The declining 50 and 200-day moving averages loom above, which typically serve as resistance points over the intermediate-term.

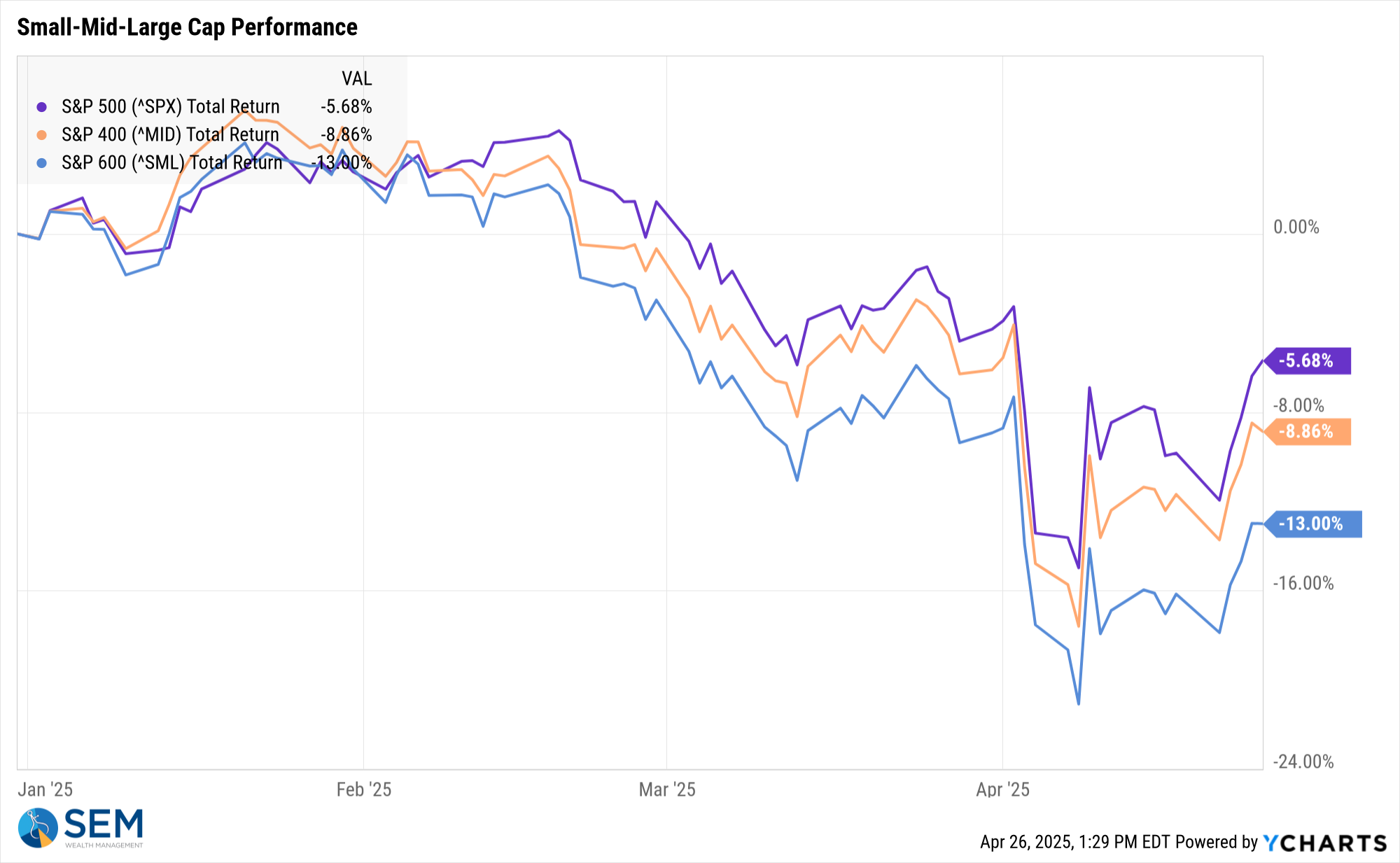

For the year, large caps remain in the lead with small caps still lagging. So much for the broadening rally I was highlighting from the election until late January.

Turning to bonds, yields again declined for the week. This remains the most important area to watch for the overall health of the economy.

SEM Model Positioning

Tactical Bond, Cornerstone Bond, and Income Allocator jumped back to buy signals on 4/24. At least according to the data, we are in a "wait and see" mode.

-*NEW* Tactical High Yield sold high yield bonds on 4/3/25 after 9 weeks in these funds. These models bought back in on 4/24. All proceeds were moved to money market or short-term bonds, with a yield around 4.1% in money markets.

-Dynamic Models are 'neutral' as of 6/7/24, reversing the half 'bearish' signal from 5/3/2024. 7/8/24 - interest rate model flipped from partially bearish to partially bullish (lower long-term rates).

-Strategic Trend Models received 1/2 of the trend sell signal on 4/5/25

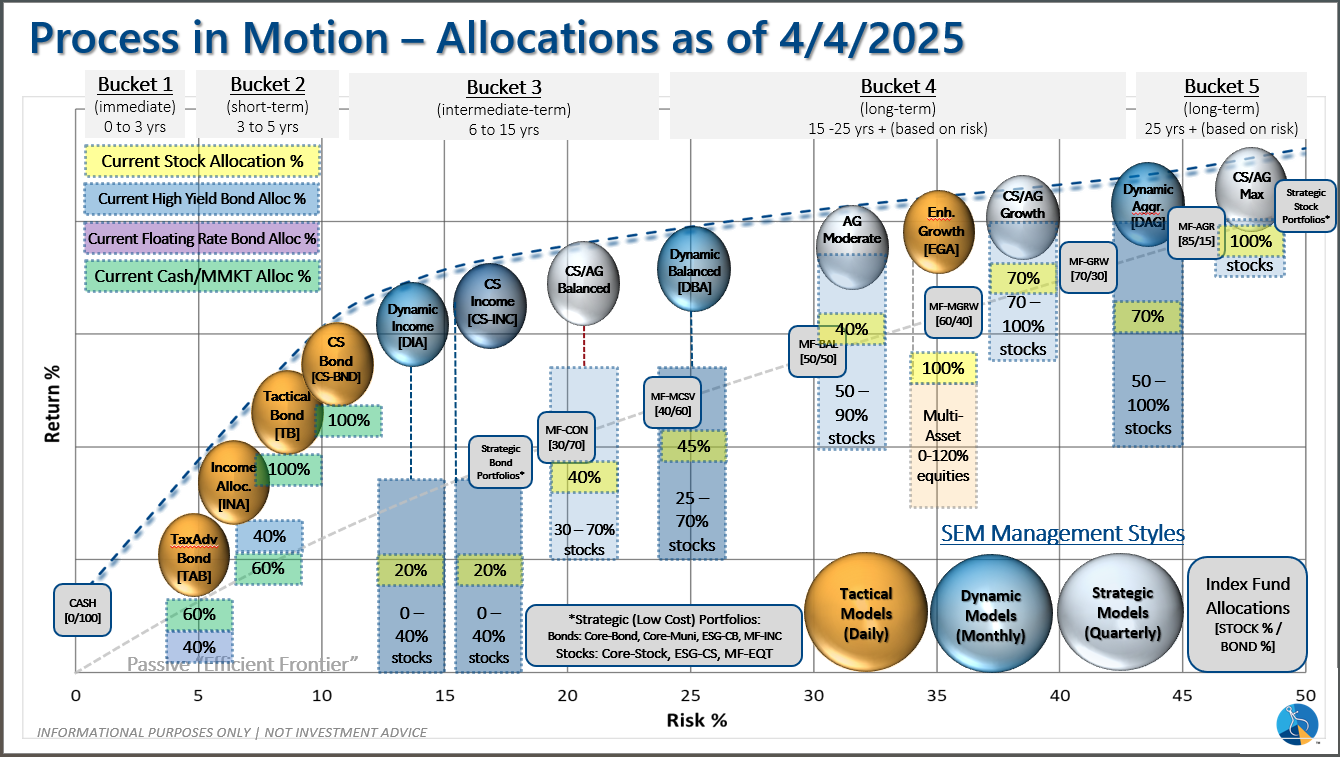

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): On 4/3/2025 our tactical high yield model sold out of high yield bond into money market.

Dynamic (monthly): The economic model was 'neutral' since February. In early May 2023 the model moved slightly negative, but reversed back to 'neutral' in June. This means 'benchmark' positions – 20% dividend stocks in Dynamic Income and 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is slightly 'bullish'.

Strategic (quarterly)*: One Trend System sold on 4/4/2025

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Questions or comments - drop us a note?

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire