Last week’s market headlines offered a masterclass in economic complexity, with every story weaving into the next. The focus of course going into the week was the Fed’s rate cut which set the tone, sparking volatility across stocks and bonds and raising fresh questions about inflation’s staying power. Housing data underscored the pain of higher rates, while Congressional gridlock and deficit drama reminded us that fiscal discipline remains elusive in Washington. FedEx’s tariff warning added to a very long list of companies exposing the real-world costs of trade policy, and the Intel-Nvidia deal highlighted both the promise and risk of chasing the next “new era” in tech. For investors, these stories aren’t just noise—they’re signals about where the market’s headed and what risks lie beneath the surface.

Let's dive into the top 5 stories (in my opinion) for the past week.

1. Fed Cuts Interest Rates, Signals More to Come

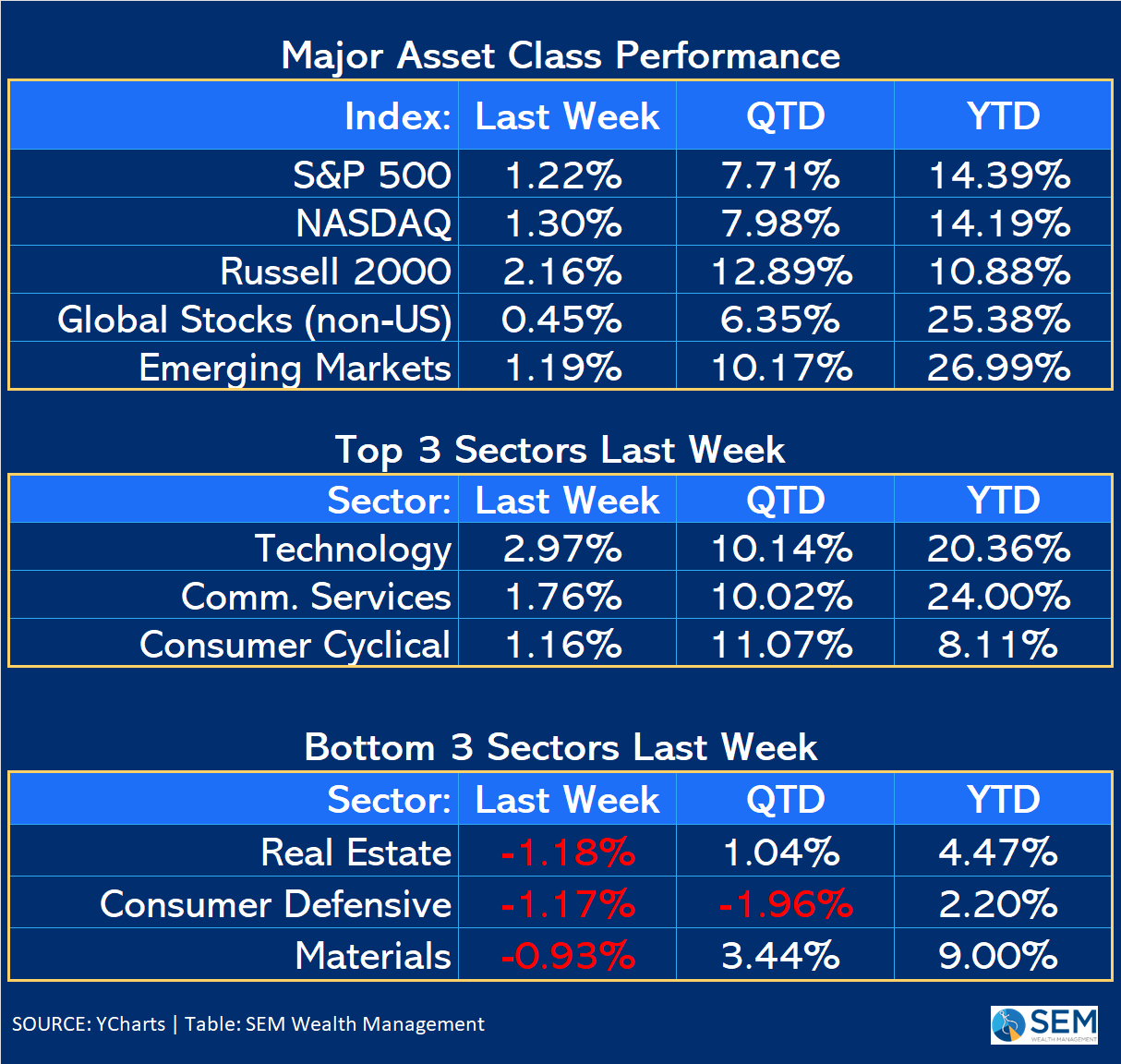

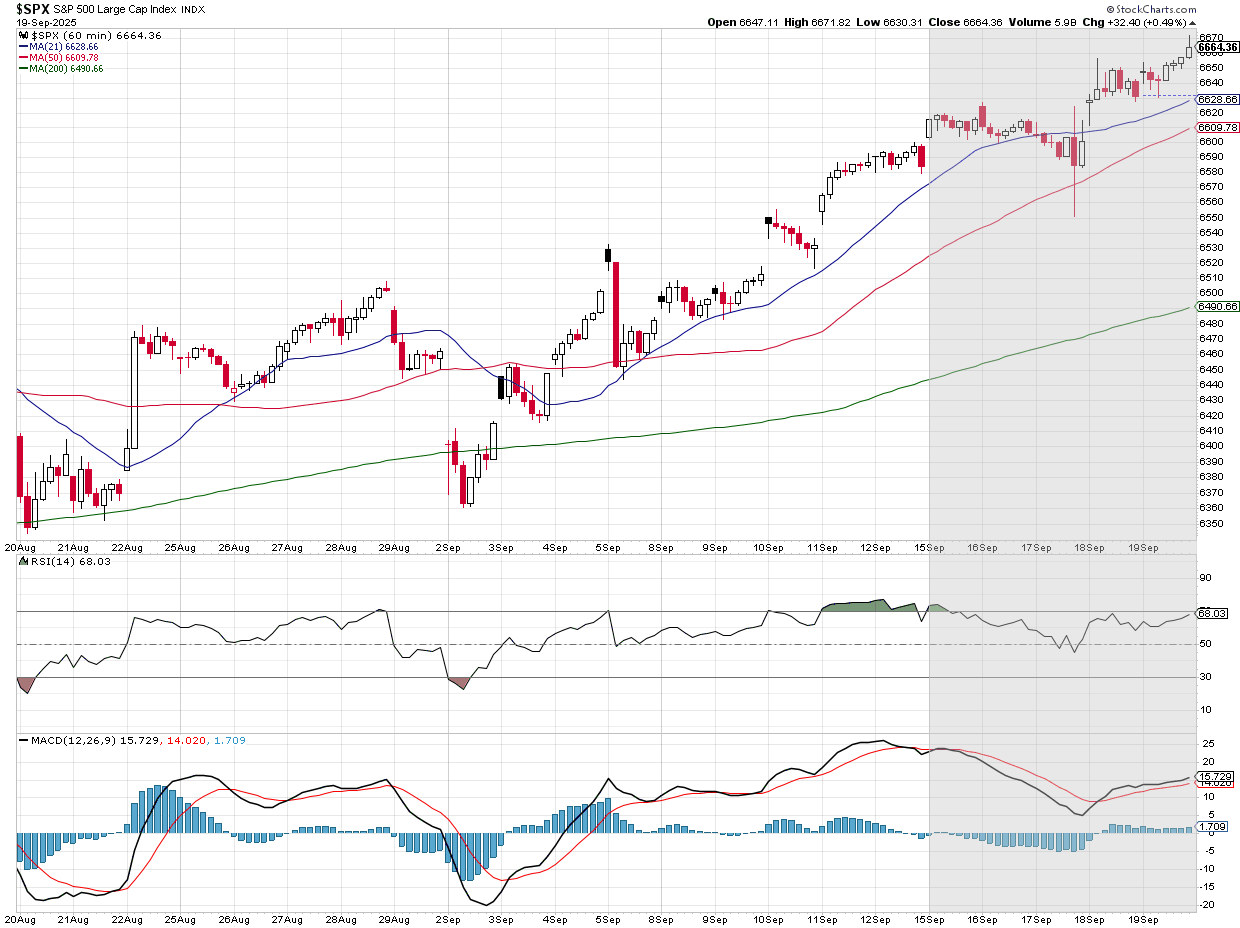

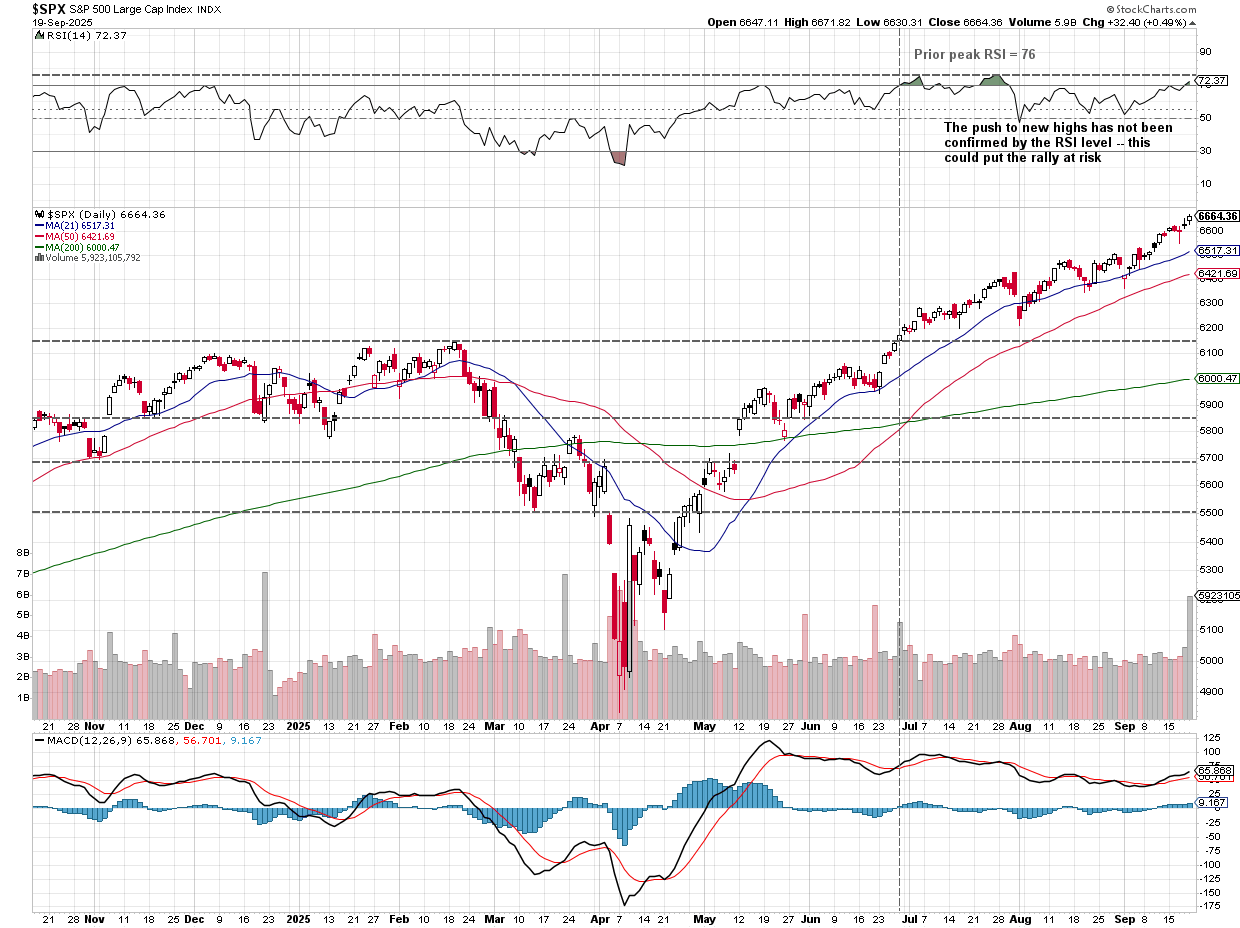

The Federal Reserve cut interest rates by 25 basis points (1/4%), its first reduction in nearly a year, and hinted at further easing. This dovish pivot was driven by signs of a weakening labor market and slowing inflation. The market reaction was generally positive, with the S&P 500 and Nasdaq hitting fresh highs to close the week. Small-cap stocks had a wild ride with some impressive gains shortly after the announcement, a sell-off, and then a mixed couple of days to close the week. The rate cut also triggered a (temporary?) rotation from tech into value stocks although by Friday tech was again leading the way.

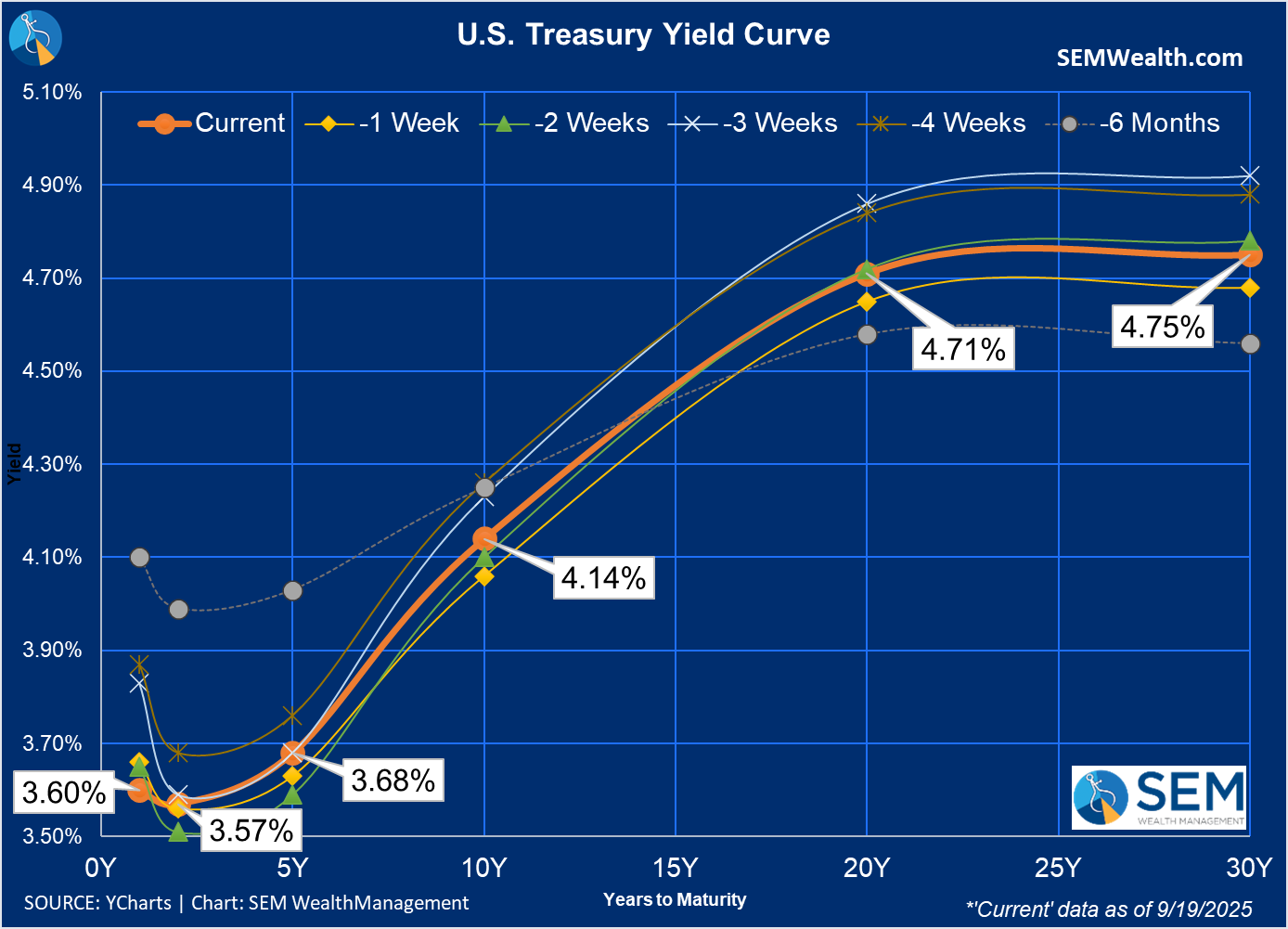

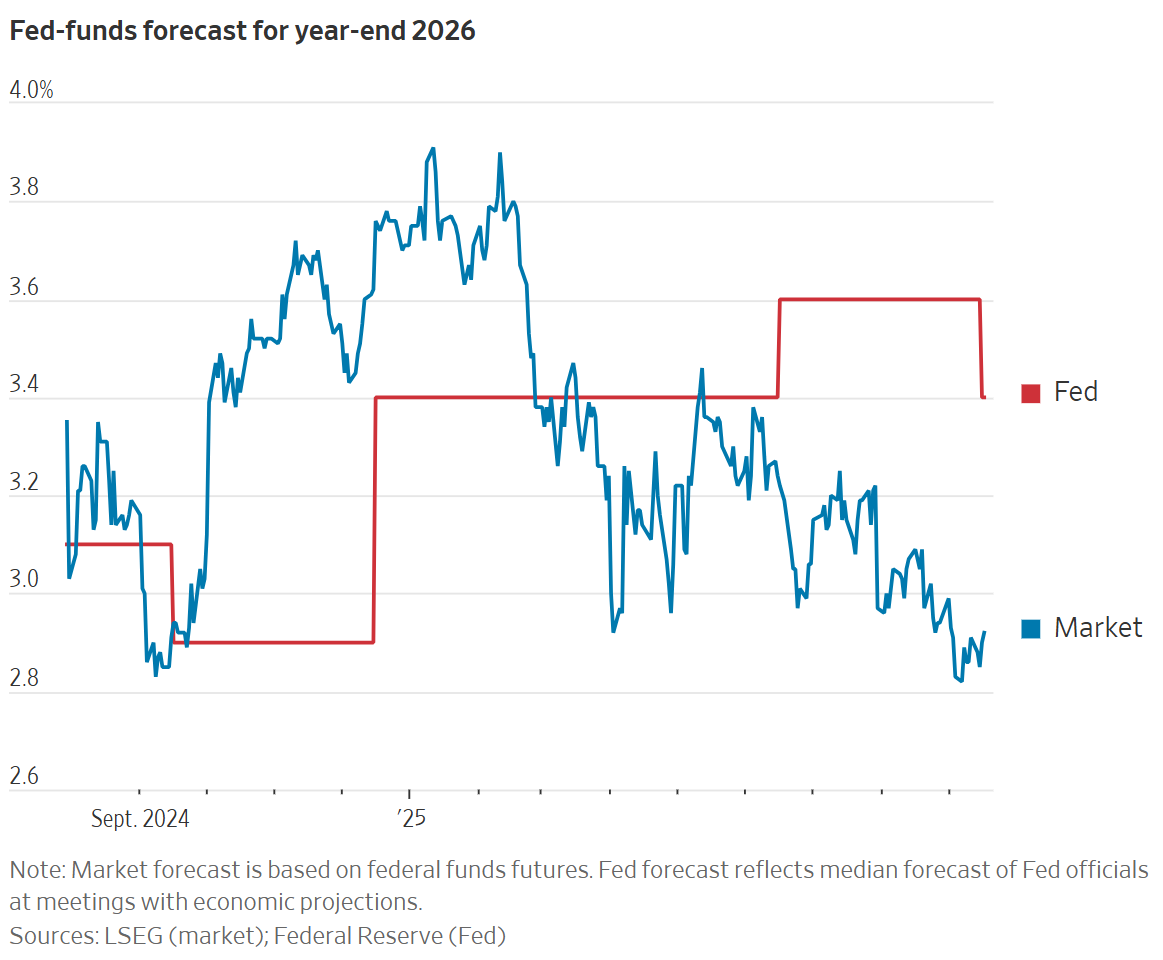

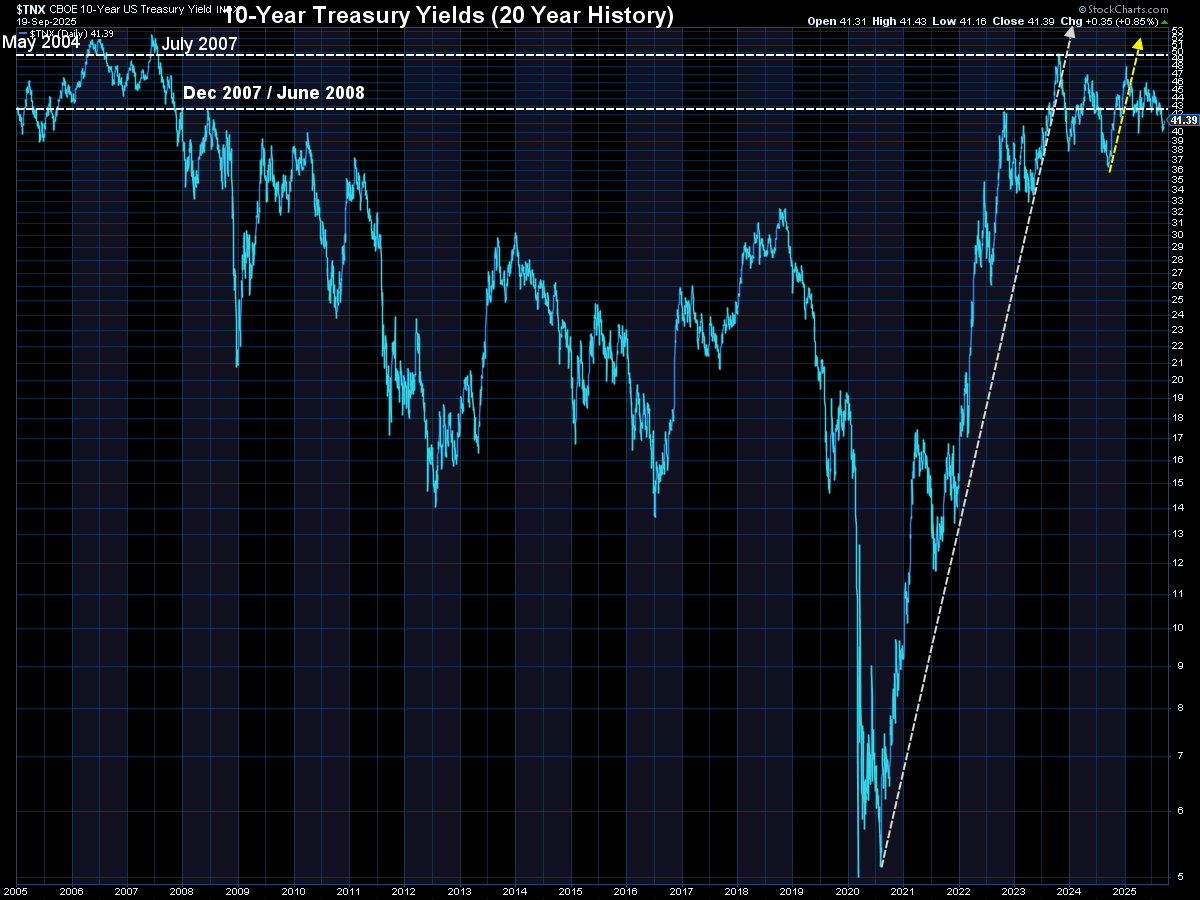

The only dissent came from newly appointed Fed member Stephen Miran, who has "temporarily" stepped down from his job as head of the White House Council of Economic Advisors. Mr. Miran dissented because he wanted a 50 basis point cut and is pushing for 1 1/2% in cuts before year end. The "story" is this is needed to boost the economy at a time where tariffs are a "one-time" reset in inflation levels, according to the White House. While the 10-year Treasury Bond was rallying (yield was dropping) the past few weeks to 4%, it rose after the Fed announcement.

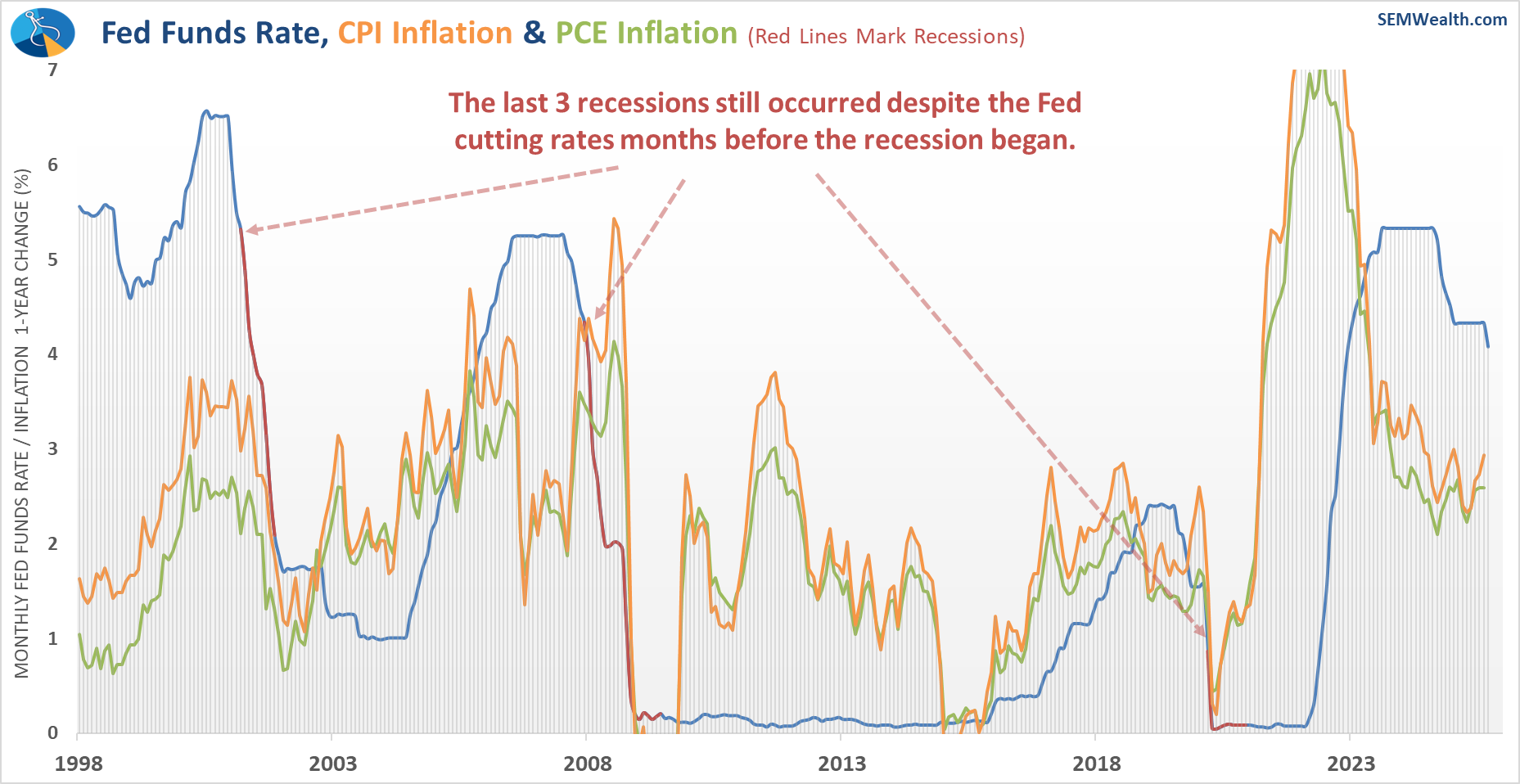

The reason for the increase could be two-fold. The first, is inflation does not appear to be going through a "one-time" or "temporary" reset period due to tariffs. The trend is up. Inflation erodes the value of your bond payments, therefore, bond investors demand higher yields if they believe inflation will be a problem. The second, and more important issue is a drop in rates does not magically prevent a recession. It simply takes too much time for rate cuts to help the economy when the slowdown has already started.

We are still down about 25 basis points over the past month on the 20 & 30 year Treasury yields and about 20 basis points on the 10-year. Remember, most consumer borrowing rates are set by the 10-20 year Treasury market, not the Fed.

The market is betting on a much more friendly Fed in 2026 (I wonder why).......

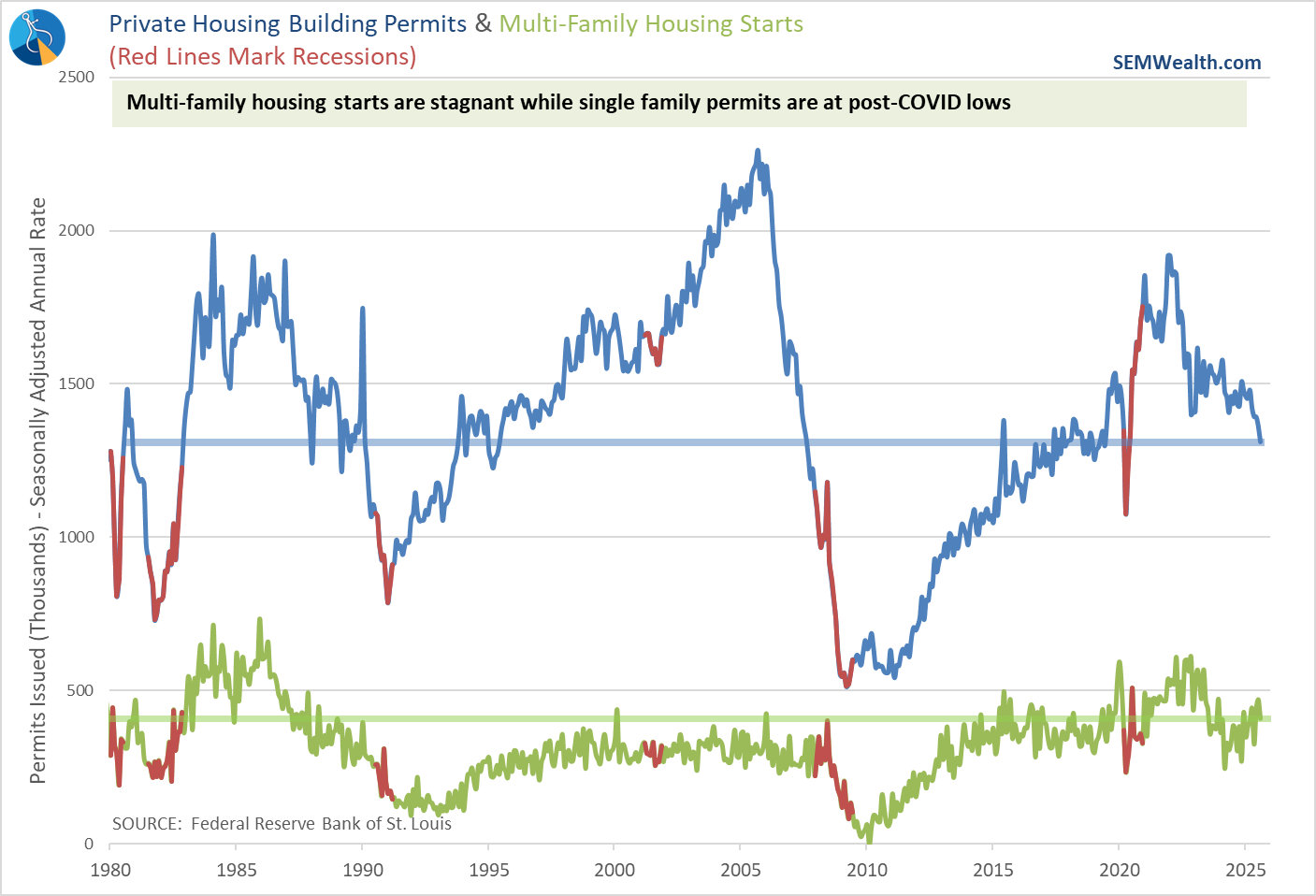

2. Housing Starts and Permits Plunge Amid Rate Pressure

U.S. housing starts fell to 6% from a year earlier, while building permits dropped 11%—both missing expectations of an increase. The decline reflects the impact of high mortgage rates, rising construction costs, which continue to weigh on builder sentiment, and a housing market that has become unattainable to most middle class families, especially younger Americans. The data added to concerns about broader economic slowing. The rise in 10-year yields post Fed rate cut could exacerbate the problem.

3. Congress Standoff Raises Shutdown Fears

Here we go again! Senate Majority Leader Chuck Schumer advanced a Republican-led spending bill, sparking backlash from progressive Democrats and raising the risk of a government shutdown. House Democrats, led by Hakeem Jeffries, warned that the bill could lead to deep cuts in federal programs. The political discord has heightened market anxiety, especially in sectors reliant on federal funding. Investors are watching closely as a shutdown could disrupt economic momentum heading into Q4.

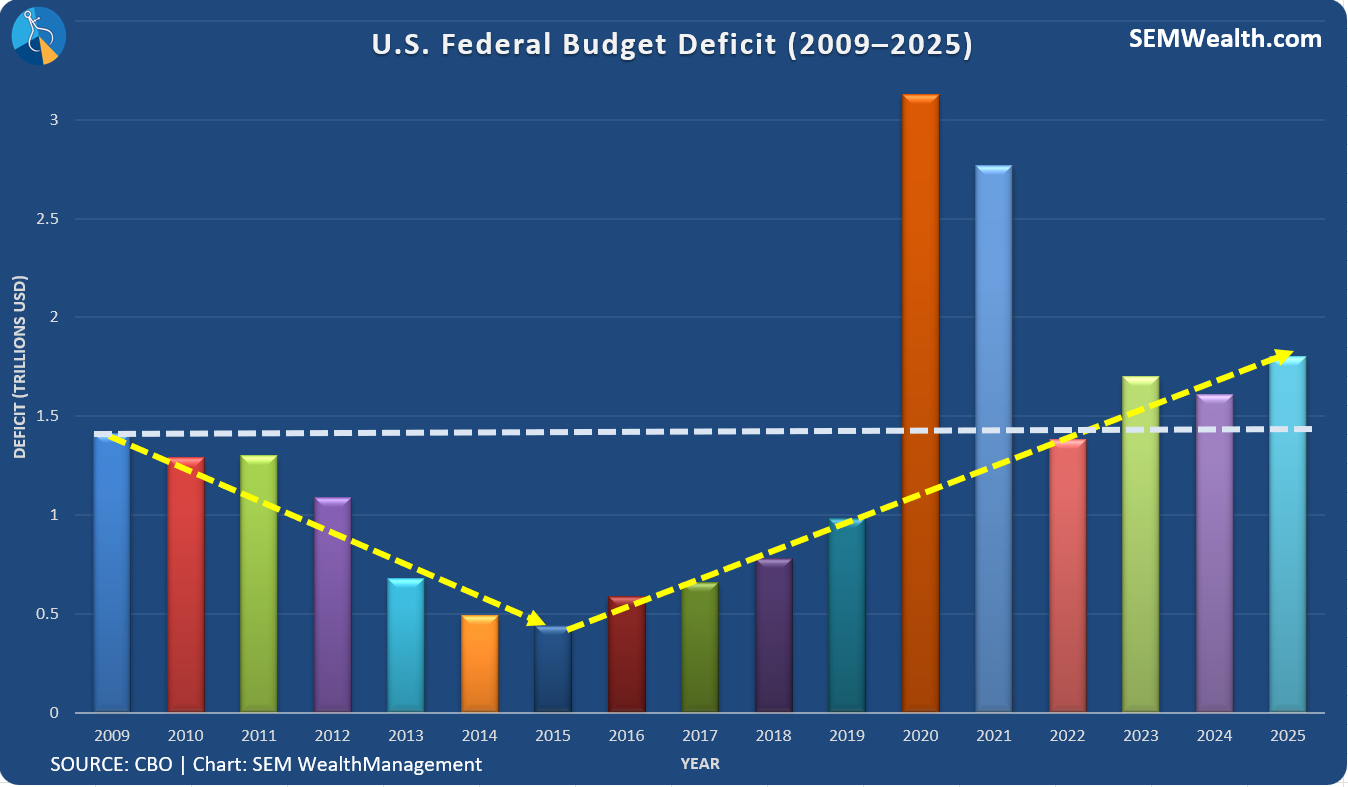

I fully expect Congress to do what they always do — punt until next year, making "compromises" to get it passed and continuing to spend money we don't have. Please do not be fooled – NEITHER party cares about the deficit. This chart shows the nice downward recovery we had following the "runaway spending" post financial crisis, ended in 2016.

I often say, this won't be a problem until it is. Just because we're able to "punt" year after year, it doesn't mean we won't pay for it. Debt is future growth brought forward. When the debt markets say enough, we won't be able to keep borrowing to fund our current "needs" and our economy (and markets) will have to reset.

4. FedEx Warns of $1 Billion Tariff Hit

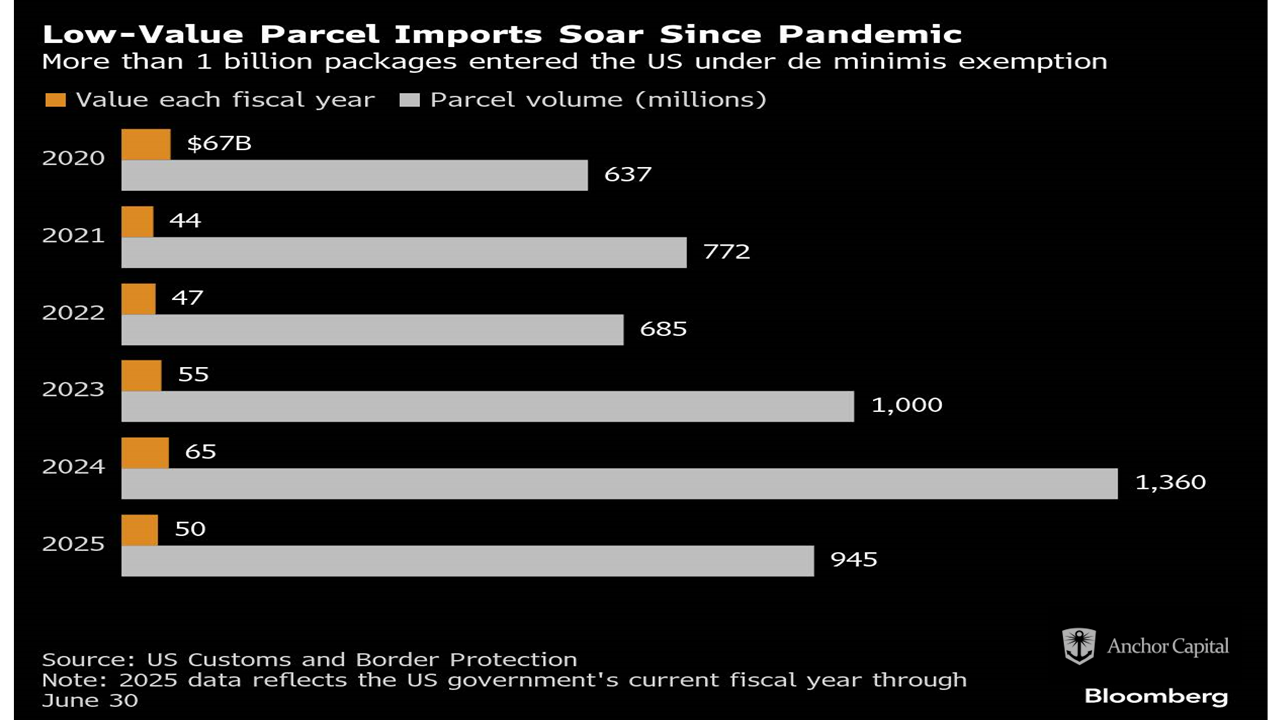

FedEx announced it expects a $1 billion hit to its fiscal 2026 earnings due to new U.S. tariffs, particularly from the elimination of the de minimis exemption for packages under $800. The company has already reduced its Trans-Pacific outbound capacity by 25% year-over-year, citing shrinking parcel volume from China. This warning adds to growing concerns about global trade disruptions, especially in logistics and transportation sectors. Analysts are watching closely for ripple effects across supply chains, pricing, and industrial earnings.

This chart from Bloomberg and Anchor Capital highlights the problem.

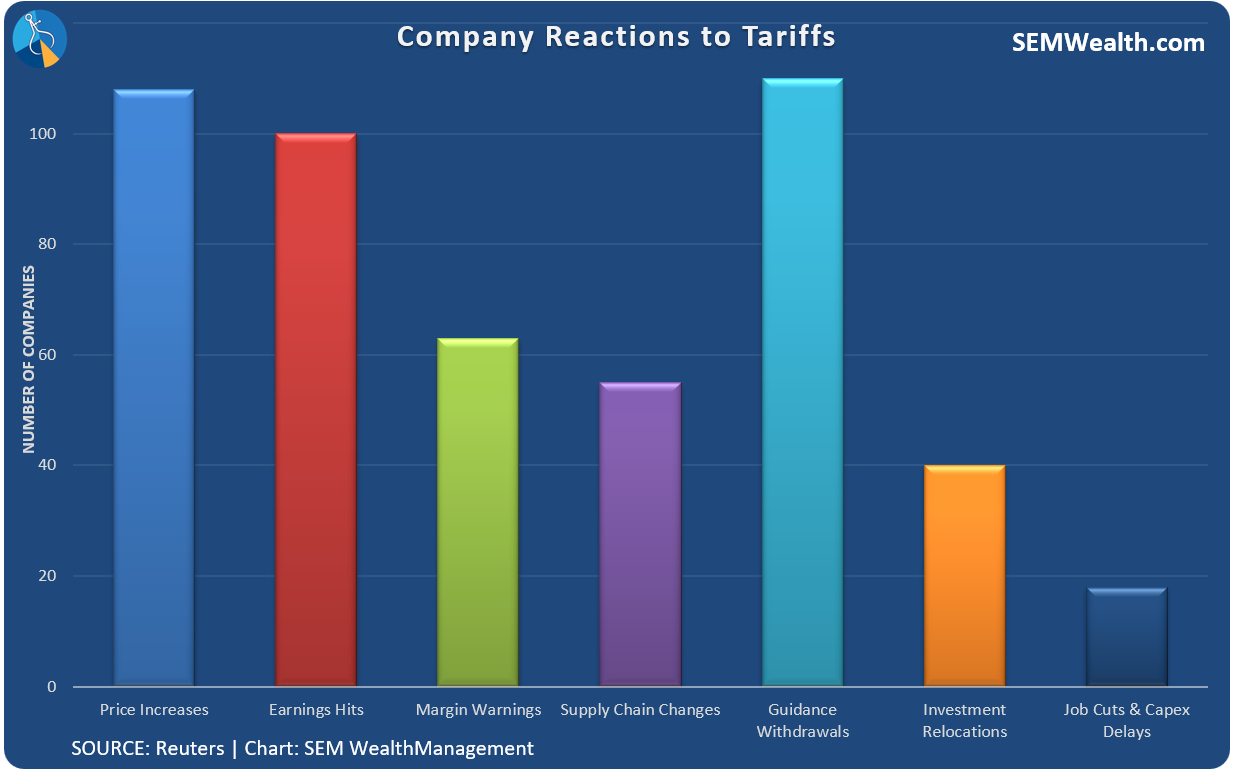

A recent study by Reuters shows Fed Ex is not alone in announcing a major impact to their earnings due to tariffs.

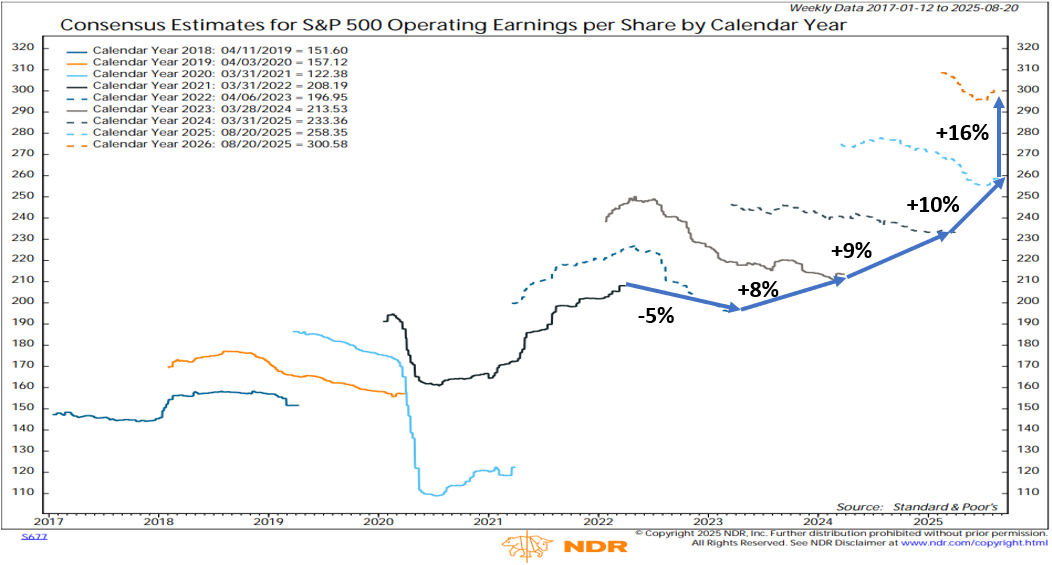

The market probably has adjusted to this, right? Apparently not. Analysts expect an impressive increase in earnings next year.

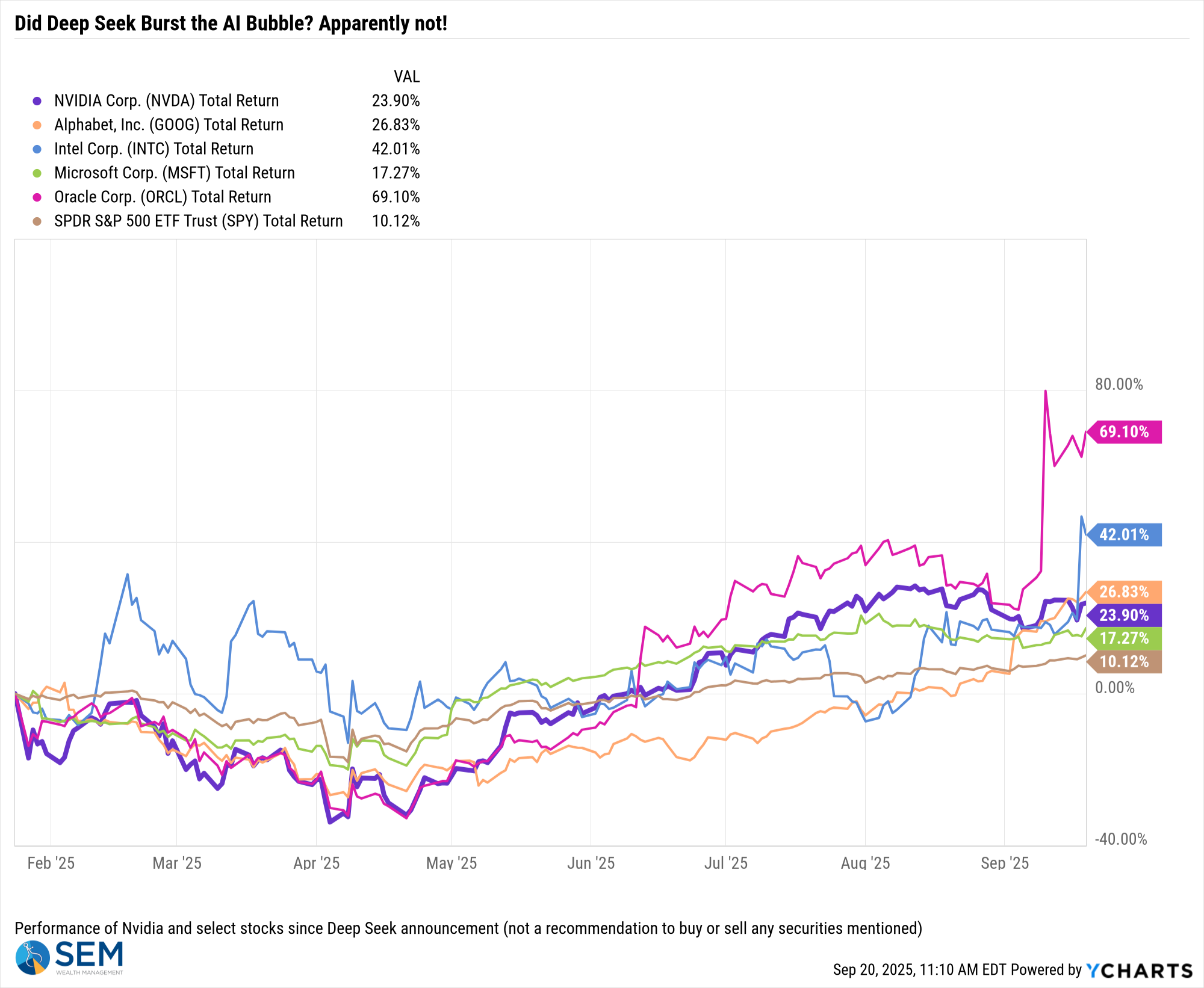

This increase is solely based on the anticipation of continued mass investment in AI, which brings us to our last story.

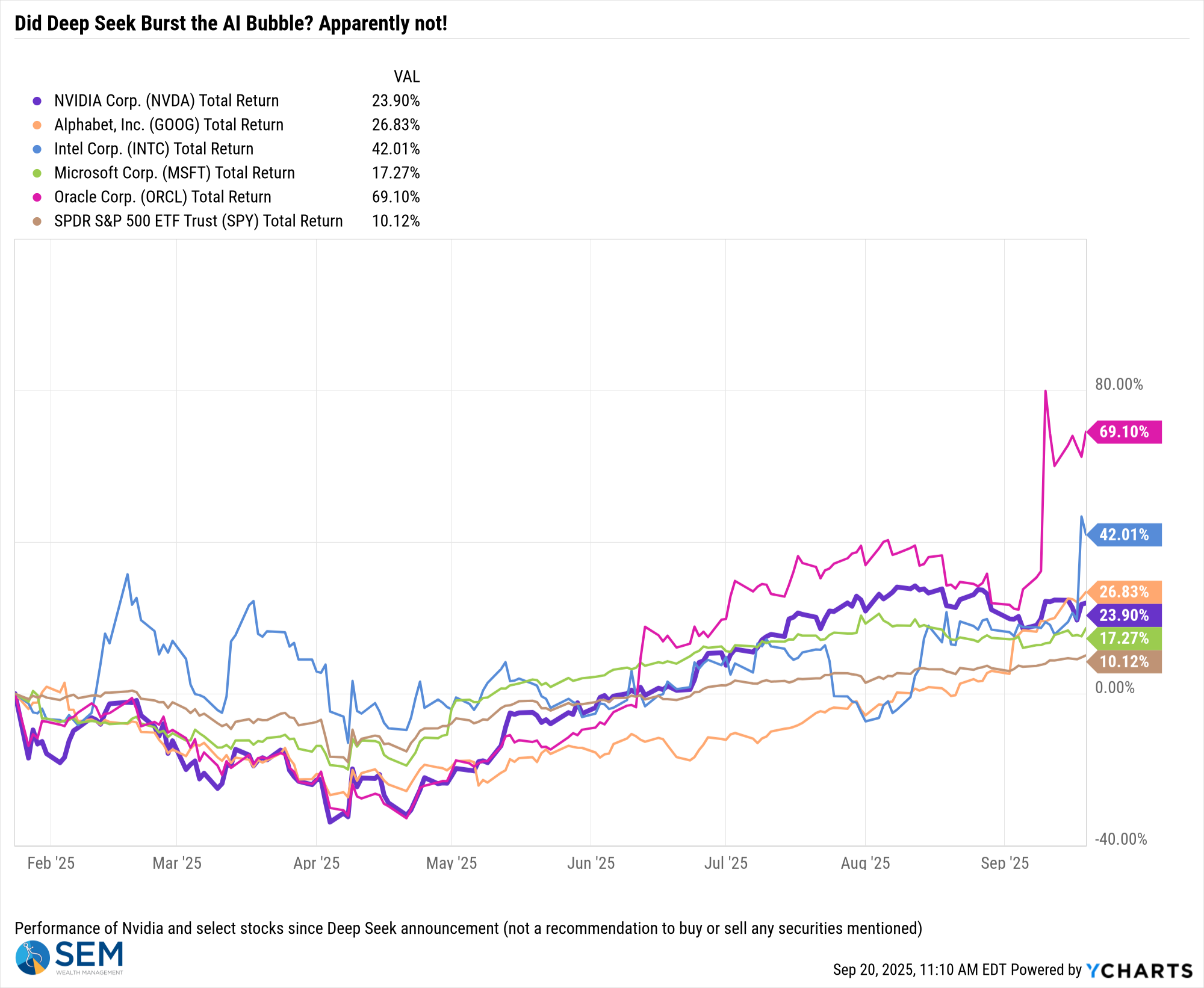

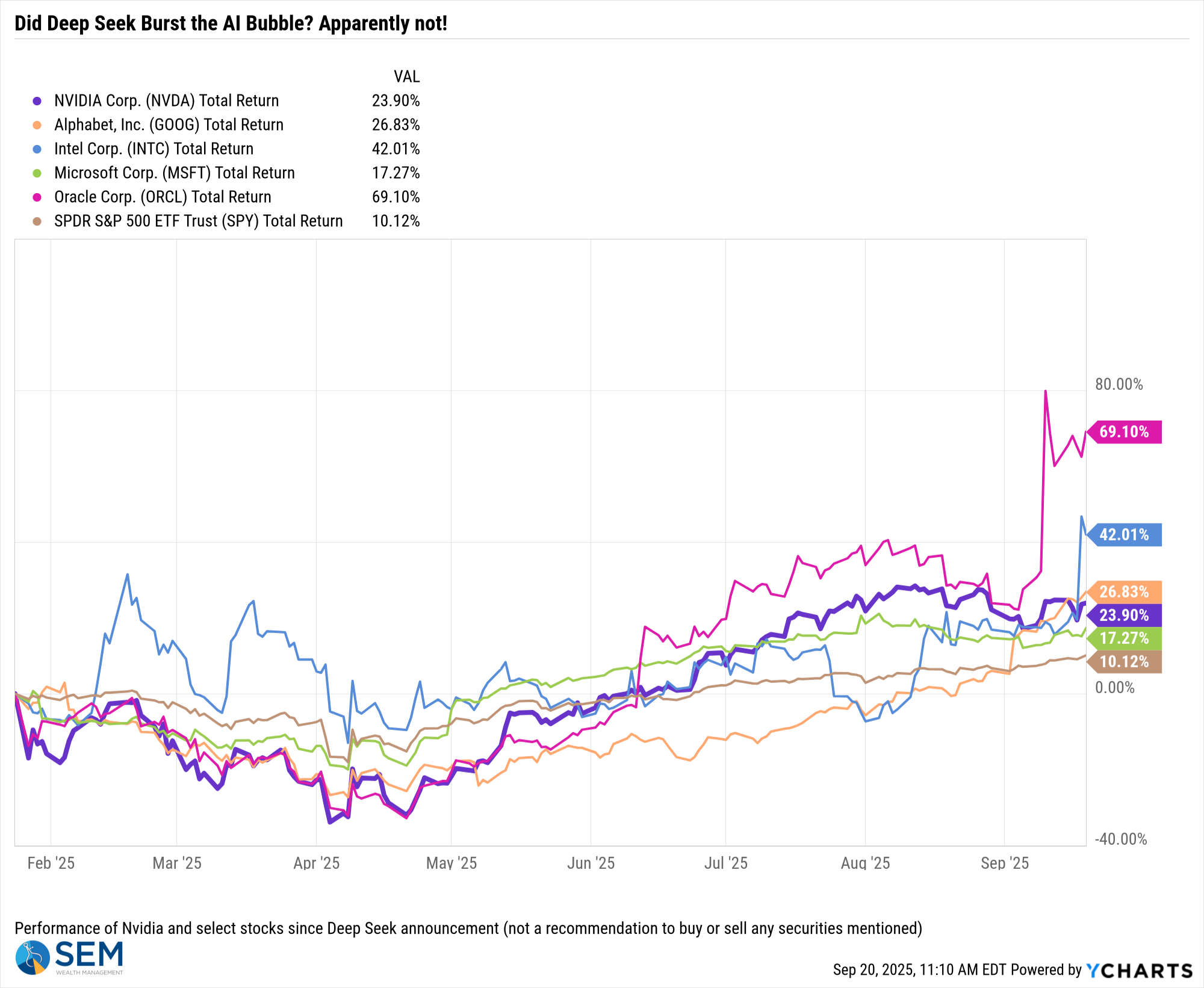

5. Intel Surges on $5 Billion Nvidia Investment

Intel stock soared nearly 23% on Thursday, marking its best day since 1987, after Nvidia announced a $5 billion investment to support Intel’s foundry business. The move is part of a broader strategy to diversify chip manufacturing amid geopolitical tensions and supply chain concerns. The investment boosted investor confidence in Intel’s turnaround plan and sparked optimism across the semiconductor sector. This deal also aligns with the Trump administration’s push for domestic tech manufacturing. Following Oracle's jaw-dropping 'backlog' announcement last week, it is clear even "mature" companies due have growth potential in this "new era".

Is this a "new era"? Having lived through several of those in my career, including the tech bubble of the 1990s, I will only say – be careful.

As start the week the message is clear: uncertainty is the only constant. Rate cuts, housing woes, political brinkmanship, and shifting corporate fortunes all point to a market that’s searching for direction. The allure of AI and tech innovation is real, but history teaches us to temper excitement with caution. Staying focused on the DATA, keeping an eye on policy shifts, and remembering that every “new era” comes with its own risks will be key for investors in the months ahead. As always, SEM will be here to help.

Toby's Take

Here's the top stories our intern, Toby found in the WSJ this week.......

9/15/2025: China Says Nvidia Violated Anti-Monopoly Law - WSJ

Nvidia is facing some legal issues stuck between the world's two largest economies. In 2020 they made a deal with China to provide an uninterrupted supply of chips and to treat Chinese customers equally. Now with the complicated situation with President Trump's trade deals, Nvidia was for a short time blocked entirely from selling chips to China, but now is only allowed to sell their less powerful chips. The issue is that they are now not technically treating Chinese customers equally compared to the rest of the world. We need to watch our models that have tech and/or AI in them because of this along with the rest of the stock market.

9/16/2025: Trump Request to Remove Fed Governor Lisa Cook Rejected by Appeals Court - WSJ

President Trump's emergency request to remove Federal Reserve Governor Lisa Cook was rejected Monday night. Now Lisa Cook is suing President Trump for violating the Federal Reserve Act by not providing a valid basis for her removal. I'm not sure how exactly this is going to affect us or our models other than maybe changing the course of interest rates.

9/17/2025: Fed Chair Powell’s Challenge: Keeping Voting Members on the Same Page - WSJ

The Fed is likely to cut rates today, but Powell is having to navigate disagreements over future policy while also figuring out who will succeed him after his term ends in May. The Fed is leaning towards voting to lower rates still, but there are a couple who are likely to dissent for a larger cut. They are President Trump appointed governors, Christopher Waller and Michelle Bowman. They both have valid and solid arguments to lower rates faster, but there is still the impression that they are politically motivated. This could affect us because people won't like the uncertainty in the markets causing more customers to come in for help.

9/18/2025: Inside the Room Where CEOs Say What They Really Think of Trump’s Policies - WSJ

Publicly big business leaders praise President Trump and his tariffs, but privately not so much. After being invited to Yale for a private meeting among big business leaders such as Chief Executive Officer of Motorola Solutions Greg Brown, Booking Holdings CEO Glenn Fogel, and Farooq Kathwari CEO Ethan Allen, they discussed privately how they really are affected by these tariffs. They said that it has become an increasingly chaotic and hard-to-navigate business environment and they don't want to speak publicly for fear of their companies being targeted by the administration or criticism from President Trump. This is a big deal because it could bring other companies to speak out against this and could either drive their stock up or shoot it down depending on the public opinion. We need to wait and find out how other companies are going to start reacting.

🗓️ The Week Ahead: September 22–26, 2025

It's a fairly heavy week of economic data and (unfortunately) more importantly some key Fed speeches.

Monday, September 22

- 08:30 AM ET – Chicago Fed National Activity Index (August)

Tuesday, September 23

- 07:45 AM ET – ICSC Weekly Retail Sales

- 08:55 AM ET – Johnson Redbook Weekly Sales

- 09:45 AM ET – S&P Global Manufacturing PMI (Flash, September)

- 09:45 AM ET – S&P Global Services PMI (Flash, September)

- 09:45 AM ET – S&P Global Composite PMI (Flash, September)

- 10:00 AM ET – Richmond Fed Manufacturing Index (September)

- 12:35 PM ET – 🏛️ Fed Chair Jerome Powell

Topic: Economic Outlook

Event: Greater Providence Chamber of Commerce

Location: Warwick, RI - 01:00 PM ET – U.S. Treasury Auction: $69B in 2-Year Notes

- 04:30 PM ET – API Weekly Crude Oil Inventory

Wednesday, September 24

- 07:00 AM ET – MBA Mortgage Applications

- 10:00 AM ET – New Home Sales (August)

- 10:30 AM ET – DOE Weekly Petroleum Status Report

- 01:00 PM ET – U.S. Treasury Auction: $70B in 5-Year Notes

Thursday, September 25

- 08:30 AM ET – Weekly Jobless Claims

- 08:30 AM ET – Final Q2 GDP:

- GDP Growth Rate

- Consumer Spending

- Price Deflator

- PCE Prices

- Core PCE Prices

- 08:30 AM ET – Durable Goods Orders (August)

- 08:30 AM ET – Advance Goods Trade Balance (August)

- 09:00 AM ET – 🏛️ Fed Vice Chair Michelle Bowman

Topic: Economic Outlook

Event: Kentucky Bankers Association Convention (Virtual) - 10:00 AM ET – Existing Home Sales (August)

- 10:30 AM ET – EIA Natural Gas Inventory

- 11:00 AM ET – Kansas City Fed Manufacturing Index (September)

- 01:00 PM ET – 🏛️ Fed Governor Michael Barr

Topic: Bank Stress Testing

Event: Peterson Institute for International Economics

Location: Washington, D.C. - 01:00 PM ET – U.S. Treasury Auction: $44B in 7-Year Notes

Friday, September 26

- 08:30 AM ET – Personal Income & Spending (August)

- 08:30 AM ET – PCE Price Index (MoM & YoY)

- 08:30 AM ET – Core PCE Price Index (MoM & YoY)

- 10:00 AM ET – University of Michigan Consumer Sentiment (Final, September)

- 10:00 AM ET – U. Michigan Inflation Expectations (1-Year & 5-Year)

- 10:00 AM ET – 🏛️ Fed Vice Chair Michelle Bowman

Topic: Supervision and Regulation

Event: Financial Markets Quality Conference

Location: Washington, D.C. - 01:00 PM ET – Baker Hughes Rig Count

💼 Noteworthy Earnings Releases: September 22–26, 2025

Tuesday, September 23

- AutoZone (AZO)

- Micron (MU)

- Worthington Enterprises (WOR)

Wednesday, September 24

- Cintas (CTAS)

- Thor Industries (THO)

- KB Home (KBH)

- Steelcase (SCS)

Thursday, September 25

- Accenture (ACN)

- CarMax (KMX)

- Jabil (JBL)

- TD Synnex (SNX)

- Costco Wholesale (COST)

- BlackBerry (BB)

- Concentrix (CNXC)

Friday, September 26

- (No major earnings reports scheduled)

Market Charts

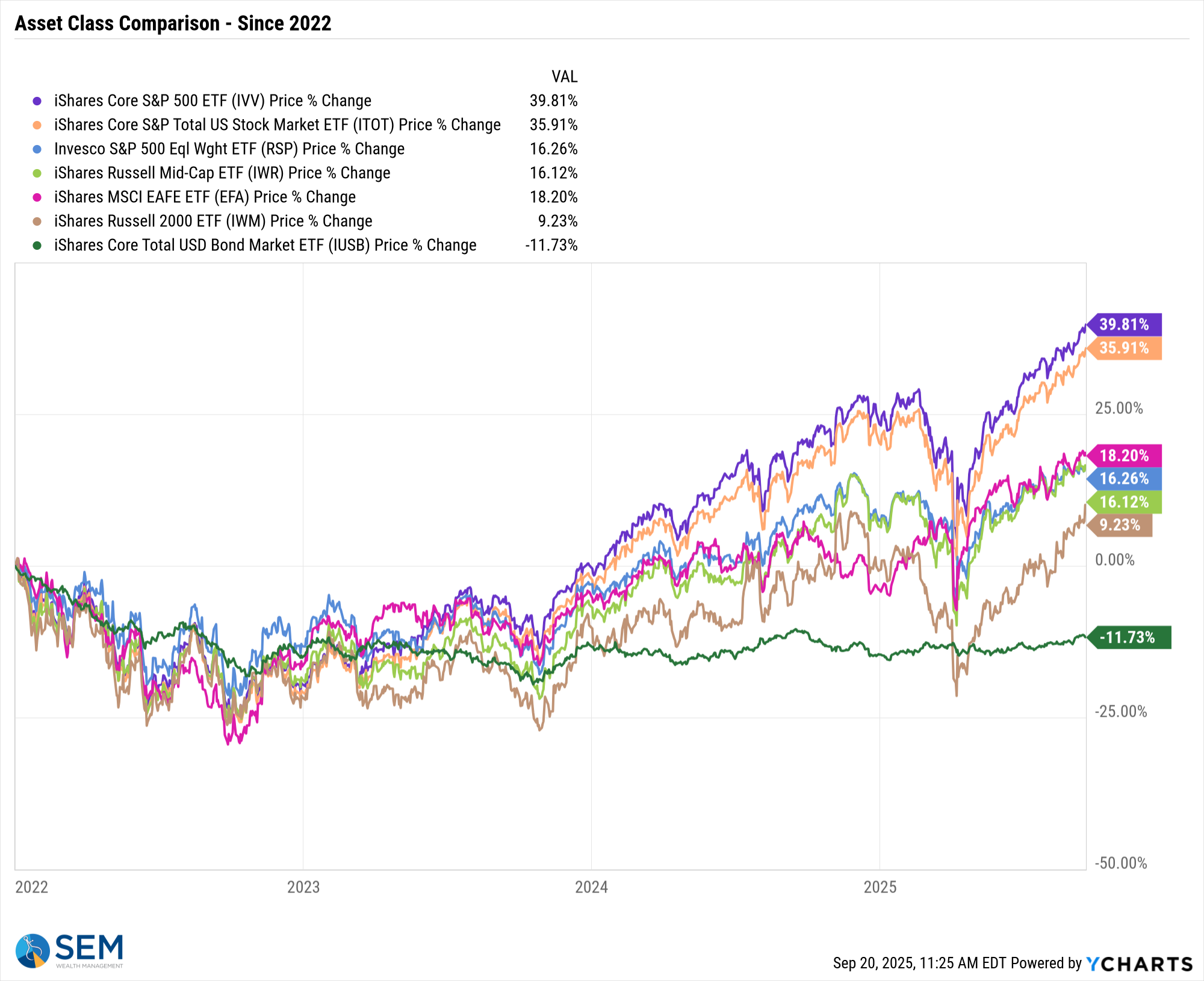

The weakest sectors had a brief moment in the sun last week following the Fed's rate cut announcement, but during the press conference the tech-led market was back.

The main thing we are watching short-term is whether the rally can broaden out and if the Relative Strength Index (RSI) of the S&P 500 can "confirm" the rally. For now, this is a speculative driven rally that should be looked at with caution.

A lot was made about the surge in small cap stocks (briefly) last week. This chart highlights the tough time small companies have had since the peak in 2021.

Earlier we took a shorter-term perspective on bonds. Zooming out to the 20-year chart of the 10-year Treasury yield, we can see we have moved into "easier" territory although rates are just now breaking below the peak rates of the financial crisis.

SEM Market Positioning

| Model Style | Current Stance | Notes |

|---|---|---|

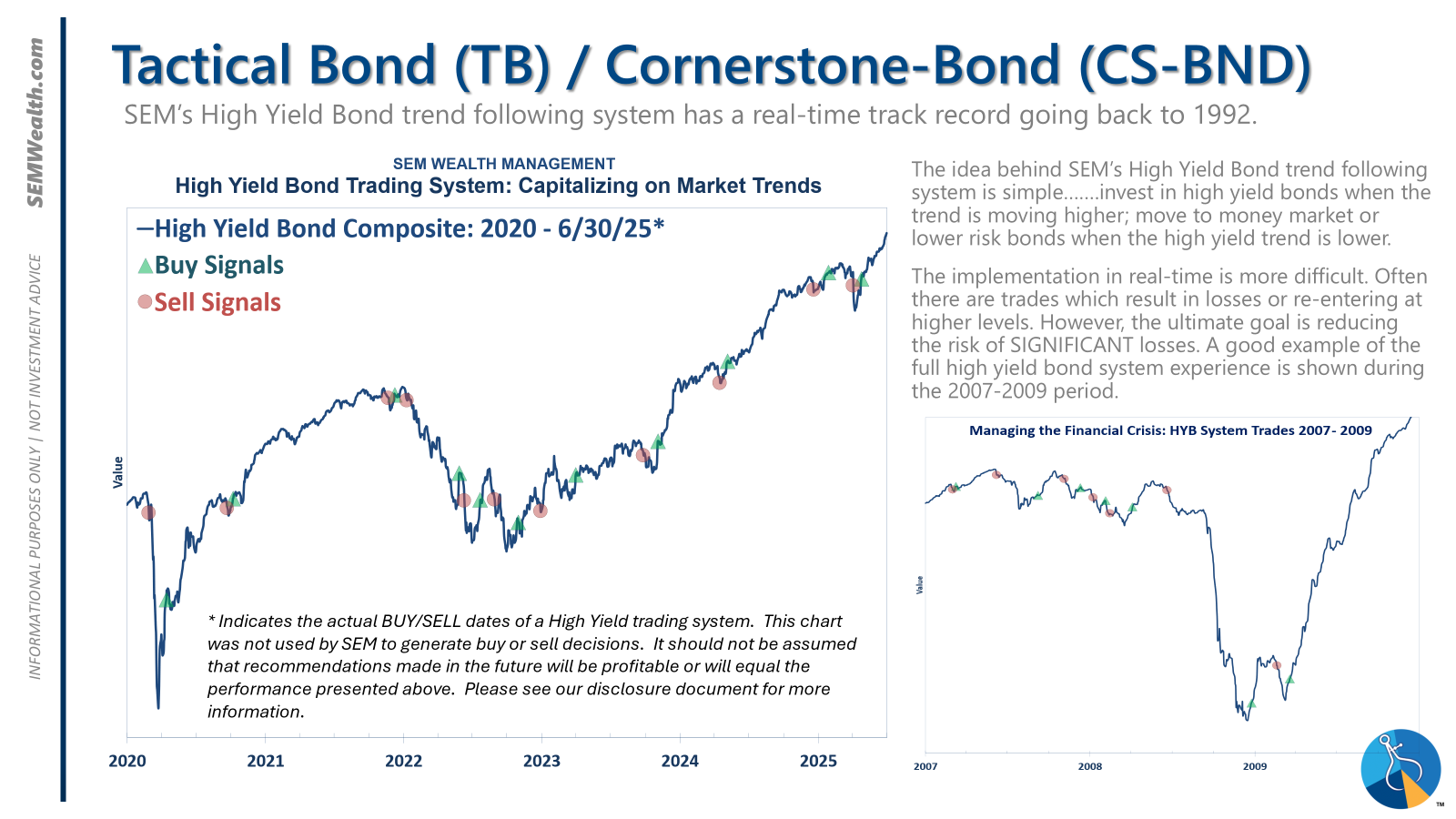

| Tactical | 100% high yield | High-yield spreads holding, but trend is slowing-watching closely |

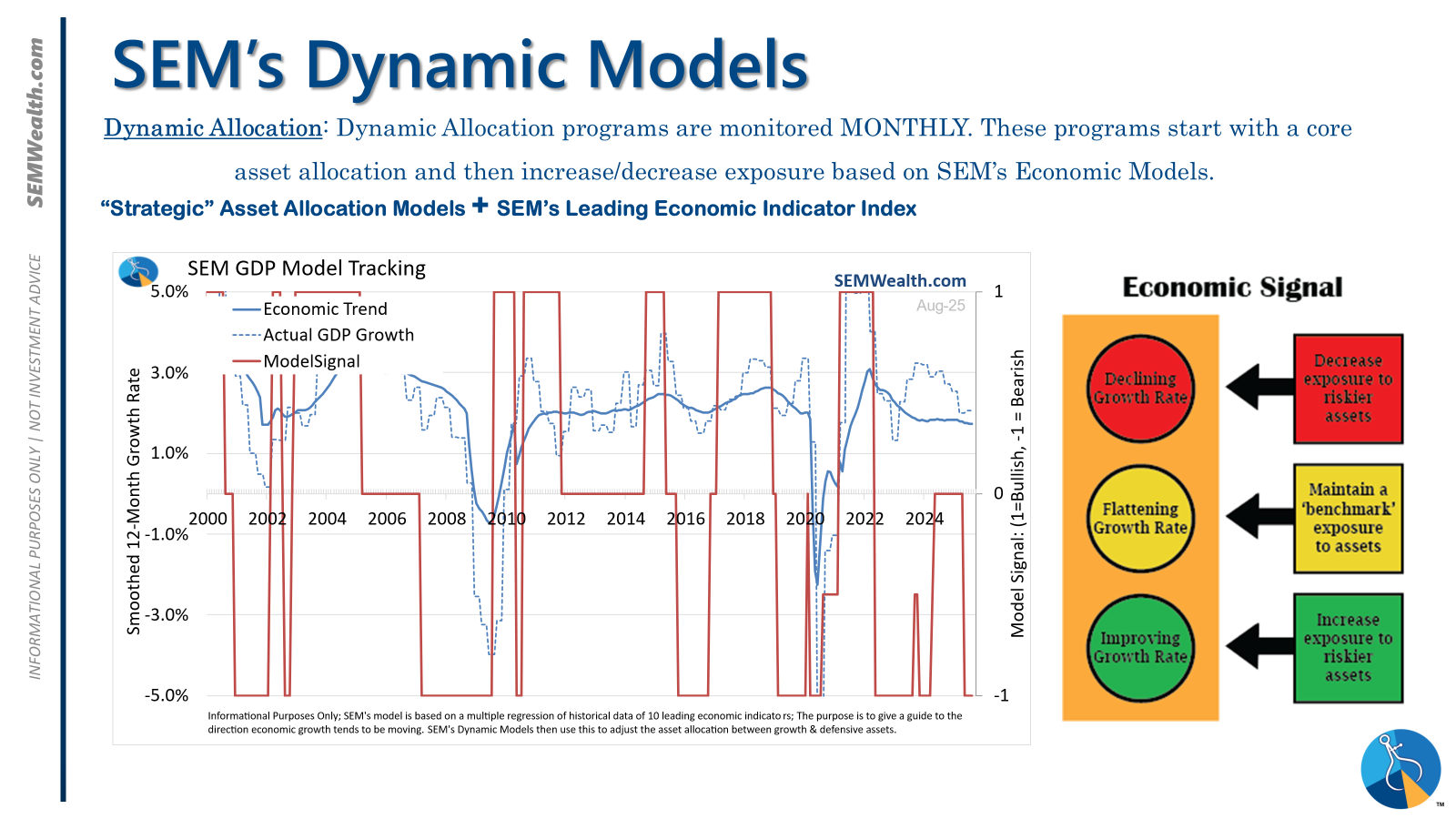

| Dynamic | Bearish | Economic model turned red – leaning defensive |

| Strategic | Slight under-weight | Trend overlay shaved 10 % equity in April -- added 5% back early July |

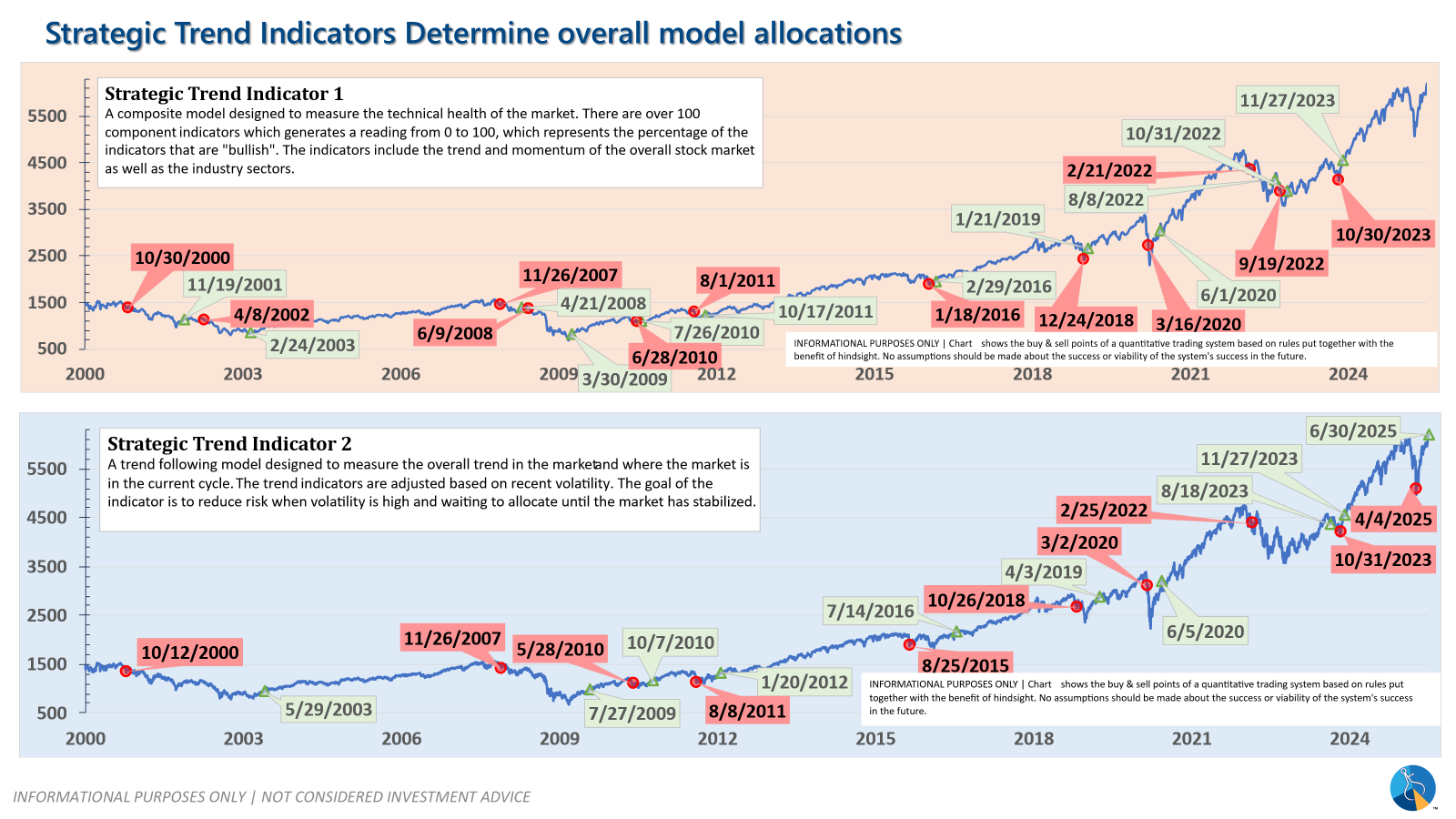

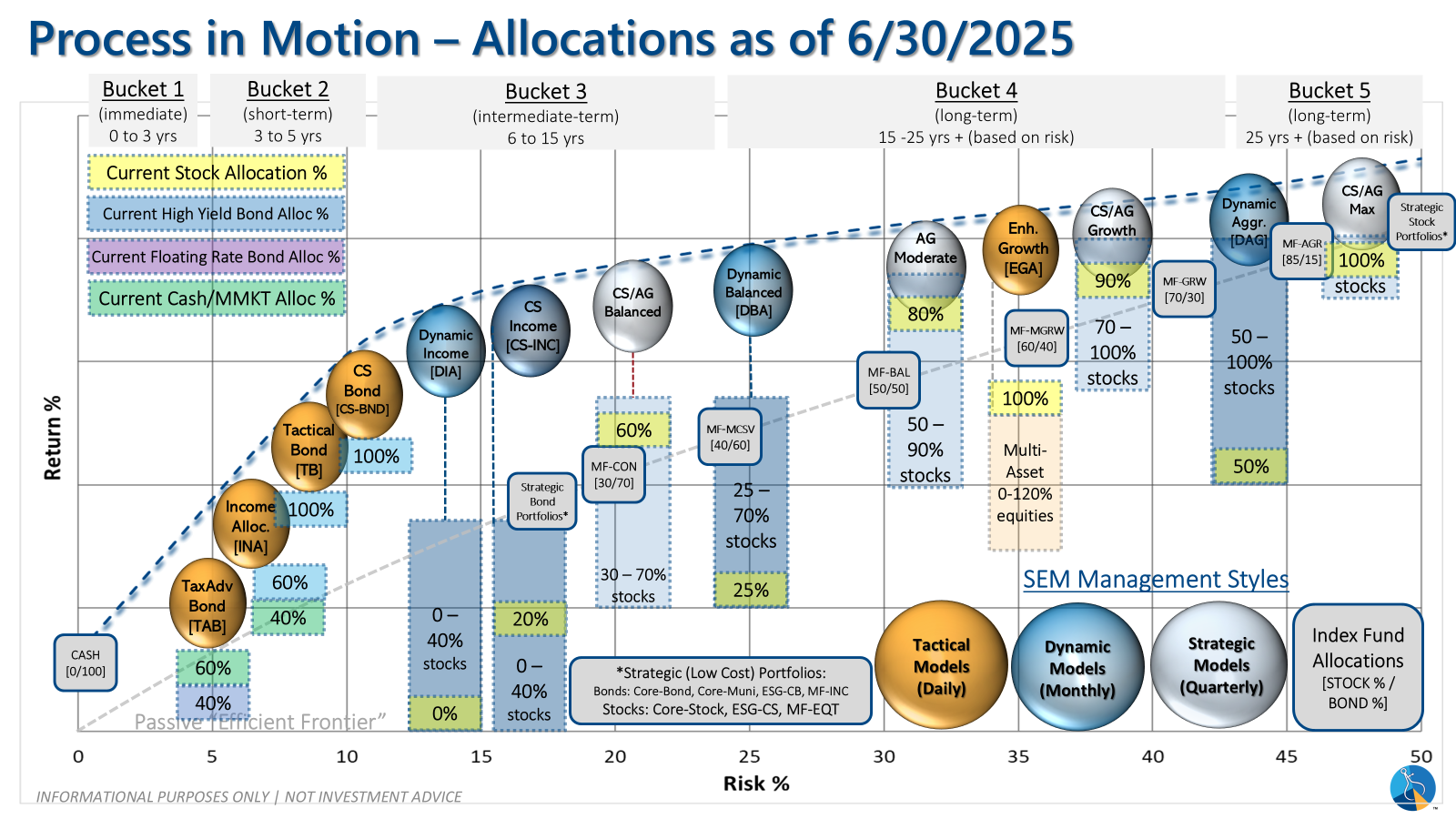

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): The high yield system has been invested since 4/23/25 after a short time out of the market following the sell signal on 4/3/25.

Dynamic (monthly): The economic model went 'bearish' in June 2025 after being 'neutral' for 11 months. This means eliminating risky assets – sell the 20% dividend stocks in Dynamic Income and the 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is 'bullish' meaning higher duration (Treasury Bond) investments for the bulk of the bonds.

Strategic (quarterly)*: One Trend System sold on 4/4/2025; Re-entered on 6/30/2025

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire