I've been managing money in the markets for over 30 years. We've had several periods of time where it was necessary to follow the news all day long. Nearly all of those times were due to some sort of crisis, whether it was the Asian currency melt-downs in 1997 and again in 1998, Y2K, 9/11, the Great Financial Crisis, the "Arab Spring", the Debt Ceiling Crisis of 2011, COVID and the Social Uprising of 2020, or the initial days of the Ukraine Russia War, there was always some sort of outside event which caused the markets to be on edge.

I don't know that I've ever had such an exhausting week of following the news than I have during President Trumps second, first week in office. I will do my best to summarize what all has happened and highlight what I believe are the important parts.

The First Leak in the AI Bubble?

But first, stocks are set to take a big hit to start the week after a Chinese start-up, DeepSeek launched their latest open-source AI model which they said would run on less-advanced chips. This of course is a major concern for companies such as Nvidia who on Friday had become the 5th largest company in the S&P 500. Going into the week Nvidia had a PE ratio of 56 with expected growth of 26%. This could also make the $200B+ expected spend on Nvidia chips in 2025 called into doubt in terms of profitability. Keep in mind that not only is Nvidia getting credit for this revenue, but the rest of the AI-related companies are expected to make money on their "investment" in Nvidia's chips.

Remember, 40% of the S&P 500 is in the top 10 companies with all but Berkshire Hathaway, United Healthcare, and Exxon Mobil tied directly or indirectly to the AI bubble.

4 Key Areas to Watch

There will be plenty of increased noise around the other actions by the President, but these 4 areas are the only ones that really matter from a market perspective:

- Debt & Deficits

- Tariffs

- Taxes

- Immigration

With that in mind here is a list of most of the executive orders issued during the last week, presented (mostly) without commentary. I probably missed some, but these were all the ones I could find.

Executive Order Blitz

- Immigration

- designate certain cartels as foreign terrorists organizations

- Suspend "resettlement" programs for refugees

- Terminate all categorical parole programs for refugees

- Reinstate "remain in Mexico" program for asylum seekers

- Remove any alien engaged in the 'invasion' of the southern border

- End birthright citizenship of babies born to undocumented immigrants (a judge has already issued an injunction on this order as it appears to violate the 14th Amendment)

- Deploy 1500 troops to Mexican border (on Friday the Pentagon readied more than 5000 additional troops in anticipation that this order will be expanded.)

- Expand fast-track deportations allowing immigration officers to deport migrants without appearing before a judge

- Energy & Environment

- Rescind protection of Alaska for drilling in coastal areas

- Pause offshore wind leasing programs

- Exit Paris climate treaty

- Revoke Biden's order to car manufacturers to cut emissions and shift to 50%+ electric sales by 2030

- Restart review of liquefied natural gas export projects paused during Biden administration

- DEI & Transgender Initiatives

- Recognize only two sexes on all federal documents and declaring men are "biologically male" and women are "biologically female"

- Rescind Biden provision allowing transgender people to serve in military

- Dismantle government diversity, equity, and inclusion (DEI) initiatives within 60 days

- Federal Workers

- Return to full-time in-office work and implement a freeze on hiring for government positions (does not include military, immigration enforcement, public safety, or security)

- Reinstate "Schedule F" executive order making it easier to fire civil servants deemed to be disloyal

- Jan 6 Pardons

- 1500+ people charged with crimes related to January 6, including members of Proud Boys and the Oath Keepers

- Health Executive Orders

- Remove US from World Health Organization (WHO)

- Rescind Biden order to lower cost of prescription drugs

- Remove COVID vaccine requirement for green card applicants

- Miscellaneous Orders

- Ensure government agencies " do not unconstitutionally abridge the free speech of any American citizen"

- Order review of all trade practices and agreements (due by April 1)

- Revoking security clearances of John Bolton and other former intelligence officials who signed a letter discrediting the Hunter Biden laptop story

- Revoke security clearance for Anthony Fauci and cancel all federal provided security protection

- Establish the Department of Government Efficiency (DOGE)

- Suspend the TikTok ban for 75 days

- Declaring federal buildings should "respect regional, traditional, and classical architectural heritage"

- End investigation into Chinese-linked telecom hack

- Designate Iranian-backed Houthis as a foreign terrorist organization

- Freeze all new funding of foreign aid, with exceptions for "humanitarian food programs" and military aid to Israel and Egypt

- Revoke rule to phase out methanol cigarettes

- Declassify JFK, RFK, and MLK assassination files

- Revoke past government policies that "act as barriers to American AI innovation" (more on AI below. No specific policies were listed and the order calls for an action plan within 180 days)

- Pardoned Silk Road founder, a dark web market place federal prosecutors said has sold more than $200 million of illegal drugs and other illicit goods

- Fired Inspector Generals for the Departments of Defense, State, Interior, Transportation, Veterans Affairs, Housing and Urban Development, Environmental Protection Agency, and the Small Business Administration. (This appears to violate the law as the Inspector Generals role is to scrutinize the departments the President is tasked with controlling and requires 30-days of notice before he can remove any of them. All must be approved by the Senate, giving Congress some say on who fills these roles.)

What Wasn't Included in the Blitz

Note that none of the above included the large tariffs Trump threatened before and after the election. The markets rallied as Trump appeared to waiver on what he may or may not do with tariffs. The order to review all trade practices and agreements is due by April 1, so we may not see much in the way of new tariffs until after that report. On Fox News Thursday night the president said he'd "rather not" use tariffs on China.

While not a surprise to most, the President's campaign promise to end the Ukraine Russia ware on "day 1" did not happen. Instead the President threatened Russia with sanctions and tariffs. He also called out China for not doing more to help end the war. The President also criticized the Ukrainian President for "talking so brave," and said he wouldn't have been able to do that if the US hadn't given Ukraine billions of dollars.

"Trump's" $500B AI Investment

On Wednesday a strategic partnership between Softbank, OpenAI, and Oracle was announced. While not an executive order and so far no public dollars will be used (we will see later on if there were tax break incentives offered), the $100B Softbank said they have committed to this project aligns with their commitment to invest $100B into US technology projects under the second Trump administration.

While I've been cautious about finding the next "rocketship" AI stock and not chasing the mania, there is no denying AI, just like affordable personal computers in the early 90s, the internet in the late 90s, smartphones in the mid 00s, this technology will make all of us more productive.

Remember, the only way to grow the economy over the long-term is to either increase workers or increase productivity (or preferably both). This investment announcement is a positive for two reasons – it doesn't use public money, the President is simply "making it easier" in order to encourage the investment". This reminded me of an article I read a few weeks back on Bloomberg, discussing the increase in productivity AI is bringing:

Skanda Amarnath: The AI Boom’s Economic Impact Is Starting to Show Up - Bloomberg

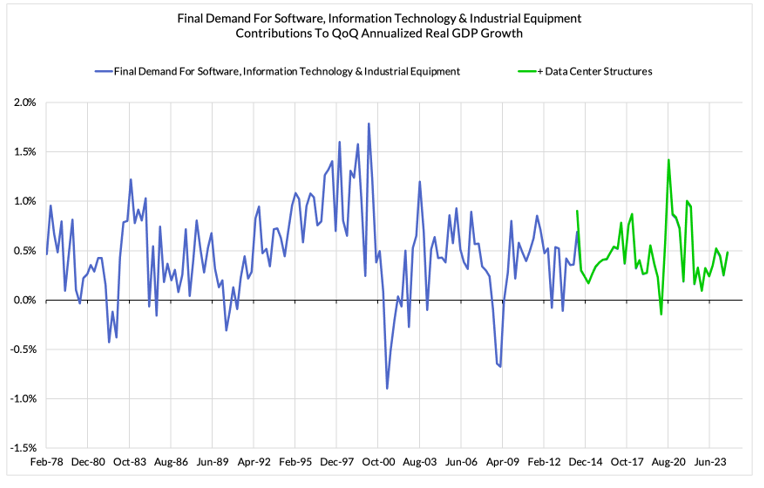

"In the third quarter of last year we saw these segments contribute 0.5% to real GDP growth. It’s not a number to sneeze at but also meaningfully lower than the 1-1.2% contribution to real GDP growth seen in the late 90s tech boom.

"A third year above 2% productivity growth would likely force the Fed to raise its estimates of potential GDP growth. And while I would disagree with drawing a conclusion that it should necessarily imply a higher neutral rate of interest (r*), plenty of other FOMC members have suggested otherwise. Booming AI investment in 2025 has the chance to be yet another catalyst to push up both short- and longer-run expectations for Fed policy.

"The other side of the coin to booming tech investment in the coming quarters is that we see subsequent analogues to the 2000-2003 downturn. Contrary to the common conception of it being a shallow recession lasting less than a year, the hangover from the late 1990s tech boom involved persistent multi-year declines in the labor market (as evidenced by the prime-age 25-54 employment rate), real business fixed investment, and the stock market.

"History rarely repeats, and there are enough differences this time around to not give in to fatalistic dooming. However, the outsized thematic role of AI and IT in US capital markets is already a lot to reckon with. Even a pure ‘sectoral’ recession could yield macro-level spillovers if volatility rises and risk preferences scale back.

Lower Prices = DECREASED Production

One of the most popular policies from President Trump is "drill baby drill". He believes by opening up more drilling oil prices will come down. He is correct in a sense, but what he is forgetting is if oil prices fall too far the profit margins for the oil drillers will be too small which will discourage them to increase production (or cause them to CUT production.)

Trump also said on Thursday he would "demand" OPEC decrease oil prices. The way OPEC would do that would be to INCREASE production and thus flood the markets with cheaper, higher quality oil. This would actually hurt U.S. exports of oil. We have to keep in mind, most of the projects are expensive, long-term endeavors so if oil prices are thought to be coming down, this could delay any new projects. Ironically, the president would need HIGHER oil prices now to encourage MORE drilling.

Fed Independence Challenged Again

On one of our advisor calls Thursday morning I said one of my fears for 2025 was a resumption of the Trump vs Fed war of words we had throughout his first term. A couple hours after the call the President said this:

“I’ll demand that interest rates drop immediately. And likewise, they should be dropping all over the world. Interest rates should follow us all over.” - Donald Trump on Thursday, January 23

One of the things which allows the US to continue to be the world's reserve currency is the independence of the Federal Reserve. The 6-year, staggered terms for Fed members, including the Chair and Vice Chair are designed to not allow a president to dictate what the Federal Reserve does with their policies. This allows other countries to trust the "full faith and credit" of the United States, including US Treasury Bonds and the US Dollar.

Dates to Watch

My two other short-term concerns in addition to Trump again trying to strong-arm the Fed are the debt ceiling and the funding of the government. The US hit the $36.2 Trillion debt ceiling on Trump's second day in office. Current Treasury Secretary Janet Yellen said they have resorted to 'emergency measures' to continue funding the government without borrowing more money. Due to the uncertainty of the timing of tax revenue these measures should give the government enough money until "spring or summer".

The other deadline is March 14, which is when the last Congress kicked the can to in December when they voted for a short-term funding bill. The president has pushed for "one big, beautiful bill" to include everything on his agenda. The president has since backed off on that, but Speaker of the House Mike Johnson and several other Republicans appear to still be working on it. This bill would include Trump's plans for border security, energy policies, manufacturing, and extending and expanding his 2017 tax cuts. The GOP has also said they would include a hike of the debt ceiling inside this bill. The razor thin majority in the House and Senate makes this a tough order, especially for Republicans who previously said they were "fiscally conservative" and voted against raising the debt ceiling.

One idea floating around this week was the Republicans would include in the next "can kicking" government funding bill to get us past March 14 increased disaster aid for California along with an increase in the debt ceiling. As several Republicans have been saying, "We can't help California without borrowing more money."

Let the circus begin!

Remember 2011?

I'm a fiscal conservative and believe in capitalism. I resigned from the Republican Party in 2008 when Republicans decided to bail out the failed Wall Street banks with government money. They not only did not help smaller banks, they made it more difficult to be a small bank because the Republicans made the Wall Street banks even bigger.

I held out hope in 2011 that Republicans were finally going to get back to their fiscally conservative roots. This is when the Tea Party stood up to the establishment inside the GOP and demanded they do something about the budget. I called that March-September 2011 episode the "Debt Ceiling Circus" because it was filled with all kinds of shows and distractions.

Unfortunately two things happened — the Tea Party ended up caving and was only able to squeeze out small cuts in spending. Worse, in the 2012 election, the GOP machine funded candidates to run against every single Tea Party candidate, effectively wiping out those who dared to stand up to the runaway spending BOTH parties seem to love.

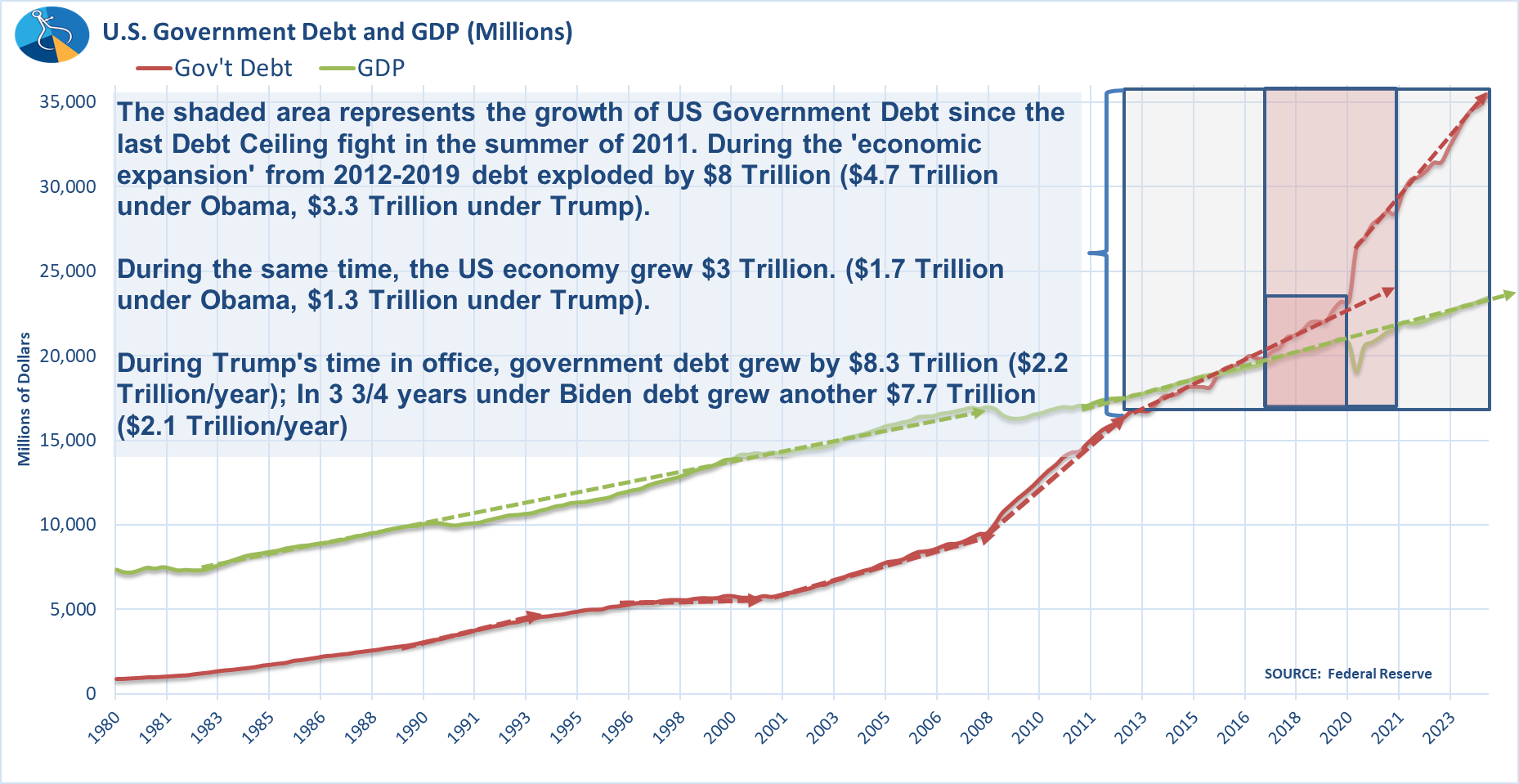

I share this chart occasionally which illustrates the US Economy (GDP) and the US Government Debt on the same axis. Remember, debt is "good" if it increases FUTURE growth. It is "bad" if it is used for things which do not grow the economy. Ultimately, the only way to grow the economy is to put more people to work (long-term) or make them more productive (long-term).

For the most part, from the 1980s to the mid 1990s Debt and GDP were growing at roughly the same pace. Then in the mid-1990s a Republican Congress and Democratic President actually slowed the pace of debt and even ran a BALANCED BUDGET (and then a surplus), which slowed the pace of debt significantly.

In 2001, George W. Bush decided since the government was running a surplus, they should refund money to tax payers. Then 9/11 happened and in the name of Patriotism we started running large deficits again. This time debt was growing faster than the economy.

The Financial Crisis, the mass bailouts of failed businesses, and all kinds of short-term "stimulus" measures spiked the debt. The Tea Party stepped in, knowing that history tells us it is difficult for a country to continue to prosper when the debt load exceeds the size of the economy.

When you zoom in on the chart you can see a couple of things:

1.) The pace of debt GRADUALLY slowed from the 2008-2011 pace (but not much)

2.) The pace of growth in the economy did not change from 2011-2019

3.) BEFORE COVID, President Trump INCREASED the pace of debt growth (with no change in the pace of economic growth)

4.) The pace of debt growth remained the same from April 2020 (Trump) through the end of 2024 (Biden)

5.) GDP Growth remains at the same pace

This brings us to the top area to watch in terms of Trump and the market – debt and deficits. By all accounts, the deficit WILL NOT go down under President Trump. Despite the promises of "DOGE", the "wasteful spending" cuts will not make a significant enough impact to pay for the extension (or expansion) of the 2017 Tax Cuts. They didn't pay for themselves last time (as witnessed by the lack of change in GDP growth and the increase in the debt load), and they are unlikely to pay for themselves again. Tariffs most certainly won't pay for them.

So now we need to prepare ourselves for a return of an old term.........

Bond Vigilantes

A bond "vigilante" is a bond investor who protests policies they deem to be too inflationary or cause runaway deficits (making the value of the bonds worth less). The vigilante protests by selling their bonds and being vocal about why. When a group of them get together it can be a powerful force. By selling bonds it drives up borrowing costs making it difficult for the issuer to continue borrowing money until they become more fiscally conservative.

The phrase was coined by Ed Yardeni in the early 1980s. The Vigilantes likely led to Paul Volker's only task as head of the Federal Reserve – to end inflation. Bond Vigilantes were also credited with the balanced budgets of the late 1990s after driving up 10-year yields from 5.2% to 8% from October 1993-November 1994.

Most of the other "vigilante" episodes occurred overseas, but there is growing concern they could reappear soon. Some of the reasons are:

- The "temporary spending increases" appear to be permanent (see chart in previous section)

- If tariffs and mass government spending sparks inflation, this erodes the value of coupon payments and may be more difficult to stop without significantly higher rates

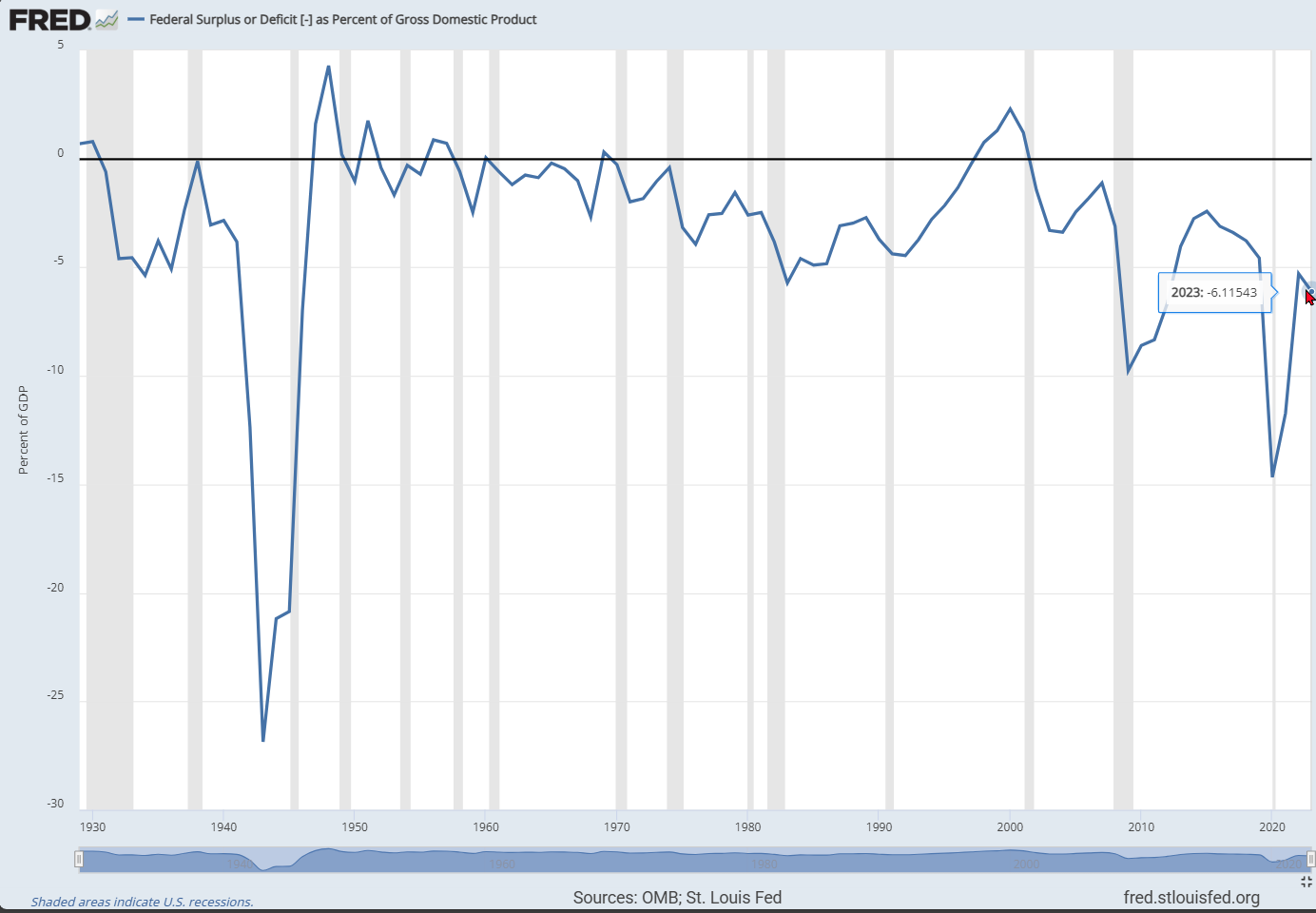

- The Deficit vs Income (GDP) equation is important – negative 2-3% deficit is thought to be tolerable, below that is a problem. As the chart below shows we are nowhere near that. When President Trump took office in 2017 it was at -3.1%. At the end of 2019 (before COVID) it had fallen to -4.6%.

If they do return, things could get ugly. The President "demanding" rates be cut could only make things worse. However, we do need to keep in mind that during the first term, President Trump's policies were highly sensitive to how the market received them. This means if the stock market gets hit, he could back off on some of the more deficit expanding initiatives to ease the fear of the "vigilantes".

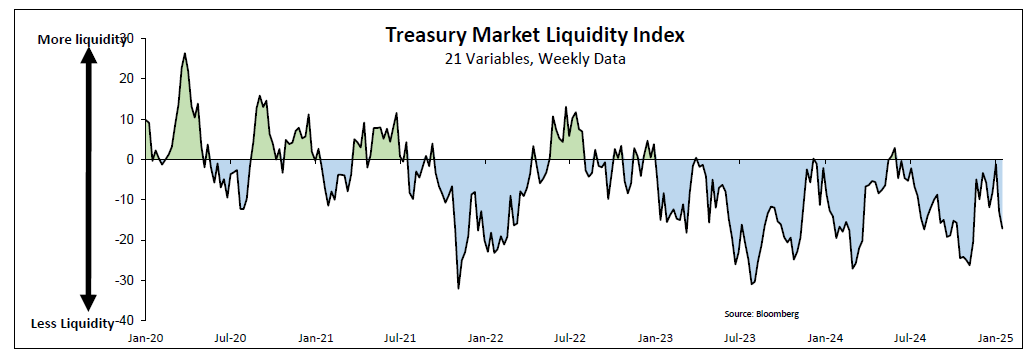

Treasury Market Liquidity Could be a Problem

The other thing which could impact the bond market is the fact liquidity has been a drag on bonds since 2022. This makes the Treasury market more volatile and could lead to big spikes in rates if the Vigilantes do return.

Market Charts

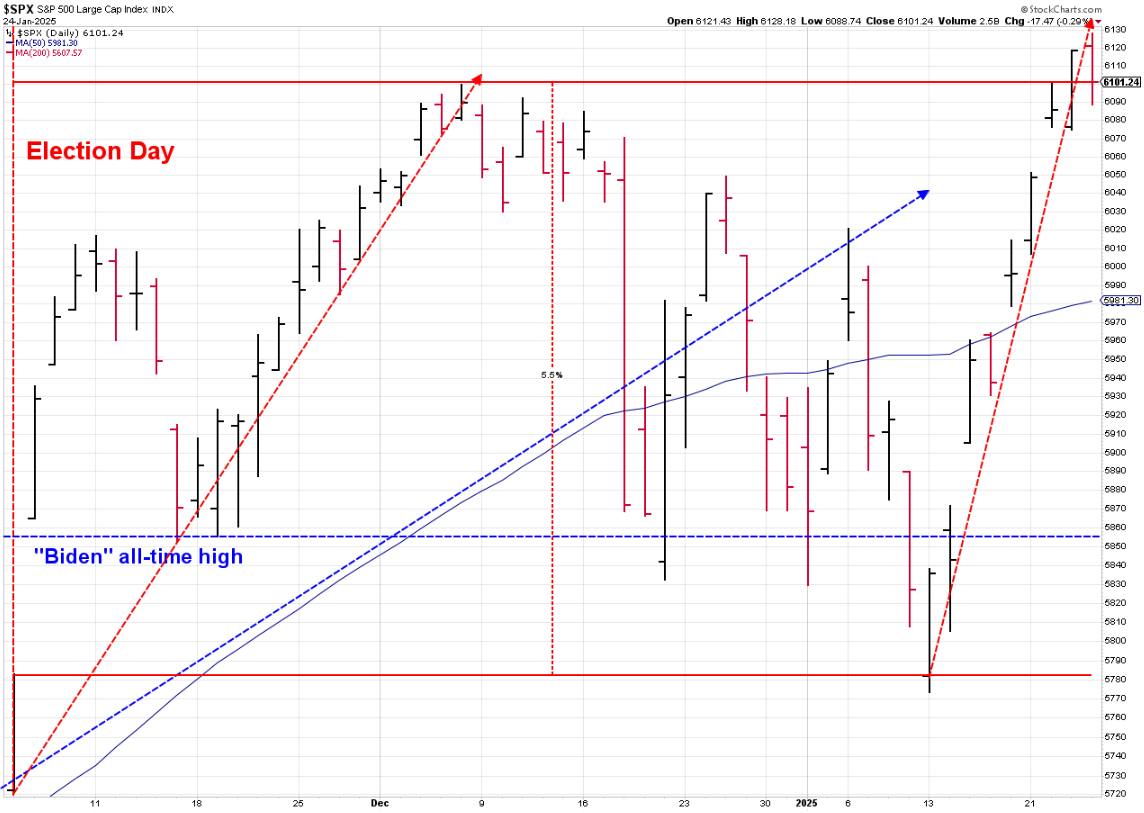

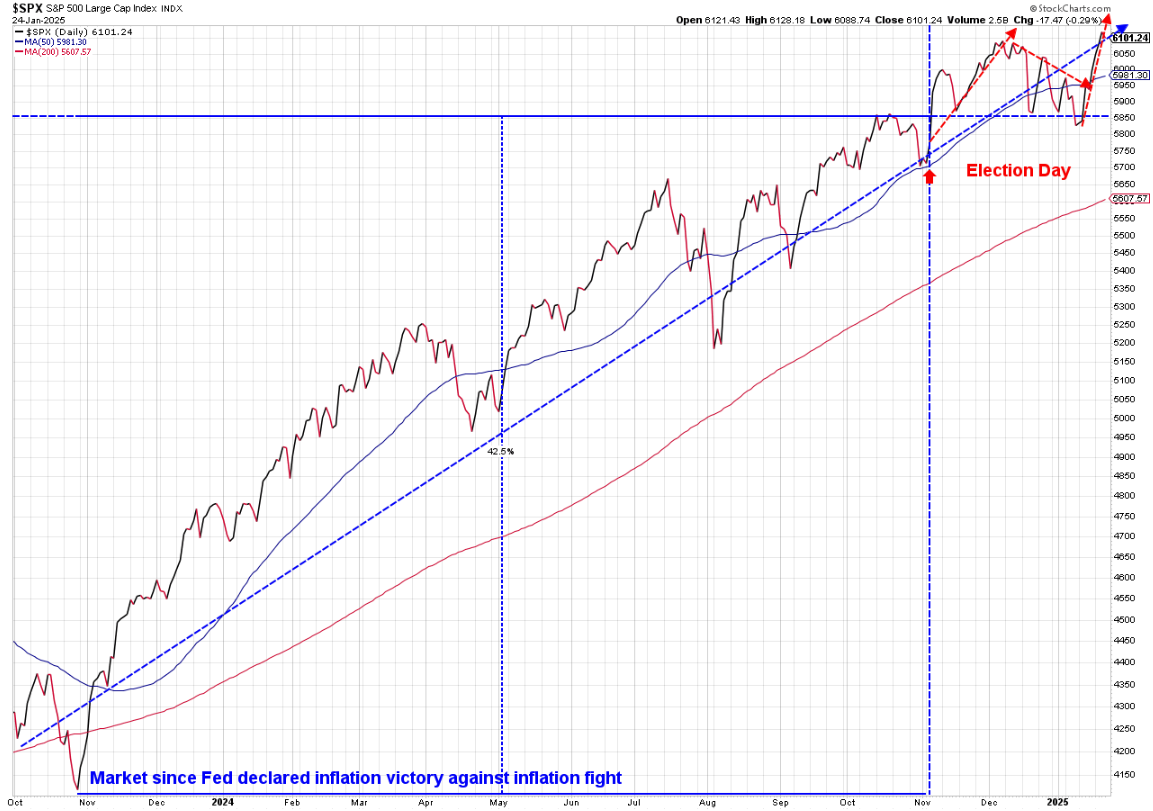

Stocks staged their best first week of a Presidential Term since Ronald Reagan's 2nd term began in 1995. The thought was we have a "pro-growth", "pro-business" President who is much more organized this time around. For all the reasons mentioned above, I would caution reading into this too much as signing mass executive orders is one thing. Getting a slim majority in Congress to implement every policy is another. For now, let's enjoy the rally as long as we can, knowing stocks cannot mathematically support this type of a rally without significant economic changes (which takes time).

The rally last week took the market back to the uptrend line started in the fall of 2023 when the Fed said they were done raising rates.

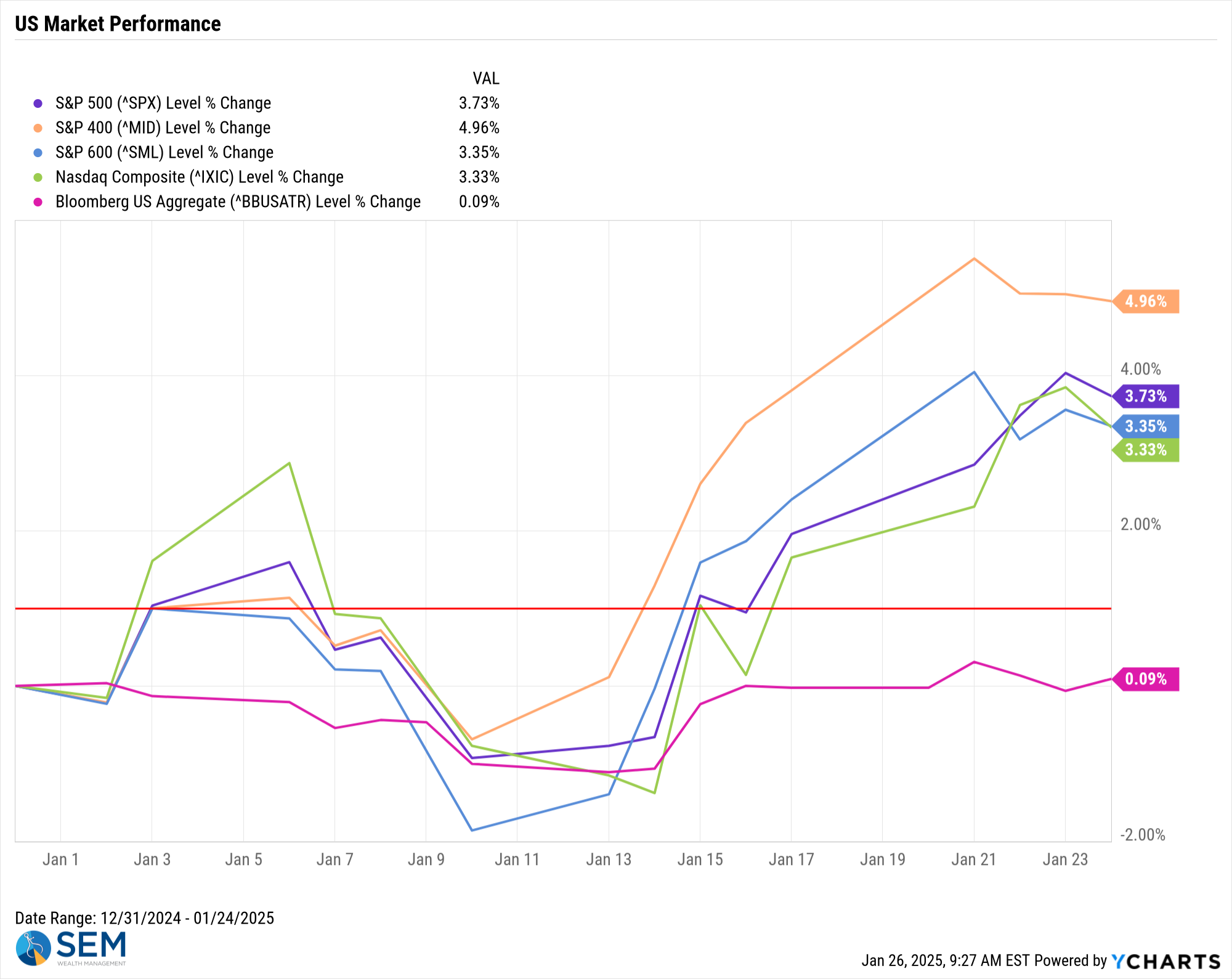

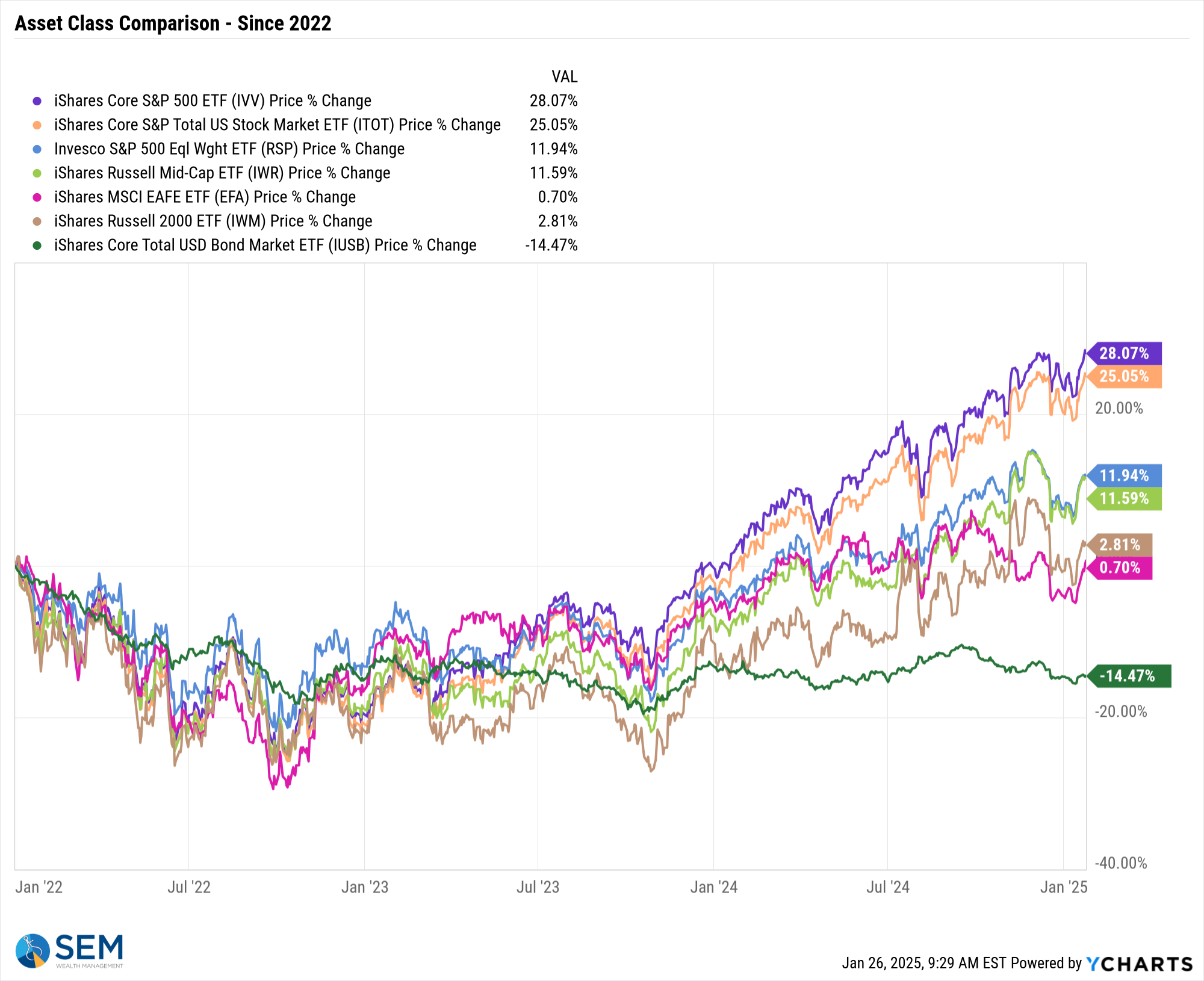

One positive so far this year is the broadening of the rally. Mid-cap stocks are at the top of the leader board for 2025, with small cap stocks just below the S&P 500 and tied with the NASDAQ.

For what it's worth, this has been a nice boost to our Cornerstone Models as by nature of the Biblically Responsible Investment screens, we often cannot invest in the mega-cap stocks which dominate the S&P 500, so we have a more mid-cap centric portfolio. AmeriGuard at the beginning of the year also picked up on the broadening and sold a chunk of large cap to invest more into mid caps. Let's hope this continues as it is a sign Wall Street sees the economy broadening out beyond the top 7-10 S&P 500 companies.

These other assets of course have a lot of catching up to do since the peak in 2021. Note the bond market remains down 14% since it's high.

As noted above and throughout the last two months, the 10-year Treasury chart is the most important one to watch. The market has already been concerned about inflation since the Fed began cutting rates in the back half of last year. If yields move higher it will be that much more difficult for the President to implement his plans which will thus hurt stock prices.

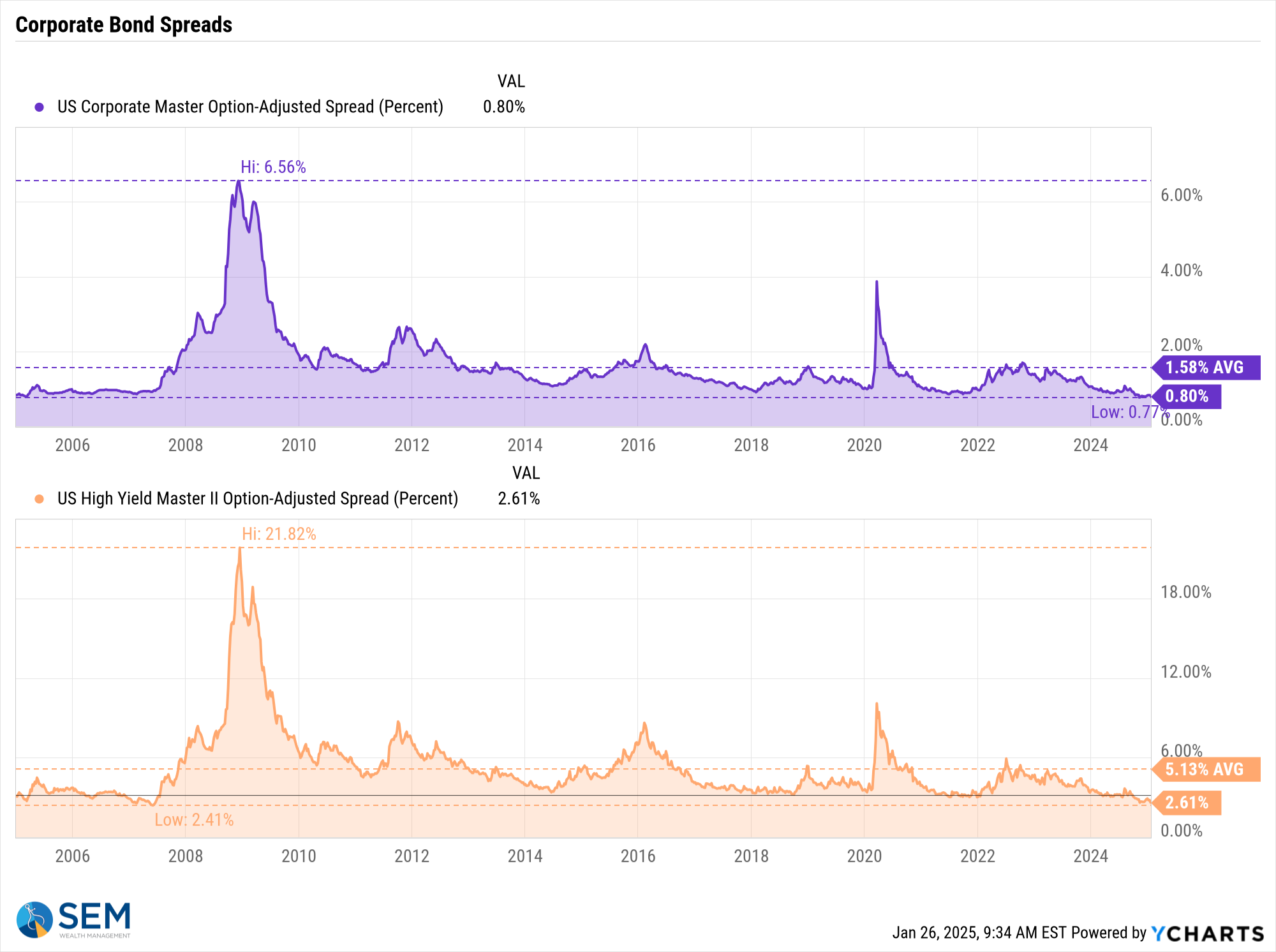

As I keep saying, for now, enjoy the rally. We will be closely watching corporate bond spreads, which are currently at or near all-time lows (a low spread or 'risk premium' means bond investors do not see near-term risk of the economy causing a round of defaults on bonds).

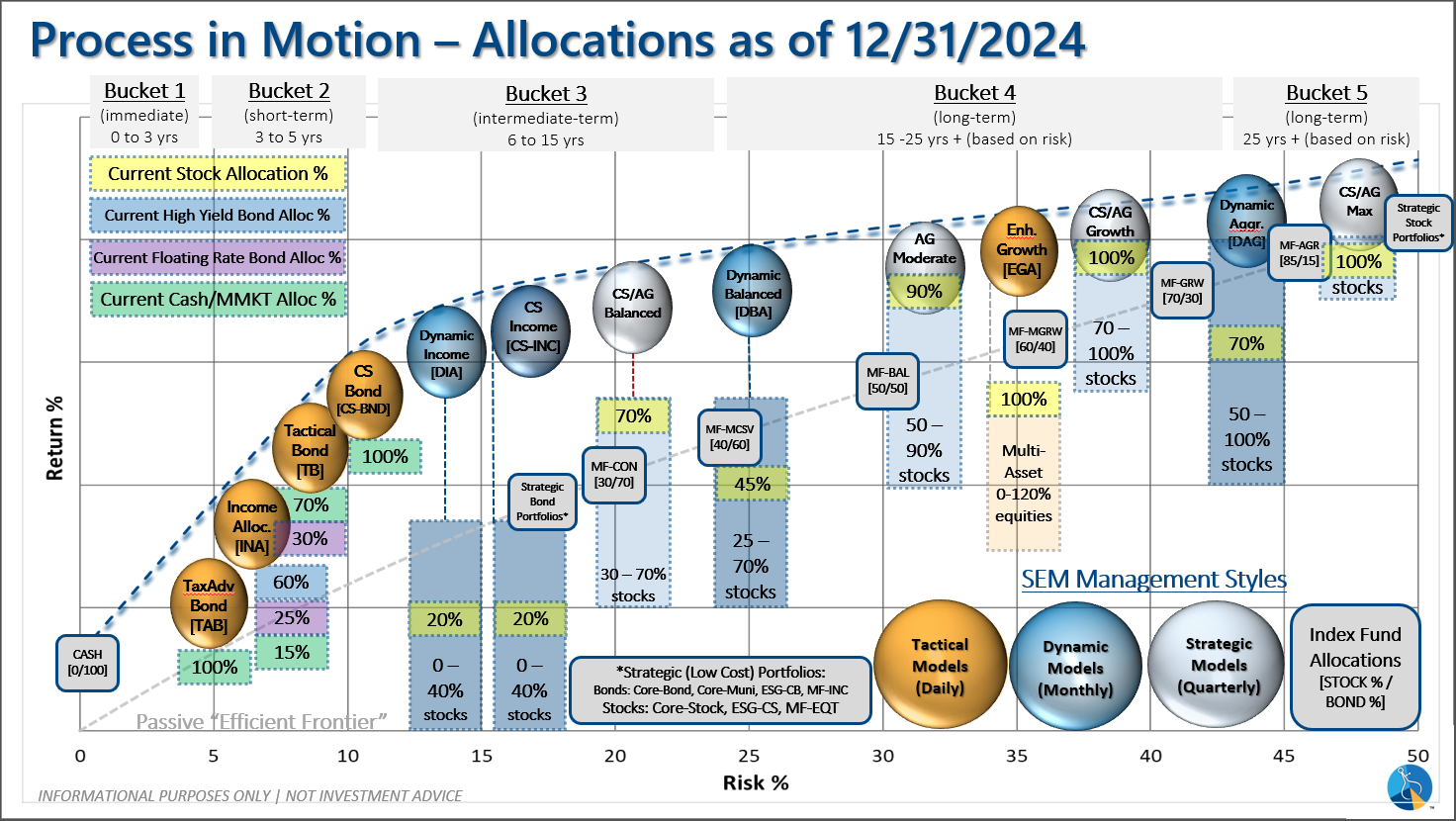

SEM Model Positioning

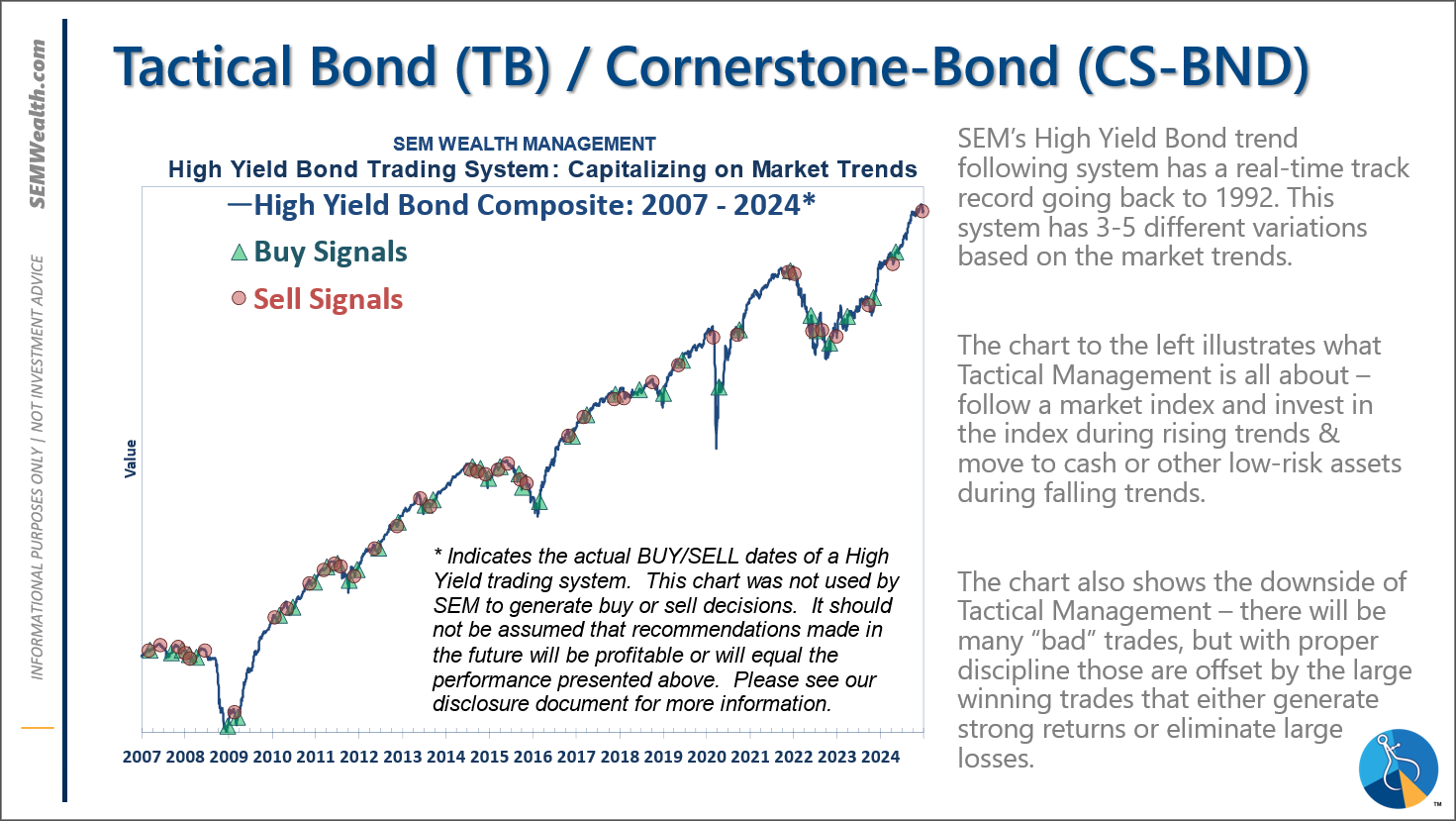

-Tactical High Yield sold our high yield bond positions purchased last spring on 12/20/24. We had added a 30% position in floating rate bonds on 12/6/24, which currently have a 9% yield compared to a 6% yield in high yields and 4.6% in money markets. This follows the partial (about 67%) buy signal on 5/6/24.

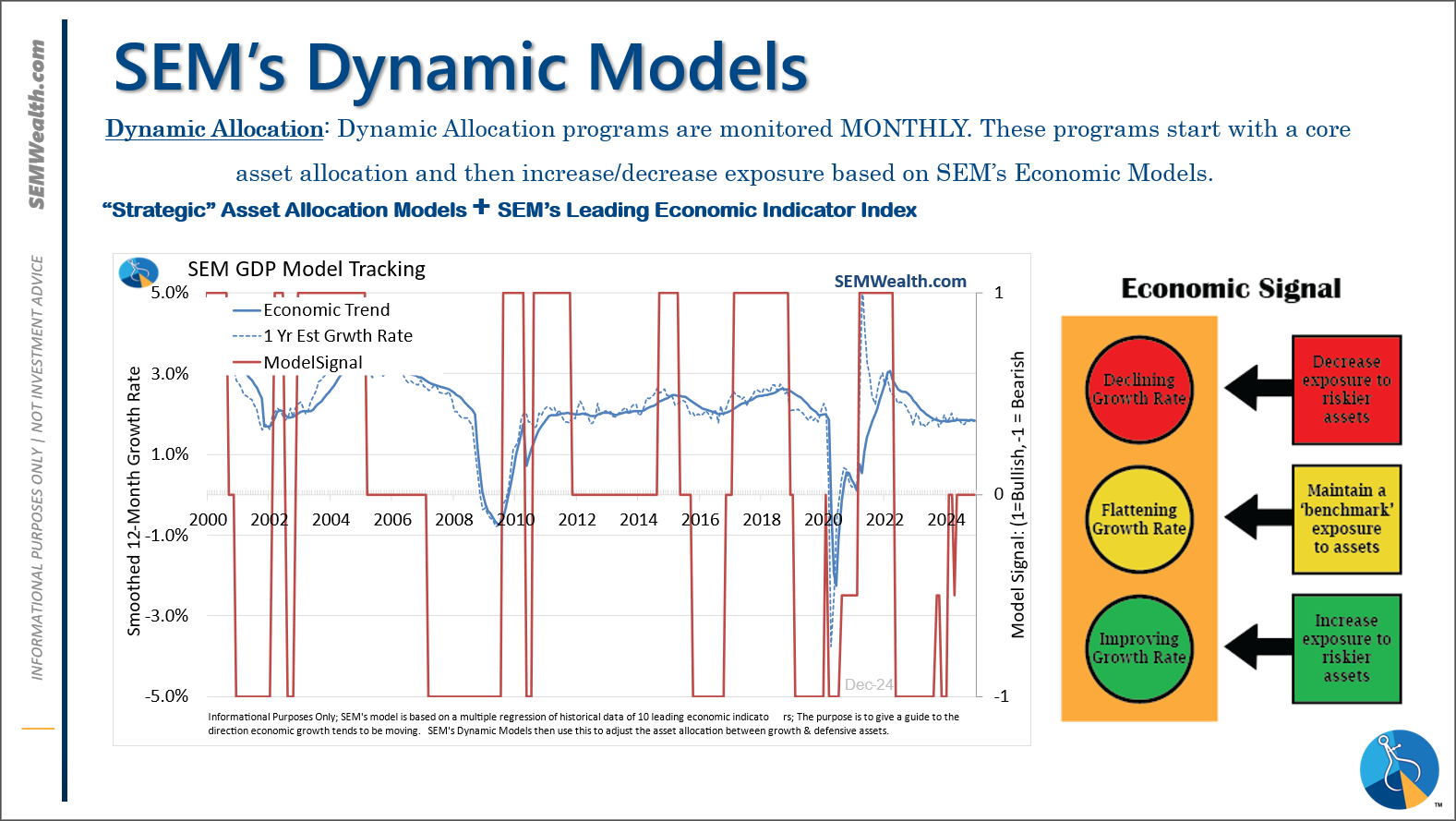

-Dynamic Models are 'neutral' as of 6/7/24, reversing the half 'bearish' signal from 5/3/2024. 7/8/24 - interest rate model flipped from partially bearish to partially bullish (lower long-term rates).

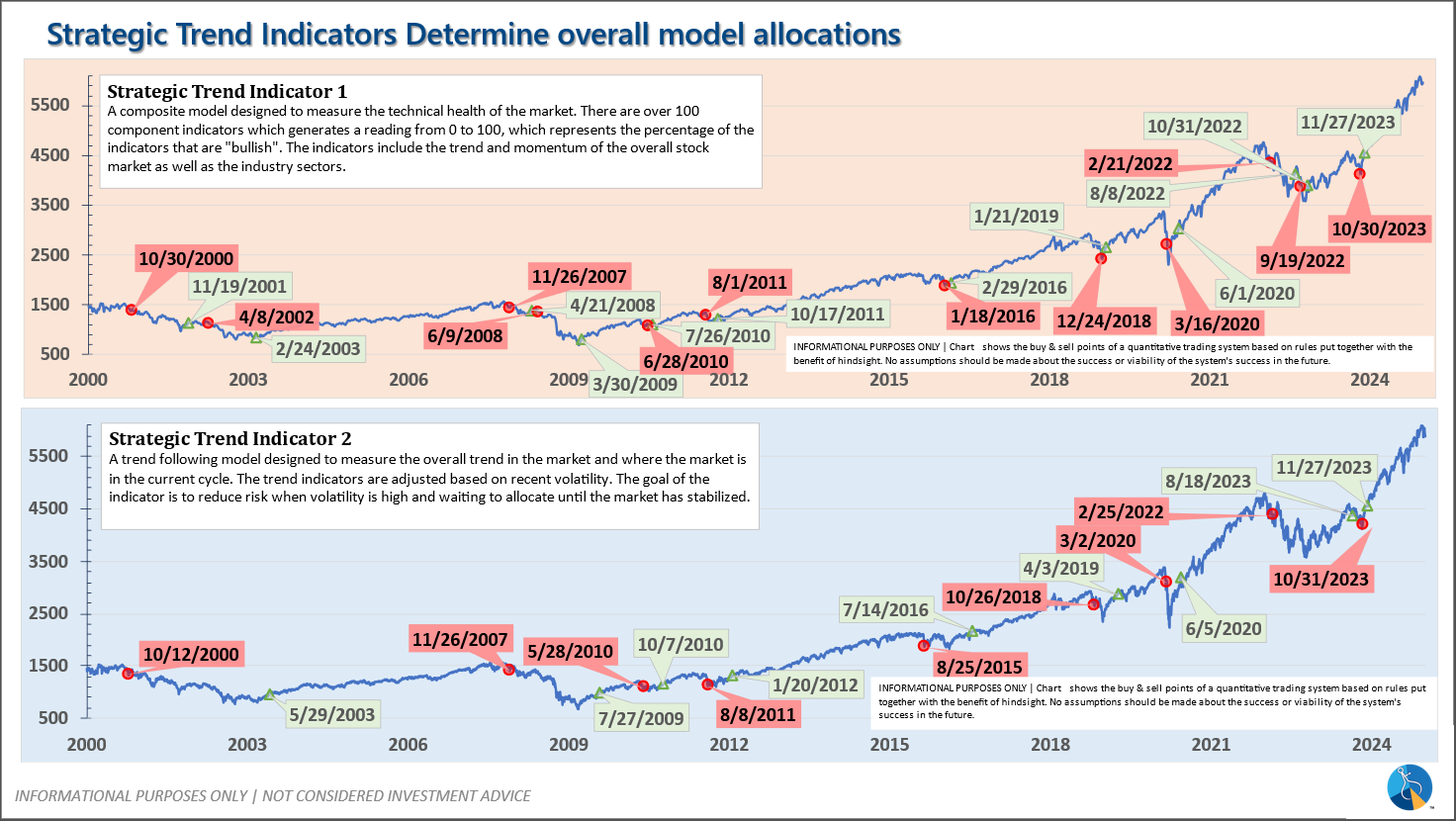

-Strategic Trend Models went on a buy 11/27/2023; 7/8/24 – small and mid-cap positions eliminated with latest Core Rotation System update – money shifted to Large Cap Value (Dividend Growth) & International Funds

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): On 12/20/2024 our tactical high yield model sold out of high yield bond (about 70% of our holdings) into money market. The other 30% is invested in shorter duration, higher yielding floating rate bonds. These instruments are not as sensitive to credit risk and are typically allocated to in the early and late stages of a high yield bond move in our model.

Dynamic (monthly): The economic model was 'neutral' since February. In early May the model moved slightly negative, but reversed back to 'neutral' in June. This means 'benchmark' positions – 20% dividend stocks in Dynamic Income and 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is slightly 'bullish'.

Strategic (quarterly)*: BOTH Trend Systems reversed back to a buy on 11/27/2023

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Questions or comments - drop us a note?

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire