There’s an old saying in finance—and pest control—that if you spot one cockroach, there are probably dozens more hiding in the walls. Over the past few weeks, a few unsettling examples have crawled into the open: some below the surface companies unraveling under the weight of opaque financing structures and excessive leverage leading to charge-offs as some bigger name Wall Street firms. These aren’t isolated incidents. They’re warning signs.

Just like cockroaches thrive in the dark, financial risk often hides in complexity. The recent blowups suggest that some corners of the market may be infested with fragile deals built on borrowed money and creative accounting. And while the headlines focus on the few we've seen, the real concern is what remains unseen. Here are a few of the "cockroaches" on my mind as we start the week.

Private Credit Defaults

"When you see one cockroach, there are probably more. I suspect when there's a downturn you will see higher-than-normal downturn type of credit losses in certain categories. I expect it to be a little bit worse than other people expect it to be, because we don’t know all the underwriting standards that all these people did. They know what they’re doing, they’ve been around a long time, but they’re not all very smart."

That's what Jamie Dimon, CEO of JP Morgan Chase said on Tuesday as he discussed the bankruptcies of Tricolor Holdings and First Brands Group. The former led to a $170 million charge-off during the 3rd quarter for JPM. Both companies were in the auto industry. Tricolor dealt with "sub-prime" auto loans while First Brands sold auto parts. While problems in the automobile sector is a warning sign for the economy, the bigger issue is what both had in common — they were double (and triple) pledging the same "assets" to various private credit companies in order to finance their operations.

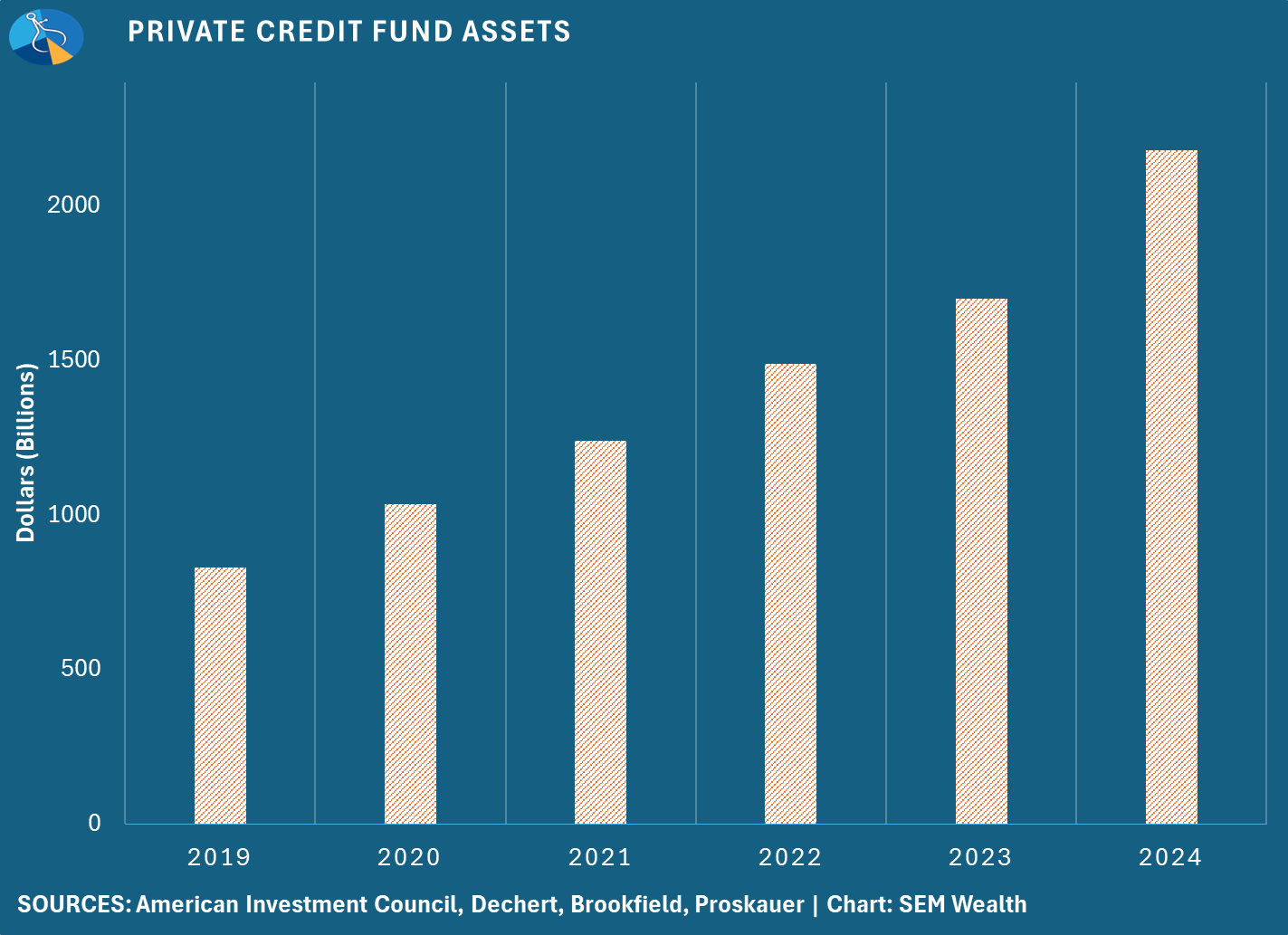

Therein lies the problem and why Jamie Dimon was ringing alarm bells. The massive proliferation of "private credit" funds the past five years has led to rapid competition. As more money chases deals and the issuers seek to attract investors with higher returns you get less due diligence. Because these funds lack the same transparency and regulations as public funds, there are less safeguards. At the end of 2024 there was an estimated $2.1 Trillion invested in these funds.

Having two large bankruptcies due to double (or triple) pledged collateral is probably not an isolated event. While this may not be a big deal (yet), note the TOTAL value of subprime mortgage originations was $1.3 Trillion at the end of 2006, with $600 Billion in originations in 2006 alone.

Real Estate Fraud

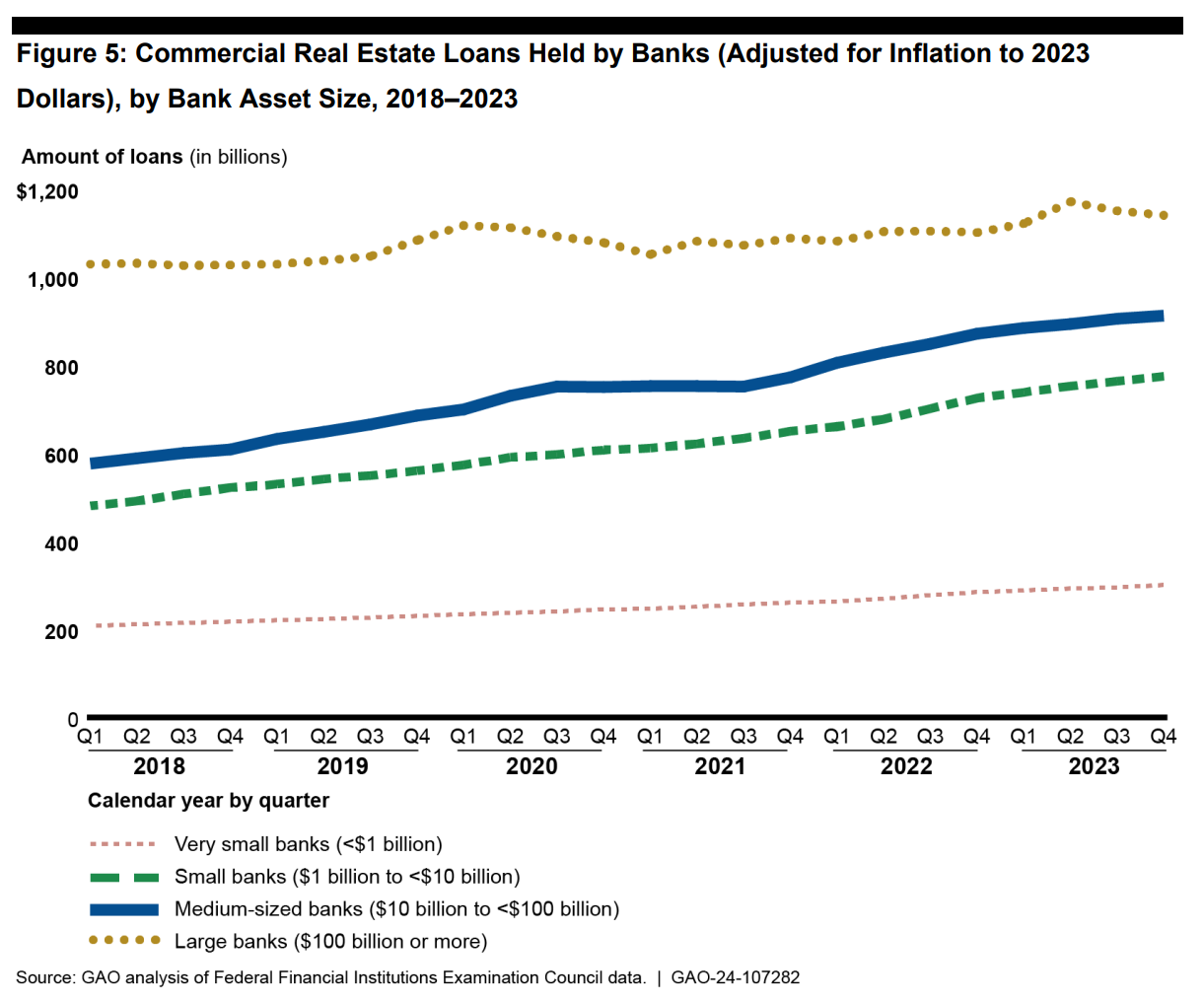

Last week Zions Bank and Western Alliance reported charge-offs from two separate and unrelated real estate deals. The theme – alleged fraud committed by the borrowers to obtain loans from the banks. The type of asset — commercial real estate. The culprit – there were undisclosed PRIVATE debt deals and asset commitments which superseded what the banks thought was their seemingly protected position. In turns out they were neither "senior" or "secured".

While these are (for now) isolated incidents, it does make you wonder how many other deals like this were issued the last few years. Problems in commercial real estate were a concern following COVID, but it seemed like this faded to the background the past couple of years as interest rates came back down. Regional banks are heavily exposed to this space. As we brought up in 2021 & 2022 that makes it seem like a minor issue, but as we all have learned there is a big chance Wall Street banks have some hidden exposure through some of their subsidiaries and other synthetic products. There is also likely relate exposure in some private credit funds.

AI Circular Investments

In our 3rd quarter newsletter the lead article was AI: Boom, Bubble, or Both..... In the bonus content I started discussing my growing concern about the growth expectations and since that time I've written several articles on the "recycling" problem I see (investing in your customers who announce the sale which spikes the stock, essentially paying for the sale.)

Last week, Broadcom and Open AI announced a deal for Open AI to deploy Broadcom's chips. The details were not released, but it was reported to be for $10-20B of chips. Broadcom's stock shot up $150 Billion that day. Is the deal really worth that much in market value? I guess time will tell.

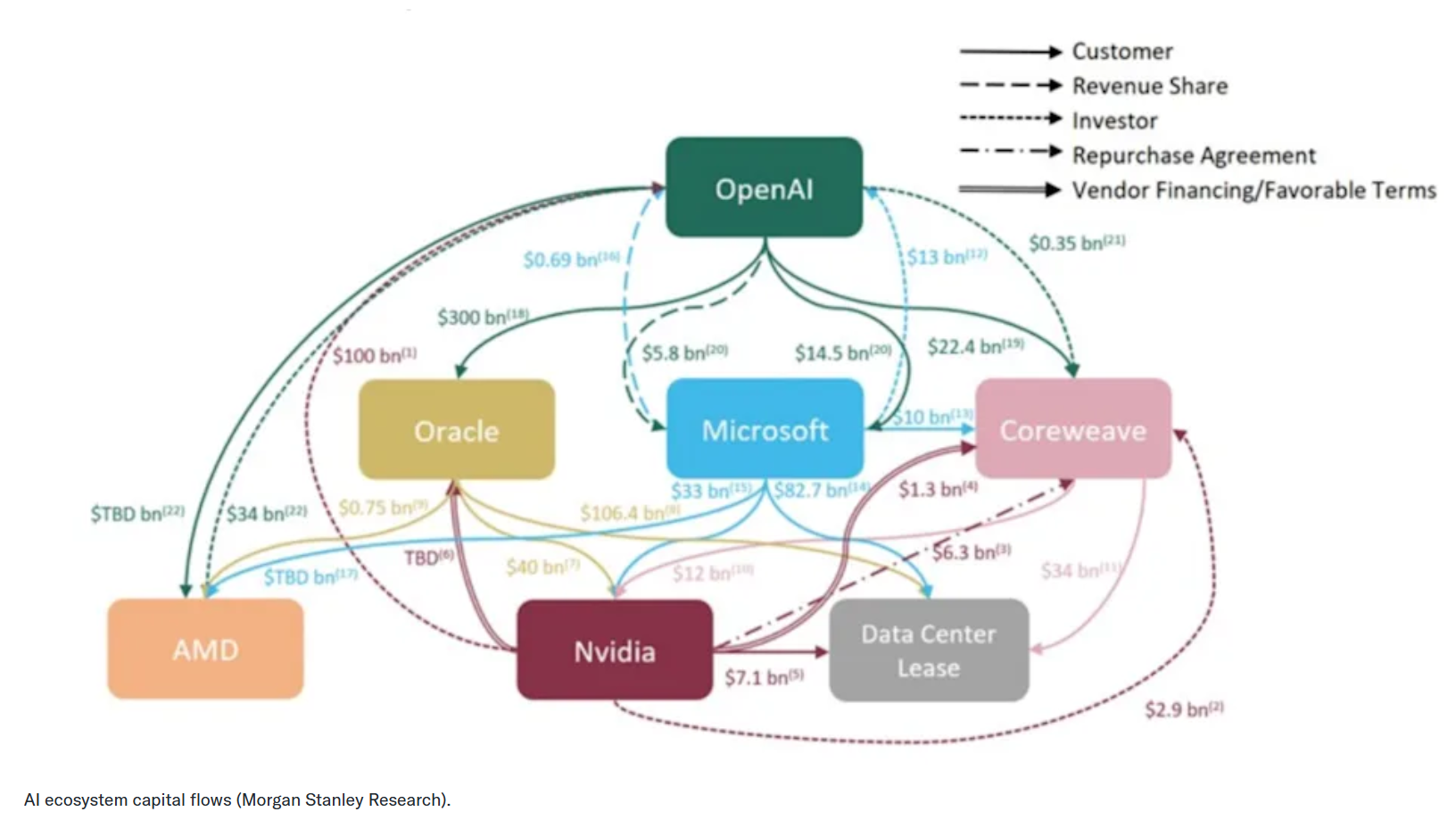

While this deal doesn't appear to be the same structure as some of the other deals Open AI has been making, the lack of clarity does leave room for us to be surprised later. The entire infrastructure is feeding itself and is becoming more and more reliant on the same companies to support it. Morgan Stanley posted this diagram highlighting the interconnectivity of the AI space.

This may work and be necessary, but it certainly creates systematic risk because if any of the connected companies falters it could threaten the whole infrastructure.

Leveraged ETFs

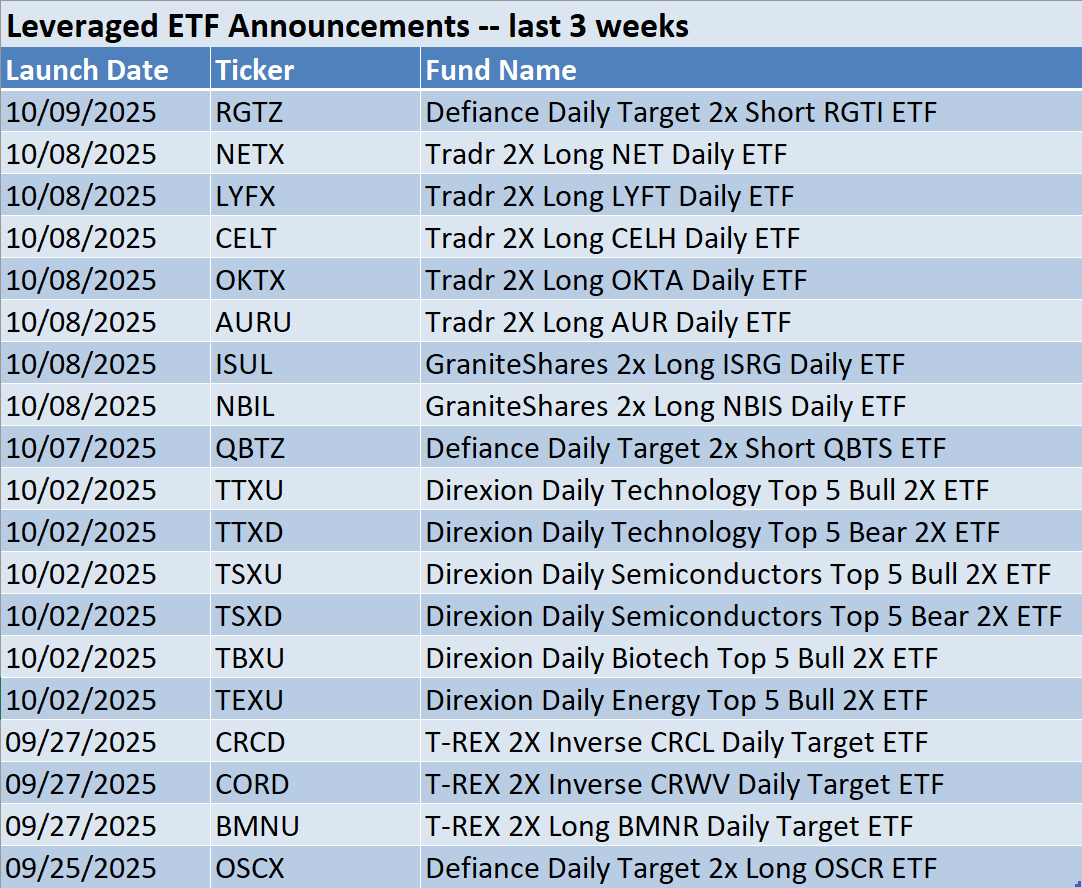

Like most of our readers, my email address has been sold by numerous people so I receive all kinds of announcements about new "products" in our industry. The last few weeks it seemed like I was getting several emails a day about new ETFs launching. Most of them seemed to have leverage on them. I don't know if this is a lost, but look at the new ETFs coming to market the last few weeks:

As of August there were 4100 ETFs issued in the US. Just over 900 of them were leveraged (22%). Of those 900 a whopping 196 were single stock ETFs. These were obviously designed for speculators, not investors. I'm not sure why we need so many of these, but the industry wouldn't issue them if there wasn't demand for them. When we see this type of demand for speculative assets, it is typically not a positive sign for the markets.

Toby's Take

A summary of WSJ articles from our intern Toby.

10/13/2025 - Four Things to Know About Beijing’s Rare-Earths Bombshell - WSJ

In retaliation of the trade war between the United States and China, China has put restrictions on their rare-earth materials. The reason this is such a big deal is in order to make any of our computer chips for our powerful AI chips or even military companies, we need the rare-earth materials. It's not like we can just get them from another country either because China controls 90% of the world's rare-earth materials, making them extremely powerful. China hasn't officially gone through with this yet, so until they do or don't we just need to wait and watch for what happens. However, big news like this does affect the market and consumers regardless if it even happens.

10/14/2025 - Ford Halts SUV Production at Kentucky Plants; F-Series Trucks at Risk as Possible Aluminum Shortage Looms. - WSJ

Ford Motor Company is facing struggles to do with a fire at an aluminum plant. This plant was their main supplier supplying 40% of their aluminum. Because of this, Ford has decided to stop or slow production of their popular SUVs in order to focus on their pickup trucks, which hold the position of the country's best selling pickup. Ford hasn't officially stated why they are doing this. At the moment Ford is trying to find other aluminum suppliers from out of the country to continue production. Depending on how Ford handles this situation, we could see their stock plummeting due to low production numbers. Even still, when people hear news about this, they are likely to sell, dropping prices anyways. All of this is sad news for Ford not just because they won't be able to produce as many vehicles for this period of time, but because they have been up 20% so far this year even with their struggles with EVs.

10/16/2025 - Why Ending the Government Shutdown Is So Hard - WSJ

The government has been shut down for three weeks now, still showing no signs of either party giving in. Both sides believe that they are winning, so they don't feel like they should go with the opposite side. The Republican side of the house is saying that they are just trying to do what Democrats always do by just voting to pass a simple, short-term bill that keeps funding the same. However, Democrats are trying to get the ACA subsidies passed into this bill. It is looking like this government shut down is going to go on longer than we all had hoped. This can be a problem for any federal government related companies we are invested in or any air travel companies because airports are having to shut down without TSA workers.

Market Charts

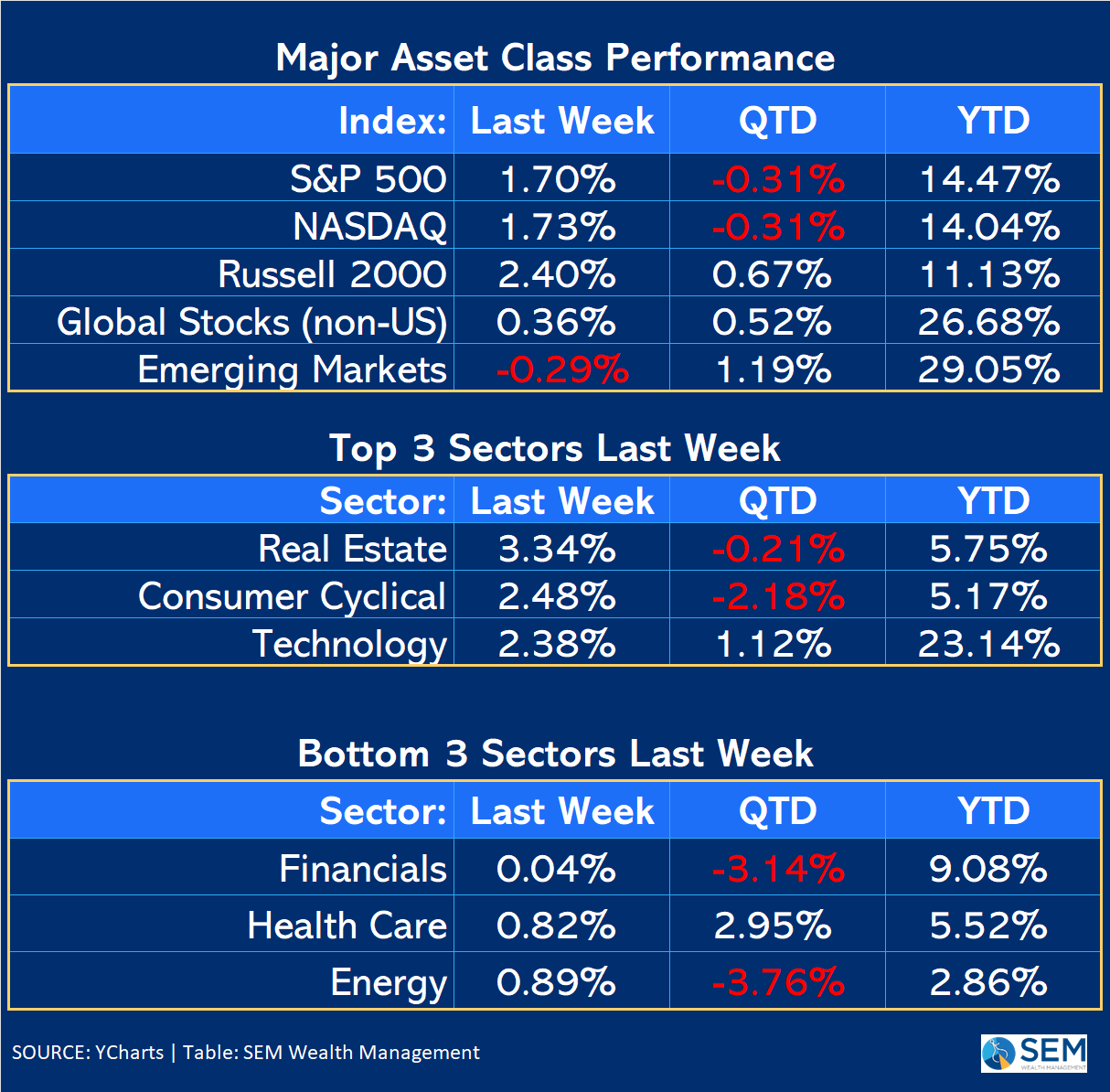

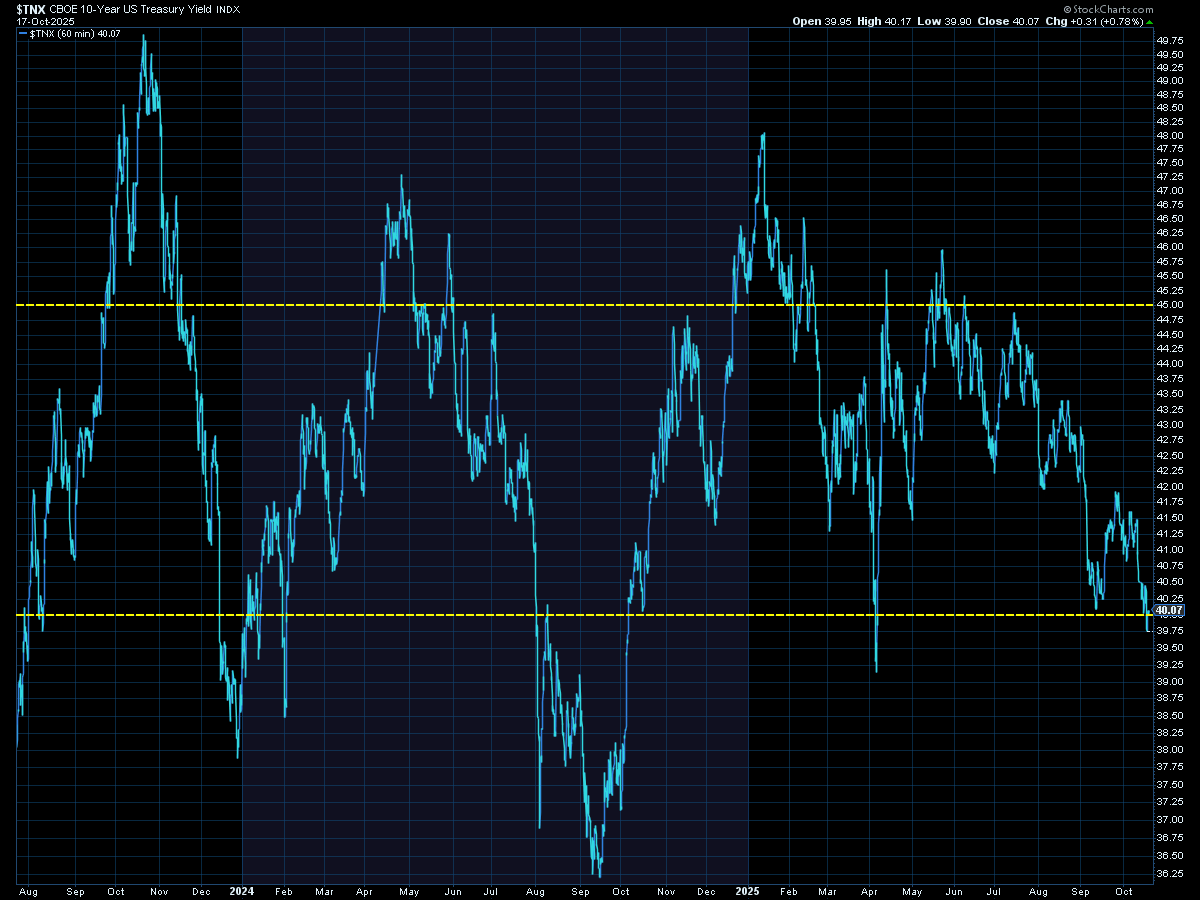

You know it's a good week for the market when the worst sector was still flat for the week. It's fascinating to see how easily the market is able to ignore the "cockroaches" and have the hope the Fed will be able to magically exterminate all of them without any damage.

The trend remains up, shown here with the 50 day moving average being the trendline. As noted last week, the RSI (momentum indicator) did give a non-confirmation on the push to new highs while hitting a recent low on the sell-off last week, so not is all well with the trend.

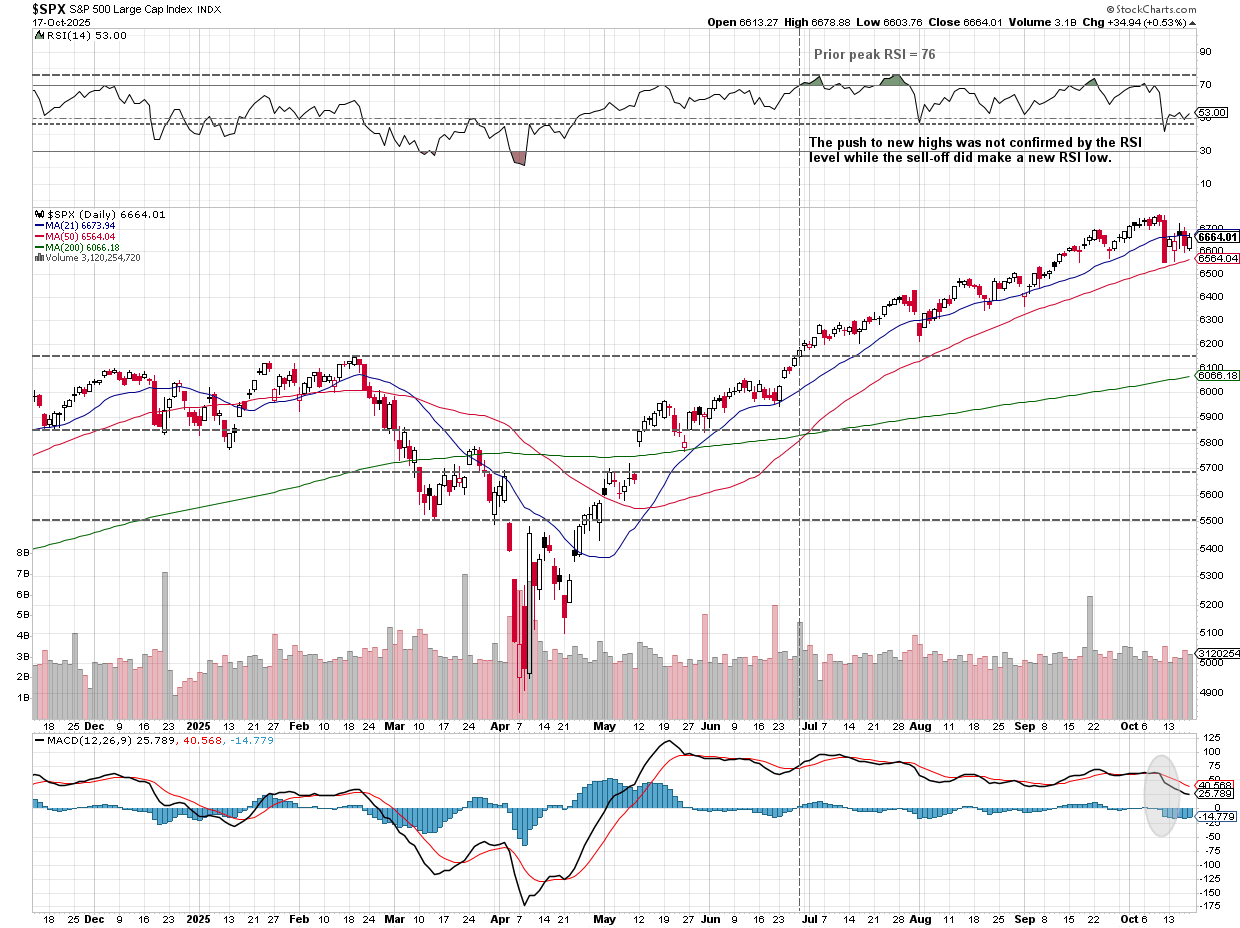

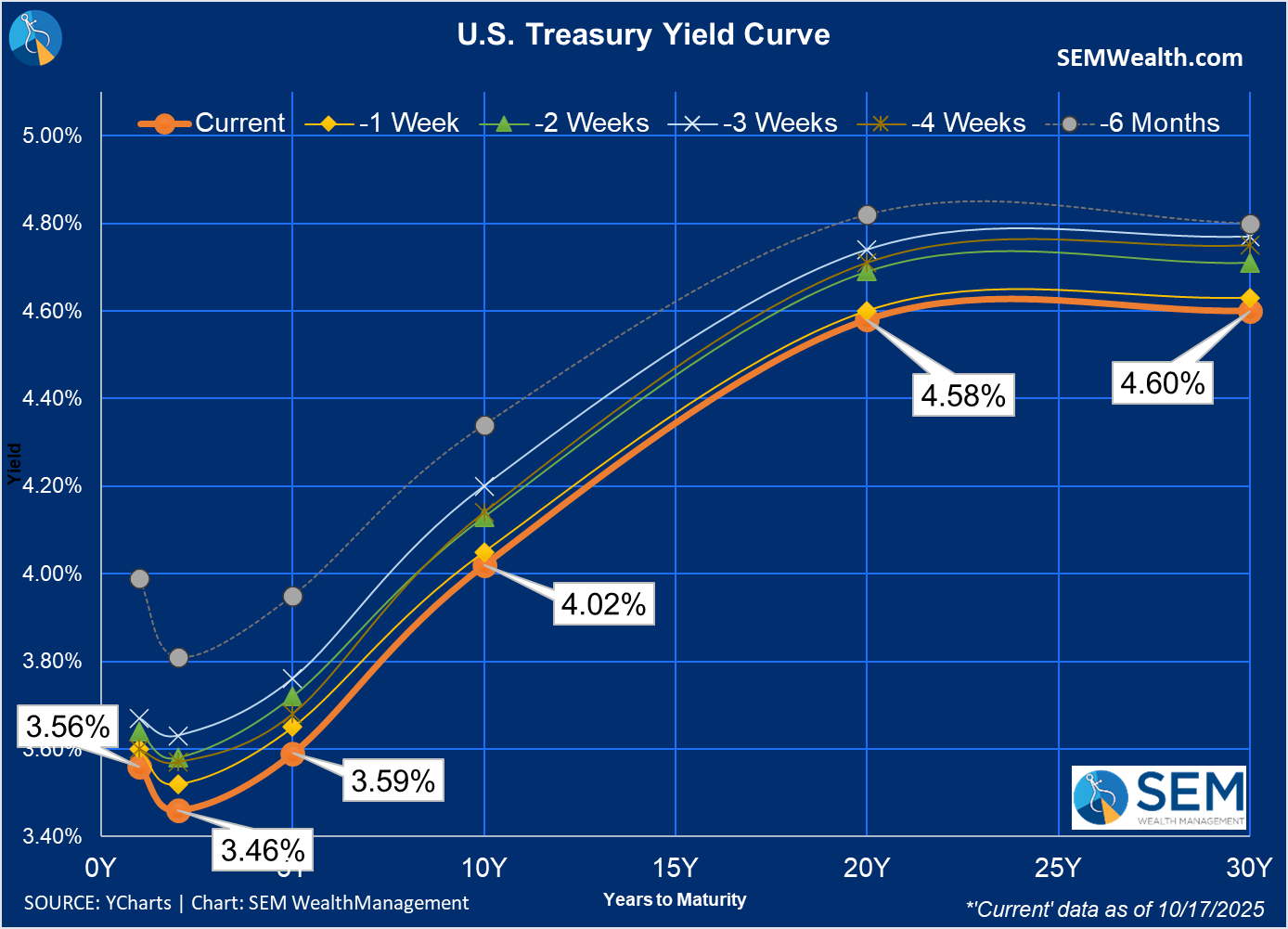

Treasury yields are trending lower again as inflation fears give way to recession concerns (most recessions are deflationary).

The entire yield curve shifted lower last week with yields hitting 6 week lows across the board.

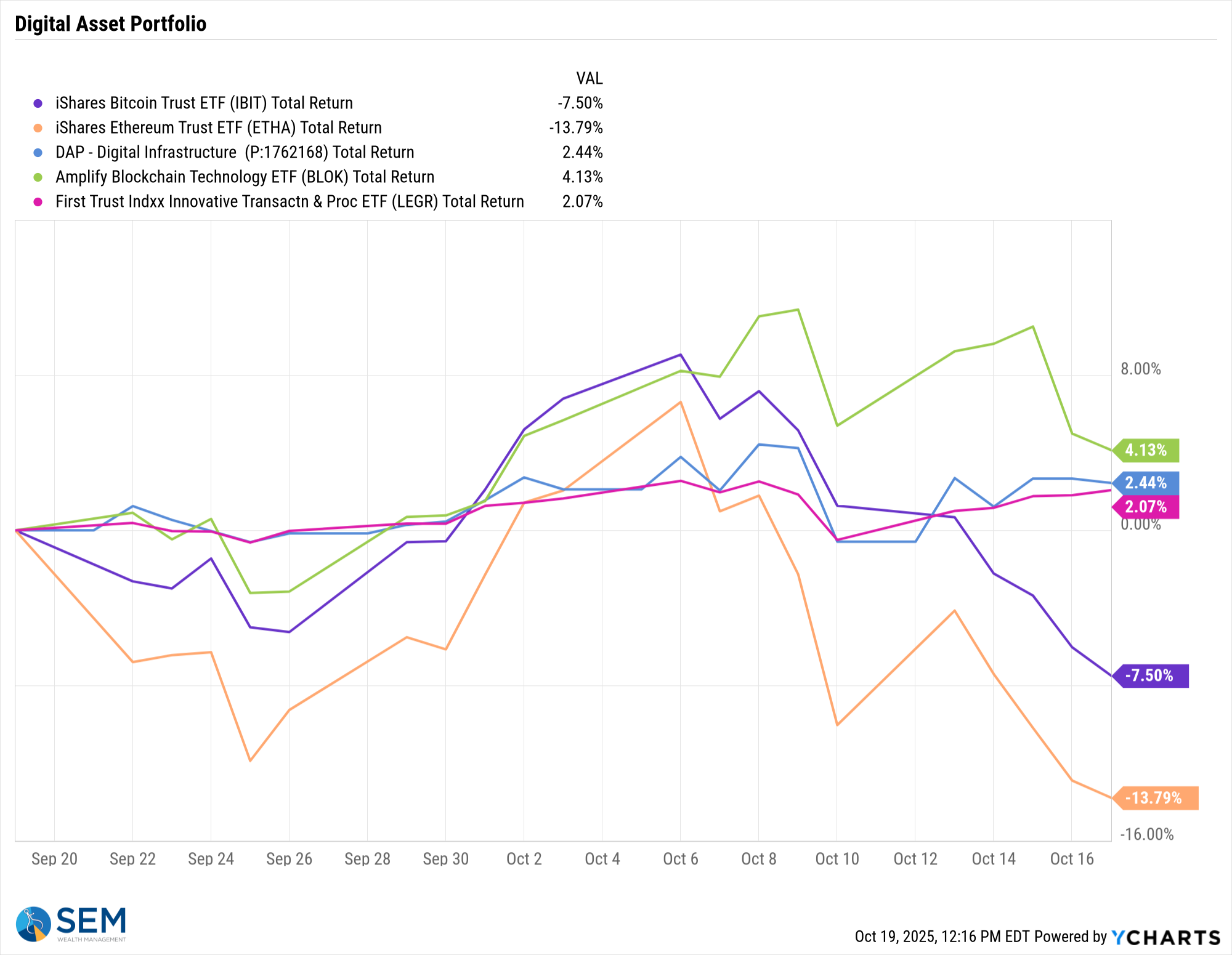

One asset class not confirming the "no risk" stock market rally is crypto currency, which is going through another down cycle.

SEM Market Positioning

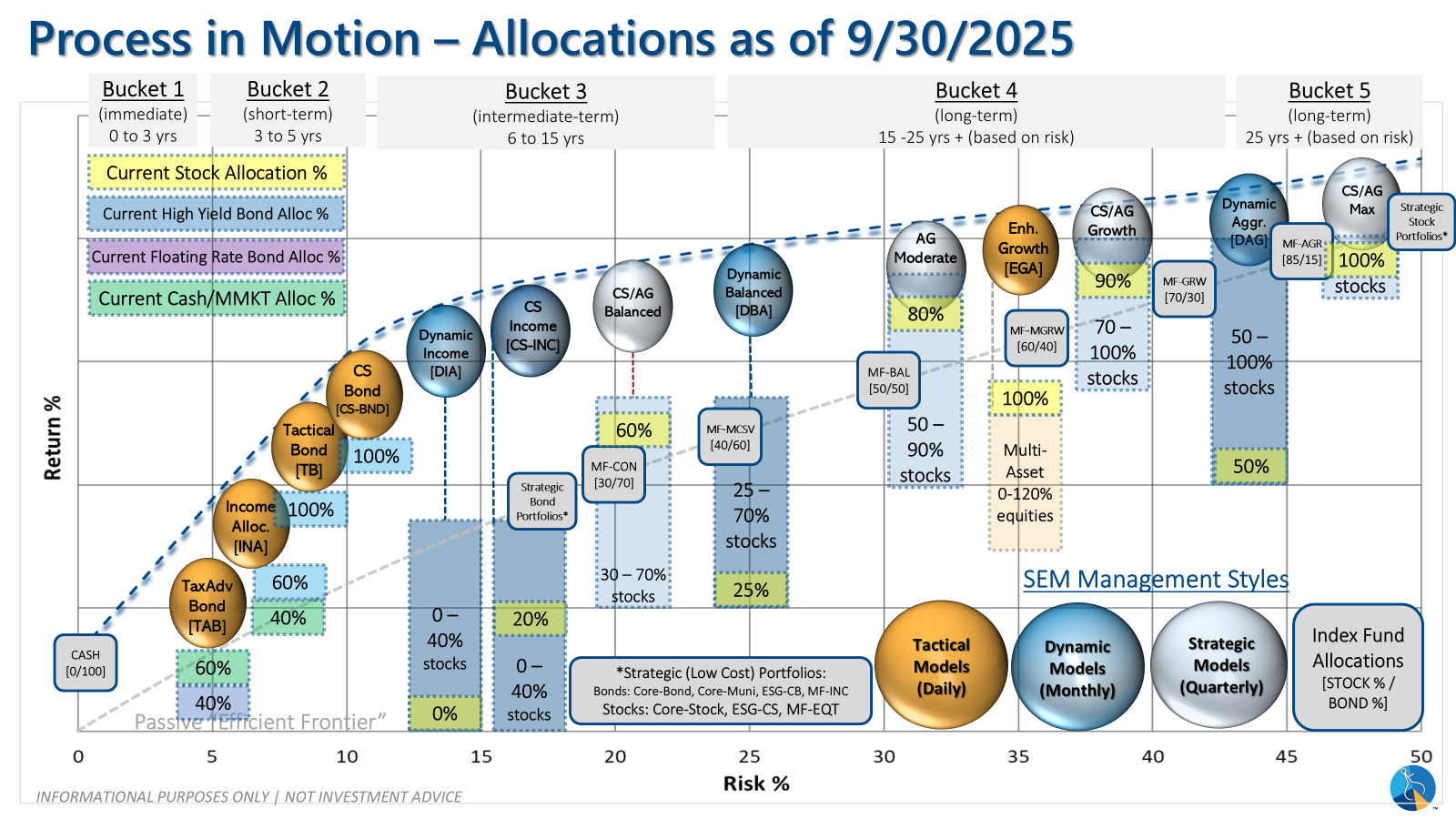

| Model Style | Current Stance | Notes |

|---|---|---|

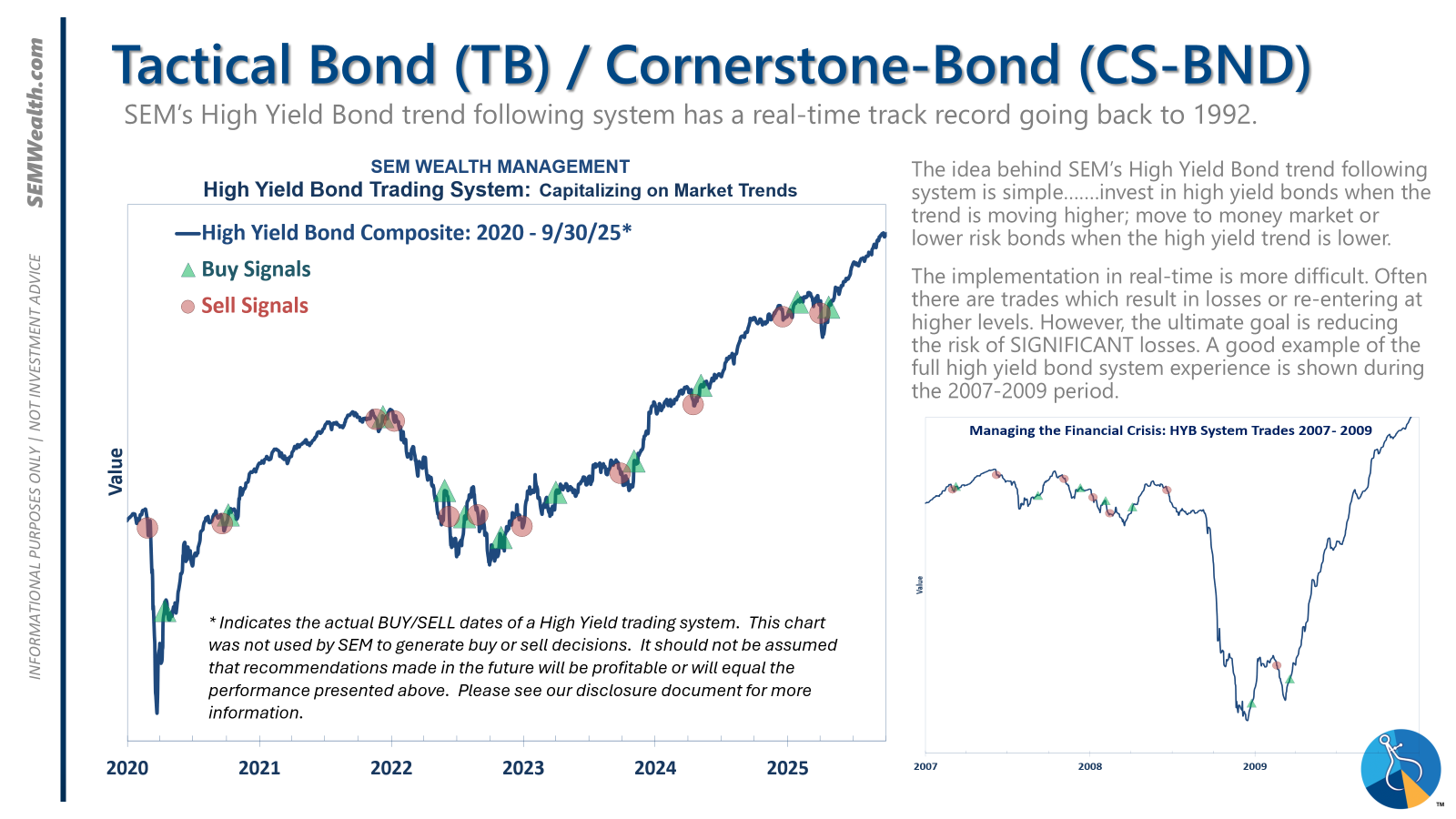

| Tactical | 100% high yield | High-yield spreads holding, but trend is slowing-watching closely |

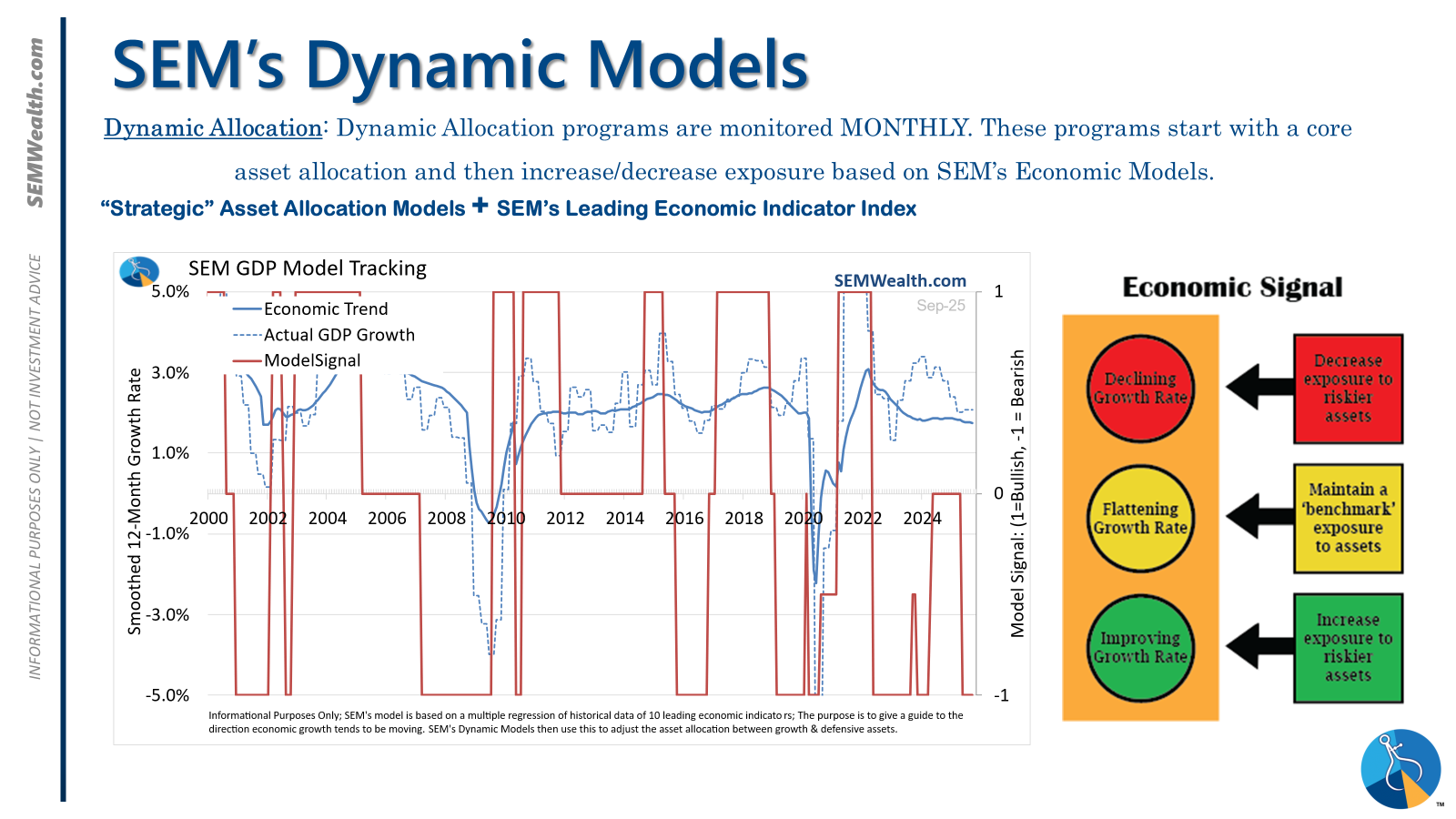

| Dynamic | Bearish | Economic model turned red – leaning defensive |

| Strategic | Slight under-weight | Trend overlay shaved 10 % equity in April -- added 5% back early July |

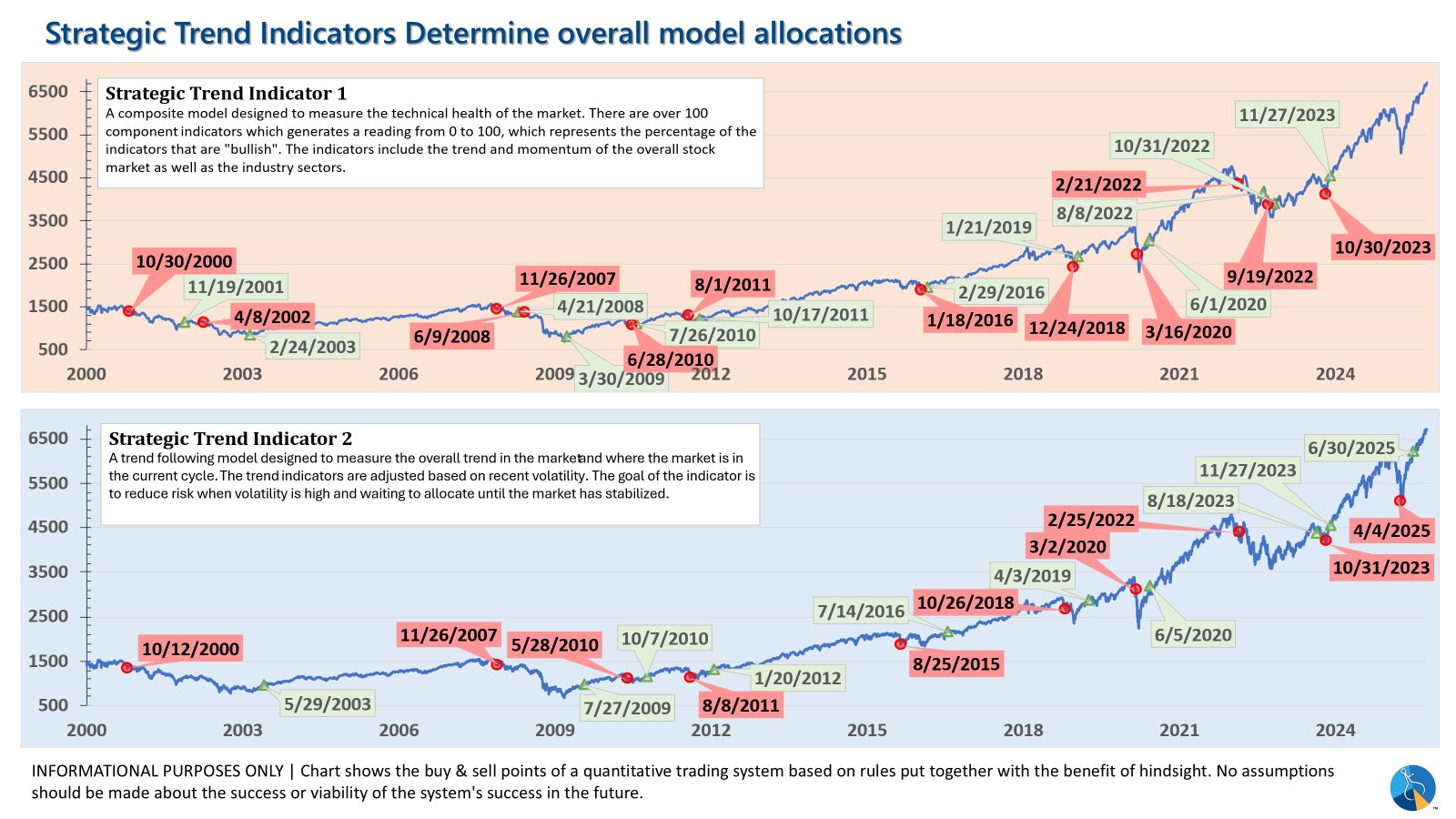

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): The high yield system has been invested since 4/23/25 after a short time out of the market following the sell signal on 4/3/25.

Dynamic (monthly): The economic model went 'bearish' in June 2025 after being 'neutral' for 11 months. This means eliminating risky assets – sell the 20% dividend stocks in Dynamic Income and the 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is 'bullish' meaning higher duration (Treasury Bond) investments for the bulk of the bonds.

Strategic (quarterly)*: One Trend System sold on 4/4/2025; Re-entered on 6/30/2025

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire