When Jesus spoke of the man who built his house on sand, He wasn’t warning us about construction codes. Instead, He was warning about the danger of confidence without substance; about basing your beliefs on something that has no stability. A foundation that looks solid in calm weather can crumble when the storm hits. Today’s AI data center boom feels eerily similar. Billions are being poured into projects with financing structures that assume endless demand and cheap capital. But what happens when the tide shifts? What if interest rates spike, energy costs sky-rocket, or the next generation of chips makes today’s infrastructure obsolete? If the base is shaky, the collapse isn’t a question of if, but when.

Last week the foundation of the AI buildout was called into question. There was no news that led to the skepticism, just some general thought exercises surrounding the financial infrastructure necessary to make the Trillion dollars and counting of investments eventually pay off. For the week, stocks were essentially flat, but some selling underneath the surface from insiders and institutional investors in some of the bigger tech stocks has some risk managers increasingly concerned about the ability for the market to withstand a storm.

Questioning the Foundation

In our 4th quarter newsletter, I lead with the title "AI: Boom, Bubble, or Both?" In the Bonus Content and in subsequent MMM entries since I've spent a lot of time writing about the fundamentals behind the AI buildout. I've found in my conversations and speaking appearances that there seems to be two equally confident sides:

Those who believe AI will change everything and we are in the beginning of the boom

-OR-

Those who believe AI is just hype, we are in another bubble, and those chasing it will lose everything

I have a different take:

AI will change everything, we are in the early stages, BUT the valuations and hype have gotten to the point where there are increasing risks to investors.

This is NORMAL for any major change. Everyone wants to get in early on the "next big thing", but others remember past bubbles bursting and want to get out early before it implodes.

I've said throughout the year that if we are using the internet buildout as a guide, we could be somewhere in the mid-90s or we could be near the end of the 90s. Subjectively making that call by either jumping in and buying the dip or selling everything makes no sense because if you are wrong, it will be quite costly.

What I don't like is the shift from equity to debt financing discussed the last couple of weeks in the blog. What I really don't like is the way every company is "selling" their services to Open AI, seeing their stock prices take significant jumps, without ever asking, "how are they going to pay us?"

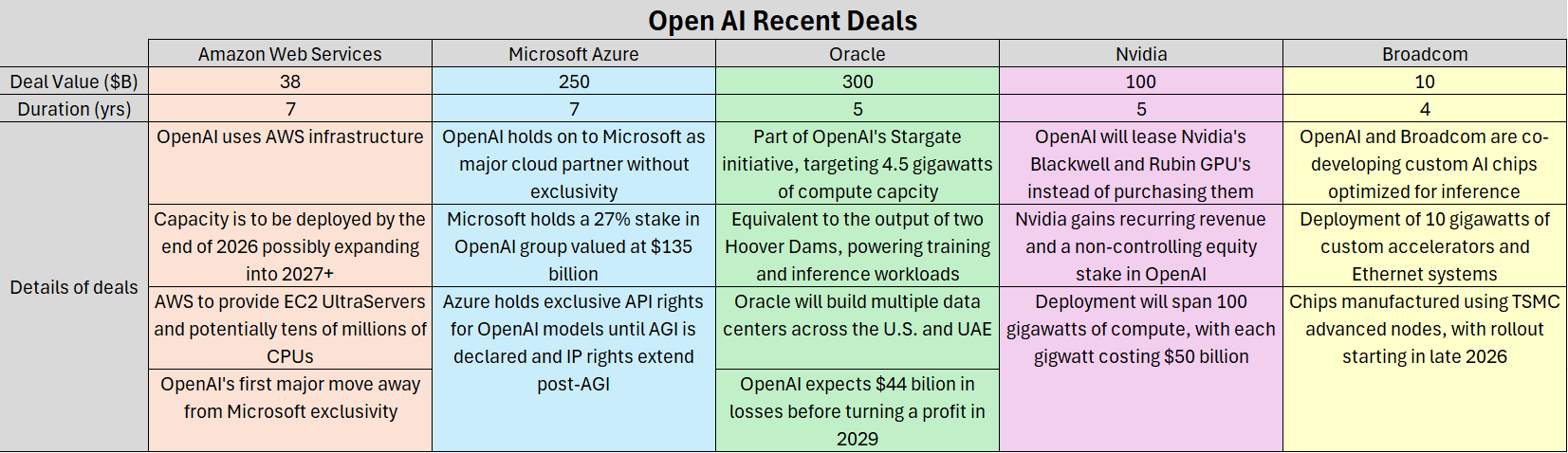

Toby put together this table of the deals Open AI has announced the past few months:

Each by themselves, seems minor, but added up, it is astonishing the commitments they have made for the next 5-7 years.

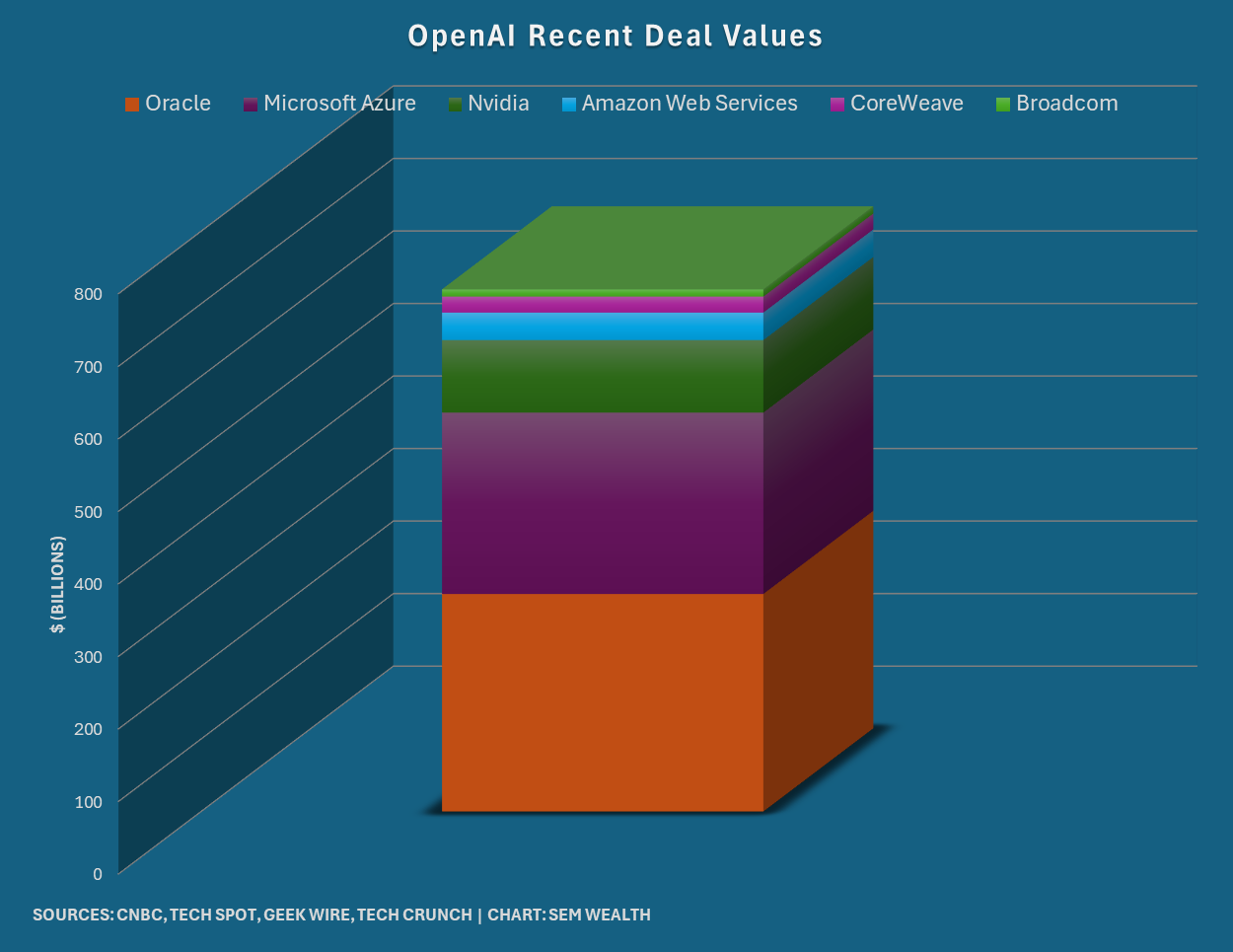

When you include CoreWeave's three deals worth $22B announced this spring, you come up with over $700B in commitments from now until 2032. Based on the source, OpenAI generated between $10-15 Billion in revenue over the past 12 months. Not cash flow. Not earnings. SALES. How is a company generating so little in sales supposed to payout $700 Billion to some of the biggest companies in the S&P 500?

The bigger question, what happens to all of the other "investments" these companies made counting on the $700B from Open AI if Open AI isn't able to come up with the money?

Is Open AI "Too Big to Fail?"

One answer to my question at the end of the last section is 'maybe the government will bail them out." Two weeks ago at a conference, Open AI's CFO hinted that due to their critical dominance in the AI space and how many US corporations are reliant on them, perhaps they are in a position where the government would backstop them to help make their buildout more affordable:

“This is where we’re looking for an ecosystem of banks, private equity, maybe even governmental, the ways governments can come to bear. This type of guarantee can really drop the cost of the financing but also increase the loan-to-value, so the amount of debt you can take on top of an equity portion." - OpenAI CFO Sarah Friar at a conference November 5, 2025

Ms. Friar afterwards walked back her comments saying she was "misunderstood". Was she? Somebody in that position would not be dropping hints at an industry conference that maybe the government should guarantee their loans on "accident". This is at the same time Open AI CEO Sam Altman has become increasingly defensive about the profitability of the company.

Would the government bailout Open AI or start offering a 'guarantee' on some of their loans? At this point, anything could happen, but investing based on the hope the government steps in is something I would not encourage people to do.

Understanding the AI Ecosystem

I've mentioned Bloomberg's Matt Levine several times throughout the years. I read his column everyday, more for 'fun' (yes I'm a nerd). He is a former Goldman Sachs investment banker and as a fellow nerd enjoys digging into the deal structures that cross his desk every day. I appreciate how he takes complex topics and makes them (a bit) easier to understand.

Here's his description of the AI Ecosystem as it stands today:

- Artificial intelligence labs like OpenAI and tech “hyperscalers” like Meta Platforms Inc. have committed to spend, collectively, trillions of dollars to build out AI infrastructure.

- They don’t have trillions of dollars.

- But they will pay for it over time with their hundreds of billions of dollars of AI-related revenue.

- They don’t have hundreds of billions of dollars of AI-related revenue either.

- But they will.

- You can tell because of their valuations. OpenAI’s equity is worth $500 billion. The only way its equity is worth $500 billion is if its future cash flows are sufficient to (1) cover its hundreds of billions of dollars of spending commitments and (2) leave hundreds of billions of dollars left over for its equity investors.

- That is, all of the future AI cash flows are not directly observable — you can’t extrapolate them from current AI cash flows or anything — but they can be inferred from equity-market enthusiasm for AI.

Read that back slowly and take in each point. Essentially, the entire structure is based on the HOPE companies like OpenAI will not only have enough cash flow to pay the $700B and counting of commitments to the rest of the S&P 500 companies, but also enough cash to keep its equity investors satisfied.

Somewhat related. Last week Apple announced a deal where they would pay Google (Alphabet) $1 Billion a year for a license to Gemini to be the backbone of "Apple Intelligence". This goes beyond the "free" contract Apple had with Open AI to put ChatGPT on iPhones as part of Siri. On the one hand, Apple is admitting it is still woefully behind in the AI race. On the other hand, if Google is willing to sell their AI technology to Apple for a mere $1B a year, doesn't that make more sense than trying to develop it yourself?

Google has spent $250 BILLION the past 3 years to build data centers to support Gemini. Apple had over $400 Billion in revenue and $112 Billion in net income the last 12 months. Is Google saying the $250B they "invested" is only worth $1B to a company the size of Apple? Are they hoping they will get so integrated into Apple's iOS that they will be able to charge them more down the line? What if Apple finally figures out their own AI?

The biggest question I continue to have is simple – WHEN (or IF) will the "hyperscalers" start generating enough revenue to justify the investment they made in AI? What if they don't? What happens to the "investments" they have on their balance sheets? What happens to the promised "revenue" rolled into their projected earnings? What happens to their stock prices?

I hope I'm wrong, but that is the big risk people are taking right now by blindly buying each and every dip in the S&P 500.

Buy high, sell higher?

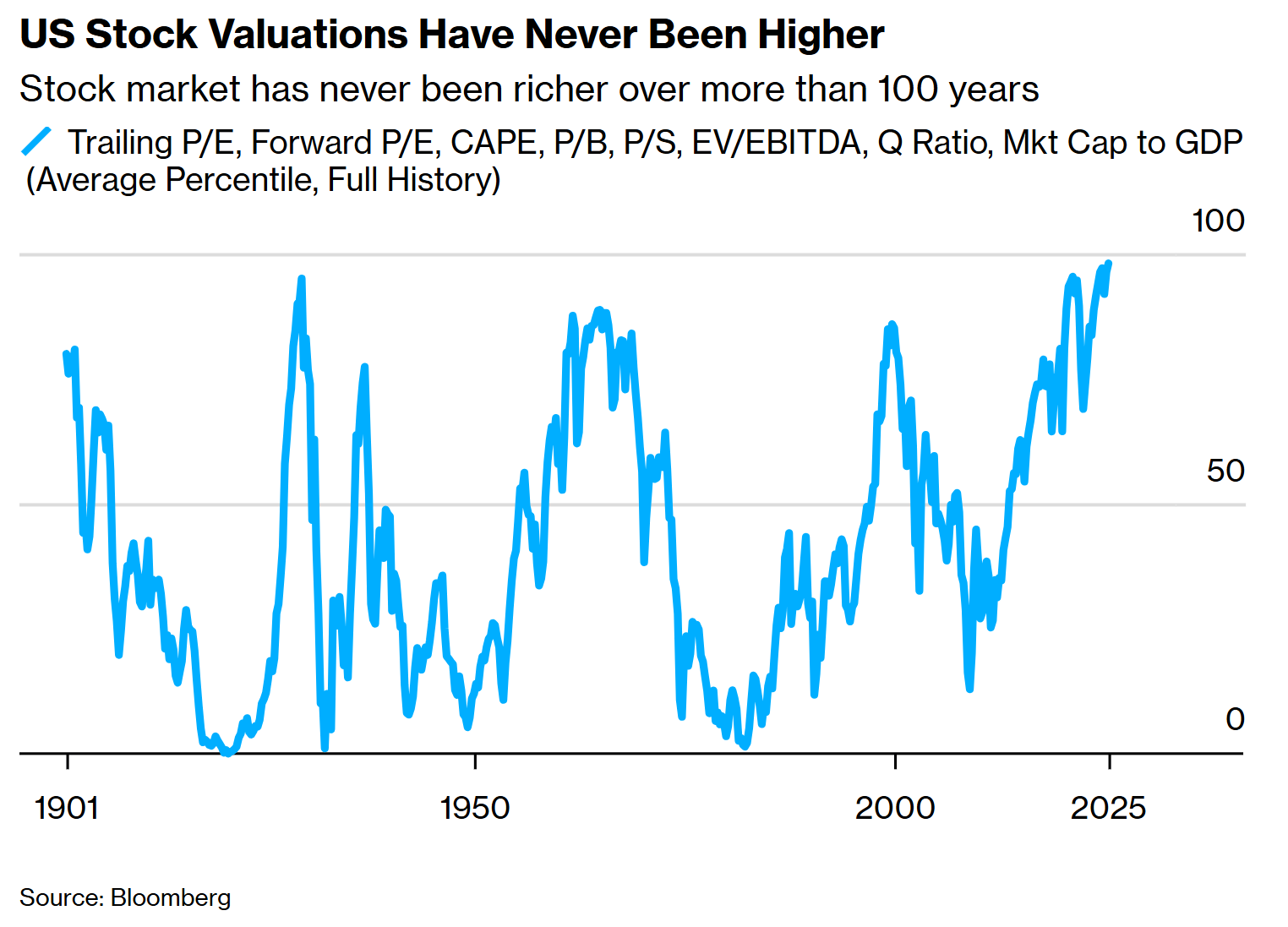

I often say 'valuations are not a good timing mechanism', but they do help us set expectations for FUTURE returns. I'm not talking about next year or even the next couple of years, but instead 7-10 year returns. For those longer-term returns, your starting point matters. When you buy at the upper end of the historical valuation ranges, you're hoping to sell at even higher valuations.

MAYBE AI will change everything and make these valuations seem cheap 10 years from now. Maybe not.

Either way, we've never seen valuations as high as they are now.

I've heard many people argue, "the P/E isn't close to what we saw in 1999, so we aren't in a bubble." The measurement above is a combination of many valuation metrics. The "E" in the P/E ratio could be artificially inflated right now, something Michael Burry (of The Big Short) fame has been arguing. Not to get into the boring accounting details, but one (such as Mr. Burry) can argue the depreciation schedules used for the AI "investments" do not account for how quickly those investments become obsolete. Some Nvidia chips are only useful for a data center for 9-15 months. Instead of being depreciated over 5 years, one could argue that should be a current year EXPENSE (thus hurting earnings).

Time will tell, but I continue to have an uneasy feeling about the accounting magic and creative financing being used which is masking how expensive stocks are at this point.

Financial Plan, Cash Flow Strategy, Investment Personality

The warnings I'm giving lately are not meant to scare people out of their investments. It is more tilted towards those who are wanting to INCREASE their investments to risky assets after a nearly unprecedented 3 year run for the stock market. It is also a reminder that if you haven't REBALANCED in the past 3 years, it wouldn't be a bad idea. You are likely dramatically overweight stocks compared to where you were 3 years ago.

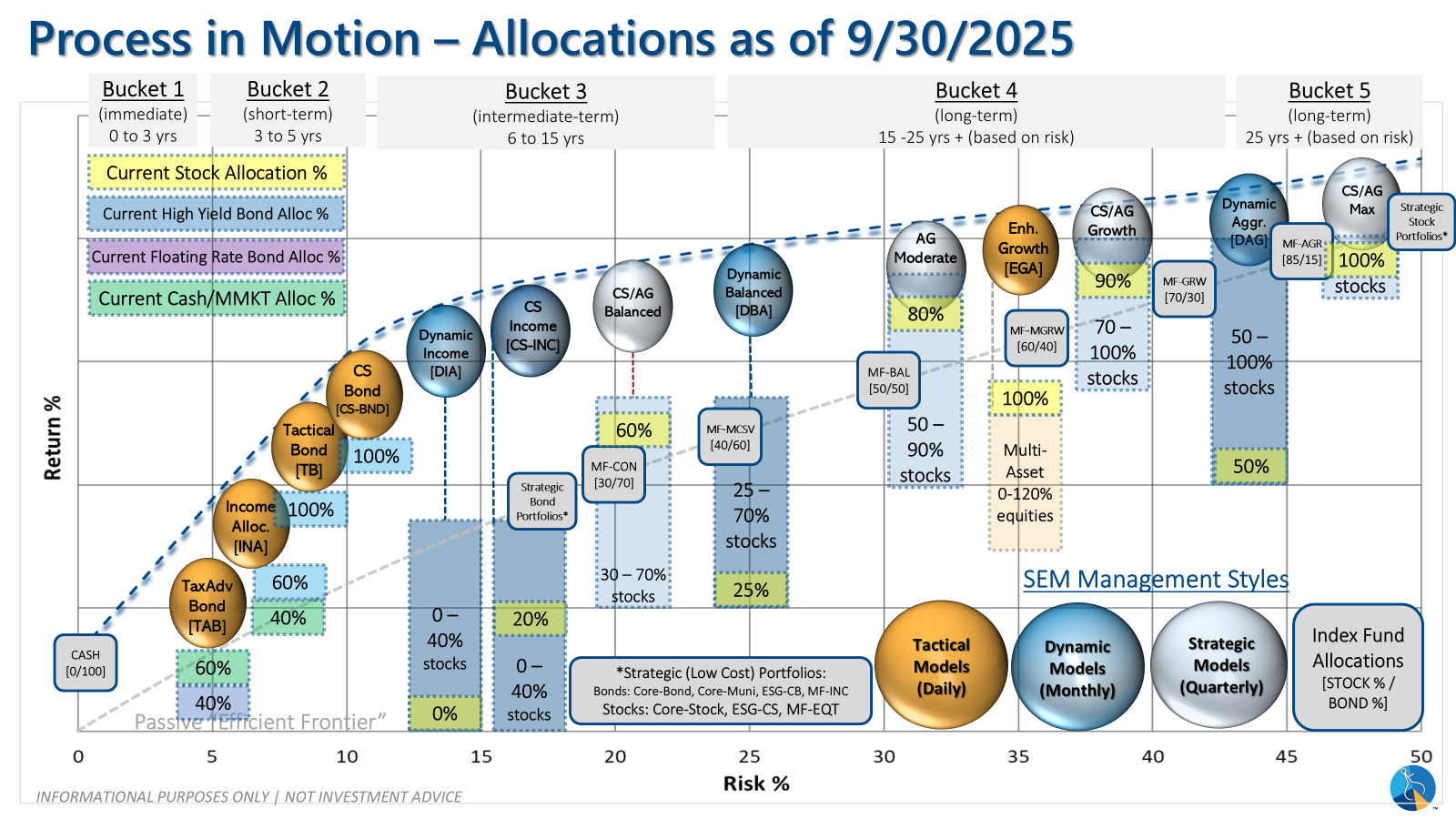

My advice to EVERYONE asking about what they should do with the market is simple: It depends on your financial plan, cash flow strategy, and investment personality. SEM's models are designed to adjust our allocations based on the DATA based on the goals and mandates of each model, but how much is allocated to each model depends on all of the above.

If you're unsure if you need to make an adjustment and are a current client of SEM, you can take our Risk Assessment, which automatically kicks off a review of your portfolio. We will send our review to your advisor to discuss.

Take the questionnaire here: Risk.SEMWealth.com

Toby's Take

11/10/2025 - Senate Clears Key Hurdle Toward Ending Government Shutdown - WSJ

The record setting Government Shutdown is maybe closer to ending…maybe. The Senate has finally voted on something! But, that something is just to simply end discussions. They are now likely to vote on a new updated version of what the house passed. The changes they made are that President Trump cannot fire and federal employees and that the continued resolution will go to the end of January. As exciting as this feels that the Government Shutdown is "ending," it's not. Because of these changes, the House now has to vote on this and that may take a while because they have been on a "vacation" since the beginning of September. No matter what, this is exciting because it does look like something that the House will also agree with to at least re-open the government.

11/11/2025 - The AI Cold War That Will Redefine Everything - WSJ

The United States and China are in what's being called "The AI Cold War" because of the race to lead the world in AI power. With restrictions on U.S. chips, China was pushed to make their own native chips. While they still aren't anywhere near as powerful as our advanced AI models, they have produced a model that "China can be proud of," Premier Li Qiang said. This is a very important race because as of right now, AI is looking to be the future and to take the lead in that would make that country the world's superpower. The government investing in American AI companies would help support our country in taking lead in the AI race.

11/12/2025 - America’s Chip Restrictions Are Biting in China - WSJ

Continuing on with the "AI Cold War" the United States restrictions on China do seem to be working pretty well at the moment. Due to the restrictions DeepSeek, China's AI upstart, wasn't able to release its latest model because of a shortage of chips. However, there are concerns about these restrictions and what the long term affects could be. If China is no longer reliant on U.S. chips, they will be forced to make their own at home and putting their best people and resources towards that, potentially surpassing the United States. President Trump did not want to discuss the potential export of the new Nvidia chip to China in the meeting with Chinese leader Xi Jinping. This was because he was warned by his top officials that the better technology could boost China's military. There are a lot of pros and a lot of cons to each decision in this matter. But, there is a possibility that with all of this competition to be better than each other, Nvidia could reach new heights leading the United States even further ahead than the competition.

11/13/2025 - Trump Signs Spending Bill, Ending Longest Shutdown in U.S. History - WSJ

The record-setting 43-day shutdown has finally come to an end. Two days after the Senate pushed through the new spending bill, the House approved it. Late last night President Trump signed it and we are out of this mess until January 30th. Obviously there are still problems with the discussion of the ACA subsidies, but we can now relax knowing that federal employees are being paid again, hopefully helping the travel side of the market. The Democrats have said that they will still be pushing for the healthcare fight, but they fortunately put that off for the time being. We can assume that the market will react positively to this news and see potential gains.

11/14/2025 - Investors Dump Tech Shares as Shutdown Relief Evaporates - WSJ

After everybody getting excited about the government shutdown coming to an end, Wall Street is having a rough day with key government reports coming out. These reports usually shape investors basic understanding of the economy. Tech stocks are declining along with the Dow Jones Industrial Average. This is a stressful time for all of the stock market because there was a rally going with the government shutdown ending and this was the worst day in a month because of government reports coming out. We just need to be wary of investors pulling out of a dropping the market and perhaps communicate a bit more about long-term investing.

Market Charts

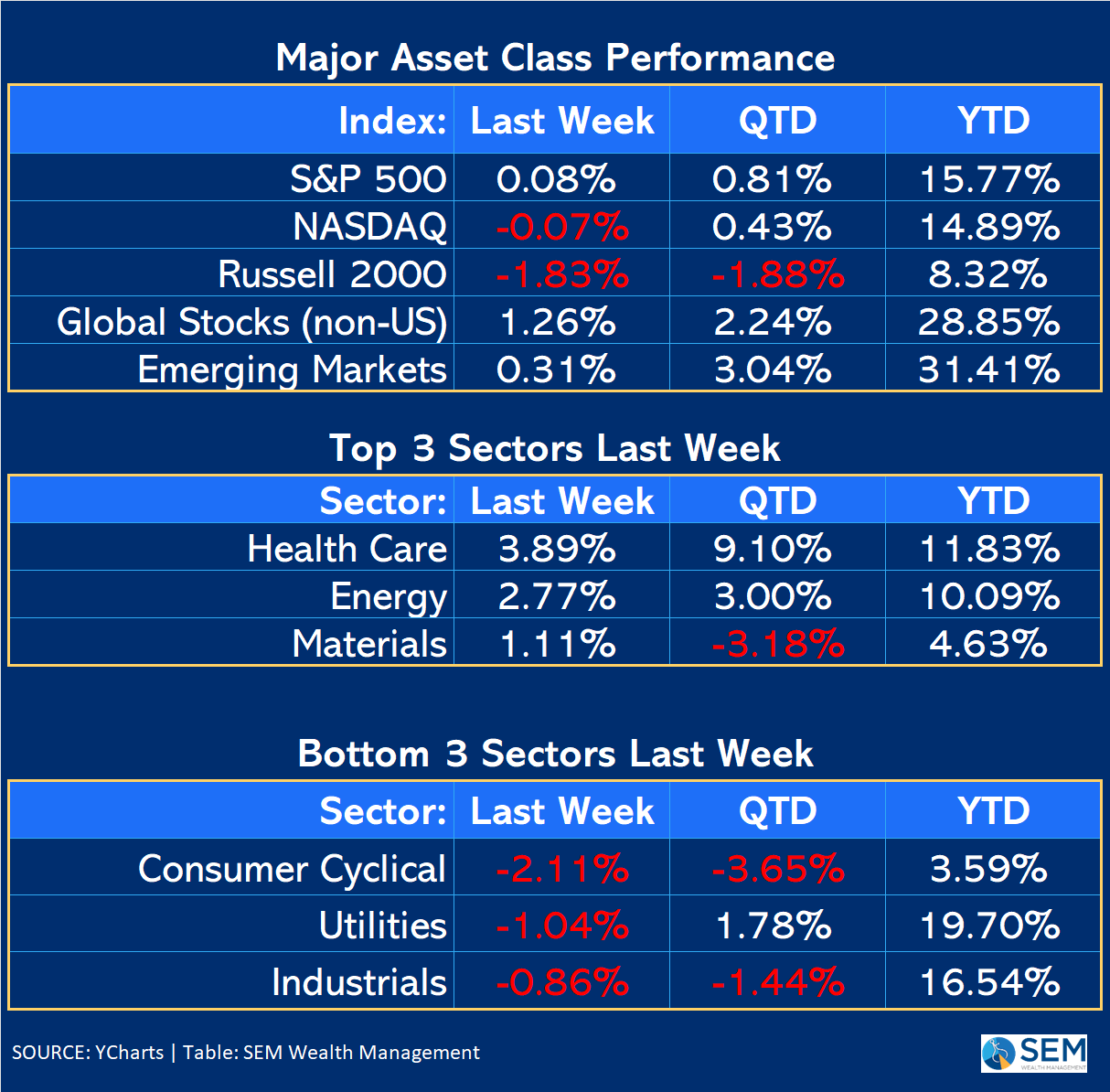

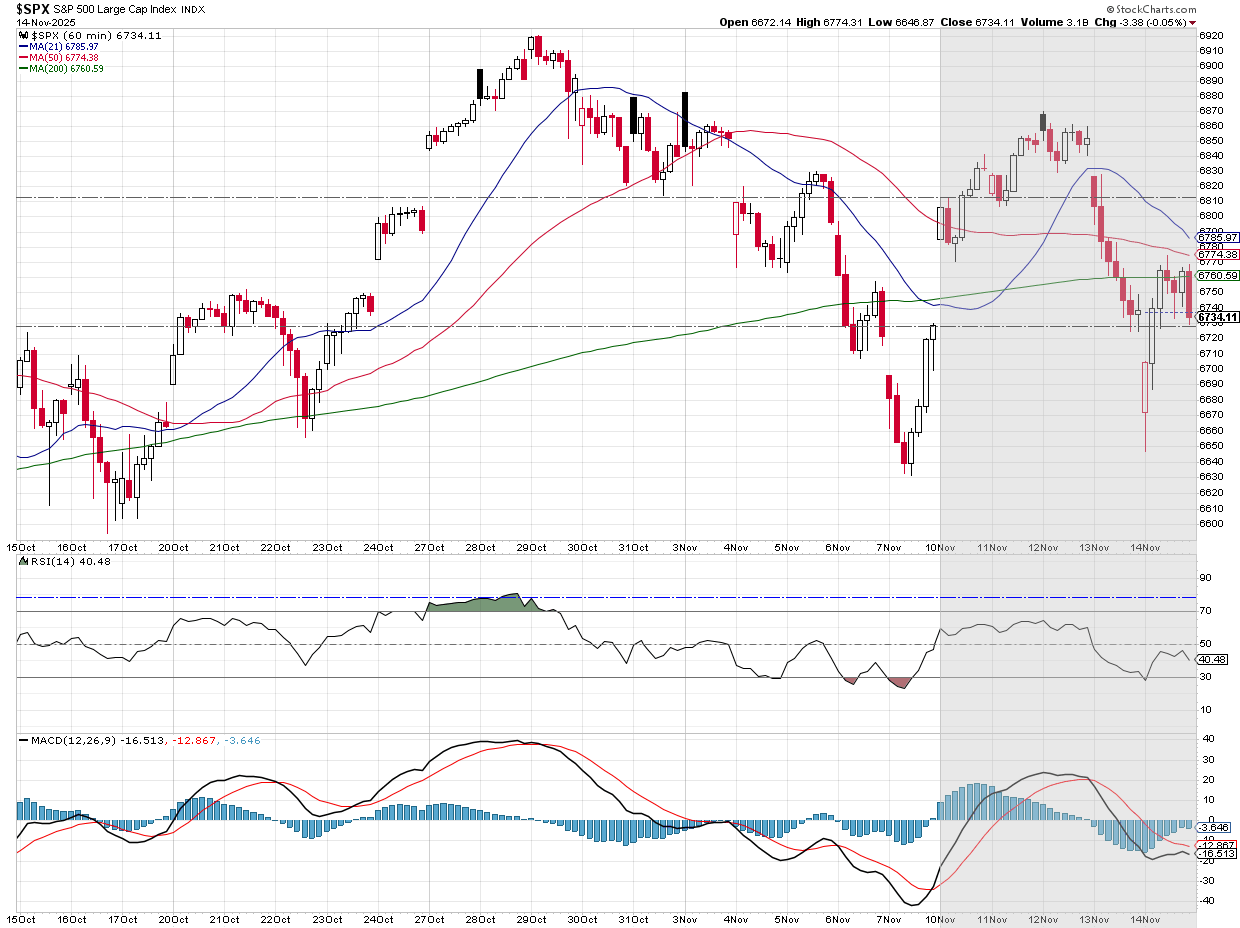

Looking at the above table, it seems like a nice, quite week. But the hourly chart tells a different story. Stocks moved higher to start the week as Congress moved to finally end the record setting shutdown. That ended shortly after the President signed the new CR.

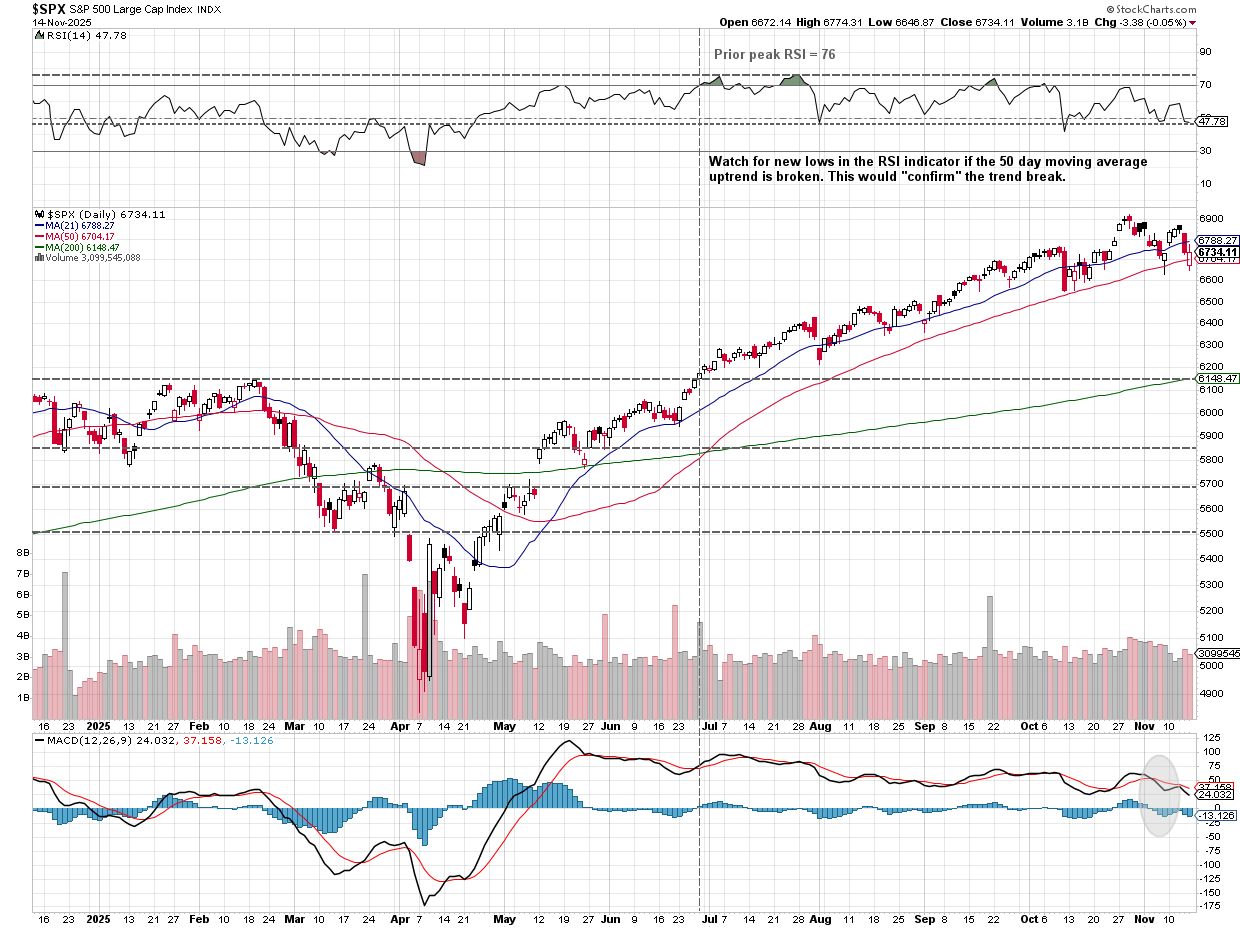

The S&P 500 ended the week again threatening to break "support". Watch the RSI for confirmation of the breakdown which could bring out plenty of profit taking.

Keep in mind, though that many investors will be hoping to wait until 2026 to sell given the huge move off the April lows and the tax hit cashing in those gains will bring.

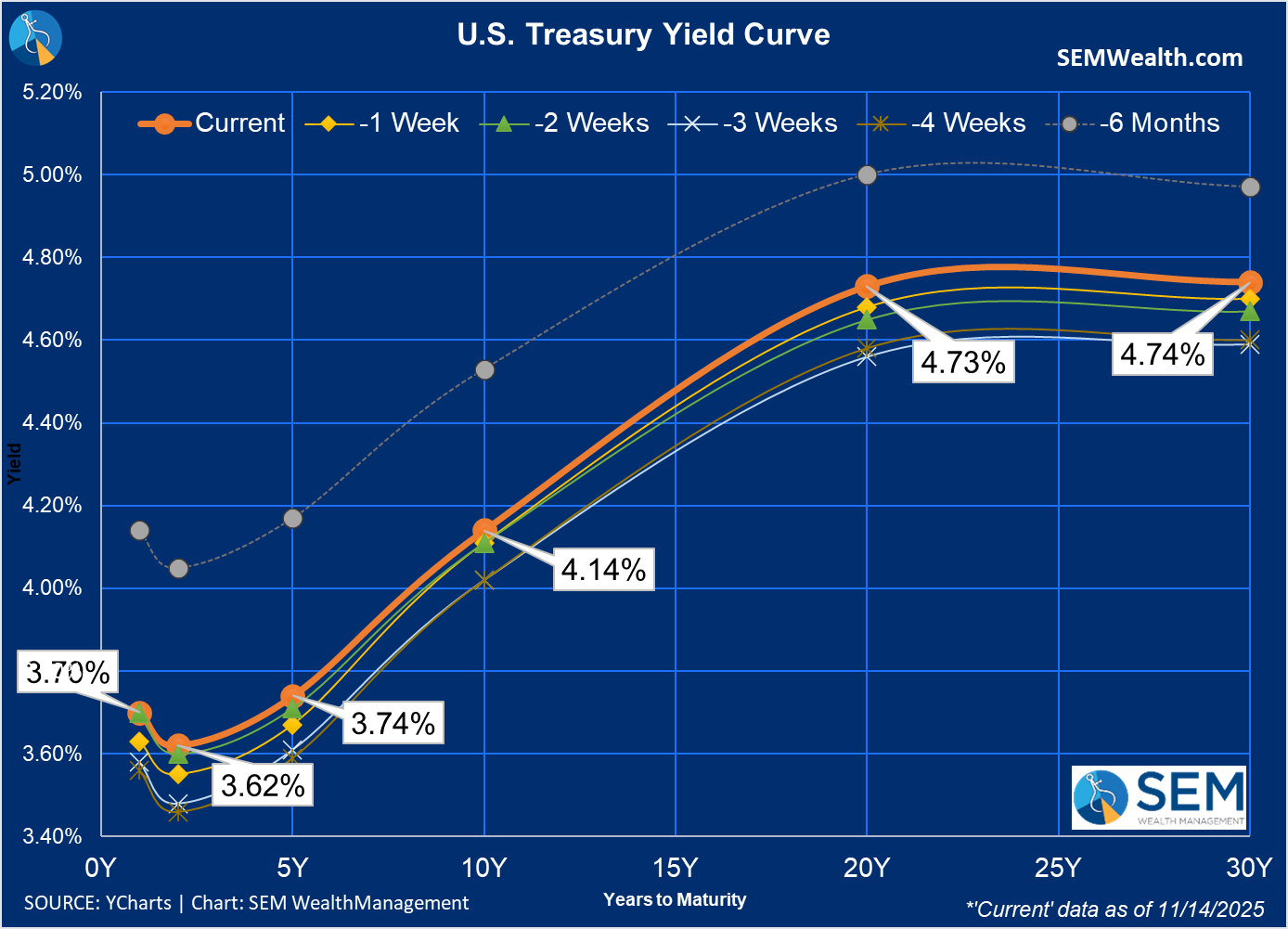

The bond market did not like the government reopening (partially because the President and his staff continue to talk about $2,000 'dividend' checks, which are both inflationary and make the deficit even worse than the near record debt demands we are seeing today.) The odds for a rate cut in December fell from nearly 90% a couple of weeks ago to 45% last week.

We are near the lower part of the very big range we've seen the past 2 years, so it would be bad news for everyone if yields continue to move up.

SEM Market Positioning

| Model Style | Current Stance | Notes |

|---|---|---|

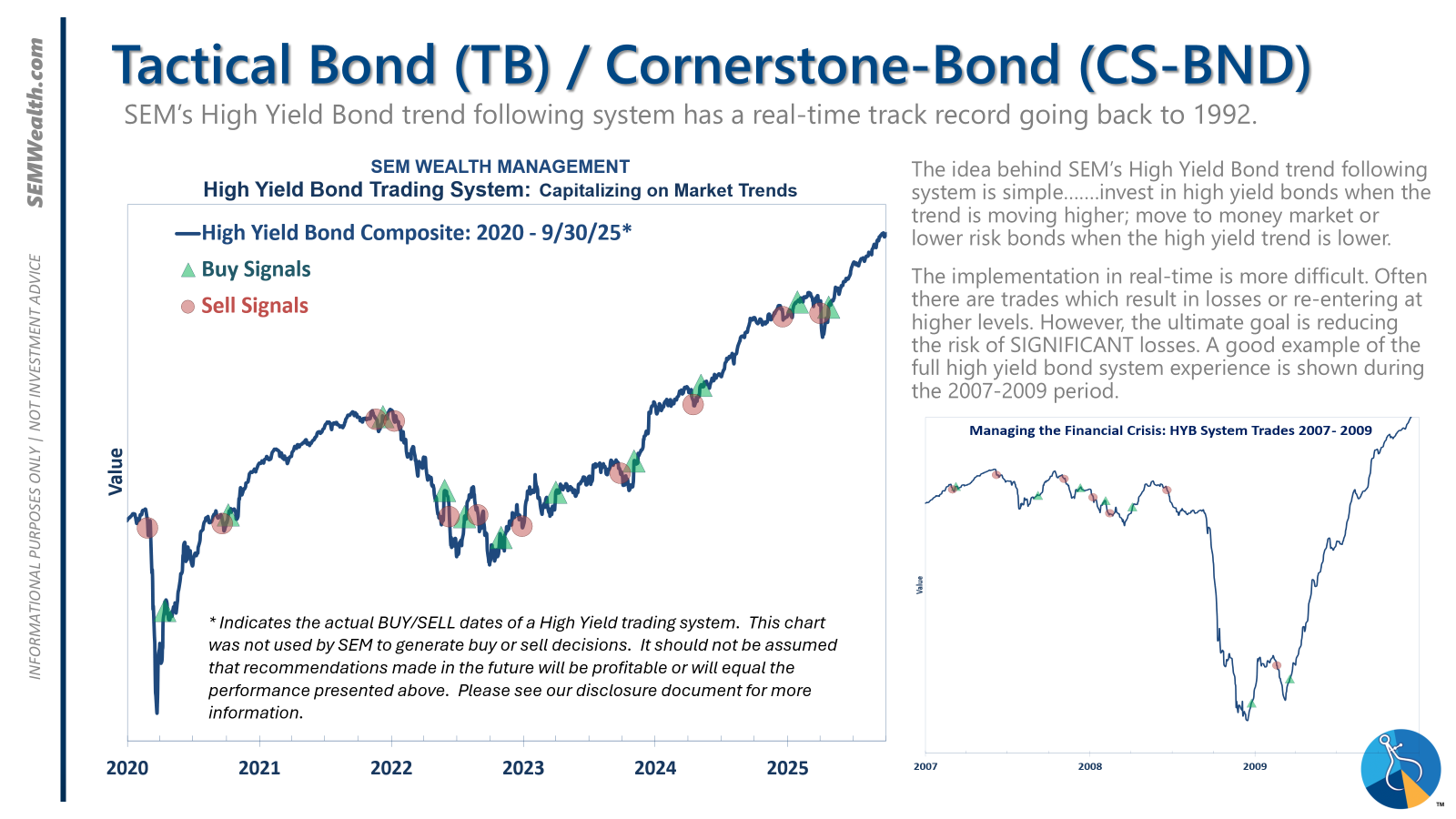

| Tactical | 100% high yield | High-yield spreads holding, but trend is slowing-watching closely |

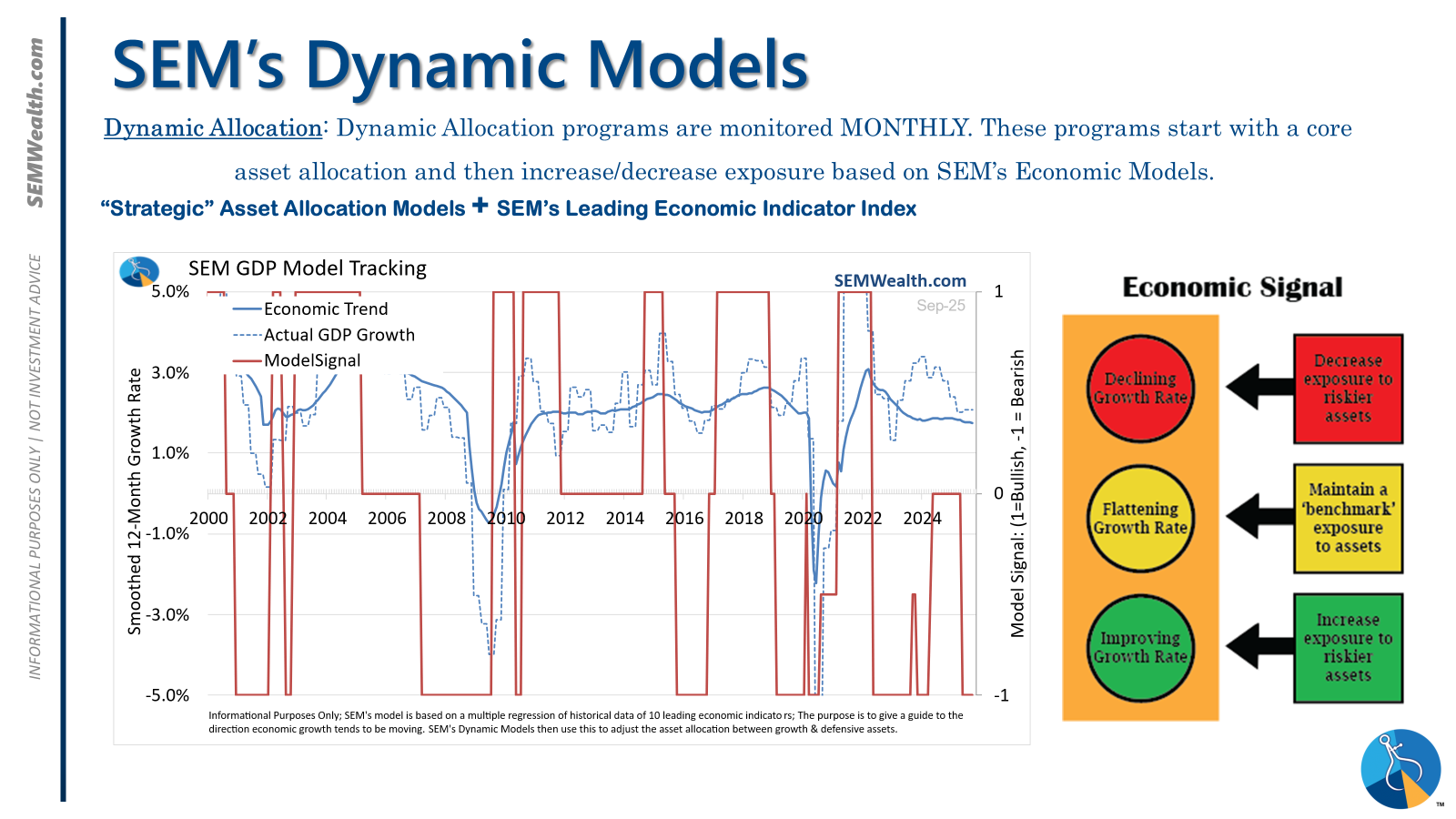

| Dynamic | Bearish | Economic model turned red – leaning defensive |

| Strategic | Slight under-weight | Trend overlay shaved 10 % equity in April -- added 5% back early July |

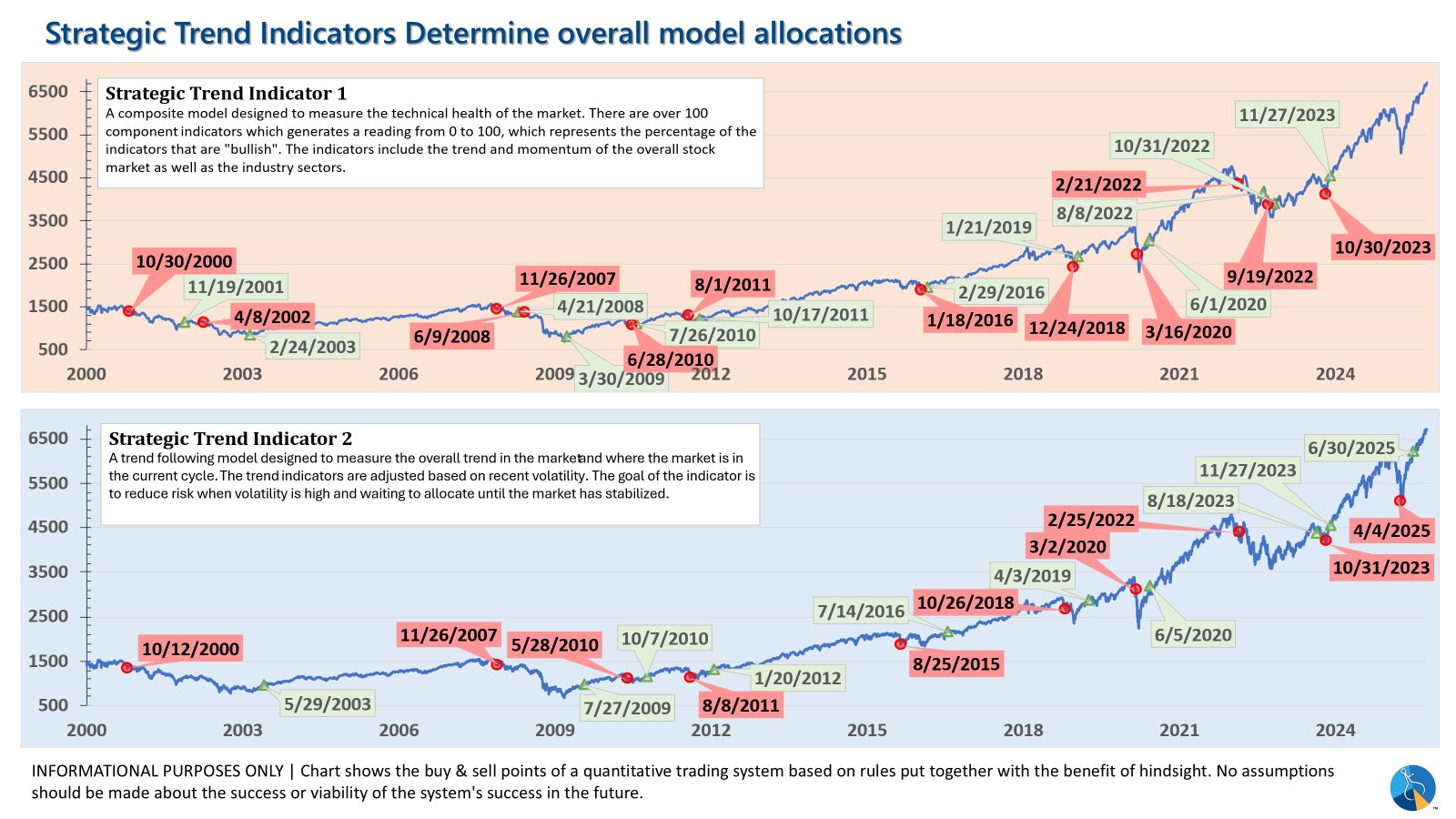

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): The high yield system has been invested since 4/23/25 after a short time out of the market following the sell signal on 4/3/25.

Dynamic (monthly): The economic model went 'bearish' in June 2025 after being 'neutral' for 11 months. This means eliminating risky assets – sell the 20% dividend stocks in Dynamic Income and the 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is 'bullish' meaning higher duration (Treasury Bond) investments for the bulk of the bonds.

Strategic (quarterly)*: One Trend System sold on 4/4/2025; Re-entered on 6/30/2025

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire