The AI Echo, The K-Shaped Split, and The Debt Trap

Last week we hosted our annual year-end economic and market outlook. We've done versions of this every fall for as long as I can remember. Fall is also a busy time for conferences and this is a popular topic when I speak at conferences. This year we've seen some big swings in the market since I first gave the presentation at the beginning of October. While some of the examples or discussion points have shifted since early October, the main point as we close out the year remains the same:

"History doesn't repeat, but it rhymes."

I’ve found myself repeating this phrase throughout the quarter. I joked in the webinar that I was the one who said it because I've been saying it so often. The quote is actually attributed to Mark Twain, but it feels tailor-made for the economic landscape we face as we close out 2025. When we look at the stock market today, we see echoes of the past—specifically the tech boom of the 1990s and the housing financing bubbles of the mid-2000s—remixed into a new, complex tune driven by Artificial Intelligence, creative financing, the Federal Reserve trying to keep everything afloat, and using government debt to

If you missed it, I'd encourage you to take a look at the replay below. The prepared remarks as always lasted 30 minutes. This year we had the most questions I can remember. They were all good ones and point to the concerns/curiosities we see from our clients and advisors across the country. I enjoy the Q&A every time for this reason.

The AI "Shell Game"

The most fascinating "rhyme" we are watching is in the Artificial Intelligence sector. There is no doubt AI will increase productivity, much like the internet did in the 90s. But the financing behind today's infrastructure build-out is concerning.

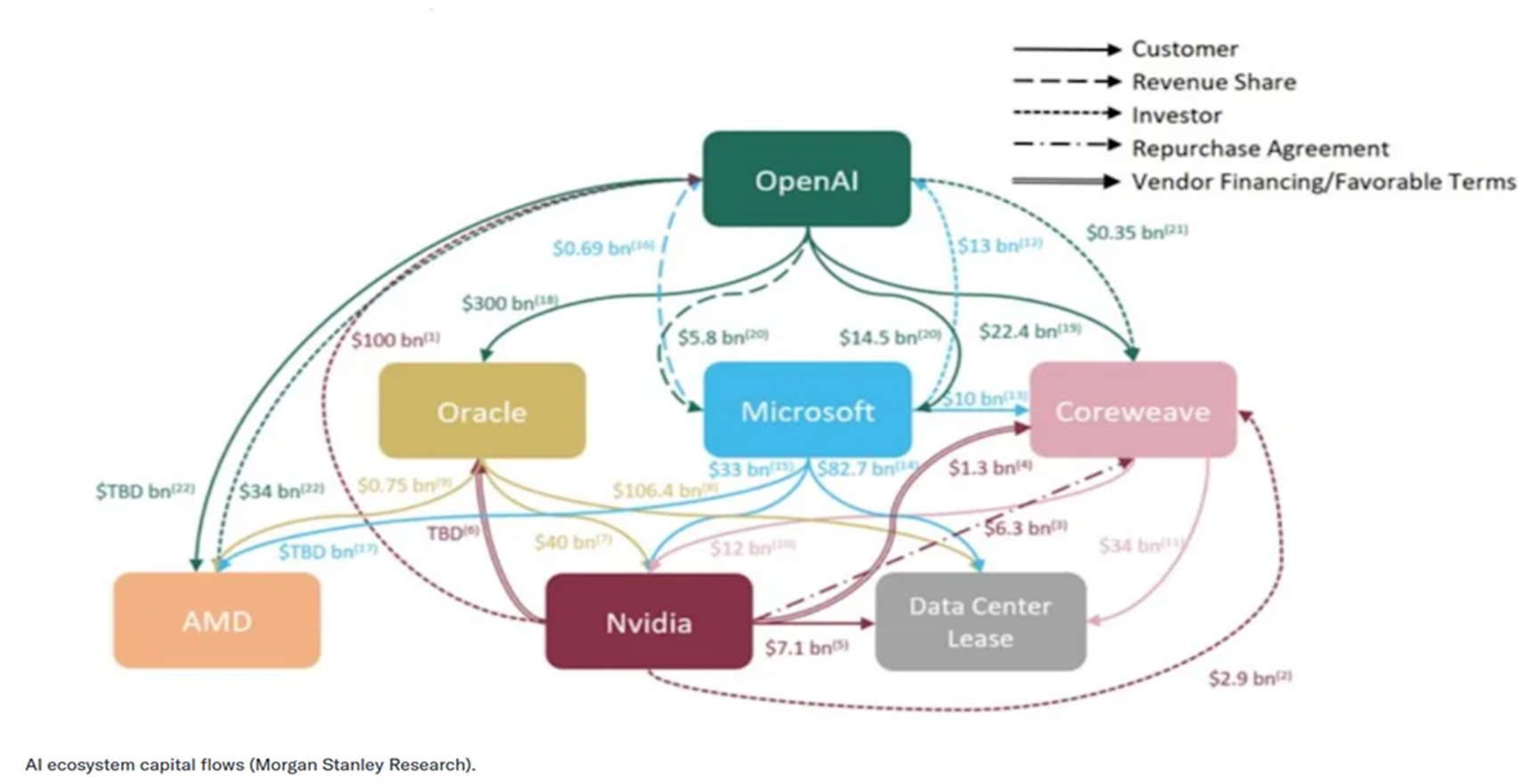

We are seeing a circular economy where tech giants and private credit funds are financing the construction of data centers that, in turn, buy chips from the tech giants. It’s a loop of "vendor financing" that boosts revenue on paper but raises serious questions about cash flow. If the end users—you and me—don't start paying significantly more for AI services to justify these trillions in infrastructure, this financing house of cards could wobble. It is starting to feel uncomfortably similar to the structured finance vehicles which became prevalent in 2005 and helped inflate the final stages of the housing/finance bubble.

I think it's important for our readers to understand, you can be overwhelmingly optimistic about the future of AI and all the amazing things it will be able to do which should make all of us more productive AND be especially worried about the bubble that we've seen inflate since ChatGPT launched a little more than 2 years ago. I've been a heavy user of various AI tools since the spring, including ChatGPT and CoPilot (both from Open AI). I've expressed my frustration with GPT 5 since it's launch in August. I'm not alone in this. The cost for Open AI to go from GPT 4 to GPT 5 was significant (they are private so the amount was not disclosed, but by all accounts it ran into the several billions of dollars - 5 times the cost to develop GPT4.)

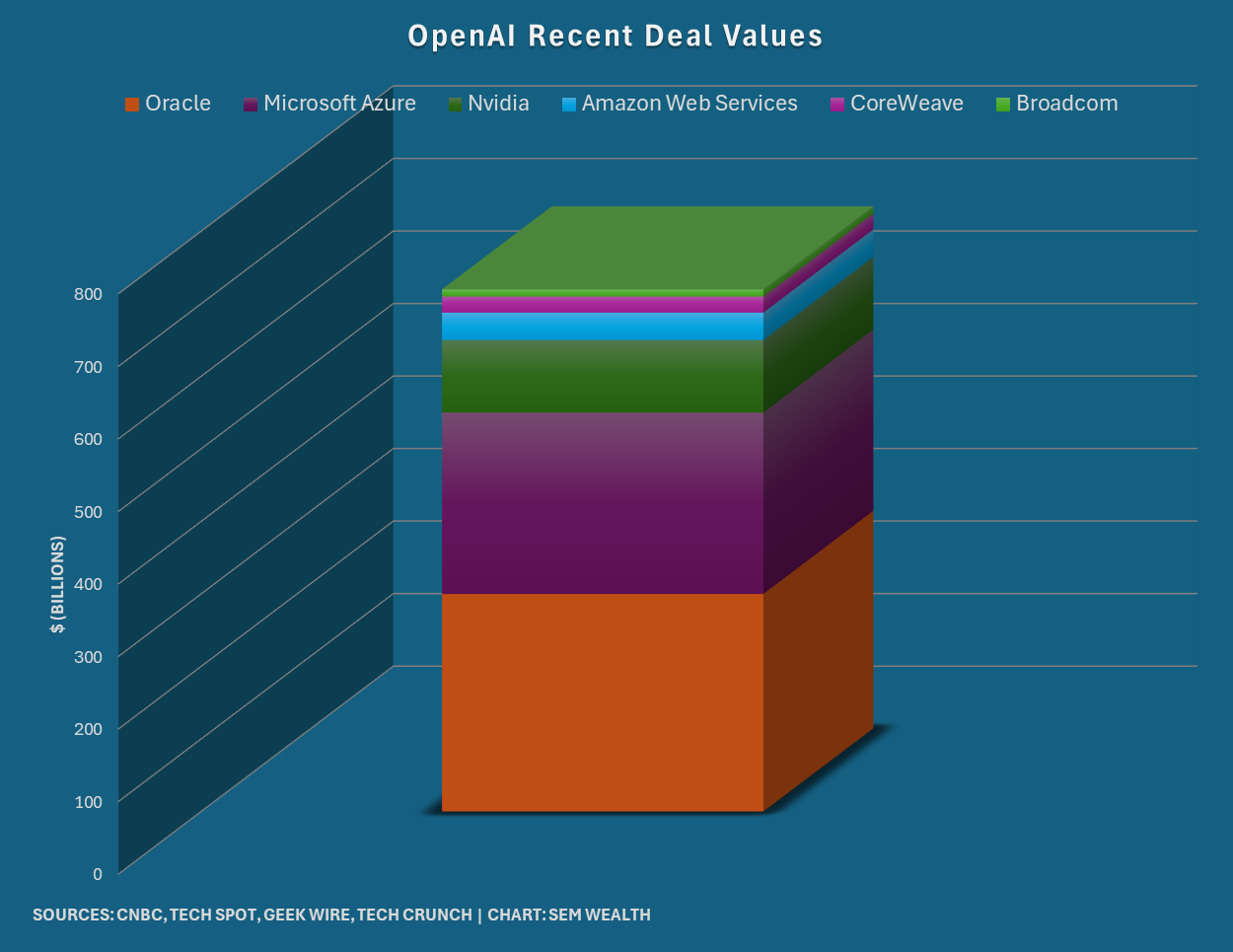

Despite this "flop" the market has not only shrugged its shoulders, it has gone crazy for any company announcing a "deal" to sell or partner with Open AI. A few week's back we showed this chart Toby created illustrating the commitments Open AI has made:

That's over $700B from a company that not only struck out with their latest development project, but also has generated just $13B in revenue over the past 12 months. That's revenue, not earnings.

I heard an analyst last week say, "it's not too early to consider whether OpenAI will be around when the technology matures." He went on to compare OpenAI, with other "first movers" Prodigy and MySpace who were eventually pushed out of business by bigger and better funded companies. This interview came on the heels of Google's launch of Gemini 3, which the experts say pushed Gemini ahead of ChatGPT. It was so shocking to OpenAI that CEO Sam Altman issued a "code red" to drop all other development work to focus on improving ChatGPT. [ChatGPT 5.2 is supposed to be released on Tuesday, December 9 as a direct response to Gemini3.]

It is still way too early to declare a winner and loser, but one of Google's clear advantages was mentioned in the blog last week – they are developing their own chips, which not only lessens their reliance on Nvidia and other chip providers, but also gives them additional revenue streams to fund their Gemini development work. When you review the commitments above and the Open AI "deal structure" as documented by Morgan Stanley, you could see the problem for so many companies if OpenAI continues to lose out to Google or other better funded companies.

I wanted today's blog to be short, so I will end the discussion on this for now, but this goes well beyond whether Gemini 3 is better than Chat GPT 5.1.

Toby's Take, Part 1

12/4/2025 - Exclusive | OpenAI CEO Sam Altman Has Explored Deal to Build Competitor to Elon Musk’s SpaceX - WSJ

OpenAI has become a rapidly growing company, but still faces the question of how they are actually turning a profit. Being that they are a non-profit they obviously aren't making much money and definitely not enough to be making these big data center build outs. Now, on top of that OpenAI is trying to figure out how to get into the rockets. This is obviously a big change and if they do get into it they will be a direct competitor with Elon Musk's Space X. They aren't a publicly traded company so we can't say how their "stock" would be affected, but depending on how things go, this can affect Elon Musk's companies and everyone making deals with OpenAI. We need to sit back and watch to see how this plays out.

The Tale of Two Economies

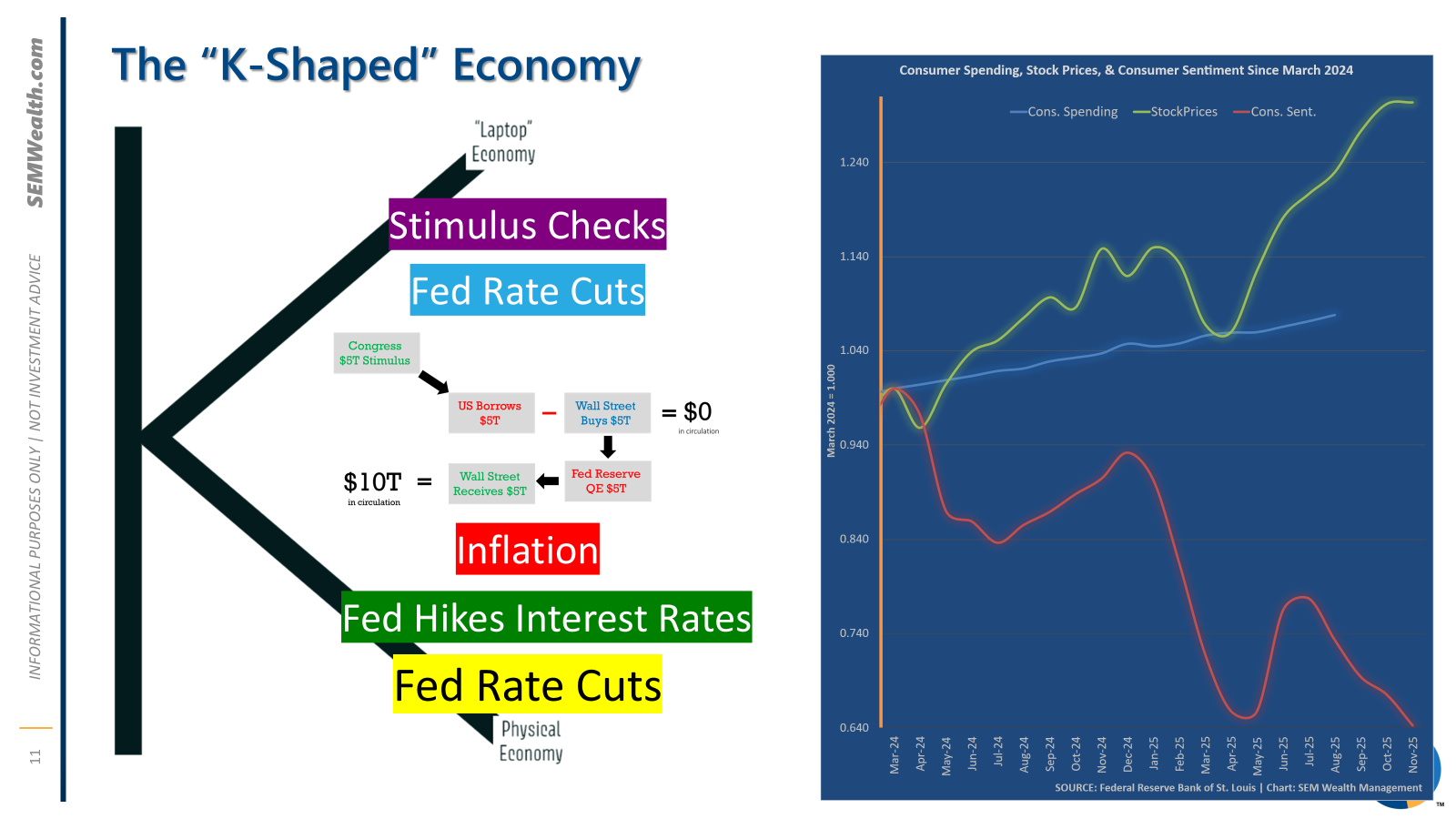

If you look strictly at the stock market, you might think the economy is roaring. But if you peel back the layers, we are living in a distinctly "K-shaped" economy.

I first began discussing this in 2020 and rather than playing the "class warfare" game simply divided the economy into two groups – those who could work from their laptops (along with those who weren't working and didn't have their incomes disrupted) and those who physically had to go to work. The top part was already fine, yet the government decided to send most of them checks anyway. (let's not forget both Trump and Biden signed deals to send stimulus checks so BOTH parties are responsible). When you give people money they don't need, they spend it on things they don't need. The checks for the lower part of the K were nowhere near enough.

The inflation this sparked was an inconvenience to the upper half of the K, but devastating to the lower half. The inflation surge also pulled many from the middle-class portion of the "laptop" economy (and many retirees) down to the lower-half of the K.

The top of the "K" today — the top 2% of earners—is doing just fine. They drive 60% of consumer spending, and their assets are inflated by the market's rally. But the bottom of the "K"—the other 98%—is telling a different story. We are seeing credit card delinquencies rise and budgets tighten. The stimulus checks are long gone, and the reality of sticky inflation has set in. Just because the stock market is disconnected from this reality doesn't mean the reality won't eventually matter.

Consumer Sentiment has only been lower than it was last month once in the last 50 years – back in the summer of 2022 when inflation was over 9%. The Fed for whatever reason is telling us inflation around 3% (and rising) is not a problem. The market has nearly a 100% probability the Fed will cut rates this week by another 1/4%. The market loves this. The rest of America? Not so much.

Toby's Take, Part 2

12/1/2025 - Gen Z Shoppers Aren’t Spending Like Retailers Need Them To - WSJ

Despite the current economic pressures, most people are spending like normal in this holiday season. Except for one major generation, Gen Z. This generation is playing a huge role in retailers sales and are realizing that they need to tighten their budget and search for more deals. Gen Z typically plays the role of setting the tone for shopping trends and with the current trend being budgeting and deal hunting, holiday spending is expected to drop. This can end up showing on many retailers Q4 earnings reports causing investors to sell and dropping their stock prices.

Speaking of GenZ, MoneyTalks with Dad, Next Gen debuted last week. This series is designed to help those just starting out. Share the link if you have anyone in that age group who could use some help.

The Math Problem We Can't Ignore

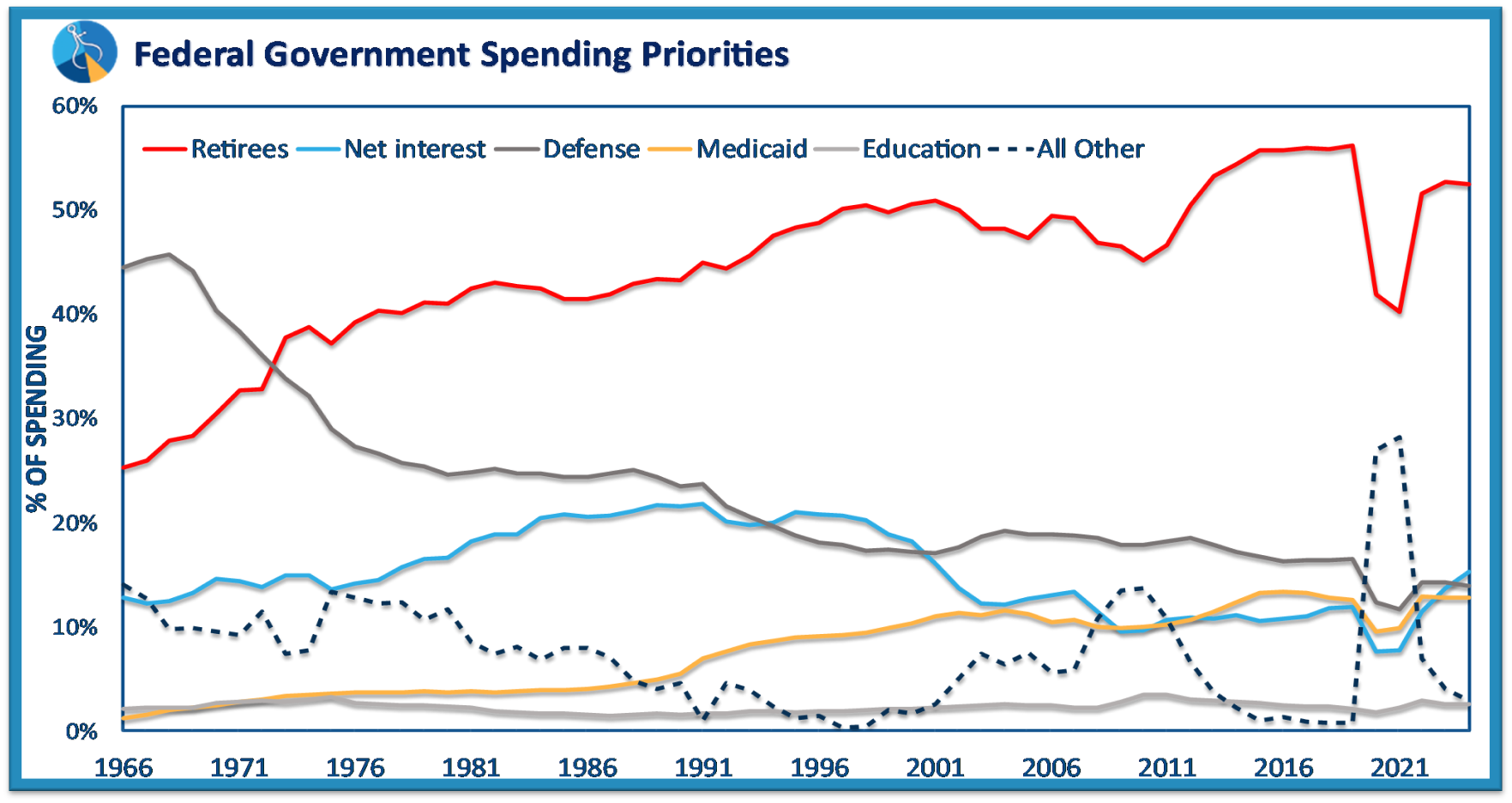

Looming over all of this is the federal budget. We have reached a tipping point where over 50% of government spending is tied up in payments to retirees (Social Security, Medicare, Federal Government Pensions, and VA Benefits). Interest on the national debt is now a higher percentage of our spending than defense.

This isn't a political statement; it’s an accounting reality. When a government spends more on its past (retirees and debt service) than its future (education, infrastructure, R&D), potential growth suffers. We are borrowing growth from the future to pay for today, and eventually, the bill comes due.

This isn't so much a 2026 problem, but it is a major problem that is getting harder and harder to avoid. Also don't forget the current continuing resolution to fund the government expires in January.

Navigating the Rhyme

So, where does this leave us for 2026?

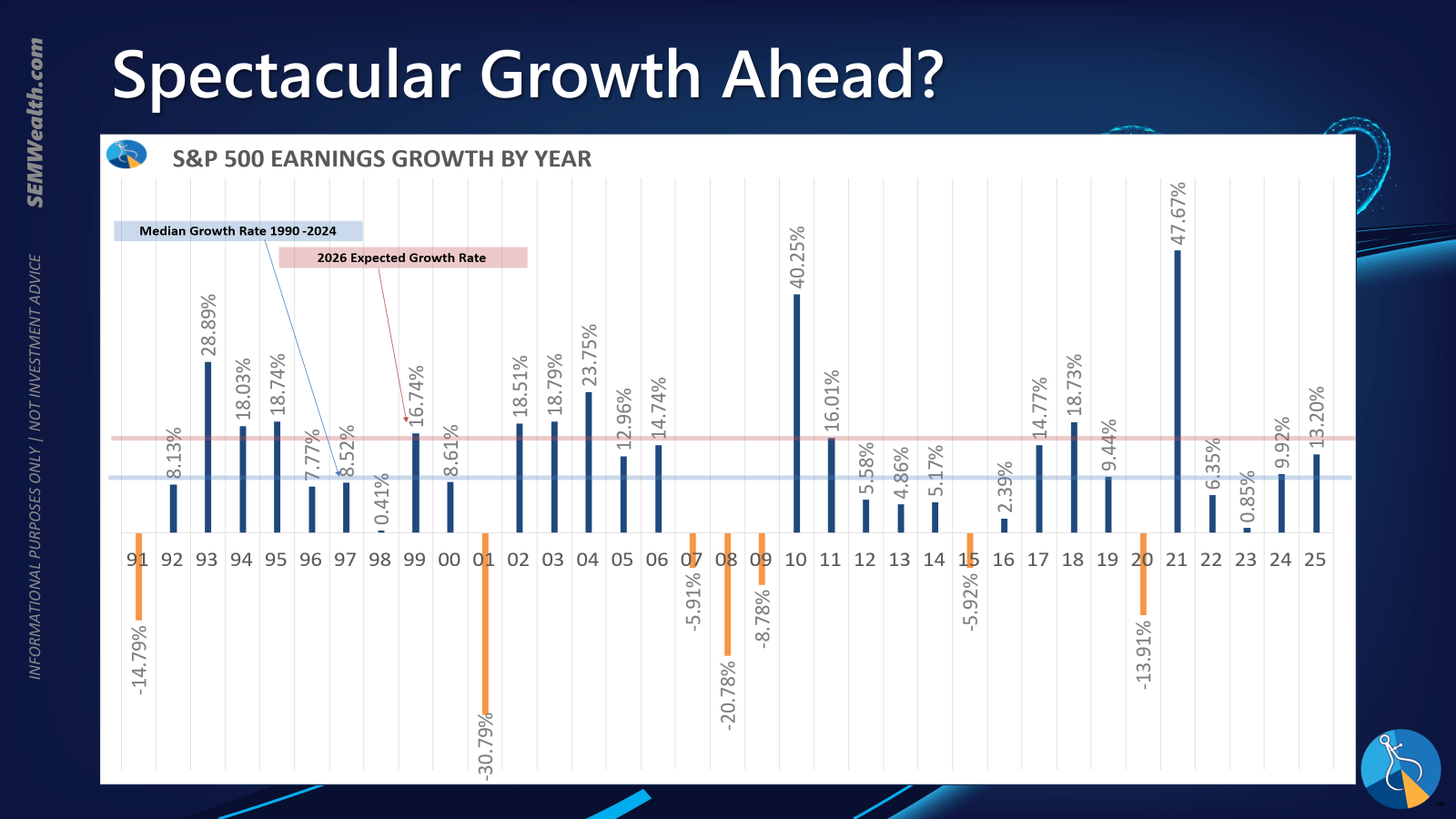

Wall Street is betting on perfection, pricing in earnings growth of 16% or higher.

Logic and a study of history would urge caution. The economy is decelerating, not accelerating. The jobs market is softening, and the consumer is tapped out. Inflation is still a problem. AI has been providing 25-50% of our economic growth this year and over 70% of the S&P 500 earnings growth. Can that continue? Sure.

This is not the time to chase returns blindly. It is the time to understand what you own and why you own it. Have you rebalanced to your target allocations over the past few years? Have you looked at your retirement needs and whether you need this much market exposure? Your asset allocation should be based on your financial plan, not your personal views on where you think the market is going next.

Each of our models plays a distinct role in a portfolio. All of the models have some sort of "risk management" applied to them. While it can be frustrating to watch the S&P 500 rally on the back of a few AI names while defensive strategies lag, remember that the goal is to survive the full cycle. Past performance is not a guarantee of future results, but historically not chasing returns in the last 1-3 years of a bullish cycle has always paid off. There will be easier and more attractive times to invest than right now.

We remain optimistic about American ingenuity and the long-term resilience of our economy. But we must respect the cycle. Human nature drives markets to extremes—both up and down. Our job is to keep a steady hand on the wheel when the road gets bumpy.

Toby's Take, Part 3

12/2/2025 - Bitcoin route picks up steam

An already difficult to understand market is getting even more unpredictable. Bitcoin is now at a 30% drop since their peak in October earlier this year. This decline hasn't stopped, in fact, it's now affecting other digital currencies. Investors are starting to sell off their other digital currencies like Ether and Solana. Because of this, it wouldn't be a bad assumption to say that these coins could just keep dropping. This can actually be a great opportunity to buy into these coins before they all eventually start going back up again. However, it can be hard to predict when the drop will stop and when it will begin to rise.

12/5/2025 - Netflix to Buy Warner Bros. After Split for $72 Billion - WSJ

There are big, yet private talks going on right now about Netflix buying Warner Bro's. Warner Bro's studios split from the cable networks. This would give arguably the most famous streaming service another huge "upgrade." If this deal or any kind of deal like it were to go through it would completely shake the streaming market, through huge revenue gains or just consumer emotions.

Market Charts

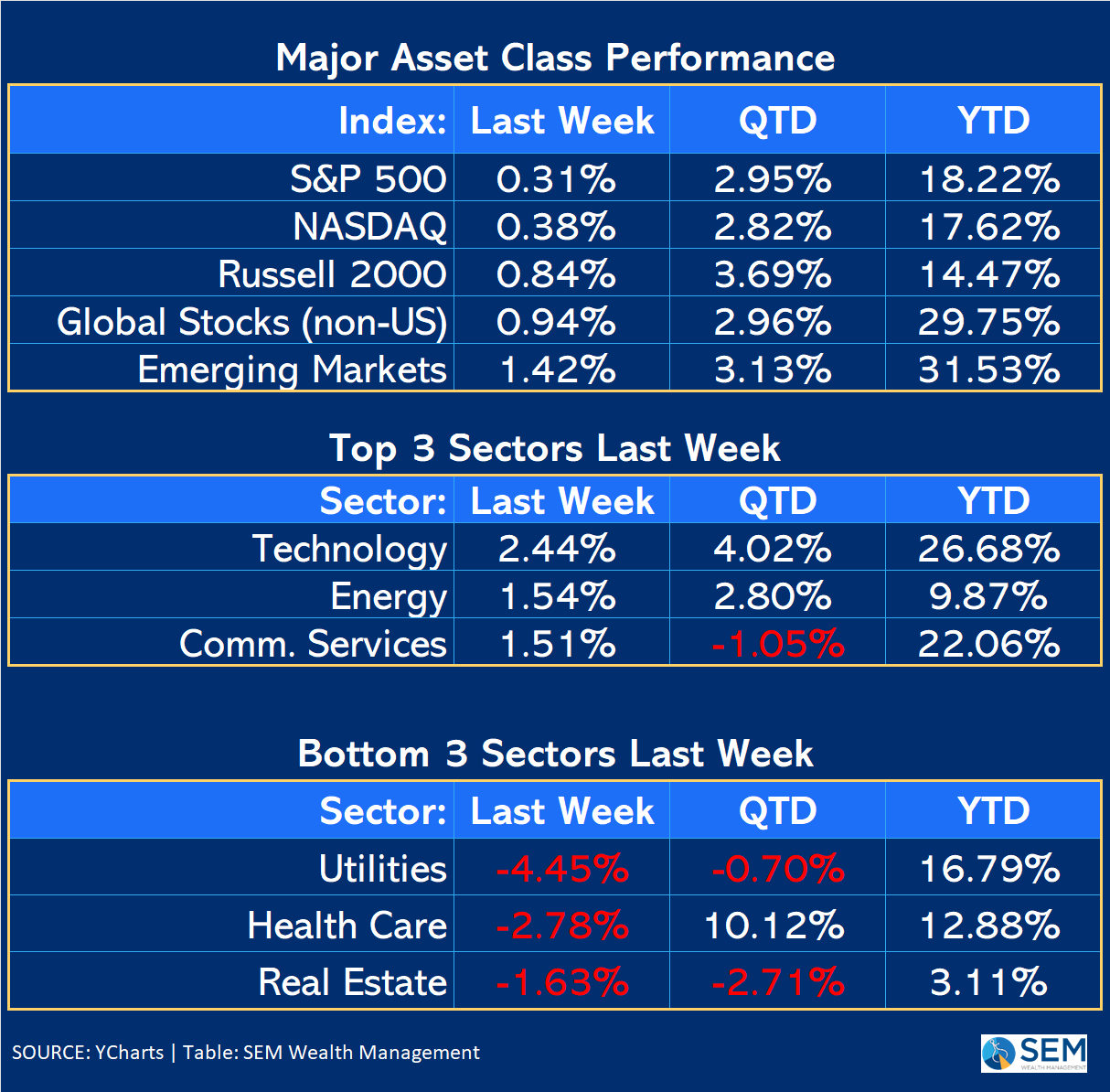

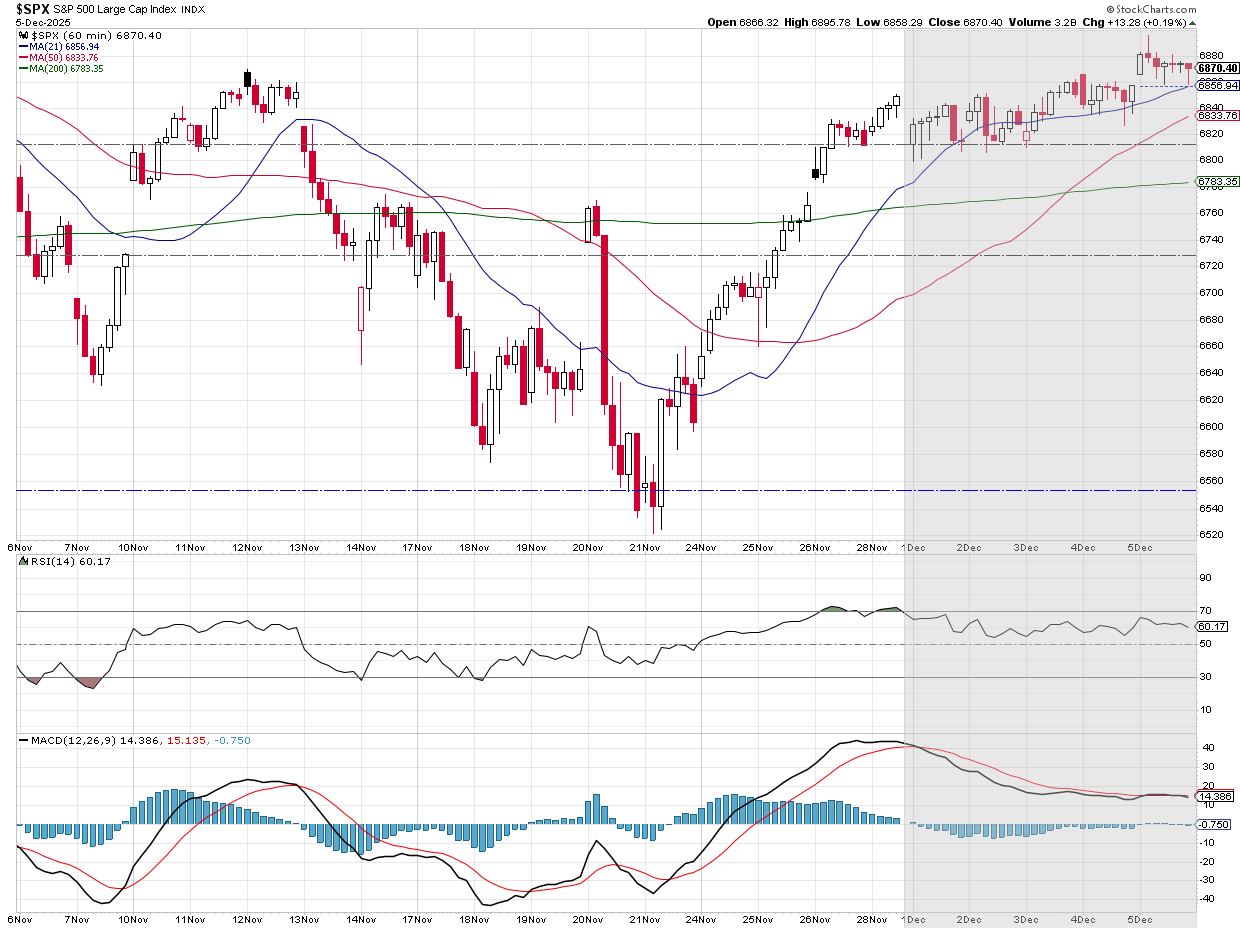

The best way to describe the market last week was a grind higher. The market closed up, but not by much.

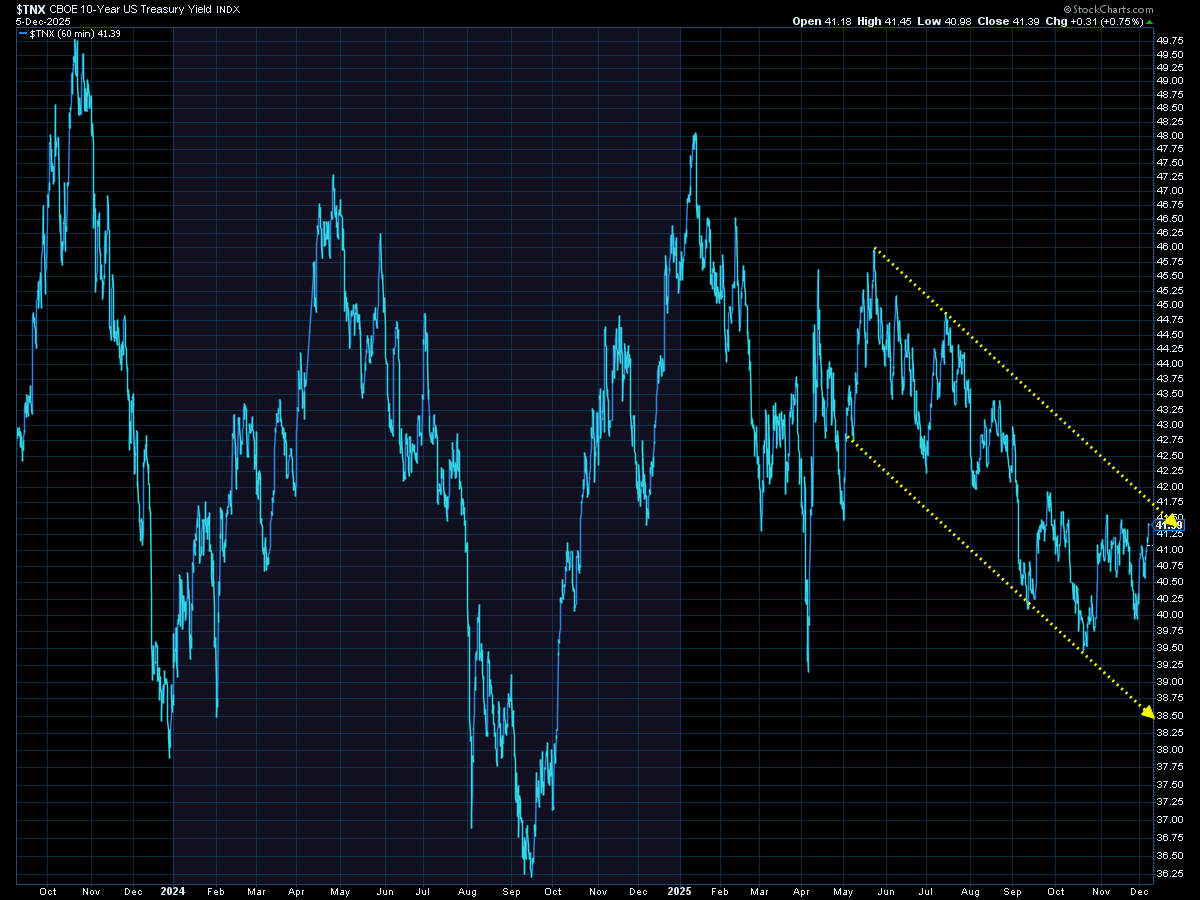

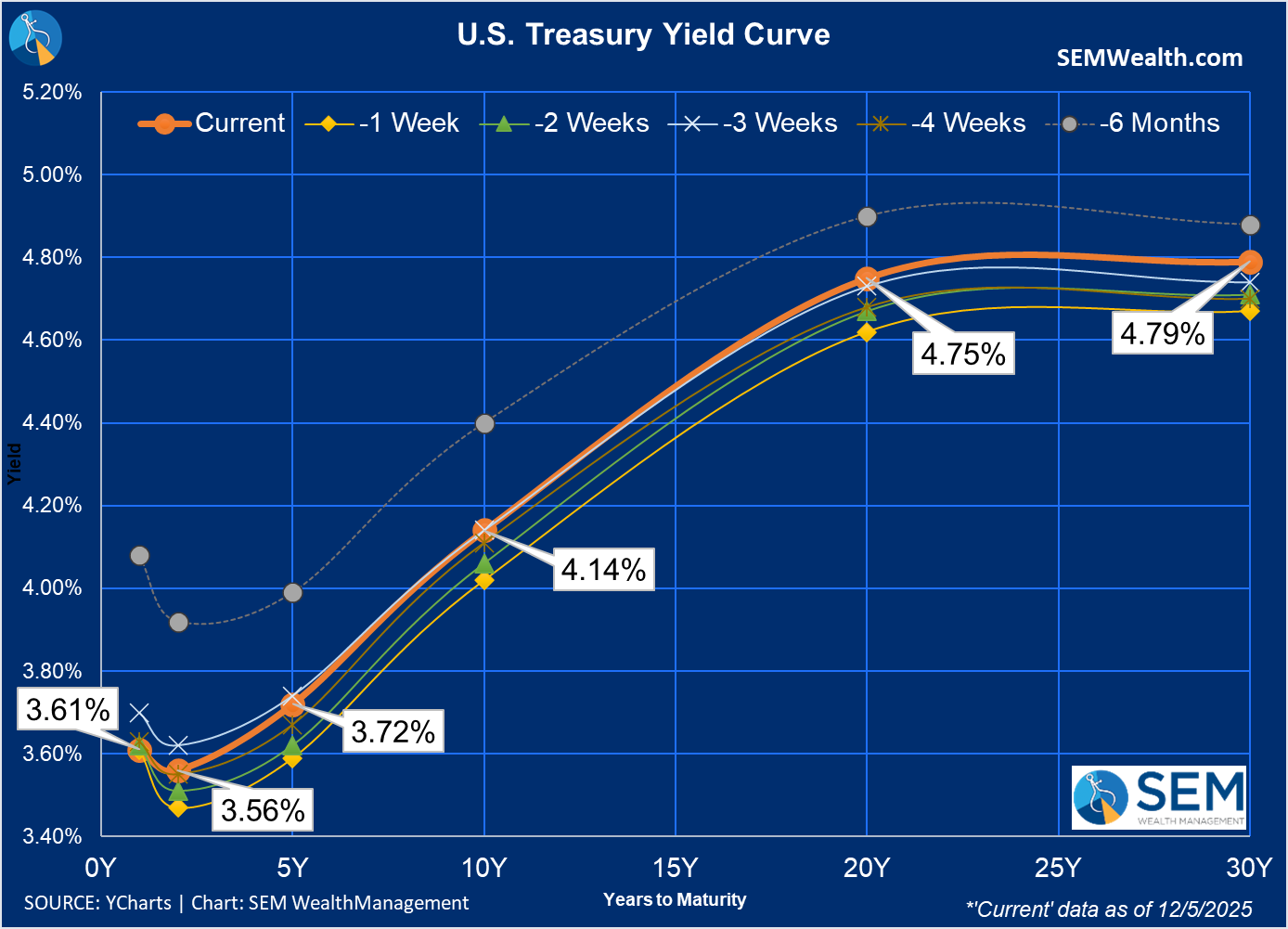

The big event of course will be the Fed's meeting this week. Last meeting the Fed cut short-term rates, but long-term rates went up. How the bond market perceives the (likely) cut will be more important than anything else said at the meeting. The 10-year yield had been trending lower since the beginning of July, making lower highs and lower lows. This time, however, yields were unable to break below the prior lows, which could mark a key trend change.

The yield curve shifted up significantly last week.

SEM Market Positioning

| Model Style | Current Stance | Notes |

|---|---|---|

| Tactical | 100% high yield | High-yield spreads holding, but trend is slowing-watching closely |

| Dynamic | Bearish | Economic model turned red – leaning defensive |

| Strategic | Slight under-weight | Trend overlay shaved 10 % equity in April -- added 5% back early July |

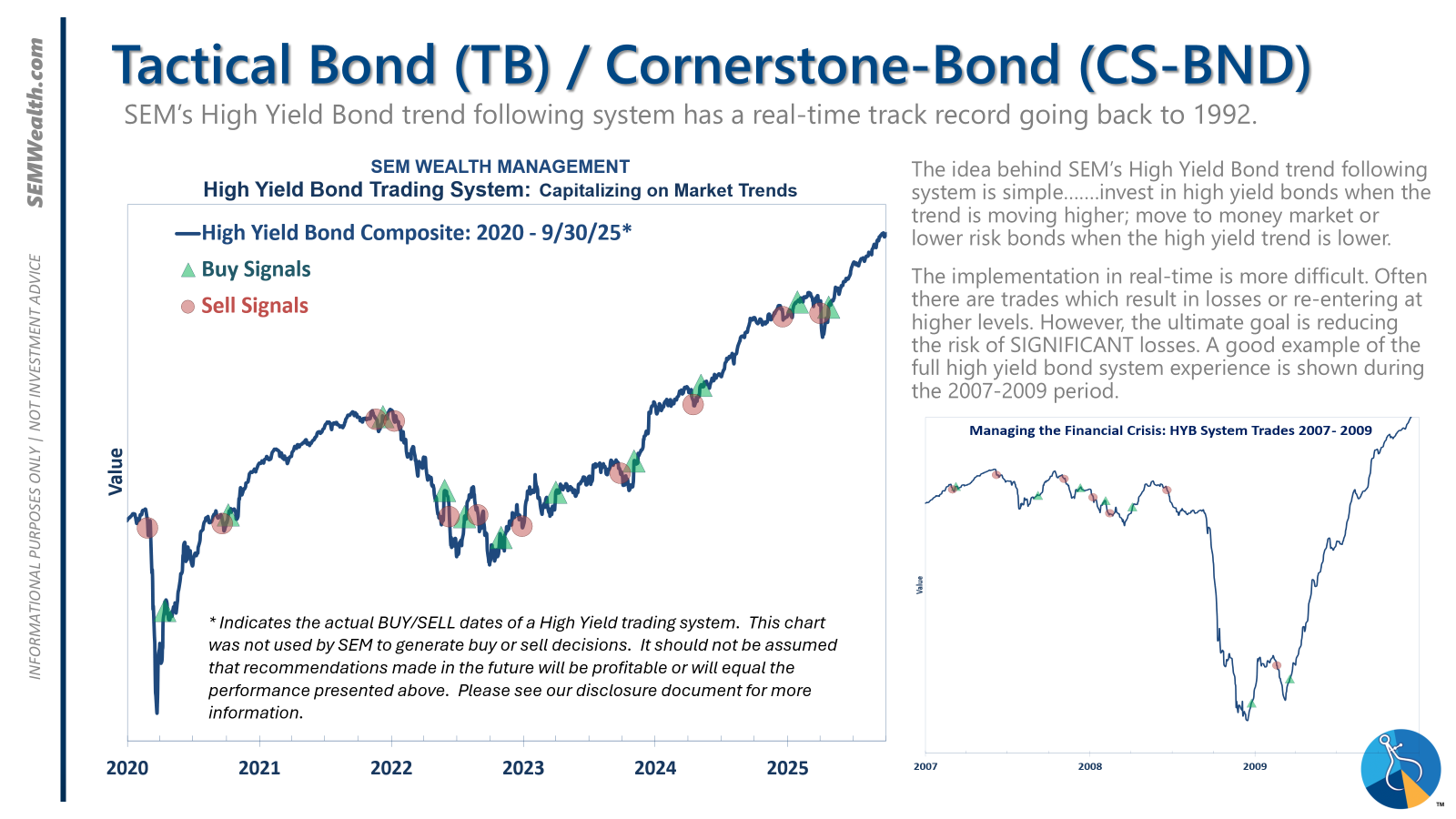

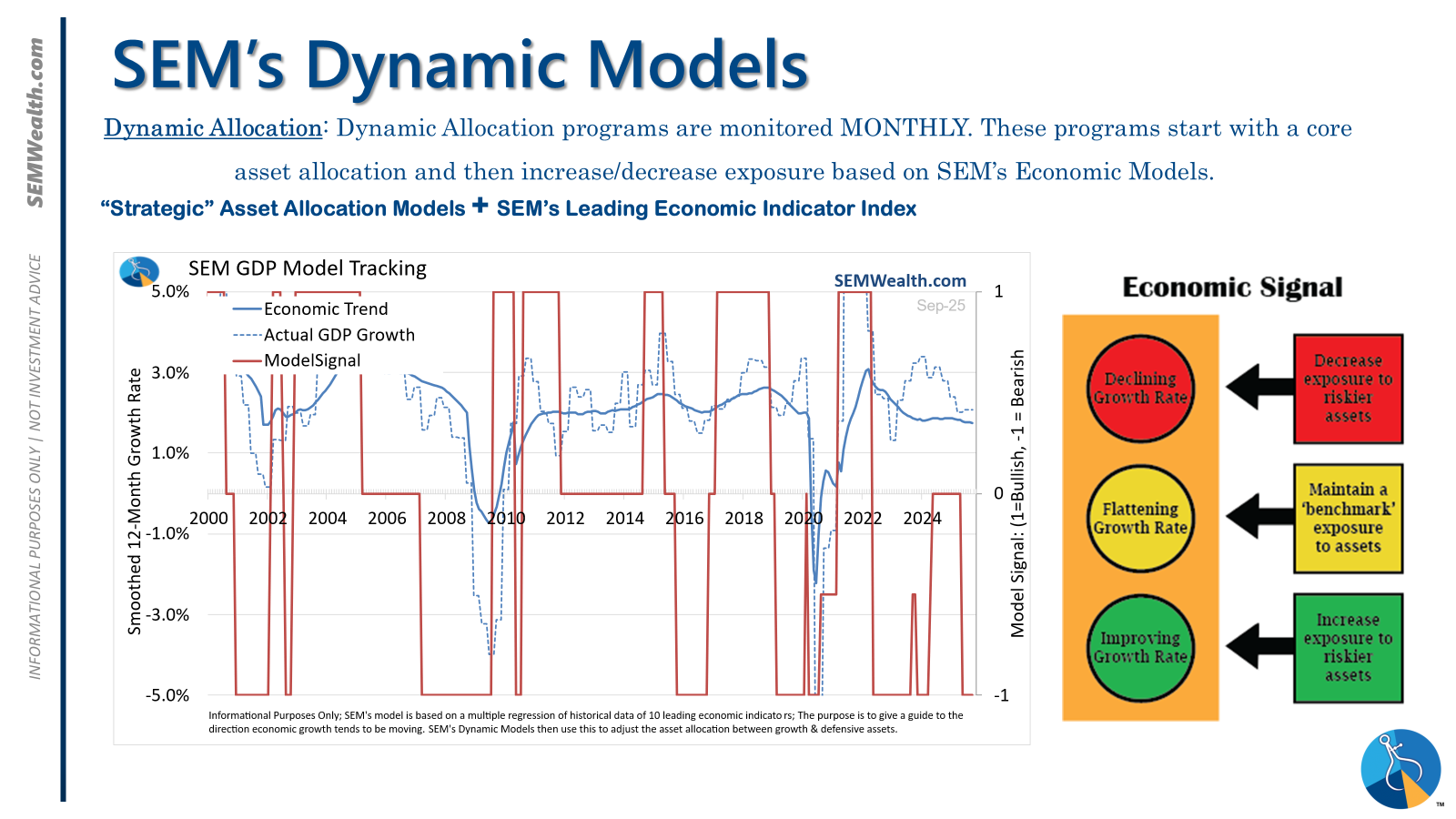

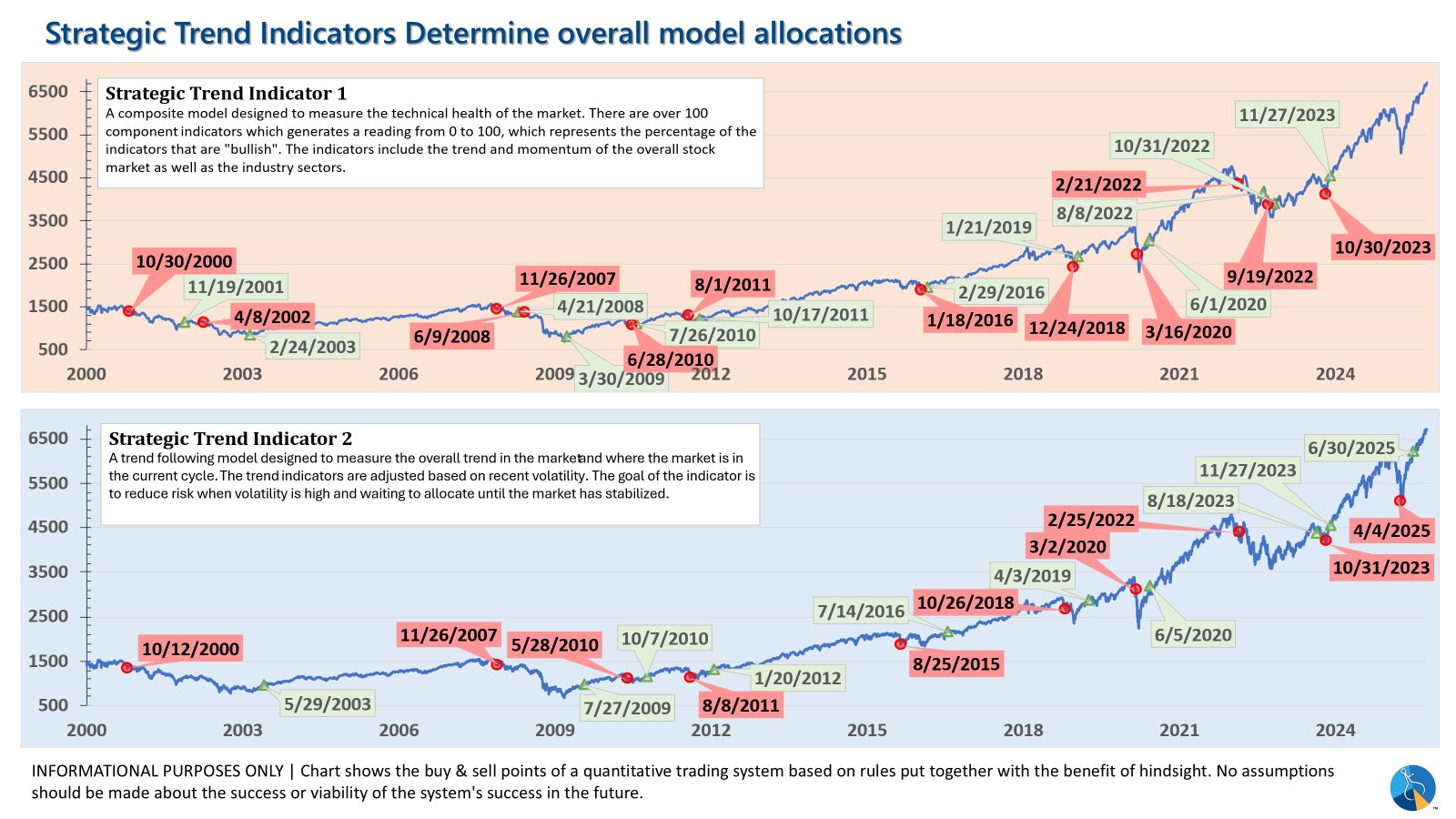

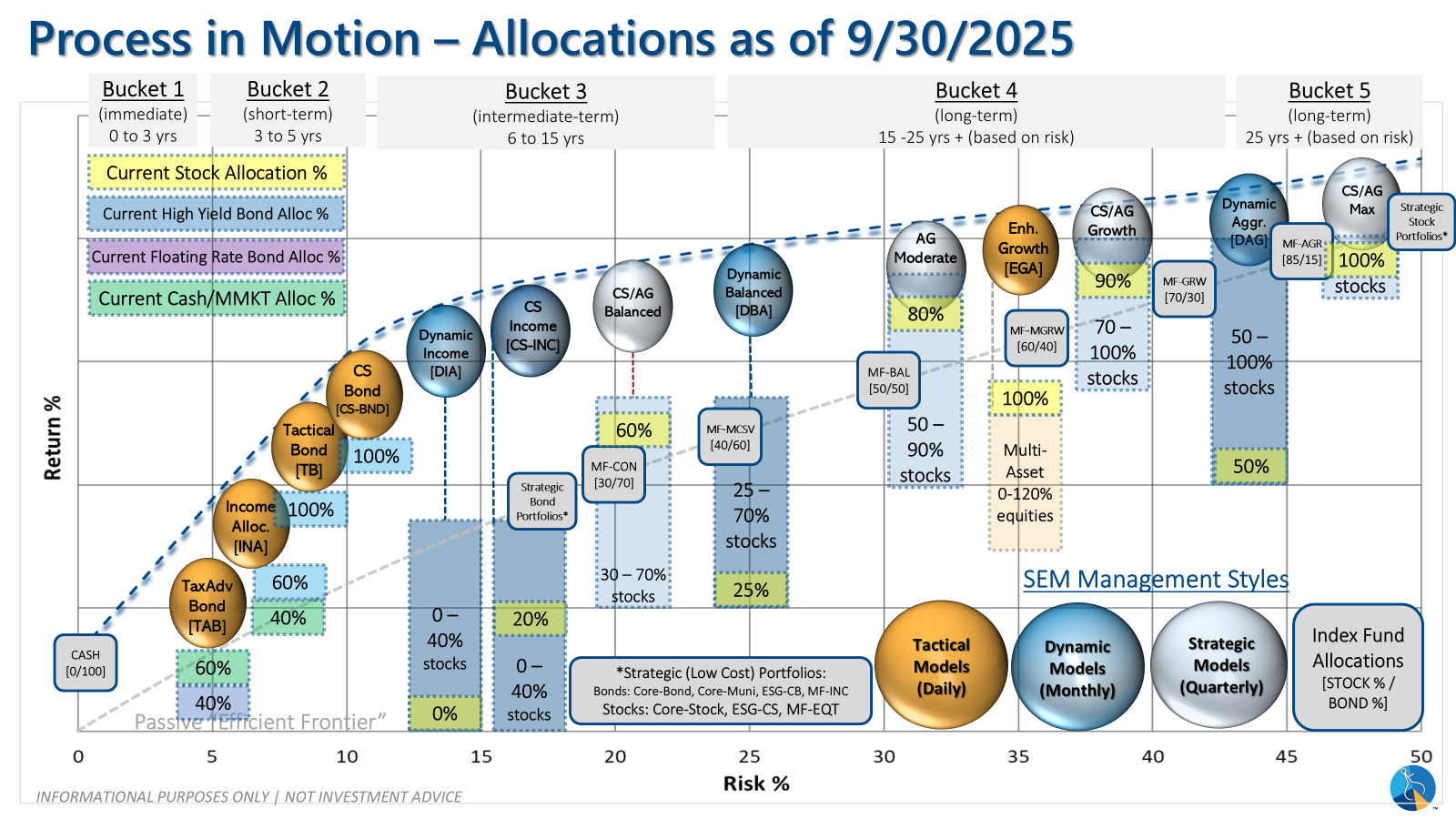

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): The high yield system has been invested since 4/23/25 after a short time out of the market following the sell signal on 4/3/25.

Dynamic (monthly): The economic model went 'bearish' in June 2025 after being 'neutral' for 11 months. This means eliminating risky assets – sell the 20% dividend stocks in Dynamic Income and the 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is 'bullish' meaning higher duration (Treasury Bond) investments for the bulk of the bonds.

Strategic (quarterly)*: One Trend System sold on 4/4/2025; Re-entered on 6/30/2025

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire