If the stock market was a living creature, I picture it as a diabolical schemer who enjoys seeing as many people suffer as possible. One way he or she would do that would be to act like your friend, to give you gifts, and make your life seem easy. Then, just as you start making changes and enjoying your relationship he or she would suddenly take advantage of your comfort and steal the very gifts you received.

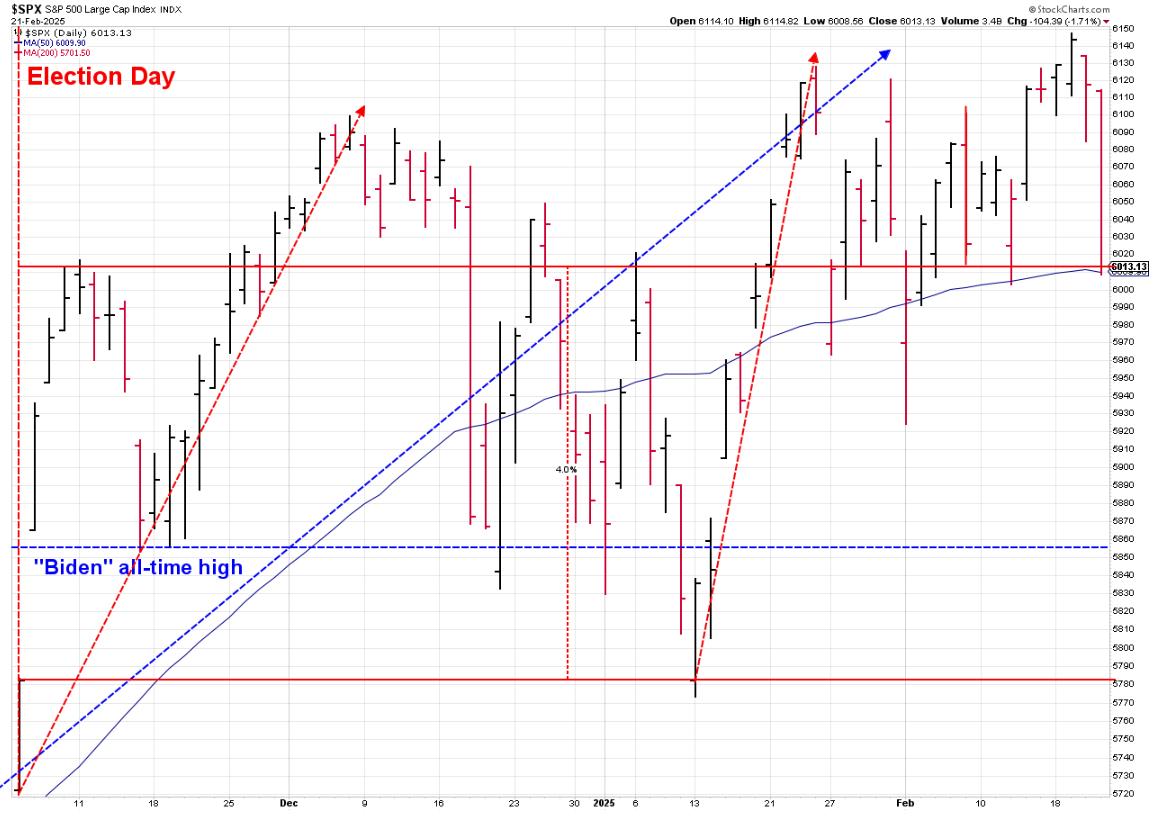

Since the election for the most part the stock market has been everyone's friend. We had a few weeks where the market reminded us that it is certainly not your friend, but overall we've enjoyed a nice uptrend. Really, we've had a strong trend since last summer when the Fed started cutting interest rates and as we show each week in the Market Charts section, a very impressive rally since late 2023. Last week and particularly on Friday the "everything is awesome" feeling was shaken a bit and we saw a wave of sellers causing stocks to end the week on a negative note.

Inflation is not going down

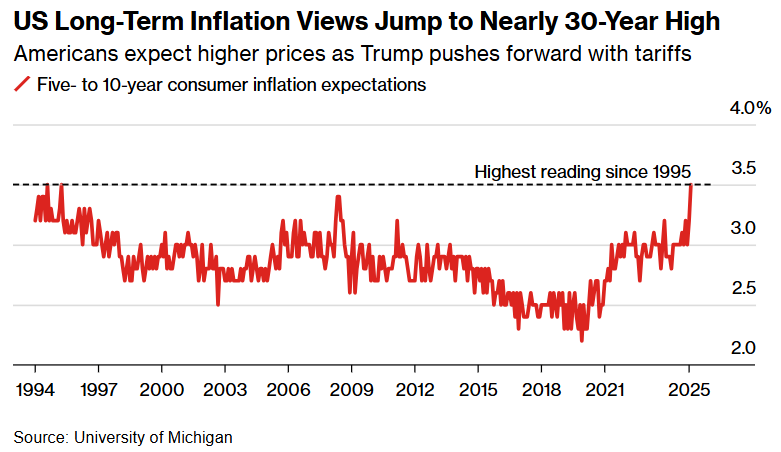

Two weeks ago much higher than expected inflation readings via the Consumer Price Index (CPI) rattled the markets. I'll let the politicians, their supporters and the various news networks assign blame (spoiler alert, it's the other party's fault). What matters to the economy (and the Fed) is what American's believe is the path of inflation. According to the latest University of Michigan poll, the path is not the way you would like it to be heading if you are banking on the Fed cutting interest rates.

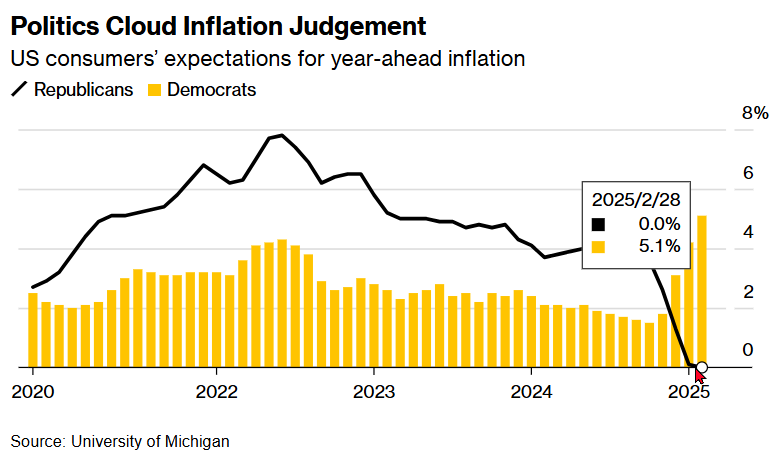

What is interesting, but not surprising is where those affiliated with a political party believe inflation is heading.

I laughed when I saw this because BOTH of the parties seem to be living in a different world. Inflation at 0%? Um, how is that supposed to happen other than a DEPRESSION?

Inflation at 5%? I guess if the President suddenly only cares about the trade deficit (and not his approval rating or the stock market performance).

I don't see EITHER happening, but this does illustrate the absolutely massive divide between the 60% of Americans who are affiliated with either the Republican or Democratic parties.

Inflation at 3.5%? Maybe, which is the problem I've stated since before the election. Trump's policies are inflationary (short-to-medium term) no matter how confidently he and Elon say they aren't. There's never been a case in the history of global economics where tariffs did not cause prices to go up.

Inflation is not understood by most which is why Episode 7 of Money Talks with Dad focused on inflation and interest rates. It just posted last week. You can watch it here:

Growth is not going up

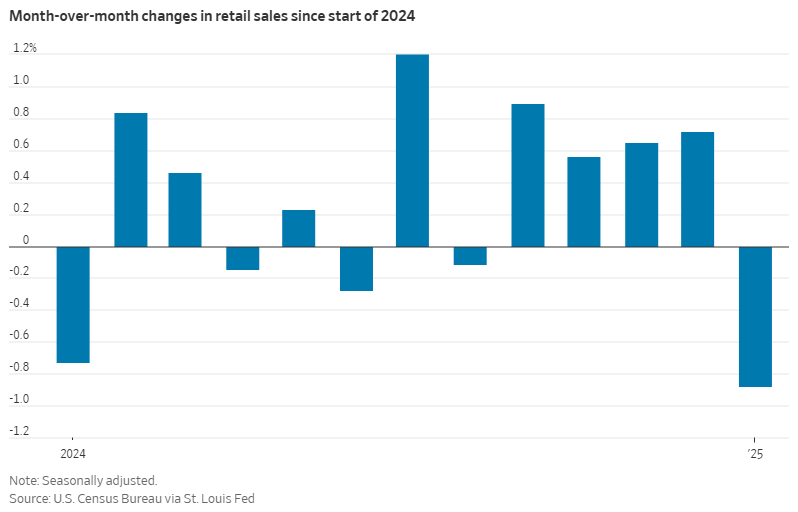

The other "surprise" that hit stocks on Friday came from two economic reports which showed a sharp slowdown in January. First, retail sales fell nearly 1% in January (compared to a year earlier).

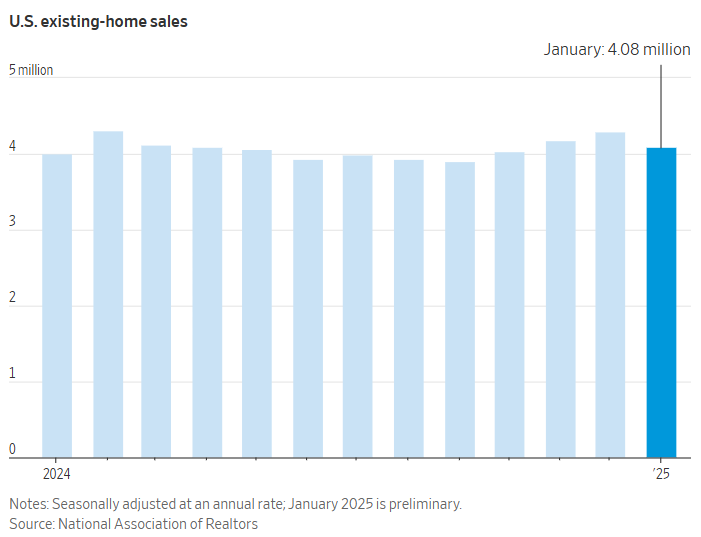

Next, existing home sales dropped nearly 5% (compared to a year earlier) in January.

To me, neither of these is much of a surprise and not something I would be concerned about, but I also haven't had the opinion that everything was going to suddenly explode to the upside for the economy. As a reminder, our economic model remains "neutral" as it has since June of last year. Here's a link to our latest economic update:

When you combine rising inflation and slowing growth you get the most ugly word for investors – stagflation. Obviously our economic model is saying we aren't there yet, but IF the trade war remains a higher priority for the President than lowering prices, it's a word that will be mentioned quite often in the months ahead.

A Right Leaning Economic Panel

I was at the Kingdom Advisors Conference last week, a conference for Christian financial advisors. One of the highlights each year is the economic panel comprised of Bob Doll of Crossmark, David Bahnsen, & Brian Wesbury of First Trust. You've most likely seen Mr. Bahnsen and Mr. Wesbury on Fox News and Fox Business quite frequently. Mr. Doll has frequent apperances on CNBC, Bloomberg, and Fox Business.

As you'd likely expect from a conference of financial advisors who are also Christian, the panelists all clearly lean to the right. Doll and Bahnsen have always been more data driven and not afraid to call out Republicans. Wesbury my entire career has been on the extreme right of economists and often mixes his political opinions with his analysis. With panels like this I like to see where there is agreement. Here are some of my bullet points:

- Tax reform and deregulation should unlock very strong economic growth

- DOGE cuts will be a net positive for the economy

- DOGE's primary benefit is the transparency

- The $$ savings will not come anywhere near the $2T or even $1T promised by Elon ($600B of his 'cuts' were in interest expense)

- Deficit must be addressed for long-term growth

- Cannot cut debt without reforms to entitlement programs -- Americans don't have the stomach for that

- ADDITIONAL tax cuts are unlikely unless Trump's "one big, beautiful bill" is passed -- if split, only the 'easy' stuff is going to happen

- Tariffs are likely a negotiating tool -- but if they aren't the short and medium term damage could be significant

- Market is priced to perfection and already assumes growth will be unlocked by tax cuts and de-regulation – makes it difficult to see strong gains and more likely we see a correction (or 2 or 3)

If I were to summarize the panel's consensus it was:

Overall Trump's agenda is good for the economy, but not as good as the headlines and market are making it appear. With stocks already at very stretched valuations we should expect the market to be disappointed with the end results.

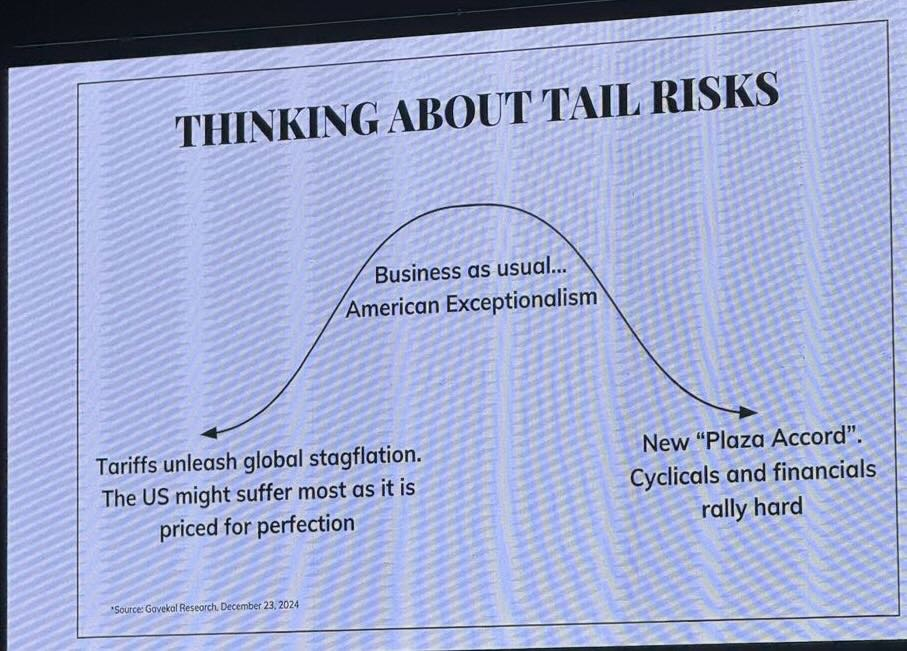

I apologize for the quality of this slide – they haven't posted the slides of the conference just yet, but Mr. Bahnsen shared this to highlight his current thought process:

The UPSIDE potential is we have to have massive trade reform and agreements that truly unlocks MORE growth in the US (and no inflation). The DOWNSIDE potential is a drawn out and increasingly aggressive trade war.

1 of the 3 panelists (Wesbury) believes the UPSIDE is likely. The other 2 believe there is a decent chance we see the DOWNSIDE occur although both reiterated what I've said since Trump 1.0 – the President cares too much about the stock market to let his trade war impact the market too much. The question is, how much tolerance will he have with market losses before capitulating and making a "deal".

For Mr. Doll's 2025 predictions, click here:

https://www.crossmarkglobal.com/wp-content/uploads/10-Predictions-for-2025-Executive-Summary.pdf

Here is a link to Mr. Bahnsen's most recent media appearances:

One of the things you always see at these conferences is some attendees taking things they hear in a presentation and immediately applying it to their business. I overheard an advisor on the phone on my way to my next session saying, "Find me the best 3 high dividend ETFs. They said we should be investing in those this year." Mr. Bahnsen, who runs one of those ETFs recommended "high growth, dividend payers" despite his "bearishness" on the near-term stock market. I also fielded a few questions about how we use dividends from attendees who knew we managed money.

A decade of below average returns

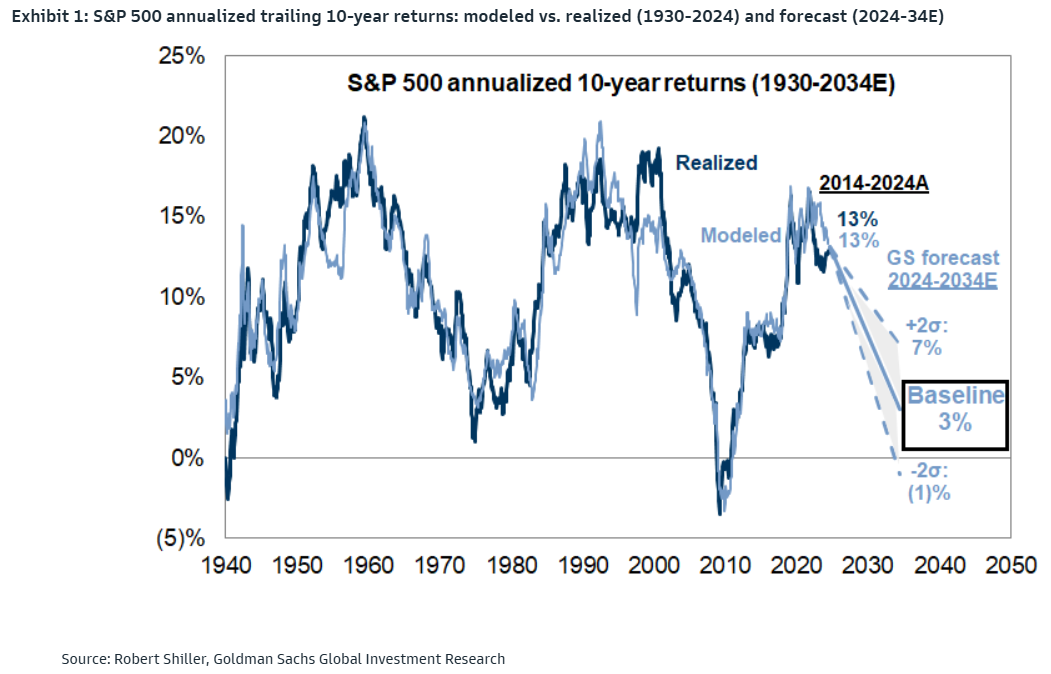

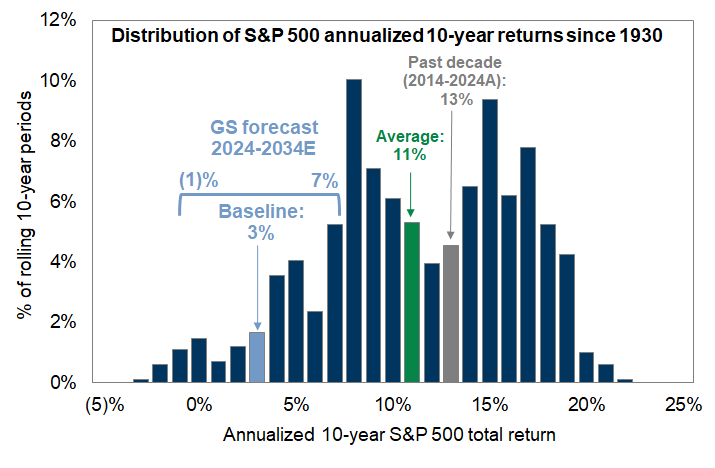

One thing Mr. Doll discussed was his viewpoint that stocks would have below average returns over the next 10 years (something our readers know I have been discussing the past couple of years & before the correction of 2022 back in the late 20-teens). He cited Goldman Sachs research, which similar to mine discusses 'potential GDP', our dual deficits (budget and trade), and most importantly the current valuations of the stock market.

We've enjoyed 13% returns the past decade, but Goldman is warning the next 10 years could be around 3% (with a range of -1% to +7%). Here is where that would fall historically:

What I always remind everyone is we will not see 10 years of meager 3% returns, but instead see a big market drop followed by the rest of the decade clawing back the losses. It's happened many times before and despite the best efforts of the Fed, Congress, President, and everyone else, will happen again.

My biggest concern is all the people who are now shifting to aggressive strategies because they believe the president is unlocking the greatest decade of economic growth in the history of our country (or at least since Reagan took office). I hope that is the case, but want everyone to have a plan and be prepared just in case that doesn't happen.

Use of AI

One of the things many people have cited as justification for another decade of double digit returns is AI. I won't spend a lot of time talking about this since we did this in our 4th Quarter Newsletter. I think AI is a tremendous tool which will make us more productive. However, just like any technology developments these tools will take time to learn how to use them correctly. Incorrect usage of them could actually be UNPRODUCTIVE.

Prior to the conference I did quite a bit of research on AI note taking apps. I looked at both cost and capabilities. I settled on Otter.AI and did a $16.99/month 30-day subscription. We've also tested Zoom and Microsoft's AI assistants. My conclusion so far is you have to proofread CAREFULLY the transcripts. AI assumes a lot when doing this and those assumptions are FREQUENTLY wrong. Using the AI summaries is even more problematic as they have all completely missed key areas that I had noted, will not understand nuance, and will flat out make conclusions which were not discussed.

During the conference I was mostly impressed with the transcript and summaries, but in the evenings when I reviewed I found some key mistakes/omissions which in some settings could be problematic.

I also found something interesting and I don't have much of a sample size to understand it. There were two questions to the panel which took up 10-15 minutes. The first was regarding Christians supporting Trump and how the panel feels about politics and religion becoming intertwined. The second was about AI itself, business uses, investment opportunities, and shortfalls. These two discussions comprised nearly 1/3 of the panel time, but did not appear in the summary. I had to go back to the transcripts to find the discussions.

By the way, if any of you want to trigger Dustin (our director of technology), just say something along the lines of what Brian Wesbury said (who believes AI is not a big deal and is doing more damage than good):

"Look folks, when you think of it AI is simply a computer that has read the entire internet. It's just fancy Google."

I've never seen Dustin so riled up.

The impact of DOGE

The panel discussion kept coming back to DOGE (the Department of Government Efficiency) that Elon Musk does or does not head (depending on official titles or who is talking about it). DOGE was also in the news quite a bit last week with mass layoffs being announced, announcements they wanted to audit the Fed, and some more executive orders being signed or implemented.

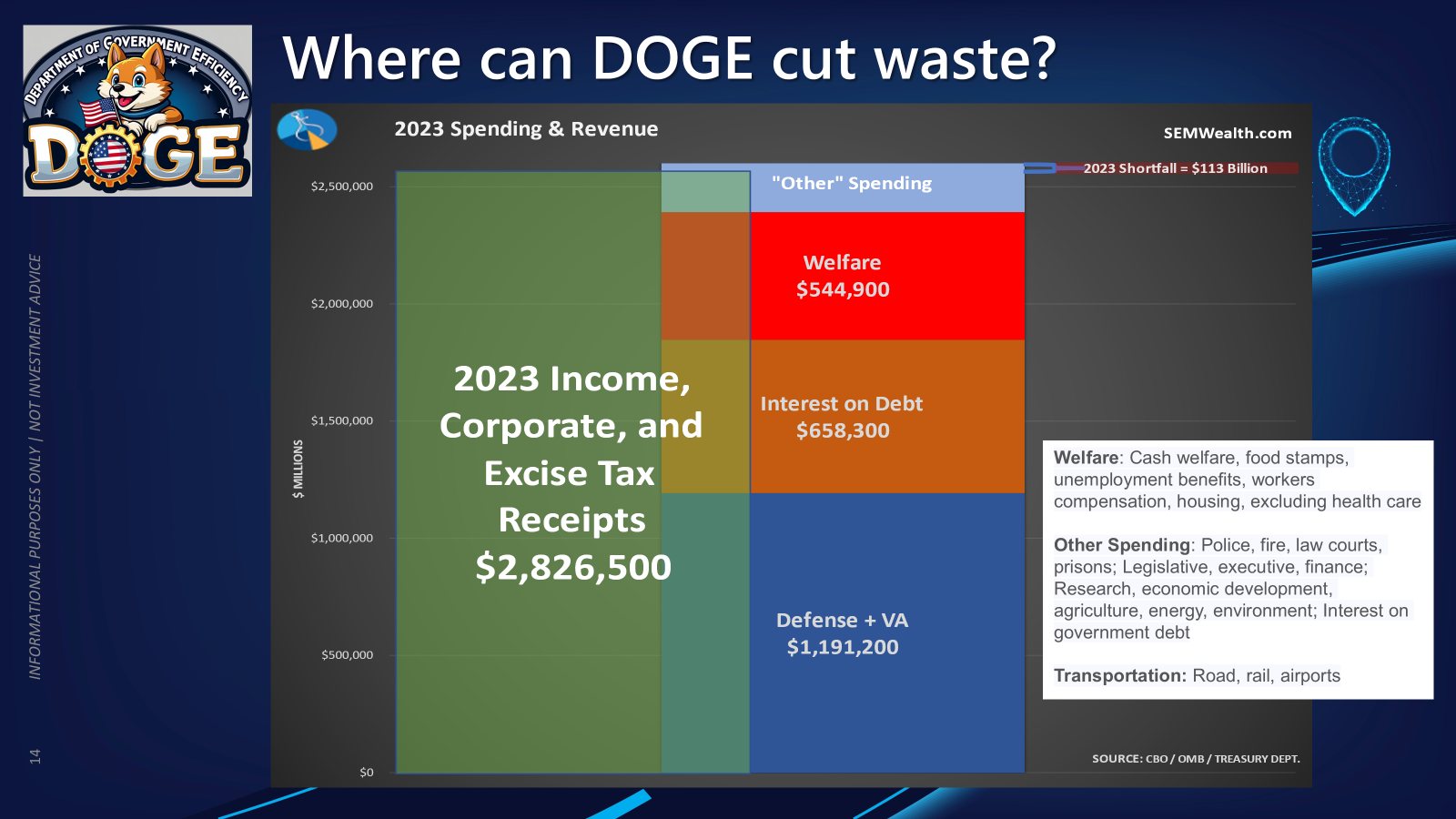

Mr. Wesbury thinks the benefits will be tangible and boost economic growth. However, Mr. Doll countered that "Elon's math doesn't math". He initially said DOGE could find $3T in cuts, he lowered that to $2T late last year, and is now even lowering expectations. The problem, according to Mr. Doll is $650 Billion of the cuts Elon assumed was from interest expenses (we can't just not pay interest). The rest are nearly impossible to find unless there are actual CUTS to Social Security and Medicare (not just finding a list of deceased people who might have gotten a check.)

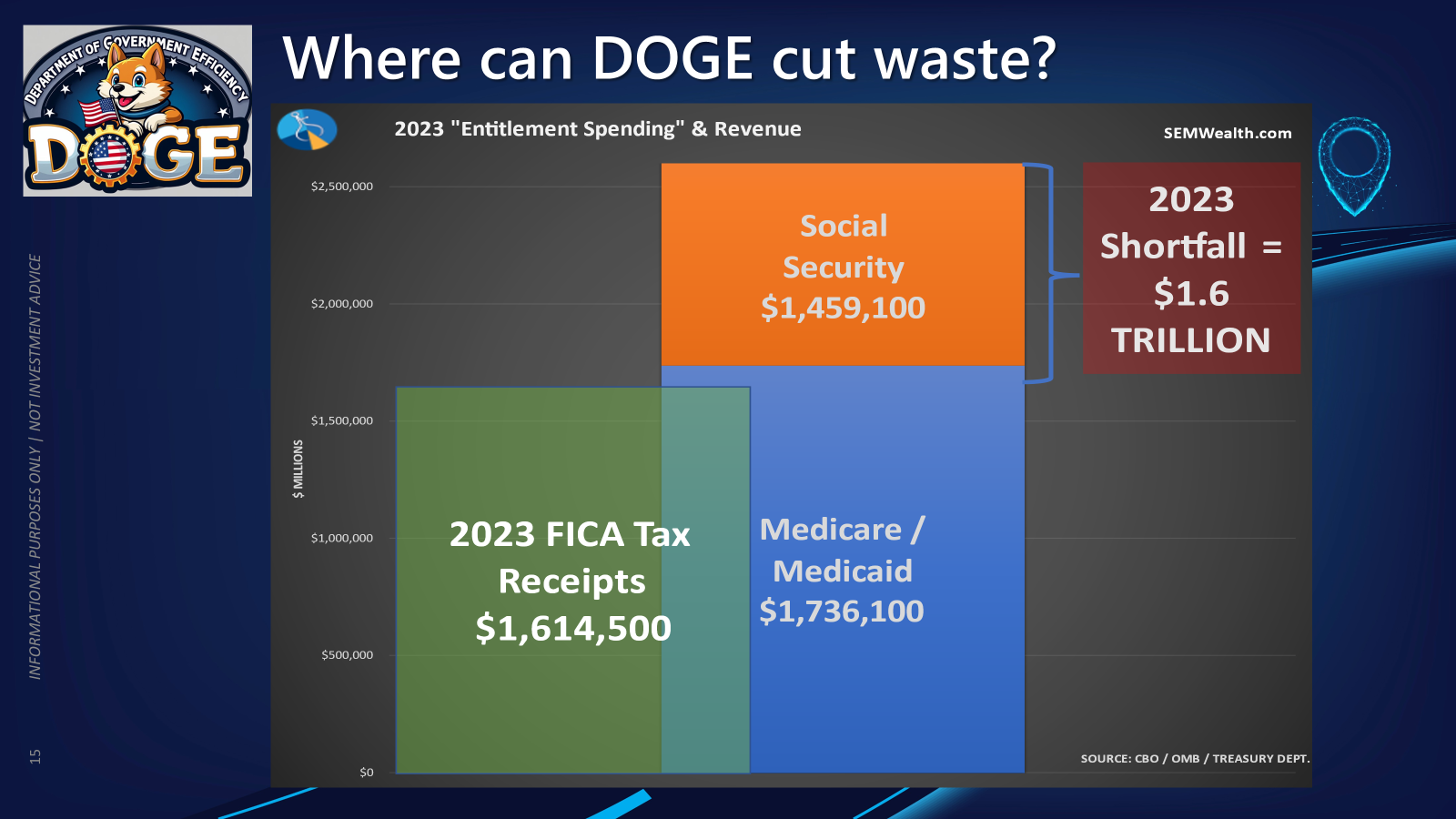

Since these weren't prepared remarks, Mr. Doll did not have any slides, but I would have loaned him this one (and challenged Mr. Wesbury to explain again how "cutting wasteful spending" is going to make a dent in our budget.)

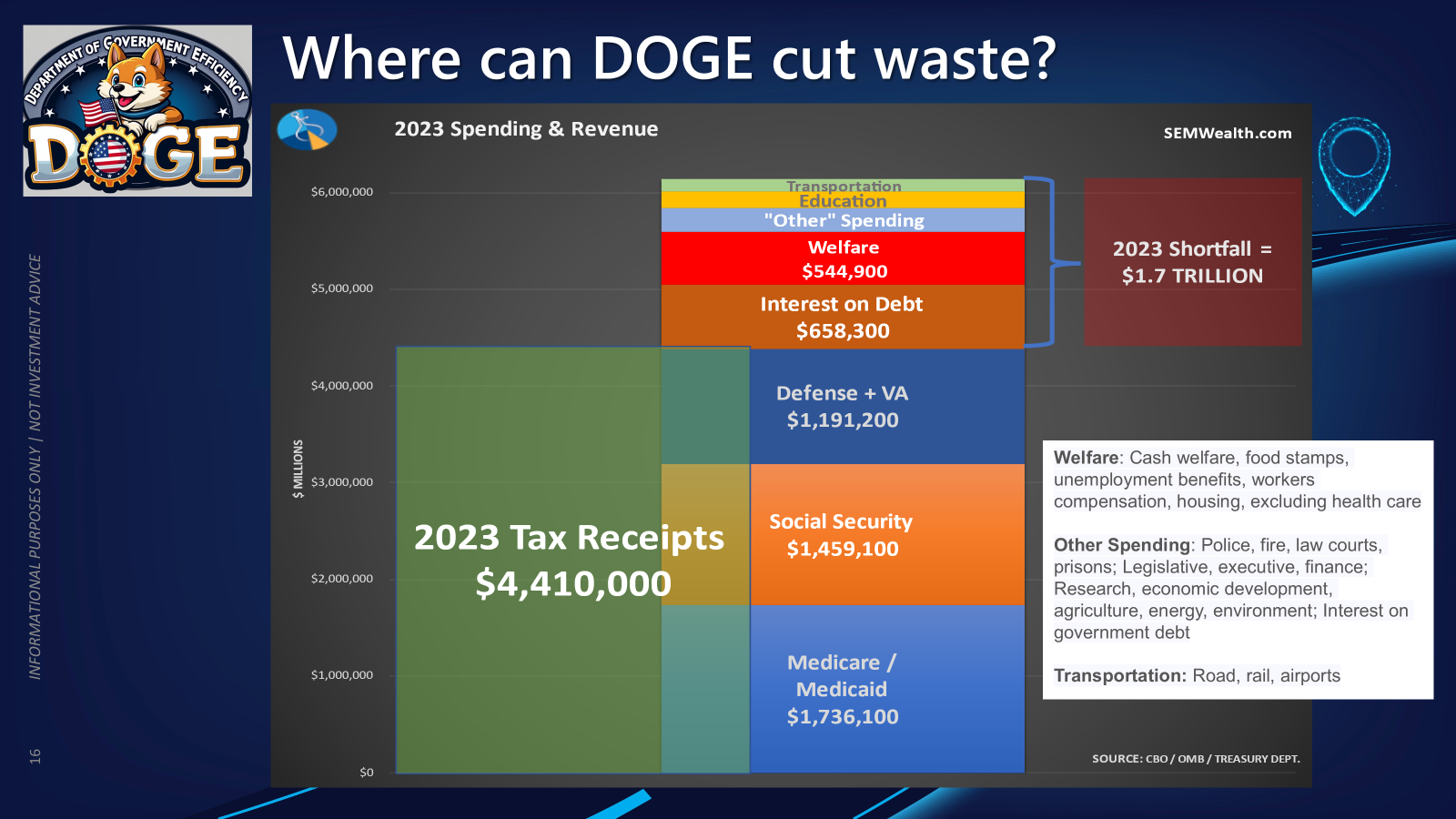

In terms of what taxes are SUPPOSED to pay for we are within a whisker of having a balanced budget.

The issue is the entitlements are not pulling their weight as FICA taxes are nowhere close enough to the benefit checks going out:

Looking at the total budget, maybe Trump and Elon (and Wesbury) believe we can just wipe out everything above the tax receipts in this chart:

Of course eliminating interest on our debt would mean defaulting on $30+ Trillion of outstanding bills, notes, and bonds.

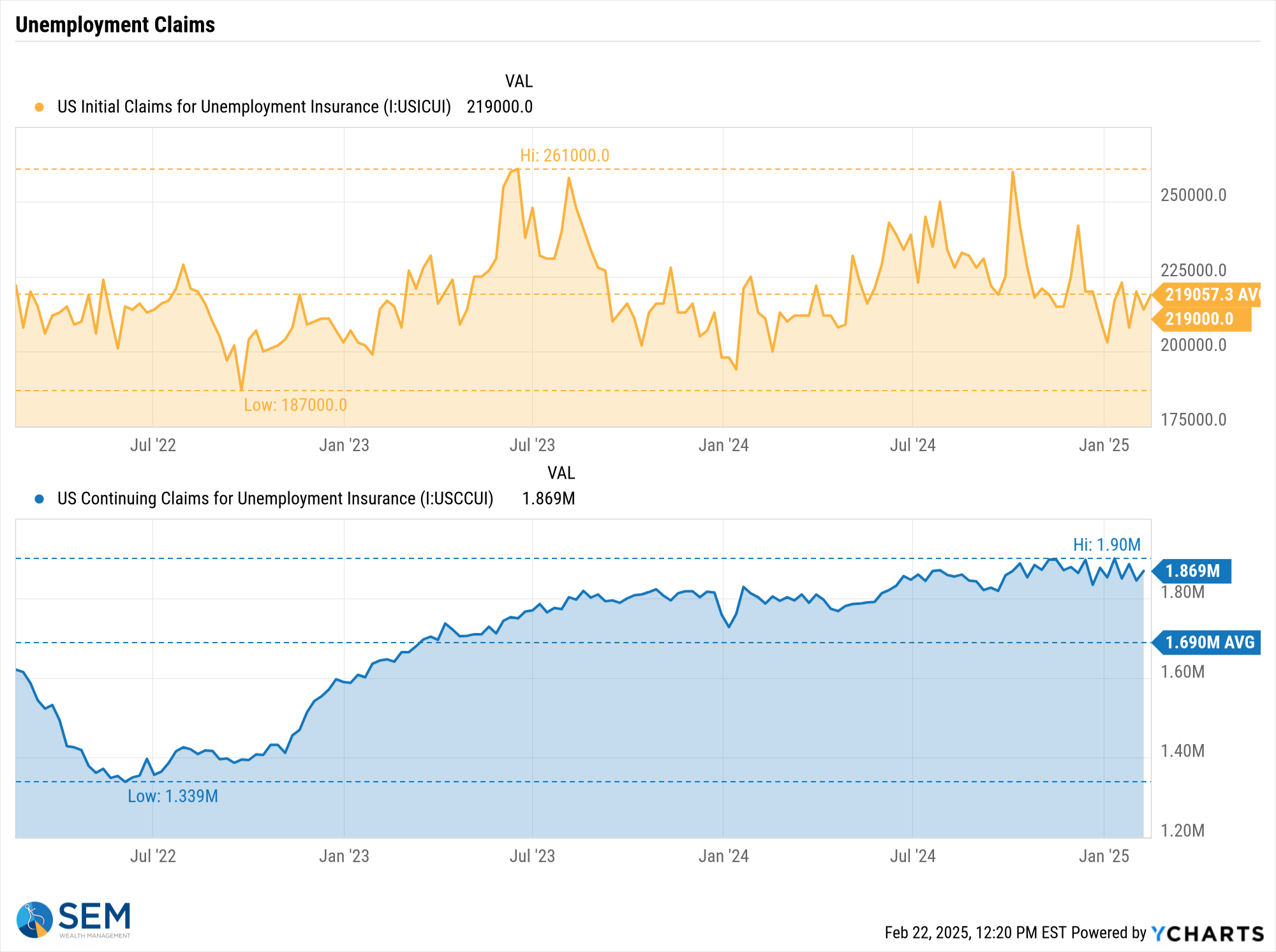

One thing we will have to watch is the impact of any cuts on the labor market. So far, other than maybe the DC area we are not seeing an uptick in unemployment claims. What is concerning is the lack of improvement in CONTINUING claims, which is an indication that if you lose a job you are not able to find one very easily.

I'm not saying cutting waste is bad. Anybody that's followed me the past 28 years knows I've constantly been criticizing both parties for the runaway spending. My issue is because we've waited so long, cutting "waste" is not anywhere near enough.

Going back to the tax cuts – the last ones did not pay for themselves and the (independent) projections say extending them will INCREASE the deficit by $4.8 Trillion over the next 10 years. This means they need to find a lot of areas to cut even more spending than the "waste" DOGE is addressing.

DOGE Dividend Check?

Whatever you call it, another big headline was the proposal from Trump, Elon, and several other administration members about sending back the savings from DOGE to Americans. Clearly they all seem to forget what happened the last time checks were sent to taxpayers — we broke the supply chain and had runaway inflation. What do they think would happen if we sent Americans checks once again at a time where inflation is already tight and the economy (according to our model) is doing 'ok". This is not the time for stimulus checks.

Here's a concept no politician will suggest – use 100% of the savings to pay down the debt used to support our economy and our standard of living the past 25 years.

Momentum & Defense Stocks Implode

Since the 'bottom' last August, Momentum stocks have had an impressive run, which has led to quite a bit of interest in our Momentum Stock Model (MSM). At the same time, Elon's mention of the F-35 program last December has destroyed the "Trump is good for defense stocks" narrative. Usually we see our Momentum & Patriot Models moving in different directions. Last week and now for the month so far, it has started to get ugly.

Both of these models are what we call "top of the pyramid" investments, meaning they do not play a meaningful role in the financial plan or cash flow strategy. They are meant to be riskier 'enhancements' that provide diversification. We don't know what the rest of the year will look like, but take a look at the last day, month, and year so far for the individual holdings:

Market Charts

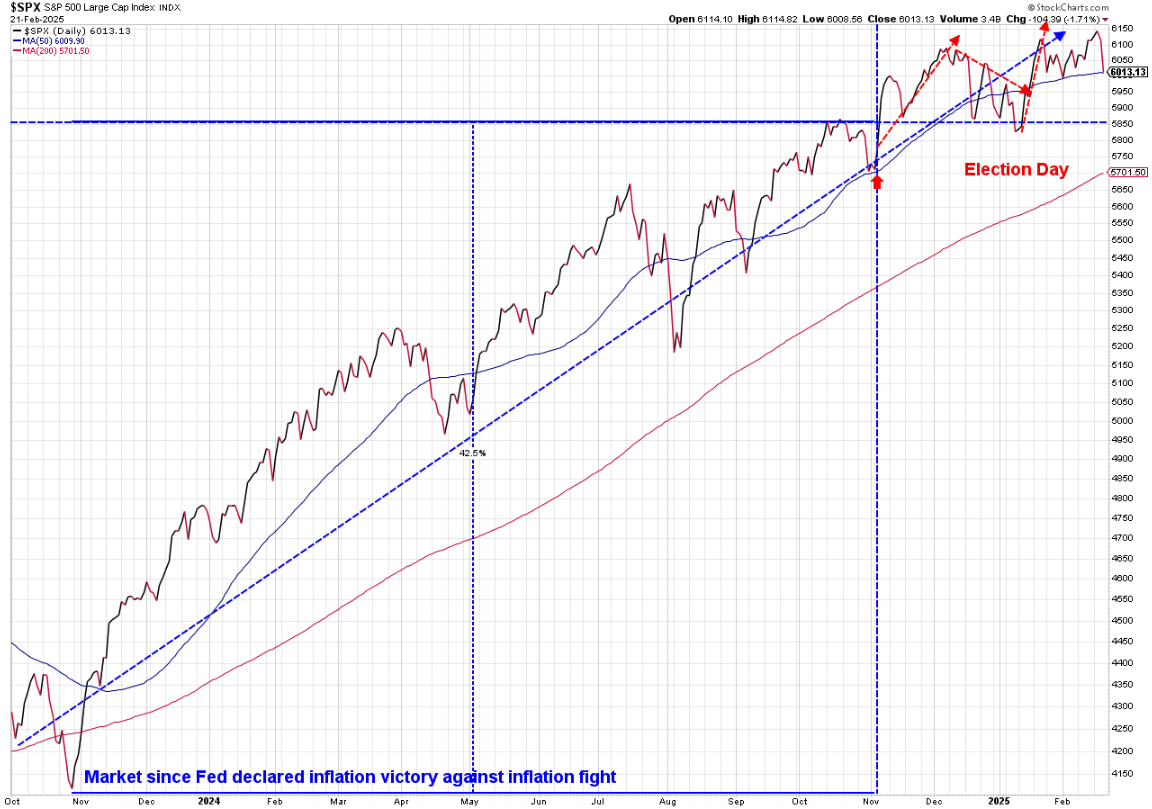

I think after a day like Friday it's important to keep things in perspective. Stocks hit an all-time high on Wednesday and are still up 4% since the election. The 50-day moving average, a measure of intermediate-term trends is still rising (barely) and stocks held that level, just as it did a few weeks back.

This is the more important chart as it shows the rally that started when the Fed ended their rate hiking cycle at the end of 2023.

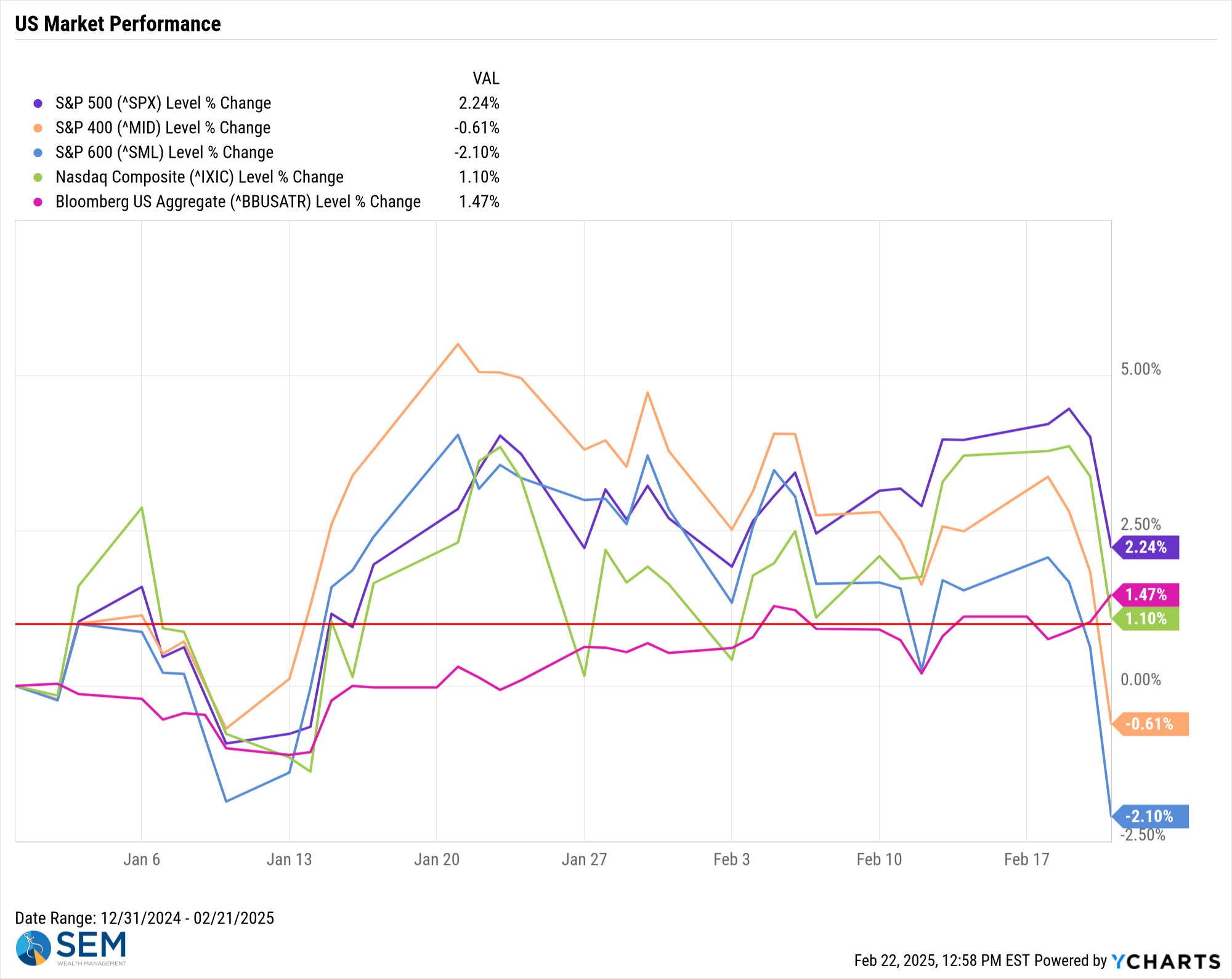

Looking at the overall markets......remember the "broadening" rally I've been talking about? Two weeks ago, large caps again passed small caps on the leaderboard. Last week's nearly 4% drop in small caps pushed them into negative territory for the year.

Bonds actually rallied last week. One thing that makes subjective analysis of the markets difficult is the fact yields have many factors which drive them. Based on the move last week, the bond market is now leaning towards growth concerns over inflation concerns. While some might say that's good news as it means the Fed could resume their rate cuts, stocks are pricing in ABOVE AVERAGE growth for the 3rd consecutive year. A slowing economy may make that more difficult which is why small caps got hit so hard.

Looking at bond yields, the peak so far this year was during the 2nd week of the year. Since that time a nice little drop has been occurring. The panel discussion multiple times mentioned the prospects of 'bond vigilantes' moving into the market and demanding the government get spending under control. The Trump administration needs lower long-term rates and despite the belief by some that Trump can dictate that, the free market sets those rates (and the Fed sets short-term rates).

SEM Model Positioning

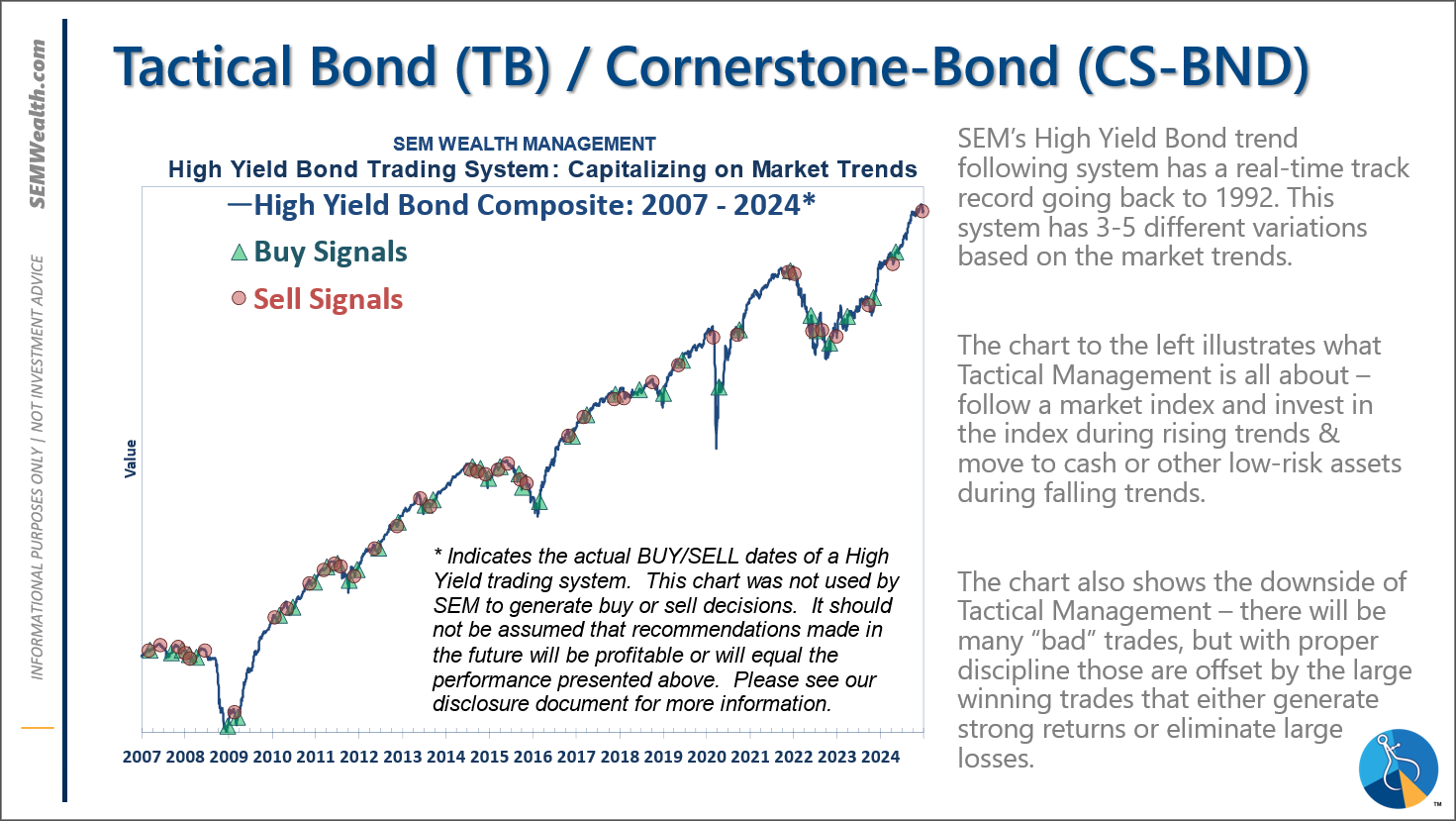

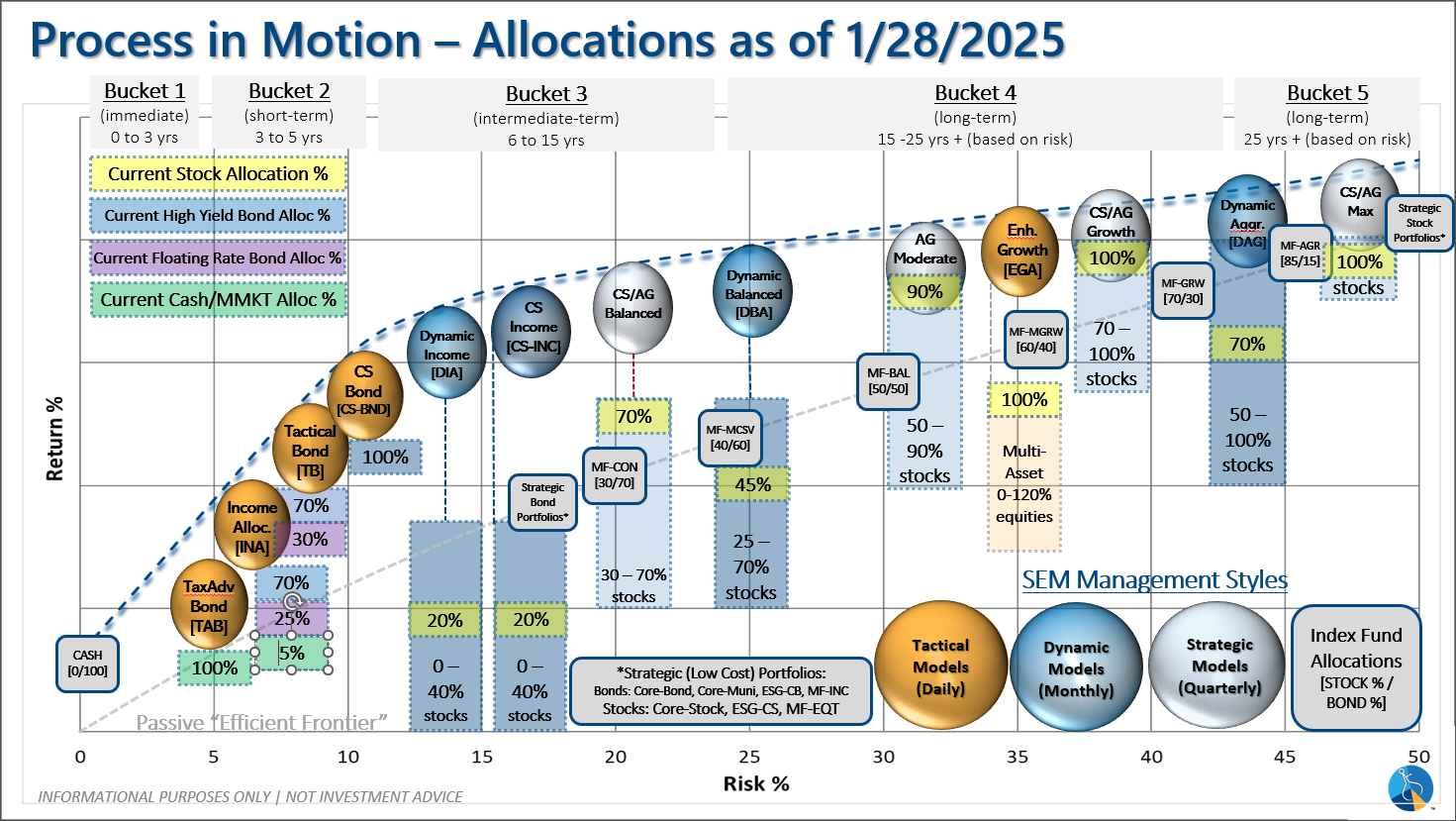

-Tactical High Yield reentered the high yield bond market on 1/27/25 after about 5 weeks on the sidelines. We had added a 30% position in floating rate bonds on 12/6/24, which currently have a 9% yield compared to a 6% yield in high yields and 4.6% in money markets.

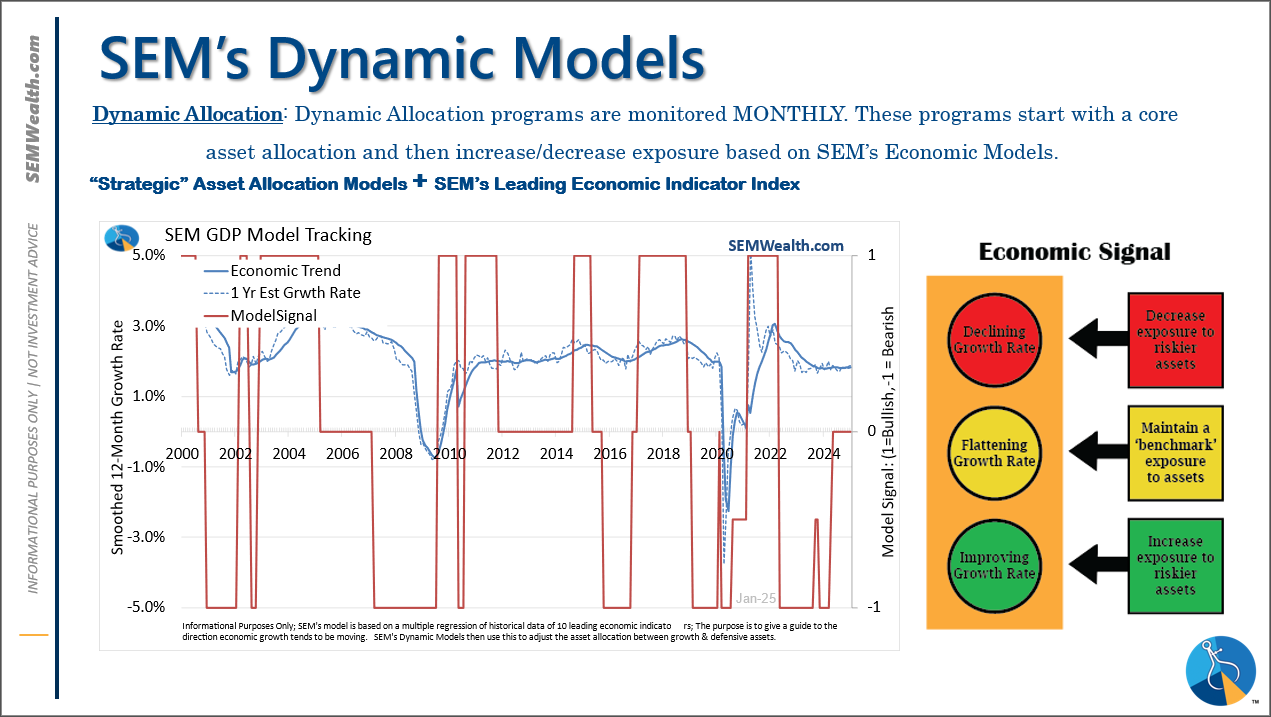

-Dynamic Models are 'neutral' as of 6/7/24, reversing the half 'bearish' signal from 5/3/2024. 7/8/24 - interest rate model flipped from partially bearish to partially bullish (lower long-term rates).

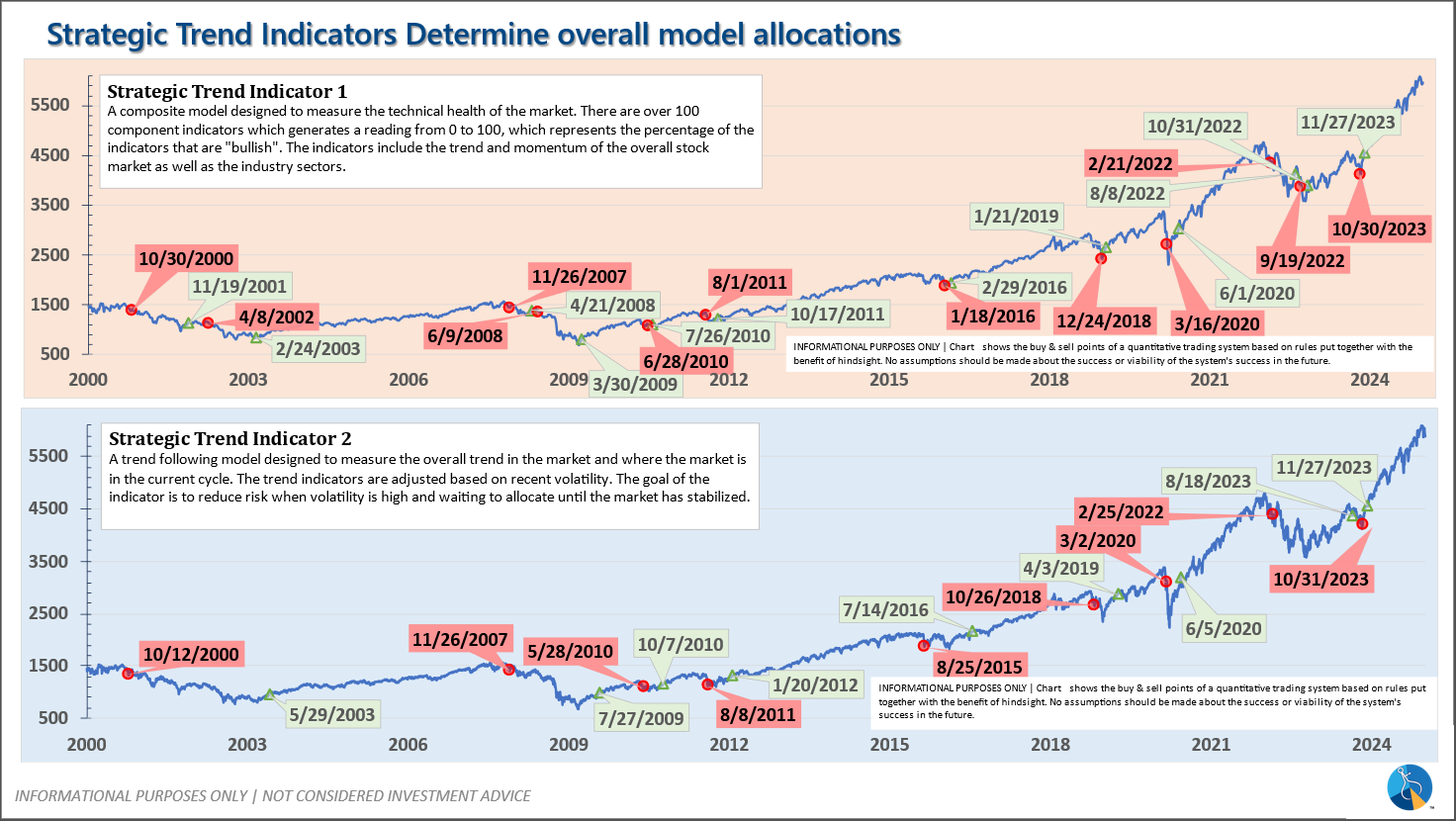

-Strategic Trend Models went on a buy 11/27/2023; 7/8/24 – small and mid-cap positions eliminated with latest Core Rotation System update – money shifted to Large Cap Value (Dividend Growth) & International Funds

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): On 12/20/2024 our tactical high yield model sold out of high yield bond (about 70% of our holdings) into money market. The other 30% is invested in shorter duration, higher yielding floating rate bonds. These instruments are not as sensitive to credit risk and are typically allocated to in the early and late stages of a high yield bond move in our model.

Dynamic (monthly): The economic model was 'neutral' since February. In early May the model moved slightly negative, but reversed back to 'neutral' in June. This means 'benchmark' positions – 20% dividend stocks in Dynamic Income and 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is slightly 'bullish'.

Strategic (quarterly)*

: BOTH Trend Systems reversed back to a buy on 11/27/2023

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Questions or comments - drop us a note?

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire