Some weeks on Wall Street feel like déjà vu, others feel like a plot twist. Last week? A little of both. AI continues to dominate the narrative (raise your hand if you're tired of hearing this), the Fed is trying to mind its own business but can’t escape political gravity, and gold continues to race AI stocks as the hottest performing asset class. With a holiday shortened trading week, I'm going to stick to a quick, rundown of the five stories I thought mattered last week in what was (again) another noisy week.

UPDATE: I originally posted this on Monday. Last week President Trump had mentioned the idea of tariffs against the NATO countries not supporting the US takeover (purchase?) of Greenland, on Monday he formalized the threat with a 10% tariff set to begin on February 1. On June 1 it will increase to 25%. I won't even begin to speculate or editorialize this other than to say this will only increase the volatility and uncertainty at a time where we really don't need it. The market (for now) is not happy with this news and is using it as an excuse to start the shortened week on a down note.

1. AI‑Chip Demand Keeps Propelling Tech

AI stocks stumbled a bit to start the year as concerns over growth, financing, and profits (which I've talked about exhaustively the last 3 months) weighed on the sector as we rolled into a new year. Last week we were reminded the AI boom isn’t slowing down (yet) as TSMC posted another blowout quarter with revenue beating expectations and guiding expectations even higher, marking its eighth consecutive quarter of profit growth. Analysts doubled down on bullish calls for Nvidia and Dell, citing monster backlogs and enterprise demand that refuses to cool.

Why it matters: AI continues to be the market’s gravity well—pulling capital, attention, and optimism into the sector.

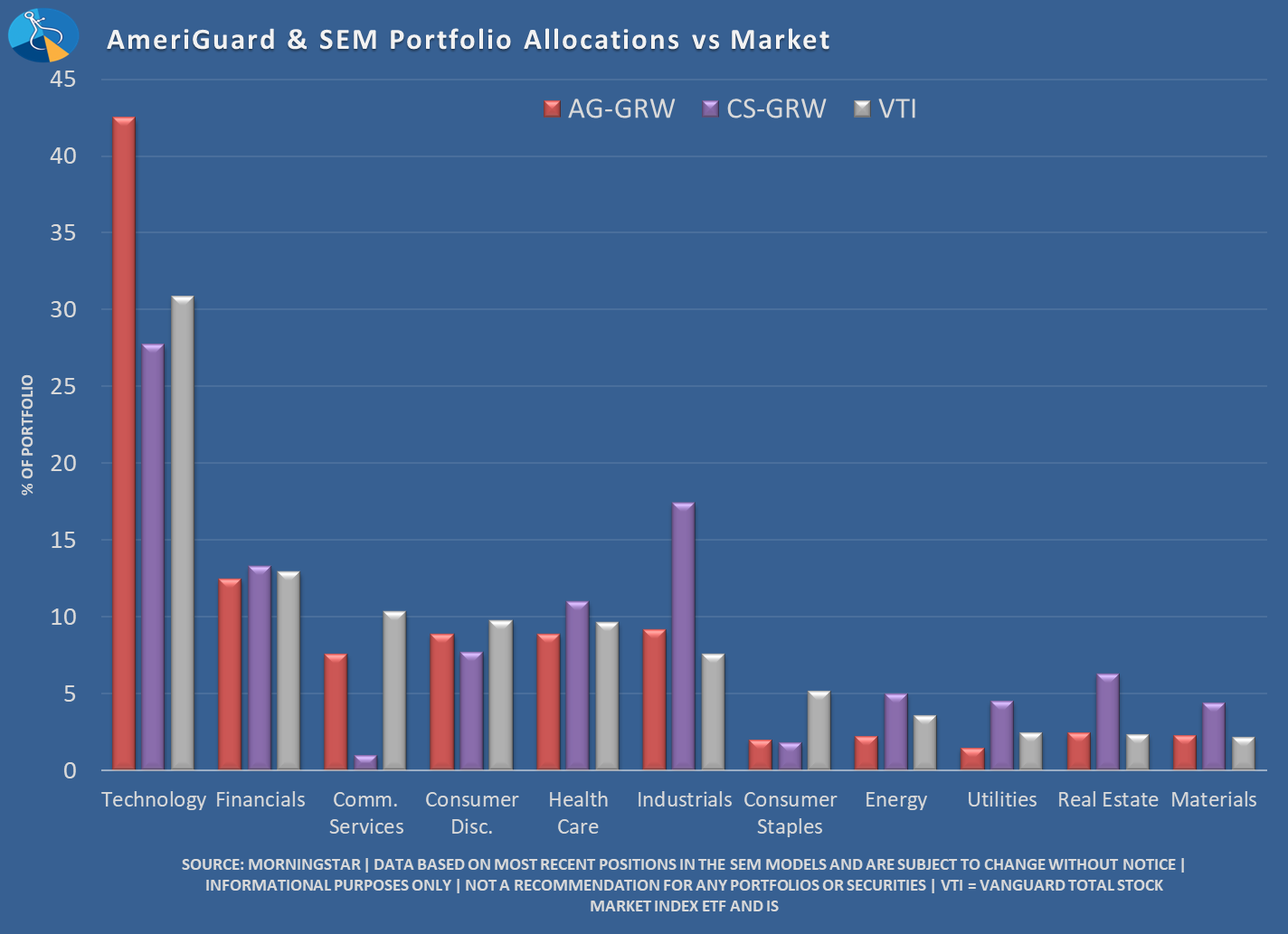

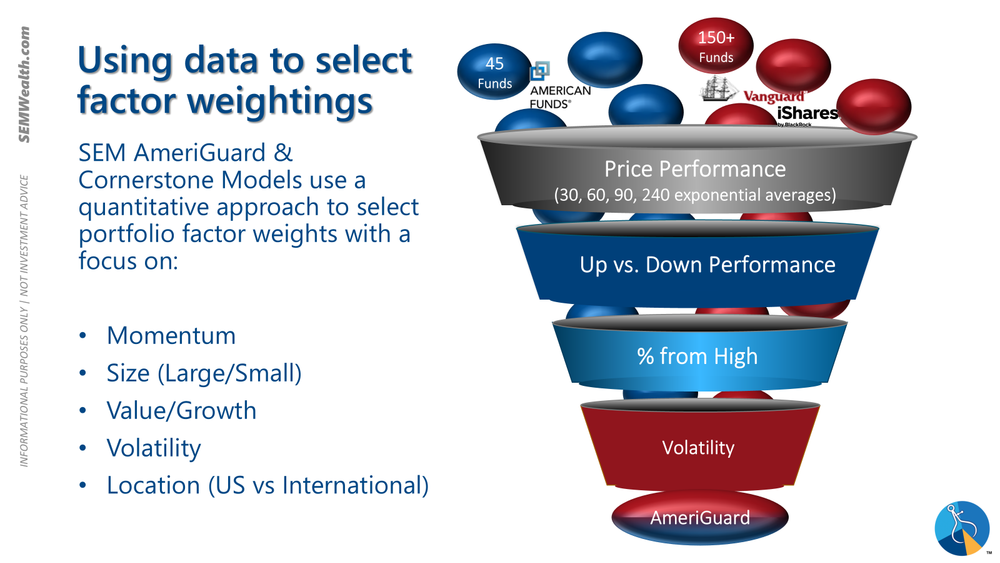

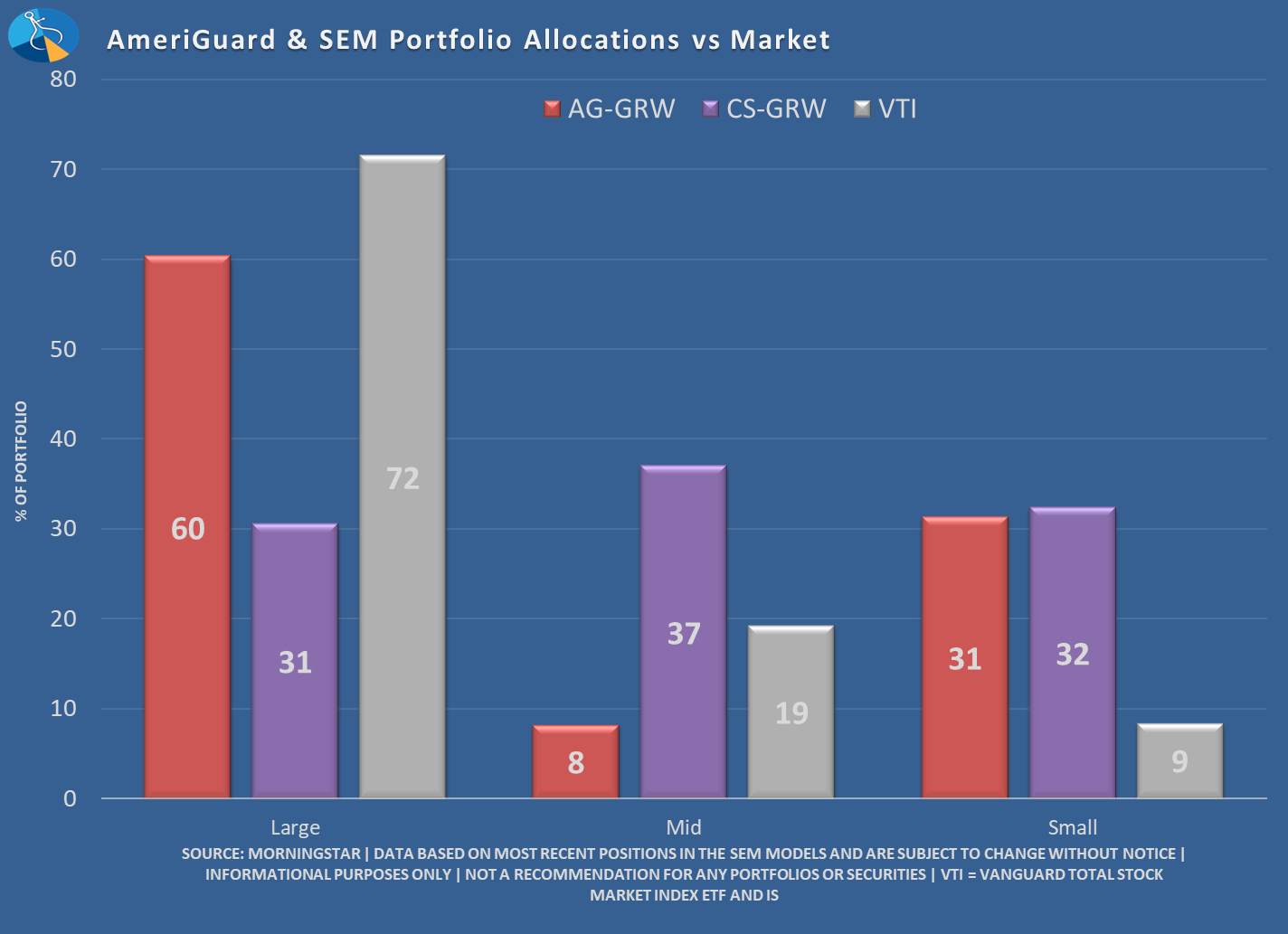

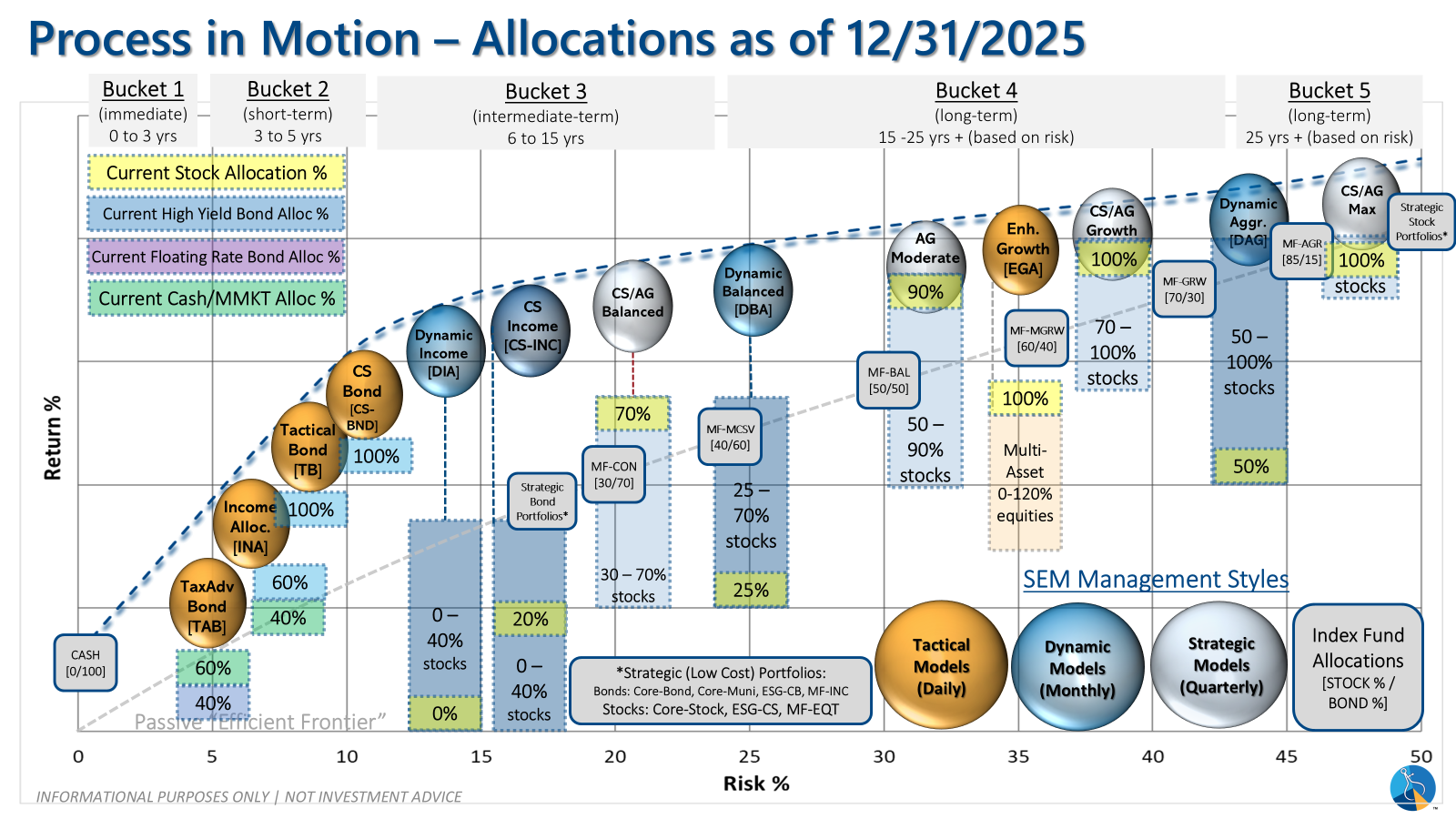

SEM Positioning: With our quarterly "core" rotation rebalance in our AmeriGuard and Cornerstone models, we increased our allocation to technology (as well as small caps). AmeriGuard is now overweight technology relative to the market and Cornerstone has as close to the maximum technology weighting as our screening process will allow.

Note 1: The exposure to technology is NOT through mega-cap technology – we are actually underweight large cap stocks in both models – see #3 below.

Note 2: Notice the overweight position Cornerstone has in "industrials". This new overweight position includes some mining related exposure, which is benefiting from the surge in precious metals as discussed in #4 below.

Note 3: These are not fundamental "long-term" positions, but simply based on our 4-tiered, 4-period filtering system.

2. Inflation Softens, Rate‑Cut Dreams Come Back to Life

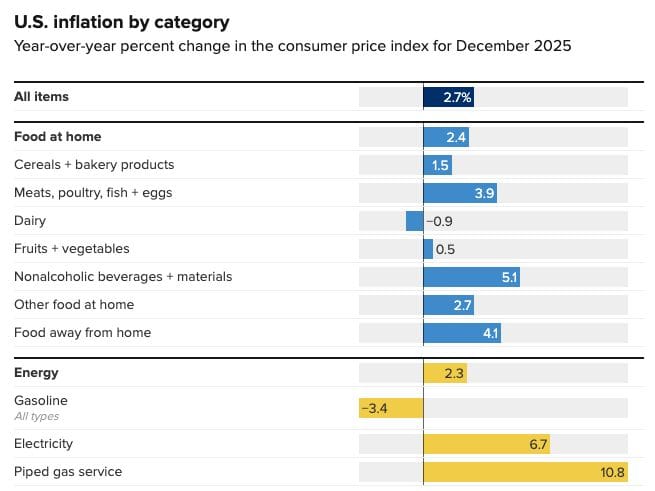

December CPI landed at 0.3%, and core CPI came in cooler than expected at 0.2%, giving investors renewed hope that 2026 might still deliver meaningful rate cuts. Stocks popped midweek on the news.

Why it matters: Cooler inflation keeps the “soft landing” fantasy alive and gives growth stocks more breathing room.

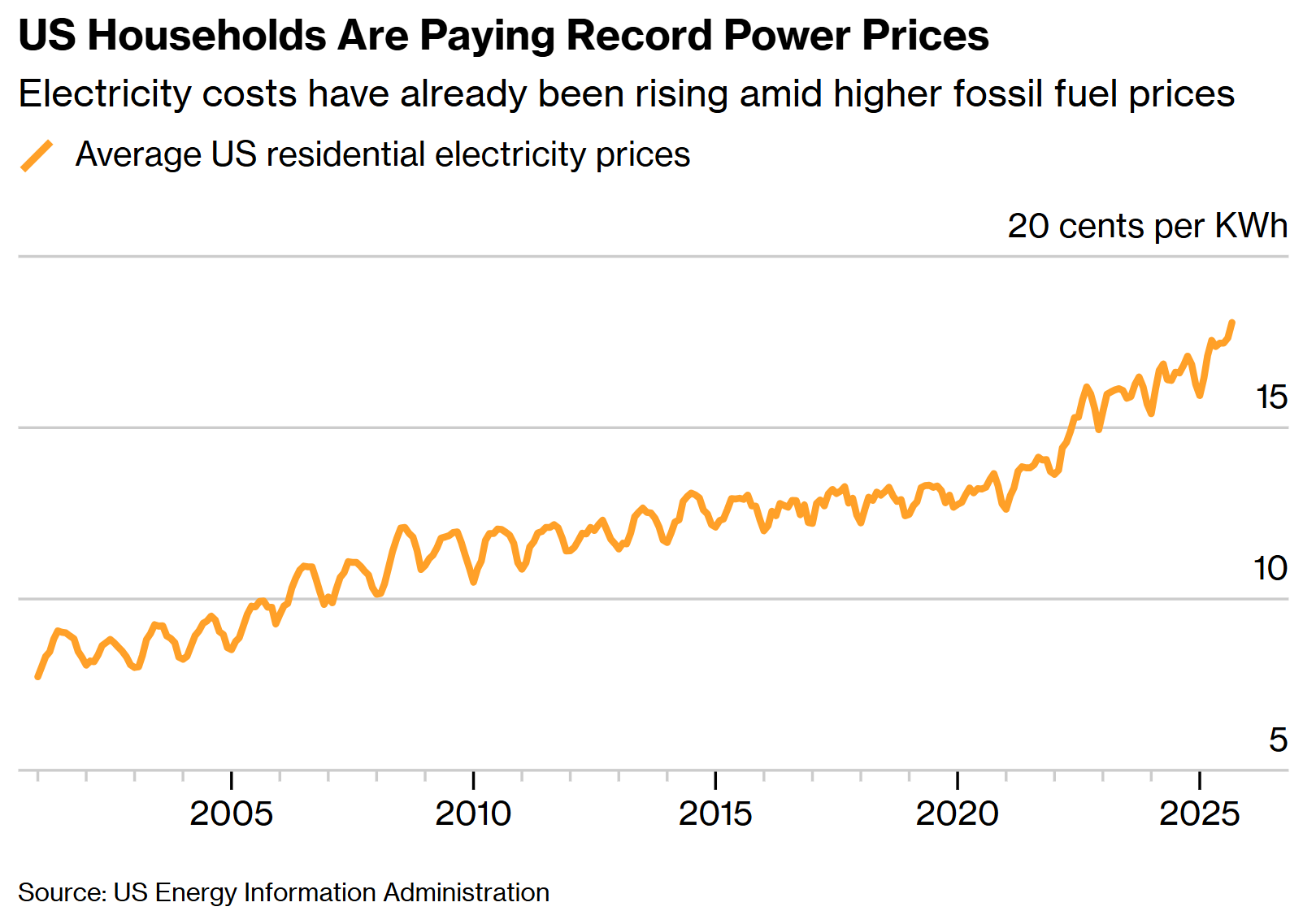

SEM's Positioning: Our interest rate model inside of Dynamic Income remains slightly "bullish" (leaning towards lower long-term interest rates.) However, some key components in the inflation index could continue to hold back the economy, in particular health care and especially utilities. While cooler temperatures in December across the country may have contributed to some of the increase, there is growing concern the data center buildout is leading to the big spikes in utility bills. This could make the Fed's job much more difficult going forward.

Next week's story? On Friday the President mentioned tech companies should "pay their own way" for the surging electricity demand as he announced a plan with several northeastern states to hold emergency electricity auctions that would compel the big tech companies to pre-purchase electricity (whether they need it or not.) That could throw a big wrench in the growth plans for the AI Data Center buildout.

3. Small Caps Surge

Since 2022, those of us who have studied history have lamented the fact small cap stocks were trailing large caps by margins not seen in decades. When the economy is expanding (as it has been since that time), small caps should do BETTER than large caps. Since the start of the year we've seen small caps work quickly to start closing the gap with large company stocks. Through Friday the Russell 2000 was up over 7% while the S&P 500 was up less than 2%.

Why it matters: Economic history tells us if large companies have too much control, the economy becomes less efficient, margins decrease, the labor market suffers and growth slows.......eventually.

SEM's Positioning: Also since 2022, SEM has lagged the S&P 500 mostly because as a fiduciary, we simply cannot allocate a large amount of our client's portfolios to an index which has 40% of its money in just 10 stocks. We also know from our study of history that narrow markets are risky markets, meaning we have guardrails in place to prevent over-concentration to large caps. In December, it became clear the market was trying to broaden out and our core rotation systems picked up on it. At the start of the year, both AmeriGuard and Cornerstone allocated even more money to small caps than they had in the 4th quarter.

If this broadening continues it could be a fun year for DIVERSIFIED portfolios like these.

4. Gold and Silver Go (more) Parabolic

Gold broke through $4,600/oz, and silver notched its own record highs as global central‑bank buying and geopolitical tensions spiked demand. Several major banks now expect gold to reach $5,000 later this year.

Why it matters: For 25 years at SEM we've talked about how over the long-term gold and other precious metals rise at the rate of inflation. The problem is they go through very volatile periods where supply/demand gets disconnected, making the volatility (risk) of these "safe" assets HIGHER than the S&P 500 (with lower long-term returns.) One reason gold is going higher is more significant. I'm trying to keep it brief today, so I won't go into all the details, but essentially, the runaway deficit spending of the US appears to be catching up with the dollar, leading central banks and other large institutions to sell dollars to stockpile gold.

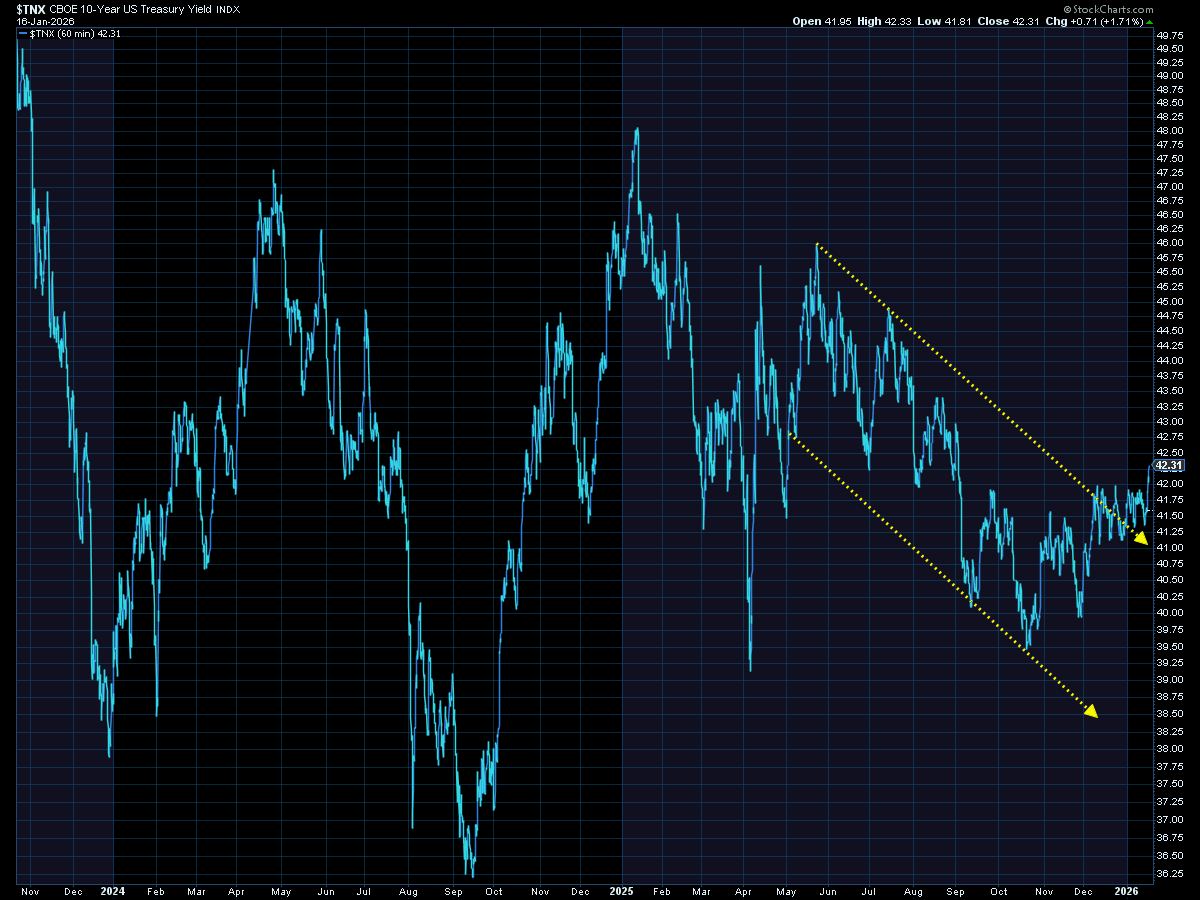

To be continued: The 10-year Treasury yield surged last week, with the biggest jump on Friday. Why? It's not clear yet, but we CANNOT see the bond market push yields higher if we want the strong growth expectations to be me this year. (As always, check out the "Market Charts" section below for the technical take on yields.)

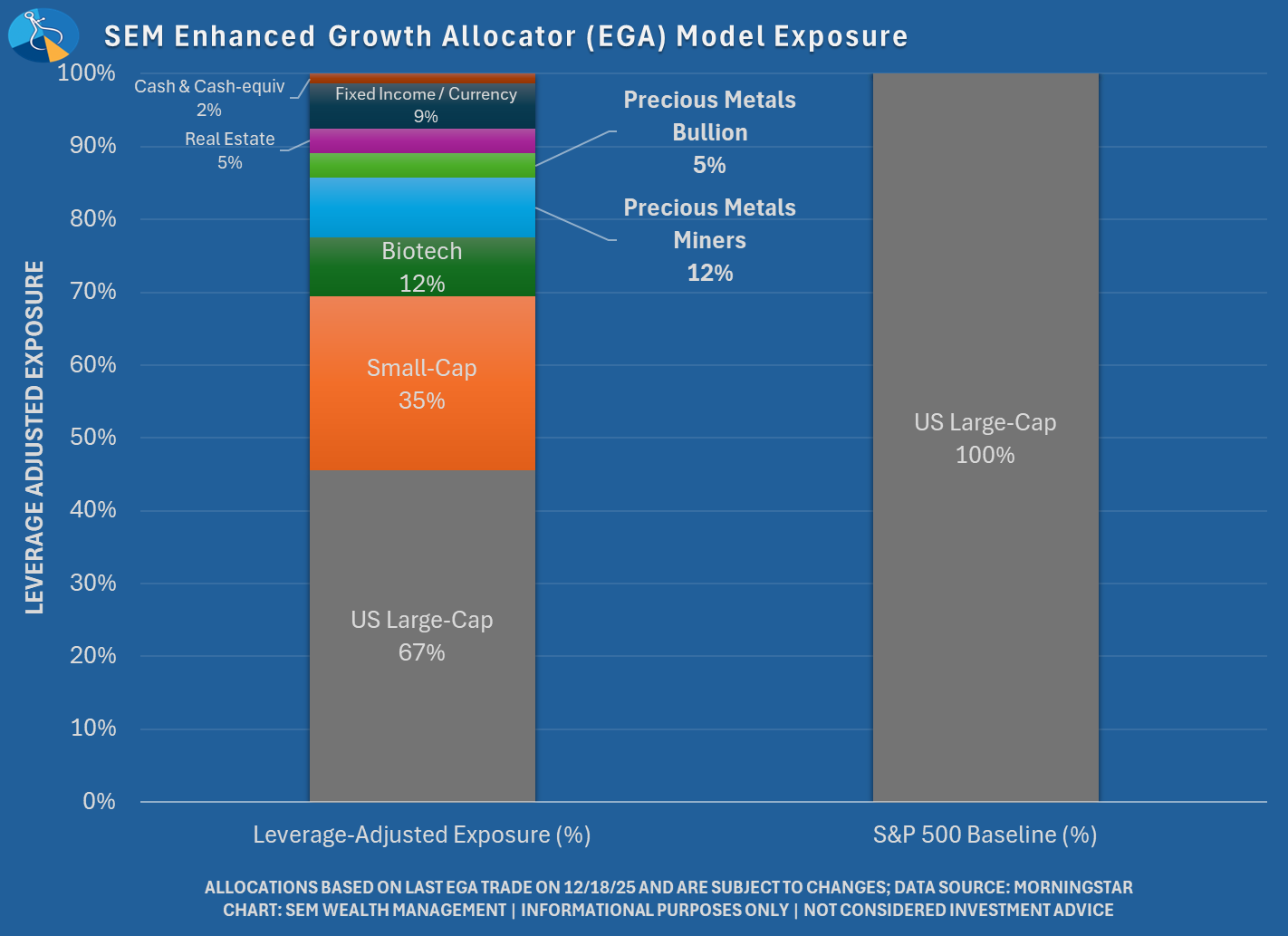

SEM's Positioning: I've been very reluctant to talk about it because I don't know how long this trend will last and I don't want to see clients positioning out of solid long-term models that fit with their financial plan into a model that is much more volatile just because it has exposure to precious metals. That model is Enhanced Growth Allocator.

This model is one of our longest-running equity models. It is very sophisticated and complicated and one that quite honestly can be too complicated for anybody wanting to understand the "why" behind our allocations. As it is, there are a few trading systems which have precious metals allocations. The model is currently 17% Precious Metals, plus a nice allocation to Biotech stocks, plus is overweight large cap stocks.

Needless to say, with this exposure EGA is having a good start to the year. Will it continue? Nobody knows, but it is a non-corelated way to diversify out of the stock market with a small portion of your portfolio.

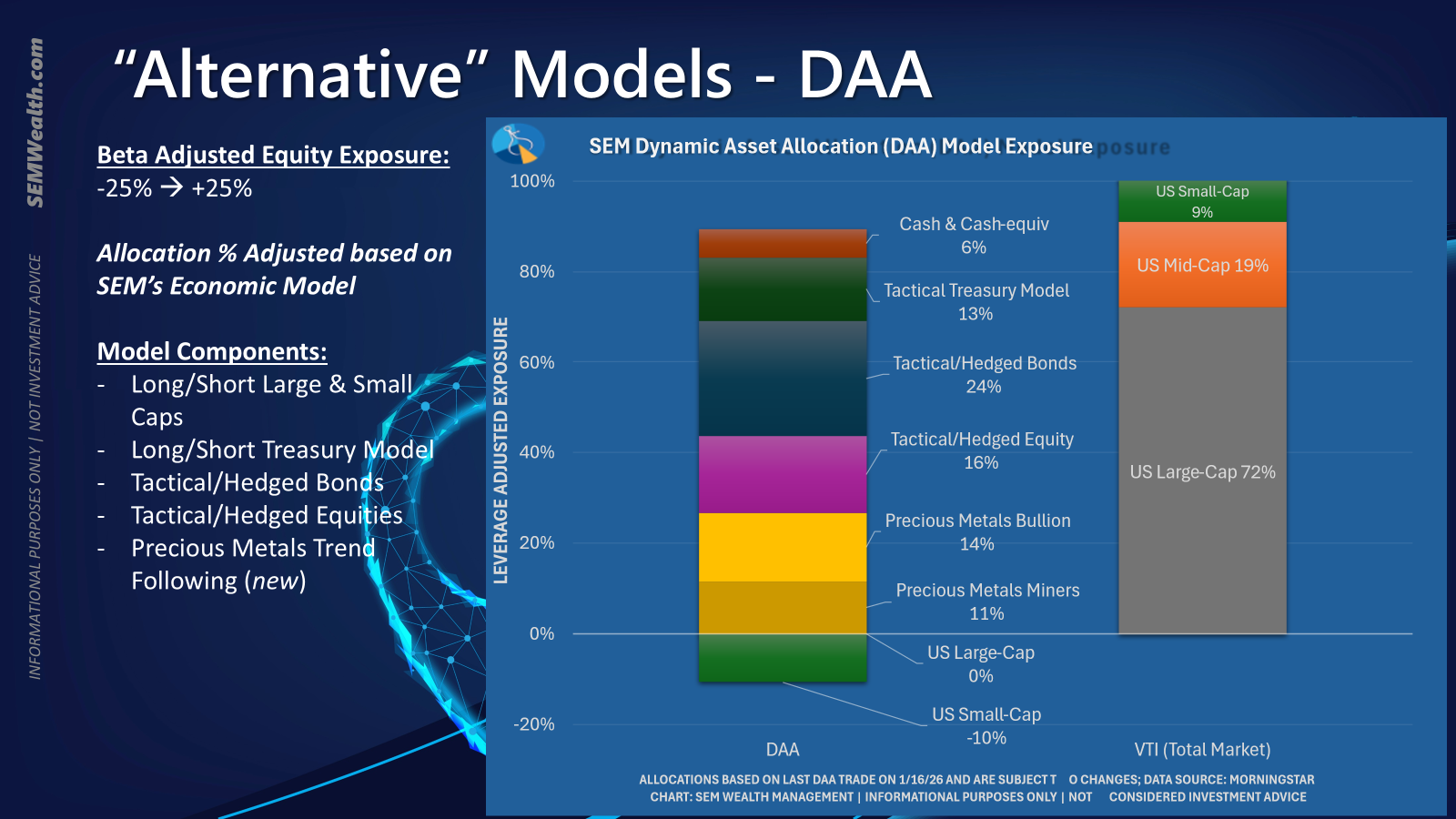

Dynamic Asset Allocator (DAA) also picked up on some metals exposure as part of our "hedging" rebalance last week. It is not as active as EGA and is not designed to generate higher returns, but it is another way to get some precious metals exposure inside of SEM's managed models. However, DAA will provide more CONSISTENT precious metals exposure (and provides a long-term trend model designed to reduce our exposure WHEN the trend reverses.)

If you'd like to see if EGA (or DAA) is a good fit in your portfolio, start by taking our RISK QUESTIONNAIRE. Make sure you check, "I'd like to speak to my advisor" and mention EGA or DAA (or gold) in the box for what you'd like to discuss. This will kick off an automatic review of your portfolio and we will send that to your advisor.

5. Credit‑Card Rate Cap Proposal Hits Financials

President Trump floated a one‑year 10% cap on credit‑card interest rates, sending shares of major lenders sharply lower—Synchrony, Capital One, AmEx, and Citigroup all took meaningful hits.

Why it matters: Policy surprises (and we've had a lot of them) can create uncertainty. At a time where the President is wanting banks to lend more money, these types of threats could end up hurting overall growth.

SEM's Positioning: Our equity models are essentially "equal weight" financials. There isn't much we can do with this specific crackdown, but the IDEA is this cap would help lower income Americans, when in fact (like the purchase of $200B of Mortgage Backed Securities we discussed last week), could end up hurting the people it's supposed to help. In this case, if the big credit card issuers pull back credit, it could serve as restrictions on growth for many businesses relying on these firms for credit. As a reminder, our Dynamic models remain "bearish" as the economic indicators continue to point to a slowing growth rate (as discussed last week.)

It's been an exhausting and volatile start to the year. We're happy with how our models have been handling it, but remain wary of a market that remains overvalued, is expecting not only above average growth, but the best growth rate of the past 3 years, and what will be a busy mid-term election year of policy ideas being floated around.

As always, we will be ready to take risk out of the portfolios when the DATA (not our opinions) says it is time.

Toby's Take

A look at our intern's top WSJ articles of the week

1/12/2026 - Trump ‘Inclined’ to Keep Exxon Out of Venezuela - WSJ

The Chief Executive of Exxon has made some genuine points about issues regarding oil investments in Venezuela. Now, because of that, President Trump said that he'll "probably be inclined to keep Exxon out." That could put a dent in Exxon's stock value and potential gains. However that can mean that other oil producers already involved could see even more gains.

1/13/2026 - Trump Allies and Officials Fear Blowback From Powell Probe - WSJ

President Trump's Department of Justice is investigating Fed Chair Jerome Powell because (according to Powell) he is resisting Trump's demands for interest rate cuts. There's a couple of concerns here, the first being what exactly did Jerome Powell do that is considered "criminal?" The second being how will this affect the market? Could we see banks react early or people react irrationally? We will have to wait and see how this pans out!

1/14/2026 - Venezuelan Opposition’s Calls to Oust Maduro Aided Legal Case for Removal, Memo Says - WSJ

After the operation in Venezuela on January 3rd, there were concerns about not just United States law, but also international law. There were concerns on if the President can jump straight to action without going through Congress, but the Office of Legal Counsel cited that there were numerous instances of presidents authorizing missions without going through Congress. Now, does that make it legal? That's questionable. But for international law purposes, the support by Maria Corina Machado to have the U.S. oust Maduro could help President Trump's legal case.

1/15/2026 - JPMorgan Chase CEO Jamie Dimon Seemed to Have Trump Figured Out—Until This Week - WSJ

The CEO of JPMorgan Chase, Jamie Dimon, has worked to rebuild his relationship with President Trump. However, it could get all messed up again because of the fight over Jerome Powell. Dimon said in defense of Powell that he didn't "agree with everything the Fed has done" but also said that it was well known that "anything that chips away" at the central bank's independence "is probably not a good idea." President Trump said quickly that Dimon is "wrong" and "it's fine what I'm doing, and we have a bad Fed person." Trump said that "We should have lower rates," and that "Jamie Dimon probably wants higher rates, maybe he makes more money that way." We know that some people can sway very quickly to anything that Trump says, so it isn't unreasonable to say that Chase's stock value could take a hit.

1/16/2026 - Chinese AI Developers Say They Can’t Beat America Without Better Chips - WSJ

Nvidia and the United States have already been leading the world's race in AI and China was hoping to take that lead. With the U.S. restrictions on chip sales to China it has made that gap seem bigger and bigger. Chinese companies have started to talk about renting computing power at data centers in Southeast Asia and the Middle East in order to get access to Rubin Chips, the next-gen hardware Nvidia introduced in January. It isn't technically illegal for China to use their chips in third countries but through all of the hoops they have to jump through it is much more of an inconvenience compared to the other well-funded American competitors.

Market Charts

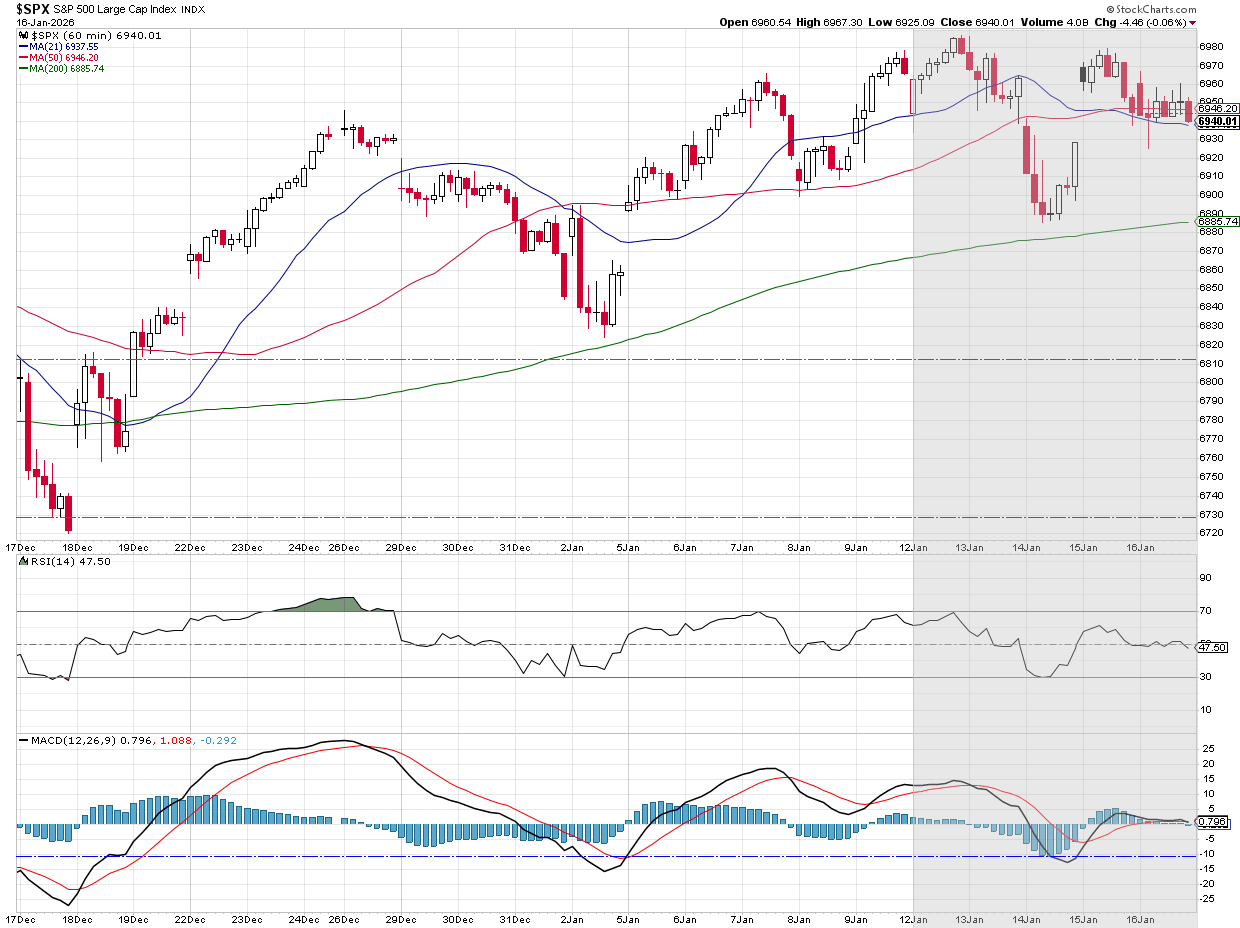

The short-term chart of the S&P 500 shows the roller coaster we've gone through each day this year.

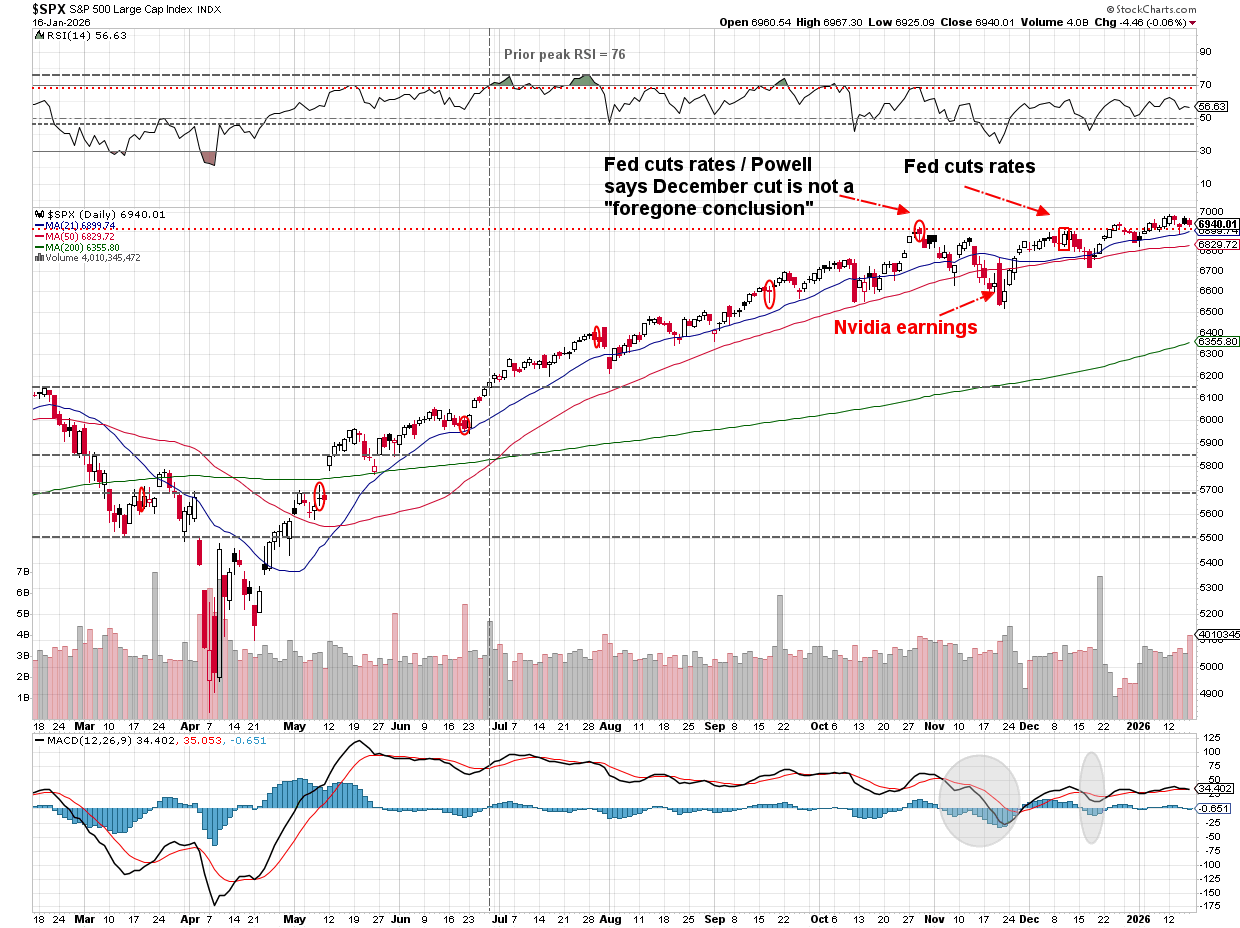

When you zoom out a bit you can see the S&P has essentially parked it right around the level it was at during the last two Fed meetings. With another meeting looming and the data mixed, it makes sense the market participants are waiting to commit to the market at these levels.

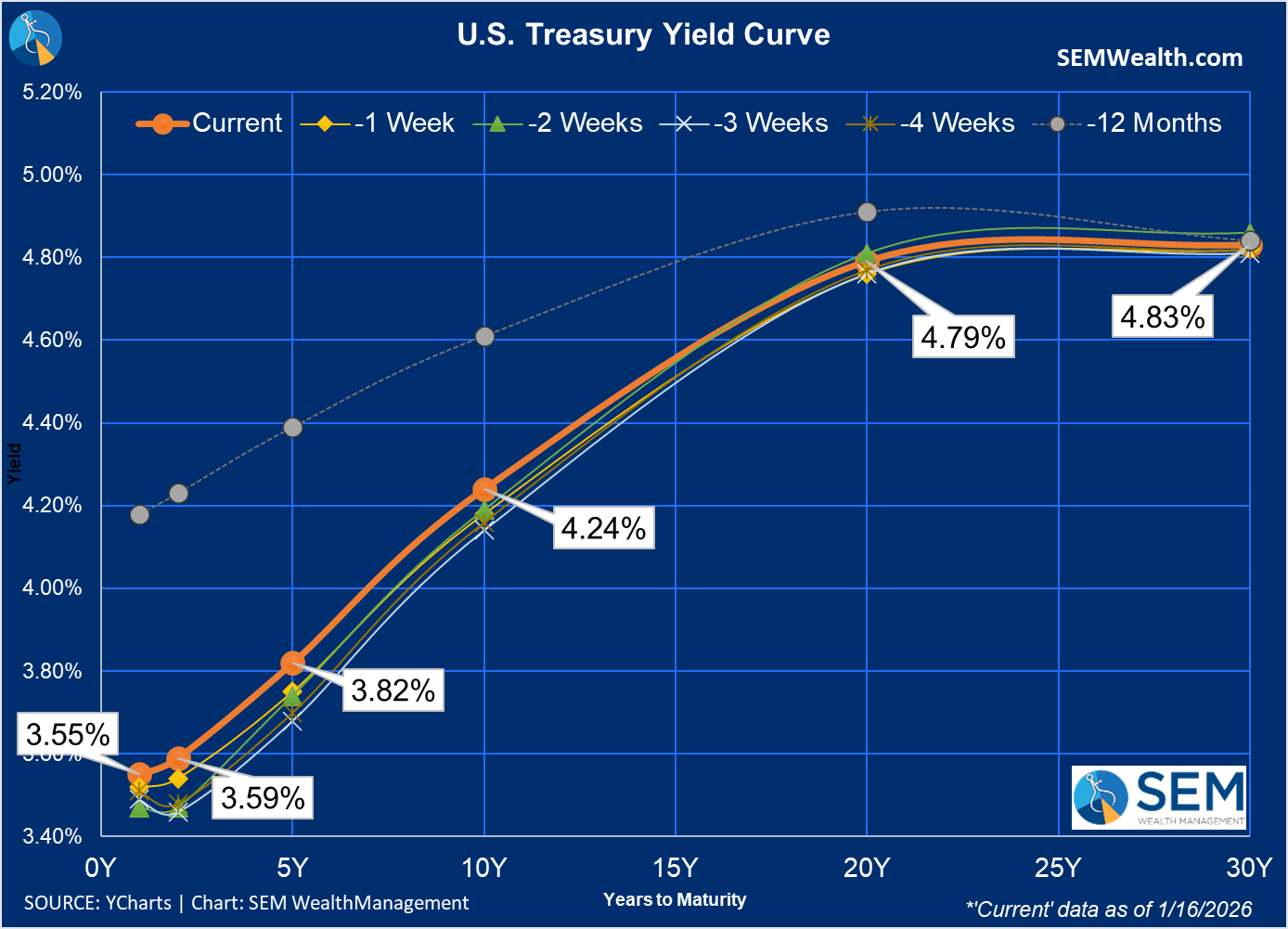

As mentioned earlier, long-term interest rates increased last week.

The 10-year yield has now clearly broken out above the downtrend channel, which is not a good sign for those banking on lower interest rates to fund their growth.

SEM Market Positioning

| Model Style | Current Stance | Notes |

|---|---|---|

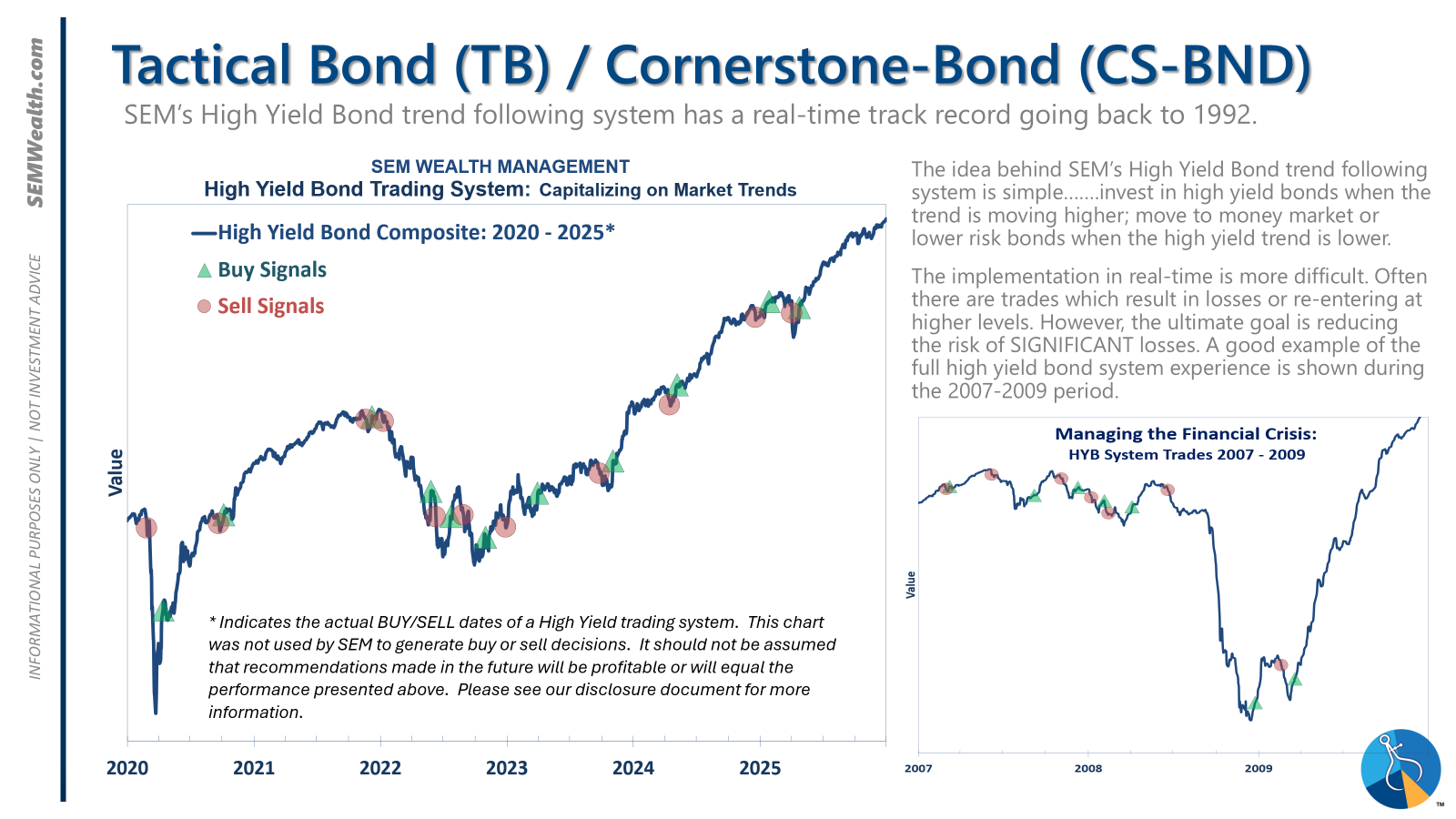

| Tactical | 100% high yield | High-yield spreads holding, but trend is slowing-watching closely |

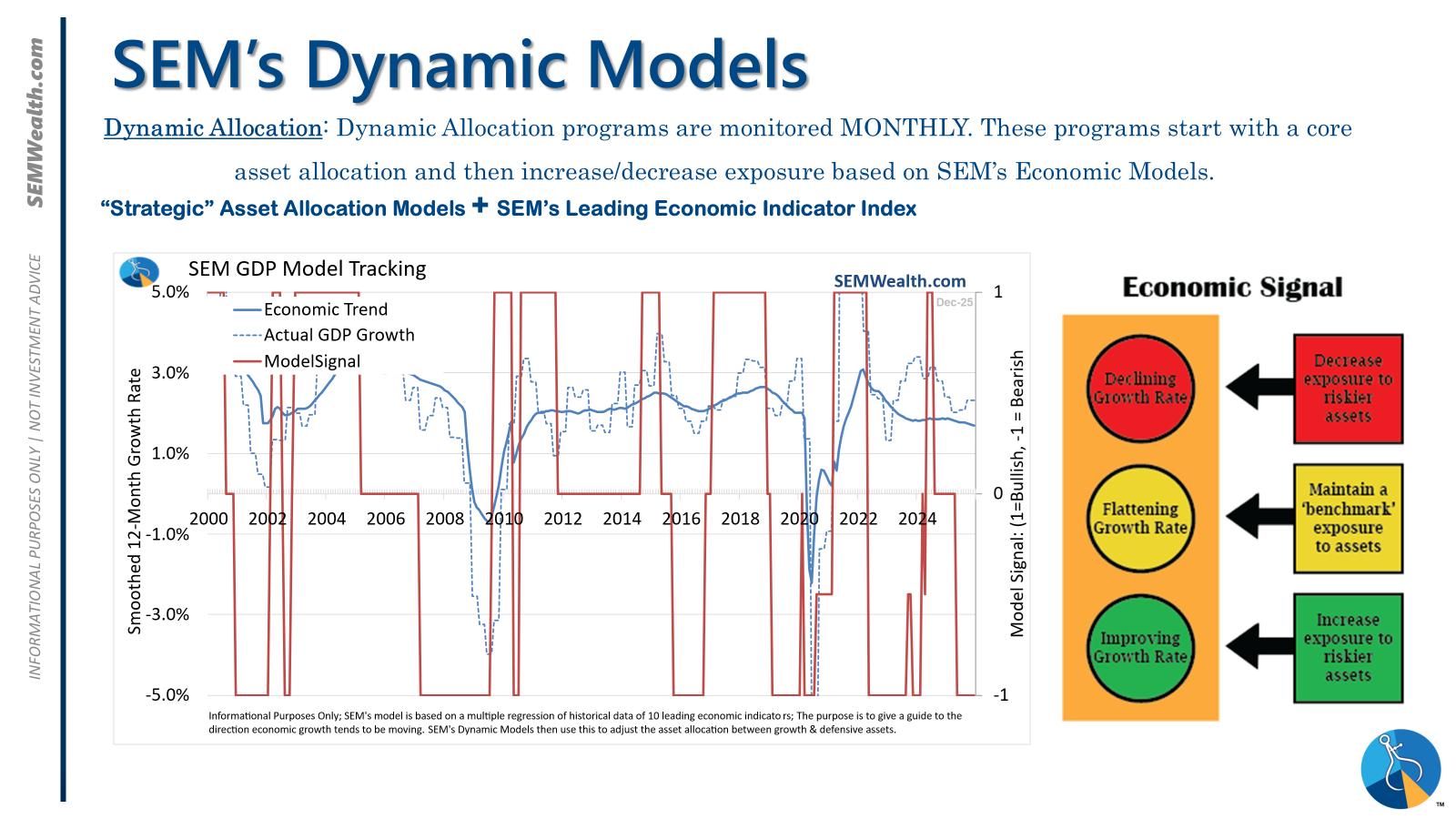

| Dynamic | Bearish | Economic model turned red June 30 '25' – leaning defensive |

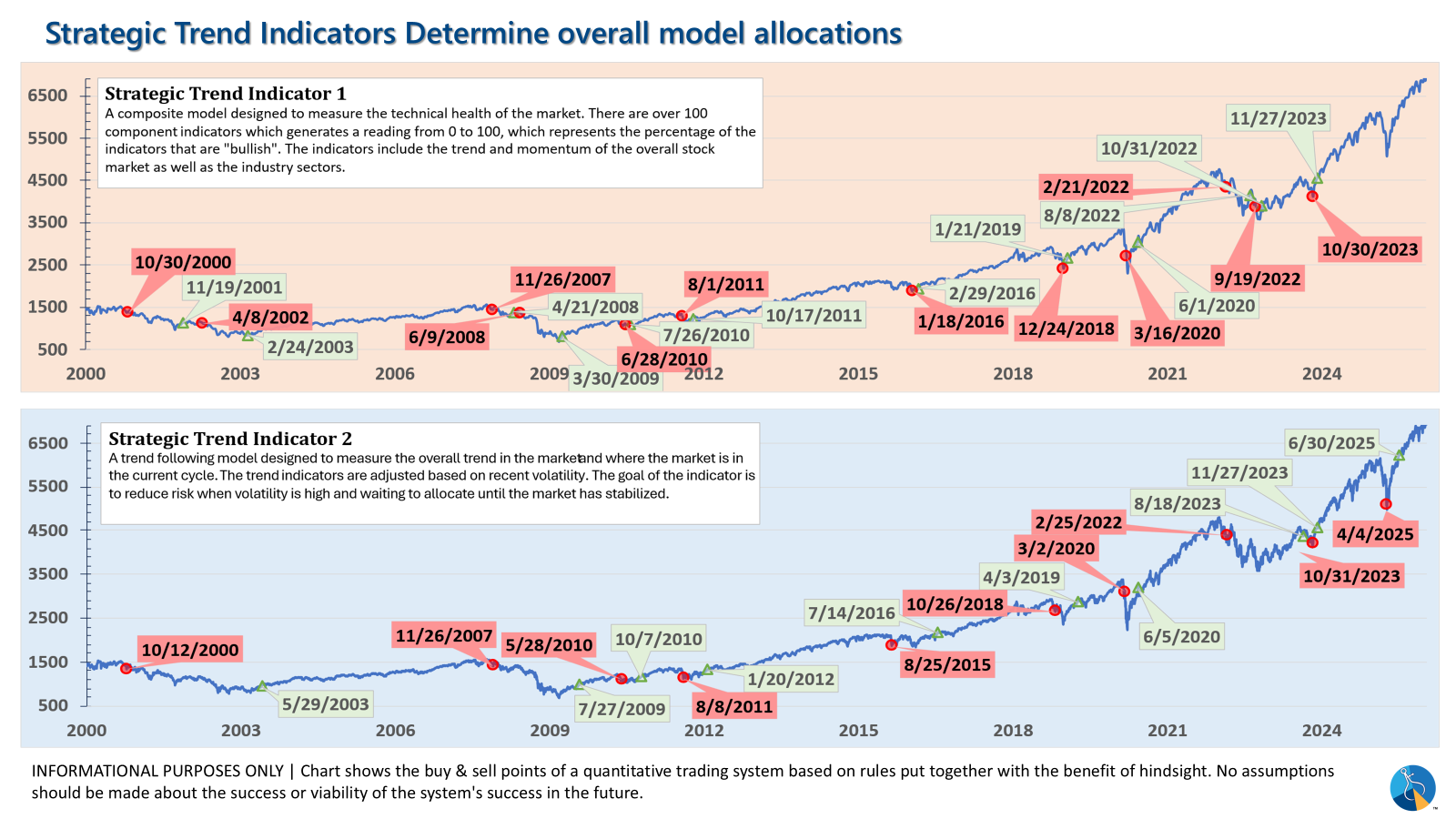

| Strategic | Fully invested | Trend overlay shaved 10 % equity in April -- added back early July |

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): The high yield system has been invested since 4/23/25 after a short time out of the market following the sell signal on 4/3/25.

Dynamic (monthly): The economic model went 'bearish' in June 2025 after being 'neutral' for 11 months. This means eliminating risky assets – sell the 20% dividend stocks in Dynamic Income and the 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is 'bullish' meaning higher duration (Treasury Bond) investments for the bulk of the bonds.

Strategic (quarterly)*: One Trend System sold on 4/4/2025; Re-entered on 6/30/2025

The core rotation is adjusted quarterly. This quarter we saw half of our international positions reduced (we sold developed markets and kept our emerging markets exposure). We also saw the remaining share of mid-cap reduced in favor of more small cap exposure. We remain with a "barbell" core portfolio – about half in large cap and half in small cap as the models expect the market to "broaden".

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire