As much of the country digs out (defrosts) from the snow and ice storm this past weekend, the stock market just endured a similar week—slick conditions, sudden slides, and brief moments of calm that didn’t quite restore traction. Last week's blog title was "Broadening Volatility" and that continued again last week with geopolitics, earnings shocks, and "safe‑haven" assets colliding to leave investors cautious heading into the heart of earnings season and a critical Fed meeting. This week we look at the icy conditions which could make it difficult in the weeks/months ahead if you aren't careful.

Here's a quick look at my top 3 stories from last week.

1. Trade War / Geopolitics drive another losing week

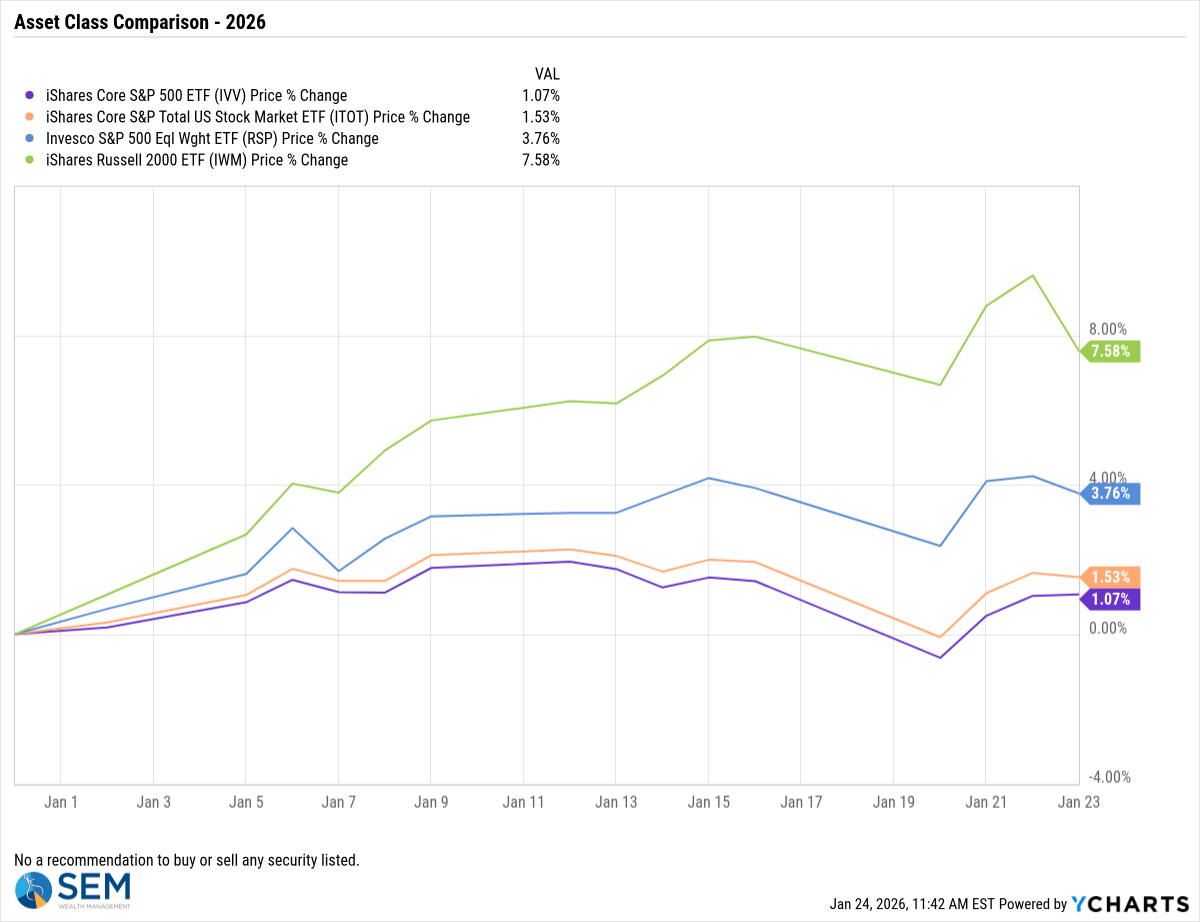

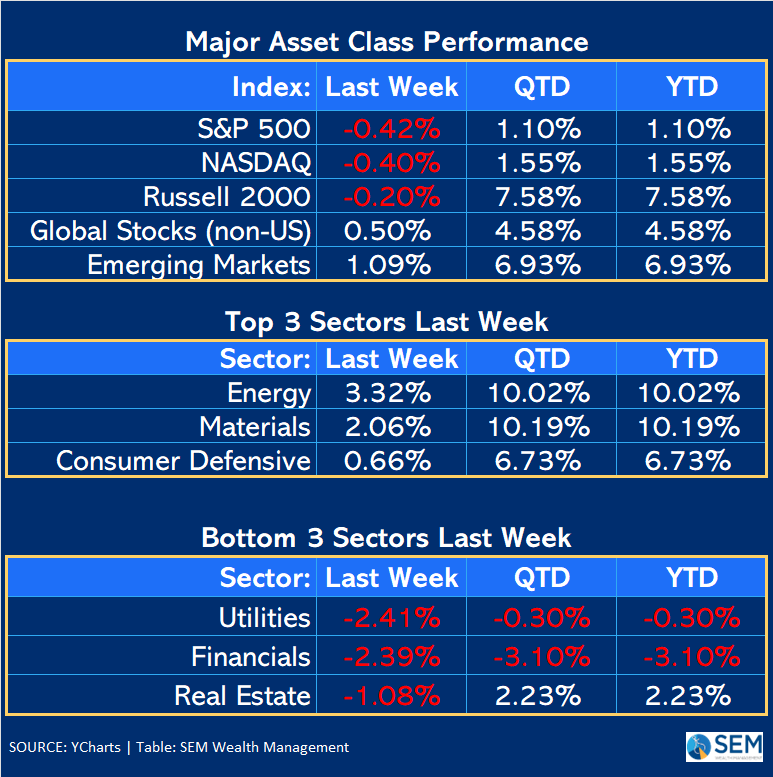

The S&P 500 posted back‑to‑back weekly losses, underscoring how fragile sentiment has become early in 2026. While it still outperformed for the week, even the small cap Russell 2000 gave back a little of its early year gains. The S&P 500 started the holiday-shortened week down with President Trump again fixated on taking Greenland. He quickly reversed course on Wednesday, first taking the threat of force off the table and then after the market closed announcing the "framework of a deal" that most importantly ended the threatened tariffs against NATO countries who didn't support his quest for Greenland. The rally was short-lived with the remaining two days seeing strength as an opportunity to sell. (This roller-coaster dominated "Toby's Take" this week – make sure you check out his brief summaries below.)

It's too early to tell if the first 3 weeks of the year is simply rebalancing back to target allocations or an actual broadening of the rally. While I've lamented the "narrowness" of the rally in the S&P 500 the last 2 years, the type of enthusiasm for small caps is a bit uncomfortable. Our economic model remains "bearish" due to the weak labor market, strained consumer, and how late we are in the economic cycle. Small caps typically struggle more than large caps during a recession, so this strength could be read as a sign that the market participants see no risk of any sort of economic slowdown.

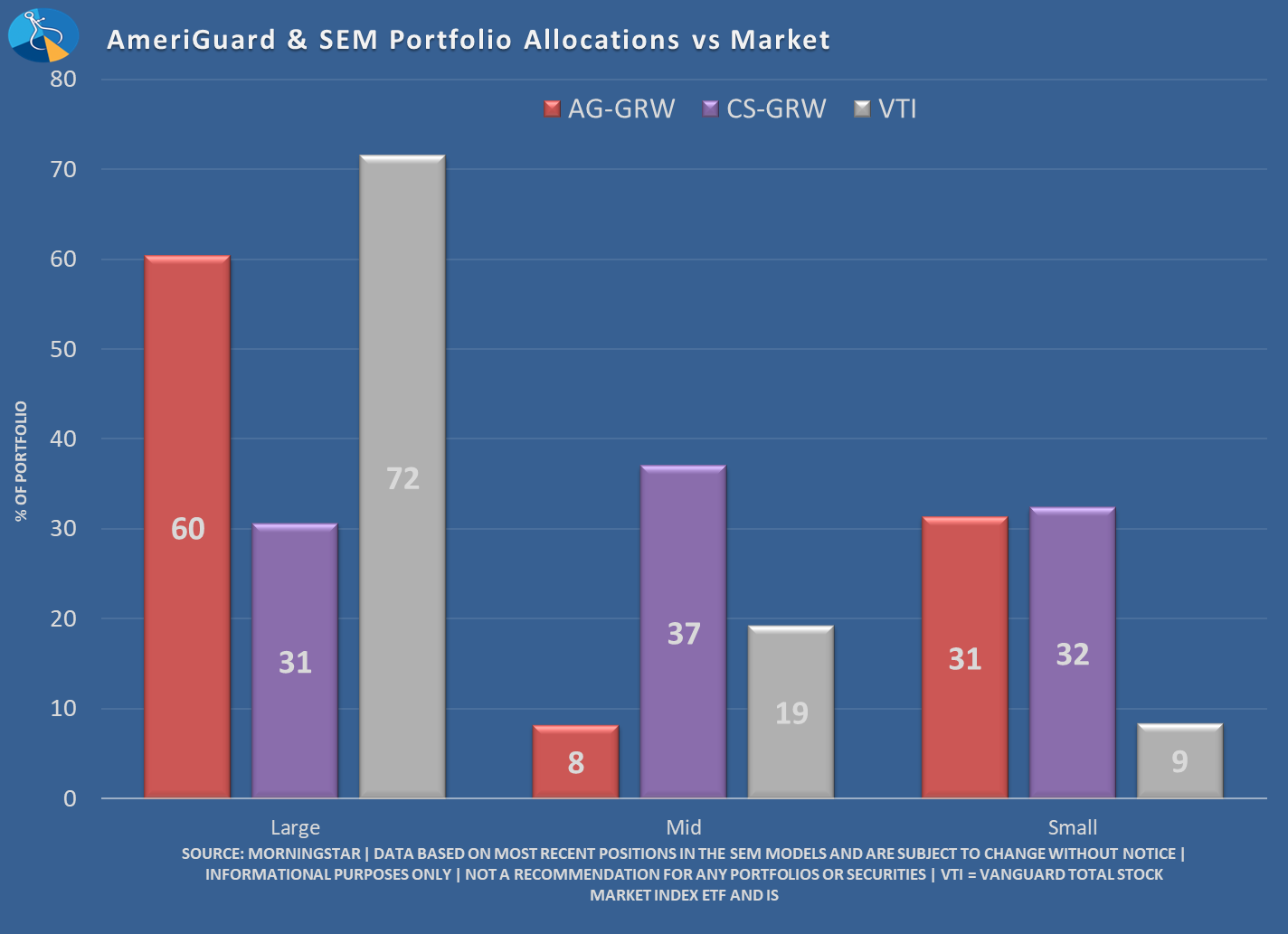

My discomfort aside, we use quantitative models based on numbers, not opinions. As I discussed last week, our "core" systems inside of AmeriGuard and Cornerstone are overweight small cap stocks, so we are certainly enjoying this rally. We don't override this allocation because the data tells us a.) the economy can continue to be driven higher by "abnormalities" for multiple years and b.) there have been times (late 70s/early 80s and in the early 2000s) where small cap stocks can outperform significantly DURING A RECESSION. The reason is the rallies up until that point were so NARROW (mega cap stocks left small caps in the dust) that when the reckoning came for large caps, small caps were ready to receive the money rebalancing out of the mega caps.

It could also be a yet to be determined "c, d, or e" – we DO NOT GUESS. We let the data drive the decisions.

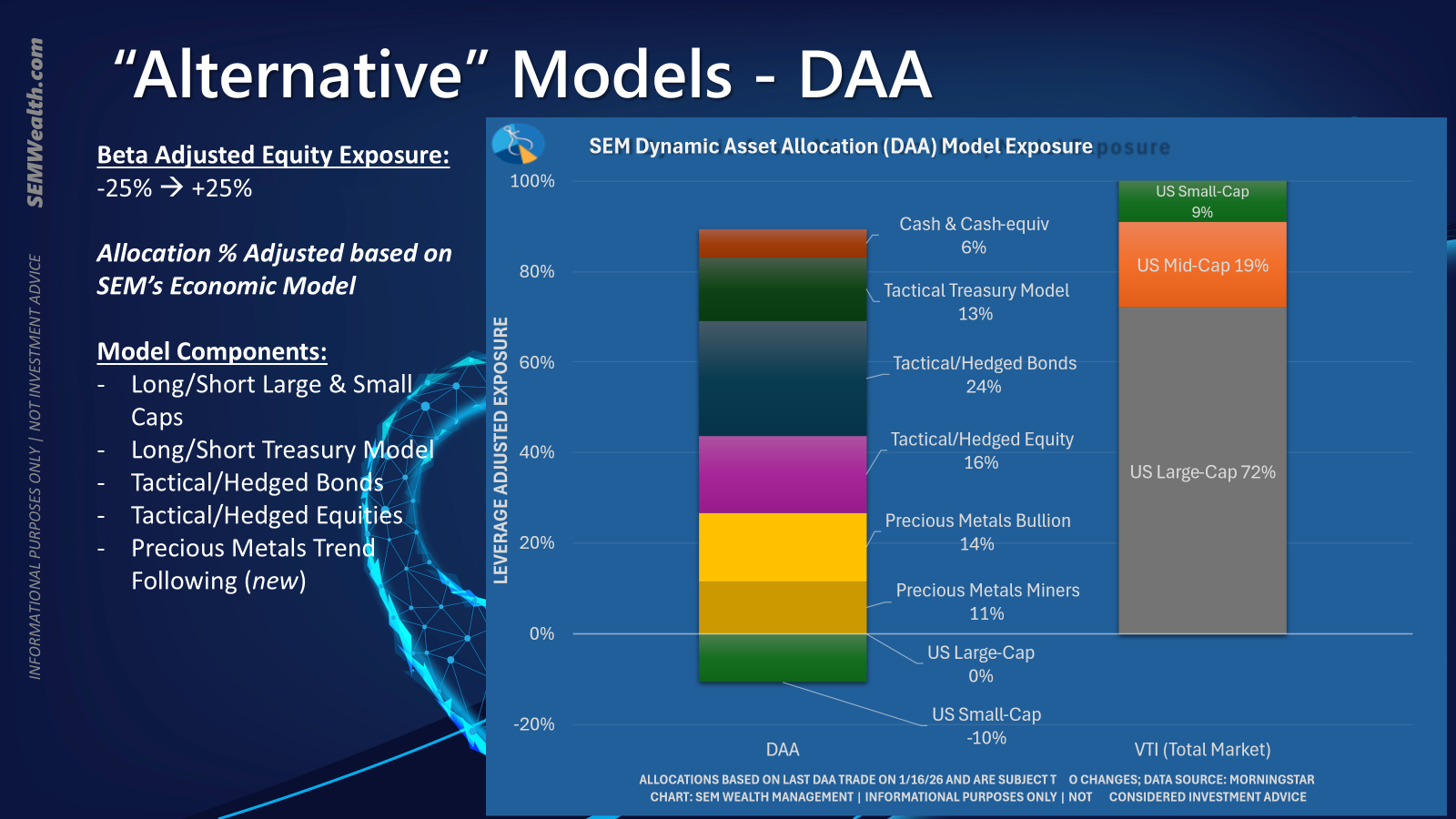

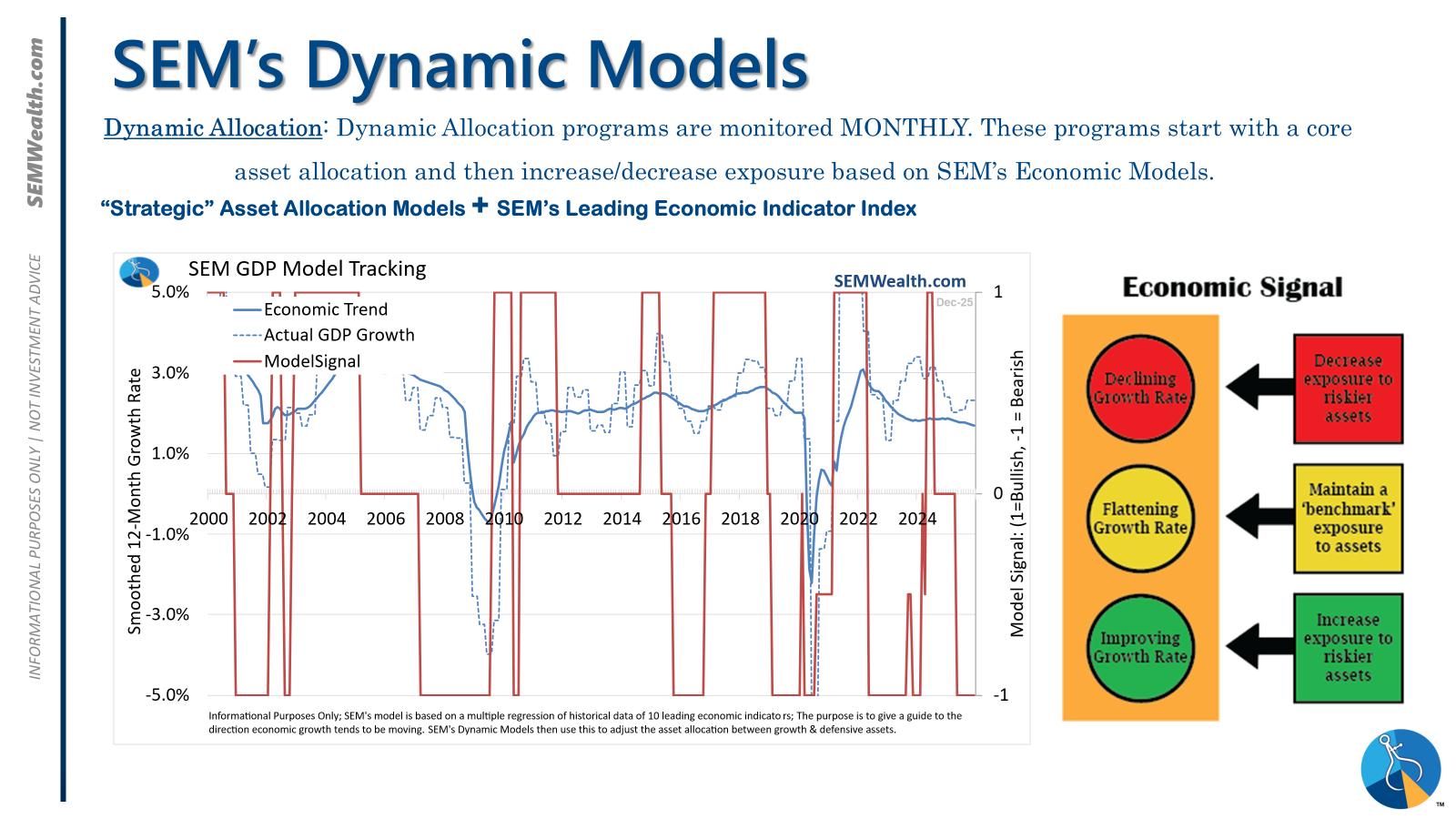

More importantly, our DIVERSIFIED approach doesn't rely on single indicators or set of ideas. This is the value of our Dynamic models which uses our economic model to set allocations. The data shows these models can be a nice ballast to our other models during a recession/downturn. While they are "out of favor" at the moment due to the economic disconnects, historically these models fall back into sync.

Check out my more detailed discussion on this in last week's blog:

2. Gold and Silver (again) shined as investors reached for "safety"

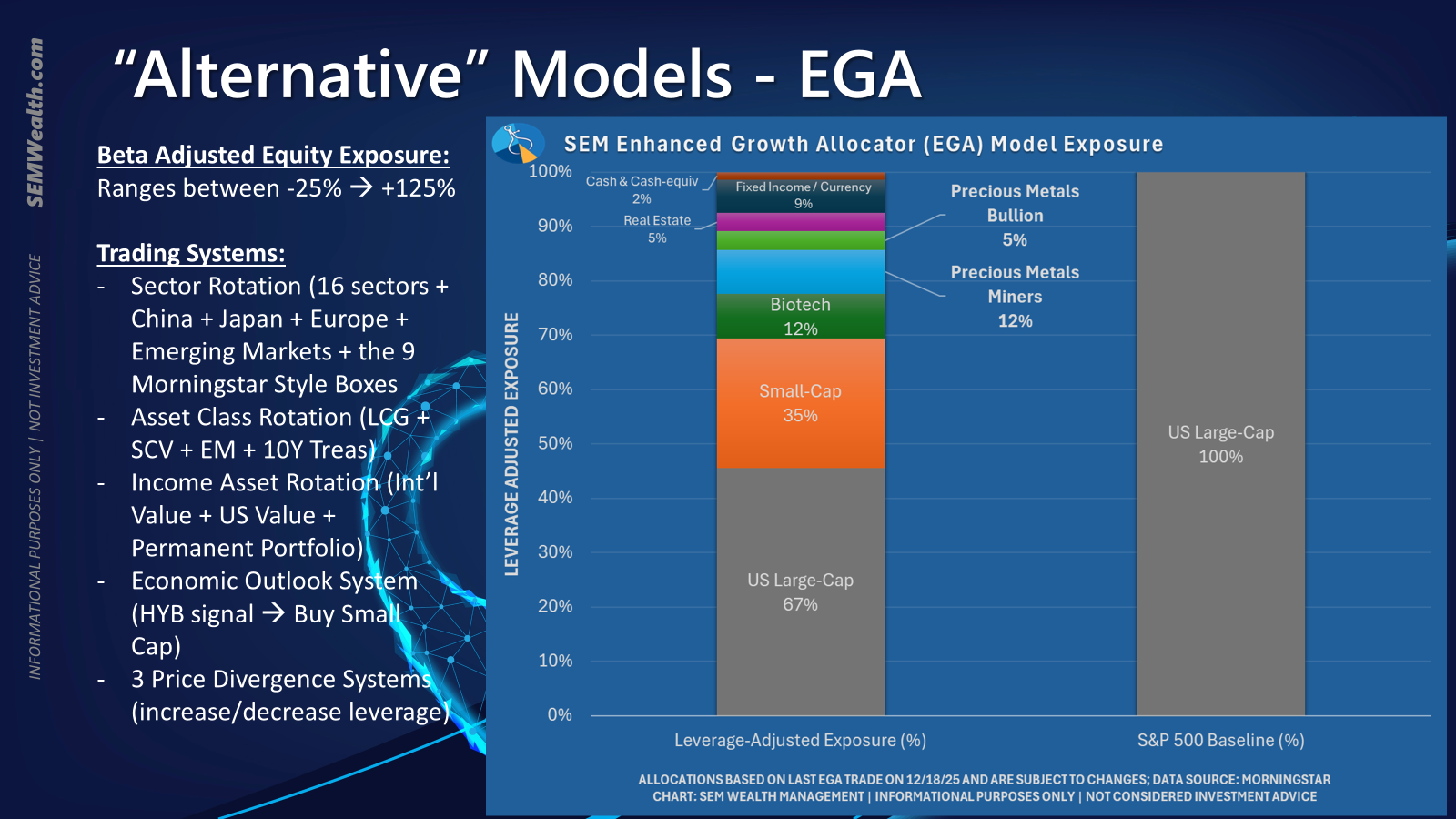

Last week I also reviewed a shift in my long-standing position on gold. There are two BIG PICTURE shifts I'm seeing that COULD justify having SOME Precious Metals exposure. I need to spend more time organizing my thoughts into a cohesive presentation as there are many different subject areas which have led me to this shift. Essentially it comes down to this:

1.) The K-Shaped economy where a large portion of our country has been left behind has led to "populism". This historically leads to "protectionism" (among many other things). This usually then leads to the dollar losing value (which is inflationary). The "among other things" items such as more business restrictions and higher taxes are also inflationary. Precious metals could be a hedge against that environment.

2.) The "run hot" economy that the Trump administration is pushing, which could include heavy influence on the Fed, stimulus checks (in the form of "tariff dividend checks"), unchecked spending (on things like defense/war) will likely lead to both higher inflation and downward pressure on the dollar.

3.) Our national debt and the lack of concern from either party about handling it. The "fiscally conservative" party that is in control of Congress and the White House is anything but fiscally conservative. How else do you explain a $1.8 Trillion projected budget deficit which is HIGHER than the party known for running high deficits? Social Security, Medicare, and Federal Government pensions currently represent 50% of our spending. They ARE NOT FUNDED by past payments, but instead are a PAY AS YOU GO entitlement. Nobody dares address this because they know the people receiving the funds will not vote for them. Higher debt loads leads to more risk, which leads to higher inflation.

I am NOT advocating static allocations to Precious Metals because I've been around long enough and have studied enough history to know that any of the 3 conditions could be resolved differently. Given the huge run in Precious Metals, the consequences of jumping in and chasing precious metals and being wrong are huge. While the financial media likes to call precious metals "safe havens", the past price performance shows they are anything but safe.

Our solution is to give clients who may be concerned about any of the 3 things above sparking higher inflation a chance to hedge their other investment positions, but still provide a way to SYSTEMATICALLY reduce/remove that allocation should the trends reverse.

I discussed the two options we have at SEM last week (Enhanced Growth Allocator [EGA] and Dynamic Asset Allocator [DAA]). These models are completely different from each other and play different roles in the overall plan. They are highly complex, but both offer ways to gain MANAGED access to Precious Metals. Currently, EGA has a 17% position and DAA is at 25%.

If you would like us to look at whether or not either of these options make sense to you, the first step is to take our RISK QUESTIONNAIRE. On there, check the box, "I'd like to speak to my advisor" and list "should I add precious metals exposure to my portfolio?" as your question to discuss.

Like the rally in small caps, I'm uncomfortable with the price movements in Precious Metals, but if the DATA says to invest, we invest.

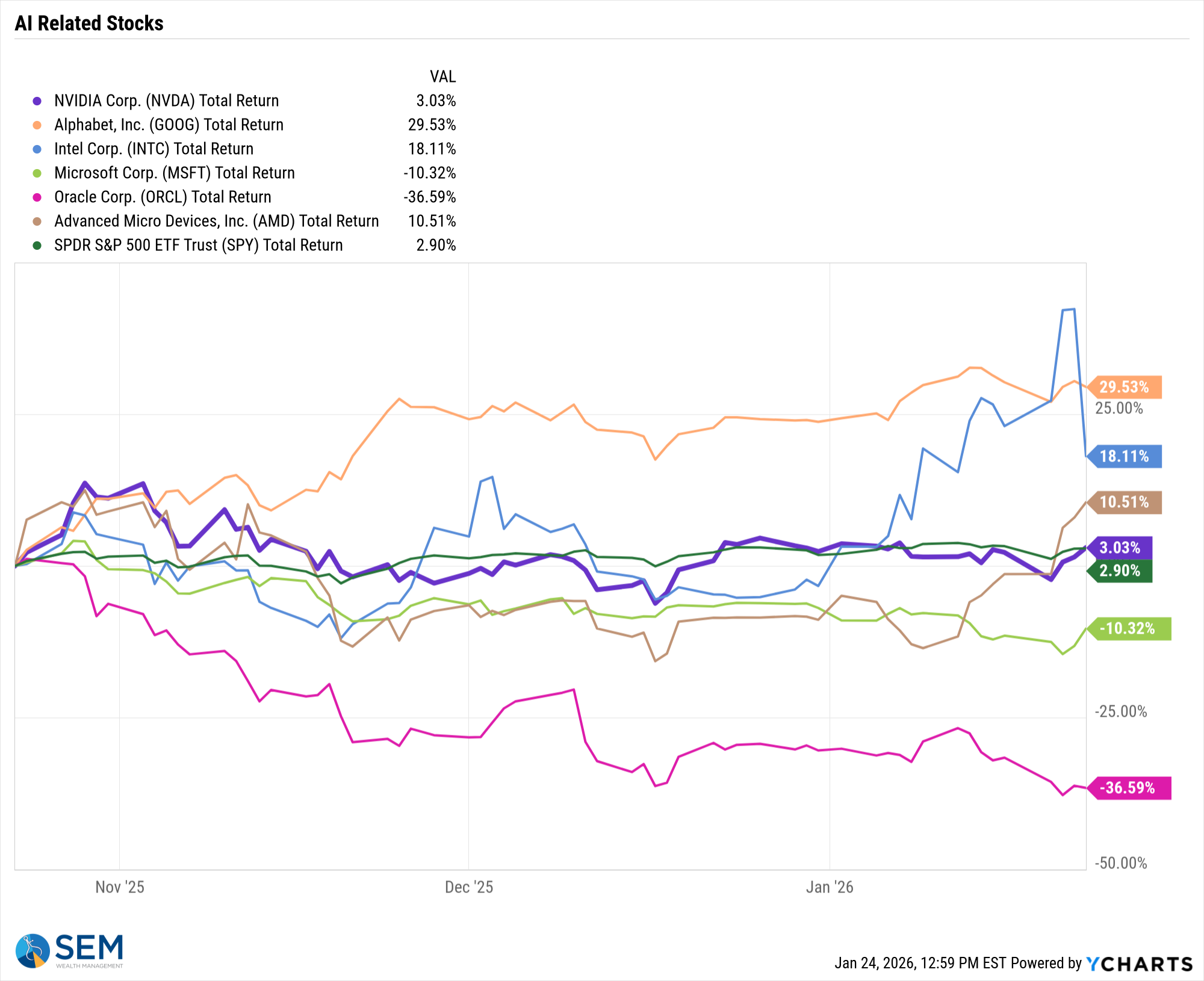

3. Intel cratered, while select AI stocks held the line

Earnings season is heating up and it already delivered its first major shock when Intel issued a weak outlook, sending shares sharply lower and weighing heavily on tech sentiment. Intel has been on a sharp rally since the Trump administration took a 10% ownership position in the stock last August. The earnings miss raised fresh doubts about Intel’s turnaround and highlighted the growing gap between legacy chipmakers and AI‑focused leaders. Will this be a huge slide like we saw with Oracle or will the stock be able to rebound. One this is certain – AI is not just one trade anymore, stock‑specific fundamentals matter more than ever and chasing the latest "hot" AI stock is not always the best thing to do.

Could be a noisy week

With markets already on edge, attention this week will be on a packed earnings calendar and this week's Federal Reserve meeting. Investors overwhelmingly expect the Fed to hold rates steady, but as we've learned, guidance on inflation, growth, and future cuts will matter far more than the decision itself.

On the earnings front, AI and data center spending/profits will be on a lot of people's minds as we see some important earnings reports on Wednesday (Microsoft, Meta, Tesla, and IBM) and Thursday (Apple).

After a week defined by headlines and whiplash, the coming days will test whether fundamentals can regain control—or whether markets remain stuck navigating icy conditions.

As always, we will be here watching the markets, our systems, and being ready to make adjustments as needed.

Stay safe!

Toby's Take

A look at our intern's top WSJ articles from the week.

1/20/2026 - Trump Speaks at White House Briefing; In Davos, Macron Denounces Tariff Pressure on Europe

President Trump's dream of the United States acquiring Greenland was talked about in Davos with many other leaders. President Trump said that the U.S. would not use force to acquire Greenland and only wanted to negotiate for the territory. He said that the U.S. needs to take control only for security reasons not minerals. Many leaders are not in support of this including Denmark who controls Greenland. There are a lot of unanswered questions surrounding this matter still which can cause a lot of uncertainty in the market. What also may not help is the tariffs that President Trump put on Europe because of the lack of support.

1/21/2026 - Trump Threatens Tariffs on Countries That Oppose His Greenland Takeover - WSJ

After a lack of support from allies President Trump has retaliated by putting tariffs on European countries that oppose his stance on "taking" Greenland. This is a little troubling because American companies have already been hit with the tariffs in place from last year and struggled. If we do end up with Greenland we could see some benefits for our AI producers because of their minerals there. We will continue to watch this matter and how it progresses both with the claim of Greenland and the tariffs.

1/22/2026 - Inside Trump’s Head-Spinning Greenland U-Turn - WSJ

After the short worry of tariffs on European nations, Trump has backed down on that and the use of force to take Greenland. This was all done because President Trump said that they have "formed the framework of a future deal." This framework says that there would be an agreement between the U.S. and Denmark to allow American forces to be stationed on the island and that there would be a boost in European security around the Arctic. It also says that the U.S. could receive a right of first refusal on Greenland's mineral resources which is to specifically block Russia and China from getting to it first. All of this new information is very exciting but mostly the part of no tariffs on those nations!

1/23/2026 - Elon Musk Is Diving Back Into U.S. Politics - WSJ

Elon Musk is back in politics! Whether you like him or not, the Republican party sure does with him already donating $10 million to a Republican Senate candidate. This does cause concern for his many large companies. He used to have a great relationship with President Trump until a falling out. That falling out forced him to take a step back from politics and focus on his companies and grow. There were even large incentives put in place by his board to motivate him to actually do his job. Now that he is showing signs of putting his time back to politics we could see declines with his various investments, especially Tesla.

Market Charts

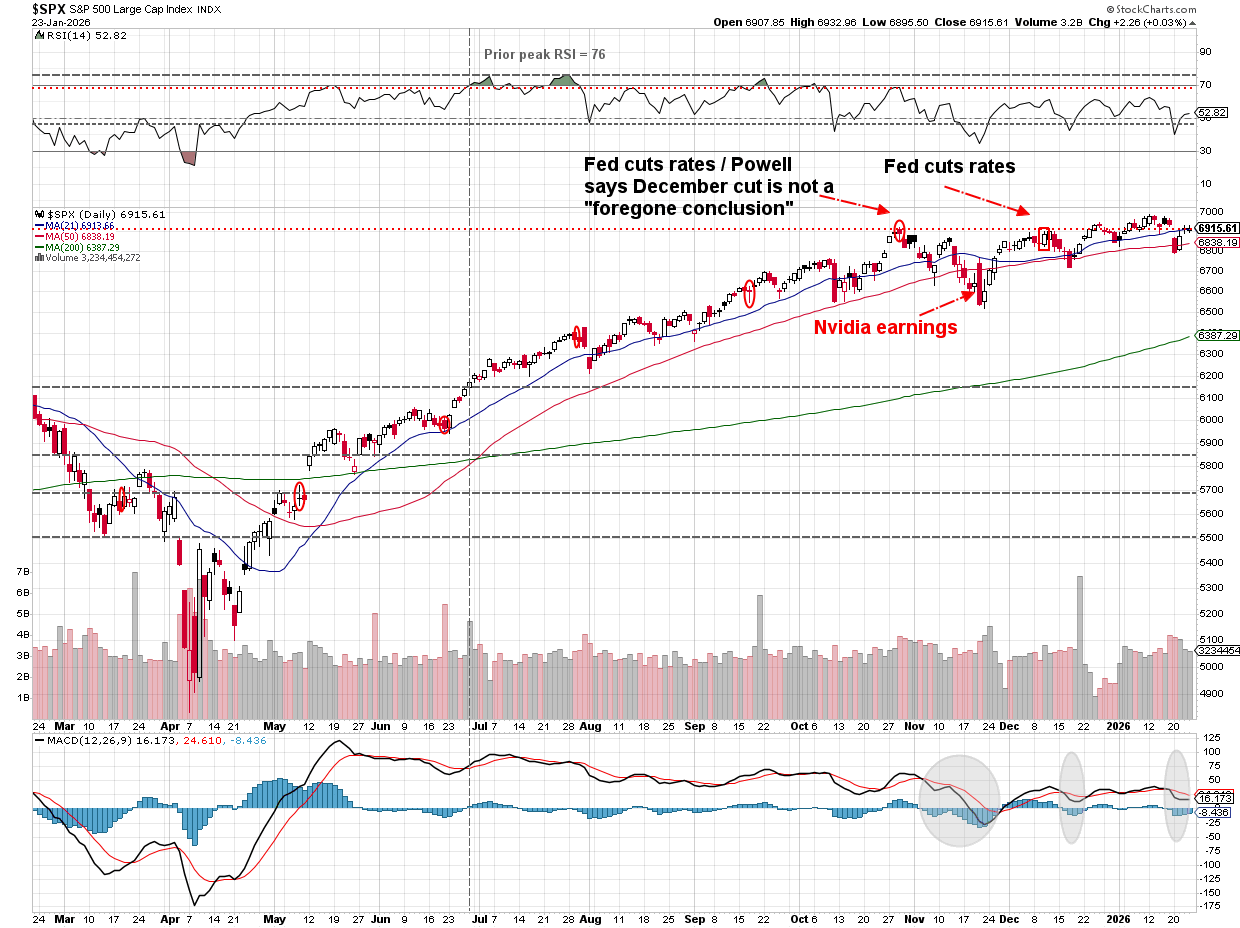

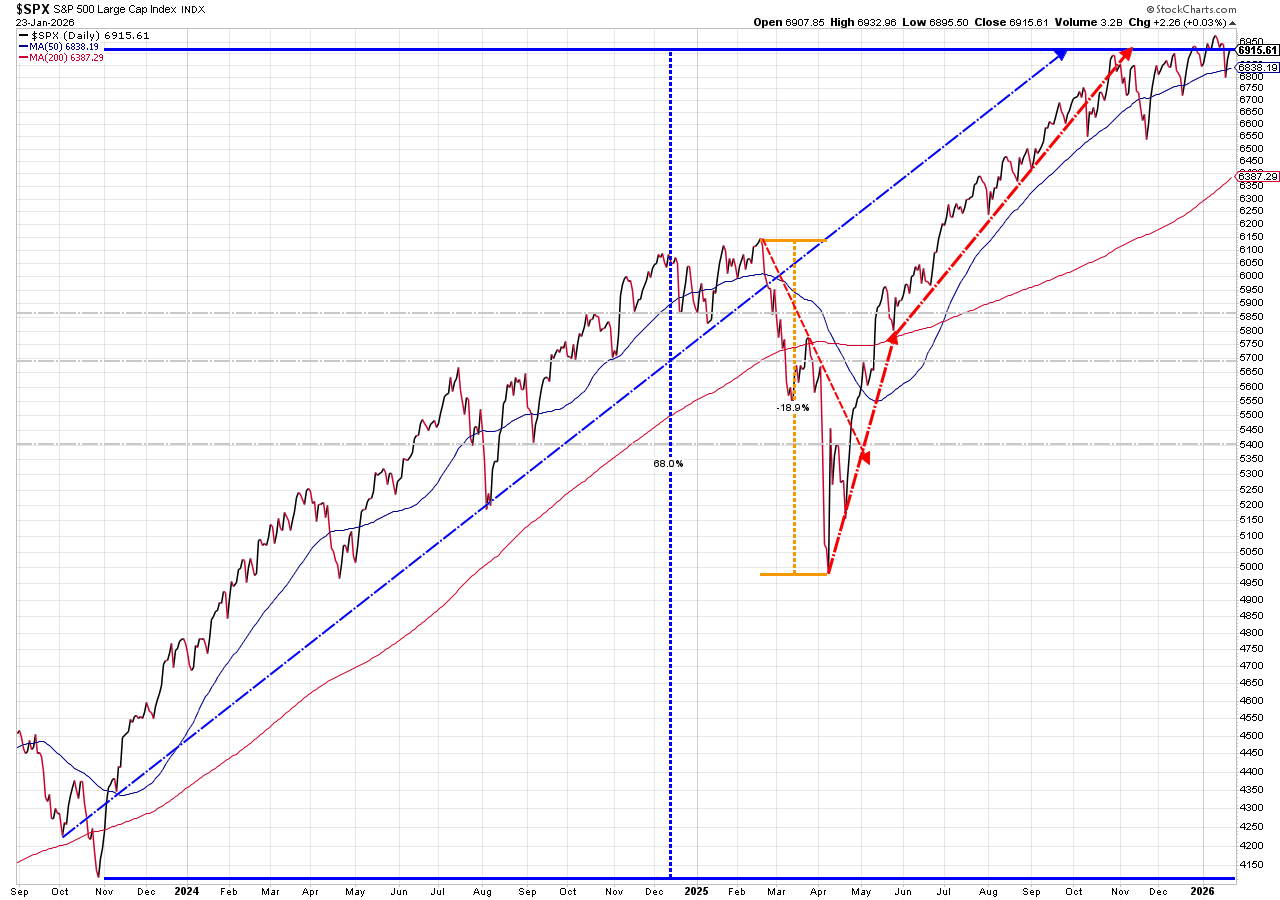

The S&P started the week on a down note, but quickly reversed. It just couldn't get enough momentum to close the week higher.

We're heading into another Fed meeting and the S&P 500 is back to where it was during the last two Fed meetings.

It may be lost in the rhetoric, but it is important to understand the Fed has been "easy" with their money. Since they announced they were done raising rates, the stock market has gone up 68% in a little over 3 years.

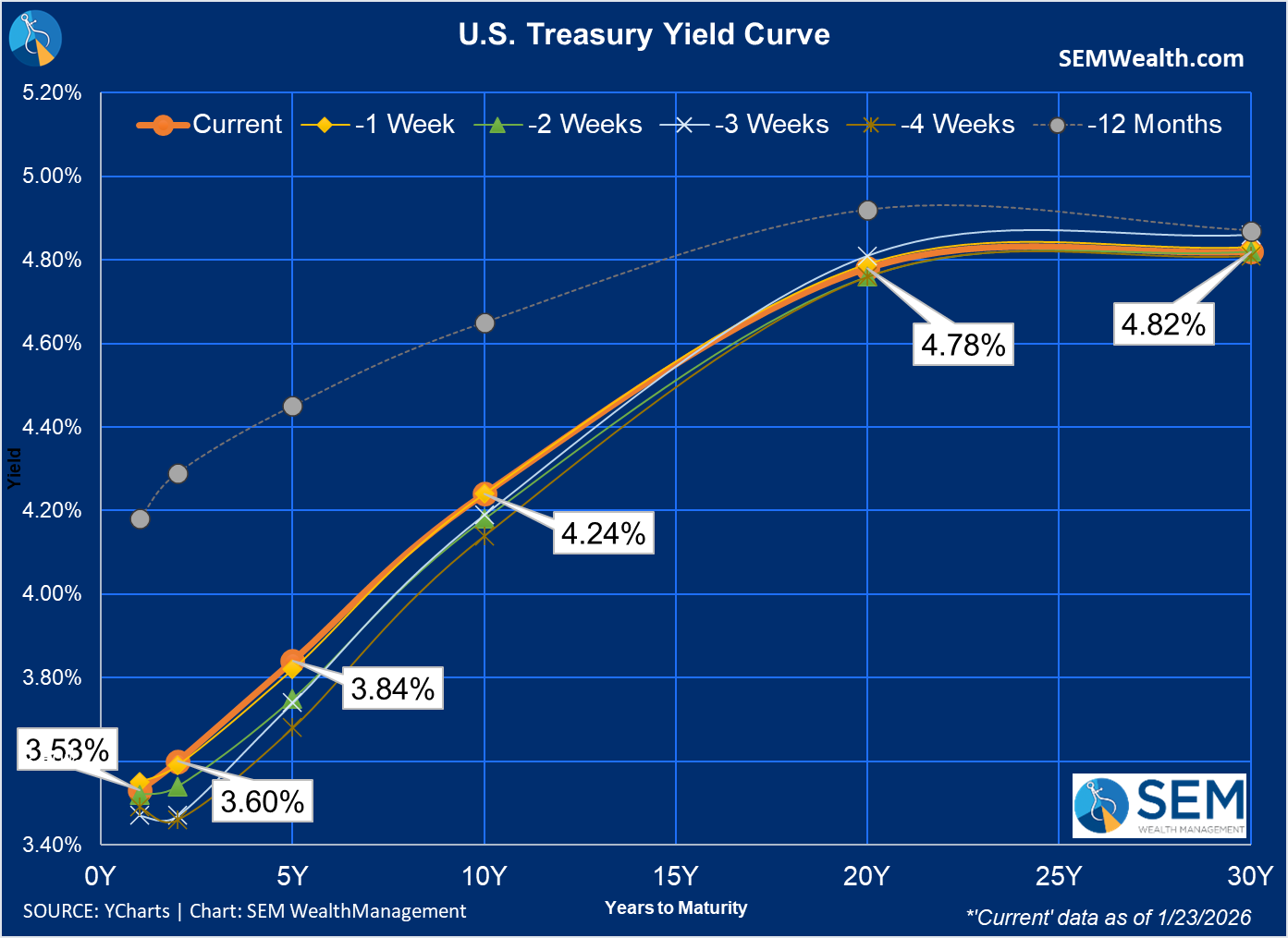

On the bond market side, interest rates were essentially unchanged for the week, but you can see from the chart below the shift higher in short-term rates over the last 3-4 weeks.

The 10-year yield spiked earlier in the week, but came back down. The chart is still a concern as it appears to be working on sustaining an up-trend in yields.

SEM Market Positioning

| Model Style | Current Stance | Notes |

|---|---|---|

| Tactical | 100% high yield | High-yield spreads holding, but trend is slowing-watching closely |

| Dynamic | Bearish | Economic model turned red June 30 '25' – leaning defensive |

| Strategic | Fully invested | Trend overlay shaved 10 % equity in April -- added back early July |

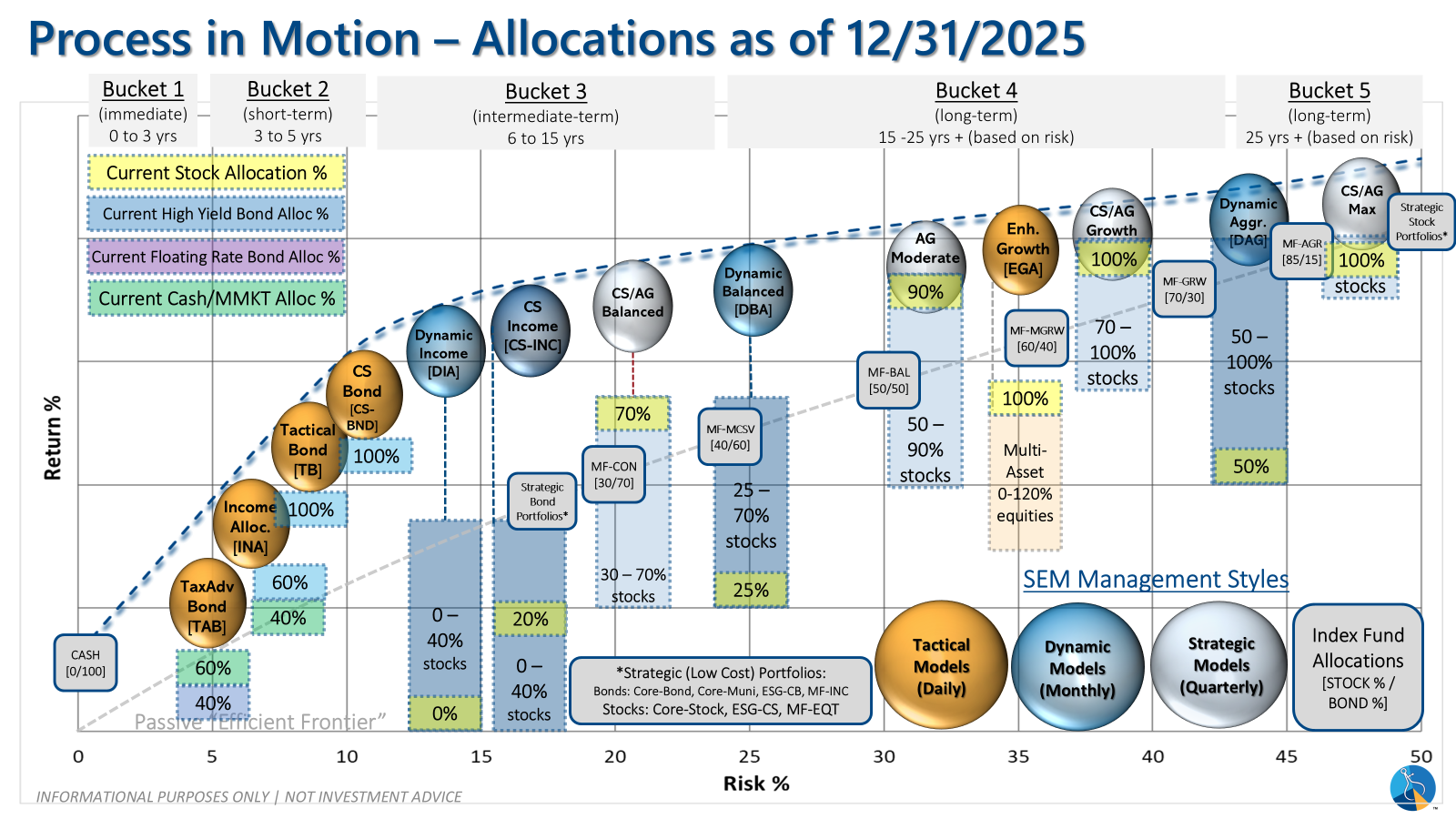

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

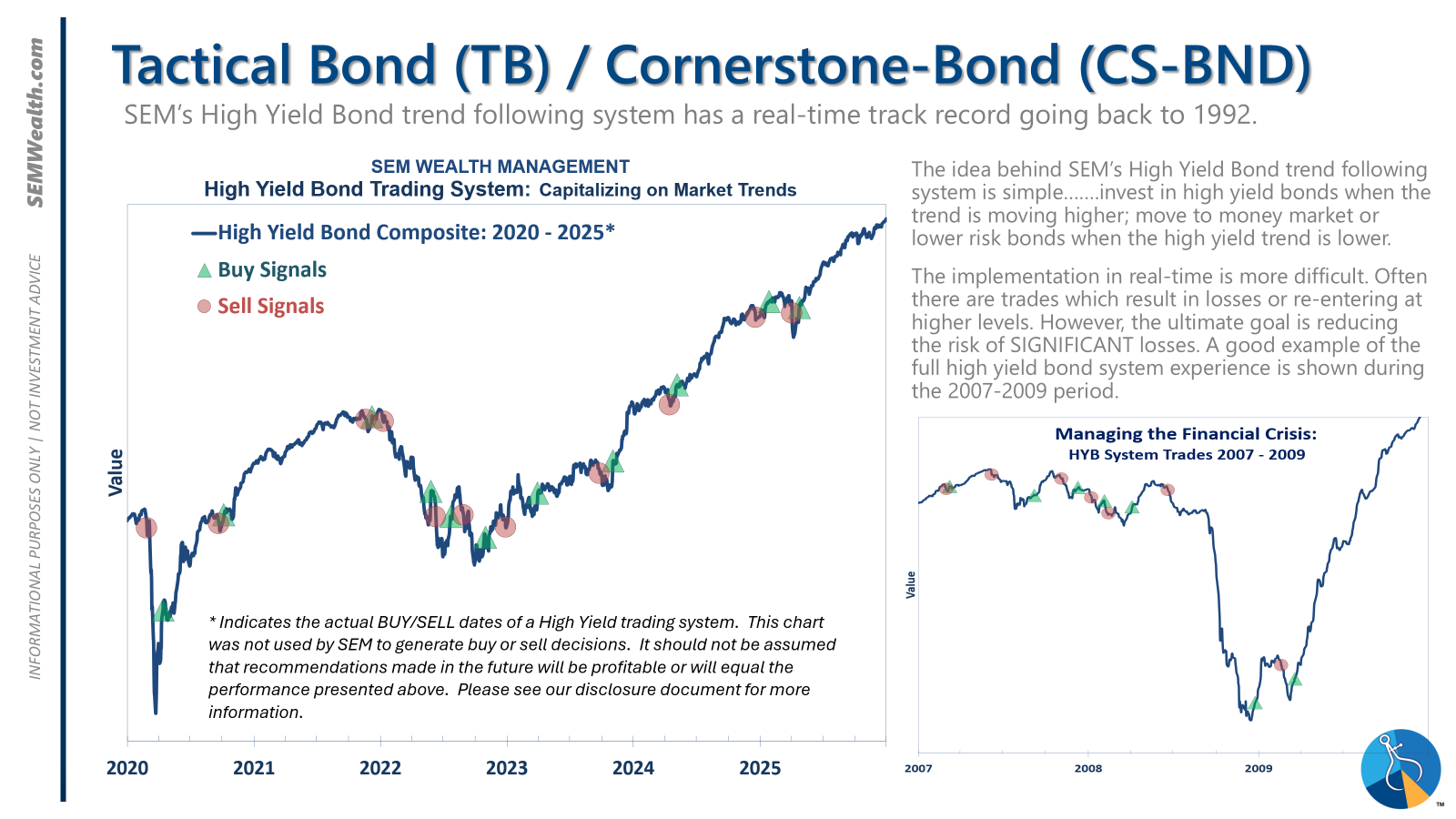

Tactical (daily): The high yield system has been invested since 4/23/25 after a short time out of the market following the sell signal on 4/3/25.

Dynamic (monthly): The economic model went 'bearish' in June 2025 after being 'neutral' for 11 months. This means eliminating risky assets – sell the 20% dividend stocks in Dynamic Income and the 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is 'bullish' meaning higher duration (Treasury Bond) investments for the bulk of the bonds.

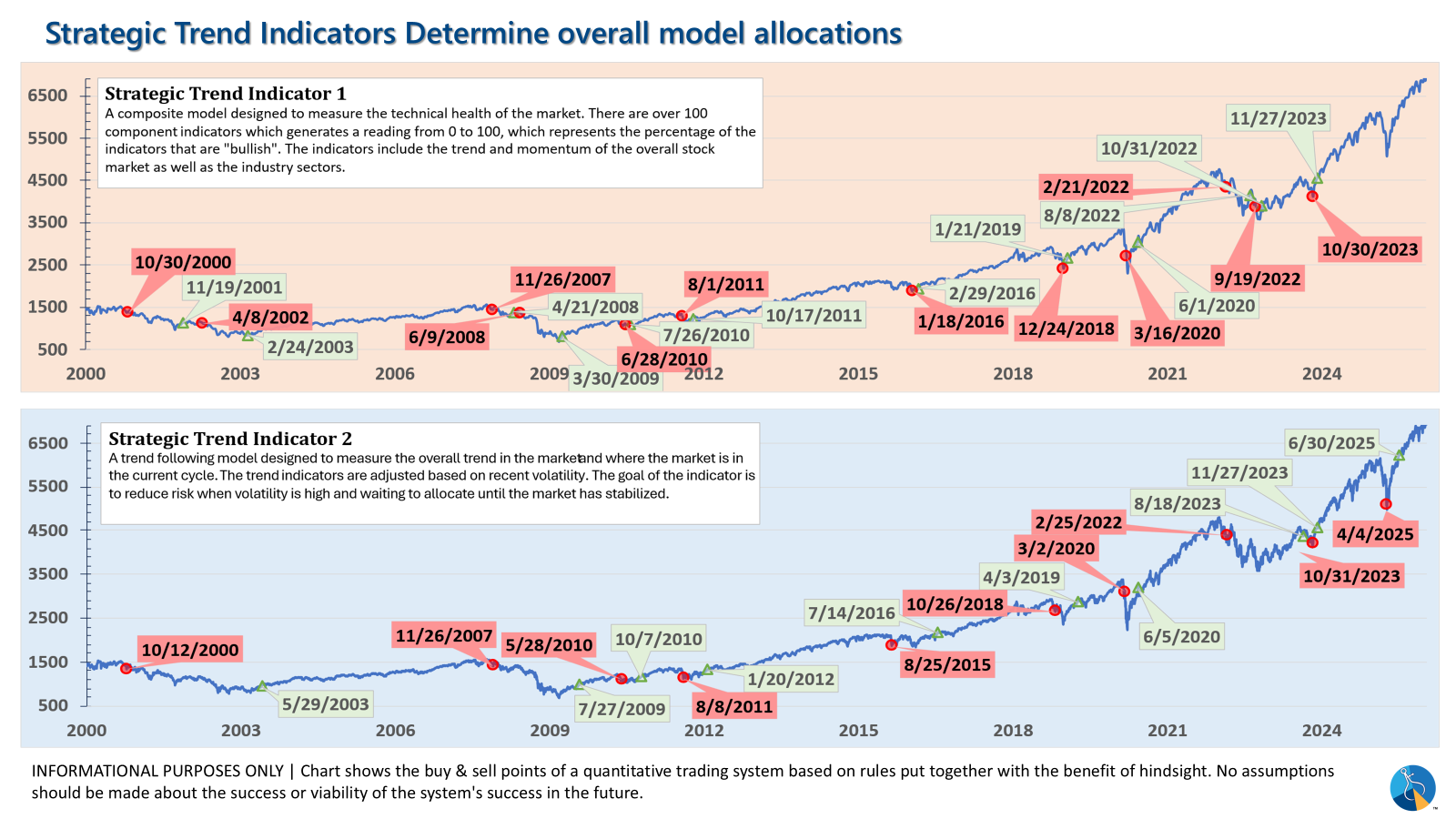

Strategic (quarterly)*: One Trend System sold on 4/4/2025; Re-entered on 6/30/2025

The core rotation is adjusted quarterly. This quarter we saw half of our international positions reduced (we sold developed markets and kept our emerging markets exposure). We also saw the remaining share of mid-cap reduced in favor of more small cap exposure. We remain with a "barbell" core portfolio – about half in large cap and half in small cap as the models expect the market to "broaden".

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire