Even before the Friday afternoon Oval Office theater, the stock market has been increasingly anxious about the long list of ideas being tossed around in DC. It is becoming especially difficult to separate politics from anything, but I will remind every reader regardless of your political leanings — DO NOT LET YOUR POLITICAL OPINIONS INFLUENCE YOUR INVESTMENT DECISIONS.

I've also heard a few Wall Street strategists say something which also is my goal in this blog – we are talking about POLICIES, not POLITICS here. Every administration and Congress has "good" and "bad" policies when it comes to the investment markets. We also need to understand the difference between short-term and long-term impacts. I do my best to use my 25+ years of experience managing money, extensive research, and all the reports which cross my inbox to focus only on the impact POLICIES have.

Every American is entitled to their political opinions and to support whichever party they believe best represents them. The greatest part about our country is if we don't like the way things are heading we can choose a new Congress in less than 2 years. We also have plenty of checks and balances in place which prevents one branch of government from having too much power.

With that said, let's take a deep breath and focus on why the stock market has developed so much anxiety.

Reasons for Anxiety

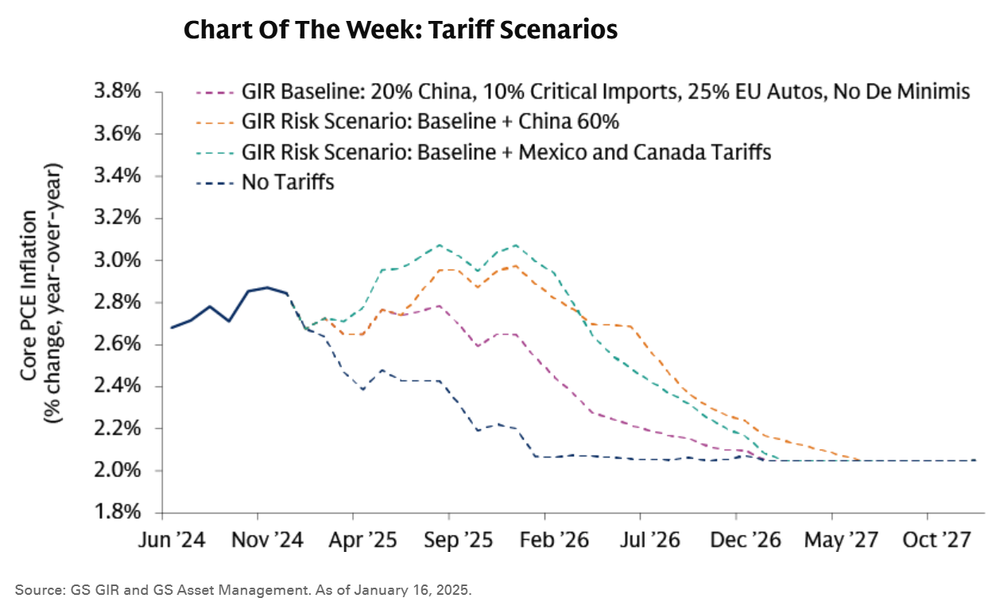

1.) Trade War / Tariffs

This is obviously front and center and something we have talked about since the beginning of the year. Late last week stocks moved to the lowest levels since Inauguration Day when the President announced the "delayed" 25% tariffs on Canada and Mexico would begin this Thursday. He also announced an "additional" 10% tariff on all Chinese goods. I posted this chart from Goldman Sachs a few weeks ago with their assessment on how much inflation would increase under a few different scenarios. Right now it looks like we are looking at either the aqua or orange colored lines:

What we still do not know (reason for anxiety):

a.) Extent of tariffs

b.) Timing of tariffs

c.) Size of tariffs

What this means is with each Truth Social post, ad hoc press comments, or any other "news" is the markets will jump around as we learn more about a, b, and c.

2.) Federal Workforce Shake-up

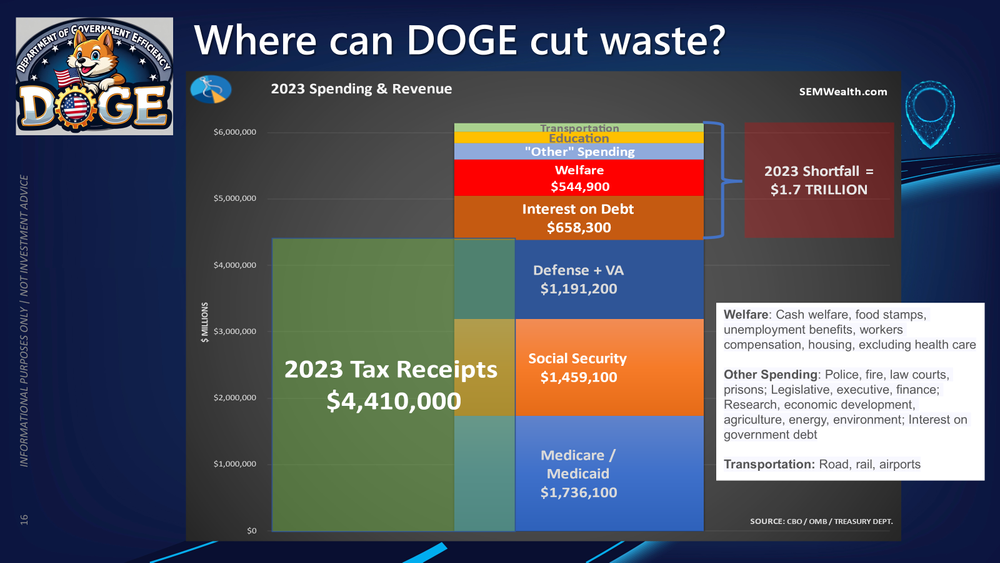

The Department of Government Efficiency (DOGE) is certainly generating the most headlines. Don't get me wrong, I've railed against government spending nearly my entire career going back to the second Bush administration (Republicans used to PAY DOWN the debt during expansions and only use deficits during recessions. That hasn't happened since the last half of Bill Clinton's administration.)

I've shared this chart often. We could cut the following DEPARTMENTS (all employees and expenses) and STILL run a Deficit of nearly $700 billion dollars:

- Welfare (all of it)

- Education

- Transportation

- Agriculture

- Energy

- Environmental Protection Agency

- Justice (federal police & fire (including forestry), prisons, courts, FBI)

- Legislative Branch (Congressional salaries and ALL staff)

- Executive Branch (ALL STAFF and expenses, including weekend trips to Florida (or wherever the current president likes to go to relax)

- International Aid

- Research

This is the "waste" so often criticized, but what both parties continue to ignore is the only way to actually work on our debt is to completely reform Social Security, Medicare, and the Department of Defense.

That's not happening, so we get the sideshow of DOGE making bold chainsaw cuts and then have Democrats criticize President Trump's spending on golf outings. NONE OF IT MATTERS in the whole scheme of things!

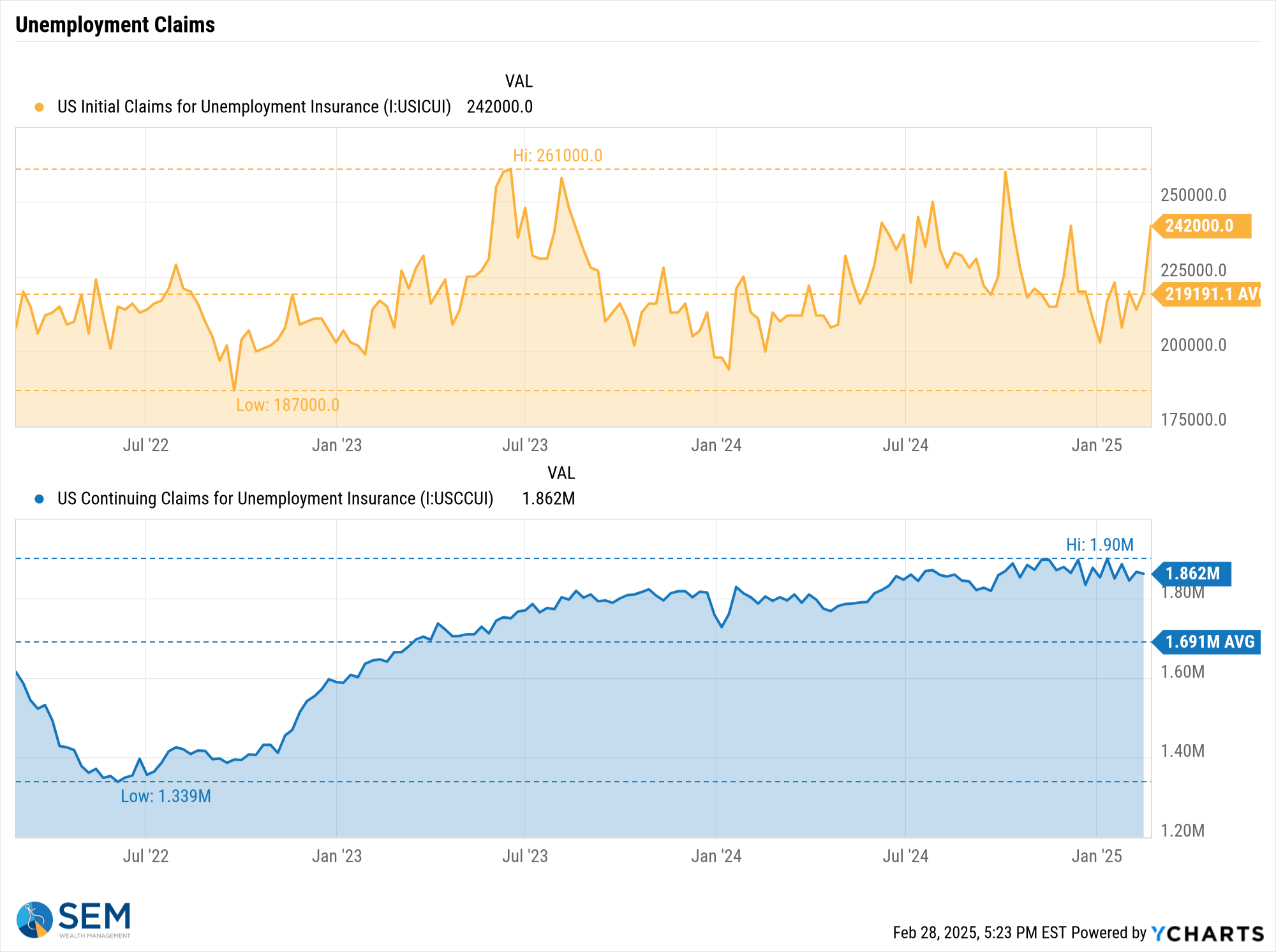

It doesn't matter if it matters, it's happening. We are already seeing it hit the labor market. Look at the spike last week in initial jobless claims.

What we still do not know (reason for anxiety)

a.) How much will employees will tighten their spending over fear of losing their job?

b.) Drop in efficiency of government services

c.) The impact on state and local governments (which are a much bigger percentage of total payrolls than federal workers, but also who receive billions in federal subsidies from the various departments)

As a small government advocate it's hard to write some of this, but these cuts will impact things such as getting help from the Social Security administration, make the pain of getting any sort of help from the VA even greater, and any other services that are already not efficient even less so.

3.) Government Shutdown on March 14

In December, Congress did what they did best – kick the can down the road. They passed an emergency spending bill to fund the government through March 14. March 14 is Friday so we will have some sort of resolution hopefully this week. Democrats have threatened to block any sort of resolution meaning Republicans will all have to be 100% on the same page (actually they can lose 1 or 2 votes in each chamber).

What we still don't know (reason for anxiety)

a.) Will Congress come together for the greater good, or play a political game of chicken?

b.) Can we get more than a couple of months' of funding so we don't have to deal with this again?

4.) Debt Ceiling and Tax Cuts

Each administration going back to George W. Bush has asked for an extension of the debt ceiling. Each time the opposite party criticizes the other for lack of fiscal constraint. Republicans blame Democrats for "wasteful spending" and Democrats blame Republicans for "handouts to the rich" via lower taxes.

Right now, the Trump administration is attempting to get a $4 Trillion extension of the debt ceiling (which ironically is probably not enough to cover the estimated bill of the planned tax cuts). At the same time the President has challenged Congress to not only extend the 2017 tax cuts but to expand them with multiple campaign promises he made, including making them PERMANENT (which is a heft dollar amount to fund).

What we still do not know (reasons for anxiety)

a.) Can we get 'one beautiful bill', which is what the market is expecting?

b.) How long will it take to get all of this passed?

c.) What are the ramifications if the tax cuts are split into multiple bills?

5.) Stagflation

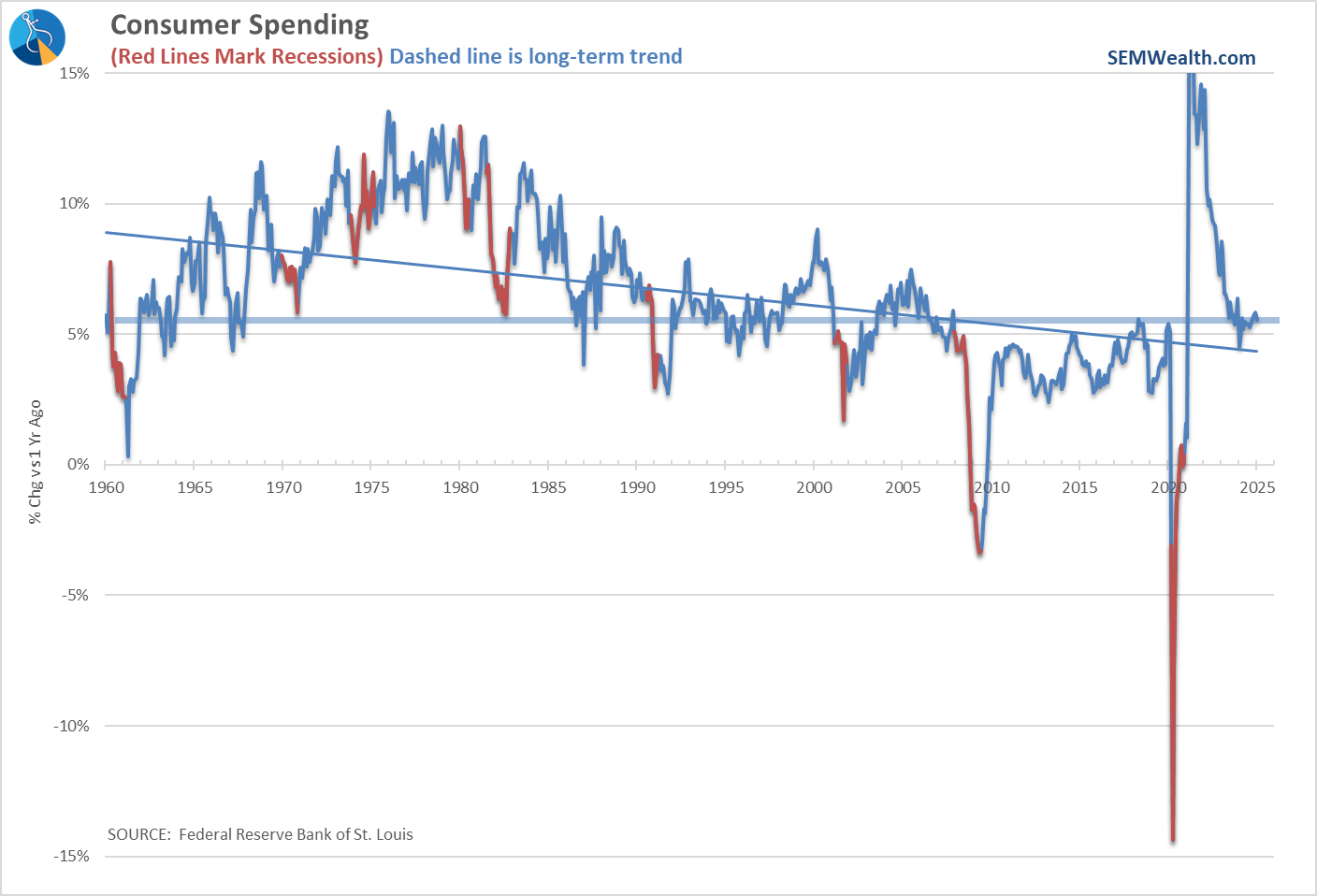

Last Monday near the end of the blog I mentioned a slightly increasing concern about stagflation – rising inflation combined with falling economic growth. Last week the economic data was not as negative as the prior week, but it still wasn't great. First off, consumer spending fell on a month-to-month basis in January for just the 4th time since 2022. Consumers have been the one thing holding up the economy the last 5 years.

On a year-over-year basis, spending is still up over 5%, so it's nothing that we are concerned about just yet, but Consumer Sentiment continued to decline in February, so we could see further tightening.

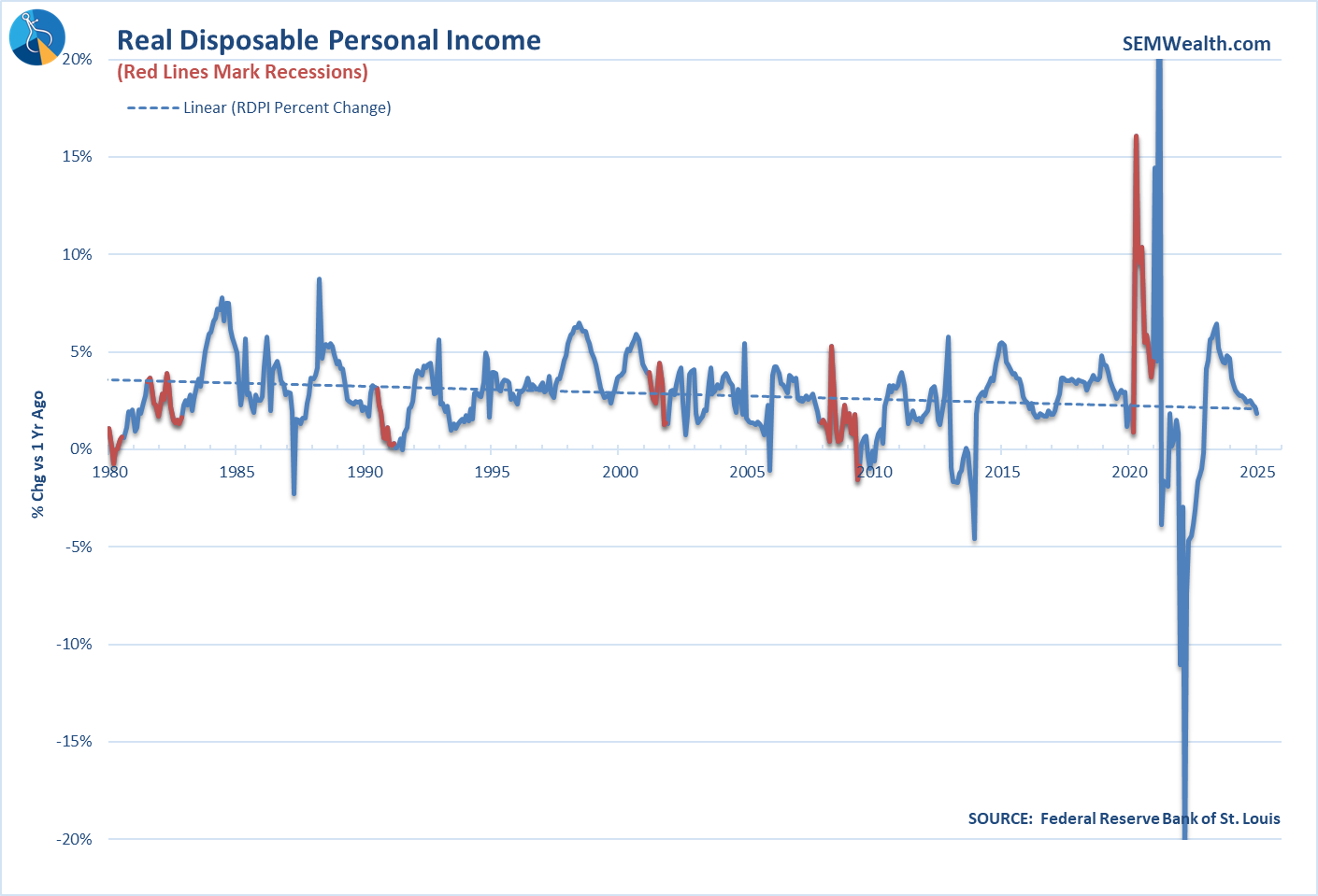

The bigger concern comes from Personal Income, which grew less than 2% year-over-year through January. Lower consumer sentiment, lower income growth, and increased anxiety are not recipes for stronger spending.

Adding to the anxiety is inflation. Regardless of the reasons, prices are not moving in the way most voters thought they would. We obviously need to give policies time to percolate through the economy, but current trends and proposed policies do not seem to be ones which would cause inflation to slow.

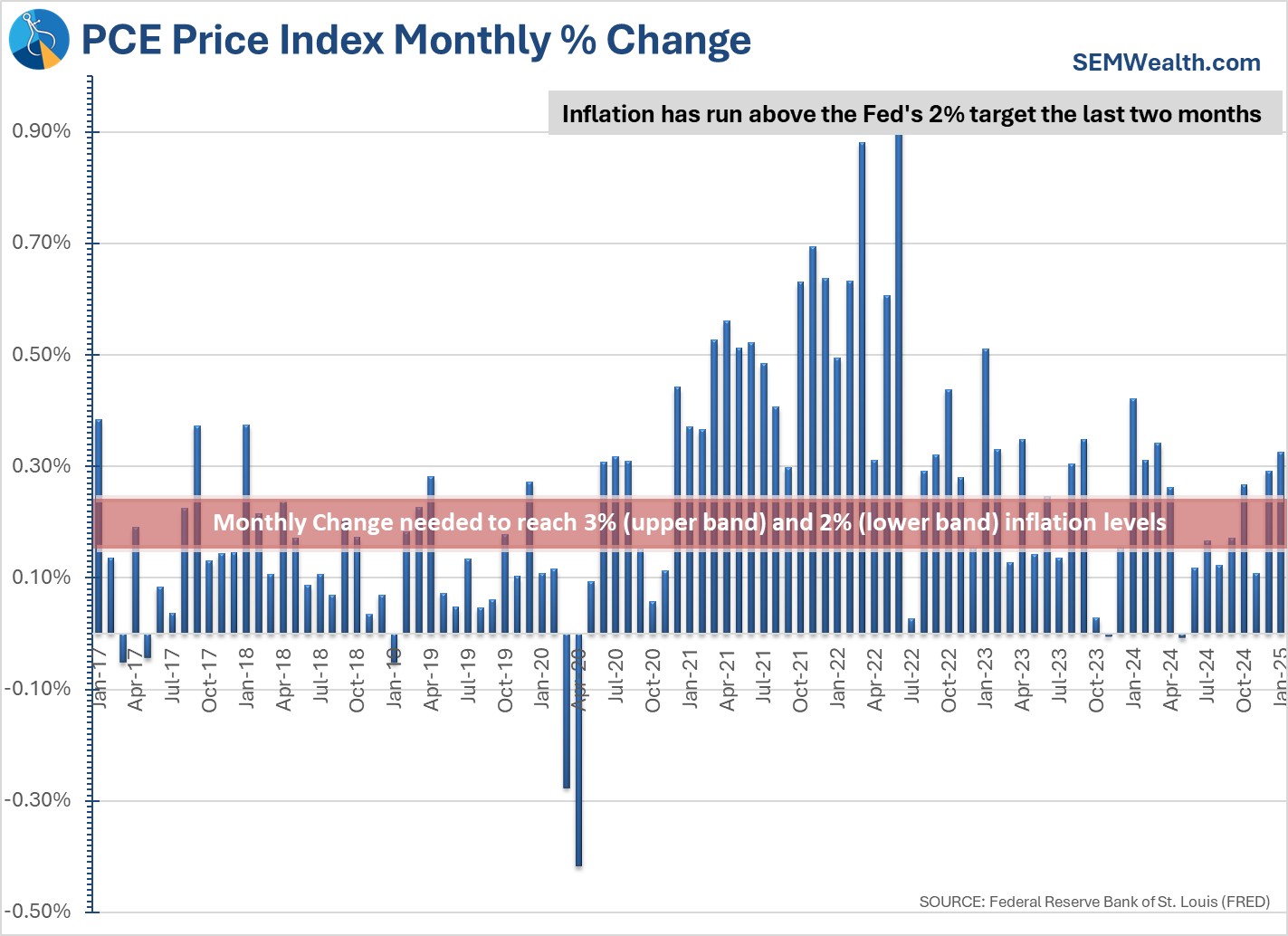

I like to use this chart to look at the month-to-month changes in inflation and how it relates to the Fed's 2% target as well as the 3% level which I believe is more likely going to be our new long-term average. For the 2nd month in a row, inflation is not only above the 2% level, but running above 3%.

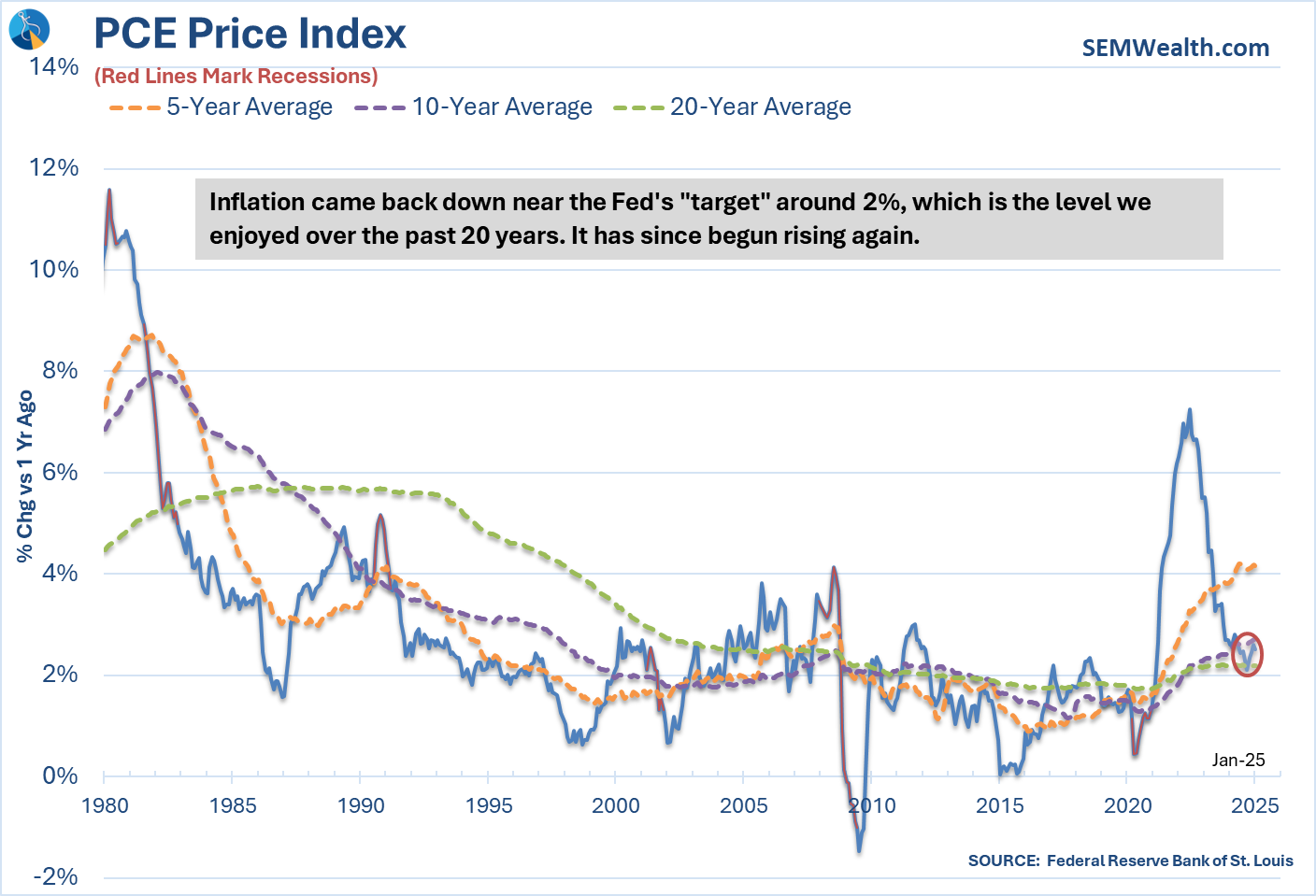

I like to use this chart to keep things in perspective as it shows the various AVERAGE inflation levels over time. Note the blue line (1-year inflation) has been rising since the Fed started cutting rates in the 2nd half of 2024 (coincidence? I think not).

What we still do not know (reason for anxiety)

a.) Will any of the reasons for anxiety listed above cause inflation to spike and/or growth to slow?

b.) How much more can consumers spend to prop up the economy?

c.) What happens if inflation continues to rise?

d.) Will the Fed be more focused on stimulating growth or fighting inflation?

6.) Geopolitical Conflicts

I know the President speaks in hyperbole, but saying Ukraine is risking World War III, it is certainly something SOME people are concerned about. On the one hand, supporting Russia (by removing any support of Ukraine) could mean a quick end to the Ukraine-Russia conflict and remove some anxiety. On the other hand, will it embolden Russia or other countries to take what they believe is rightfully theirs? What happens if Ukraine doesn't back down and Russia decides to go after other former Soviet states? How does Europe react? Having the 3rd largest economy in the world involved in a growing, regional conflict is certainly not good for economic growth.

I write all of this to outline what the markets are concerned about. As a reminder, the reason SEM follows a quantitative, data-driven approach is we do not have to react to the headlines. The volatility has been noticed by our models, but nothing has yet triggered. All of this could resolve favorably or it could deteriorate quickly.

Either way, we will be ready. No emotion. No politics. No opinion. That's the only way to handle this market right now.

Market Charts

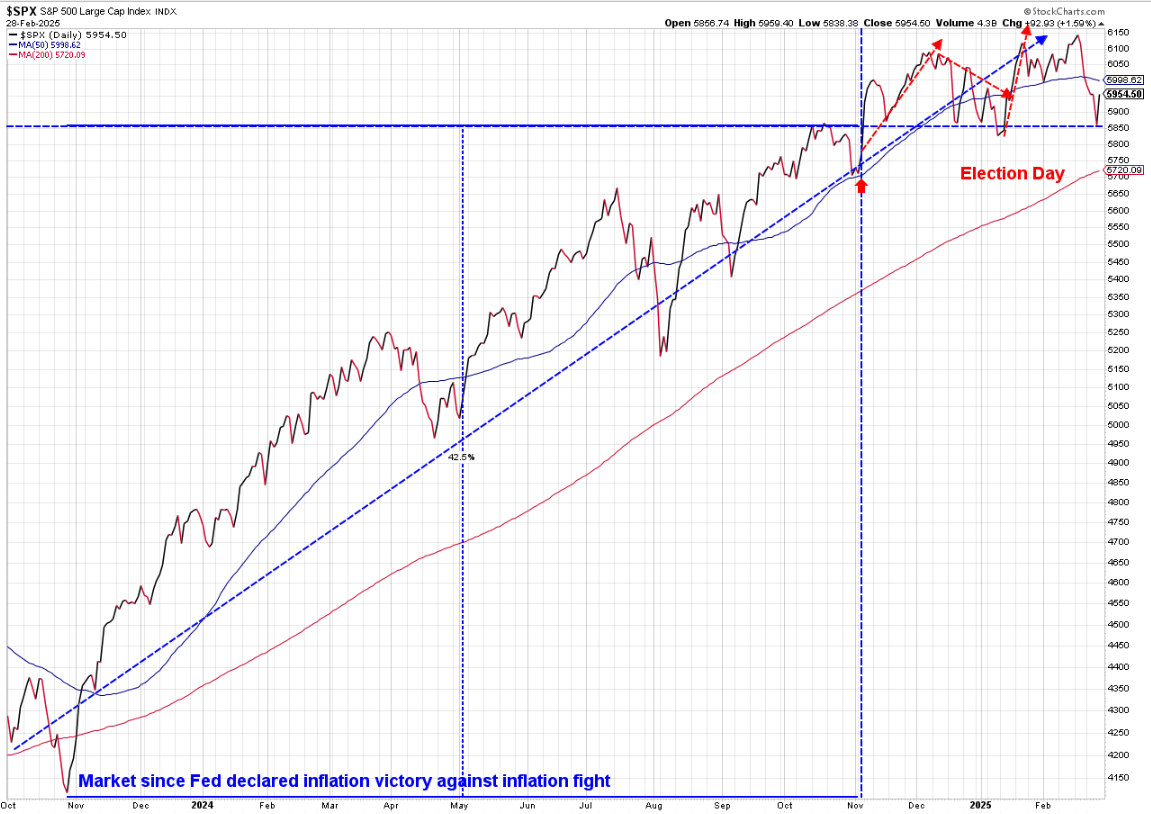

Since February 20 the anxiety has certainly been heating up. Look at the daily range of the S&P 500 in the orange box below.

Stocks Friday briefly hit the lowest point since Inauguration Day following whatever you want to call the Oval Office meeting with Ukraine's President. Stocks did recover to end the day/week/month, but the market remains below the now declining 50-day moving average, which could be an early sign the short-term trend is reversing.

Zooming out, the post-election day market now looks to have gone from an up-trend to a "consolidation" trend. Consolidations typically end with a resumption to the prior trend, but this isn't the usual market right now.

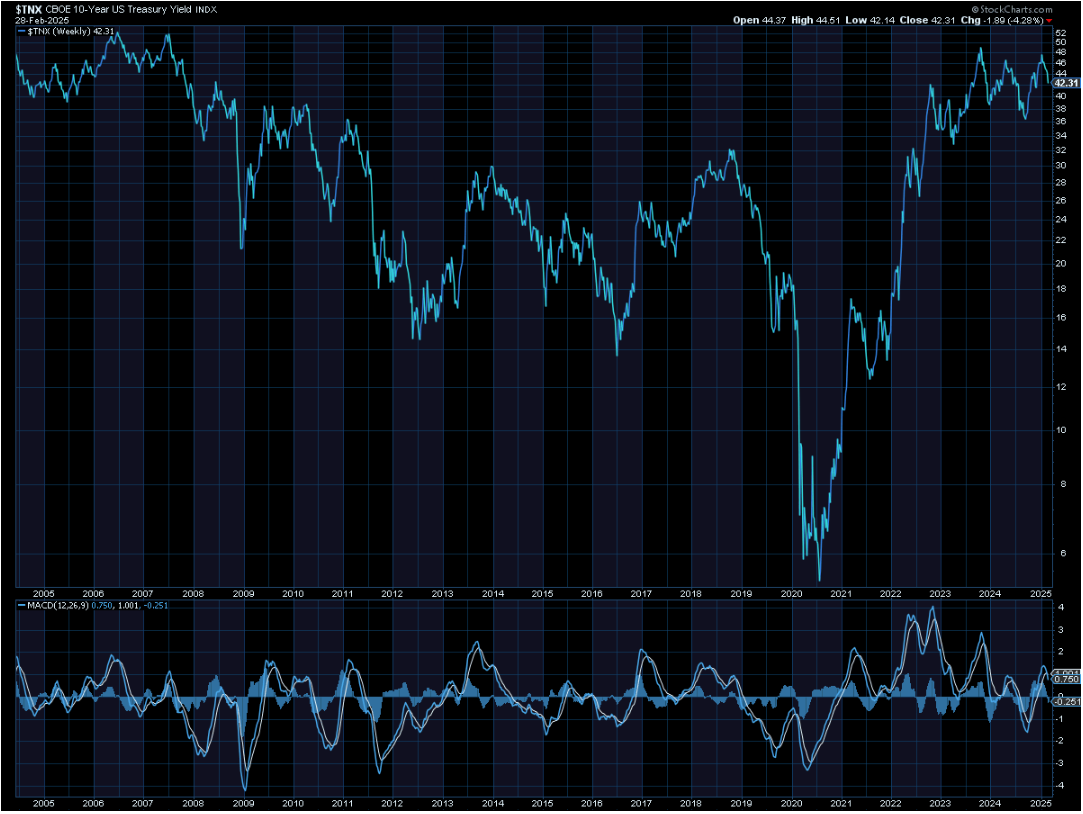

Speaking of consolidation, the longer-term weekly chart of Treasury Yields look to be in a consolidation period going all the way back to mid-2023. While the recent anxiety out of DC has caused yields to drop quickly the last few weeks, the prior trend was up, so the most likely resumption would be for yields to move higher once this phase is over.

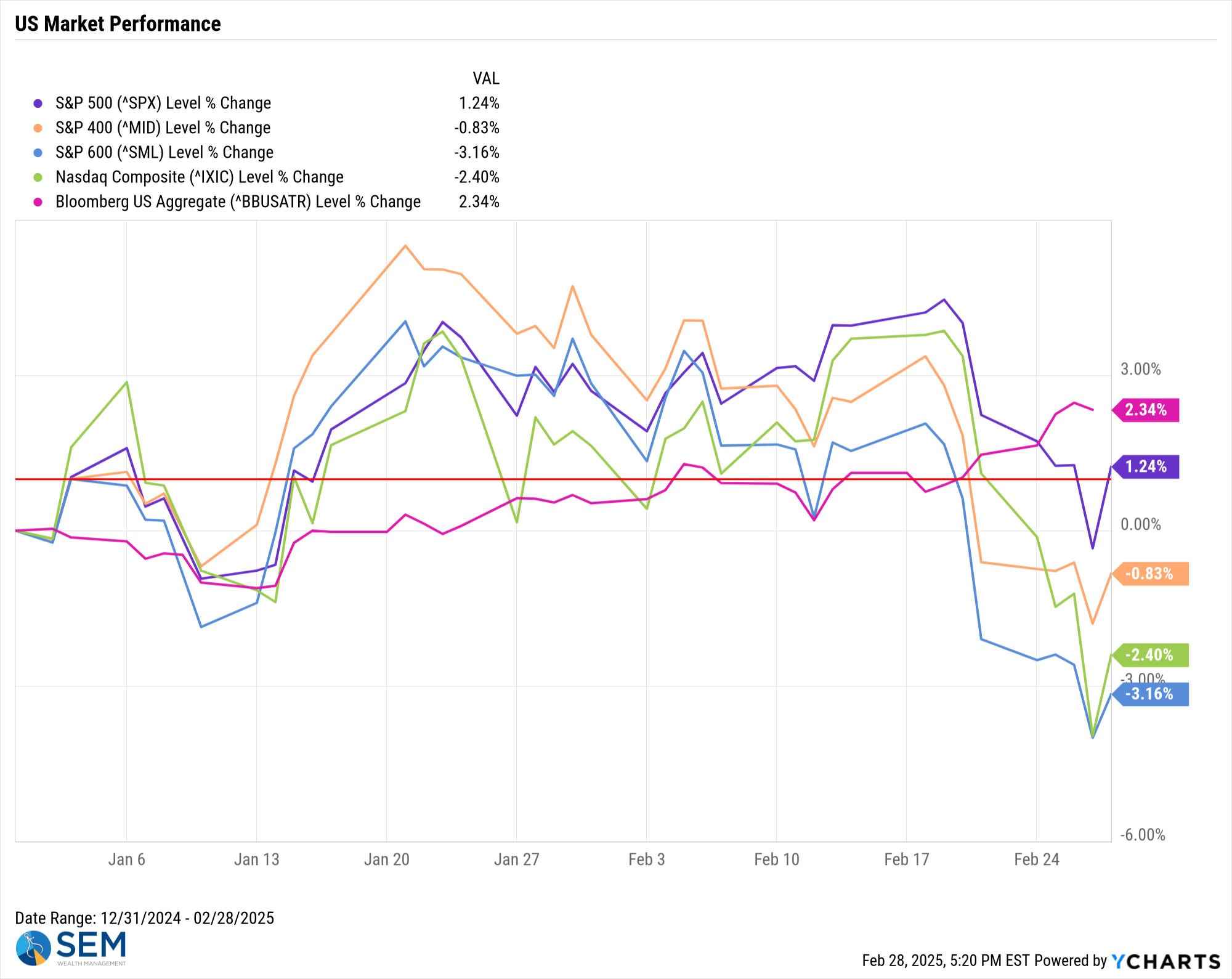

Looking at the markets overall, bonds have taken the lead on the year-to-date performance chart, with the rally on Friday moving the S&P 500 back into positive territory. The "broadening" rally of January has clearly ended with small and mid-cap stocks suffering the most over the past week.

The bond market does not appear to share the same anxiety as the stock market. Corporate Bond spreads, which usually spike when the markets are concerned about growth remain near all-time lows.

SEM Model Positioning

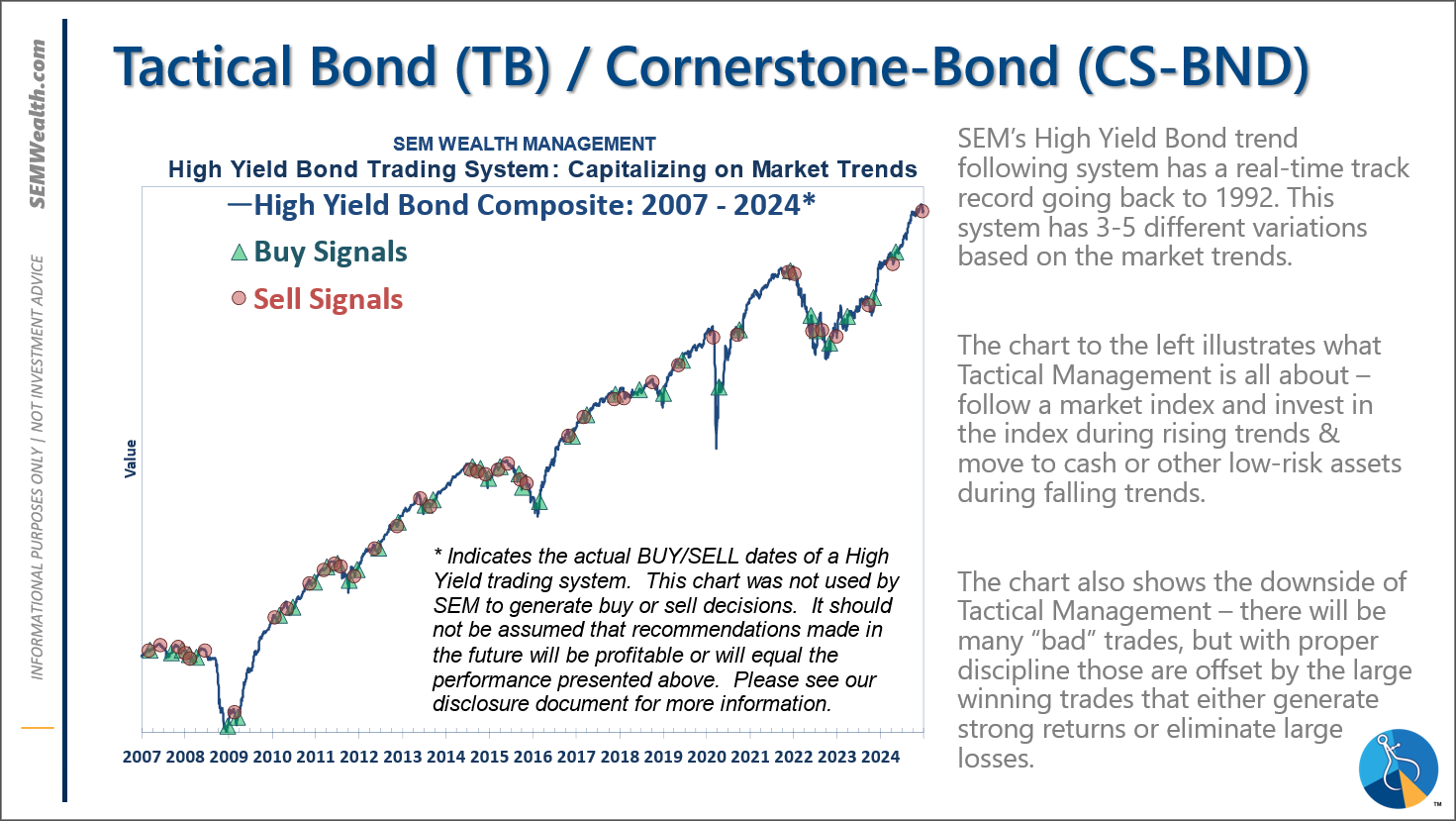

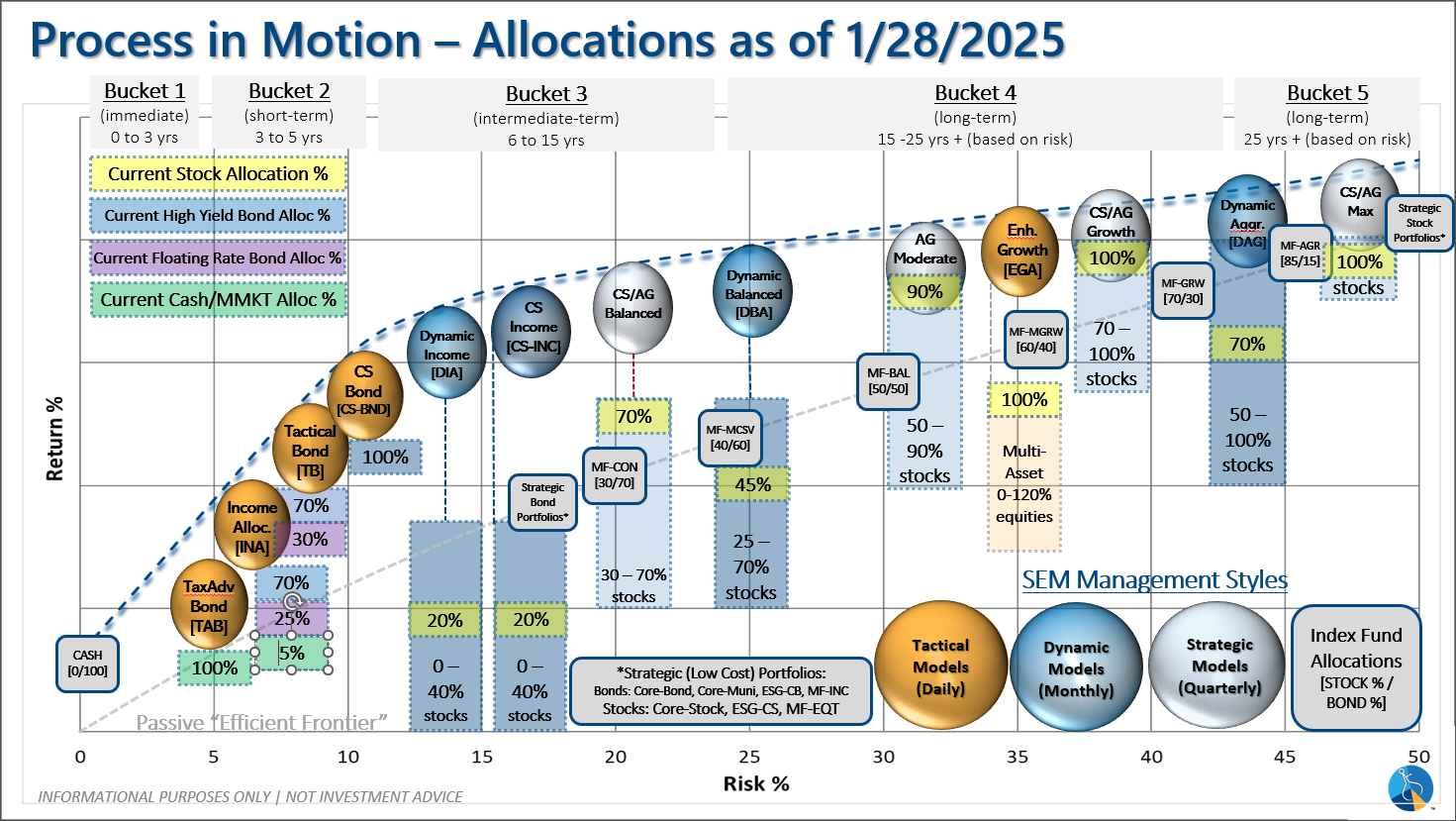

-Tactical High Yield reentered the high yield bond market on 1/27/25 after about 5 weeks on the sidelines. We had added a 30% position in floating rate bonds on 12/6/24, which currently have a 9% yield compared to a 6% yield in high yields and 4.6% in money markets.

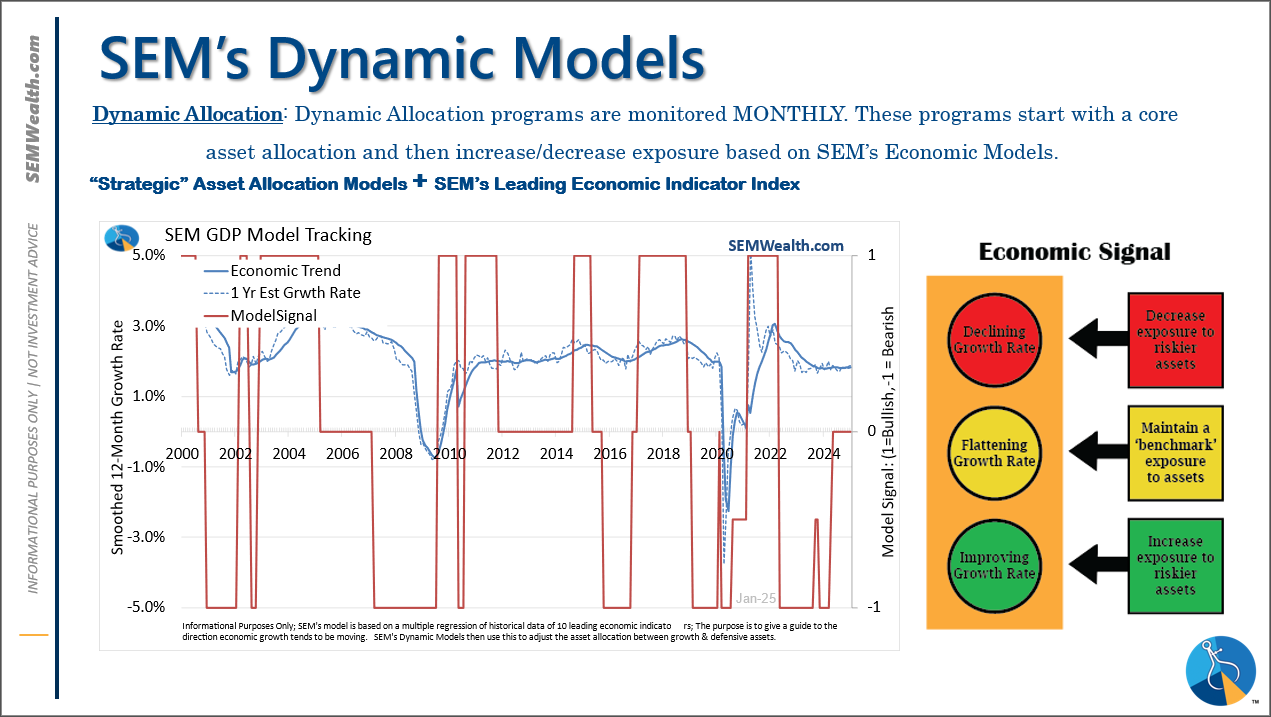

-Dynamic Models are 'neutral' as of 6/7/24, reversing the half 'bearish' signal from 5/3/2024. 7/8/24 - interest rate model flipped from partially bearish to partially bullish (lower long-term rates).

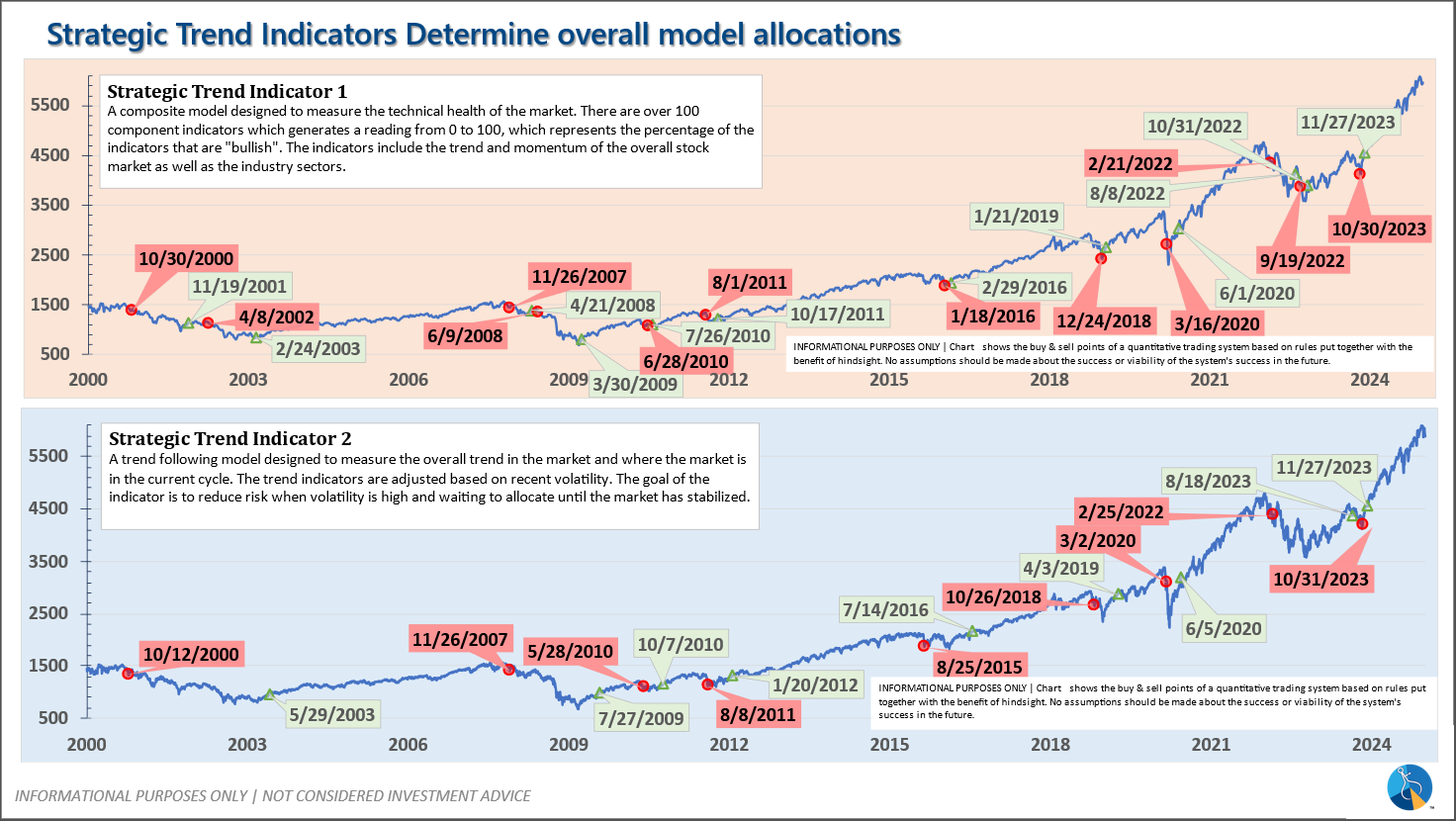

-Strategic Trend Models went on a buy 11/27/2023; 7/8/24 – small and mid-cap positions eliminated with latest Core Rotation System update – money shifted to Large Cap Value (Dividend Growth) & International Funds

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): On 12/20/2024 our tactical high yield model sold out of high yield bond (about 70% of our holdings) into money market. The other 30% is invested in shorter duration, higher yielding floating rate bonds. These instruments are not as sensitive to credit risk and are typically allocated to in the early and late stages of a high yield bond move in our model.

Dynamic (monthly): The economic model was 'neutral' since February. In early May the model moved slightly negative, but reversed back to 'neutral' in June. This means 'benchmark' positions – 20% dividend stocks in Dynamic Income and 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is slightly 'bullish'.

Strategic (quarterly)*

: BOTH Trend Systems reversed back to a buy on 11/27/2023

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Questions or comments - drop us a note?

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire