I'm currently at the Kingdom Advisor Conference and just finished a 3 hour session on Faith Based Investing. I'll be sharing more of what I've learned in the weeks ahead. The speakers this morning all highlighted the myth many people have about any Socially Responsible Investments (SRI) -- you have to sacrifice returns. I'll be the first to admit I shared the same belief without ever digging too deep into the data. As Cody mentioned a few weeks back (see Investing with Your Heart) when we did our own research we were surprised to see a diversified Biblically Responsible Portfolio historically has met or exceeded the returns of a "secular" diversified portfolio.

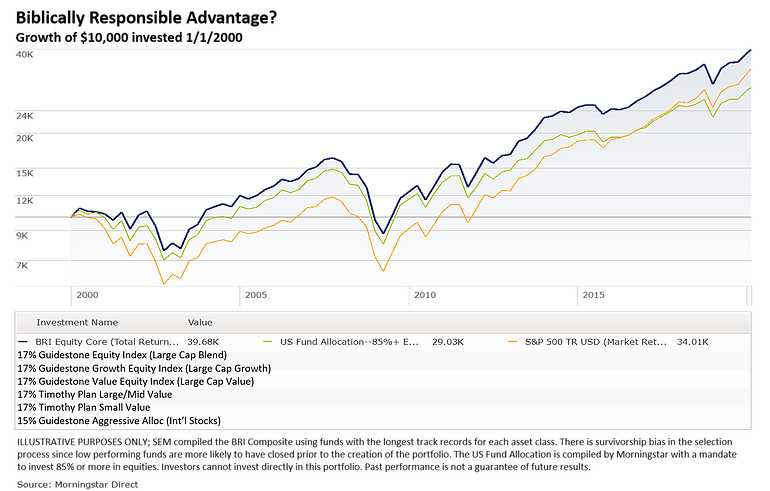

I was actually surprised how many "faith based" funds had been around for two decades or more as we started to dig into it further. I also was pleasantly surprised that going back to at least 2000 you could fill out all the important asset classes. Our preliminary portfolio was quite simple -- create a portfolio with an "all world" mandate and see how it compares to an equivalent index. Here is what we found:

There are two key takeaways from this:

- There is clearly some sort of value to having a Biblically Responsible approach. One of them is likely due to the focus on STAKEHOLDER values that most BRI portfolios screen for. There is a great deal of overlap between "BRI" and "SRI" investing. The common thread of "doing good" tends to lead to better long-term performance for those companies.

- Until 2013ish, the diversified BRI or even the Morningstar US Aggressive Allocation index had a clear advantage over the S&P 500. Since that time, diversification has hurt. That won't always be the case and is one reason we are weary of the current market environment where two stocks (Microsoft and Apple) represent 10% of the S&P 500 and 5 stocks represent nearly 20% of it.

This is obviously a new approach for SEM, but one that is something I am quite passionate about. Brandi and I just celebrated our 19th wedding anniversary, which is also the 19th anniversary of when we got right with God and became Christians. Everything we have is because of God and we are both passionate about finding ways to glorify his Kingdom with our business. We of course instilled this in our children which makes us excited to have so many of them joining SEM to help take us to the next level.

Those of you who have heard me speak at all the last 15 years have probably heard my strong belief about why so many people feel left behind. The stock market does not seem to match the economic realities of a vast majority of Americans. I strongly believe it is because of the shift in the 1990s from maximizing STAKEHOLDER value to maximizing SHAREHOLDER value. Our screens so far have shown the stock market tends to reward companies over the long-term who focus on the STAKEHOLDERS.

I've always been a believer of being a good steward of our God-given assets. We are quite excited about our new Cornerstone Models at SEM where we take the advantage of a BRI screen and apply the key driver of SEM's success all of these years -- a focus on the risk/return potential in the current market environment. I've always said a passive buy & hold strategy is "lazy". If we have the ability to side-step some of the inevitable large losses in the stock market, to avoid being sucked into the "greedy" stage near the end of a bull market, and not give up too much of the upside return, we should do so. The benefit of course is it helps all of us, from money managers, to financial advisors, to end clients avoid being subject to the natural emotions that occur at both the euphoric tops in the market and the frightening drop that always follows.

If you'd like to learn more about how Cornerstone works, we've started piecing together a portion of our website here. As I digest all of the information from the Kingdom Advisors conference we'll be adding a lot more materials, graphics, videos, etc to help you show your clients the value of a Biblically Responsible Approach.