The market has been in a free fall this week. While I watch CNBC and Bloomberg on alternating days in the office, at home we watch the local news in the mornings. It is typically filled with weather, traffic, reports on happenings in the Richmond area, and some "feel good" stories. When the drop in the stock markets makes it into the local news reports I know emotions are starting to run high. The rapidly increasing number of direct messages on Facebook are also a good indication.

First off, I'm not a medical expert. I do have contacts who are in the medical and biotech fields who have given me some valuable insights on the Coronavirus. The spike in cases we are seeing is typical and expected. Their viewpoint is we could see this continue through late March or early April at which point we should see a fall-off in the number of cases. This is likely a seasonal virus. The real concern will be what happens next winter if a vaccine has not been found to eradicate the virus as it lays dormant around the world. Based on what we've seen with SARS, MERS, and other similar viruses, my money would be on the medical experts coming together and figuring this one out. They just need a little time.

I could be wrong and certainly would not blame people for taking proper precautions, but it is far too early to be overreacting to this latest pandemic. Heart disease is the number one killer of Americans, yet nobody seems to be rushing to eat better and exercise more. Yes it can get worse, but we need to keep this in perspective and trust the scientists.

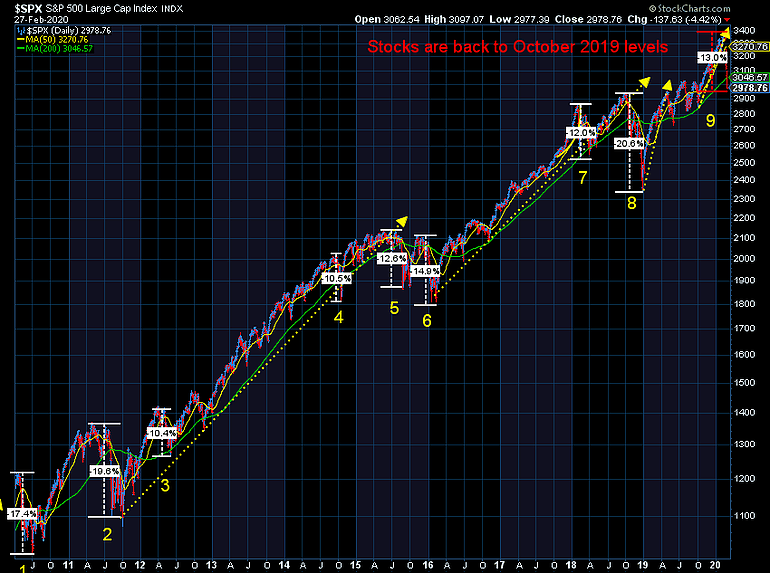

Regardless of the cause of the drop, investors also need a little perspective on the drop in the market. As humans we think in terms of dollars (or points on the Dow), not in percents. We also tend to believe any number we saw in our investment portfolios is ours so thus any drop in that number is a loss. So if somebody logged in on February 18 to their 401k and saw a value of $500,000 and today see $460,000 they believe they lost $40,000. Most of us forget that back in October that same account may have been worth $415,000 and a year ago it was probably $368,000. Rather than celebrating the fact they are far ahead of where they were 5-12 months ago, we are humans and FEEL the loss. This can create emotions that often cause us to make less than rational decisions.

The last time we saw this kind of panic in the markets was in December 2018. At that time I posted a couple of videos to walk you through the highly subjective (and full of emotional biases) way stocks are valued. If you want to know how the market works, check out the Finance 351 post here.

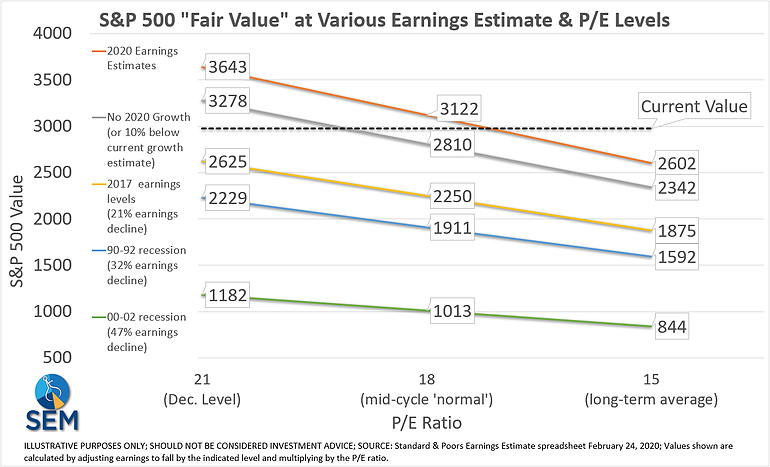

I updated one of the charts from that video series below. Keep in mind the "value" of the stock market is essentially a combination of what people believe companies will earn in the future and a multiplier of those earnings to account for risks and future growth. The problem is nobody knows what earnings will be in the future. At the beginning of 2019 the consensus view for S&P 500 earnings was $171.74. So far it looks like the actual number is $155.84 (or 10% off the mark.) The reason stocks went up was because investors decided rather than paying 15 times earnings as they were at the start of 2019, they ended up paying 21 times earnings.

The reason they were willing to pay money for LOWER earnings is they believe the uncertainty of the tariffs was behind them and 2020 would bring significant growth.

Now we are facing the opposite scenario. Not only are 2020 earnings expectations possibly too high, but the uncertainty of the Coronavirus and the impact on the worldwide economy is causing investors to re-think paying a multiple of 21 for those earnings. That's the problem with "fundamental" analysis. Normal behavioral biases cause over-optimistic expectations for earnings at the same time you feel "good" about the prospects for the market (and thus are willing to pay a higher multiple of those earnings.) Those emotions can easily be reversed.

When that happens you get over-reactions to the downside.

The chart above illustrates what the "fair value" would be for the stock market under a long list of scenarios. If you believe the Coronavirus fears are over-blown AND the P/E ratio being paid at the beginning of the year (21) was reasonable, stocks are significantly undervalued. Your price target would be 3643 (or 22% higher from last night's close). Even if you believe the Coronavirus is going to cause earnings growth for 2020 to be wiped out AND you still believe 21 is a reasonable P/E ratio, stocks are 10% undervalued.

The problem is the assumption that 21 was a reasonable P/E ratio. If you believe we are in the "mid-cycle" of the economic expansion, looking at market history, the P/E should be closer to 18. A P/E of 21 is for environments where the economy is starting an upward swing in growth, something the data simply does not support. A P/E of 18 and the assumption earnings will not be disrupted this year means stocks are currently at fair value around 3122. If growth is wiped out for the year, stocks are still 6% OVERvalued even after the 13% drop from the highs.

You can see the wide array of market valuations based on different assumptions. The current value of the market is based on the overall consensus view of all market participants. They vote with their buy/sell orders. I updated my long-term chart.

Nothing that has happened so far has caused any big changes in SEM's models. Our Dynamic models were best positioned for this type of environment. Remember, they've been in "bearish" mode due to the downward sloping growth rate for the economy the past 12+ months. I continue to advocate Dynamic Income Allocation (DIA) in all portfolios from Moderate down to an Income oriented client. Our Dynamic Aggressive Allocation (DAG) model is also something I typically recommend for most Moderate to Aggressive clients.

The tactical models were fully invested a week ago. They've already taken some if not all of the allocation to more defensive strategies. As you would expect, our "strategic" AmeriGuard and Cornerstone models are designed for longer-term allocations and remain fully invested.

The reason SEM is so valuable inside the financial plan is our wide-ranging strategies which completely remove emotions from the equation. Nobody likes losing money, but it is part of investing. The key is having a plan in place for no matter what happens. We've seen 8 other sell-offs of 10% or more since 2010. Until proven otherwise we remain in an uptrend. When that happens, our models will adjust accordingly.

Note: Article was originally posted February 26, 2020 and contains updates through the market close of February 27, 2020.