When your only tool is a hammer, everything looks like a nail.

This was the first thought that came to my mind on Tuesday when the Federal Reserve announced an emergency rate cut of 0.50%. We saw a Pavlovian reaction by market participants with stocks rallying 3% in the first half hour after the announcement. This followed a spectacular 3.5% rally in the last hour of the trading day on Monday.

Expect Volatility

Market participants are clearly searching for a bottom. Emotions are high and everyone is on edge. People who were looking to sell at any price the week before are now looking to catch the bottom. Those who knew they were chasing stocks at unreasonably high levels with unreasonably high expectations for earnings are also looking to unload their stocks at higher prices. At the same time, everyone is trying to guess what the economic impact will be, how long it will last, how much demand will be delayed versus lost, and if there will be any collateral damage.

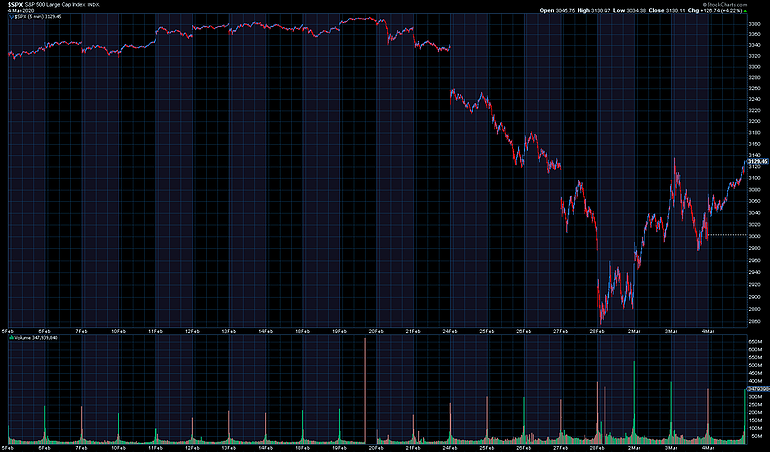

Here's a chart of the last 10 days for the S&P 500 illustrating the volatility.

I have a hard time believing this crisis will be instantly averted in the next few weeks. We'll likely need to wait and see how fast this spreads in the US and how many big events are cancelled. Thankfully none of our investment decisions are based on the opinions of me, Rick, Cody, Steve, or anybody else. It's all based on data.

What our study of data says will happen is an attempt at a big rally. We could easily see a 50% recovery of the losses, if not a little bit more. What usually follows then is another leg down, often more scary than the first one. The previous lows will be tested and possibly broken. Depending on the internal statistics during that sell-off, that could be the bottom. If broken, we could look at another down cycle with similar patterns as this one.

It's not worth guessing. When the market becomes this volatile all of our data says it is best to wait. Easier times to make money will come.

The Fed Doesn't have the Right Tools

Let's turn to the Fed. We've been conditioned since 1998 to believe the Fed has all the tools to fight any crisis. With hindsight people look back and look at the 2000-2002 bear market/recession and even the 2008 bear market/recession as proof the Federal Reserve's tools eventually work.

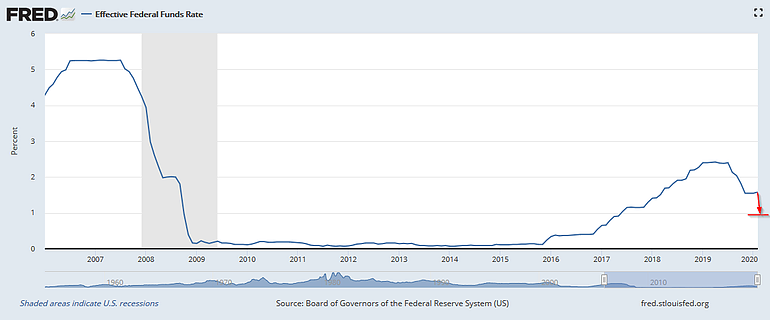

For the better part of 10 years, economists far more intelligent than me have argued the Fed needed to "normalize" their policy so they have a bigger arsenal to fight the next economic crisis. Their tools were short-term interest rates, which went from 5% in 2007 all the way down to just above 0% from late 2008 through the end of 2015. They then raised rates gradually through the beginning of 2019, hitting 2.5%. They then cut rates down to 1.5% from July to November 2019. After Tuesday's emergency cut, they are down to 1%.

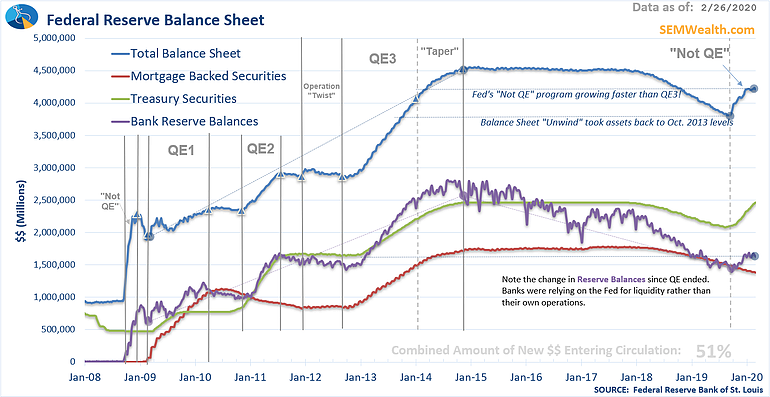

The other tool they have is their balance sheet. They can create money and purchase assets from the Wall Street banks. This allows the Wall Street banks to purchase bonds at a dealer discount and then sell them at the market price. It also provides liquidity for banks to do whatever they want with the money. The idea is they would make loans to businesses who would use that money to invest in plants and equipment. Instead we've seen it used to help fund stock buybacks, mergers, and to take private companies public. It has been a great boon to the stock market.

The Fed has attempted over the past 10 years to scale back their balance sheet activities. The biggest attempt was from 2017 until July 2019 when they let the maturing bonds roll off their balance sheet rather than using the funds to purchase more bonds. As the market stumbled, the Fed started cutting rates and ended their balance sheet tapering.

The problem is the banks were used to the liquidity, and at the same time the economic growth was not supporting the tax cuts which meant the US Government was needing to borrow an increasing amount of money to fund the budget deficits. The banking system was struggling to cover their overnight cash demands, and the Fed had to jump in and start buying assets again from the banks. They refused to call it "Quantitative Easing", but whatever it is, this helped spur a huge 4th quarter rally for stocks.

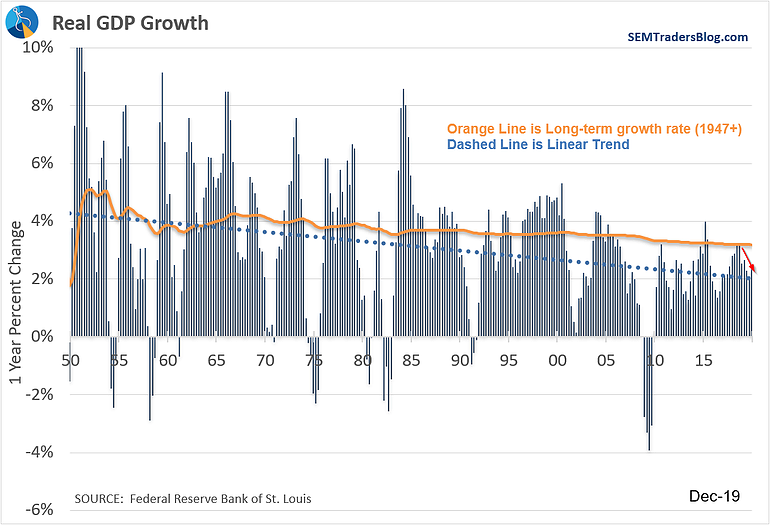

The problem is, despite cutting rates AND providing the Wall Street banks more free money, the economy has not improved. Our economic model has been "bearish" since early 2019, indicating a declining growth rate. It remains there today.

The much bigger problem is the fact despite unprecedented measures which pumped trillions of dollars into the economy the past 12 years, we've only had 2 quarters with above average growth. Even with the tax cuts in 2017, the best the economy could do was hit the average growth rate. The impact quickly wore off.

I've said for a decade, you don't fight a debt problem by encouraging more debt. Debt is future spending pulled forward. If debt is used to actually invest in things that add to future growth rates, it can be profitable. When it is used to pay investors dividends, buyback stocks, or refinance existing debt, it turns into a drag on the economy.

The Fed is going to have to come up with some different tools than cutting interest rates and Quantitative Easing. The problem is, they will continue to use these tools until it is clear they aren't working. At that point, how much damage will have been done to the financial system?

This Isn't a Nail

Going back to the opening quote, I still don't understand what the Fed was trying to do with their rate cut. Chairman Powell stated that the "financial system is functioning normally," and this is more of a demand shift (growth will still occur, just a little bit later) rather than a demand shock (growth has disappeared.)

If that was true, why not issue that statement without the rate cut? Look at any time the Fed has tried to raise rates and how the stock market has reacted. They won't be able to raise rates back to 1.5% if they are correct.

The bigger issue is, I cannot fathom how moving short-term interest rates down will help stimulate economic growth. It's not like all those companies banning travel, cancelling conferences, or telling their employees to stay at home will see credit card and auto loan rates reduced and decide paying 0.50% less in interest is more important than getting sick.

Worse, the market already had slashed rates for the Fed and they have been since early 2019. Remember, mortgages and other longer-term debt is priced using a spread over Treasury bonds, not the short-term rates the Fed controls. We've seen the 10 year plunge from from 3% at the end of 2018 to 0.97% on Tuesday. Mortgage brokers cannot keep up with demand for refinancing.

The problem is what these lower rates and growth in refinancing activity does to the banks and investors in the mortgage backed securities tied to the original loans. Historically, it is very bad news for these securities and those who invested in them counting on the higher interest rates.

What is "Fair Value"?

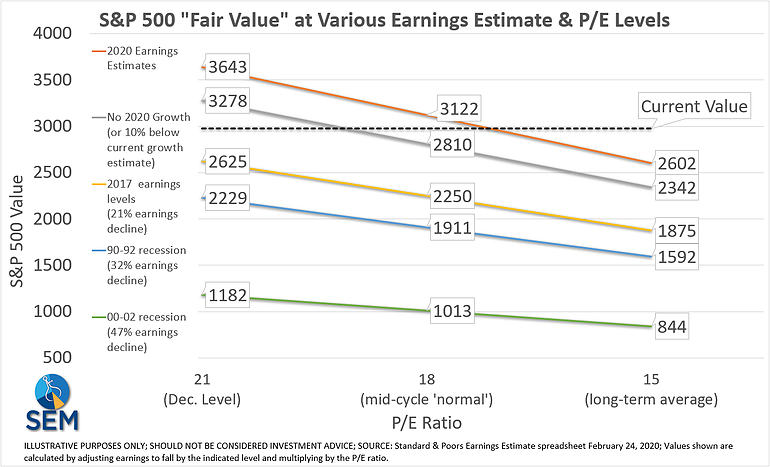

Last week I attempted to explain why stock prices could fall 12% in a week. The reason is, we see market participants struggling to determine a.) What earnings will be in the future and b.) what a reasonable multiple (P/E ratio) is for those earnings. Here's the chart illustrating the "fair value" at various inputs.

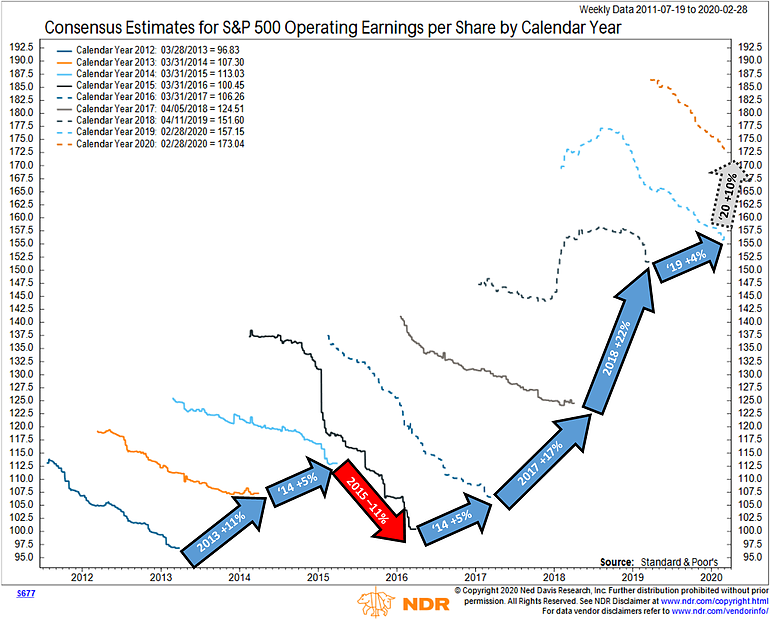

We haven't seen what the official estimate for earnings is for this week, but through last Friday we've only seen the growth expectations decline slightly. Goldman Sachs has stated they believe earnings would be flat in 2020. This would put your "fair value" estimate along the grey line (2nd from the top). Professor Jeremy Siegel said we could see a drop of 20-30% in earnings before a recovery in 2021 or 2022. That would put your "fair value" somewhere along the gold or blue line (3rd and 4th) line.

As you can see, earnings estimates almost always fall throughout the year, so the orange and grey lines are likely not a good estimate for value. The other issue is how much those earnings are worth. The long-term average P/E is 15, which is significantly above where the market was at in January, as well as where we are at currently. Even if you believe the Fed, that this is simply a "mid-cycle" economic slowdown, a more reasonable P/E is 18.

In other words, there is a strong case that stocks are still overvalued today. They are back to October 2019 levels. At that time the assumption was for 12% earnings growth, a return to 3%+ economic growth, and no real concerns anywhere on the horizon. If you buy stocks today, you are essentially saying the October 2019 expectations were reasonable.

Getting Back to the Basics

On a long-term chart, past recessionary bear markets seem mild. Having managed money through the last two, I can tell you they were not mild, and I saw advisors and investors alike making emotional decisions that caused significant long-term damage to their financial picture. The issue was not that the market went down -- that should have been expected. Recessionary Bear markets will happen regardless of what the Federal Reserve does. In fact, I've argued they actually make the magnitude of the bear markets much worse because they created a false sense of security and when people realize the Fed cannot prevent it, the losses become much worse.

As we said to our SEM clients last week, "your financial advisor recommended your investment allocation based on your financial plan, cash flow needs, risk tolerance, and investment personality. Unless any of those things changed this week, you should not make any adjustments."

We've created a free tool that helps our advisors and clients check their asset allocation. It can be found here or by clicking on the button at the top of SEMWealth.com. At the end of the 10 question survey, there is an option to upload a statement of your non-SEM investments to receive a free report detailing the risks you have in your portfolio.

If you found yourself far too exposed to losses this week, doubting your financial plan, or just wondering if you were still on the right track, it is not too late to make some critical decisions. Again, we are only back to October 2019 levels; levels which were pricing in a "Goldilocks" environment for 2020. Common sense tells us those expectations were unreasonable. If you'd like to review ways SEM could help, let me know. Even if this ends up being a non-event, we will have a REAL recessionary bear market at some point soon. History, math, and common sense tell us that.

Stay Up to Date

The purpose of the Trader's Blog is to provide thoughtful, easy to digest articles, that are likely not being put out by the mainstream financial media or Wall Street. We often will be the voice of reason during scary times, like we were last week, but we also will provide more big picture pieces to help advisors and investors look beyond the most recent market action.

Hear are some of the warnings we gave readers just since last August about the risks in the market:

August 21 - Betting on a Boom: "Given our economic model's continued warning signs about growth and the huge jump in the P/E multiple the market is very susceptible to a double whammy --- slower than expected earnings growth and a contraction in the P/E multiple. If you're in a buy & hold strategy I'd be VERY cautious at this point."

October 8 - Your Starting Point Matters: "Buy & hold investing in theory would work if investors were robots. Instead, investors are "irrational" according to economists and end up buying after market rallies and selling after market sell-offs. We don't consider investors "irrational", instead we know they are human."

October 10 - A Plan for All Markets: "Emotions will get the best of us at some point, both as investment managers and advisors. I heard all kinds of opinions from advisors who are paid to be financial planners wanting to insert their own market outlook on their clients' portfolios. My question was always, "what if you're wrong?" Most said they would adjust. I know from experience those adjustments are often far too late (or too early). When the heat is on, we tend to make even more emotional mistakes with our decisions."

October 17 - We just want you to stick to the plan: "I emphasized to the group --- if you want the best, liquid, long-term investment the stock market is the place to be. The problem is few people will stick with it long enough to receive those rewards. Everything we are doing at SEM is to provide ways to ensure investors (and their advisors) stick to the overall financial plan. I then showed the statistics from our database of a question we've used with our clients the last 15+ years along with the number of times clients in those categories would be uncomfortable. The vast majority are uncomfortable losing more than 20%. This is our sweet spot."

December 10 - Perceptual Bailouts: "I continue to hear from the financial advisors we work with that a.) The short-term funding issues are nothing to worry about, or b.) surely the Federal Reserve will not let the financial system implode. Rather than once again reminding everyone that too much debt is a bad thing, that paying a high premium for stocks when GDP growth is running below average, and most importantly that since their beginnings a hundred years ago the Fed has had one primary job -- to prevent the financial system from imploding. They've had additional jobs added to the list -- controlling inflation and maximizing employment, but those are both tied to not letting the financial system implode."

January 22 - Not an Ideal Time to Invest: "SEM's portfolios will not be perfect, but the goal is to reduce market exposure as we get to the riskiest point in the cycle (the data is saying we are close to that point now). We will not get down to our minimum investments until the data is clear the up cycle is over and we've entered the down cycle. Likewise, the systems are designed to let the down cycle play out and not get back to maximum investments until we've received clear signals the worst is over. Again it is not perfect, but this strategy allows our clients to receive the long-term benefits of the stock market at a level of risk they should be able to stick with."

January 29 - The High Risk of Bonds: "What worries me the most is the blanket recommendation to use dividend paying stocks to replace bond income. Dividend paying stocks have lost 35-50% during past recessionary bear markets. In exchange for that type of risk you are getting a 2% yield. Even junk bonds, which are paying 4-5% yields have less risk than dividend paying stocks."

Giving up on Treasury Bonds completely means giving up on some potentially sizable returns. Consider the environment where we'd see yields fall -- expectations of a looming recession. At the same time this would likely lead to large losses in stock prices. Those investors who dumped their bonds to buy dividend paying stocks would get hammered on both sides of that trade -- they'd miss some potentially large returns from Treasury Bonds as well as losing significant amounts of money on their stock investments."

February 26 - A Little Perspective Helps: "The reason SEM is so valuable inside the financial plan is our wide-ranging strategies which completely remove emotions from the equation. Nobody likes losing money, but it is part of investing. The key is having a plan in place for no matter what happens. We've seen 8 other sell-offs of 10% or more since 2010. Until proven otherwise we remain in an uptrend. When that happens, our models will adjust accordingly."

If you'd like to stay up-to-date you can follow us on LinkedIn (click here), Facebook (click here), or subscribe to our weekly emails (click here).

Finally, last April I wrote a white paper for advisors discussing ways they can prepare for a Bear Market. It is certainly not too late. The advice has not changed. We now have another example of a market shock which can be used to re-adjust client portfolios so they are ready for a REAL bear market. Click here to read the paper.

Regardless of what happens next, as we've done since 1992, we will be here unemotionally ready to put our clients' plans into place.