At the start of the year we always are bombarded by forecasts of what the 'experts' believe could happen in the year ahead. Whether specific or implied, the overwhelming consensus is investors should reduce their bond exposure and add more stock exposure.

The arguments are all similar --- Treasury bond yields are below the dividend yield, rates are likely to move higher which causes bond prices to drop, and the yields are too low for investors to meet their goals.

I always shudder when I see this type of blanket advice, especially when I see clients in review meetings who have heard something similar and are asking why we aren't recommending the same thing. My answer has always been the same regardless of where we are at in the economic/market cycle:

- There are so many different types of bonds, all of which react differently to different economic environments. This makes blanket recommendations dangerous.

- The return/risk relationship between bonds and dividend paying stocks is not even comparable.

Investors can invest in short, intermediate, or long-term bonds. All carry different risks in terms of what happens when interest rates change. In addition, Treasury Bond yields move with the economic outlook. If the economy is growing strong you'll see rates move higher, but if not, we could easily see rates move lower on Treasury Bonds. High yield or "junk" bond prices react more to the economic outlook, which means you could see junk bond yields drop and prices rise at the same time Treasury bond yields increase and prices drop. Both COULD play a vital role in portfolios depending on the overall financial plan, cash flow needs, and investment personality of the investor.

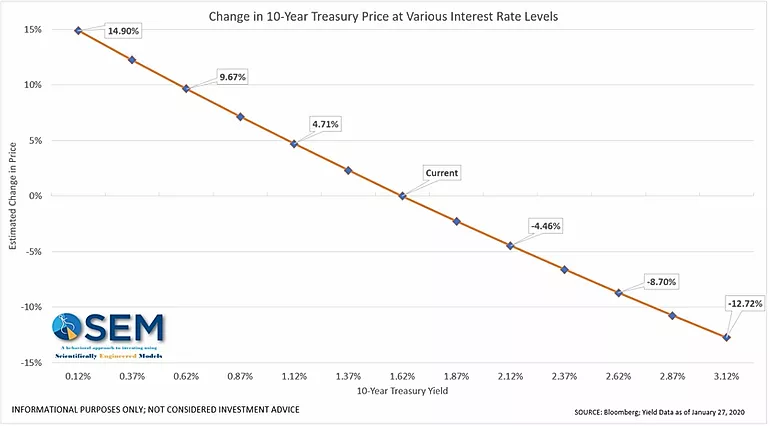

What worries me the most is the blanket recommendation to use dividend paying stocks to replace bond income. Dividend paying stocks have lost 35-50% during past recessionary bear markets. In exchange for that type of risk you are getting a 2% yield. Even junk bonds, which are paying 4-5% yields have less risk than dividend paying stocks. Looking at Treasury Bonds, this week's Chart of the Week illustrates what would happen to 10-year Treasury prices as interest rates go up or down. Each dot on the chart is a 1/4% change in rates.

As you can see with a move of 1.5% higher in rates we would see a loss of 13%. I don't know if most people investing in Treasury Bonds realize they could lose that much. Conversely, giving up on Treasury Bonds completely means giving up on some potentially sizable returns. Consider the environment where we'd see yields fall -- expectations of a looming recession. At the same time this would likely lead to large losses in stock prices. Those investors who dumped their bonds to buy dividend paying stocks would get hammered on both sides of that trade -- they'd miss some potentially large returns from Treasury Bonds as well as losing significant amounts of money on their stock investments.

Even Vanguard is recommending active fixed income management

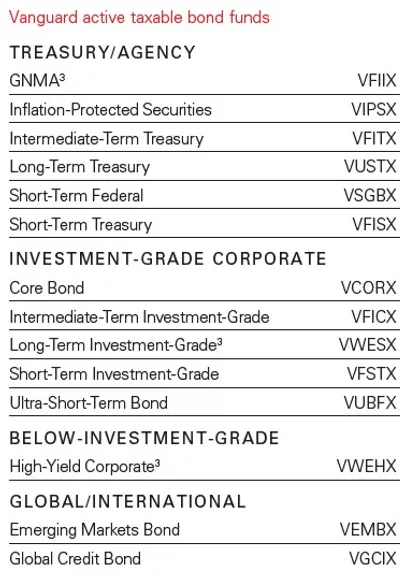

Investing in bonds, especially in this environment can be especially risky. Apparently Vanguard agrees. This week I received an update from Vanguard titled: "Fixed Income - The time is ripe for active". I was a bit surprised to hear this from the "passive is the only way" manager. The report discusses all the reasons to be active in each segment of the fixed income markets. What they do not discuss is HOW to allocate to the different segments.

Take a look at their "active" fixed income line-up. They might be "active" in terms of how they select specific issues inside an index, but they then leave it up to the advisor or investor to determine the duration, the credit risk, and even the region to invest. This is the CRITICAL determinant of both portfolio performance and the amount of risk inside a fixed income portfolio. This is where SEM comes in.

At SEM we actively manage the fixed income exposure for our clients and advisors, taking advantage of disconnects in interest rates and the return/risk potential of various investments. We can increase or decrease Treasury Bond, high yield bond, and even dividend stock exposure allowing our clients to not take on the high risk of buying and holding bonds (or worse dividend paying stocks.) While we appreciate fund families like Vanguard providing active security selection in their segments, the key decision is how much is invested in each segment. This is something SEM has always excelled at, going back to our founding in 1992.