The stock market is supposed to be “efficient”, which means it is pricing in the current value of all future earnings for the component companies. Of course, nobody knows what those future earnings will be, so we often see wide swings between investors who are overly optimistic and overly pessimistic. Small news items (like tweets from the President) cause market participants to adjust rapidly their future expectations.

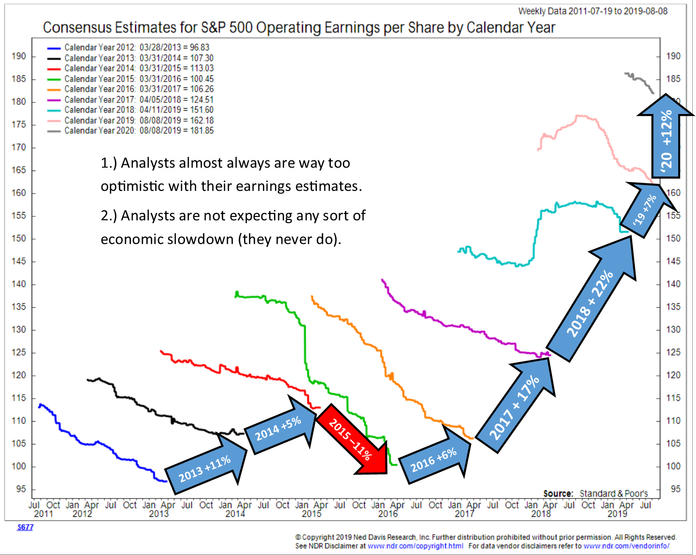

At SEM, we do not believe the market is efficient and instead represents the consensus feelings of market participants. If participants are feeling optimistic they will buy stocks and prices will rise. If they are pessimistic they will sell and stock prices will fall. All of the indicators we utilize are mechanical in nature and designed to measure the ebbs and flows of investor sentiment, rather than guessing about what will happen to corporate earnings. I still cannot fathom how corporate managers and Wall Street analysts can predict what earnings will look like in 3 months let alone for the next two years. Yet for some reason market participants use these numbers with confidence.

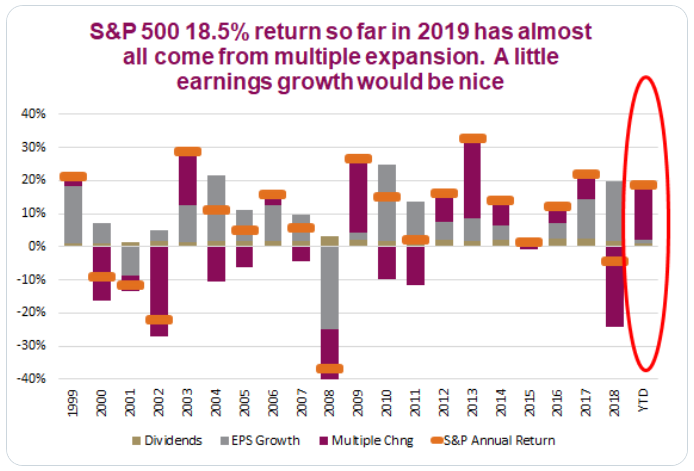

One thing I find interesting is to look at the components of stock market growth. Stock returns can be broken down to growth in earnings, growth in dividends, and “multiple expansion.” Stocks SHOULD go up if earnings and dividends are growing, but that is not always the case. Multiple expansion is by far the most volatile component of returns. Essentially it is how much investors are willing to pay for a dollar of earnings. If investors are betting on a boom, the multiple will go up and drive prices higher. If investors are less certain, multiples will fall and prices will drop.

2019 has seen some of the best returns for stocks during this entire 10+ year bull market. I would be more excited if this was due to some impressive earnings growth numbers. Instead, nearly all of the returns for the S&P 500 have been due to “multiple expansion.” (h/t to Babak @TN who has some great charts on his Twitter feed)

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

Going into the year, the S&P 500 P/E ratio was 19.6. It currently is 21.8. If we multiply that 2.2 point jump in the P/E ratio by the S&P 500 earnings we see a jump of 340 S&P 500 points (or all but a few of the points gained). What I’m concerned about is the fact the market is not expecting any sort of slowdown in earnings growth. In fact, analysts are expecting a strong acceleration in growth in 2020.

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

Given our economic model’s continued warning signs about growth and the huge jump in the P/E multiple the market is very susceptible to a double whammy — slower than expected earnings growth and a contraction in the P/E multiple. If you’re in a buy & hold strategy I’d be VERY cautious at this point.