Stock market cheerleaders often point to the high earnings growth rate projections when recommending investors “buy any dip” in the stock market. Last week we highlighted both the very high expectations for earnings growth along with a big increase in the “multiple” (Price/Earnings ratio). Essentially, stocks believe the risk of recession is low and investors should confidently pay a premium for growth (despite what the yield curve and other economic indicators are saying.)

I came from an accounting background so I always enjoyed digging into the financial statements of companies to figure out which ones could make solid long-term investments. Prior to joining SEM and continuing into the early years after I joined SEM, I was a “fundamental” analyst & portfolio manager, meaning I relied solely on the accounting statements when determining where I should invest. I thought financial statements filed with the SEC were iron-clad snapshots of what really happened at the corporations.

In the late 1990s and early 2000s my view of corporate financials changed. We learned many big name companies essentially “cooked the books” to make their income statements and balance sheets look far better than they were. Waste Management, Cendant, WorldCom, Tyco, HealthSouth, Lucent, Nortel, & of course Enron were all companies loved by investors due to their “strong growth”. While some new regulations were put in place to try and eliminate these false statements, over the last 15 years we’ve seen companies switch from “GAAP” earnings to “Operating” earnings. Essentially, analysts and investors have allowed companies to take out things the company believe should not be included. Now when you see a P/E ratio you aren’t dividing the price by the “bottom line” earnings (what the company actually made), but rather what the company says earnings should be (operating earnings).

We now see companies consistently and conveniently “beating” expectations. They can shift the timing of revenues and expenses or argue that some items (such as merger expenses or product launches) should be ignored because they are not “ongoing”. They can adjust depreciation schedules, amortization of leases, and accounting of interest among other things to fit their view of what should be “ongoing” revenue and expenses.

We’ve all heard of GIGO (Garbage In-Garbage Out) when it comes to investment models. I can’t think of more garbage than using “operating earnings” in any valuation calculations. In other words, if you are using anything with an “E” in your formula, I wouldn’t trust the output.

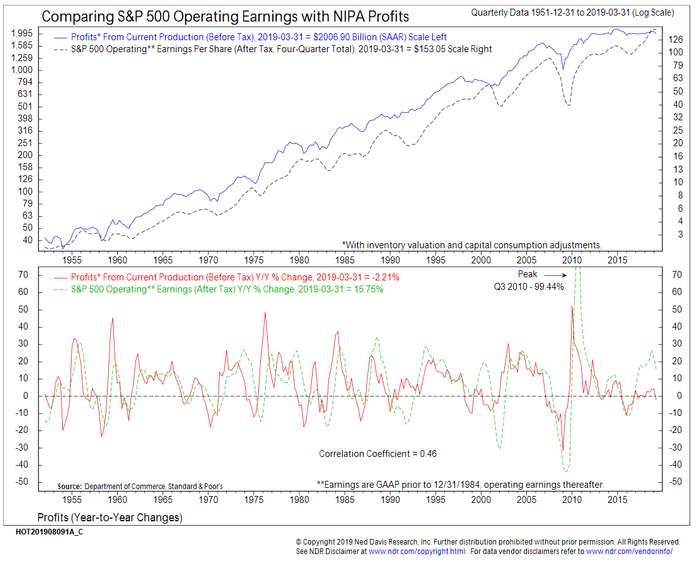

For those of you that have put your faith in the stock market continuing its march higher the next few years due to strong earnings growth, I would take a look at the deviation between S&P 500 Operating Earnings and the NIPA Profits reported by the government. NIPA Profits are calculated by the government using data reported by corporations. The rules are much more stringent on how revenue and expenses are reported. In the NIPA data you lose the desire of corporations to make their books look good for investors and instead get to see what is really happening. Blackrock recently posted an article highlighting the reason we should pay attention to the NIPA data:

-

NIPA data historically leads the S&P 500 data

-

NIPA data goes back longer than the S&P 500 data

-

NIPA data does a better job accounting for foreign profits

-

NIPA accounting methods are uniform

-

NIPA data is based on a broader set of sources

This brings us to this week’s Chart of the Week, which shows the trend in NIPA profits has turned lower. If we consider this to be a leading, more accurate indicator of the health of US Corporations, I would be worried if I was buying and holding stocks at this point. NIPA Profits peaked in late 2014 and have started to roll over. According to Blackrock, NIPA Profits lead S&P Operating Earnings by 2-4 quarters.

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

Remember, corporations can temporarily shift revenues and expenses around, but as Warren Buffett said, “when the tide goes out you discover who’s been swimming naked.” In other words, when the recession hits companies won’t be able to use tricks to “beat expectations.” Instead, stock prices will adjust to the new reality.